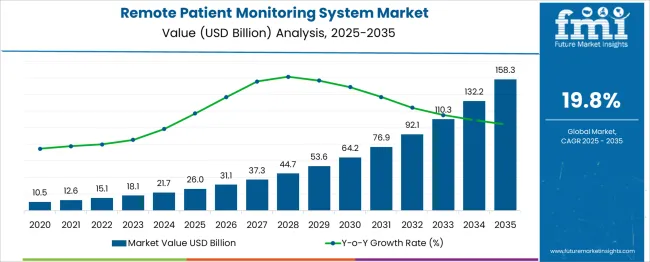

The global remote patient monitoring system market is likely to reach from USD 26 billion in 2025 to approximately USD 158.3 billion by 2035, recording an absolute increase of USD 132.16 billion over the forecast period. This translates into a total growth of 505.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 19.8% between 2025 and 2035. The market size is expected to grow by nearly 6.05X during the same period, supported by the rising adoption of digital health technologies and increasing demand for home-based patient care solutions across global healthcare systems.

Between 2025 and 2030, the market is projected to expand from USD 26 billion to USD 64.2 billion, resulting in a value increase of USD 38.2 billion, which represents 28.8% of the total forecast growth for the decade. This phase of growth will be shaped by rising prevalence of chronic diseases, increasing healthcare digitization initiatives, and growing preference for home-based patient monitoring solutions. Healthcare providers are expanding their remote monitoring capabilities to address the growing complexity of patient care management outside traditional clinical settings.

From 2030 to 2035, the market is forecast to grow from USD 64.2 billion to USD 158.3 billion, adding another USD 94.1 billion, which constitutes 71.2% of the ten-year expansion. This period is expected to be characterized by the expansion of artificial intelligence integration, the development of advanced biosensor technologies, and the widespread adoption of Internet of Things-enabled monitoring devices across diverse patient populations. The growing implementation of 5G networks and edge computing will drive demand for more sophisticated real-time monitoring capabilities and enhanced data analytics.

Between 2020 and 2025, the remote patient monitoring system market experienced accelerated expansion, driven by increasing chronic disease prevalence and growing healthcare cost containment pressures. The market developed as healthcare systems recognized the need for continuous patient monitoring technologies and remote care coordination platforms. Insurance coverage and regulatory frameworks began supporting remote monitoring adoption to improve patient outcomes and reduce healthcare delivery costs.

| Market | Value |

|---|---|

| Remote Patient Monitoring System (2025) | USD 26 billion |

| Remote Patient Monitoring System (2035) | USD 158.3 billion |

| Forecast CAGR (2025-2035) | 19.8% |

Market expansion is being supported by the rapid increase in chronic disease prevalence and the corresponding need for continuous patient monitoring solutions outside traditional healthcare facilities. Modern healthcare systems rely on remote monitoring technologies to provide timely intervention, reduce hospital readmissions, and improve patient engagement in their own care management. Even routine health monitoring can require comprehensive data collection to maintain optimal patient outcomes and prevent disease progression.

The growing complexity of chronic disease management and increasing focus on value-based care delivery are driving demand for advanced monitoring systems and integrated healthcare platforms from certified technology providers. Healthcare insurance systems are increasingly covering remote monitoring services to reduce care costs and improve population health outcomes. Medical device regulations and healthcare quality standards are establishing comprehensive monitoring protocols that require specialized equipment and trained healthcare teams.

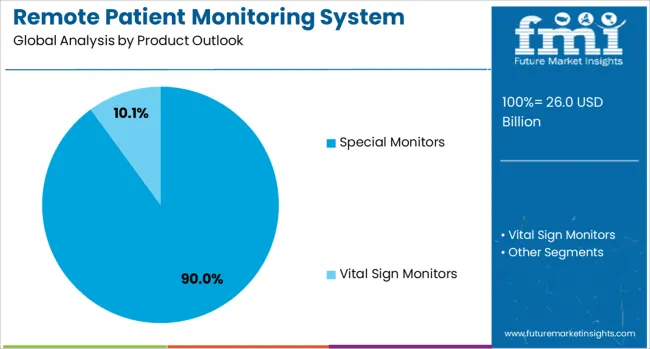

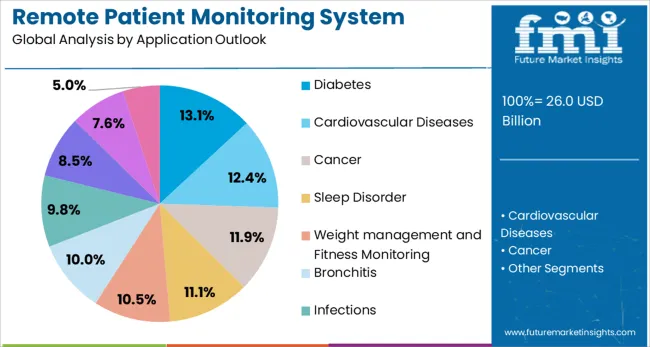

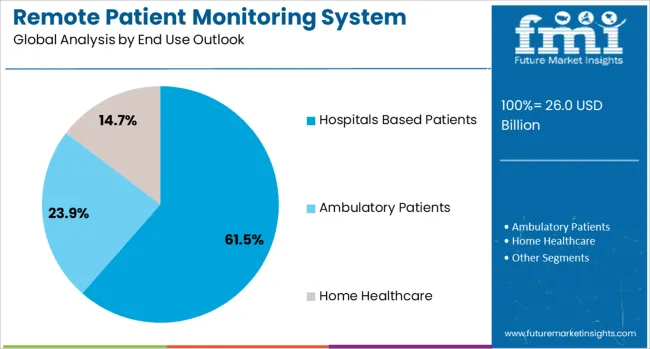

The market is segmented by product type, application, end use, and region. By product type, the market is divided into special monitors, Anesthesia monitors, blood glucose monitors, cardiac rhythm monitors, respiratory monitors, fetal heart monitors, prothrombin monitors, multi parameter monitors, vital sign monitors, blood pressure monitors, pulse oximeters, heart rate monitors, temperature monitors, respiratory rate monitors, brain monitoring, and others. Based on application, the market is categorized into diabetes, cardiovascular diseases, cancer, sleep disorders, weight management and fitness monitoring, bronchitis, infections, viruses, dehydration, and hypertension. In terms of end use, the market is segmented into hospital-based patients, ambulatory patients, and home healthcare. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Special monitors are projected to account for 90% of the remote patient monitoring system market in 2025. This leading share is supported by the comprehensive functionality and versatility of specialized monitoring devices that can track multiple patient parameters simultaneously. Special monitors provide essential data collection capabilities for diverse chronic conditions and are critical for maintaining continuous patient surveillance in remote settings. The segment benefits from established clinical protocols and comprehensive device options from multiple manufacturers.

Diabetes is expected to represent 13.1% of remote patient monitoring system application demand in 2025. This significant share reflects the high prevalence of diabetes globally and the critical need for continuous glucose monitoring in diabetes management protocols. Diabetes monitoring applications provide real-time blood glucose data and enable proactive treatment adjustments to prevent complications. The segment benefits from growing patient awareness and widespread healthcare provider adoption of diabetes monitoring technologies.

Hospital-based patients are projected to contribute 61.5% of the market in 2025, representing healthcare facilities that utilize remote monitoring for inpatient and transitional care management. These systems enable continuous patient surveillance, early intervention capabilities, and efficient resource allocation within hospital networks. Hospital-based monitoring typically provides comprehensive patient data integration with electronic health records and clinical decision support systems. The segment is supported by growing focuses on patient safety and clinical outcome optimization.

The market is advancing rapidly due to increasing chronic disease prevalence and growing recognition of remote care delivery benefits. The market faces challenges including data security concerns, regulatory compliance requirements, and varying reimbursement policies across different healthcare systems. Standardization efforts and interoperability initiatives continue to influence technology adoption and market development patterns.

The growing implementation of artificial intelligence and machine learning algorithms is enabling predictive analytics and automated alert systems that improve clinical decision-making. Advanced data processing capabilities provide healthcare providers with actionable insights from continuous patient monitoring data streams. These technologies are particularly valuable for identifying early warning signs of health deterioration and enabling proactive intervention strategies.

Modern remote monitoring systems are incorporating Internet of Things connectivity and integrated sensor networks that provide comprehensive patient data collection. Integration of wearable devices, smart home technologies, and mobile health applications enables seamless monitoring experiences for patients and healthcare providers. Advanced connectivity also supports real-time data transmission and remote clinical consultation capabilities.

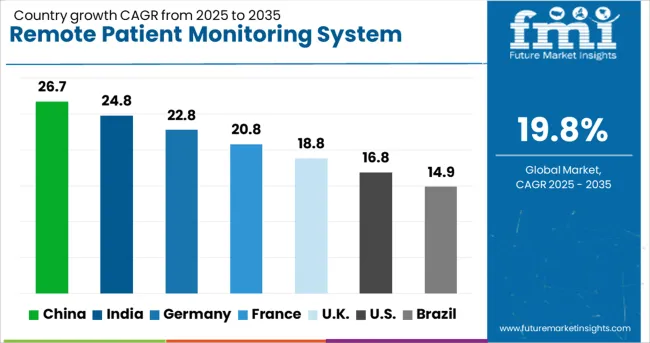

| Countries | CAGR (2025-2035) |

|---|---|

| China | 26.7% |

| India | 24.8% |

| Germany | 22.8% |

| France | 20.8% |

| United Kingdom | 18.8% |

| United States | 16.8% |

| Brazil | 14.9% |

The market is growing rapidly, with China leading at a 26.7% CAGR through 2035, driven by massive healthcare digitization initiatives, expanding elderly population, and government support for telemedicine infrastructure development. India follows at 24.8%, supported by increasing smartphone penetration, growing chronic disease burden, and expanding healthcare access programs. Germany grows steadily at 22.8%, focus on data security standards and integrated healthcare system efficiency. France records 20.8%, focusing on universal healthcare coverage and remote monitoring integration. The United Kingdom shows strong growth at 18.8%, prioritizing National Health Service digital transformation. The United States maintains steady growth at 16.8%, while Brazil demonstrates emerging market potential at 14.9%. China and India emerge as the leading drivers of global remote patient monitoring system market expansion.

Revenue from remote patient monitoring systems in China is projected to exhibit the highest growth rate with a CAGR of 26.7% through 2035, driven by massive government investment in healthcare digitization and expanding telemedicine infrastructure across urban and rural regions. The country's rapidly aging population and increasing chronic disease prevalence are creating significant demand for continuous patient monitoring solutions. Major technology companies and healthcare providers are establishing comprehensive remote monitoring platforms to support the growing population requiring ongoing health surveillance and management.

Revenue from remote patient monitoring systems in India is expanding at a CAGR of 24.8%, supported by increasing smartphone adoption, growing internet connectivity, and expanding awareness of digital health solutions. The country's large population with limited healthcare access is driving demand for scalable remote monitoring technologies. Healthcare startups and established medical device companies are gradually establishing capabilities to serve diverse patient populations requiring continuous health monitoring and chronic disease management.

Demand for remote patient monitoring systems in Germany is projected to grow at a CAGR of 22.8%, supported by the country's focuses on data privacy standards and systematic integration with existing healthcare infrastructure. German healthcare providers are implementing comprehensive remote monitoring capabilities that meet stringent regulatory requirements and patient data protection standards. The market is characterized by focus on clinical evidence validation, advanced cybersecurity measures, and compliance with comprehensive medical device regulations.

Demand for remote patient monitoring systems in France is expanding at a CAGR of 20.8%, driven by integration with universal healthcare coverage and focuses on healthcare system efficiency optimization. French healthcare providers are establishing standardized remote monitoring protocols that improve patient access while controlling healthcare delivery costs. The market benefits from comprehensive reimbursement policies and coordinated implementation across public and private healthcare facilities.

Growth Outlook for Remote Patient Monitoring System Market in the UK

Demand for remote patient monitoring systems in the United Kingdom is expanding at a CAGR of 18.8%, driven by National Health Service digital transformation initiatives and focuses on integrated care delivery models. British healthcare providers are implementing comprehensive remote monitoring frameworks that optimize resource allocation and improve patient outcomes across diverse population groups. The market benefits from coordinated implementation strategies and standardized clinical guidelines for remote patient care.

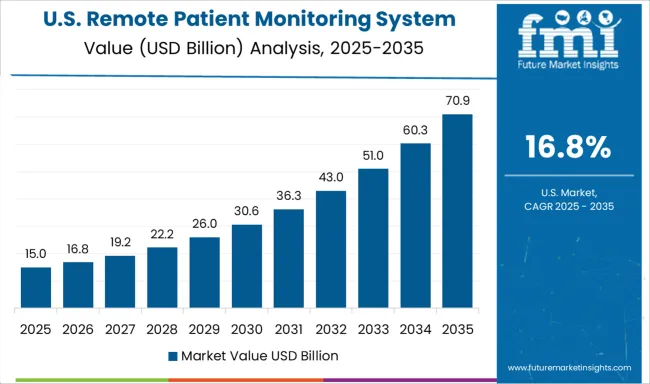

Demand for remote patient monitoring systems in the United States is projected to grow at a CAGR of 16.8% through 2035, supported by established healthcare technology infrastructure and comprehensive insurance coverage for remote monitoring services. American healthcare providers are implementing sophisticated patient monitoring platforms that integrate with electronic health records and clinical decision support systems. The market is characterized by advanced regulatory frameworks, established reimbursement mechanisms, and comprehensive quality measurement programs.

Revenue from remote patient monitoring systems in Brazil is expanding at a CAGR of 14.9%, driven by improving healthcare infrastructure and growing recognition of remote care delivery benefits. Brazilian healthcare providers are gradually establishing remote monitoring capabilities that serve diverse patient populations across urban and regional markets. The country's expanding middle class and increasing chronic disease awareness are creating opportunities for technology providers to expand their market presence.

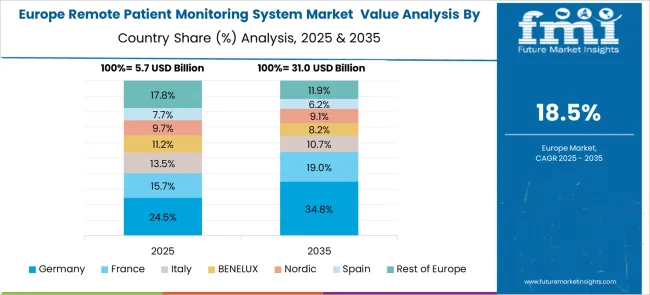

The market in Europe is projected to grow from USD 6.85 billion in 2025 to USD 31.47 billion by 2035, registering a CAGR of 16.5% over the forecast period. Germany is expected to maintain its leadership with a 28.2% market share in 2025, supported by its advanced healthcare infrastructure and comprehensive digital health initiatives across major metropolitan regions.

The United Kingdom follows with a 22.1% share, driven by National Health Service digital transformation programs and integrated care delivery models. France accounts for 18.7% of the European market, focusing on universal healthcare coverage and standardized remote monitoring protocols. Italy maintains a 12.3% share through expanding telemedicine capabilities and chronic disease management programs. Spain contributes 8.9% of the European market, supported by growing elderly population and healthcare digitization initiatives. The Nordic region holds 6.2% market share, characterized by advanced technology adoption and comprehensive patient data management systems. BENELUX countries account for 4.8% through integrated healthcare networks and cross-border care coordination programs.

The Rest of Europe region represents 8.8% of the market, encompassing Eastern European countries with expanding healthcare infrastructure and increasing adoption of digital health solutions. This region demonstrates significant growth potential through government healthcare modernization programs and increasing chronic disease awareness initiatives. Germany leads the European remote patient monitoring market through comprehensive healthcare digitization strategies and advanced medical device manufacturing capabilities. The country focus on data privacy compliance, interoperability standards, and clinical evidence validation for remote monitoring technologies. German healthcare providers implement systematic integration approaches that optimize workflow efficiency while maintaining stringent regulatory compliance requirements.

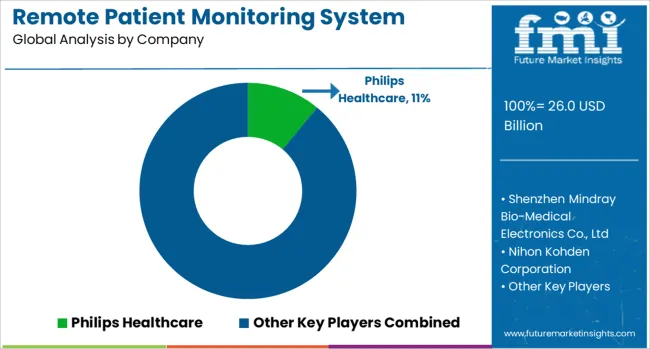

The market is defined by competition among established medical device manufacturers, healthcare technology companies, and digital health platform providers. Companies are investing in advanced sensor technologies, artificial intelligence integration, cloud computing platforms, and clinical validation studies to deliver accurate, reliable, and user-friendly monitoring solutions. Strategic partnerships, technological innovation, and regulatory compliance are central to strengthening product portfolios and market presence.

Philips Healthcare, Netherlands-based, offers comprehensive remote monitoring platforms with focus on clinical integration, data analytics, and patient engagement capabilities. Shenzhen Mindray Bio-Medical Electronics Co. Ltd provides advanced monitoring devices with focuses on affordability and global market accessibility. Nihon Kohden Corporation delivers specialized monitoring technologies with focus on clinical accuracy and reliability. Omron Corporation focuses on consumer-focused monitoring devices with user-friendly interfaces and home healthcare applications.

OSI Systems Inc offers comprehensive monitoring solutions integrated with healthcare facility management systems. Koninklijke Philips N.V. provides advanced digital health platforms with artificial intelligence integration and clinical decision support. F. Hoffmann-La Roche Ltd delivers specialized monitoring technologies for chronic disease management. Welch Allyn, Smiths Medical, Abbott, Boston Scientific Corporation, Dräger Medical, GE Healthcare, Honeywell, Johnson & Johnson, LifeWatch, and Medtronic offer specialized monitoring expertise, innovative sensor technologies, and clinical reliability across global and regional healthcare markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 26 billion |

| Product Type | Special Monitors, Anesthesia Monitors, Blood Glucose Monitors, Cardiac Rhythm Monitors, Respiratory Monitors, Fetal Heart Monitors, Prothrombin Monitors, Multi Parameter Monitors, Vital Sign Monitors, Blood Pressure Monitors, Pulse Oximeters, Heart Rate Monitors, Temperature Monitors, Respiratory Rate Monitors, Brain Monitoring, and Others |

| Application | Diabetes, cardiovascular diseases, cancer, sleep disorders, weight management and fitness monitoring, bronchitis, infections, viruses, dehydration, and hypertension |

| End Use | Hospital-based patients, ambulatory patients, and home healthcare |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France |

| Key Companies Profiled | Philips Healthcare, Shenzhen Mindray Bio-Medical Electronics Co. Ltd, Nihon Kohden Corporation, Omron Corporation, OSI Systems Inc, Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd, Welch Allyn, Smiths Medical, Abbott, Boston Scientific Corporation, Dräger Medical, GE Healthcare, Honeywell, Johnson & Johnson, LifeWatch, Medtronic |

| Additional Attributes | Dollar sales by product type, application, and end use, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established medical device manufacturers and emerging digital health providers, healthcare provider preferences for integrated platforms versus standalone devices, integration with electronic health records and clinical decision support systems, innovations in artificial intelligence analytics and predictive monitoring capabilities, and adoption of Internet of Things connectivity with advanced sensor networks and real-time data transmission for enhanced patient care coordination. |

Product Type:

Application:

End Use:

Region:

The global remote patient monitoring system market is estimated to be valued at USD 26.0 billion in 2025.

The market size for the remote patient monitoring system market is projected to reach USD 158.3 billion by 2035.

The remote patient monitoring system market is expected to grow at a 19.8% CAGR between 2025 and 2035.

The key product types in remote patient monitoring system market are special monitors, _anesthesia monitors, _blood glucose monitors, _cardiac rhythm monitor, _respiratory monitor, _fetal heart monitors, _prothrombin monitors, _multi parameter monitors (mpm), _others, vital sign monitors, _blood pressure monitors, _pulse oximeters, _heart rate monitor (ecg), _temperature monitor, _respiratory rate monitor and _brain monitoring (eeg).

In terms of application outlook, diabetes segment to command 13.1% share in the remote patient monitoring system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Remote Lockout Tool Market Size and Share Forecast Outlook 2025 to 2035

Remote Desktop Software Market Forecast and Outlook 2025 to 2035

Remote Assist Headrest Market Size and Share Forecast Outlook 2025 to 2035

Remote Endarterectomy Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Valve Tissue Expanders Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Remote Operated Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Remote DC Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Towers Market Size and Share Forecast Outlook 2025 to 2035

Remote AF Detection Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Remote Vehicle Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Remote Learning Technology Spending Market Analysis by Technology Software, Technology Services, Learning Mode, End User and Region Through 2025 to 2035

Remote Sensing Services Market Trends - Growth & Forecast 2025 to 2035

Remote Cooled Cube Ice Machines Market – Advanced Refrigeration & Industry Growth 2025 to 2035

Remote Healthcare Market - Growth & Innovations 2025 to 2035

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Remote Plasma Source Market

Remote Magnetic Catheter Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA