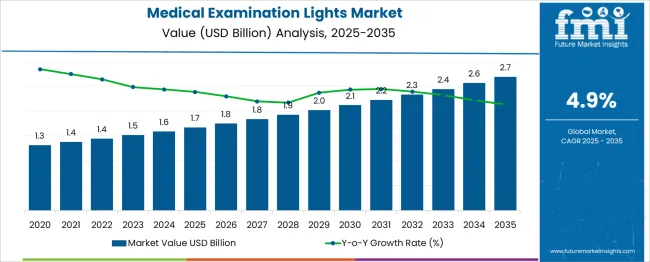

The global medical examination lights market is projected to grow from USD 1.7 billion in 2025 to approximately USD 2.7 billion by 2035, recording an absolute increase of USD 1.02 billion over the forecast period. This translates into a total growth of 61.0%, with the market forecast to expand at a CAGR of 4.9% between 2025 and 2035. The market size is expected to grow by nearly 1.61X during the same period, supported by increasing healthcare infrastructure development, growing demand for energy-efficient lighting solutions, and expanding medical facility construction worldwide.

Between 2025 and 2030, the Medical Examination Lights market is projected to expand from USD 1.7 billion to USD 2.08 billion, resulting in a value increase of USD 0.41 billion, which represents 40.2% of the total forecast growth for the decade. This phase of growth will be shaped by increasing adoption of LED technology in healthcare facilities, expanding outpatient care infrastructure, and growing demand for energy-efficient medical lighting solutions across global healthcare systems.

From 2030 to 2035, the market is forecast to grow from USD 2.08 billion to USD 2.7 billion, adding another USD 0.61 billion, which constitutes 59.8% of the ten-year expansion. This period is expected to be characterized by advancement in smart lighting technologies, expansion of specialty medical facilities, and development of integrated lighting systems that combine examination illumination with digital health monitoring capabilities.

| Metric | Value |

| Estimated Value in (2025E) | USD 1.7 billion |

| Forecast Value in (2035F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

Market expansion is being supported by increasing healthcare infrastructure development worldwide, driving demand for comprehensive medical equipment, including advanced examination lighting systems that enhance diagnostic accuracy and clinical workflow efficiency. Growing focus on patient safety and healthcare quality standards is creating opportunities for high-performance medical lighting solutions that provide optimal illumination for diverse medical procedures and examinations.

The expanding adoption of LED technology in healthcare facilities is driving demand for energy-efficient examination lights that offer superior light quality, longer operational life, and reduced maintenance costs compared to traditional lighting systems. Increasing construction of outpatient facilities, specialty clinics, and ambulatory surgical centers is creating demand for diverse examination lighting solutions across multiple healthcare settings and medical specialties.

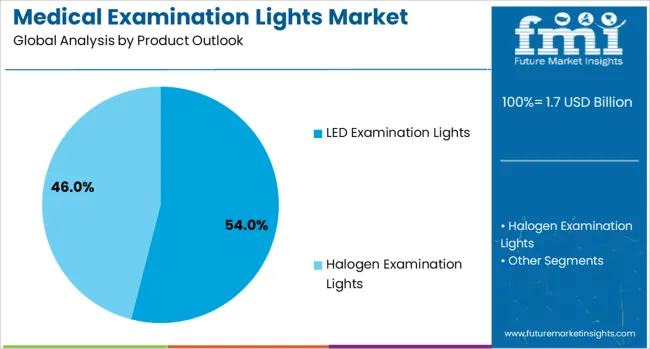

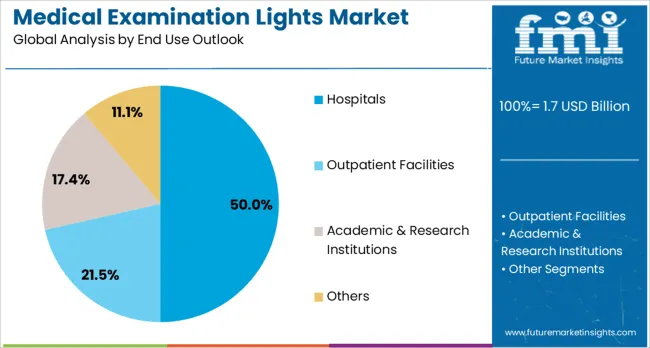

The market is segmented by product type, mounting type, application, end use, and region. By product type, the market is divided into LED examination lights, halogen examination lights, and others. Based on mounting type, the market is categorized into ceiling-mounted, wall-mounted, mobile/floor-standing, head lights/lamps/clamp-on, combination, and others. In terms of application, the market is segmented into general examination, gynecological examination, dental examination, ENT examination, dermatology, and others. By end use, the market is divided into hospitals, outpatient facilities, academic & research institutions, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

LED examination lights are projected to account for 54% of the medical examination lights market in 2025. This leading share is supported by superior energy efficiency, longer operational life, and enhanced light quality characteristics that make LED technology the preferred choice for modern healthcare facilities. LED examination lights provide consistent color temperature, reduced heat generation, and lower maintenance requirements that appeal to healthcare administrators seeking cost-effective lighting solutions. The segment benefits from declining LED costs and comprehensive availability across diverse mounting configurations and specialty applications.

Ceiling-mounted examination lights are expected to represent 40% of mounting configuration demand in 2025. This segment provides optimal overhead illumination for general medical examinations while maximizing floor space utilization and clinical workflow efficiency. Ceiling-mounted systems offer superior light distribution patterns and adjustable positioning capabilities that support diverse examination procedures across multiple medical specialties. The segment benefits from established installation practices and comprehensive integration with medical facility design standards.

Hospitals are projected to contribute 50% of the market in 2025, representing comprehensive medical facilities that require extensive examination lighting infrastructure across emergency departments, outpatient clinics, and specialty care units. Hospital-based applications demand reliable, high-performance lighting systems that support diverse medical procedures while meeting stringent healthcare quality and safety standards. The segment is supported by ongoing hospital construction and renovation projects that incorporate modern examination lighting technologies.

The market is advancing steadily due to increasing healthcare infrastructure development and growing adoption of energy-efficient lighting technologies. The market faces challenges including high initial costs of advanced LED systems, need for specialized installation and maintenance expertise, and varying regional healthcare facility standards that affect product specifications. Innovation in smart lighting technologies and integrated healthcare systems continues to influence examination light development patterns.

The growing focus on connected healthcare infrastructure is driving development of intelligent examination lighting systems that integrate with electronic health records, environmental control systems, and digital health monitoring platforms. Advanced smart lighting solutions enable automated light adjustment based on procedure requirements, real-time energy monitoring, and predictive maintenance capabilities that optimize healthcare facility operations while enhancing clinical workflow efficiency.

Modern examination light manufacturers are developing specialized lighting solutions for specific medical applications, including dermatology, gynecology, dental procedures, and ENT examinations that require unique illumination characteristics and mounting configurations. Customized lighting systems provide optimized color rendering, adjustable intensity controls, and specialized beam patterns that enhance diagnostic accuracy while meeting specific procedural requirements across diverse medical specialties.

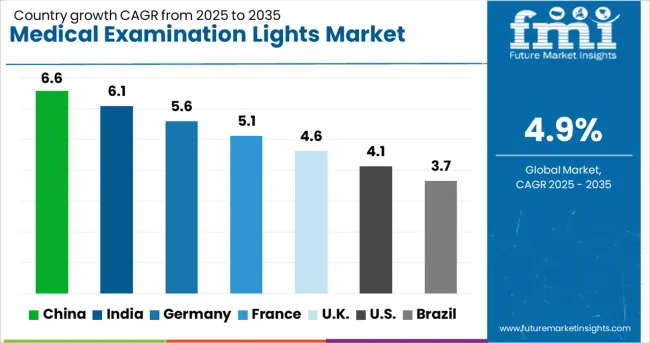

| Country | CAGR (2025-2035) |

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| United Kingdom | 4.6% |

| United States | 4.1% |

| Brazil | 3.7% |

The medical examination lights market is growing across global markets, with China leading at a 6.6% CAGR through 2035, driven by massive healthcare infrastructure expansion and increasing hospital construction that creates substantial demand for advanced examination lighting systems, followed by India at 6.1% supported by medical tourism growth and expanding private healthcare sector development, while Germany records 5.6% emphasizing advanced medical technology and quality standards, France grows at 5.1% with healthcare excellence initiatives and facility modernization programs, the United Kingdom shows 4.6% growth focusing on NHS modernization and healthcare efficiency improvements, the United States expands at 4.1% with technology innovation and comprehensive medical facility construction, and Brazil maintains 3.7% growth supported by healthcare system development and increasing medical equipment quality awareness that drives adoption of reliable examination lighting solutions across diverse healthcare settings.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from medical examination lights in China is projected to exhibit the highest growth rate with a CAGR of 6.6% through 2035, driven by massive healthcare infrastructure expansion, increasing hospital construction, and growing adoption of advanced medical equipment across public and private healthcare facilities. The country's comprehensive healthcare modernization programs are creating substantial demand for high-quality examination lighting systems. Major medical equipment manufacturers are establishing production and distribution capabilities to serve growing domestic and regional markets.

Revenue from medical examination lights in India is expanding at a CAGR of 6.1%, supported by growing medical tourism industry, expanding private healthcare sector, and increasing government investments in public health infrastructure, which drive demand for quality medical equipment, including examination lighting systems. The country's cost-effective healthcare delivery and skilled medical workforce are attracting domestic and international healthcare investments. Medical equipment suppliers are developing localized products and service capabilities.

Demand for medical examination lights in Germany is projected to grow at a CAGR of 5.6%, supported by leadership in medical technology development, established healthcare infrastructure, and stringent quality standards that drive adoption of high-performance examination lighting systems. German healthcare facilities are implementing comprehensive lighting solutions that emphasize clinical effectiveness, energy efficiency, and long-term reliability. The market is characterized by a focus on innovation, precision, and environmental friendliness.

Demand for medical examination lights in France is expanding at a CAGR of 5.1%, driven by established healthcare system, comprehensive medical infrastructure, and growing focus on healthcare quality improvement that requires advanced examination lighting solutions. French healthcare facilities are implementing modern lighting technologies that enhance clinical capabilities while supporting energy efficiency goals. The market benefits from strong healthcare spending and established medical equipment procurement practices.

Demand for medical examination lights in the UK is growing at a CAGR of 4.6%, supported by National Health Service modernization programs, focus on healthcare efficiency, and growing adoption of energy-efficient medical equipment that reduces operational costs while maintaining clinical effectiveness. British healthcare facilities are prioritizing examination lighting solutions that provide superior performance and cost-effectiveness. The market is characterized by a focus on evidence-based procurement and clinical outcomes.

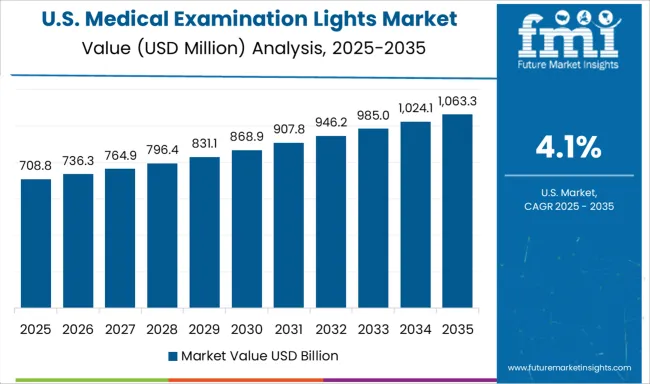

Demand for medical examination lights in the USA is expanding at a CAGR of 4.1%, driven by advanced healthcare infrastructure, comprehensive medical technology adoption, and ongoing healthcare facility construction that creates demand for state-of-the-art examination lighting systems. Large healthcare systems are implementing comprehensive lighting modernization programs that emphasize LED technology and smart building integration. The market benefits from robust healthcare spending and established medical equipment markets.

Revenue from medical examination lights in Brazil is growing at a CAGR of 3.7%, driven by expanding healthcare system, increasing public and private healthcare investments, and growing awareness of medical equipment quality that supports adoption of advanced examination lighting solutions. The country's large population and improving healthcare access are creating opportunities for medical equipment expansion. Companies are developing cost-effective solutions tailored to Brazilian healthcare market requirements.

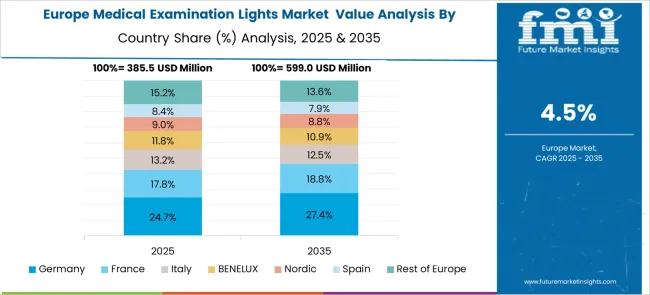

The European medical examination lights market is characterized by mature healthcare systems and comprehensive regulatory frameworks that promote high-quality medical equipment adoption across diverse healthcare facilities. Countries across the region maintain stringent quality standards and energy efficiency requirements that drive adoption of advanced LED examination lighting technologies while supporting clinical effectiveness and operational cost optimization. The market benefits from established medical equipment procurement processes, comprehensive healthcare infrastructure, and strong focus on patient safety and clinical quality that creates demand for innovative examination lighting solutions across hospitals, outpatient facilities, and specialty medical centers.

The medical examination lights market is defined by competition among medical equipment manufacturers, lighting technology specialists, and healthcare infrastructure suppliers offering diverse examination lighting solutions for medical facilities and clinical applications. Companies are investing in LED technology advancement, smart lighting integration, energy efficiency optimization, and clinical application development to deliver high-performance examination lights that meet evolving healthcare facility requirements and clinical workflow needs. Strategic partnerships, product innovation, and global distribution expansion are central to strengthening product portfolios and market positioning.

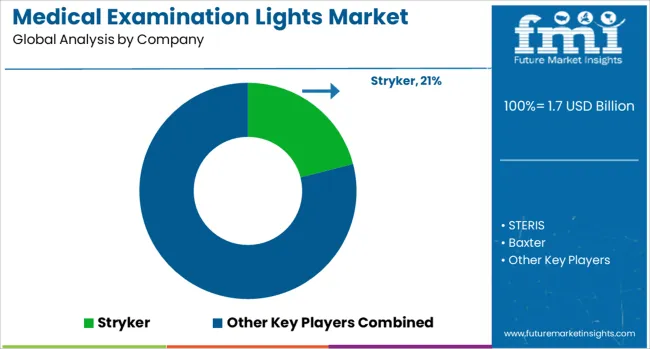

Major examination lighting manufacturers maintain comprehensive product development capabilities and extensive clinical support services that enable healthcare facilities to implement optimal lighting solutions for diverse medical applications and facility configurations. Stryker, USA-based, offers comprehensive examination lighting portfolios emphasizing clinical performance and operational reliability across surgical and examination applications. STERIS provides advanced medical lighting solutions with a focus on infection control and clinical effectiveness. Baxter delivers specialized examination lighting systems with a focus on healthcare facility integration and workflow optimization.

IndoSurgicals Private Limited and TECHNOMED INDIA offer cost-effective lighting solutions tailored to emerging market requirements. S.I.M.E.O.N. Medical GmbH & Co. KG, Medical Illumination, Skytron LLC, Burton Medical LLC, SHANGHAI HUIFENG MEDICAL INSTRUMENT CO. LTD., Photonic Optische Geräte (WILD Group), Dr. Mach GmbH & Co. KG, Brandon Medical, Derungs Light AG, Waldmann Lighting (Waldmann Group), and Getinge provide specialized examination lighting expertise, advanced technology integration, and comprehensive service support across global and regional healthcare markets.

| Item | Value |

| Quantitative Units | USD 2.7 billion |

| Product Type | LED Examination Lights, Halogen Examination Lights, Others |

| Mounting Type | Ceiling-Mounted, Wall-Mounted, Mobile/Floor-Standing, Head Lights/Lamps/Clamp-On, Combination, Others |

| Application | General Examination, Gynecological Examination, Dental Examination, ENT Examination, Dermatology, Others |

| End Use | Hospitals, Outpatient Facilities, Academic & Research Institutions, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Stryker; STERIS; Baxter; IndoSurgicals Private Limited; TECHNOMED INDIA; S.I.M.E.O.N. Medical GmbH & Co. KG; Medical Illumination; Skytron, LLC; Burton Medical, LLC; SHANGHAI HUIFENG MEDICAL INSTRUMENT CO., LTD.; Photonic Optische Geräte (WILD Group); Dr. Mach GmbH & Co. KG; Brandon Medical; Derungs Light AG; Waldmann Lighting (Waldmann Group); Getinge |

| Additional Attributes | Dollar sales by product type, mounting type, application, and end use, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established medical equipment manufacturers and lighting technology specialists, adoption of LED technology and energy-efficient lighting solutions, integration with smart healthcare infrastructure and digital health monitoring systems, innovations in specialty medical lighting applications and customized solutions, and development of comprehensive clinical workflow optimization and facility management capabilities. |

The global medical examination lights market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the medical examination lights market is projected to reach USD 2.7 billion by 2035.

The medical examination lights market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in medical examination lights market are led examination lights and halogen examination lights.

In terms of mounting outlook , ceiling-mounted segment to command 40.0% share in the medical examination lights market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA