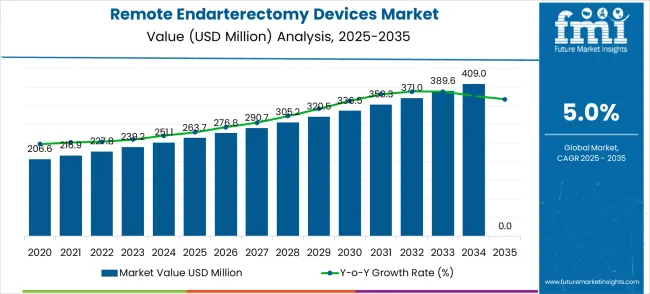

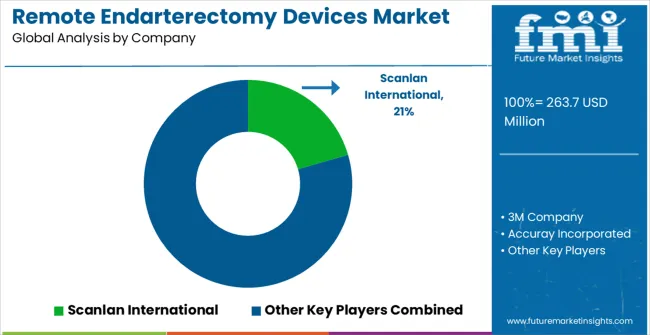

The Remote Endarterectomy Devices Market is estimated to be valued at USD 263.7 million in 2025 and is projected to reach USD 429.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Remote Endarterectomy Devices Market Estimated Value in (2025 E) | USD 263.7 million |

| Remote Endarterectomy Devices Market Forecast Value in (2035 F) | USD 429.5 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The Remote Endarterectomy Devices market is witnessing steady growth, driven by the increasing prevalence of vascular diseases and the demand for minimally invasive surgical interventions. Rising incidences of atherosclerosis, arterial occlusions, and peripheral artery diseases have created a critical need for advanced endarterectomy devices that offer precise plaque removal while minimizing complications. Adoption is being supported by technological advancements in device design, including enhanced navigation, imaging integration, and improved catheter systems that allow surgeons to perform procedures remotely with higher accuracy.

The market is further strengthened by growing awareness among healthcare providers regarding patient safety, reduced recovery times, and improved surgical outcomes associated with remote procedures. Hospitals and specialized clinics are increasingly implementing these devices to optimize operating room efficiency and enhance procedural success rates.

Continuous research collaborations, clinical trials, and regulatory approvals are facilitating the development of safer and more effective devices As vascular disease prevalence continues to rise and minimally invasive interventions gain prominence, the Remote Endarterectomy Devices market is expected to maintain sustainable growth, supported by innovation, clinical adoption, and increased healthcare infrastructure investments.

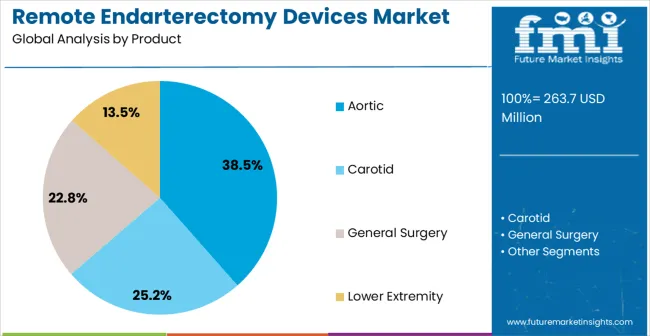

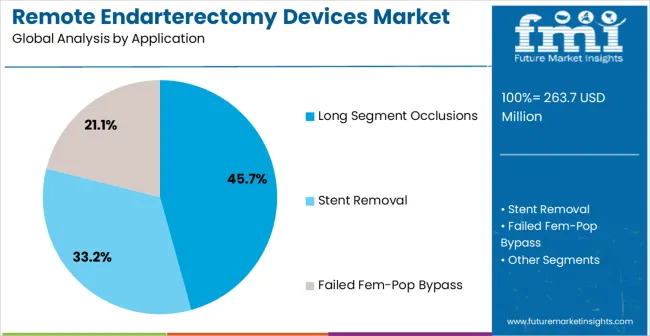

The remote endarterectomy devices market is segmented by product, application, end user, and geographic regions. By product, remote endarterectomy devices market is divided into Aortic, Carotid, General Surgery, and Lower Extremity. In terms of application, remote endarterectomy devices market is classified into Long Segment Occlusions, Stent Removal, and Failed Fem-Pop Bypass.

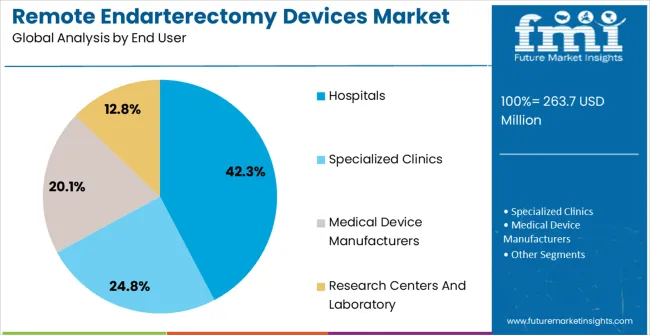

Based on end user, remote endarterectomy devices market is segmented into Hospitals, Specialized Clinics, Medical Device Manufacturers, and Research Centers And Laboratory. Regionally, the remote endarterectomy devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aortic product segment is projected to hold 38.5% of the market revenue in 2025, positioning it as the leading product type. Growth in this segment is being driven by the high incidence of aortic occlusions and aneurysms requiring precise plaque removal and vessel restoration. Remote endarterectomy devices designed for aortic applications enable surgeons to perform complex procedures with enhanced accuracy, reducing the risk of vessel damage and post-operative complications.

Advanced imaging guidance, flexible catheter systems, and software-assisted navigation contribute to improved procedural outcomes and patient safety. Hospitals and surgical centers are increasingly adopting these products due to their ability to optimize operating room efficiency and reduce recovery times.

The ability to perform minimally invasive procedures while maintaining high success rates has strengthened preference for aortic devices As healthcare providers continue to prioritize patient safety, efficiency, and advanced surgical capabilities, the aortic product segment is expected to maintain market leadership, supported by ongoing technological innovation and growing demand for vascular interventions.

The long segment occlusions application segment is anticipated to account for 45.7% of the market revenue in 2025, making it the leading application area. Growth is being driven by the increasing prevalence of extended arterial blockages that require precise and controlled removal for effective treatment. Remote endarterectomy devices offer enhanced reach and maneuverability, allowing surgeons to treat longer occluded vessels with minimal invasiveness.

Integration with imaging technologies and navigational software ensures accurate plaque removal while reducing procedure times and patient recovery periods. The adoption of these devices is supported by hospitals and vascular surgery centers seeking safer alternatives to traditional open surgeries. Clinical outcomes are improved due to reduced intraoperative risks, lower complication rates, and shorter hospital stays.

Regulatory approvals, continuous product innovation, and growing awareness of minimally invasive treatment benefits are further supporting segment growth As demand for effective long segment occlusion treatments rises globally, this application segment is expected to remain the primary driver of market expansion.

The hospitals end-user segment is projected to hold 42.3% of the market revenue in 2025, establishing it as the leading end-use category. Growth in this segment is being driven by the increasing adoption of remote endarterectomy devices for minimally invasive vascular procedures that improve patient safety, operational efficiency, and surgical outcomes. Hospitals are investing in advanced surgical technologies, imaging systems, and staff training to enhance procedural precision and reduce complications.

The ability to perform complex endarterectomy procedures remotely allows for optimized utilization of operating room resources and shorter patient recovery times. Increasing vascular disease prevalence and rising patient demand for minimally invasive interventions are further fueling adoption.

Integration with hospital information systems, compliance with regulatory standards, and the emphasis on outcome-based care reinforce the preference for hospitals as primary end users As healthcare institutions continue to prioritize efficiency, patient safety, and high-quality surgical outcomes, the hospitals segment is expected to maintain market leadership, supported by continuous innovation, clinical adoption, and increasing procedural volumes.

Remote Endarterectomy (RE) is minimally invasive procedure which is a combination of surgical and endovascular techniques. Remote Endarterectomy (RE) is performed through a small inguinal incision. Although it is implemented through a small inguinal incision, it allows the complete debulking of the arterial plaque.

Remote Endarterectomy is basically used for the treatment of long-segmented superficial femoral artery (SFA) occlusive disease. This procedure is more preferred over other processes for the reason that, it is also used to treat iliac artery occlusive disease and stent removal.

RE is a better and long-lasting alternative for the standard bypass procedures. Remote Endarterectomy Device are the devices which are mainly used to remove the severe atherosclerotic blockages from the major arteries of the leg in an invasive procedure requiring a single incision in the research.

The current Remote Endarterectomy Device on the market has limited applications due to its design. Remote Endarterectomy is used in the peripheral vascular surgery to eliminate plaque from an occluded femoral artery. Use and maintain the native artery.

Products which are presently used by the surgeons have restricted flexibility with a fixed diameter metal ring that cannot accommodate changes in the size of the artery and irregular, calcified plaque formation.

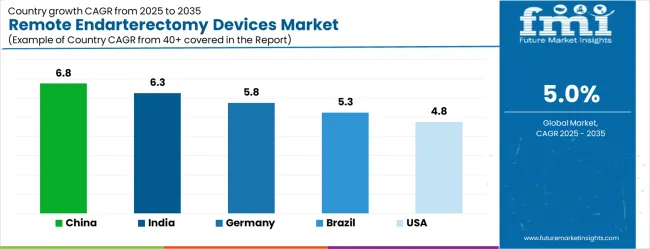

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| Brazil | 5.3% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

The Remote Endarterectomy Devices Market is expected to register a CAGR of 5.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.8%, followed by India at 6.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Japan posts the lowest CAGR at 3.8%, yet still underscores a broadly positive trajectory for the global Remote Endarterectomy Devices Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.8%.

The USA Remote Endarterectomy Devices Market is estimated to be valued at USD 92.0 million in 2025 and is anticipated to reach a valuation of USD 92.0 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 14.2 million and USD 6.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 263.7 Million |

| Product | Aortic, Carotid, General Surgery, and Lower Extremity |

| Application | Long Segment Occlusions, Stent Removal, and Failed Fem-Pop Bypass |

| End User | Hospitals, Specialized Clinics, Medical Device Manufacturers, and Research Centers And Laboratory |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Scanlan International, 3M Company, Accuray Incorporated, Alliqua BioMedical, Delcath Systems, ICU Medical, and iRhythm Technologies |

The global remote endarterectomy devices market is estimated to be valued at USD 263.7 million in 2025.

The market size for the remote endarterectomy devices market is projected to reach USD 429.5 million by 2035.

The remote endarterectomy devices market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in remote endarterectomy devices market are aortic, carotid, general surgery and lower extremity.

In terms of application, long segment occlusions segment to command 45.7% share in the remote endarterectomy devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Remote ICU Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Lockout Tool Market Size and Share Forecast Outlook 2025 to 2035

Remote Desktop Software Market Forecast and Outlook 2025 to 2035

Remote Assist Headrest Market Size and Share Forecast Outlook 2025 to 2035

Remote Electrocardiogram Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Remote Valve Tissue Expanders Market Size and Share Forecast Outlook 2025 to 2035

Remote Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Remote Operated Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Remote DC Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Towers Market Size and Share Forecast Outlook 2025 to 2035

Remote AF Detection Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Remote Vehicle Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Remote Home Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Remote Learning Technology Spending Market Analysis by Technology Software, Technology Services, Learning Mode, End User and Region Through 2025 to 2035

Remote Sensing Services Market Trends - Growth & Forecast 2025 to 2035

Remote Cooled Cube Ice Machines Market – Advanced Refrigeration & Industry Growth 2025 to 2035

Remote Healthcare Market - Growth & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA