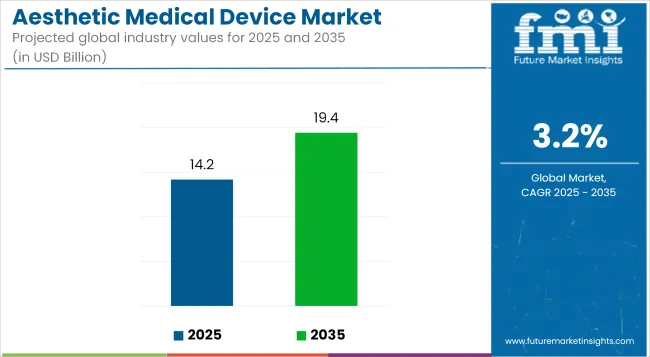

The global aesthetic medical device market is expected to grow significantly, with an estimated market size of USD 14.17 billion in 2025 and projected to reach USD 19.42 billion by 2035, reflecting a CAGR of 3.2%. This growth is driven by rising consumer demand for non-invasive and minimally invasive aesthetic treatments, as well as advancements in medical technologies.

The increasing awareness and preference for aesthetic procedures are driving this trend. Aesthetic devices, ranging from facial aesthetics to body contouring and hair removal, have become increasingly popular due to their ability to offer effective treatments with minimal downtime and discomfort.

Several companies are playing a key role in shaping the market's growth through innovative product launches. In 2023, Alma Lasers launched the Alma Veil, a multi-application platform that integrates artificial intelligence (AI) to enhance treatment precision. Later in July 2023, the company introduced the Alma Harmony, a state-of-the-art aesthetic platform designed to offer a range of versatile in-office treatments.

By 2025, Alma Lasers continued its innovation trajectory, focusing on evidence-based solutions and personalized treatments to meet the evolving needs of patients. These innovations are enhancing the precision and outcomes of aesthetic procedures, thereby driving the market forward.

Similarly, Merz Aesthetics is advancing its R&D efforts by appointing Samantha Kerr, Ph.D., as Chief Scientific Officer in March 2025. The company also expanded the versatility of its Radiesse® product, with approval from Health Canada in June 2025 for the treatment of moderate wrinkles in the décolleté area.

The aesthetic medical device market also benefits from the increasing focus on minimally invasive procedures and personalized treatments. With the growing demand for non-invasive procedures, companies are increasingly adopting advanced technologies such as AI, machine learning, and real-time data integration into their devices.

Emerging markets, especially in Asia-Pacific, are contributing significantly to market growth as improving healthcare infrastructure and rising disposable incomes make aesthetic treatments more accessible. Despite challenges such as high treatment costs and regulatory hurdles, the demand for aesthetic devices is expected to continue growing, with technological advancements playing a key role in expanding the market.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 14.17 billion |

| Market Size in 2035 | USD 19.42 billion |

| CAGR (2025 to 2035) | 3.2% |

The aesthetic medical device market is set to grow significantly, driven by key segments such as energy-based aesthetic devices and applications in skin resurfacing and tightening. Energy-based devices are expected to dominate the product segment, while skin resurfacing and tightening will remain the leading application segment due to their increasing popularity in non-invasive cosmetic procedures.

Energy-based aesthetic devices are expected to dominate the product segment, capturing 60% of the market share by 2025. These devices, which use various forms of energy such as laser, radiofrequency, ultrasound, and light to perform cosmetic procedures, are widely preferred due to their effectiveness, non-invasive nature, and minimal recovery time.

They are commonly used in procedures like hair removal, wrinkle reduction, fat reduction, and skin rejuvenation. Leading companies such as Cynosure, Lumenis, and Candela Corporation are developing advanced energy-based aesthetic devices, offering innovative solutions that cater to the growing demand for aesthetic treatments.

The rise in consumer interest in non-invasive cosmetic procedures, combined with technological advancements in energy-based devices, is expected to drive the growth of this segment. These devices are becoming more accessible and affordable, contributing to their widespread adoption in aesthetic practices worldwide.

Skin resurfacing and tightening are projected to capture 15% of the application segment market share by 2025. These procedures are in high demand due to their ability to improve skin appearance, reduce wrinkles, and restore youthful skin without the need for invasive surgery.

Skin resurfacing typically involves techniques like laser therapy, which removes damaged skin layers to reveal fresher, smoother skin. Skin tightening, on the other hand, uses energy-based devices like radiofrequency and ultrasound to stimulate collagen production and tighten the skin.

The growing interest in anti-aging treatments and the increasing popularity of minimally invasive procedures are driving the demand for skin resurfacing and tightening applications. Companies such as Alma Lasers, Syneron Candela, and Sciton are at the forefront of providing advanced solutions for skin resurfacing and tightening.

As consumers seek effective and non-invasive ways to maintain youthful skin, the skin resurfacing and tightening segment is expected to experience continued growth, solidifying its position in the aesthetic medical device market.

The aesthetic medical device market is anticipated to surpass a valuation of USD 18.82 billion by 2035. The market is expected to rise at a 3.2% CAGR through 2035. While the market is expected to experience remarkable growth, several factors could adversely affect its development:

| Details | Attributes |

|---|---|

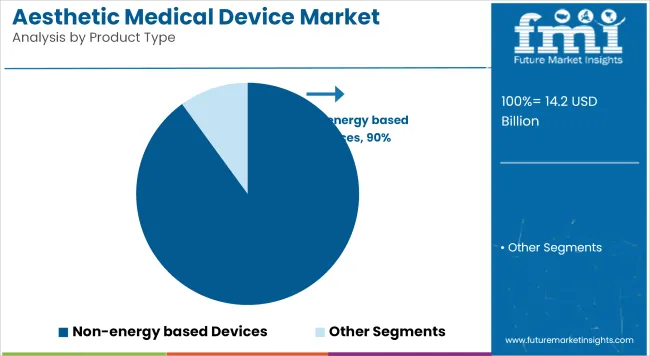

| Top Product | Non-energy based Devices |

| Market Share in 2025 | 89.99% |

Depending on the product, the aesthetic medical device market is bifurcated into energy-based aesthetic devices, laser-assisted liposuction devices, laser resurfacing devices, non-energy-based aesthetic devices, etc. The non-energy-based devices segment is anticipated to hold a market value of 89.99%.

| Attributes | Details |

|---|---|

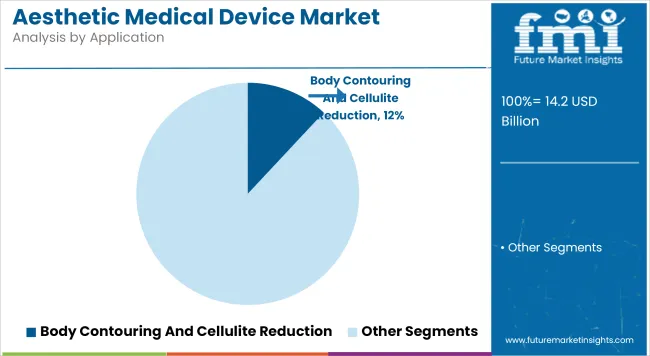

| Top Application | Body Contouring And Cellulite Reduction |

| Market Share in 2025 | 11.94% |

The aesthetic medical device market is categorized by applications such as anti-aging, wrinkle reduction, facelift, lip augmentation, and body contouring and cellulite reduction. The body contouring and cellulite reduction sector dominates the market with a share of 11.94%.

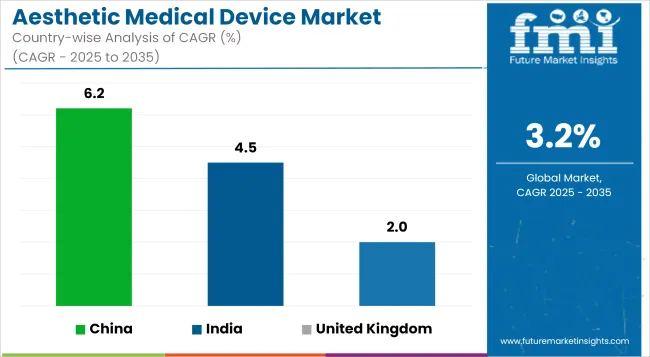

The section provides an analysis of the aesthetic medical device market by country, including India, China, and the United Kingdom. The table presents the CAGR for each country, indicating the expected growth of the market in that country through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 6.20% |

| India | 4.50% |

| United Kingdom | 2.00% |

China leads the global aesthetic medical device market. Over the next ten years, the Chinese demand for aesthetic medical devices is projected to rise at a 6.20% CAGR.

Over the years, China is become one of the largest hubs for medical tourism. Each year, millions of individuals flock to the country to take advantage of its advanced medical facilities. This has pushed healthcare facilities in China to adopt and acquire sophisticated facial aesthetic devices to cater to the demands of these tourists. Besides this, the government in China has always promoted the cosmetic industry, which has further encouraged companies to enter the market space.

The Indian aesthetic medical device market is anticipated to retain its dominance by progressing at an annual growth rate of 4.50% through 2035.

The Indian healthcare sector, in the last few decades, has been going through a watershed moment. Various government schemes and initiatives have brought a substantial amount of Indians into the healthcare sector. This has considerably increased the number of potential consumers in the country. Apart from this, government schemes and subsidies are also pushing companies to offer sophisticated facial rejuvenating treatments to consumers, which is eventually augmenting the market growth.

The United Kingdom aesthetic medical device market is anticipated to register a CAGR of 2.00% until 2035.

The United Kingdom is blessed with a multitude of reasons that make it one of the leading countries in this market. First and foremost, are the ongoing beauty trends due to social media and the effect of social media influencers on the general public.

Women and men take inspiration from these beauty influencers, which is generating an excellent demand for aesthetic medical devices in the country. Also, the rising disposable income of the middle-class population is contributing significantly to the growth of the aesthetic medical device market in the United Kingdom.

The global market for aesthetic medical devices consists of companies that have a strong foothold due to their prolonged presence in the industry. Some of the prominent companies in the aesthetic medical device industry are Alma Lasers, Merz Pharma, Bausch Health Companies Inc., Lumenis Be Ltd., Venus Concept, etc.

These companies are investing millions of dollars to make their offerings inexpensive so that the general population, especially in emerging economies, can afford them. Besides this, they are also collaborating with social media influencers, with millions of virtual followers, to market their products effectively.

Recent Developments

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 14.17 billion |

| Market Size in 2035 | USD 19.42 billion |

| CAGR (2025 to 2035) | 3.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed | Energy-Based Aesthetic Devices (Laser-Assisted Liposuction (LAL), Laser Resurfacing Devices, RFAL Devices, PAL Devices, UAL Devices, IPL Equipment, Cellulite Reduction Devices), Non-Energy Based Aesthetic Devices (Facial Aesthetics Products, Dermal Fillers, Botulinum Toxin Injections, Microdermabrasions/Chemical Peels, PRP, Microneedling, Implants) |

| Applications Analyzed | Skin Resurfacing and Tightening, Anti-Aging, Wrinkle Reduction, Face Lift, Lip Augmentation, Acne & Scar Treatment, Hair Removal, Body Contouring and Cellulite Reduction, Tattoo Removal, Breast Augmentation, Abdominoplasty, Lower Body Lift, Upper Body Lift, Liposuction, Dermabrasion, Dentistry, Others |

| Body Parts Analyzed | Face, Eyes, Nose, Lip, Ears, Body and Extremities (Arms, Elbow, Buttocks, Feet, Thigh, Breast, Neck, Scalp) |

| End-User Categories Analyzed | Hospitals, Ambulatory Surgical Clinics, Free Standing Aesthetic Centers, Dermatology and Cosmetology Clinics, Dental Clinics, Medical Spas and Wellness Centers |

| Regions Covered | North America, Latin America, Asia Pacific, Middle East and Africa (MEA), Europe |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, GCC Countries, South Africa |

| Key Players influencing the Market | Alma Lasers, Merz Pharma, Bausch Health Companies Inc., Lumenis Be Ltd., Venus Concept, Candela Corporation, Cutera Inc., Fotona, InMode, Asclepion Laser Technologies GmbH, Quanta System |

| Additional Attributes | Dollar sales by product type (energy-based vs non-energy-based), Dollar sales by application (anti-aging, wrinkle reduction, etc.), Growth trends in aesthetic treatments across body parts, Regional demand dynamics across key markets in North America, Europe, and Asia-Pacific |

The global aesthetic medical device market is expected to be worth USD 14.17 billion in 2025.

The market for aesthetic medical devices is expected to reach USD 19.42 billion by 2035.

The aesthetic medical device market is growing at a CAGR of 3.2% from 2025 to 2035.

Alma Lasers, Merz Pharma, Bausch Health Companies Inc., Lumenis Be Ltd., Venus Concept, etc., and 3M Company, etc. are some of the major players in the market for aesthetic medical devices.

The valuation for the aesthetic medical device market was USD 13.24 billion in 2024.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by End User, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by End User, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Technology, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End User, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 21: Global Market Attractiveness by Technology, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by End User, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Technology, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by End User, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 45: North America Market Attractiveness by Technology, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by End User, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Technology, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by End User, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Technology, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 71: Latin America Market Attractiveness by End User, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Technology, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Technology, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by End User, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Technology, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Technology, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by End User, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Technology, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Technology, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Technology, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by End User, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Technology, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 167: East Asia Market Attractiveness by End User, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Technology, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Technology, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by End User, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aesthetic Medicine And Cosmetic Surgery Market

Brazil Aesthetic Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Lamps And Units For Aesthetic Medicine Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Smart Drug Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Medical Anti-Decubitus Air Mattress Market Size and Share Forecast Outlook 2025 to 2035

Medical Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Medical Biodegradable Magnesium Alloy Market Size and Share Forecast Outlook 2025 to 2035

Medical Holography Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA