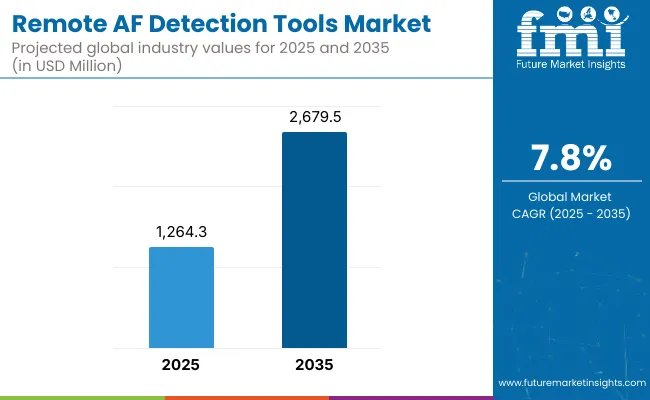

The Remote AF Detection Tools Market has been forecasted to attain a valuation of USD 1,264.3 million in 2025, rising to USD 2,679.5 million by 2035, resulting in an incremental gain of USD 1,415.2 million, which reflects a 47.2% increase over the forecast decade. A compound annual growth rate (CAGR) of 7.8% is expected to be recorded, indicating a rapid expansion trajectory for the remote AF detection tools market.

Remote AF Detection Tools Market Key Takeaways

| Metric | Value |

| Market Estimated Value in (2025E) | USD 1,264.3 million |

| Market Forecast Value in (2035F) | USD 2,679.5 million |

| Forecast CAGR (2025 to 2035) | 7.8% |

During the initial five-year phase from 2025 to 2030, a heavy incline is projected from USD 1,264.3 million to approximately USD 1,840.6 million adding nearly USD 576.3 million, which would contribute 68.7% of the total decade growth.

This period is expected to be defined by increasing cardiovascular disease prevalence, growing consumer adoption of wearable devices, and expanding remote patient monitoring capabilities. Strong uptake is likely to be witnessed across aging populations and healthcare systems globally, particularly in North America and Europe.

Between 2030 and 2035, the market is projected to expand further by USD 838.9 million, supported by enhanced AI integration, improved diagnostic accuracy of consumer devices, and deeper penetration in clinical workflows.

Advanced photo plethysmography sensors, machine learning algorithms, and seamless electronic health record integration are expected to serve as growth amplifiers in the latter half. A higher adoption rate across smartwatches, patch monitors, and implantable cardiac monitors is anticipated, shifting volume away from traditional Holter monitoring systems.

During this period, growth was led by smartwatch-based detection systems, with Apple Watch and FDA-cleared devices like AliveCorKardiaMobile dominating the consumer and clinical segments. Global leaders such as iRhythm Technologies and Medtronic secured market leadership by developing clinically validated, AI-powered solutions with high sensitivity and specificity for atrial fibrillation detection.

Revenue concentration was observed in the wearable devices and implantable cardiac monitors segments, while smartphone-based applications and patch monitors showed rapid adoption rates. By 2025, the market is expected to pivot toward integrated healthcare platforms, real-time clinical decision support, and AI-enhanced diagnostic algorithms.

The revenue mix is projected to shift as continuous monitoring solutions grow faster than episodic detection devices, contributing to more comprehensive patient care across demographic groups. Competitive advantage is transitioning from device accuracy alone to ecosystem integration, encompassing clinical workflow optimization, remote patient management, and predictive analytics capabilities.

The growth of the Remote AF Detection Tools Market is underpinned by a combination of clinical imperatives and technological innovations specifically tailored for atrial fibrillation management. AF remains one of the most common cardiac arrhythmias linked to a significant proportion of ischemic strokes globally, yet a substantial share of patients remain undiagnosed due to the intermittent and frequently asymptomatic presentation of the condition.

Remote detection devices address this critical gap by enabling continuous or frequent rhythm monitoring beyond traditional clinical environments, offering the potential for earlier diagnosis and timely therapeutic intervention.

The widespread adoption of telehealth accelerated by global health crises has further catalyzed remote cardiac monitoring deployment. Integration within comprehensive digital health platforms enables seamless sharing of cardiac data with clinicians, fostering closer patient-provider collaboration, better monitoring compliance, and more personalized disease management strategies.

Moreover, patient and provider awareness regarding the serious health risks posed by undiagnosed AF, balanced with the convenience and non-intrusive use of wearable devices, has reinforced demand. Collectively, these clinical and technological factors position the Remote AF Detection Tools Market for continued expansion as the convergence of healthcare delivery innovation and cardiovascular disease prevention unfolds.

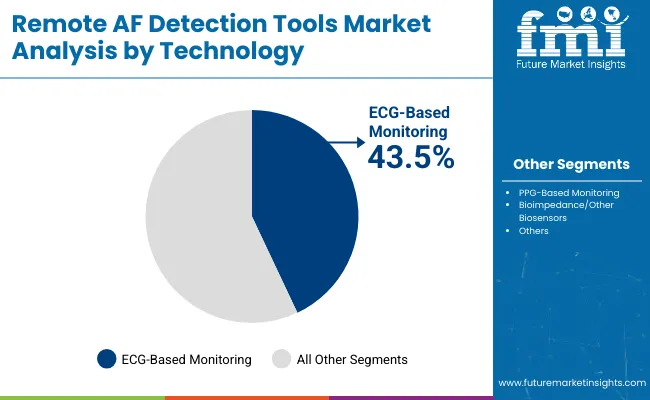

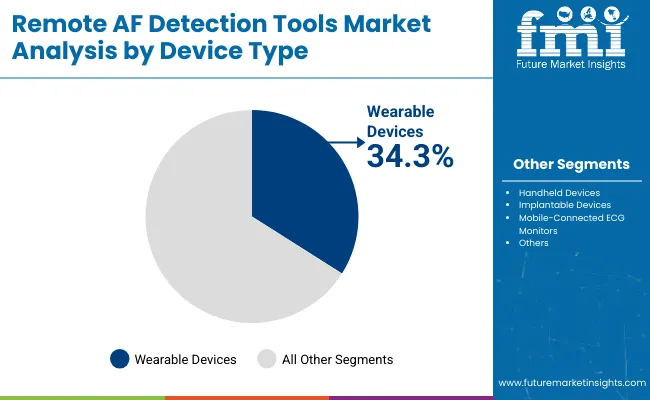

The market is segmented by technology, device, end-user, and region. Technology include ECG-Based Monitoring, PPG-Based Monitoring, Bioimpedance/Other Biosensorshighlighting the core elements driving adoption. By Devices includes Wearable Devices, Handheld Devices, Implantable Devices, Mobile-Connected ECG Monitors and Others. By Indication, the scope of the study includes Symptomatic AF, Asymptomatic/Subclinical AF, Post-Surgical/Post-Ablation AF and Screening in High-Risk Groups.

End User classification covers Hospitals & Cardiology Clinics, Ambulatory Surgical Centers (ASCs), Homecare Settings, Research & Academic Institutions. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Technology | Market Value Share, 2025 |

|---|---|

| ECG-Based Monitoring | 43.5% |

| PPG-Based Monitoring | 27.3% |

| Bioimpedance/Other Biosensors | 12.4% |

| Others | 16.7% |

The ECG-based monitoring segment has been projected to lead the market with a 43.5% share in 2025, and it continue to do so. The remote AF detection tools market is characterized by diverse technological platforms that reflect varied approaches to arrhythmia detection. Among these, ECG-based monitoring remains the cornerstone, providing gold-standard cardiac electrical activity measurements capable of precise arrhythmia diagnosis.

Photoplethysmography (PPG)-based monitoring devices have gained traction due to their integration in popular wearable technologies, offering non-invasive pulse waveform analysis that supports early detection of irregular heart rhythms with convenience, though with some limitations in specificity compared to ECG. Emerging biosensor technologies, including bioimpedance and other novel sensor modalities, are gradually entering the market, promising enhanced sensitivity and multi-parameter cardiac monitoring capabilities.

| Device Type | Market Value Share, 2025 |

|---|---|

| Wearable Devices | 34.3% |

| Handheld Devices | 21.6% |

| Implantable Devices | 16.3% |

| Mobile-Connected ECG Monitors | 12.3% |

| Others | 15.4% |

Device type segmentation highlights wearables as the primary growth factor with a 34.3% share in 2025, encompassing smartwatches, fitness bands, and patch monitors favored for their ease of use and continuous data capture. Handheld devices, often employing single-lead ECG recordings, facilitate spot checks and intermittent monitoring, especially valuable in clinical or home settings where continuous wear may not be feasible.

Implantable devices, while more invasive, offer unbeatable reliability and prolonged monitoring durations, playing a specialized role in patients requiring rigorous arrhythmia surveillance. Additionally, mobile-connected ECG monitors bridge clinical accuracy with patient mobility, enabling convenient cardiac assessments without sacrificing data quality.

The adoption of remote AF detection tools has been rapidly expanding, though certain scientific and commercial barriers remain. Rising consumer demand for cognitive enhancement is counterbalanced by formulation challenges, regulatory ambiguity, and varying awareness across global regions.

Robust Clinical Evidence Is Driving Confidence in Remote AF Detection

The expansion of the remote AF detection tools market is strongly supported by an increasing body of clinical evidence validating the effectiveness of remote monitoring devices. Peer-reviewed research and clinical trials confirm the ability of modern wearables, patch-based monitors, and ECG devices to accurately detect atrial fibrillation episodes, including asymptomatic cases that often go unnoticed in traditional clinical evaluations.

This foundation of trusted clinical data has accelerated acceptance among healthcare providers, leading to greater incorporation of remote AF detection into standard diagnostic and preventive cardiology protocols. Regulatory endorsements and guideline updates further solidify the role of these tools as reliable instruments for early AF identification and stroke risk reduction.

Growing Adoption of Clinician-Managed Remote Monitoring Pathways

A key growth driver for the remote AF detection tools market is the rising integration of these technologies within clinician-managed care frameworks. Cardiologists and specialized arrhythmia clinics are increasingly prescribing and overseeing remote AF monitoring, enabling personalized rhythm assessment and timely therapeutic decisions.

This proactive, practitioner-led model facilitates close monitoring of patients post-ablation or those at high risk, improving management outcomes and patient engagement. Strategic collaborations between device developers and healthcare institutions are expanding digital infrastructure to support seamless data sharing and clinical workflow integration. This trend highlights the critical role of healthcare professionals in driving long-term adoption and maximizing the clinical benefits of remote AF detection technologies.

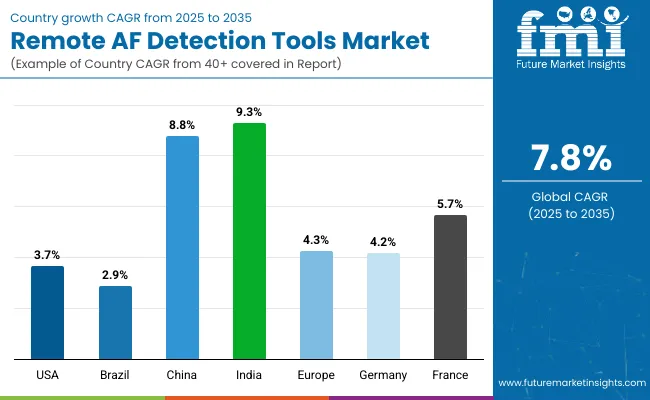

| Countries | CAGR |

|---|---|

| United States | 3.7% |

| Brazil | 2.9% |

| China | 8.8% |

| India | 9.3% |

| Europe | 4.3% |

| Germany | 4.2% |

| France | 5.7% |

The Remote AF Detection Tools Market displays significant variability in adoption and growth rates across different countries, shaped by healthcare infrastructure, technological readiness, and national health priorities.

In the United States, established digital health ecosystems and strong physician engagement have positioned the country at the forefront of remote AF detection, with continuous growth projected at a CAGR of 3.7%. The high prevalence of atrial fibrillation, robust research activity surrounding wearable ECG and patch monitors, and supportive reimbursement structures all contribute to this steady market expansion. United States clinical practice remains highly receptive to remote monitoring innovations as part of routine arrhythmia management and post-stroke prevention.

Across Europe, the market is expected to grow at a CAGR of 4.3%. National health systems, especially in countries such as Germany (4.2% CAGR) and France (5.7% CAGR), have embraced remote AF detection as part of comprehensive cardiac care and stroke prevention efforts.

Regulatory clarity and ongoing clinical trials advance the adoption of remote monitoring solutions, while regional initiatives promote integrated digital health applications across hospital and ambulatory care settings. In France, higher growth reflects strong investment in telemedicine and public health innovation, with widespread inclusion of digital tools in cardiac arrhythmia management protocols.

| Year | USA |

|---|---|

| 2025 | 393.9 |

| 2026 | 407.9 |

| 2027 | 422.5 |

| 2028 | 437.9 |

| 2029 | 453.9 |

| 2030 | 470.6 |

| 2031 | 487.9 |

| 2032 | 505.9 |

| 2033 | 525.2 |

| 2034 | 545.5 |

| 2035 | 566.5 |

The remote AF detection tools market in the United States has been forecasted to expand at a CAGR of 3.7% between 2025 and 2035. This growth is fueled by widespread adoption of remote monitoring for early arrhythmia detection, addressing the needs of both aging populations and individuals at elevated cardiovascular risk.

Clinical validation of wearable ECG and advanced monitoring technologies has received strong recognition among United States-based cardiologists, streamlining integration into preventive care and chronic disease management pathways.

Digital health platforms and virtual cardiac care clinics have played a pivotal role in personalizing arrhythmia management protocols, with remote AF detection tools now supporting a range of patient scenarios from home-based screening to hospital-led post-procedural surveillance.

The United States market has further benefited from a shift toward consumer-directed, non-invasive cardiac monitoring, meeting growing demand for continuous and accessible rhythm assessment outside traditional care settings.

The remote AF detection tools market in the United Kingdom is projected to grow at a CAGR of 5.0% during 2025-2035 driven by government initiatives aimed at reducing stroke incidence via early AF detection. Increased integration of remote monitoring technology within NHS pathways and cardiac rehabilitation programs has enhanced access for both urban and rural populations.

Furthermore, digital transformation efforts within the UK healthcare system have boosted adoption of telecardiology and home-based monitoring, supporting seamless data sharing between patients and care teams.

India’s remote AF detection tools market is expected to grow at a CAGR of 9.3% between 2025 and 2035, propelled by increasing cardiovascular disease prevalence and rising digital health penetration. Urban centers with advanced healthcare infrastructure are adopting mobile ECG and wearable devices at a fast pace.

Additionally, the rise of health-tech startups and e-pharmacies has cultivated a nascent but expanding consumer base for remote cardiac monitoring technologies. However, rural healthcare access and AF awareness remain challenges for market expansion.

China’s remote AF detection tools market is projected to expand at a CAGR of 8.8% from 2025 to 2035. China is emerging as one of the fastest-growing markets for Remote AF Detection Tools due to government-backed digital health policies and expanding urban healthcare infrastructure.

Large-scale public health programs targeting cardiovascular disease screenings have incorporated remote ECG monitoring as a scalable solution. Moreover, domestic medical device manufacturers are innovating cost-effective remote AF detection products, increasing accessibility across varying income groups.

The Remote AF Detection Tools Market in Germany is forecasted to achieve a CAGR of 4.2% between 2025 and 2035. Germany’s Remote AF Detection Tools Market is benefiting from a well-established healthcare system that prioritizes preventive cardiology and digital health integration.

A growing focus on outpatient management of chronic conditions is creating demand for continuous remote rhythm assessment technologies. High clinician trust in validated ECG monitoring devices and reimbursement support are key enablers for market growth, alongside patient preference for non-invasive cardiovascular monitoring methods.

| Technology | 2025 Share (%) |

|---|---|

| ECG-Based Monitoring | 43.5% |

| PPG-Based Monitoring | 29.3% |

| Bioimpedance/Other Biosensors | 10.4% |

| Others | 16.7% |

The remote AF detection tools market in Japan has been projected to reach USD 49.3 million by 2025. ECH-based monitoring leads the technology landscape with a 43.5% share, followed by PPG-based monitoring and bioimpedance/otherbiosensors at 29.3% & 10.4% respectively. Japan’s market growth for Remote AF Detection Tools is primarily driven by an aging population with a high burden of cardiovascular disease and proactive governmental health policies.

Remote monitoring technologies are increasingly integrated into both preventive health checkups and post-stroke follow-up care. Consumer acceptance of wearable medical devices is relatively high due to cultural emphasis on technological health solutions and longevity.

| End User | Market Value Share, 2025 |

|---|---|

| Hospitals & Cardiology Clinics | 33.3% |

| Ambulatory Surgical Centers (ASCs) | 29.4% |

| Homecare Settings | 19.5% |

| Research & Academic Institutions | 11.4% |

| Telehealth Providers | 6.4% |

The remote AF detection tools market in South Korea has been projected to reach USD 35.4 million in 2025. Hospitals & Cardiology Clinics are expected to lead distribution with a 33.3% share, followed ambulatory surgical centers (29.4%) and homecare settings (19.5%). South Korea’s remote AF detection market is growing fast, supported by one of the world’s most digitally connected populations and advanced telehealth infrastructure.

Government policies emphasize early disease detection and management through smart health technologies, accelerating adoption across clinical and consumer segments. The country’s strong technology manufacturing base also contributes to locally produced innovative wearable cardiac monitors.

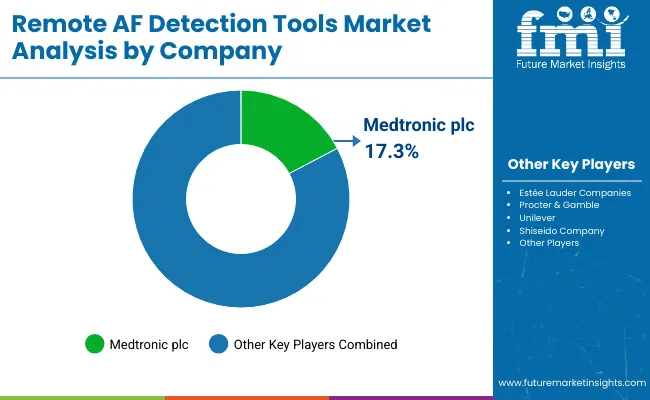

The remote AF detection tools market is consolidated, defined by a multi-tier structure that includes global technology leaders, mid‑sized innovators, and niche digital health specialists. Companies such as Medtronic, Philips, and iRhythm Technologies have established leadership by leveraging clinically validated remote monitoring portfolios, extensive R&D investment, and strategic collaborations with healthcare systems. These firms have built strong reputations through device approvals, large-scale clinical trials, and close integration with telehealth and electronic health record platforms.

Mid‑sized innovatorsincluding AliveCor, Qardio, and others are gaining traction by introducing wearable ECG devices, smart patches, and AI-powered arrhythmia analysis apps. Their ability to rapidly iterate on product design, focus on user-friendly interfaces, and build partnerships with mobile health and pharmacy chains has contributed to regional expansion, especially in consumer-oriented and ambulatory care settings.

Niche specialists such as Bardy Diagnostics, ATsens, and certain regional startups excel in producing highly specialized remote AF detection solutions such as ultra-lightweight continuous monitors or software-driven analytics for post-surgical care. These companies often focus on targeted populations, including post-ablation patients or those requiring high-frequency monitoring, and tailor their offerings for integration within specific clinical workflows.

Market differentiation is increasingly built around ecosystem value; companies are enhancing competitive positioning by embedding secure cloud platforms, enabling direct-to-clinician data transfer, providing customizable digital dashboards, and integrating with broader remote patient monitoring suites.

Key Developments in Remote AF Detection Tools Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,189.7 million |

| Technology | ECG-Based Monitoring, PPG-Based Monitoring, Bioimpedance/Other Biosensors and Others |

| Device Type | Wearable Devices, Handheld Devices, Implantable Devices, Mobile-Connected ECG Monitors and Others |

| Indication Type | Symptomatic AF, Asymptomatic/Subclinical AF, Post-Surgical/Post-Ablation AF and Screening in High-Risk Groups |

| End User | Hospitals & Cardiology Clinics, Ambulatory Surgical Centers (ASCs), Homecare Settings, Research & Academic Institutions and Telehealth Providers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Europe, Germany, France and UK |

| Key Companies Profiled | Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, iRhythm Technologies, Philips Healthcare, GE Healthcare, Siemens Healthineers, AliveCor, Qardio, Bardy Diagnostics , ATsens and Others |

The global Remote AF Detection Tools Market is estimated to be valued at USD 1,264.3 million in 2025.

The market size for the Remote AF Detection Tools Market is projected to reach approximately USD 2,679.5 million by 2035.

The Remote AF Detection Tools Market is expected to grow at a CAGR of 7.8% between 2025 and 2035.

The key product formats in the Remote AF Detection Tools Market include ECG-Based Monitoring, PPG-Based Monitoring, Bioimpedance/Other Biosensors and Others.

In terms of device type, wearable devices segment is projected to command the highest share at 34.3% in the Remote AF Detection Tools Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Remote ICU Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Lockout Tool Market Size and Share Forecast Outlook 2025 to 2035

Remote Desktop Software Market Forecast and Outlook 2025 to 2035

Remote Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Assist Headrest Market Size and Share Forecast Outlook 2025 to 2035

Remote Endarterectomy Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Electrocardiogram Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Remote Valve Tissue Expanders Market Size and Share Forecast Outlook 2025 to 2035

Remote Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Remote Operated Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Remote DC Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Towers Market Size and Share Forecast Outlook 2025 to 2035

Remote Vehicle Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Remote Home Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Remote Learning Technology Spending Market Analysis by Technology Software, Technology Services, Learning Mode, End User and Region Through 2025 to 2035

Remote Sensing Services Market Trends - Growth & Forecast 2025 to 2035

Remote Cooled Cube Ice Machines Market – Advanced Refrigeration & Industry Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA