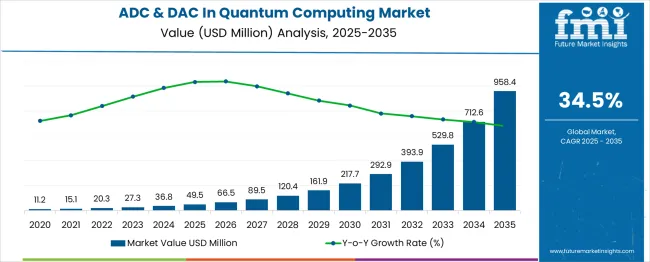

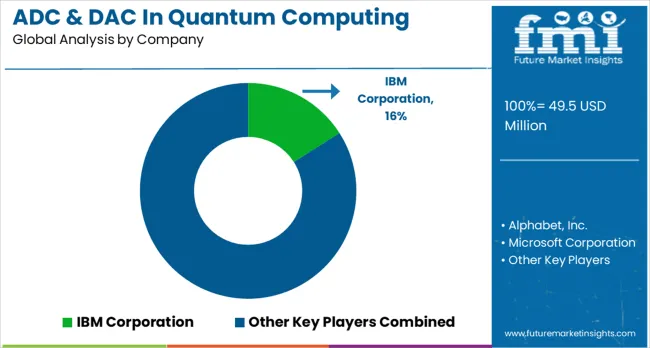

The global ADC and DAC in quantum computing market is expected to grow from USD 49.5 million in 2025 to USD 958.4 million by 2035, reflecting a 34.5% CAGR and generating an absolute dollar opportunity of USD 908.9 million. Growth is driven by increasing adoption of quantum computing across research, finance, pharmaceuticals, and defense sectors, where high-performance analog-to-digital (ADC) and digital-to-analog converters (DAC) are critical for accurate qubit control, readout, and signal processing. Technological innovations, including low-noise, high-speed converters and scalable integration with quantum processors, further support market expansion globally.

Year-on-year (YoY) growth analysis focus on the dynamic progression of the market over the forecast period. From 2025 to 2027, YoY growth is exceptionally high, reflecting early-stage adoption and initial deployment in North America and Europe, driven by leading quantum research institutions and corporate labs. Between 2028 and 2031, YoY growth moderates slightly but remains robust as Asia Pacific and select emerging markets accelerate adoption through investment in quantum infrastructure and expanding industrial applications. From 2032 to 2035, YoY growth stabilizes at a high level, fueled by the commercialization of quantum systems, integration into practical applications, and continued advancements in ADC and DAC performance. The YoY analysis confirms a high-velocity growth trajectory, emphasizing the transformative role of ADC and DAC technologies in enabling precise quantum computing operations while supporting the market’s rapid expansion from niche research to widespread industrial deployment.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 49.5 million |

| Forecast Value in (2035F) | USD 958.4 million |

| Forecast CAGR (2025 to 2035) | 34.5% |

The ADC and DAC in quantum computing market is driven by five primary parent markets with specific shares. Quantum hardware development leads with 35%, as high-precision analog-to-digital and digital-to-analog converters are critical for qubit control and readout. Research and academic institutions contribute 15%, using ADCs and DACs for experimental quantum systems and prototyping. Cloud-based quantum services account for 10%, integrating converters in remote quantum processing units. Semiconductor and electronics companies represent 5%, supplying components for quantum processor interfaces. Defense and aerospace hold 7%, leveraging quantum computing for advanced simulations and secure communications. These segments collectively shape global demand.

Recent developments in the ADC and DAC in quantum computing market focus on precision, speed, and integration. Manufacturers are developing high-resolution, low-latency converters optimized for qubit manipulation and error correction. Cryogenic-compatible and low-noise designs are improving signal fidelity and coherence times. Integration with FPGA platforms and quantum control software is enabling scalable and modular quantum architectures. Investments in quantum computing research, growth of commercial quantum services, and government funding initiatives are accelerating adoption.

Market expansion is being supported by the increasing investment in quantum computing development and the corresponding demand for precise control electronics that can enable reliable quantum state manipulation and measurement. Modern quantum computing systems require extremely precise signal conditioning and conversion capabilities to maintain quantum coherence and achieve high-fidelity quantum operations. ADC & DAC components' proven ability to provide the necessary precision and speed for quantum control systems makes them essential infrastructure for practical quantum computing implementations.

The growing focus on fault-tolerant quantum computing and error correction is driving demand for ADC & DAC solutions that can support real-time feedback loops and sophisticated control algorithms. Quantum system developers' preference for components that combine ultra-low noise with high-speed operation is creating opportunities for specialized quantum-optimized signal conversion technologies. The rising influence of quantum-classical hybrid computing approaches is also contributing to increased adoption of ADC & DAC systems that can interface quantum processors with classical control and data processing systems.

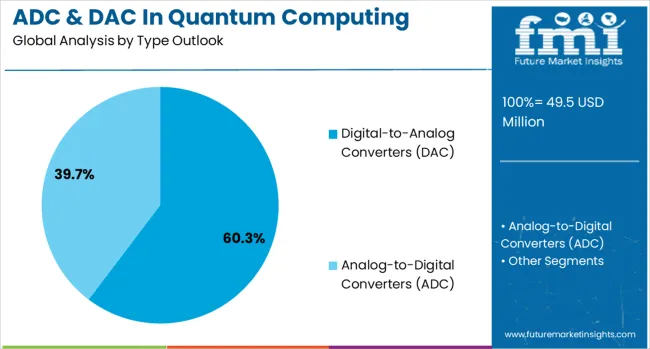

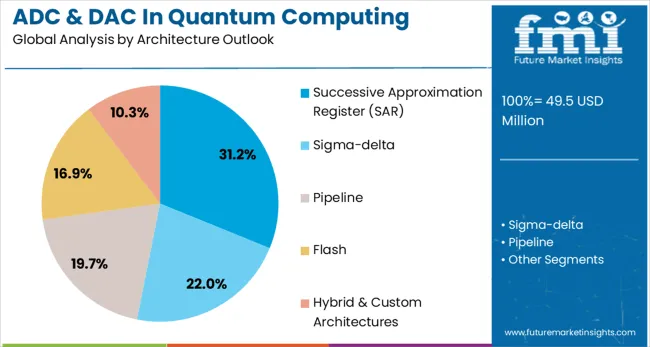

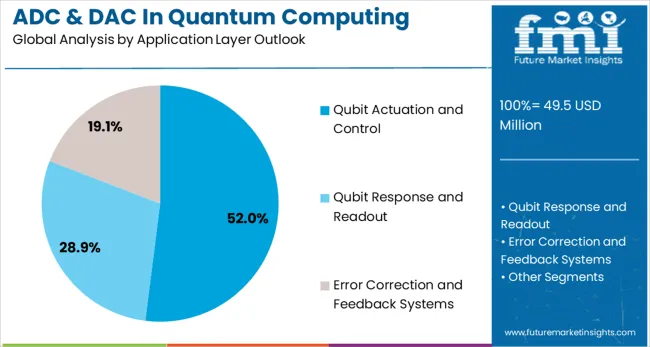

The market is segmented by type, architecture, qubit type, application layer, and region. By type, the market is divided into digital-to-analog converters (DAC) and analog-to-digital converters (ADC). Based on architecture, the market is categorized into successive approximation register (SAR), sigma-delta, pipeline, flash, and hybrid & custom architectures. In terms of qubit type, the market is segmented into superconducting qubits, trapped-ion qubits, spin qubits (e.g., quantum dots), and topological and other experimental qubits. By application layer, the market is classified into qubit actuation and control, qubit response and readout, and error correction and feedback systems. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The digital-to-analog converters (DAC) segment is projected to account for 60.0% of the ADC & DAC in the quantum computing market in 2025, reaffirming its position as the dominant converter type. Quantum system developers increasingly require DAC components for their critical role in generating precise analog control signals for qubit manipulation, gate operations, and quantum state preparation. DACs' essential function in converting digital control instructions into precise analog voltages and currents directly addresses quantum computing requirements for accurate qubit control and quantum operation execution.

This converter type forms the foundation of quantum control systems, as it represents the primary interface between classical digital control systems and analog quantum hardware components. Developer investments in high-resolution DAC technologies and ultra-low noise analog systems continue to strengthen adoption in quantum applications. With quantum systems prioritizing control precision and signal fidelity, DACs align with both performance requirements and operational reliability needs, making them the central component of quantum control electronics.

Successive approximation register (SAR) architecture is projected to represent 31.0% of ADC & DAC demand in quantum computing applications in 2025, underscoring its critical role in applications requiring high resolution and moderate speed performance. Quantum system designers prefer SAR architecture for its combination of high resolution, low power consumption, and predictable conversion timing that aligns with quantum control system requirements. Positioned as optimal technology for precise measurement and control applications, SAR converters offer both accuracy benefits and system integration advantages.

The segment is supported by the SAR architecture's inherently low noise characteristics and ability to provide consistent performance across temperature variations common in quantum computing environments. Additionally, SAR converters enable flexible sampling rates and resolution trade-offs that can be optimized for specific quantum control applications. As quantum systems require increasingly precise control and measurement capabilities, SAR architecture will continue to dominate applications while supporting reliable and accurate quantum operation.

The superconducting qubits segment is forecasted to contribute 47% of the ADC & DAC in the quantum computing market in 2025, reflecting the dominant role of superconducting quantum processors in current quantum computing development. Quantum computing companies increasingly utilize superconducting qubit systems for their scalability potential and established fabrication processes, requiring specialized ADC & DAC solutions optimized for cryogenic operation and radiofrequency control signals. This aligns with quantum computing industry trends that emphasize near-term quantum advantage and practical quantum system deployment.

The segment benefits from continuous advancement in superconducting qubit technology and growing commercial investment in superconducting quantum processors from major technology companies. With established quantum computing platforms and proven scalability pathways, superconducting qubits serve as the primary driver of ADC & DAC demand, making them a critical foundation for quantum control electronics market growth and technology development.

The qubit actuation and control application layer is forecasted to contribute 52% of the ADC & DAC in the quantum computing market in 2025, reflecting the primary requirement for precise quantum state manipulation and gate operation control. Quantum system developers increasingly rely on sophisticated control electronics to generate precise microwave pulses, voltage signals, and magnetic fields required for quantum gate operations and qubit state preparation. This aligns with quantum computing development priorities that emphasize high-fidelity quantum operations and scalable control architectures.

The segment benefits from the growing complexity of quantum algorithms and increasing focus on quantum error correction that requires precise and coordinated qubit control across large quantum processor arrays. With fundamental importance for quantum system operation and growing system scale requirements, qubit actuation and control serve as the primary application for ADC & DAC components, making it a critical driver of market growth and technology advancement in quantum electronics.

The ADC & DAC in the quantum computing market are advancing rapidly due to increasing investment in quantum computing commercialization and growing demand for fault-tolerant quantum systems requiring sophisticated control electronics. The market faces challenges, including extreme performance requirements for cryogenic operation, ultra-low noise specifications, and limited availability of quantum-optimized electronic components. Innovation in specialized quantum electronics and integrated control systems continues to influence product development and market expansion patterns.

The growing development of fault-tolerant quantum computing architectures is enabling the deployment of sophisticated error correction protocols that require real-time feedback control and high-speed signal processing capabilities. Advanced error correction systems demand ADC & DAC components that can operate at the speeds necessary for quantum error correction while maintaining the precision required for quantum state fidelity. Quantum computing companies are increasingly investing in error correction hardware that represents the path to practical quantum advantage.

Modern quantum computing systems are incorporating hybrid quantum-classical processing approaches that require seamless integration between quantum processors and classical control systems through advanced ADC & DAC interfaces. These hybrid systems enhance quantum computing capabilities while enabling real-time classical optimization and quantum algorithm execution. Advanced integration also allows quantum systems to leverage classical computing resources for quantum state preparation and result processing that improves system performance.

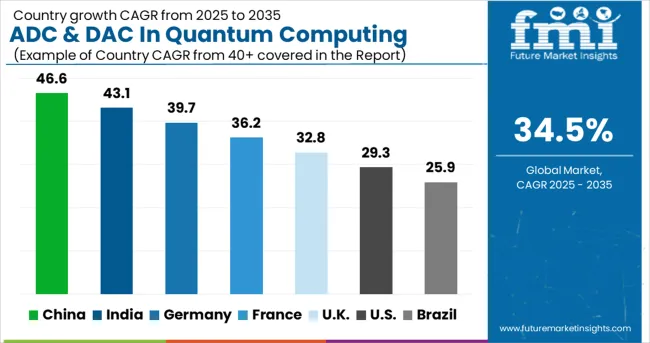

| Countries | CAGR (2025-2035) |

|---|---|

| China | 46.6% |

| India | 43.1% |

| Germany | 39.7% |

| France | 36.2% |

| UK | 32.8% |

| USA | 29.3% |

| Brazil | 25.9% |

The ADC & DAC in quantum computing market is expected to surge from USD 49.5 million in 2025 to USD 958.4 million by 2035, registering a robust global CAGR of 35%, fueled by rapid advancements in quantum hardware, increasing R&D investments, and growing demand for high-precision signal processing. China leads at 46.6%, about 1.33× the global rate, driven by BRICS-led technology initiatives, strong government support, and expanding quantum research programs. India follows at 43.1%, 1.23× the global benchmark, supported by growing academic and industrial research, and adoption in emerging quantum startups. Germany records 39.7%, 1.14× the global CAGR, reflecting OECD-focused innovation, precision engineering, and integration with European quantum initiatives. France posts 36.2%, slightly above the global rate, fueled by research collaborations and pilot deployments. The United Kingdom stands at 32.8%, near the global average, driven by specialized research centers and early commercial applications. The United States records 29.3%, 0.84× the benchmark, with adoption concentrated in defense, computing, and advanced research sectors. Brazil grows at 25.9%, 0.74× the global rate, reflecting emerging interest in quantum hardware and educational initiatives.

China is leading the Asia-Pacific quantum computing market with a CAGR of 46.6%, well above the global 35% average. Expansion is driven by government programs supporting biotechnology and quantum technology parks, alongside domestic companies scaling high-speed DACs and high-resolution ADCs. China is increasing capacity to improve qubit fidelity and reduce error rates. Over 200 active clinical trials in 2024 highlight the growing reliance on specialized CDMO services. Firms like WuXi AppTec and Vigene Biosciences are establishing modular facilities equipped with automated bioprocessing for quantum hardware. International collaborations are enhancing knowledge transfer and technical capabilities. China is focused on aligning manufacturing with experimental quantum systems, ensuring leadership in the Asia-Pacific ADC/DAC market.

The ADC & DAC market in India is advancing at 43.1% CAGR, driven by government-supported quantum initiatives and emerging start-ups. High-precision signal converters are being integrated into superconducting and trapped-ion qubit platforms. Key innovation hubs include Bangalore, Pune, and Hyderabad, with firms like Syngene International developing modular, GMP-compliant ADC/DAC solutions. International partnerships support technology transfer, while local R&D focuses on latency reduction and resolution enhancement. The market benefits from a skilled workforce trained in quantum electronics, ensuring reliability for global collaborations. India’s cost-efficient manufacturing and robust academic linkages are expanding the adoption of ADC/DAC technologies for both domestic and multinational quantum programs.

Germany is expanding at 39.7% CAGR due to advanced semiconductor manufacturing and engineering precision. German CDMOs and tech start-ups focus on low-latency DACs and high-bit ADCs for superconducting and topological qubits. Collaboration with European quantum initiatives facilitates scalable processor solutions. Over 70 gene therapy and quantum projects in 2024 leveraged German ADC/DAC modules. Automation and continuous manufacturing systems reduce error rates and improve system coherence. German firms emphasize harmonization of R&D and production, enhancing service quality. Advanced analytics and modular signal processing are widely adopted, reinforcing Germany’s role in the European market for specialized quantum hardware components.

France is advancing at 36.2% CAGR, driven by academic research, national quantum programs, and government innovation grants. CDMOs prioritize integration of high-resolution ADCs and high-speed DACs into superconducting qubits. Collaboration among Paris-Saclay, Grenoble, and Toulouse clusters accelerates modular signal conversion development. Focus is on minimizing error rates and improving signal-to-noise ratios. Firms like Yposkesi and Sanofi’s contract divisions invest in digitalized biomanufacturing platforms and regulatory pathway optimization. The market is research-intensive, bridging academic breakthroughs with scalable manufacturing solutions. International collaborations enhance France’s reputation for innovation, ensuring compliance and quality in commercial quantum hardware production.

The UK is growing at 32.8% CAGR, supported by strong regulatory frameworks and vibrant research clusters. CDMOs integrate ADC/DAC modules into superconducting and silicon qubits, enhancing readout speed and reducing errors. Oxford, Cambridge, and London-based start-ups are key contributors to innovation. Regulatory oversight ensures international clients trust UK-based solutions. Firms like Oxford Biomedica expand modular cleanrooms and single-use bioreactors for scalable production.

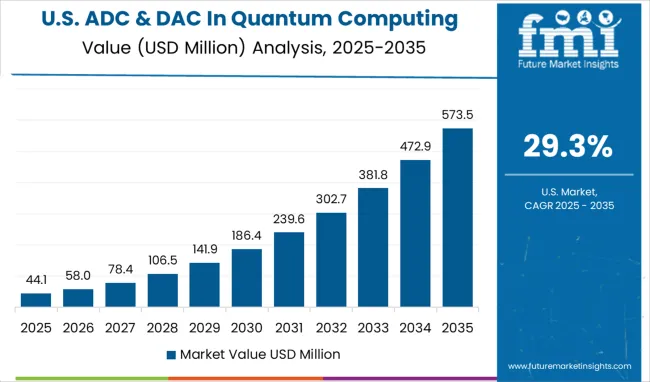

The US is expanding at 29.3% CAGR, supported by a robust commercial and government-backed quantum ecosystem. Companies such as Catalent, Honeywell Quantum Solutions, and IBM Q focus on ultra-high-resolution ADCs and high-speed DACs to reduce error and improve qubit coherence. More than 280 ongoing AAV-based quantum trials in 2024 emphasize reliance on high-fidelity signal conversion. Automation, AI-assisted monitoring, and digital twins improve efficiency. Full-service offerings combine process optimization, regulatory guidance, and commercial manufacturing, strengthening US leadership in global quantum hardware. The US market focus on scaling modular ADC/DAC platforms for superconducting, trapped-ion, and photonic qubit architectures.

Brazil is growing at 25.9% CAGR, driven by emerging research programs and start-ups focusing on cost-efficient quantum control solutions. Brazilian laboratories are implementing high-resolution ADCs and high-speed DACs for superconducting and trapped-ion platforms. Academic partnerships foster research-driven innovation in modular signal conversion systems. Investments focus on enhancing signal fidelity, noise reduction, and error mitigation. The market serves domestic research institutions while enabling international collaborations in Latin America. Brazil is establishing a foundation for scalable quantum hardware manufacturing.

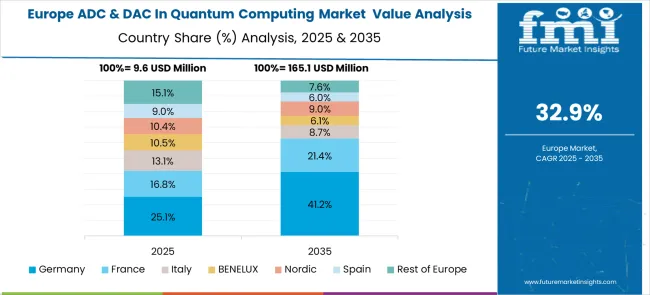

The ADC & DAC in the quantum computing market in Europe demonstrates advanced development across major economies, with Germany showing a strong presence through its quantum research leadership and priority on quantum technology development, supported by research institutions and technology companies leveraging engineering excellence to develop high-performance quantum control electronics that emphasize precision, reliability, and integration capabilities for superconducting and trapped-ion quantum systems. France represents a significant market driven by its quantum computing research initiatives and sophisticated understanding of quantum hardware requirements, with organizations focusing on advanced quantum control solutions that combine French quantum expertise with cutting-edge analog electronics for enhanced quantum system performance and scalability in research and commercial quantum computing applications.

The UK exhibits considerable growth through its focus on quantum computing innovation and university research programs, with strong development of quantum control technologies across research institutions, quantum computing companies, and specialized electronics manufacturers. Germany and France show expanding interest in integrated quantum control systems, particularly in quantum-classical hybrid architectures and fault-tolerant quantum computing implementations. BENELUX countries contribute through their focus on quantum technology innovation and advanced electronics development. Eastern Europe and the Nordic regions display growing potential driven by increasing quantum research investment and expanding quantum technology partnerships.

IBM Corporation, USA-based, is a key player in the ADC and DAC segment of quantum computing, developing high-speed, high-precision data conversion systems essential for controlling and reading qubits with minimal noise and maximal accuracy. Alphabet Inc., with global operations, integrates analog-to-digital and digital-to-analog technologies into its quantum hardware, enhancing computational fidelity and signal integrity across its experimental and commercial platforms. Microsoft Corporation, USA, focuses on hybrid quantum-classical computing environments, providing ADC and DAC solutions that enable seamless integration of quantum processors with classical control electronics. Amazon.com, Inc., USA, leverages its cloud-based Braket service, embedding advanced signal conversion systems to support complex quantum algorithms and high-performance data acquisition for diverse research and industrial applications. These companies emphasize scalable, reliable, and efficient ADC and DAC designs to meet the growing demands of quantum computing development and deployment.

D-Wave Quantum Inc., USA, specializes in quantum annealing systems and incorporates ADC and DAC modules for precise qubit initialization, readout, and error correction. IonQ, Inc., USA, uses high-fidelity conversion technologies in its trapped-ion quantum computers to enhance qubit coherence and control accuracy. Quantinuum, USA, offers integrated analog and digital conversion systems across its hardware and software stack, ensuring operational reliability and optimized signal processing. Rigetti Computing, Inc., USA, designs custom ADC and DAC circuits for superconducting qubits, achieving low-latency control and high-precision readout. Omni Design Technologies, Inc., USA, provides specialized signal processing components tailored to quantum computing, enabling effective qubit measurement and system monitoring.

Riverlane Ltd., UK, integrates ADC and DAC functionalities within its quantum software and hardware co-design, optimizing real-time qubit readout and operational performance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 49.5 Million |

| Type | Digital-to-Analog Converters (DAC), Analog-to-Digital Converters (ADC) |

| Architecture | Successive Approximation Register (SAR), Sigma-delta, Pipeline, Flash, Hybrid & Custom Architectures |

| Qubit Type | Superconducting Qubits, Trapped-Ion Qubits, Spin Qubits (e.g., quantum dots), Topological and Other Experimental Qubits |

| Application Layer | Qubit Actuation and Control, Qubit Response and Readout, Error Correction and Feedback Systems |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | IBM Corporation, Alphabet Inc., Microsoft Corporation, Amazon.com Inc, D-Wave Quantum Inc., IonQ Inc., Quantinuum, Rigetti Computing, Inc., Omni Design Technologies Inc., and Riverlane Ltd |

| Additional Attributes | Dollar sales by type and qubit type category, regional demand trends, competitive landscape, buyer preferences for DAC versus ADC applications, integration with quantum control systems, innovations in cryogenic electronics, ultra-low noise design, and quantum-classical hybrid system development |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global adc & dac in quantum computing market is estimated to be valued at USD 49.5 million in 2025.

The market size for the adc & dac in quantum computing market is projected to reach USD 958.4 million by 2035.

The adc & dac in quantum computing market is expected to grow at a 34.5% CAGR between 2025 and 2035.

The key product types in adc & dac in quantum computing market are digital-to-analog converters (dac) and analog-to-digital converters (adc).

In terms of architecture outlook, successive approximation register (sar) segment to command 31.2% share in the adc & dac in quantum computing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breadcrumbs Market Size and Share Forecast Outlook 2025 to 2035

Broadcast Switchers Market Size and Share Forecast Outlook 2025 to 2035

Broadcast Equipment Market Growth - Trends & Forecast 2025 to 2035

LTE and 5G Broadcast Market – Future of Video Streaming

Television Broadcasting Services Market Insights – Growth & Forecast 2023-2033

4K Satellite Broadcasting Market Size and Share Forecast Outlook 2025 to 2035

Azodicarbonamide (ADC) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Special-Purpose Analog-to-Digital Converters (ADCs) Market Forecast and Outlook 2025 to 2035

R & D Cloud Collaboration Market Size and Share Forecast Outlook 2025 to 2035

US & Canada Sports & Athletic Insoles Market Trends - Growth & Forecast 2024 to 2034

LTE & 5G for Critical Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Cap and Closure Market Trends - Growth & Demand 2025-2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Growth – Trends & Forecast 2025 to 2035

USA & Canada Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

The USA & Canada OTC Pet Nutritional Supplements Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA