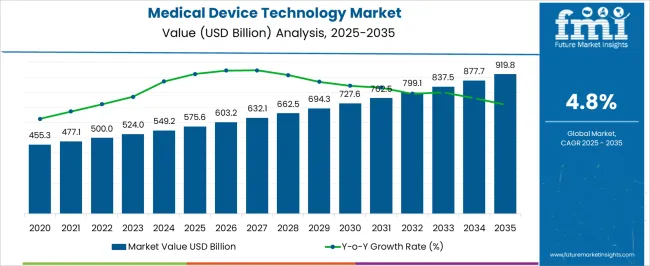

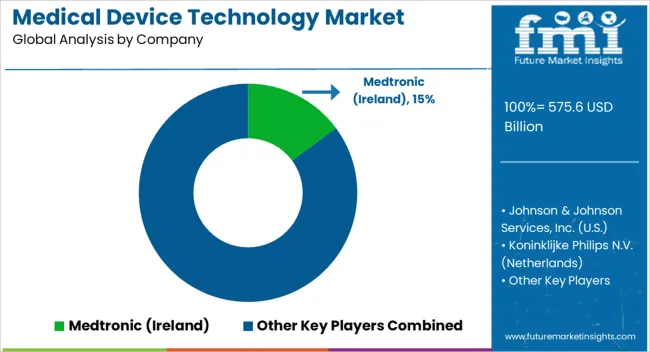

The Medical Device Technology Market is estimated to be valued at USD 575.6 billion in 2025 and is projected to reach USD 919.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Medical Device Technology Market Estimated Value in (2025 E) | USD 575.6 billion |

| Medical Device Technology Market Forecast Value in (2035 F) | USD 919.8 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The medical device technology market is witnessing steady growth, driven by increasing demand for innovative healthcare solutions and advanced medical equipment across hospitals, clinics, and outpatient care centers. Rising investments in healthcare infrastructure, coupled with the growing prevalence of chronic diseases and aging populations, are boosting the adoption of medical devices.

Technological advancements in diagnostic, therapeutic, and monitoring devices are enhancing clinical outcomes and improving operational efficiency in healthcare facilities. Integration of digital health solutions, artificial intelligence, and connected devices is further expanding the capabilities of medical devices, enabling real-time monitoring, predictive analytics, and personalized treatment plans.

Regulatory approvals and standards for safety and efficacy are supporting the adoption of high-quality devices, while healthcare providers are increasingly prioritizing devices that improve patient care and workflow efficiency As healthcare spending continues to rise globally, and hospitals seek scalable, interoperable, and precise medical technologies, the market is expected to maintain robust growth over the coming decade.

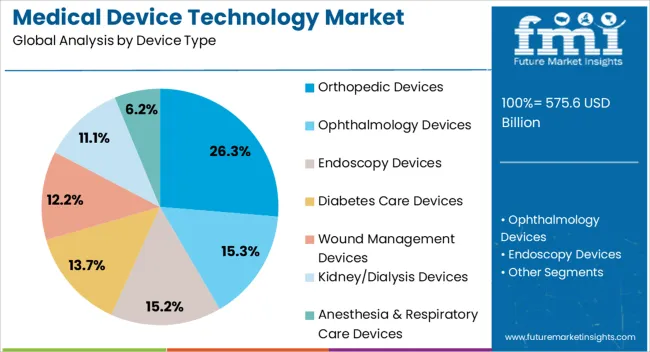

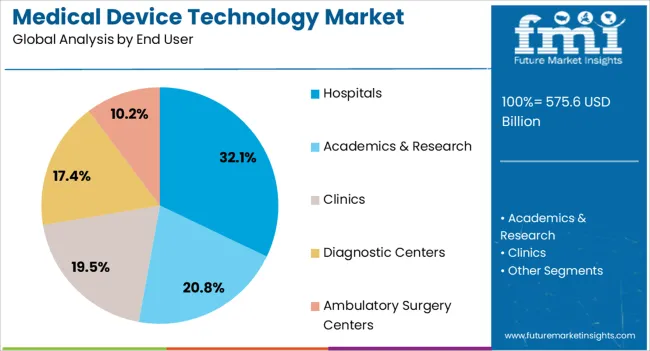

The medical device technology market is segmented by device type, end user, and geographic regions. By device type, medical device technology market is divided into Orthopedic Devices, Ophthalmology Devices, Endoscopy Devices, Diabetes Care Devices, Wound Management Devices, Kidney/Dialysis Devices, and Anesthesia & Respiratory Care Devices. In terms of end user, medical device technology market is classified into Hospitals, Academics & Research, Clinics, Diagnostic Centers, and Ambulatory Surgery Centers. Regionally, the medical device technology industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The orthopedic devices segment is projected to hold 26.3% of the medical device technology market revenue share in 2025, making it the leading device type. This dominance is being driven by the rising prevalence of musculoskeletal disorders, including fractures, arthritis, and osteoporosis, which have created strong demand for implants, prosthetics, and surgical instruments. Technological advancements in minimally invasive procedures, smart implants, and customized orthopedic solutions are enhancing patient outcomes and recovery times.

The segment benefits from the ability of orthopedic devices to improve mobility and quality of life, which is particularly valued in aging populations. Hospitals and specialized orthopedic centers are increasingly investing in advanced devices that support precision surgery and efficient post-operative care.

The segment’s growth is also supported by ongoing research and development, allowing manufacturers to offer innovative materials, design improvements, and digital integration for enhanced monitoring These factors collectively reinforce the segment’s leadership position in the medical device technology market.

The hospitals end-user segment is expected to account for 32.1% of the medical device technology market revenue share in 2025, establishing it as the leading end-user category. This is being driven by the concentration of critical care, surgical, and diagnostic services in hospitals, which require high-performance, reliable, and interoperable medical devices. Hospitals are prioritizing devices that enhance patient safety, operational efficiency, and treatment precision, which increases demand for technologically advanced solutions.

Investments in hospital infrastructure, modernization of surgical suites, and adoption of connected medical systems are further boosting market growth. Additionally, hospitals are leveraging digital health integration, real-time monitoring, and advanced imaging and surgical technologies to optimize clinical outcomes and streamline workflows.

Regulatory compliance, accreditation standards, and increasing patient expectations for high-quality care are also driving hospitals to adopt state-of-the-art medical devices As global healthcare infrastructure expands and hospitals continue to invest in advanced technologies, this end-user segment is anticipated to maintain its leadership in market revenue share.

The primary driver of the industry is the aging population and the increasing prevalence of chronic diseases. As populations age globally, the incidence of chronic conditions such as cardiovascular diseases, diabetes, and orthopedic disorders rises.

Medical devices play a crucial role in the diagnosis, treatment, and management of the conditions, driving demand for innovative technologies that can address the unique needs of aging patients.

Advancements in medical device technologies, such as implantable devices, remote monitoring systems, and minimally invasive surgical tools, cater to the specific healthcare requirements of elderly populations, contributing to medical device technology market growth.

A significant restraint in the industry is the stringent regulatory requirements imposed by regulatory bodies worldwide. Regulatory compliance is essential for ensuring the safety, efficacy, and quality of medical devices, but the complex and lengthy approval processes can delay market entry and increase development costs for manufacturers.

Frequent changes in regulations and varying requirements across different regions pose challenges for companies seeking to navigate the regulatory landscape. Compliance with regulatory standards necessitates substantial investments in research, testing, and documentation, which can deter smaller companies from entering the industry and limit innovation.

An opportunity in the medical device technology market lies in the rise of telemedicine and remote monitoring solutions. The increasing adoption of telehealth services, spurred by the COVID 19 pandemic and the need for remote healthcare delivery, creates a demand for medical devices that enable virtual consultations, remote patient monitoring, and home based diagnostics.

Devices such as wearable sensors, remote monitoring systems, and telemedicine platforms offer healthcare providers real time access to patient data, facilitating timely interventions and continuity of care.

The expansion of telemedicine presents opportunities for medical device manufacturers to develop innovative technologies tailored to the growing telehealth industry, enhancing patient outcomes and expanding access to healthcare services, opening new opportunities in the industry.

A notable trend in the medical device technology market is the integration of artificial intelligence and machine learning algorithms into medical devices. Artificial intelligence powered technologies enhance the capabilities of medical devices by enabling automated data analysis, predictive analytics, and personalized treatment recommendations.

Medical devices equipped with artificial intelligence algorithms can improve diagnostic accuracy, optimize treatment plans, and streamline workflow processes for healthcare providers. Artificial intelligence driven medical devices facilitate remote monitoring and telemedicine initiatives, enabling more efficient and cost effective healthcare delivery.

The integration of artificial intelligence and machine learning represents a transformative trend in the medical device technology market, driving innovation, improving patient care, and shaping the future of healthcare delivery industry.

In the United States, 3D printing in medical device manufacturing is a driving force in the industry, revolutionizing the industry. This technology allows for the production of highly customized, patient specific medical devices with unparalleled precision and efficiency.

From implants and prosthetics to surgical guides and anatomical models, 3D printing enables the creation of complex devices tailored to individual patient anatomy.

This level of customization enhances treatment outcomes, reduces surgical complications, and improves patient satisfaction. As 3D printing technology continues to advance, its widespread adoption is expected to reshape the medical device technology industry in the United States.

Implantable bioelectronics is driving the medical device technology industry in the United Kingdom. The innovative devices utilize electrical stimulation to modulate neural activity, offering targeted therapy for various medical conditions.

In the United Kingdom, implantable bioelectronics are gaining prominence for treating chronic pain, neurological disorders, and metabolic diseases with fewer side effects compared to traditional treatments.

The growing demand for personalized medicine and advancements in bioelectronics technology are driving market growth, offering new avenues for disease management and improving patient outcomes in the United Kingdom medical device technology market.

Wearable health monitoring devices are driving the medical device technology market in India by revolutionizing healthcare accessibility and delivery. The devices offer real time monitoring of vital signs, activity levels, and other health metrics, empowering individuals to take proactive control of their well being.

With vast population and growing healthcare needs in India, wearable devices provide scalable solutions for remote patient monitoring, chronic disease management, and preventive care.

Advancements in sensor technology and data analytics enhance the accuracy and usability of wearable devices, making them indispensable tools in evolving healthcare industry of India further driving the medical device technology market growth.

In the medical device technology market, the dominant segment by device type is diagnostic imaging devices. The devices, including X ray machines, MRI scanners, and ultrasound systems, play a critical role in diagnosing various medical conditions by producing detailed images of internal body structures.

Diagnostic imaging devices are widely used across healthcare settings for their versatility, accuracy, and non invasive nature. Diagnostic imaging devices aid healthcare providers in making informed clinical decisions, guiding treatment planning, and monitoring patient progress.

Given their indispensable role in modern medicine, diagnostic imaging devices hold a significant industry share and are essential components of healthcare delivery systems worldwide.

Hospitals emerge as the dominant segment by end user in the medical device technology industry. Hospitals serve as major hubs for healthcare delivery, diagnosis, and treatment, requiring a diverse range of medical devices to cater to various patient needs.

From diagnostic imaging equipment to surgical instruments and patient monitoring devices, hospitals rely heavily on medical technology to provide comprehensive care to patients.

The large scale operations and infrastructure of hospitals make them significant contributors to the demand for medical device technologies, consolidating their position as the leading end user segment in the medical device technology industry.

In the competitive landscape of the medical device technology industry, several key players vie for dominance, each bringing unique strengths and innovations to the forefront. Established corporations with extensive resources and global reach compete alongside nimble startups, driving innovation and industry expansion.

Strategic partnerships, mergers, and acquisitions are common strategies employed to enhance product portfolios and gain competitive advantage. Regulatory compliance, technological advancements, and customer satisfaction play pivotal roles in shaping industry dynamics.

The competitive landscape is dynamic and evolving, with companies continuously striving to develop cutting edge technologies and maintain industry leadership in this rapidly advancing industry.

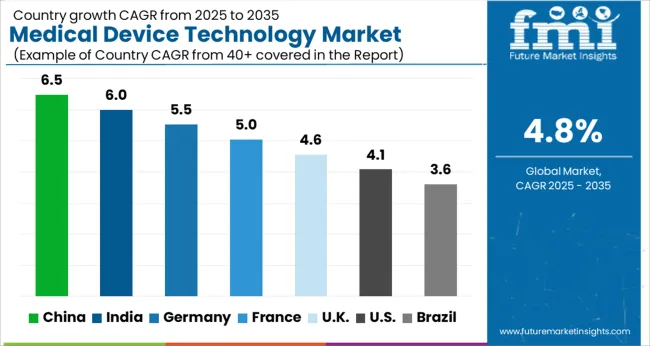

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

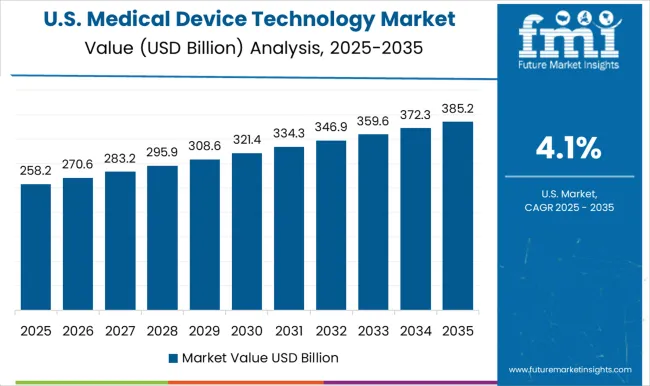

| USA | 4.1% |

| Brazil | 3.6% |

The Medical Device Technology Market is expected to register a CAGR of 4.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.5%, followed by India at 6.0%. Developed markets such as Germany, France, and the Kcontinue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.6%, yet still underscores a broadly positive trajectory for the global Medical Device Technology Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.5%. The USA Medical Device Technology Market is estimated to be valued at USD 199.7 billion in 2025 and is anticipated to reach a valuation of USD 297.9 billion by 2035. Sales are projected to rise at a CAGR of 4.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 29.9 billion and USD 15.9 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 575.6 Billion |

| Device Type | Orthopedic Devices, Ophthalmology Devices, Endoscopy Devices, Diabetes Care Devices, Wound Management Devices, Kidney/Dialysis Devices, and Anesthesia & Respiratory Care Devices |

| End User | Hospitals, Academics & Research, Clinics, Diagnostic Centers, and Ambulatory Surgery Centers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Medtronic (Ireland), Johnson & Johnson Services, Inc. (USA), Koninklijke Philips N.V. (Netherlands), F. Hoffmann-La Roche Ltd. (Switzerland), Boston Scientific Corporation (USA), Fresenius Medical Care AG (Germany), GE Healthcare (USA), Siemens Healthineers AG (Germany), Stryker (USA), Abbott (USA), BD (USA), and Cardinal Health (USA) |

The global medical device technology market is estimated to be valued at USD 575.6 billion in 2025.

The market size for the medical device technology market is projected to reach USD 919.8 billion by 2035.

The medical device technology market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in medical device technology market are orthopedic devices, ophthalmology devices, endoscopy devices, diabetes care devices, wound management devices, kidney/dialysis devices and anesthesia & respiratory care devices.

In terms of end user, hospitals segment to command 32.1% share in the medical device technology market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Packaging Market Size, Share & Forecast 2025 to 2035

Medical Device & Equipment Tags Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Understanding Market Share Trends in Medical Device Packaging

Medical Device Analytical Testing Outsourcing Market Trends – Growth & Forecast 2024-2034

Medical Cleaning Devices Market Overview - Trends & Forecast 2025 to 2035

Medical EMR Input Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Terahertz Technology Market Trends - Growth & Forecast 2025 to 2035

Cardiac Medical Device Market

Wearable Medical Device Market Size and Share Forecast Outlook 2025 to 2035

Portable Medical Devices Market Analysis - Growth & Forecast 2025 to 2035

Homecare Medical Devices Market Outlook – Industry Growth & Forecast 2025 to 2035

Aesthetic Medical Device Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

AI-enabled Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Medical Devices Market is segmented by drug type, treatment and distribution channel from 2025 to 2035

Reprocessed Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA