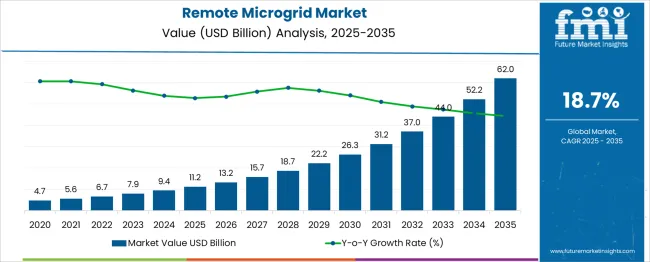

The remote microgrid market is estimated to be valued at USD 11.2 billion in 2025 and is projected to reach USD 62.0 billion by 2035, registering a compound annual growth rate (CAGR) of 18.7% over the forecast period. The market is projected to create an absolute gain of USD 50.8 billion and achieve a growth multiplier of 5.54x over the decade. This rapid expansion, supported by a robust CAGR of 18.7%, is fueled by the increasing need for energy resilience, renewable integration, and electrification of remote areas. During the first five years (2025–2030), the market grows from USD 11.2 billion to USD 26.3 billion, adding USD 15.1 billion, which accounts for 29.7% of the total growth, with a 5-year multiplier of 2.35x driven by rising installations in mining, defense, and rural electrification projects. The second half (2030–2035) adds a significant USD 35.7 billion, representing 70.3% of incremental growth, as advanced microgrid control systems, hybrid generation models, and energy storage integration scale across emerging markets and industrial sectors.

Yearly increments escalate from USD 2.0 billion in early years to nearly USD 9.8 billion in the final phase, reflecting aggressive deployment of off-grid renewable solutions. Manufacturers and developers investing in modular microgrid systems, AI-based energy management, and hydrogen-backed storage will capture maximum value in this USD 50.8 billion opportunity, reinforcing their role in decentralized energy infrastructure.

| Metric | Value |

|---|---|

| Remote Microgrid Market Estimated Value in (2025 E) | USD 11.2 billion |

| Remote Microgrid Market Forecast Value in (2035 F) | USD 62.0 billion |

| Forecast CAGR (2025 to 2035) | 18.7% |

The remote microgrid market holds a notable position within several energy and distributed generation sectors. In the microgrid market, its share is approximately 30–35%, as remote applications form a significant portion of deployments for isolated communities, islands, and industrial sites. Within the renewable energy integration market, it accounts for about 6–7%, given that remote microgrids often combine solar, wind, and hybrid systems to reduce diesel dependence. In the distributed energy resources (DER) market, its share stands at nearly 8–10%, as remote microgrids rely heavily on localized generation and storage. For the off-grid power systems market, remote microgrids dominate with a share of around 40–45%, since they provide reliable alternatives to centralized grids in inaccessible regions.

In the energy storage and backup solutions market, their contribution is about 5–6%, driven by the inclusion of battery systems for balancing intermittent renewables. Rising electrification efforts in remote areas, energy security concerns for industrial operations, and falling costs of renewable technologies propel growth. Technological advancements in advanced storage systems, smart controllers, and hybrid microgrid designs further enhance reliability and cost-efficiency. As governments and organizations focus on decarbonization and resilient power supply, remote microgrids are expected to expand their role across these parent markets globally.

Market expansion is being driven by the need to deliver stable power to remote and off-grid locations, particularly in regions with limited infrastructure or frequent grid disruptions. Rising investments in rural electrification, disaster-prone zone resilience, and mining operations have further supported market adoption. The integration of intelligent control systems, renewable sources, and storage technologies has positioned remote microgrids as essential components in the energy transition.

Increasing policy support, coupled with declining costs of solar, battery storage, and digital monitoring technologies, is reinforcing their viability across diverse geographies. As nations prioritize energy security, emissions reduction, and sustainable development, the remote microgrid market is expected to experience consistent growth, supported by public-private collaborations and innovations in modular and scalable energy solutions..

The remote microgrid market is segmented by connectivity, power source, storage device, grid type, and geographic regions. The connectivity of the remote microgrid market is divided into off-grid and grid-connected. The power source of the remote microgrid market is classified into Diesel generators, Natural gas, Solar PV, CHP, and Others. The storage device market for the remote microgrid is segmented into Lithium-ion, Lead acid, Flow battery, Flywheels, and Others. The grid type of the remote microgrid market is segmented into AC, DC, and Hybrid. Regionally, the remote microgrid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

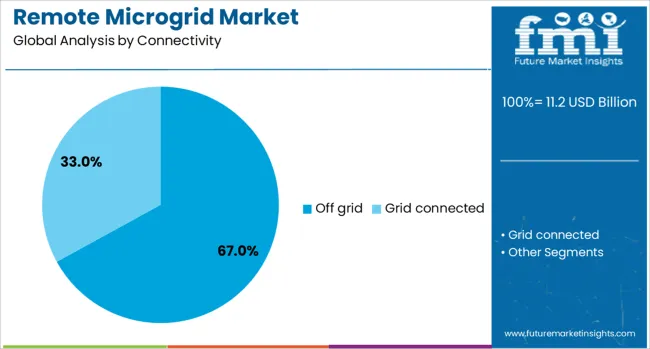

The off-grid connectivity segment is projected to account for 67% of the Remote Microgrid market revenue share in 2025, making it the dominant connectivity type. Growth in this segment has been driven by the widespread need to supply reliable electricity to remote regions where central grid access is unavailable or unreliable. This segment has benefited from increasing government and NGO initiatives focused on rural electrification and energy equity.

The ability of off-grid systems to integrate renewable energy sources with advanced control capabilities has strengthened their operational independence. Their modular design has allowed deployment in diverse terrains and isolated communities, providing flexible power delivery without relying on extensive transmission infrastructure.

The segment’s leadership is also attributed to the reduced costs of photovoltaic systems and energy storage, which have made off-grid microgrids more accessible and cost-effective. As sustainable development goals continue to guide global energy strategies, off grid microgrids are expected to remain pivotal in closing the energy access gap.

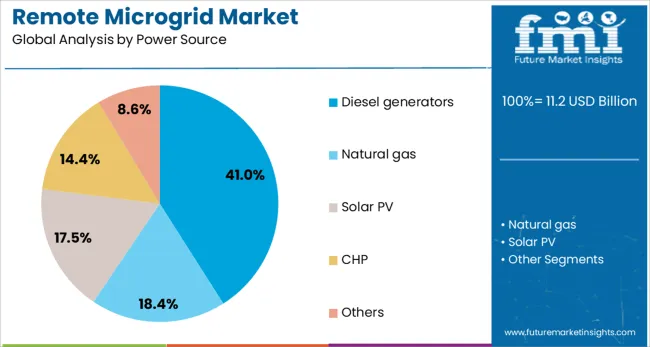

The diesel generators segment is expected to hold 41% of the Remote Microgrid market revenue share in 2025, establishing it as the leading power source segment. This dominance is supported by the reliability, fuel availability, and load balancing capabilities provided by diesel generation, particularly in off-grid and harsh environmental conditions. Diesel generators have been widely adopted as the backbone of many microgrids due to their proven performance, scalability, and ability to operate independently or in hybrid configurations.

The segment's resilience in extreme weather and remote deployments has reinforced its relevance despite rising environmental concerns. Operational familiarity and long service life have further cemented its position in applications requiring continuous power, such as military outposts, mining sites, and island communities.

While renewable integration continues to rise, diesel generators are expected to maintain a central role in microgrid systems where fuel supply chains and rugged performance remain essential. The hybridization of diesel systems with renewable sources is also contributing to extended viability and improved emissions profiles..

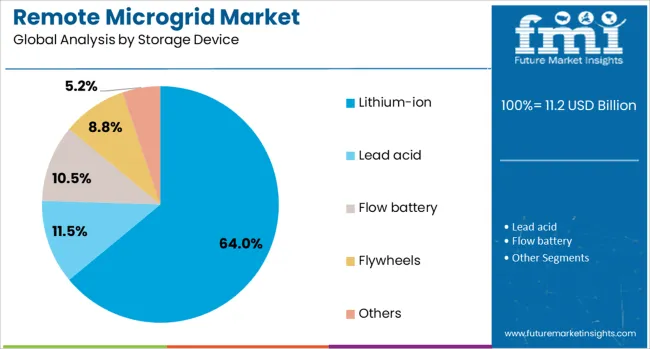

The lithium ion segment is projected to represent 64% of the Remote Microgrid market revenue share in 2025, positioning it as the leading storage device segment. This leadership has been achieved through significant advancements in battery energy density, efficiency, and lifespan, making lithium ion technology a preferred choice for microgrid storage applications. The ability of lithium ion systems to provide fast response times, stable voltage output, and deep cycling capability has supported their integration with both renewable and conventional power sources.

Enhanced by decreasing costs and compact modular designs, these batteries have become central to energy storage strategies in off grid environments. Safety improvements, smart battery management systems, and support for remote monitoring have further increased their adoption.

The scalability of lithium ion storage systems has also enabled deployment in a wide range of microgrid sizes, from small community installations to industrial-scale setups. As global microgrid developers prioritize energy reliability and carbon reduction, lithium ion storage devices are expected to remain at the forefront of the storage segment..

The remote microgrid market is witnessing accelerated adoption due to the growing need for reliable off-grid power in industrial, defense, and rural applications. Growth drivers include energy security concerns and rising deployment in mining and islanded communities. Opportunities have emerged in integrating storage and hybrid generation solutions for cost optimization. Trends such as AI-based predictive management and modular system deployment are shaping operational strategies. However, high installation costs, complex regulatory approvals, and supply chain delays remain key restraints. The outlook indicates strong expansion driven by industrial users and government-supported rural electrification initiatives.

The major growth driver for remote microgrids has been the increasing demand for consistent power supply in remote locations. In 2024 and 2025, projects in mining belts of Australia and Africa adopted microgrids to ensure uninterrupted operations. Government-backed rural electrification programs in India and Southeast Asia have also increased deployment in isolated communities. Defense establishments have adopted remote microgrids for enhanced resilience and energy autonomy. This trajectory emphasizes the critical role of microgrids in delivering operational reliability where traditional grid access is either unavailable or economically unfeasible.

Significant opportunities have been identified in hybrid system deployment and energy storage integration. In 2025, remote microgrids combined with solar-diesel hybrids and advanced battery systems gained prominence in Latin America and Arctic regions for off-grid applications. Demand for high-capacity storage has surged as industrial users seek cost predictability and reduced dependence on fossil fuels. Microgrid providers collaborating with energy storage manufacturers have captured new contracts in defense and commercial sectors. This evolving scenario underscores the value of hybrid solutions in extending microgrid capabilities and reducing operational volatility across remote installations.

Emerging trends indicate increased preference for modular microgrid architectures and AI-enabled control systems. In 2024, modular solutions were deployed in mining operations, allowing scalability with minimal installation delays. Digital optimization platforms using predictive analytics have enhanced system reliability and reduced fuel costs in hybrid configurations. Remote monitoring via cloud-based dashboards has become a standard feature for operators seeking real-time performance insights. These trends highlight an industry-wide pivot toward intelligent systems and configurable designs, reinforcing the adaptability of remote microgrids in challenging environments and large-scale industrial deployments.

Market restraints stem primarily from high upfront capital requirements and regulatory compliance challenges. In 2025, several microgrid projects in developing economies were deferred due to cost concerns and a lack of financing models. Grid interconnection standards and land clearance regulations further delayed implementation timelines. Additionally, the volatility in component pricing, particularly for energy storage systems, has complicated budget planning. These constraints suggest that vendors must prioritize cost-effective modular designs, innovative financing options, and regulatory support partnerships to sustain growth and overcome the hurdles limiting broad-based market penetration.

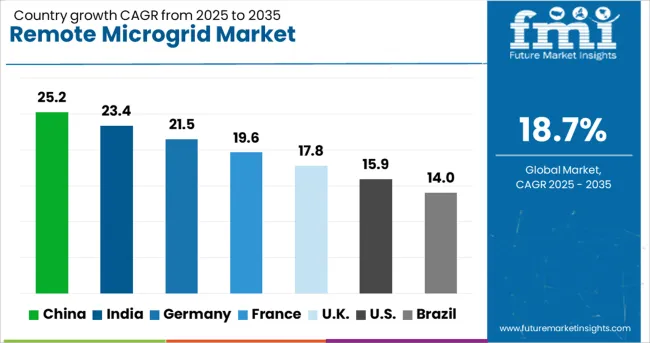

| Country | CAGR |

|---|---|

| China | 25.2% |

| India | 23.4% |

| Germany | 21.5% |

| France | 19.6% |

| UK | 17.8% |

| USA | 15.9% |

| Brazil | 14.0% |

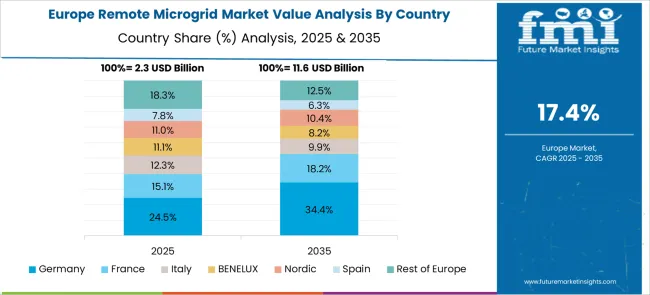

The global remote microgrid market is forecasted to grow at an impressive 18.7% CAGR during 2025–2035. China leads with 25.2% CAGR, propelled by large-scale rural electrification and renewable integration programs. India follows at 23.4%, driven by government-led energy access initiatives and distributed solar adoption. France grows at 19.6%, supported by EU clean energy targets and deployment in islanded grids. The UK posts 17.8% CAGR, focusing on resilience projects and carbon-neutral strategies, while the United States records 15.9%, reflecting modernization of military bases and community energy systems. Asia-Pacific dominates market expansion through aggressive renewable policies and grid decentralization efforts, while Europe and North America prioritize regulatory compliance, energy security, and digital integration of microgrid systems.

The remote microgrid market in China is expected to expand at 25.2% CAGR, leading global growth through 2035. Rapid rural electrification, coupled with the country’s renewable energy strategy, drives large-scale deployment of solar-diesel hybrid and energy storage-integrated microgrids. State-owned utilities invest heavily in modular microgrid designs for remote mining regions and island territories. The national carbon-neutrality roadmap promotes advanced digital control systems for optimizing load management. Local manufacturers scale production of lithium-based storage systems to support microgrid efficiency, while international players focus on providing smart controllers and AI-based optimization solutions.

India is projected to grow at 23.4% CAGR, driven by ambitious targets under the National Electricity Plan and rural electrification initiatives. Increasing reliance on solar-diesel hybrid microgrids for remote villages and telecom towers reinforces market growth. The push for decentralized power generation supports adoption in industrial clusters and islanded grids. State renewable energy agencies partner with private developers to roll out solar-based microgrids in low-access regions. Deployment of smart metering and IoT-based controllers enhances efficiency in demand response and load optimization, ensuring affordability and scalability.

France records 19.6% CAGR, supported by the country’s strong commitment to EU renewable energy directives and decarbonization strategies. Remote microgrids play a vital role in supplying clean energy to island regions and military installations. Government incentives and green financing mechanisms boost deployment of renewable-powered microgrids integrated with advanced battery storage. The industrial sector adopts microgrids for resilience against grid instability and to meet sustainability compliance. French technology providers focus on microgrid automation and predictive analytics to improve energy forecasting and cost control.

The United Kingdom is projected to expand at 17.8% CAGR, with deployment driven by resilience needs in remote communities and government initiatives promoting carbon-neutral energy infrastructure. Microgrids are increasingly used in data centers, defense sites, and rural healthcare facilities to ensure energy security. The country prioritizes hybrid renewable configurations integrated with battery energy storage and hydrogen systems. Utilities and private developers invest in digital microgrid platforms offering grid-interactive functionalities for balancing local demand and supporting grid decarbonization targets.

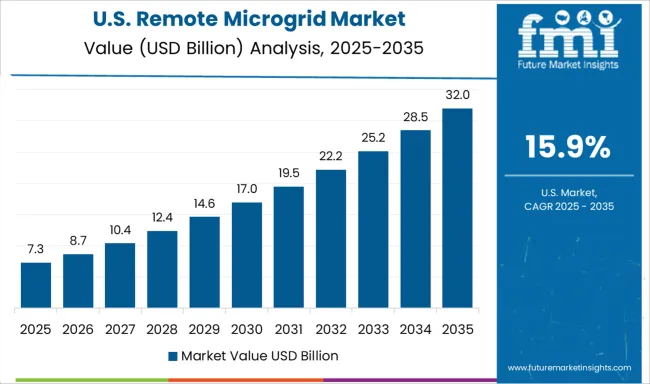

The United States remote microgrid market is set to grow at 15.9% CAGR, driven by increasing investments in community energy resilience, disaster recovery systems, and military applications. Federal funding under clean energy programs supports microgrid projects integrating solar, wind, and battery storage. Adoption is rising in regions affected by extreme weather events, where microgrids provide reliable backup power. Utilities deploy modular and containerized microgrids for rapid deployment in remote areas. The integration of AI-based control systems and advanced cybersecurity solutions ensures secure and optimized grid operations.

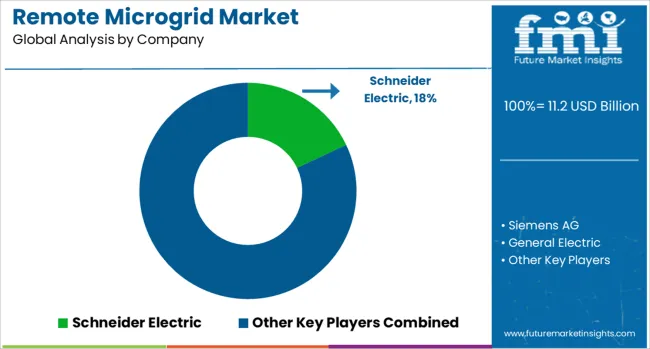

The remote microgrid market is moderately consolidated, with Schneider Electric recognized as a leading player due to its advanced microgrid control solutions, strong expertise in energy automation, and global deployment capabilities. The company provides end-to-end systems integrating renewable energy, energy storage, and smart grid technologies tailored for remote communities, industrial sites, and critical infrastructure. Key players include Siemens AG, General Electric, Eaton, HOMER Energy (UL Solutions), and ABB. These companies deliver comprehensive microgrid solutions combining distributed energy resources, grid management software, and advanced analytics to ensure energy reliability and efficiency in isolated or off-grid locations.

Their offerings focus on seamless integration of renewable energy, optimization of power flows, and reducing dependency on diesel generators. Market growth is driven by rising demand for resilient power systems in remote regions, increased renewable energy adoption, and the need for cost-effective alternatives to traditional grid extension. Leading suppliers are investing in modular microgrid designs, IoT-enabled monitoring platforms, and AI-based energy optimization systems to enhance performance.

Emerging trends include hybrid microgrids incorporating solar, wind, and storage systems, as well as blockchain-based energy trading within decentralized networks. Asia-Pacific and Africa are key growth regions due to rural electrification initiatives, while North America and Europe lead in technology adoption for critical facilities and commercial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.2 Billion |

| Connectivity | Off grid and Grid connected |

| Power Source | Diesel generators, Natural gas, Solar PV, CHP, and Others |

| Storage Device | Lithium-ion, Lead acid, Flow battery, Flywheels, and Others |

| Grid Type | AC, DC, and Hybrid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, Siemens AG, General Electric, Eaton, HOMER Energy (UL Solutions), and ABB |

| Additional Attributes | Dollar sales by connectivity (AC, DC, hybrid) and power source (solar PV, diesel, natural gas, CHP). Market size USD 9.4 billion in 2024 with \~18.7 % CAGR to 2034. Asia-Pacific and North America dominate growth. Buyers seek hybrid renewable systems, edge-AI energy optimization, modular hydrogen storage, and fast-deploy microgrid configurations. |

The global remote microgrid market is estimated to be valued at USD 11.2 billion in 2025.

The market size for the remote microgrid market is projected to reach USD 62.0 billion by 2035.

The remote microgrid market is expected to grow at a 18.7% CAGR between 2025 and 2035.

The key product types in remote microgrid market are off grid and grid connected.

In terms of power source, diesel generators segment to command 41.0% share in the remote microgrid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Remote DC Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote ICU Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Lockout Tool Market Size and Share Forecast Outlook 2025 to 2035

Remote Desktop Software Market Forecast and Outlook 2025 to 2035

Remote Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Assist Headrest Market Size and Share Forecast Outlook 2025 to 2035

Remote Endarterectomy Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Electrocardiogram Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Remote Valve Tissue Expanders Market Size and Share Forecast Outlook 2025 to 2035

Remote Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Remote Operated Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Remote Towers Market Size and Share Forecast Outlook 2025 to 2035

Remote AF Detection Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Remote Vehicle Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Remote Home Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Remote Learning Technology Spending Market Analysis by Technology Software, Technology Services, Learning Mode, End User and Region Through 2025 to 2035

Remote Sensing Services Market Trends - Growth & Forecast 2025 to 2035

Remote Cooled Cube Ice Machines Market – Advanced Refrigeration & Industry Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA