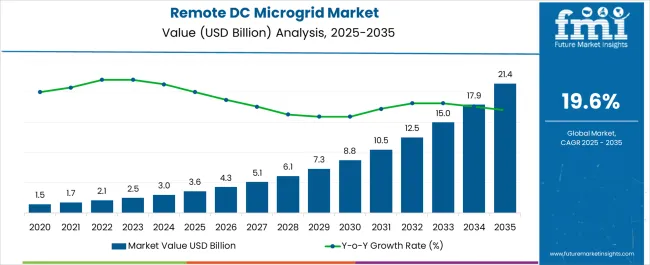

The Remote DC Microgrid Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 21.4 billion by 2035, registering a compound annual growth rate (CAGR) of 19.6% over the forecast period. This increase represents a nearly sixfold expansion, reflecting intensified global demand for off-grid and decentralized energy solutions. When evaluated in absolute dollar increments year-on-year, the market shows a clearly accelerating pattern. Growth in the early years (2025–2028) remains modest, averaging less than USD 1 billion per year. From 2029 onward, the market begins to add over USD 2 billion annually, with the final year (2035) alone contributing USD 3.5 billion in absolute growth. Such a dramatic expansion suggests a significant scale-up in rural electrification projects, renewable energy deployments, and defense and telecom operations in remote areas.

Key inflection years include 2029, when the market crosses the USD 10 billion threshold, and 2032, when cumulative growth from the baseline exceeds USD 11.4 billion. The strong compound absolute growth rate, combined with consistent year-over-year acceleration, implies that Remote DC Microgrid systems are shifting from early-stage pilots to wide-scale implementation. High capital influx, declining component costs, and favorable energy policy are expected to sustain this long-term expansion trajectory.

| Metric | Value |

|---|---|

| Remote DC Microgrid Market Estimated Value in (2025 E) | USD 3.6 billion |

| Remote DC Microgrid Market Forecast Value in (2035 F) | USD 21.4 billion |

| Forecast CAGR (2025 to 2035) | 19.6% |

The Remote DC Microgrid market is experiencing accelerated expansion due to increasing demand for resilient, decentralized power systems in remote and off-grid areas. Growth is being driven by the need for reliable electrification in rural and inaccessible regions, where traditional grid connectivity remains technically challenging and economically unfeasible. The integration of solar photovoltaic systems, advanced battery storage, and DC distribution has emerged as a cost-effective and energy-efficient solution to power supply limitations.

As governments and energy providers push toward net-zero carbon goals, the adoption of DC microgrids is gaining traction, especially in locations requiring low-maintenance and self-sustaining infrastructures. Advancements in control systems, modular designs, and battery technologies are further supporting widespread deployment.

Investment initiatives in renewable energy infrastructure, coupled with the growing availability of government subsidies and green energy programs, are expected to sustain market growth. The market outlook remains strong as innovations in connectivity, storage, and power source integration continue to address longstanding energy access challenges globally..

The remote DC microgrid market is segmented by connectivity, power source, storage device, and geographic regions. The connectivity of the remote DC microgrid market is divided into off-grid and grid-connected. In terms of power source, the remote DC microgrid market is classified into Solar PV, Diesel generators, Natural gas, CHP, and others. The storage device of the remote DC microgrid market is segmented into Lithium-ion, Lead acid, Flow battery, Flywheels, and others. Regionally, the remote DC microgrid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

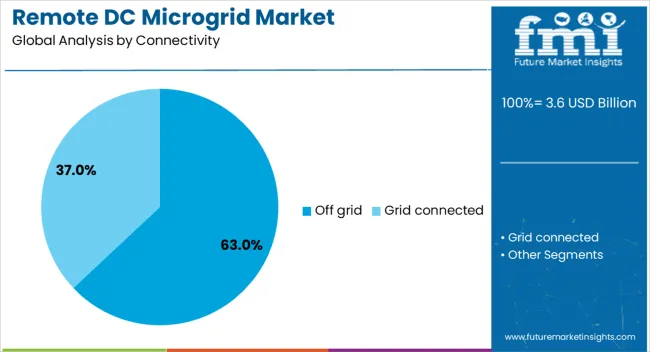

The off-grid connectivity segment is projected to capture 63% of the Remote DC Microgrid market revenue share in 2025, making it the dominant connectivity model. This leadership position has been supported by the need to provide electricity in areas where traditional grid infrastructure is either unavailable or economically impractical. Deployment in remote communities, island regions, and disaster-prone zones has increased, owing to the reliability and self-sufficiency of off grid DC microgrids.

These systems have been preferred for their ease of installation, reduced transmission losses, and operational independence. Additionally, energy service providers have favored off grid systems to meet rural electrification targets without the delay or cost of grid extension.

Regulatory incentives and international aid programs have also played a vital role in facilitating installations. As the demand for autonomous energy solutions grows, the off grid segment is expected to maintain its leading position due to its high scalability, low maintenance, and strong alignment with renewable energy integration goals..

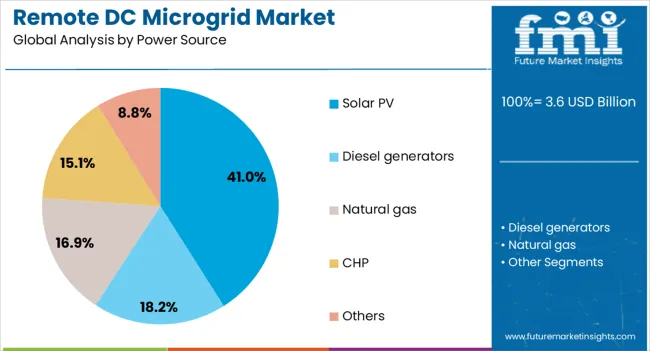

The solar PV power source segment is anticipated to represent 41% of the Remote DC Microgrid market revenue share in 2025, emerging as the leading energy generation source. The increasing preference for solar PV has been driven by its declining cost, ease of integration with DC infrastructure, and suitability for remote environments. As solar technologies continue to improve in efficiency and affordability, their adoption in off grid and microgrid applications has accelerated.

Solar PV systems have been widely used in regions with high solar irradiance, providing a consistent and renewable source of power. Their compatibility with battery storage and software-driven energy management has enabled stable, long-term operation without dependence on fossil fuels.

Furthermore, policy support for clean energy adoption, along with technological maturity in solar module manufacturing, has reinforced market penetration. The environmental advantages, operational simplicity, and rapid deployability of solar PV have solidified its position as the preferred power source within the DC microgrid ecosystem..

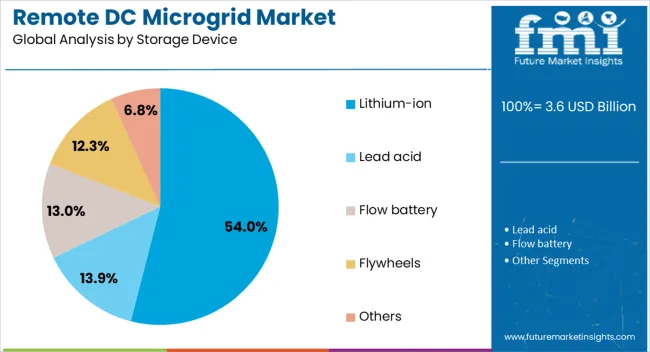

The lithium ion storage device segment is expected to command 54% of the Remote DC Microgrid market revenue share in 2025, securing its place as the leading energy storage technology. This growth has been driven by the high energy density, long cycle life, and rapid charge-discharge capabilities of lithium ion batteries. Their performance efficiency and scalability have made them ideal for remote applications where reliability and space optimization are critical.

Lithium ion storage has been favored for its compatibility with solar PV systems and for supporting seamless power delivery during periods of low generation or peak demand. The reduced cost of lithium ion technology, combined with advancements in battery management systems, has further encouraged widespread adoption.

Government incentives and corporate investments in energy storage research have accelerated innovation, leading to safer and more efficient battery systems. As power resilience and decentralized energy access become top priorities, lithium ion storage devices are expected to continue dominating the energy storage landscape in remote DC microgrid deployments..

Demand for remote DC microgrids has expanded sharply as energy access needs grow in off-grid communities, mining camps, telecom towers, and rural electrification zones. Sales of hybrid photovoltaic systems coupled with DC battery storage and DC distribution lines are being adopted rapidly. Growth is strongest in Asia‑Pacific and Africa, where grid extension is weighted by terrain difficulty. Key trends include modular solar combined with DC‑dc converters, plug‑and‑play panels, and DC appliance ecosystems. Drivers include resilience, lower operation cost, and reduced transmission loss. Challenges include local technician scarcity, intermittent component quality, and evolving off-grid regulatory alignment.

Adoption of DC microgrids has accelerated in communities underserved by national grids. Over 770 million people globally lack reliable grid access, creating strong market pull for decentralized power systems. In regions such as East Africa and Southeast Asia, community-scale DC microgrids ranging from 3 to 25 kW are increasingly being deployed to power schools, clinics, agricultural assets, and telecommunications. Operators report diesel substitution rates exceeding 80%, resulting in OPEX reductions of USD 0.12–0.20 per kWh. Modular DC kits with integrated charge controllers and LFP batteries are reducing installation time by 20–30%, while appliance compatibility with DC voltages (24 V/48 V) minimizes system complexity. Rural electrification programs are bundling microgrids with irrigation pumps, freezers, and LED lighting to promote economic inclusion and increase system payback, with pay-as-you-go models enhancing end-user affordability and adoption.

DC microgrids offer superior energy conversion efficiency compared to AC-based mini-grids by eliminating inverter-related losses. Average system losses are reduced by 8–12% when DC distribution is used end-to-end, particularly for low-load or intermittent applications. Advancements in DC appliances, including direct-drive refrigerators, water pumps, and telecom hardware, have enabled full system integration without the need for voltage conversion. Lithium iron phosphate (LiFePO₄) batteries, favored for thermal stability and deep discharge capabilities, are being combined with MPPT-enabled charge controllers to improve energy yield. DC modularity allows for stackable solar panels and battery banks, simplifying future upgrades. Microgrid operators are increasingly selecting components with Bluetooth-enabled diagnostics, remote firmware updates, and over-the-air load control, which improve operational transparency, system longevity, and O&M efficiency in isolated locations.

Remote DC microgrids are demonstrating superior reliability and climate resilience in decentralized deployments. In areas exposed to extreme heat, flooding, or logistical inaccessibility, DC microgrids using passively cooled enclosures and weather-sealed battery cabinets have reported availability rates above 95%. Hybrid systems combining photovoltaic generation with LFP storage and, in some cases, supplemental wind or hydro, have become popular in islanded settings. System design now includes UV-resistant cables, integrated thermal disconnects, and panel-level surge protection to minimize outages. Microgrid operators are leveraging predictive analytics to optimize battery discharge cycles and prolong service life. In disaster-prone regions, mobile DC microgrids mounted on trailers are deployed for emergency services. Such resilience-enhanced configurations are now supported through climate adaptation funds and NGO-led development finance programs targeting vulnerable energy-deficient zones.

Despite technical advances, the scalability of DC microgrids is restricted by skill shortages and hardware inconsistency. Installation errors from undertrained local technicians remain a leading cause of early system failure, especially in regions with limited access to certified installers. Component interoperability issues, especially across charge controllers, batteries, and DC appliances, lead to energy leakage and unreliable runtime. Equipment sourced from low-cost suppliers often suffers from a short lifecycle, with performance drops of 15–25% after 18–24 months of operation. Regulatory frameworks in many countries lack definitions for standalone DC systems, impeding project registration, financing, and insurance. Donor-funded and government projects are responding by implementing training programs and promoting quality-verified procurement standards. However, until a unified certification framework is adopted globally, DC microgrids will remain difficult to scale sustainably beyond pilot-level deployments.

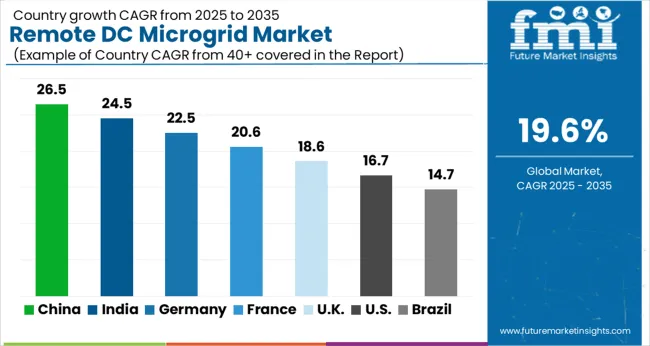

| Country | CAGR |

|---|---|

| China | 26.5% |

| India | 24.5% |

| Germany | 22.5% |

| France | 20.6% |

| UK | 18.6% |

| USA | 16.7% |

| Brazil | 14.7% |

The market is set to expand at a global CAGR of 19.6% between 2025 and 2035, with BRICS and emerging Asian economies leading the surge. China is expected to grow at 26.5%, driven by ambitious rural electrification goals and a robust local solar manufacturing ecosystem. India follows closely at 24.5%, fueled by decentralized energy initiatives across remote states and support from international climate funds. Germany, growing at 22.5%, benefits from stringent energy efficiency mandates and support for off-grid industrial solutions. The UK, at 18.6%, is scaling up remote energy systems for defense and island-based infrastructure. The USA trails at 16.7%, reflecting a maturing but slower-growing market. OECD nations show steady demand for military and disaster-resilient grids, while ASEAN and BRICS countries are propelling volume-led growth due to rural energy access policies and grid instability challenges. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to expand at a CAGR of 26.5% from 2025 to 2035, driven by state-led electrification programs in off-grid areas of Tibet, Xinjiang, and western Sichuan. Remote DC microgrids are preferred in these regions due to lower transmission losses, high PV compatibility, and integration ease with modular energy storage. Key suppliers including Sungrow, Huawei, and NR Electric are deploying containerized DC microgrid systems in border and island territories. Policies under the 14th Five-Year Plan and Belt and Road Initiative are boosting the installation of microgrids in strategic border zones and overseas rural electrification projects.

India is expected to grow at a CAGR of 24.5% from 2025 to 2035, supported by rising deployment of rural electrification projects using solar-DC infrastructure. Government schemes like Saubhagya and Deen Dayal Upadhyaya Gram Jyoti Yojana are leveraging DC microgrids for tribal, hilly, and forested areas. Startups and nonprofits are leading deployments in regions like Odisha, Jharkhand, and the Northeast, where rugged terrain hinders conventional grid expansion. DC microgrids reduce inverter losses, making them ideal for regions with low solar insolation and variable load patterns.

Germany is forecast to witness a CAGR of 22.5% through 2035, fueled by the country’s push for decentralized renewable energy systems and climate-resilient power infrastructure. Research hubs in Saxony and Berlin are developing high-efficiency DC microgrid controllers that manage EV charging, PV input, and heat pump demand within industrial parks. Rural communities are experimenting with cooperative-led DC systems to support carbon-neutral housing clusters. The country’s push toward electrified buildings and off-grid resilience is fostering partnerships between inverter firms and storage providers.

The UK is projected to expand at a CAGR of 18.6% from 2025 to 2035, as energy developers target grid-independent systems in remote islands, rural Scotland, and backup-critical military facilities. DC microgrids are particularly suited for maritime locations and research outposts where cable cost, salt exposure, and energy storage integration challenge conventional AC systems. The Carbon Trust and BEIS are co-funding pilot projects that use battery-first DC topologies for greater system reliability. Additionally, interest is growing in using DC microgrids in post-disaster restoration and EV infrastructure.

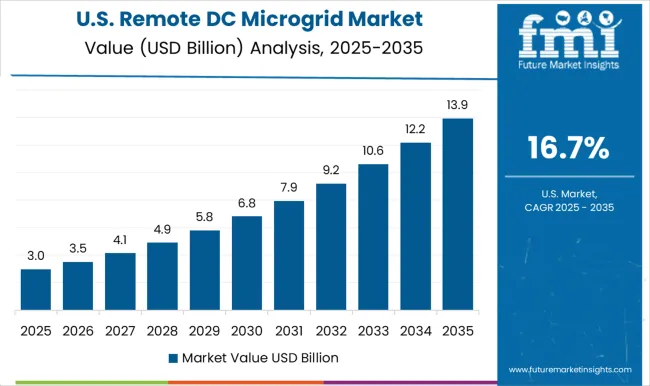

The US is expected to achieve a CAGR of 16.7% from 2025 to 2035, led by rising deployment in remote Native American reservations, Alaskan villages, and disaster-prone areas like Puerto Rico. DOE-backed programs such as the Microgrid R&D Program and Grid Modernization Lab Consortium are promoting DC configurations for their energy efficiency and resilience. Military bases in isolated zones are also adopting remote DC microgrids for secure power delivery. Startups like BoxPower and Xendee are offering modular, plug-and-play solutions with pre-integrated batteries, solar, and smart control systems.

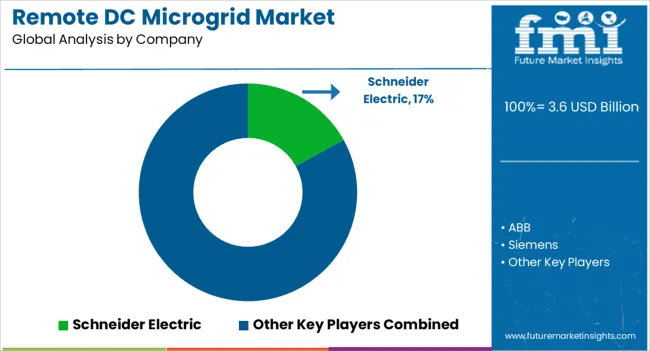

The market has been shaped by rising off-grid energy needs, particularly in remote and island communities, mining operations, and military applications. Driven by the transition to low-carbon infrastructure and increased electrification of remote areas, DC microgrids are being adopted for their higher efficiency, simplified architecture, and seamless integration with renewable energy systems. As lithium-ion storage and solar PV become more cost-effective, DC microgrids are being favored over traditional AC grids for reliability, energy resilience, and reduced conversion losses. Schneider Electric has positioned itself as a key player by offering modular, scalable DC microgrid systems supported by EcoStruxure architecture, enabling real-time energy monitoring and automation.

ABB has leveraged its expertise in power electronics to deliver advanced DC switchgear and smart control platforms optimized for hybrid and renewable energy integration. Siemens has focused on customized microgrid solutions that include intelligent energy management systems and integrated battery storage. Eaton has developed containerized microgrid units tailored for rural electrification, emphasizing plug-and-play installations. Tesla, through its Powerpack and Megapack solutions, has advanced the market by bundling solar and DC storage with predictive control. General Electric continues to invest in hybrid systems for defense and industrial use, supporting rapid deployment and autonomous operation.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Connectivity | Off grid and Grid connected |

| Power Source | Solar PV, Diesel generators, Natural gas, CHP, and Others |

| Storage Device | Lithium-ion, Lead acid, Flow battery, Flywheels, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, Siemens, Eaton, Tesla Inc., and General Electric |

| Additional Attributes | Dollar sales by system configuration (off-grid DC microgrids with solar-battery, wind-battery hybrids) and end‑use sector (rural electrification, telecom towers, mining camps), demand dynamics fueled by off-grid reliability needs and energy access programs, regional adoption trends across Africa, Asia‑Pacific and Latin America, innovation in DC-rated inverters and modular plug-and-play microgrid designs, environmental benefits of reduced fuel generator reliance and minimized transmission losses, and emerging use cases in telecom backup power, remote healthcare clinic electrification, and island microgrid electrification projects. |

The global remote DC microgrid market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the remote DC microgrid market is projected to reach USD 21.4 billion by 2035.

The remote DC microgrid market is expected to grow at a 19.6% CAGR between 2025 and 2035.

The key product types in remote DC microgrid market are off grid and grid connected.

In terms of power source, solar pv segment to command 41.0% share in the remote DC microgrid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Remote Microgrid Market Size and Share Forecast Outlook 2025 to 2035

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote ICU Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Lockout Tool Market Size and Share Forecast Outlook 2025 to 2035

Remote Desktop Software Market Forecast and Outlook 2025 to 2035

Remote Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Assist Headrest Market Size and Share Forecast Outlook 2025 to 2035

Remote Endarterectomy Devices Market Size and Share Forecast Outlook 2025 to 2035

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Remote Electrocardiogram Monitoring Market Size and Share Forecast Outlook 2025 to 2035

DC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

DC and PKI Market Size and Share Forecast Outlook 2025 to 2035

Remote Valve Tissue Expanders Market Size and Share Forecast Outlook 2025 to 2035

Remote Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Remote Operated Vehicle Market Size and Share Forecast Outlook 2025 to 2035

DCIM Market Size and Share Forecast Outlook 2025 to 2035

DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

DC Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA