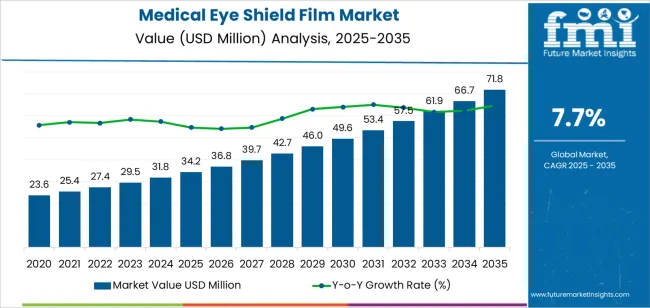

The medical eye shield film market is valued at USD 34.2 million in 2025 and is expected to reach USD 71.8 million by 2035, reflecting growing emphasis on ocular protection in surgical environments, postoperative recovery management, and infection prevention protocols. Demand is driven by rising ophthalmic procedure volumes, expansion of outpatient surgery centers, and heightened focus on preventing contamination during perioperative care. Medical eye shield films are increasingly adopted in cataract surgery, refractive procedures, and general ophthalmic interventions where protection against particulate exposure, accidental contact, and microbial contamination is necessary. Manufacturers focus on improving film transparency, breathability, and patient comfort, ensuring shields remain secure while allowing adequate visibility during recovery.

From 2025 to 2030, the market expands from USD 34.2 million to approximately USD 49.5 million, adding USD 15.3 million in value and accounting for 43 percent of total decade growth. Adoption during this phase is led by high-clarity protective films that maintain visual comfort while preventing corneal abrasion and postoperative disturbance. From 2030 to 2035, growth accelerates toward USD 71.8 million, adding USD 22.3 million or 57 percent of overall expansion. This period is driven by broader deployment across surgical centers, integration of antimicrobial surface treatments, and increased usage in home-based recovery kits. As clinical protocols shift toward standardized eye protection, suppliers offering enhanced adhesion stability, skin-safe materials, and compatibility with both pediatric and adult care settings are positioned to gain competitive advantage.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New film sales (PET, PC, specialty materials) | 46% | Medical device OEM-driven, surgical supply demand |

| Custom-cut protective shields | 24% | Pre-formed masks, glasses, surgical barriers | |

| Medical device components | 18% | Integrated equipment protection, instrument covers | |

| Replacement films & accessories | 12% | Adhesive strips, mounting hardware, cleaning supplies | |

| Future (3-5 yrs) | Advanced barrier films | 40-44% | Antimicrobial coatings, enhanced clarity, anti-fog properties |

| Custom fabricated shields | 22-26% | Patient-specific designs, surgical specialty applications | |

| Medical device integration | 18-22% | OEM partnerships, embedded protection systems | |

| Replacement & consumables | 10-14% | Recurring revenue from healthcare facilities | |

| Specialty coatings | 5-8% | Anti-reflective, UV protection, scratch resistance | |

| Sterilization services | 3-5% | Pre-sterilized products, validation support |

The latter half (2030-2035) will witness continued growth from USD 49.5 million to USD 71.8 million, representing an addition of USD 22.3 million or 57% of the decade's expansion. This period will be defined by mass market penetration of specialized film technologies, integration with comprehensive infection prevention platforms, and seamless compatibility with existing medical device infrastructure. The market trajectory signals fundamental shifts in how healthcare facilities approach surgical eye protection and contamination prevention, with participants positioned to benefit from growing demand across multiple material types and application segments.

Regional dynamics reveal distinct adoption patterns, with developed markets leading technology advancement while emerging economies show accelerating growth through healthcare infrastructure modernization programs. North American markets maintain steady expansion supported by surgical safety regulations and infection control requirements, while Asian markets demonstrate rapid growth driven by healthcare facility expansion and medical device manufacturing development. European markets show moderate growth influenced by stringent quality standards and medical device regulations.

Healthcare industry evolution drives fundamental changes in medical eye shield film specifications, with surgical teams and device manufacturers increasingly prioritizing products that combine optical performance, barrier protection, and biocompatibility features. The decade ahead will witness transformation from basic protective films toward sophisticated barrier materials with advanced clarity enhancement, antimicrobial coatings, and ergonomic application features that meet diverse surgical and diagnostic equipment requirements.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 34.2 million |

| Market Forecast (2035) | USD 71.8 million |

| Growth Rate | 7.7% CAGR |

| Leading Material Type | PET Film |

| Primary Application | Mask Segment |

The market demonstrates strong fundamentals with PET film systems capturing a dominant share through superior optical clarity capabilities and medical device manufacturing optimization. Mask applications drive primary demand, supported by increasing surgical procedures and personal protective equipment requirements. Geographic expansion remains concentrated in developed markets with established healthcare infrastructure, while emerging economies show accelerating adoption rates driven by medical safety initiatives and rising infection control standards.

Healthcare trends favor medical eye shield films that integrate protective performance with optical quality features, creating opportunities for manufacturers offering comprehensive product portfolios. The decade ahead presents expansion potential across surgical protection segments, medical device applications, and safety eyewear manufacturing, with market participants positioned to capitalize on growing demand for high-performance barrier films that meet evolving healthcare standards and surgical safety preferences.

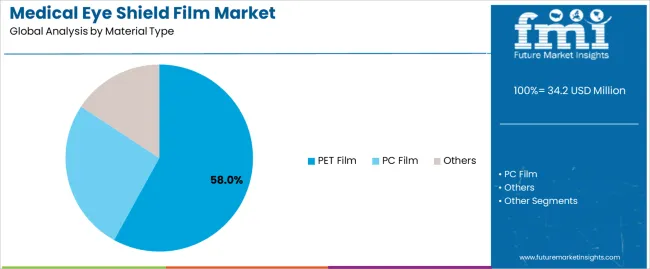

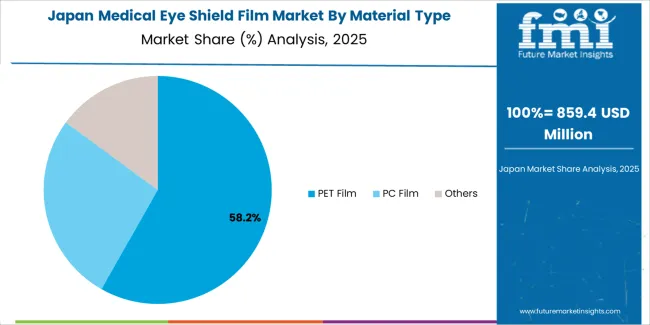

Primary Classification: The market segments by material type into PET film, PC film, and others, representing the evolution from traditional barrier materials to advanced optical protection solutions for comprehensive medical device and personal protective equipment optimization.

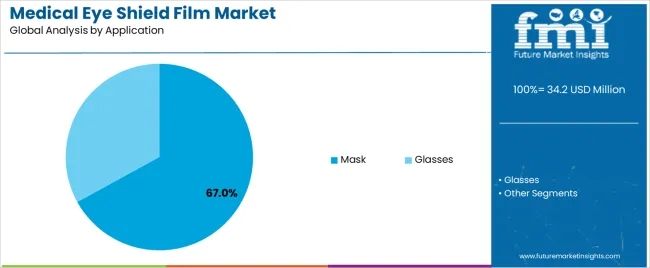

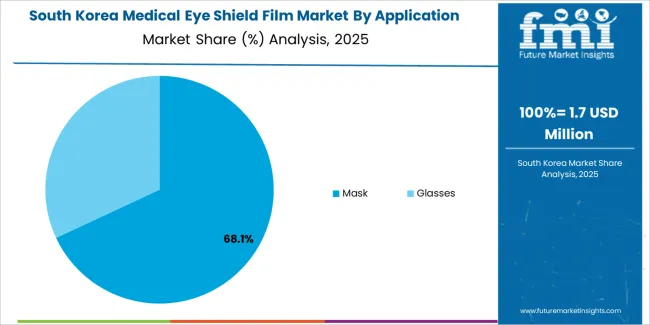

Secondary Classification: Application segmentation divides the market into mask and glasses sectors, reflecting distinct requirements for design flexibility, optical performance, and protection standards.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by healthcare infrastructure expansion programs.

The classification structure reveals material progression from standard protective films toward sophisticated barrier systems with enhanced optical performance and biocompatibility capabilities, while application diversity spans from surgical face shields to protective eyewear requiring precise clarity and safety solutions.

Market Position: PET film systems command the leading position in the market with 58% market share through advanced optical properties, including superior clarity performance, dimensional stability, and medical device manufacturing optimization that enable healthcare facilities to achieve optimal protection effectiveness across diverse surgical and diagnostic environments.

Value Drivers: The segment benefits from medical device manufacturer preference for reliable barrier materials that provide consistent optical performance, sterilization compatibility, and biocompatibility characteristics without requiring significant formulation modifications. Advanced material features enable excellent clarity maintenance, chemical resistance, and integration with various fabrication processes, where optical quality and safety compliance represent critical medical device requirements.

Competitive Advantages: PET film systems differentiate through proven material reliability, consistent optical properties, and compatibility with medical device manufacturing standards that enhance product effectiveness while maintaining optimal clarity performance suitable for diverse healthcare applications.

Key market characteristics:

PC film systems maintain a 28% market position in the market due to their impact resistance properties and enhanced durability advantages. These materials appeal to applications requiring superior mechanical strength with effective optical clarity for protective eyewear applications. Market growth is driven by safety equipment expansion, focusing robust protection solutions and operational longevity through optimized polymer designs.

Other film materials including specialty polymers and composite systems capture 14% market share through specialized protection requirements in advanced medical applications, custom device fabrication, and high-performance barrier scenarios. These applications demand distinctive material characteristics capable of delivering specialized properties while providing effective optical performance and regulatory compliance capabilities.

Market Context: Mask applications demonstrate 67.0% market share with 8.2% CAGR due to widespread adoption of face shield protection and increasing focus on surgical safety enhancement, infection prevention, and healthcare worker protection applications that maximize safety compliance while maintaining visibility standards.

Appeal Factors: Healthcare facilities prioritize product effectiveness, comfort optimization, and integration with existing personal protective equipment that enables coordinated safety operations across multiple clinical scenarios. The segment benefits from substantial infection control investment and healthcare safety programs that emphasize the acquisition of face shield films for surgical procedures and patient care applications.

Growth Drivers: Surgical safety protocols incorporate eye shield films as standard components for infection prevention, while pandemic preparedness increases demand for protective barrier capabilities that comply with safety standards and minimize contamination complexity.

Market Challenges: Varying design requirements and sterilization protocols may limit material standardization across different healthcare facilities or clinical scenarios.

Application dynamics include:

Glasses applications capture market share through essential protection requirements in surgical procedures, laboratory work, and healthcare environments. These applications demand transparent film materials capable of providing impact protection while maintaining effective optical clarity and visual comfort capabilities.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Surgical procedure growth & healthcare facility expansion | ★★★★★ | Increasing surgical volumes require effective eye protection solutions with validated safety performance and infection control capabilities across operating environments. |

| Driver | Infection control regulations & healthcare safety standards | ★★★★★ | Stringent safety protocols transform barrier films from optional to mandatory; manufacturers providing validated products gain healthcare adoption. |

| Driver | Medical device manufacturing growth & OEM demand | ★★★★☆ | Equipment manufacturers need integrated protection solutions; demand for custom-fabricated films and specialized coatings expanding market opportunities. |

| Restraint | Material cost pressures & supply chain dependencies | ★★★★☆ | Raw material price fluctuations affect product pricing; manufacturers face margin compression during commodity cost escalation periods. |

| Restraint | Sterilization compatibility requirements & regulatory complexity | ★★★☆☆ | Multiple sterilization methods require material validation; compliance testing and approval processes limit material innovation speed. |

| Trend | Antimicrobial coatings & infection prevention features | ★★★★★ | Advanced surface treatments reduce contamination risk; functional coatings and barrier enhancement become core value propositions. |

| Trend | Customization demand & patient-specific applications | ★★★★☆ | Growing preference for tailored protection solutions and specialized designs drives manufacturers toward flexible fabrication capabilities and custom order processing. |

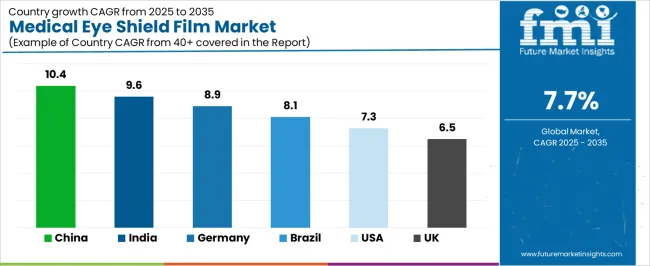

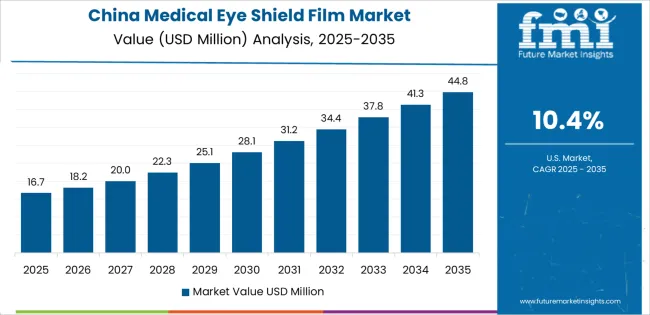

The market demonstrates varied regional dynamics with Growth Leaders including China (10.4% growth rate) and India (9.6% growth rate) driving expansion through healthcare infrastructure initiatives and medical device manufacturing development. Steady Performers encompass Germany (8.9% growth rate), Brazil (8.1% growth rate), and developed regions, benefiting from established healthcare systems and medical safety adoption. Mature Markets feature United States (7.3% growth rate) and United Kingdom (6.5% growth rate), where surgical safety programs and infection control requirements support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through healthcare expansion and manufacturing development, while North American countries maintain steady expansion supported by regulatory compliance and safety standardization requirements. European markets show moderate growth driven by medical device applications and quality integration trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 10.4% | Focus on manufacturing partnerships | Quality standard variations |

| India | 9.6% | Offer cost-effective solutions | Distribution infrastructure gaps |

| Germany | 8.9% | Lead with precision materials | Certification complexity |

| Brazil | 8.1% | Value-oriented products | Import duty impacts |

| USA | 7.3% | Provide regulatory support | Competitive pricing pressure |

| UK | 6.5% | Push safety validation | NHS procurement constraints |

China establishes fastest market growth through aggressive medical device manufacturing programs and comprehensive healthcare infrastructure development, integrating medical eye shield films as standard components in surgical equipment and personal protective equipment production installations. The country's 10.4% growth rate reflects government initiatives promoting medical device manufacturing advancement and healthcare safety capabilities that mandate the use of quality barrier materials in medical and surgical facilities. Growth concentrates in major manufacturing centers, including Shanghai, Shenzhen, and Beijing, where medical device production showcases integrated film systems that appeal to manufacturers seeking effective protection capabilities and cost-efficient material applications.

Chinese manufacturers are developing competitive film products that combine domestic production advantages with improving quality features, including enhanced clarity and biocompatibility capabilities. Distribution channels through medical equipment suppliers and healthcare distributors expand market access, while government support for medical device manufacturing supports adoption across diverse healthcare and medical device segments.

Strategic Market Indicators:

In Mumbai, Delhi, and Bangalore, medical device manufacturers and healthcare facilities are implementing medical eye shield films as standard materials for protective equipment and surgical device applications, driven by increasing government healthcare investment and manufacturing modernization programs that emphasize the importance of quality medical materials. The market holds a 9.6% growth rate, supported by government healthcare initiatives and medical device infrastructure development programs that promote advanced barrier films for medical and surgical facilities. Indian manufacturers are adopting film materials that provide effective protection performance and cost advantages, particularly appealing in regions where healthcare affordability and safety compliance represent critical procurement requirements.

Market expansion benefits from growing medical device capabilities and healthcare infrastructure development that enable broader availability of quality eye shield films for medical and protective equipment applications. Material adoption follows patterns established in medical supplies, where value pricing and performance reliability drive purchasing decisions and production deployment.

Market Intelligence Brief:

Germany establishes technology leadership through comprehensive medical device programs and advanced manufacturing standards, integrating medical eye shield films across surgical equipment and protective device applications. The country's 8.9% growth rate reflects established medical device relationships and mature material technology adoption that supports widespread use of precision barrier films in medical manufacturing and healthcare facilities. Growth concentrates in major industrial centers, including Baden-Württemberg, Bavaria, and North Rhine-Westphalia, where medical technology showcases mature film deployment that appeals to manufacturers seeking proven optical performance capabilities and regulatory compliance applications.

German manufacturers leverage engineering expertise and comprehensive testing protocols, including biocompatibility validation and optical performance documentation that create material credibility and technical advantages. The market benefits from stringent medical device regulations and quality management requirements that support barrier film use while encouraging material advancement and performance optimization.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse healthcare demand, including hospital system development in São Paulo and Rio de Janeiro, medical device manufacturing upgrades, and government healthcare programs that increasingly incorporate barrier films for surgical safety applications. The country maintains a 8.1% growth rate, driven by rising healthcare activity and increasing recognition of infection control material benefits, including effective eye protection and contamination prevention.

Market dynamics focus on affordable film materials that balance adequate performance with cost considerations important to Brazilian healthcare providers. Growing healthcare infrastructure creates continued demand for modern protective films in new facility construction and safety equipment modernization projects.

Strategic Market Considerations:

The United States establishes market leadership through comprehensive healthcare safety programs and advanced medical device infrastructure, integrating medical eye shield films across surgical facilities and medical equipment manufacturing applications. The country's 7.3% growth rate reflects established regulatory relationships and mature medical material adoption that supports widespread use of validated barrier films in healthcare and medical device facilities. Growth concentrates in major medical technology centers, including Massachusetts, California, and Minnesota, where medical device excellence showcases mature film deployment that appeals to manufacturers seeking proven safety capabilities and regulatory compliance applications.

American material suppliers leverage established distribution networks and comprehensive regulatory capabilities, including FDA compliance support and validation documentation that create product acceptance and market advantages. The market benefits from mature medical device standards and healthcare safety requirements that support barrier film use while encouraging material innovation and performance improvement.

Market Intelligence Brief:

The United Kingdom's medical technology market demonstrates established medical eye shield film deployment with documented safety effectiveness in surgical applications and medical device manufacturing through integration with existing healthcare systems and safety infrastructure. The country maintains a 6.5% growth rate. Medical centers, including London, Manchester, and Cambridge, showcase quality installations where barrier films integrate with comprehensive safety equipment platforms and healthcare management systems to optimize protection operations and infection control effectiveness.

British healthcare providers prioritize material safety and regulatory compliance in film selection, creating demand for validated materials with proven features, including biocompatibility documentation and optical performance specifications. The market benefits from National Health Service infrastructure and medical device regulations that provide consistent operational benefits and compliance with national healthcare standards.

Market Intelligence Brief:

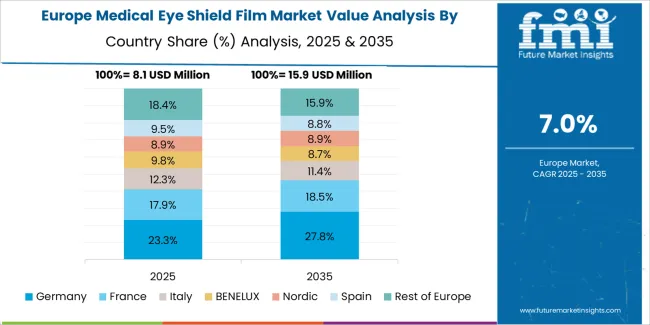

The medical eye shield film market in Europe is projected to grow from USD 12.6 million in 2025 to USD 51.1 million by 2035, registering a CAGR of 15.1% over the forecast period. Germany is expected to maintain its leadership position with a 35.4% market share in 2025, supported by its advanced medical device manufacturing infrastructure and major healthcare technology centers.

United Kingdom follows with a 21.7% share in 2025, driven by comprehensive healthcare safety programs and medical device quality initiatives. France holds a 18.9% share through surgical protection applications and infection control requirements. Italy commands a 12.8% share, while Spain accounts for 11.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.8% to 6.7% by 2035, attributed to increasing material adoption in Nordic countries and emerging Eastern European healthcare facilities implementing safety modernization programs.

Japan demonstrates sophisticated medical eye shield film deployment through premium medical device manufacturing and stringent quality control standards. The market maintains steady growth driven by surgical equipment demand and advanced healthcare facility requirements. Japanese manufacturers emphasize material precision and optical quality features that meet rigorous medical device regulations. Technology partnerships with polymer suppliers enable advanced material formulations and clarity optimization suitable for Japanese medical standards and demanding healthcare applications including ophthalmic procedures.

South Korea shows robust market expansion through intensive medical device industry investment and healthcare infrastructure development programs. Seoul, major hospital systems, and medical equipment manufacturers lead adoption with advanced barrier film materials incorporating enhanced performance features. The market benefits from government healthcare initiatives and medical technology advancement programs that promote innovative protection materials. Korean medical device manufacturers focus on optical clarity and biocompatibility features aligned with export market requirements and technological innovation objectives for international medical device applications.

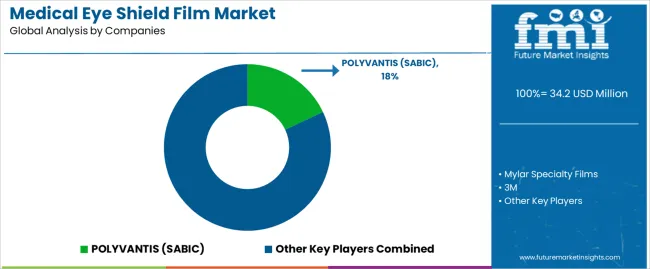

The medical eye shield film market features approximately 15-20 specialized manufacturers, with the top 3-5 companies controlling roughly 60-65% of global revenue. Market leadership depends on material technology expertise, medical device partnerships, and regulatory approval capabilities rather than production scale advantages. Competition centers on optical performance, biocompatibility validation, and fabrication flexibility that drive adoption across medical device manufacturers and healthcare institutions.

Basic film extrusion processes and standard polymer formulations represent established technology, with manufacturers differentiating through optical clarity enhancement, surface treatment capabilities, and customization services. Margin opportunities exist in specialized coatings offering antimicrobial properties, anti-fog treatments, and enhanced scratch resistance that command premium pricing. Companies maintaining strong medical device relationships and regulatory compliance expertise capture market advantages through product validation and manufacturing integration.

Global manufacturers leverage material science expertise for advanced formulations and multi-regional regulatory approvals, though specialized converters often compete effectively through custom fabrication and rapid prototyping services. Technology innovation focuses on coating development, clarity optimization, and sterilization compatibility rather than fundamental material changes. Market dynamics favor participants with medical device expertise who understand application requirements and provide comprehensive technical support alongside material offerings.

Medical device partnerships increasingly differentiate competitors, with leading manufacturers collaborating on integrated protection solutions, custom fabrication projects, and performance validation programs that strengthen market positioning. Fabrication services and technical consultation become important competitive factors. The market favors participants balancing material engineering with customer collaboration effectiveness while maintaining product quality standards that meet regulatory requirements and medical device performance expectations.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global platforms | Material formulations, multi-region supply, regulatory expertise | Proven compliance, consistent quality, established distribution | Innovation speed; customization flexibility |

| Technology innovators | Advanced coatings; specialty polymers; optical enhancement | Performance differentiation; patent protection; medical device appeal | Market penetration; production scale |

| Regional specialists | Local fabrication, rapid prototyping, market proximity | Customer responsiveness; flexible manufacturing; regional knowledge | Technology breadth; regulatory resources |

| Medical device ecosystems | Integrated solutions, OEM partnerships, application expertise | Device validation; market access; technical integration | Material innovation; commodity pressure |

| Item | Value |

|---|---|

| Quantitative Units | USD 34.2 million |

| Material Type | PET Film, PC Film, Others |

| Application | Mask, Glasses |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Brazil, France, Canada, South Korea, and 25+ additional countries |

| Key Companies Profiled | POLYVANTIS (SABIC), Mylar Specialty Films, 3M, Covestro, Envirafiex, Dexerials Corporation, Klöckner Pentaplast, WeeTect, Ergis, China Lucky Film |

| Additional Attributes | Dollar sales by material type and application categories, regional adoption trends across North America, East Asia, and Western Europe, competitive landscape with polymer film manufacturers and medical device suppliers, healthcare provider preferences for optical clarity and biocompatibility, integration with medical device standards and sterilization systems, innovations in barrier film technology and coating enhancement, and development of antimicrobial solutions with enhanced performance and healthcare safety optimization capabilities. |

The global medical eye shield film market is estimated to be valued at USD 34.2 million in 2025.

The market size for the medical eye shield film market is projected to reach USD 71.8 million by 2035.

The medical eye shield film market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in medical eye shield film market are pet film, pc film and others.

In terms of application, mask segment to command 67.0% share in the medical eye shield film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Smart Drug Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA