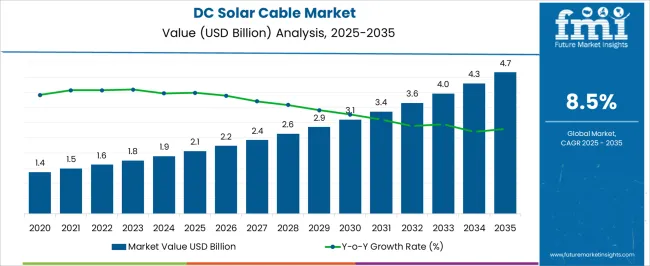

The DC solar cable market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period. The 5-year growth block analysis of the DC solar cable market indicates a steady upward trajectory, with market value projected to rise from USD 2.1 billion in 2025 to USD 3.1 billion by 2030, reflecting a compound annual growth rate (CAGR) of 8.5%. Over this period, the market is expected to experience consistent annual growth, with values increasing from USD 2.1 billion in 2025 to USD 2.2 billion in 2026, reaching USD 2.4 billion by 2027.

This progression reflects the growing adoption of DC solar cables in residential, commercial, and utility-scale solar installations, where the need for efficient, durable, and reliable cabling solutions is becoming increasingly critical. By 2030, the DC solar cable market is projected to reach USD 3.1 billion, driven by the rising deployment of solar power systems and the demand for high-performance electrical infrastructure. The steady growth highlights the importance of cables that ensure safe energy transmission and long-term operational efficiency. Market players offering quality, certified products are likely to gain a competitive edge as the demand for reliable cabling systems increases.

This trend suggests that the DC solar cable market will continue to expand, reinforcing its role as a foundational component in solar power networks and creating opportunities for suppliers to address both performance and operational requirements in solar installations.

| Metric | Value |

|---|---|

| DC Solar Cable Market Estimated Value in (2025 E) | USD 2.1 billion |

| DC Solar Cable Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The DC solar cable market is a specialized segment within the broader solar energy market, where it currently holds around 3-4% share, reflecting its essential role in transmitting direct current from solar panels to inverters and ensuring system efficiency. Within the electrical cables and wires market, DC solar cables represent approximately 2-3% share, as they are a niche product designed to withstand UV exposure, high temperatures, and outdoor environmental conditions. In the renewable energy infrastructure market, their share is about 4-5%, driven by the rapid installation of utility-scale solar farms and distributed solar systems that require reliable, high-performance cabling solutions.

Within the photovoltaic system components market, DC solar cables capture close to 5% share, as they form a critical part of the system along with modules, inverters, and mounting structures, directly influencing overall energy output and safety compliance. In the broader energy and power distribution market, DC solar cables hold around 2-3% share, reflecting their specialized application in solar power integration rather than general electricity transmission.

Key advancements in solar panel efficiency and inverter technologies have heightened the need for durable, high-performance cabling systems. Increasing adoption of decentralized power generation and government incentives supporting clean energy are also fueling market expansion. Long-term growth is supported by safety regulations, environmental compliance standards, and the demand for flexible cable systems optimized for low-voltage direct current environments.

The DC solar cable market is segmented by conductor, application, and geographic regions. By conductor, DC solar cable market is divided into Copper, Aluminum, and Others. In terms of application, DC solar cable market is classified into Industrial, Residential, and Commercial. Regionally, the DC solar cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

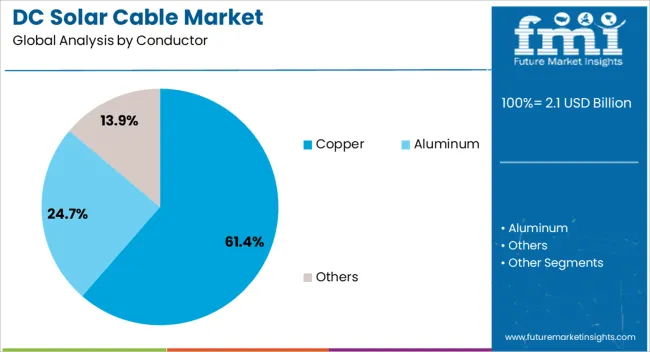

Copper conductors are projected to dominate the DC solar cable market with a 61.40% share in 2025, due to their superior electrical conductivity and long-term durability. Their high thermal resistance and low power loss make copper ideal for photovoltaic applications, especially where energy efficiency is paramount.

Safety compliance, fire resistance standards, and compatibility with a wide range of solar panel configurations further support the segment's growth. Copper's mechanical flexibility also enables easier installation across residential rooftops and large-scale solar farms, contributing to its continued dominance.

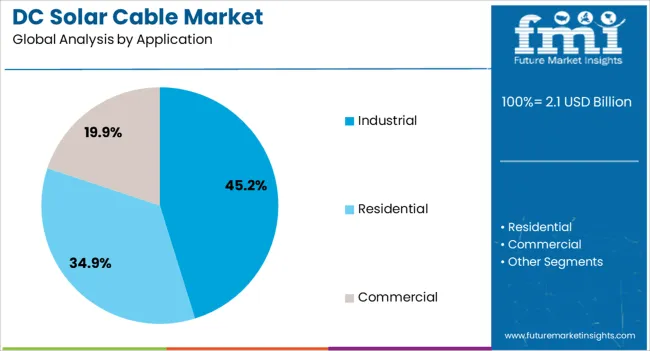

The industrial segment is expected to lead the application landscape with a 45.20% share by 2025. This growth is driven by the rising deployment of solar energy systems across manufacturing plants, data centers, and warehouse complexes.

Industries are leveraging solar power to reduce operational costs, meet sustainability targets, and ensure grid independence. The increasing adoption of large-scale rooftop and ground-mounted systems requires robust and high-capacity DC cabling, favoring tailored solutions for industrial-grade infrastructure.

With growing ESG mandates and carbon-neutral goals, solar integration in the industrial sector is expected to sustain strong demand for specialized DC cables.

The satellite solar cell materials market is expanding as reliance on satellites for communications, navigation, and defense grows globally. Opportunities are increasing with large commercial constellations and deep-space missions, while trends emphasize multi-junction efficiency, lightweight composites, and radiation-resistant designs. Challenges remain in cost barriers, material sourcing, and supply chain resilience. In my opinion, long-term competitiveness will favor manufacturers that combine innovation with cost-effective production, positioning them to meet rising demand from both government and commercial satellite operators worldwide.

The DC solar cable market is being driven by the rapid growth of solar photovoltaic (PV) installations globally. As residential, commercial, and utility-scale solar projects expand, the need for high-quality direct current (DC) cables capable of withstanding high temperatures, UV exposure, and environmental stress is rising. Efficient and reliable DC cabling is critical to ensuring uninterrupted power transmission from solar modules to inverters. Rising investments in renewable energy infrastructure, especially in Asia-Pacific and North America, are sustaining market demand.

Significant opportunities exist for DC solar cables with enhanced performance characteristics. Low-smoke, halogen-free, flame-retardant, and anti-corrosion cables are increasingly preferred for both rooftop and utility-scale installations. Demand is rising for long-lasting, flexible, and easy-to-install cable solutions that minimize energy losses and reduce maintenance costs. Manufacturers that develop tailored products for extreme climates, offshore solar farms, and high-voltage applications are well-positioned to capitalize on emerging opportunities. Growth is further supported by regulatory mandates favoring certified and high-quality cabling solutions.

A key trend in the market is the move toward standardized, certified cables and integration with digital monitoring systems. Solar PV developers increasingly prefer cables compliant with international standards such as IEC and UL for safety, reliability, and interoperability. Smart monitoring technologies, including real-time performance tracking and fault detection, are being incorporated into solar cabling networks, enabling predictive maintenance and minimizing downtime. These trends are shaping the market toward higher efficiency, operational transparency, and reduced lifecycle costs for solar PV systems.

The DC solar cable market faces challenges from high material and installation costs. Premium cables with advanced features can increase project capital expenditure, impacting adoption in price-sensitive regions. Harsh environmental conditions, such as extreme heat, UV exposure, and moisture, can degrade cable performance over time, necessitating frequent replacements. Supply chain disruptions for high-grade copper or specialized insulation materials also pose challenges. To overcome these barriers, manufacturers are focusing on cost-effective production, quality assurance, and durable materials that can withstand demanding conditions while ensuring long-term reliability.

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

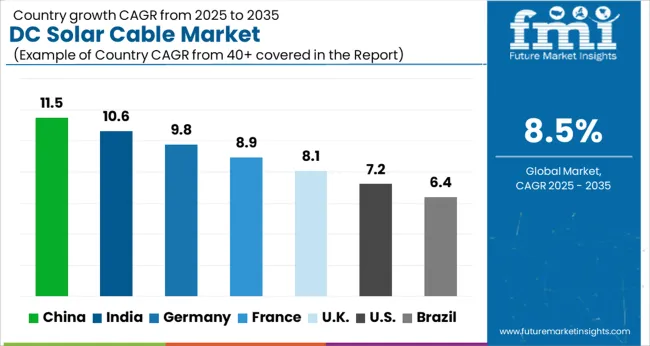

The global DC solar cable market is projected to grow at a CAGR of 8.5% from 2025 to 2035. China leads with a growth rate of 11.5%, followed by India at 10.6% and France at 8.9%. The United Kingdom records a growth rate of 8.1%, while the United States shows the slowest growth at 7.2%. Expansion is supported by the increasing adoption of solar energy systems, rooftop and utility-scale installations, and government incentives for renewable energy. Emerging economies such as China and India benefit from large-scale solar projects and supportive policies, while developed markets like the USA, UK, and France are focusing on high-efficiency installations and integration with smart energy networks. This report includes insights on 40+ countries; the top markets are shown here for reference.

The DC solar cable market in China is growing at 11.5% CAGR, the highest among leading countries. Growth is driven by large-scale solar farms, rooftop installations, and government subsidies promoting solar energy adoption. Domestic manufacturers are expanding production capacity to meet demand for high-efficiency, weather-resistant cables. The integration of solar projects with smart grid networks further boosts adoption. Increasing investments in renewable energy infrastructure and energy storage solutions reinforce market growth.

The DC solar cable market in India is advancing at 10.6% CAGR, fueled by rapid growth in solar energy capacity and government incentives. Solar parks, rooftop installations, and rural electrification projects create steady demand for high-quality DC cables. Manufacturers are focusing on UV-resistant, flame-retardant, and high-conductivity cables to meet safety and efficiency standards. Partnerships with global suppliers support technology transfer and product reliability. The market benefits from large-scale adoption of solar energy solutions across commercial, industrial, and residential sectors.

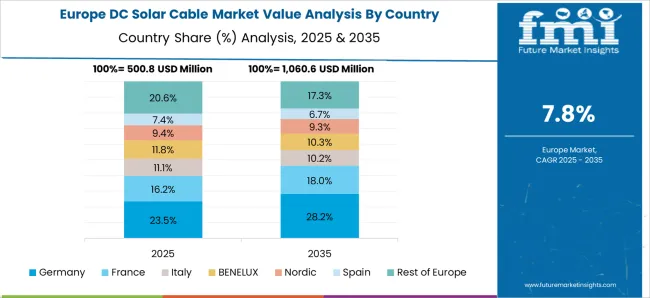

The DC solar cable market in France is growing at 8.9% CAGR, supported by increasing renewable energy capacity and solar energy initiatives. Large-scale solar farms and distributed rooftop systems require reliable, durable DC cables. Regulatory frameworks promoting clean energy and grid integration drive adoption. Manufacturers are emphasizing high-performance cables with resistance to environmental stress and long-term durability. Industrial and commercial solar applications further contribute to steady market expansion.

The DC solar cable market in the United Kingdom is expanding at 8.1% CAGR, influenced by increasing solar capacity and adoption of residential and commercial PV systems. Cables with high conductivity, UV resistance, and durability are preferred for rooftop and utility-scale projects. Integration with energy storage systems and smart grids boosts demand. Government initiatives and subsidies to promote solar energy adoption continue to support growth. The market emphasizes long-term reliability and compliance with European safety standards.

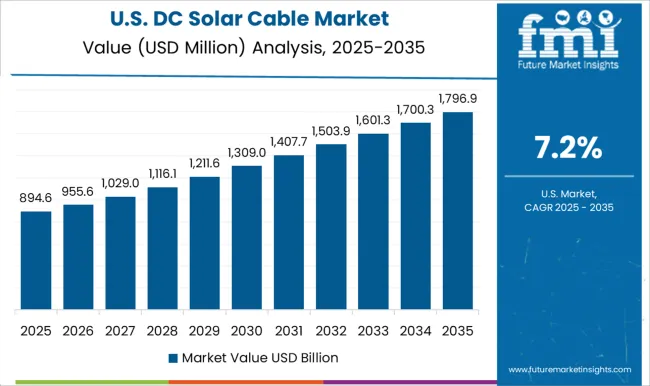

The DC solar cable market in the United States is growing at 7.2% CAGR, the slowest among leading nations. Growth is supported by utility-scale solar farms, rooftop installations, and government incentives promoting renewable energy adoption. Manufacturers focus on durable, flame-retardant, and high-conductivity cables to ensure safety and efficiency. Integration with energy storage solutions and smart energy networks enhances market demand. The market also benefits from residential and commercial solar expansion and federal renewable energy targets.

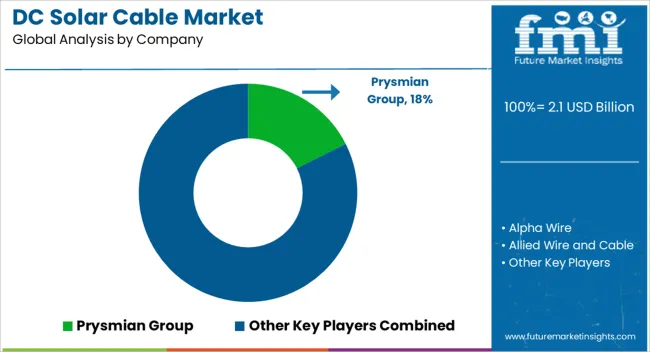

Leading suppliers in the DC solar cable market, such as Prysmian Group, Alpha Wire, and Allied Wire and Cable, are competing by delivering high-quality, durable cables designed for efficient energy transfer in solar photovoltaic systems. Prysmian Group emphasizes cables that meet rigorous safety and performance standards, presenting brochures that highlight UV resistance, low voltage drop, and long-term reliability. Alpha Wire and Allied Wire focus on flexible, high-conductivity solutions suitable for both residential and utility-scale solar installations. Belden and Fujikura position their cables around superior insulation and weather-resistant properties, ensuring consistent performance in harsh environments.

Other key players, including General Cable, Havells, and Lapp Group, differentiate through specialized product lines for high-voltage and large-scale solar farms. KEI Industries, Nexans, and Southwire Company highlight regional manufacturing and rapid delivery capabilities. Helukabel, Leoni, and RR Kabel emphasize customizable lengths and cross-sectional options to meet specific project requirements. Furukawa Electric and TE Connectivity showcase integrated system solutions combining cables and connectors, improving installation efficiency. Product brochures consistently present cables as essential enablers of solar energy output, focusing on durability, safety, and compliance with global standards. Strategies revolve around technical differentiation, reliability, and meeting diverse application needs across commercial, industrial, and residential solar markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Conductor | Copper, Aluminum, and Others |

| Application | Industrial, Residential, and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Prysmian Group, Alpha Wire, Allied Wire and Cable, Belden, Fujikura, Furukawa Electric, General Cable, Havells, Helukabel, Hellenic Group, Kabelwerk Eupen, KEI Industries, Lapp Group, Leoni, LS Cable and System, Nexans, Northwire, Polycab, RR Kabel, Southwire Company, and TE Connectivity |

| Additional Attributes | Dollar sales by cable type (single-core, multi-core) and insulation material (PVC, XLPE, LSZH) are key metrics. Trends include rising demand for durable, weather-resistant cables in residential, commercial, and utility-scale solar installations. Regional adoption, advancements in cable performance, and increasing solar energy deployment are driving market growth. |

The global DC solar cable market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the DC solar cable market is projected to reach USD 4.7 billion by 2035.

The DC solar cable market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in DC solar cable market are copper, aluminum and others.

In terms of application, industrial segment to command 45.2% share in the DC solar cable market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

DC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

DC and PKI Market Size and Share Forecast Outlook 2025 to 2035

DCIM Market Size and Share Forecast Outlook 2025 to 2035

DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

DC Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

DC BEV On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

DC Motor Control Devices Market Size and Share Forecast Outlook 2025 to 2035

DC Powered Servers Market Size and Share Forecast Outlook 2025 to 2035

DC Switchgear Market - Size, Share, and Forecast 2025 to 2035

DC Power Supplies Market - Size, Share, and Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

DC Power Supply Module Market – Powering IoT & Electronics

DC Drive Market Size, Share, Trends & Forecast 2024-2034

DC-DC Converter Market Insights – Size, Demand & Forecast 2023-2033

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

PDC Drill Bits Market Size and Share Forecast Outlook 2025 to 2035

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Converter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA