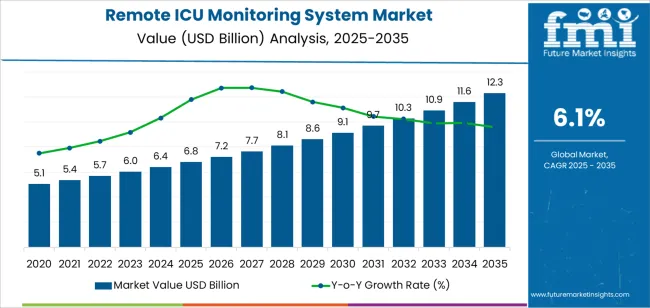

The global remote ICU monitoring system market is projected to reach USD 12.3 billion by 2035, recording an absolute increase of USD 5,501.4 million over the forecast period. The market is valued at USD 6.8 billion in 2025 and is set to rise at a CAGR of 6.1% during the assessment period. The overall market size is expected to grow by nearly 1.8 times during the same period, supported by increasing demand for telemedicine infrastructure worldwide, driving demand for efficient remote patient monitoring solutions and increasing investments in digital healthcare transformation and critical care capacity expansion projects globally. However, integration complexities with existing hospital information systems and data security concerns may pose challenges to market expansion.

The market expansion reflects fundamental shifts in healthcare delivery models, where remote ICU monitoring systems enable hospitals to address critical care specialist shortages while maintaining high standards of patient care. Healthcare facilities across developed and emerging markets are investing in centralized command centers and tele-ICU hubs that allow intensivists to remotely monitor multiple ICU beds across geographically dispersed facilities.

This transformation is particularly significant in regions facing acute shortages of critical care physicians, where remote monitoring technologies provide cost-effective access to specialist expertise without requiring physical presence at every facility.

Technological advancements in artificial intelligence, machine learning algorithms, and predictive analytics are reshaping the remote ICU monitoring landscape. Modern systems incorporate early warning capabilities that detect patient deterioration hours before traditional monitoring methods, enabling proactive clinical interventions. Integration with electronic health records and hospital information systems allows seamless data flow and comprehensive patient management. Cloud-based platforms and mobile applications enable physicians to access real-time patient data from any location, supporting flexible work arrangements and rapid response to clinical emergencies.

Government healthcare digitization initiatives and pandemic preparedness strategies accelerate market growth. The COVID-19 pandemic demonstrated the critical importance of remote monitoring infrastructure for managing surge capacity and protecting healthcare workers from infectious disease exposure. Regulatory frameworks in major markets increasingly support telemedicine reimbursement, creating sustainable business models for remote ICU monitoring programs. Public and private healthcare systems recognize these technologies as essential components of modern critical care delivery, driving sustained investment in monitoring infrastructure, network connectivity, and clinical training programs that enable successful remote ICU program implementation across diverse healthcare environments.

Between 2025 and 2030, the remote ICU monitoring system market is projected to expand from USD 6.8 billion to USD 9,156.8 million, resulting in a value increase of USD 2,346.5 million, which represents 42.7% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for critical care capacity solutions and remote healthcare delivery systems, product innovation in artificial intelligence-powered patient monitoring and predictive analytics platforms, as well as expanding integration with electronic health records and hospital information systems. Companies are establishing competitive positions through investment in advanced data transmission technologies, cloud-based monitoring infrastructure, and strategic market expansion across hospital intensive care units, remote telemedicine centers, and cross-regional medical collaboration applications.

From 2030 to 2035, the market is forecast to grow from USD 9,156.8 million to USD 12.3 billion, adding another USD 3,154.9 million, which constitutes 57.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized remote monitoring systems, including advanced communication modules and integrated analytics platforms tailored for specific critical care requirements, strategic collaborations between healthcare technology providers and hospital networks, and an enhanced focus on interoperability standards and cybersecurity protocols. The growing emphasis on healthcare workforce optimization and pandemic preparedness will drive demand for advanced, high-performance remote ICU monitoring solutions across diverse healthcare delivery applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 6.8 billion |

| Market Forecast Value (2035) | USD 12.3 billion |

| Forecast CAGR (2025-2035) | 6.1% |

The remote ICU monitoring system market grows by enabling healthcare facilities to achieve superior patient outcomes and clinical efficiency while addressing critical care specialist shortages. Hospital administrators face mounting pressure to improve critical care capacity and clinical surveillance capabilities, with remote ICU monitoring solutions typically providing 20-35% improvement in patient safety metrics over conventional bedside-only systems, making these technologies essential for modern acute care delivery. The telemedicine infrastructure expansion creates demand for advanced remote monitoring platforms that can facilitate real-time clinical decision support, enable continuous vital sign tracking, and ensure consistent care delivery across geographically dispersed healthcare facilities.

Government initiatives promoting digital health adoption and healthcare infrastructure modernization drive implementation in hospital intensive care units, remote telemedicine centers, and cross-regional medical collaboration programs, where remote monitoring has a direct impact on clinical outcomes and operational efficiency. The global shift toward value-based care models and integrated healthcare networks accelerates remote ICU monitoring demand as hospitals seek solutions that enhance specialist utilization and patient throughput. However, high implementation costs and interoperability challenges with legacy medical equipment may limit adoption rates among smaller healthcare facilities and regions with underdeveloped broadband infrastructure.

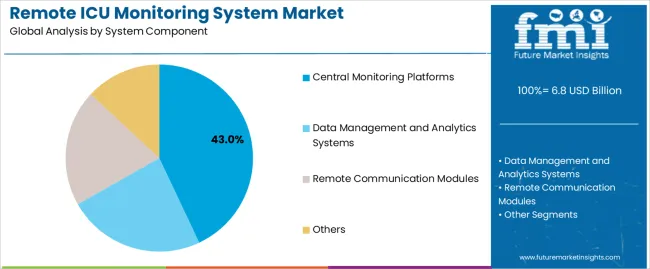

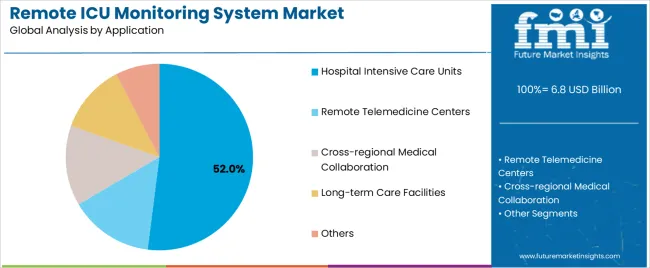

The market is segmented by system component, application, and region. By system component, the market is divided into central monitoring platforms, data management and analytics systems, remote communication modules, and others. Based on application, the market is categorized into hospital intensive care units, remote telemedicine centers, cross-regional medical collaboration, long-term care facilities, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

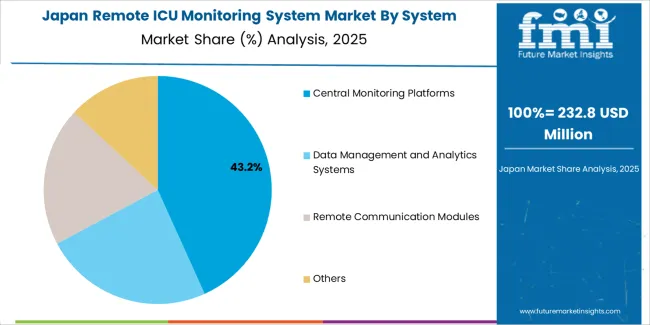

The central monitoring platforms segment represents the dominant force in the remote ICU monitoring system market, capturing approximately 43.0% of total market share in 2025. This advanced category encompasses integrated monitoring workstations, multi-patient display systems, alert management platforms, and centralized control interfaces, delivering comprehensive clinical surveillance capabilities with real-time data aggregation features. The central monitoring platforms segment's market leadership stems from its essential role in coordinating patient data streams, enabling clinical workflow optimization, and providing intensive care specialists with consolidated information access across multiple monitored patients simultaneously.

The data management and analytics systems segment maintains a substantial 28.0% market share, serving healthcare facilities that require advanced data processing capabilities through predictive analytics engines, clinical decision support tools, and automated reporting systems. The remote communication modules segment accounts for 21.0% market share, featuring video conferencing integration, secure messaging platforms, and teleconsultation interfaces. The others segment, including mobile access solutions and peripheral integration modules, represents 8.0% market share.

Key advantages driving the central monitoring platforms segment include:

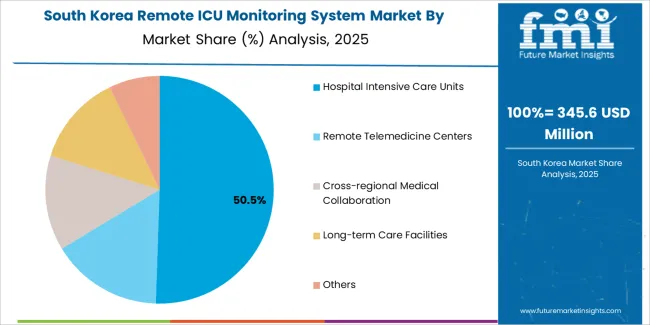

Hospital intensive care units dominate the remote ICU monitoring system market with approximately 52.0% market share in 2025, reflecting the critical need for enhanced clinical surveillance and specialist support in acute care environments. The hospital intensive care units segment's market leadership is reinforced by widespread adoption in medical-surgical ICUs, cardiac intensive care units, neurological critical care departments, and trauma centers, which require continuous patient monitoring and immediate access to intensivist expertise regardless of physical location constraints.

The remote telemedicine centers segment represents 24.0% market share through specialized command center operations including centralized ICU support hubs, regional tele-critical care networks, and academic medical center consulting services. The cross-regional medical collaboration segment accounts for 13.0% market share, featuring inter-hospital consultation systems and rural healthcare support programs. The long-term care facilities segment holds 7.0% market share, while others segment represents 4.0% of the market.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to healthcare delivery and clinical outcomes. First, critical care specialist shortages create increasing requirements for remote monitoring infrastructure, with global intensivist supply covering only 15-30% of critical care beds in many healthcare systems, requiring technology solutions that extend specialist reach across multiple facilities simultaneously. Second, healthcare quality improvement initiatives drive hospitals toward continuous surveillance systems, with remote ICU monitoring reducing preventable adverse events by 20-35% while improving length of stay metrics and overall patient satisfaction scores. Third, pandemic preparedness requirements and surge capacity planning accelerate adoption across North America, Europe, and Asia-Pacific regions where healthcare systems prioritize resilient critical care infrastructure.

Market restraints include implementation costs exceeding USD 500,000-2,000,000 per facility for comprehensive system deployment, including hardware installation, software licensing, network infrastructure upgrades, and staff training requirements that strain capital budgets at smaller hospitals. Integration challenges with diverse medical device ecosystems pose technical barriers, as healthcare facilities typically operate 10-25 different patient monitoring brands and legacy equipment that may lack standardized data output protocols. Clinician resistance to workflow changes creates additional adoption friction, as bedside nursing staff and physicians require comprehensive change management programs and ongoing technical support to achieve optimal system utilization during the 6-12 month implementation period.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where government healthcare digitization programs provide funding support and regulatory frameworks that incentivize telemedicine infrastructure deployment. Technology advancement trends toward artificial intelligence-powered clinical decision support, automated early warning systems with machine learning algorithms, and mobile-optimized interfaces that enable remote specialist access via tablets and smartphones are driving next-generation product development. However, the market thesis could face disruption if cybersecurity incidents targeting connected medical devices undermine clinician and patient confidence or if reimbursement policy changes reduce financial incentives for remote monitoring program operation.

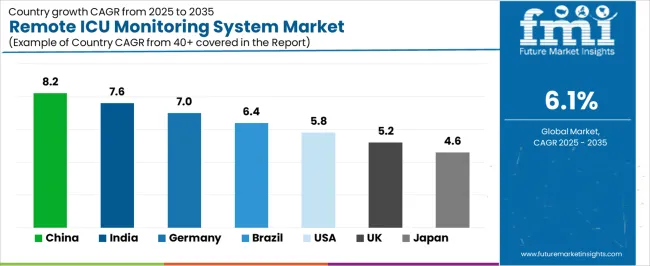

| Country | CAGR (2025-2035) |

|---|---|

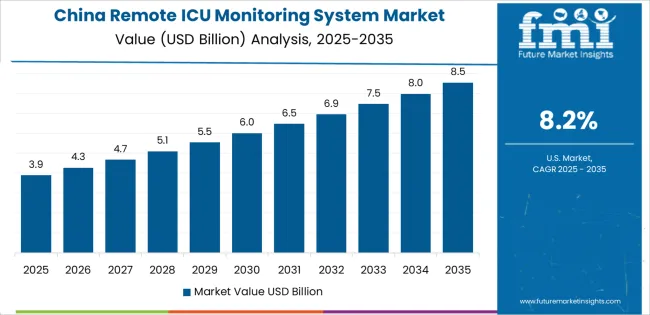

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| Brazil | 6.4% |

| USA | 5.8% |

| UK | 5.2% |

| Japan | 4.6% |

The remote ICU monitoring system market is gaining momentum worldwide, with China taking the lead thanks to aggressive hospital digitization initiatives and critical care infrastructure expansion programs. Close behind, India benefits from telemedicine policy reforms and urban tertiary care hospital modernization, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where comprehensive digital health strategies and university hospital innovation centers strengthen its role in European healthcare technology deployment. Brazil demonstrates robust growth through public health system modernization and private hospital network expansion, signaling continued investment in advanced monitoring infrastructure. Meanwhile, the USA stands out for its established tele-ICU networks and clinical evidence base supporting remote monitoring adoption, while the UK and Japan continue to record consistent progress driven by National Health Service transformation programs and aging population healthcare demands. Together, China and India anchor the global expansion story, while established markets build stability and maturity into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the Remote ICU Monitoring System Market with a CAGR of 8.2% through 2035. The country's leadership position stems from comprehensive Healthy China 2030 strategy implementation, massive hospital construction programs, and aggressive medical informatization targets driving adoption of advanced critical care monitoring systems. Growth is concentrated in major healthcare regions, including Beijing, Shanghai, Guangdong, and Jiangsu provinces, where tertiary hospitals and regional medical centers are implementing telemedicine platforms for critical care delivery and specialist consultation services. Distribution channels through public hospital procurement systems, provincial health commissions, and medical equipment distributors expand deployment across teaching hospitals and prefecture-level medical facilities. The country's National Healthcare Security Administration provides policy support for telemedicine service reimbursement, including payment frameworks for remote ICU consultation and continuous monitoring services.

Key market factors:

In metropolitan areas, secondary cities, and medical tourism destinations, the adoption of remote ICU monitoring systems is accelerating across corporate hospital chains, government tertiary care centers, and specialty critical care facilities, driven by telemedicine regulation clarification and National Digital Health Mission implementation. The market demonstrates strong growth momentum with a CAGR of 7.6% through 2035, linked to comprehensive healthcare digitization programs and increasing focus on clinical quality improvement solutions. Indian hospitals are implementing remote monitoring platforms and centralized command center operations to address intensivist shortages while meeting accreditation standards required by national and international healthcare quality bodies. The country's Ayushman Bharat Digital Mission creates sustained demand for interoperable health information systems, while increasing emphasis on patient safety drives adoption of continuous surveillance technologies that enhance clinical outcomes.

Germany's advanced healthcare system demonstrates sophisticated implementation of remote ICU monitoring infrastructure, with documented case studies showing 25-40% reduction in ICU mortality rates through tele-critical care program deployment across university hospital networks. The country's healthcare infrastructure in major medical centers, including Berlin, Munich, Hamburg, and Düsseldorf, showcases integration of monitoring technologies with existing clinical information systems, leveraging expertise in medical device manufacturing and quality management standards. German hospitals emphasize evidence-based implementation and clinical validation, creating demand for certified medical devices that support patient safety commitments and meet stringent Medical Device Regulation requirements. The market maintains strong growth through focus on clinical excellence and interoperability standards, with a CAGR of 7.0% through 2035.

Key development areas:

The Brazilian market leads Latin American adoption based on integration with private hospital networks and public health system modernization programs supporting expanded critical care access. The country shows solid potential with a CAGR of 6.4% through 2035, driven by SUS (Sistema Único de Saúde) telemedicine expansion and increasing demand for specialist consultation services across major metropolitan areas, including São Paulo, Rio de Janeiro, Brasília, and Porto Alegre. Brazilian hospitals are adopting remote monitoring systems for compliance with patient safety protocols, particularly in high-acuity environments requiring continuous surveillance and in regions with limited intensivist availability. Technology deployment channels through hospital chains, healthcare cooperatives, and public procurement programs expand coverage across diverse critical care operations.

Leading market segments:

The USA remote ICU monitoring system market demonstrates mature implementation focused on established tele-critical care networks and evidence-based clinical programs, with documented integration across 10-15% of the country's 5,500+ hospitals operating intensive care units. The country maintains steady growth momentum with a CAGR of 5.8% through 2035, driven by continued rural hospital participation and academic medical center expansion of remote monitoring services to affiliated community hospitals. Major healthcare regions, including California, Texas, New York, and Midwest hospital systems, showcase advanced deployment of command center operations where board-certified intensivists remotely monitor 100-150 ICU beds simultaneously using sophisticated clinical decision support platforms.

Key market characteristics:

In NHS trusts across England, Scotland, Wales, and Northern Ireland, critical care departments are implementing remote monitoring capabilities to address intensivist workforce constraints and improve patient safety outcomes, with documented case studies showing enhanced clinical surveillance in district general hospitals receiving support from regional teaching centers. The market shows solid growth potential with a CAGR of 5.2% through 2035, linked to NHS Long Term Plan digital transformation priorities, critical care capacity expansion following pandemic lessons learned, and increasing focus on reducing clinical variation across the integrated care system network. British hospitals are adopting standardized remote monitoring platforms and regional tele-ICU hub configurations to ensure consistent critical care quality while optimizing specialist workforce deployment across geographically distributed facilities.

Market development factors:

Japan's remote ICU monitoring market demonstrates sophisticated implementation focused on university hospital networks and advanced critical care centers, with documented integration of monitoring systems achieving compliance with strict medical device regulations and hospital accreditation requirements. The country maintains steady growth through emphasis on clinical quality improvement and patient safety initiatives, with a CAGR of 4.6% through 2035, driven by aging population healthcare demands and continued investment in medical technology infrastructure across major medical centers in Tokyo, Osaka, Nagoya, and Fukuoka metropolitan areas. Japanese hospitals prioritize vendor relationships with established medical device manufacturers and emphasize long-term technical support capabilities when selecting remote monitoring platforms.

Key market characteristics:

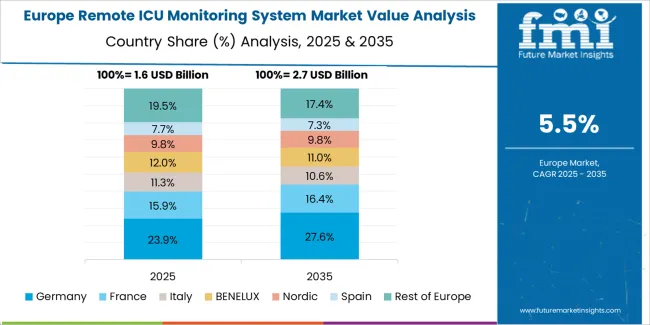

The remote ICU monitoring system market in Europe is projected to grow from USD 1,640.0 million in 2025 to USD 2,884.4 million by 2035, registering a CAGR of 5.8% over the forecast period. Germany is expected to maintain its leadership position with a 24.5% market share in 2025, declining slightly to 23.8% by 2035, supported by its advanced university hospital infrastructure and major medical centers including Berlin, Munich, and Hamburg critical care facilities.

France follows with a 19.2% share in 2025, projected to reach 19.5% by 2035, driven by comprehensive hospital digitization programs and AP-HP (Assistance Publique-Hôpitaux de Paris) telemedicine expansion initiatives. The United Kingdom holds a 17.8% share in 2025, expected to reach 18.1% by 2035 through NHS digital transformation investment. Italy commands a 14.3% share in both 2025 and 2035, backed by regional health authority modernization programs. Spain accounts for 11.2% in 2025, rising to 11.4% by 2035 on public hospital technology upgrades. The Netherlands maintains 6.5% in 2025, reaching 6.7% by 2035 on academic medical center innovation programs. The Rest of Europe region is anticipated to hold 6.5% in 2025, expanding to 6.2% by 2035, attributed to increasing remote ICU monitoring adoption in Nordic countries and emerging Central & Eastern European hospital digitization programs.

The Japanese remote ICU monitoring system market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of central monitoring platforms and data analytics systems with existing hospital information infrastructure across university medical centers, national medical organizations, and advanced tertiary care facilities. Japan's emphasis on patient safety standards and clinical evidence validation drives demand for certified medical devices that support regulatory compliance and quality improvement commitments in critical care environments. The market benefits from strong partnerships between international medical technology providers and domestic healthcare system integrators including Nihon Kohden and other established medical electronics companies, creating comprehensive service ecosystems that prioritize system reliability and clinical workflow optimization. Medical centers in Tokyo, Osaka, Kyoto, and other major metropolitan areas showcase advanced remote monitoring implementations where platforms achieve 99% uptime and seamless integration with electronic medical record systems deployed across Japanese hospital networks.

The South Korean remote ICU monitoring system market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive clinical validation services and technical support capabilities for critical care and emergency medicine applications. The market demonstrates increasing emphasis on smart hospital initiatives and advanced clinical information systems, as Korean hospitals increasingly demand monitoring solutions that integrate with domestic electronic medical record platforms and sophisticated hospital automation systems deployed across Seoul National University Hospital, Asan Medical Center, and other leading medical institutions. Regional medical device manufacturers are gaining market share through strategic partnerships with international technology suppliers, offering specialized services including Korean medical device certification support and customized clinical workflow programs for intensive care operations. The competitive landscape shows increasing collaboration between multinational healthcare IT companies and Korean hospital associations, creating hybrid service models that combine international clinical best practices with local healthcare delivery requirements and regulatory compliance frameworks.

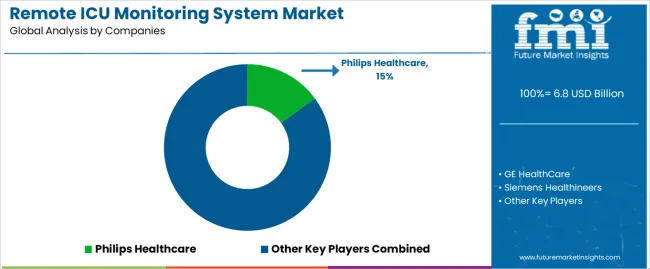

The remote ICU monitoring system market features approximately 20-25 meaningful players with moderate concentration, where the top three companies control roughly 35-40% of global market share through established hospital relationships and comprehensive clinical service networks. Competition centers on system reliability, clinical evidence validation, and integration capabilities rather than price competition alone. Philips Healthcare leads with approximately 15% market share through its comprehensive eICU program and established critical care monitoring portfolio.

Market leaders include Philips Healthcare, GE HealthCare, and Siemens Healthineers, which maintain competitive advantages through decades of medical device manufacturing expertise, global hospital customer bases, and proven clinical outcome data from large-scale tele-ICU deployments across multiple countries. These companies leverage research and development investments in artificial intelligence algorithms, predictive analytics platforms, and interoperability standards to defend market positions while expanding into emerging markets and rural healthcare applications.

Challengers encompass Medtronic and Drägerwerk AG, which compete through specialized critical care monitoring systems and strong regional presence in North America and Europe. Product specialists, including Mindray, Nihon Kohden, and Hill-Rom, focus on specific geographic markets or technology components, offering differentiated capabilities in patient monitoring equipment integration, mobile access solutions, and workflow optimization tools.

Emerging vendors including Capsule Technologies and Sotera Wireless create competitive pressure through innovative data aggregation platforms and wireless monitoring solutions that address interoperability challenges and enable rapid deployment in diverse hospital environments. Market dynamics favor companies that combine regulatory compliance expertise across multiple jurisdictions with comprehensive clinical support services that address the complete implementation lifecycle from needs assessment through ongoing technical optimization and clinical program management.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.8 billion |

| System Component | Central Monitoring Platforms, Data Management and Analytics Systems, Remote Communication Modules, Others |

| Application | Hospital Intensive Care Units, Remote Telemedicine Centers, Cross-regional Medical Collaboration, Long-term Care Facilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Philips Healthcare, GE HealthCare, Siemens Healthineers, Medtronic, Drägerwerk AG, Mindray, Nihon Kohden, Hill-Rom, Fresenius Medical Care, Elekta, Masimo Corporation, Smiths Medical, Spacelabs Healthcare, Capsule Technologies, Sotera Wireless |

| Additional Attributes | Dollar sales by system component and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with healthcare technology providers and hospital networks, implementation requirements and technical specifications, integration with electronic health records and hospital information systems, innovations in artificial intelligence and predictive analytics, and development of specialized remote monitoring solutions with enhanced clinical decision support and interoperability capabilities. |

The global remote icu monitoring system market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the remote icu monitoring system market is projected to reach USD 12.3 billion by 2035.

The remote icu monitoring system market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in remote icu monitoring system market are central monitoring platforms, data management and analytics systems, remote communication modules and others.

In terms of application, hospital intensive care units segment to command 52.0% share in the remote icu monitoring system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Remote Lockout Tool Market Size and Share Forecast Outlook 2025 to 2035

Remote Desktop Software Market Forecast and Outlook 2025 to 2035

Remote Assist Headrest Market Size and Share Forecast Outlook 2025 to 2035

Remote Endarterectomy Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Valve Tissue Expanders Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Remote Operated Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Remote DC Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Towers Market Size and Share Forecast Outlook 2025 to 2035

Remote AF Detection Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Remote Vehicle Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Remote Learning Technology Spending Market Analysis by Technology Software, Technology Services, Learning Mode, End User and Region Through 2025 to 2035

Remote Sensing Services Market Trends - Growth & Forecast 2025 to 2035

Remote Cooled Cube Ice Machines Market – Advanced Refrigeration & Industry Growth 2025 to 2035

Remote Healthcare Market - Growth & Innovations 2025 to 2035

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Remote Plasma Source Market

Remote Magnetic Catheter Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA