The remote patient monitoring (RPM) devices market is advancing rapidly, propelled by the global shift toward decentralized healthcare and the growing burden of chronic diseases. Clinical studies and hospital reports have emphasized the critical role of RPM technologies in enhancing patient outcomes, reducing hospital readmissions, and enabling timely clinical interventions.

The integration of digital health ecosystems with cloud-based platforms, AI analytics, and mobile connectivity has expanded the clinical utility of RPM devices across a range of conditions. Strategic investments from healthcare providers and medical device manufacturers have accelerated the development of compact, real-time monitoring solutions designed for continuous tracking of vital parameters.

Additionally, reimbursement reforms and digital health regulations in key markets have facilitated broader adoption across both inpatient and outpatient care models. Future growth is expected to be influenced by increased deployment of connected monitoring solutions in cardiac and post-acute care, rising demand from aging populations, and ongoing innovation in wearable health technologies. Leading the market are Vital Sign Monitors by product type, Cardiovascular Diseases by application, and Hospital-Based Patients in end-use due to their critical role in acute care and chronic disease management.

| Metric | Value |

|---|---|

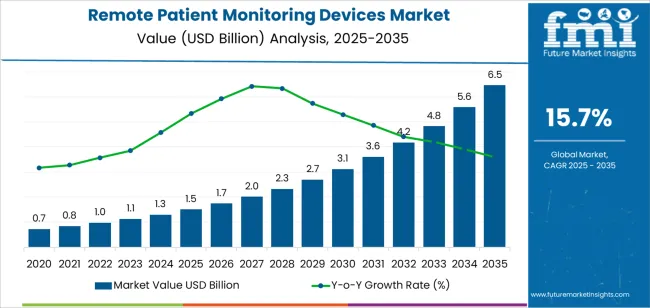

| Remote Patient Monitoring Devices Market Estimated Value in (2025 E) | USD 1.5 billion |

| Remote Patient Monitoring Devices Market Forecast Value in (2035 F) | USD 6.5 billion |

| Forecast CAGR (2025 to 2035) | 15.7% |

The market is segmented by Product Type, Application, and End User and region. By Product Type, the market is divided into Vital Sign Monitors and Special Monitors. In terms of Application, the market is classified into Cardiovascular Diseases, Diabetes, Cancer, Hypertension, Infections, Bronchitis, Dehydration, Sleep Disorder, and Others. Based on End User, the market is segmented into Hospital-Based Patients, Homecare, Ambulatory Patients, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

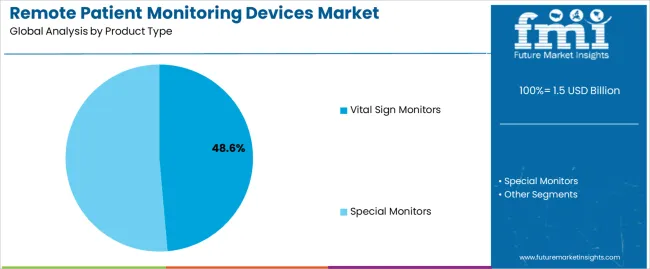

The Vital Sign Monitors segment is projected to account for 48.6% of the remote patient monitoring devices market revenue in 2025, maintaining its lead among product categories. This dominance has been driven by the essential role of vital sign tracking in continuous patient assessment and early detection of clinical deterioration.

Devices monitoring parameters such as heart rate, blood pressure, temperature, and oxygen saturation have been widely adopted in both hospital and homecare settings. Medical institutions have favored vital sign monitors for their real-time alerting capabilities and seamless integration with electronic health records.

The miniaturization of sensors and the availability of wireless data transmission have enhanced usability and patient compliance. Moreover, the COVID-19 pandemic accelerated the deployment of contactless and remote monitoring tools, reinforcing demand for vital sign tracking. With ongoing advancements in wearable sensor technology and AI-powered data interpretation, the Vital Sign Monitors segment is expected to retain its dominant position across multiple care settings.

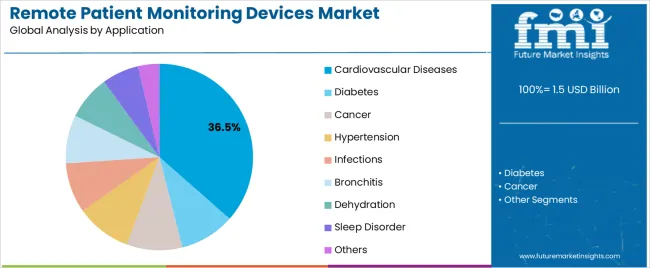

The Cardiovascular Diseases segment is projected to contribute 36.5% of the remote patient monitoring devices market revenue in 2025, establishing itself as the leading application category. This growth has been supported by the high global prevalence of heart-related conditions and the need for ongoing, real-time cardiac monitoring.

Clinical data has underscored the effectiveness of RPM in managing hypertension, arrhythmias, heart failure, and post-surgical cardiac care, reducing the risk of acute events through early intervention. Hospitals and cardiology practices have increasingly implemented RPM protocols for cardiovascular patients to ensure timely detection of abnormal vital signs and to guide medication adherence.

Regulatory support for reimbursable remote cardiac monitoring programs has expanded patient access, especially in chronic care settings. Additionally, innovations in ECG patch monitors, implantable loop recorders, and cloud-based analytics have improved diagnostic accuracy. As the burden of cardiovascular diseases continues to rise globally, this segment is expected to remain a priority area for RPM technology deployment.

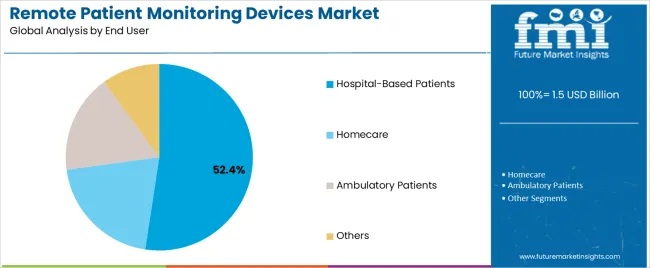

The Hospital-Based Patients segment is projected to hold 52.4% of the remote patient monitoring devices market revenue in 2025, reinforcing its leadership in end-use adoption. Growth in this segment has been driven by the need for continuous monitoring of high-risk and post-acute patients within hospital settings.

Healthcare institutions have invested in RPM infrastructure to reduce ICU occupancy, improve care coordination, and facilitate early discharge with outpatient follow-up. Hospital-based RPM programs have gained momentum due to their role in preventing adverse events, particularly among patients with chronic illnesses or those recovering from surgery.

Medical device companies have partnered with hospital networks to deploy integrated RPM platforms that connect bedside monitors with centralized dashboards for real-time analytics and clinical decision-making. Additionally, infection control protocols and the need to minimize in-person interactions have strengthened the case for contactless monitoring. As hospitals continue to digitize care delivery pathways and optimize resource allocation, the Hospital-Based Patients segment is expected to remain the primary driver of RPM device utilization.

The transition to value based care models in healthcare is a significant factor. The models prioritize outcomes and cost effectiveness, making remote patient monitoring an appealing option for ongoing patient care and minimizing hospital readmissions.

Patient convenience and the rising inclination for home based treatment both play important roles. Remote patient monitoring enables patients to obtain high quality care without the need for repeated trips to healthcare institutions, hence increasing patient satisfaction and adherence to treatment programs.

The proliferation of high speed internet and mobile connection expands access to remote patient monitoring solutions, including in rural and underserved regions.

The increased emphasis on preventative healthcare is accelerating the implementation of remote patient monitoring. Remote patient monitoring promotes a proactive approach to health maintenance by enabling early diagnosis and control of health concerns, resulting in lower long term healthcare expenditures and better population health outcomes.

The integration of artificial intelligence and machine learning technology is a key development in the remote patient monitoring sector. The new technologies are transforming remote patient monitoring by improving data analysis and prediction capacities, resulting in more precise and faster healthcare treatments.

Artificial intelligence and machine learning systems can evaluate massive volumes of patient data gathered from wearable devices and sensors, recognizing trends and forecasting future health concerns before this becomes urgent.

Artificial intelligence and machine learning provide customized healthcare by adapting treatment strategies based on specific patient data, resulting in better overall patient outcomes. As the technologies improve, their incorporation with remote patient monitoring devices is expected to produce substantial advances in remote healthcare delivery.

The remote patient monitoring devices market in the United States is expanding rapidly, driven by technological improvements, the rising frequency of chronic illnesses, and an aging population.

Remote patient monitoring devices provide continuous monitoring of patients health problems from the comfort of their own homes, decreasing the need for frequent hospital trips and increasing the efficiency of healthcare delivery.

The increased prevalence of cardiovascular illnesses, diabetes, and respiratory ailments, all of which require constant monitoring and care, are key drivers of the market. The COVID 19 pandemic has hastened the deployment of remote patient monitoring devices as healthcare practitioners and patients attempt to avoid physical encounters in order to slow the virus transmission.

Wearable gadgets, smart sensors, and powerful data analytics are changing the way patients are monitored. The gadgets deliver real time health data, allowing for rapid medical interventions and individualized treatment regimens. The integration of telehealth services with remote patient monitoring devices market devices is increasing their usefulness.

Government initiatives and favorable reimbursement regulations are also important factors in encouraging the use of remote patient monitoring devices. The United States is in the lead, with significant expenditures in digital health infrastructure.

The remote patient monitoring devices market in the United States is expected to develop strongly, with improved patient outcomes, lower healthcare expenditures, and a more proactive approach to health management.

The need for remote patient monitoring devices in Germany is developing significantly, owing to the rising frequency of chronic illnesses, an aging population, and ongoing medical technological advances. The COVID 19 pandemic has expedited this trend, emphasizing the need of remote healthcare solutions in reducing hospital overcrowding and lowering infection risks.

Their government and healthcare providers are progressively using remote patient monitoring devices into integrated care approaches. The devices allow for continuous monitoring of patients vital signs.

which improves the management of chronic ailments including diabetes, cardiovascular disease, and respiratory problems. The use of artificial intelligence and machine learning in the devices improves predictive analytics, enabling early intervention and individualized treatment strategies.

The legislative framework in Germany is also changing to facilitate the use of remote patient monitoring technology. The European Union Medical Device Regulation assures that devices fulfill high safety and effectiveness requirements, improving customer trust and driving industry growth.

Reimbursement regulations for telehealth services are improving, promoting greater usage by healthcare providers. Demand for remote patient monitoring devices in Germany is strong, with prospects of ongoing growth.

The remote patient monitoring devices market in India is expanding rapidly, owing to a numerous significant developments. The rising incidence of chronic illnesses such as diabetes, hypertension, and cardiovascular disease demands ongoing health monitoring, which remote patient monitoring devices technologies provide. The expanding aging population needs effective healthcare management systems, which boosts remote patient monitoring devices adoption.

Technological advances, such as the integration of artificial intelligence and machine learning, improve the capabilities of remote patient monitoring devices, making them more accurate and user friendly. The proliferation of smartphones and increased internet connectivity also play an important role in enabling smooth data transfer and real time tracking.

Government measures encouraging digital health and telemedicine services provide substantial assistance for the remote patient monitoring devices industry. The COVID 19 pandemic has increased the use of remote healthcare technologies, emphasizing the significance of reducing hospital visits. As patients and healthcare professionals become more aware and accepting of telehealth services, the remote patient monitoring devices industry in India grows.

Blood pressure monitors are the dominant product type category in the global remote patient monitoring devices market. This is owing to the high incidence of hypertension, which requires regular monitoring for successful therapy. Blood pressure monitors are important for detecting and preventing problems linked with cardiovascular illnesses.

Their ease of use, low cost, and connectivity with mobile health applications make them popular with consumers and healthcare practitioners. The growing awareness of hypertension and the significance of proactive health management fuels demand for blood pressure monitors, driving the market growth.

Cardiovascular diseases are the dominant application segment in the remote patient monitoring device market. This is due to the high incidence and considerable death rates associated with cardiovascular disorders, which necessitate ongoing and precise monitoring.

Remote patient monitoring devices give real time data on essential factors such as heart rate, blood pressure, and oxygen levels, allowing for early intervention and better treatment of cardiac diseases. Developments in wearable technology and increased acceptance of telehealth services support the usage of remote patient monitoring devices for cardiovascular diseases, propelling the segment demand and the market growth.

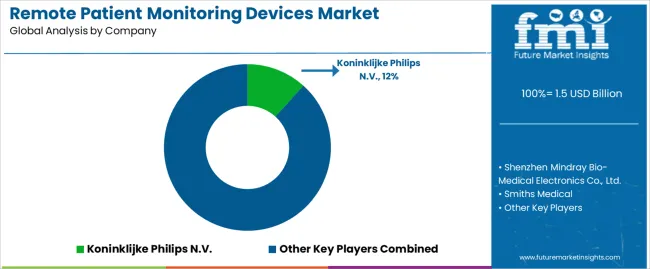

The remote patient monitoring devices market is extremely competitive, fueled by advances in telemedicine and rising demand for home healthcare. Koninklijke Philips N.V., and GE Healthcare are among the leading providers of comprehensive RPM solutions. Emerging firms provide novel, low cost technologies, increasing competition.

The industry is expanding steadily, fueled by technical advancements such as AI integration and wearable health technology. Regulatory support and the increased frequency of chronic illnesses help to drive market growth.

Companies are spending extensively in research and development and strategic alliances to obtain a competitive advantage by improving patient outcomes and streamlining healthcare delivery.

Recent Developments

In June 2025, Koninklijke Philips N.V. has launched its next-generation AI-enabled cardiovascular ultrasound platform, which will assist speed up cardiac ultrasound analysis using proven AI technology while reducing the strain on echocardiography laboratories.

The new FDA 510(k) authorized AI apps, which are integrated into Philips' EPIQ CVx and Affiniti CVx ultrasound systems, considerably expand the company's cardiovascular imaging and diagnosis solutions by automating measurements and speeding up workflows to increase productivity.

In May 2025, Roche announced today that the Tina-quant® lipoprotein Lp(a) RxDx test has been designated as a Breakthrough Device by the United States Food and Drug Administration (FDA) to identify patients who may benefit from a new Lp(a)-lowering medication that is presently being developed. Lp(a) is emerging as a significant, yet underappreciated, prospective risk factor for cardiovascular disease, and a major public health concern.

In terms of product type, the market encompasses vital sign monitors (heart rate monitors (ecg) blood pressure monitors, respiratory rate monitors, brain monitoring (eeg), temperature monitors, pulse oximeters and others) and special monitors (blood glucose monitors, fetal heart monitors, multi-parameter monitors (mpm), anaesthesia monitors, prothrombin monitors and others.

Application segment is categorized into cardiovascular diseases, diabetes, cancer, hypertension, infections, bronchitis, dehydration, sleep disorder, weight management & fitness monitoring and others.

The end user of remote patient monitoring devices hospital based patients, homecare, ambulatory patients and others.

As per region, the industry is divided into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe and Middle East & Africa

The global remote patient monitoring devices market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the remote patient monitoring devices market is projected to reach USD 6.5 billion by 2035.

The remote patient monitoring devices market is expected to grow at a 15.7% CAGR between 2025 and 2035.

The key product types in remote patient monitoring devices market are vital sign monitors, _heart rate monitors (ecg), _blood pressure monitors, _respiratory rate monitors, _brain monitoring (eeg), _temperature monitors, _pulse oximeters, _others, special monitors, _blood glucose monitors, _fetal heart monitors, _multi-parameter monitors (mpm), _anaesthesia monitors, _prothrombin monitors and _others.

In terms of application, cardiovascular diseases segment to command 36.5% share in the remote patient monitoring devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Remote Lockout Tool Market Size and Share Forecast Outlook 2025 to 2035

Remote Desktop Software Market Forecast and Outlook 2025 to 2035

Remote Assist Headrest Market Size and Share Forecast Outlook 2025 to 2035

Remote Valve Tissue Expanders Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Remote Operated Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Remote DC Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Towers Market Size and Share Forecast Outlook 2025 to 2035

Remote AF Detection Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Remote Vehicle Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Remote Learning Technology Spending Market Analysis by Technology Software, Technology Services, Learning Mode, End User and Region Through 2025 to 2035

Remote Sensing Services Market Trends - Growth & Forecast 2025 to 2035

Remote Cooled Cube Ice Machines Market – Advanced Refrigeration & Industry Growth 2025 to 2035

Remote Healthcare Market - Growth & Innovations 2025 to 2035

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Remote Magnetic Catheter Systems Market

Remote Plasma Source Market

Remote Endarterectomy Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA