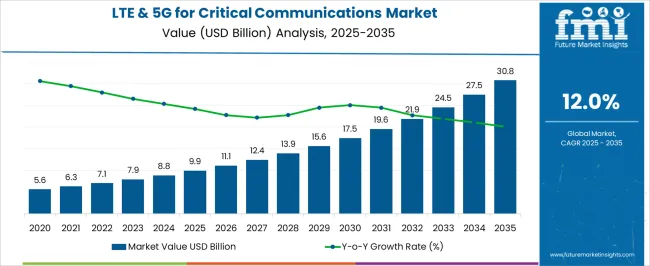

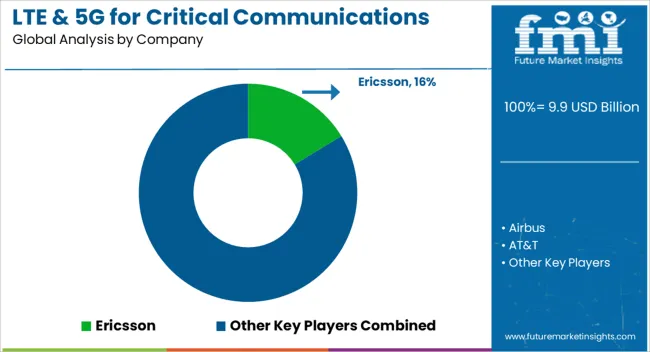

The LTE & 5G for critical communications market is estimated to be valued at USD 9.9 billion in 2025 and is projected to reach USD 30.8 billion by 2035, registering a compound annual growth rate (CAGR) of 12.0% over the forecast period. Technology contributions within this market demonstrate clear differentiation between LTE and 5G segments, driven by deployment timelines, performance capabilities, and adoption incentives. The LTE technologies dominate the market, providing reliable, mission-critical connectivity for public safety, utilities, and industrial applications.

The early years of the forecast period, 2025 to 2028, see LTE accounting for a majority share of revenue, supported by widespread infrastructure, proven interoperability, and established regulatory compliance. The stable growth of LTE during these years reflects incremental upgrades and integration of enhanced features such as LTE-M and narrowband IoT to meet low-latency and high-reliability demands. From 2028 onward, 5G technologies will increasingly contribute to market expansion, fueled by ultra-reliable low-latency communication (URLLC) requirements, network slicing, and high bandwidth for data-intensive critical applications. By 2035, 5G adoption accelerates, comprising a significant proportion of the overall market revenue, while LTE continues to provide foundational coverage in hybrid network architectures.

The contribution analysis highlights a transition from LTE-led growth in the early forecast period to 5G-driven expansion in the later years, illustrating the complementary and progressively dominant role of next-generation technologies in enabling mission-critical communications across industries globally.

| Metric | Value |

|---|---|

| LTE & 5G for Critical Communications Market Estimated Value in (2025 E) | USD 9.9 billion |

| LTE & 5G for Critical Communications Market Forecast Value in (2035 F) | USD 30.8 billion |

| Forecast CAGR (2025 to 2035) | 12.0% |

The LTE and 5G for Critical Communications market is undergoing rapid transformation, propelled by the increasing need for high-reliability and low-latency connectivity across mission-critical sectors. Strong demand is being observed from public safety agencies, energy grids, defense forces, and transportation systems requiring an uninterrupted communication infrastructure. Strategic investments in 5G infrastructure have been reported in multiple regions, focusing on secure and dedicated network slices for emergency services and industrial automation.

Hardware vendors and telecom operators are aligning with government-backed initiatives to deploy private networks tailored for critical communication, as reflected in technology industry news and operator statements. The shift from traditional LMR systems toward broadband-based communications is being enabled by 5G's advanced features, including ultra-reliable low-latency communication and massive machine-type communication.

These capabilities are strengthening the market’s role in supporting national security, real-time situational awareness, and disaster response. As per investor briefings and official government programs, the outlook remains robust, supported by continued spectrum allocation, rising public-private collaborations, and the ongoing evolution of 3GPP standards.

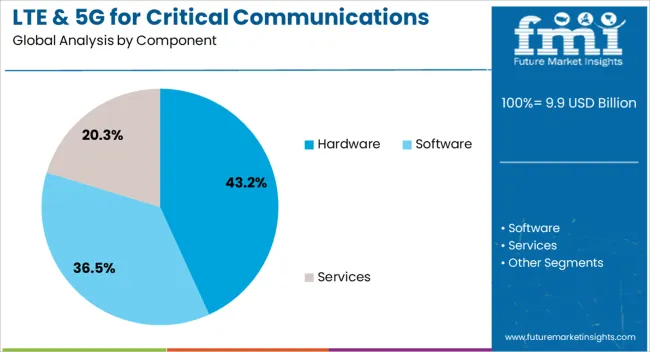

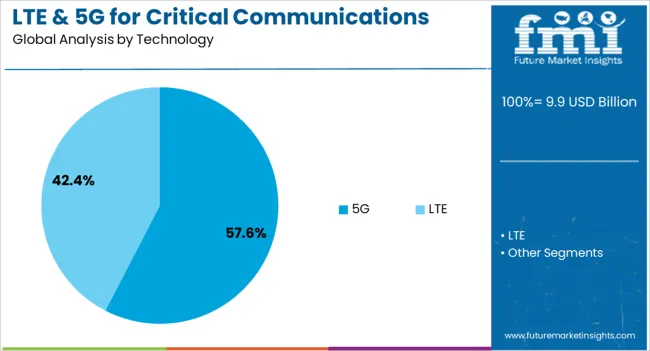

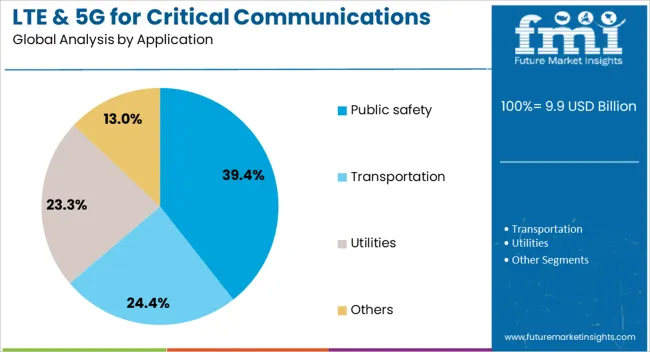

The LTE & 5G for critical communications market is segmented by component, technology, application, and geographic regions. By component, the LTE & 5G for critical communications market is divided into Hardware, Software, and Services. In terms of technology, the critical communications market for LTE and 5 G is classified into 5G and LTE. Based on the application of the LTE & 5G for the critical communications market, it is segmented into Public safety, Transportation, Utilities, and Others. Regionally, the LTE & 5G for critical communications industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware component segment is expected to contribute 43.2% of the LTE and 5G for Critical Communications market revenue share in 2025, marking it as the leading component type. This dominance has been driven by the critical role of network infrastructure equipment, user devices, antennas, and edge routers in establishing reliable and high-performing communication systems. According to product announcements and infrastructure deployment updates, organizations are prioritizing hardware to modernize mission-critical operations with 5G-ready capabilities.

The segment's performance has been supported by increasing investments in ruggedized hardware, compliant with stringent operational requirements found in defense, emergency services, and remote industrial environments. Equipment designed for fail-safe communication has gained traction due to the heightened demand for uninterrupted connectivity in high-risk scenarios.

The growing adoption of private LTE and 5G networks in public and industrial safety frameworks has further reinforced the necessity of specialized hardware.

The 5G technology segment is projected to hold 57.6% of the LTE and 5G for Critical Communications market revenue share in 2025, making it the dominant technology type. Its leading position is being supported by its advanced capabilities, including low latency, enhanced mobile broadband, and ultra-reliable communication features essential for mission-critical operations.

Technology provider roadmaps and telecom operator announcements have emphasized the accelerated rollout of 5G-based private networks across critical applications such as first responder coordination, real-time monitoring, and autonomous systems. Adoption has been influenced by the improved scalability and network slicing functionalities offered by 5G, enabling dedicated communication layers for emergency and industrial users.

Strategic alliances between network vendors and public sector entities are also enabling the development of customized 5G solutions tailored for national security, disaster response, and public safety.

The public safety application segment is anticipated to account for 39.4% of the LTE and 5G for Critical Communications market revenue share in 2025, securing its place as the leading application area. This leadership is attributed to the segment’s high dependency on uninterrupted, real-time communication systems, particularly during emergency response and crisis management.

Statements from defense and emergency agencies have highlighted the increased adoption of broadband-enabled mission-critical services, allowing seamless video, voice, and data communication for law enforcement, fire services, and medical responders. The segment’s growth has been supported by regulatory initiatives aimed at modernizing public safety networks, including the implementation of dedicated 5G network slices and private LTE setups.

Integration with AI-driven dispatch systems and geolocation tracking tools has further enhanced operational efficiency and decision-making The segment’s continued dominance is also linked to its role in ensuring national resilience, public order, and faster response times during high-risk situations, making it a core application within the critical communications landscape.

The market has been evolving due to rising demand for reliable, secure, and high-speed connectivity in public safety, utilities, transportation, and industrial sectors. Network operators and enterprises have increasingly adopted advanced wireless technologies to ensure uninterrupted communication during emergencies or mission-critical operations. Investments in private networks, broadband integration, and edge computing have enhanced real-time data transmission capabilities. The convergence of LTE and 5G standards has facilitated low-latency, high-bandwidth communication, supporting advanced applications and operational efficiency in critical communications worldwide.

Public safety agencies have been a key driver of LTE and 5G adoption for critical communications. Police, fire, and emergency medical services have increasingly relied on broadband networks to support mission-critical voice, video, and data services. Real-time situational awareness, mobile command centers, and remote surveillance have been enhanced through high-speed connectivity. Interoperability with legacy radio systems has been prioritized to ensure seamless communication across multiple agencies. Government initiatives promoting nationwide emergency communication networks have accelerated deployment. Investments in ruggedized devices, secure endpoints, and mobile applications have further strengthened operational capabilities. Training programs and pilot projects have encouraged adoption, enabling personnel to respond efficiently to emergencies. The continuous integration of LTE and 5G technologies has resulted in robust, resilient, and scalable networks that are crucial for public safety operations globally.

The utility and industrial sectors have been driving demand for LTE and 5G-based critical communications to improve operational efficiency and safety. Smart grids, oil and gas operations, mining, and manufacturing facilities have leveraged wireless broadband for real-time monitoring and automated control systems. High-reliability networks have enabled predictive maintenance, remote inspections, and instant alerts for system anomalies. Integration with Internet of Things (IoT) devices has provided operational intelligence while minimizing downtime. Security protocols and private network deployments have ensured data integrity and restricted access. The need to maintain uninterrupted communication during hazardous or remote operations has further reinforced adoption. These factors have positioned LTE and 5G technologies as critical enablers for digital transformation in industrial and utility sectors, strengthening the market for mission-critical broadband communications solutions.

Technological advancements have been pivotal in expanding LTE and 5G capabilities for critical communications. Network slicing, edge computing, and low-latency connectivity have enabled real-time data processing for emergency management, industrial automation, and remote operations. Advanced antenna systems, massive MIMO, and millimeter-wave technologies have enhanced coverage and reliability. Device ecosystems, including ruggedized terminals, smartphones, and IoT sensors, have been optimized for mission-critical applications. Software-defined networking (SDN) and network function virtualization (NFV) have improved flexibility, scalability, and rapid deployment. Cybersecurity measures such as encryption, authentication, and intrusion detection have strengthened network resilience. Continuous innovation has facilitated seamless interoperability with legacy systems and other communication protocols. Collectively, these technological advancements have enhanced service quality, operational reliability, and safety, driving adoption across public and private sector critical communication networks worldwide.

Government policies and regulatory frameworks have played a central role in the growth of LTE and 5G for critical communications. Spectrum allocation for public safety and enterprise networks has enabLED dedicated bandwidth for mission-critical operations. Regulations promoting standardization, interoperability, and network security have supported wide-scale deployment. Public-private partnerships have been established to accelerate the rollout of advanced communication networks across urban and rural areas. Funding programs and subsidies have encouraged innovation, testing, and adoption of LTE and 5G technologies for critical operations. Compliance with emergency communication standards has mandated the integration of resilient, secure, and reliable networks. These regulatory measures have reduced barriers to market entry, increased stakeholder confidence, and ensured continuous development. As a result, policy-driven initiatives have strengthened the adoption of LTE and 5G for critical communications across multiple sectors globally.

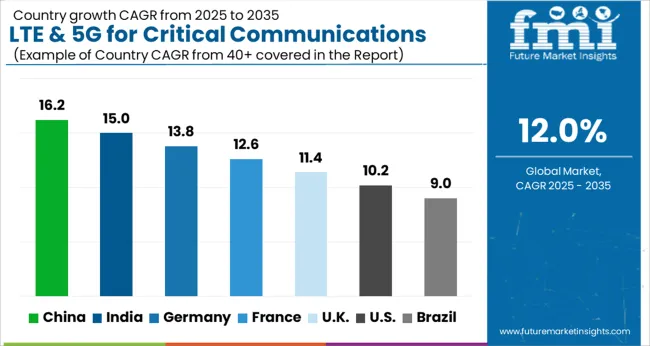

The market is expected to grow at a CAGR of 12.0% between 2025 and 2035, fueled by increased adoption of mission-critical networks, public safety applications, and advanced wireless technologies. China, with a 16.2% CAGR, leads through large-scale network deployments and government-backed modernization initiatives. India follows at 15.0%, expanding coverage for emergency services and industrial communications. Germany grows at 13.8%, supported by strong investments in secure communication networks and smart city programs. The UK, at 11.4%, focuses on integrating LTE and 5G for public safety and critical infrastructure. The USA, at 10.2%, experiences steady adoption driven by federal initiatives and private sector infrastructure upgrades. This report covers 40+ countries, with the top markets highlighted here for reference.

China is projected to expand at a CAGR of 16.2% in the market from 2025 to 2035. Rapid deployment of public safety networks, smart city projects, and industrial automation applications is accelerating adoption. Integration of 5G private networks for emergency services, transportation, and utilities is gaining momentum. Telecom operators and technology providers are collaborating to enhance ultra-reliable low-latency communication coverage. Government-led initiatives and strategic investments in network infrastructure are driving demand, positioning China as a global leader in critical communications technology.

India is anticipated to grow at a CAGR of 15.0% in LTE and 5G critical communication solutions during 2025 to 2035. Investments in nationwide public safety networks and industrial IoT applications are driving growth. Telecom operators are implementing private 5G networks for defense, utilities, and transportation sectors. Strategic alliances with international technology providers are accelerating deployment of advanced communication technologies. Increasing focus on emergency response systems and digital transformation initiatives is supporting expansion, making India one of the fastest-growing markets in Asia Pacific.

Germany is forecast to record a CAGR of 13.8% in LTE and 5G for critical communications between 2025 and 2035. Adoption is driven by transportation, industrial automation, and energy sector requirements. Public safety authorities are increasingly deploying private 5G networks for mission-critical applications. Government initiatives supporting digital infrastructure and smart grid integration are facilitating growth. Collaboration between telecom operators and industrial consortia is enhancing service reliability and network coverage. Germany is positioned to be a leading European hub for critical communications technologies.

The United Kingdom is anticipated to grow at a CAGR of 11.4% in LTE and 5G critical communications solutions from 2025 to 2035. Expansion is supported by investments in public safety networks, emergency response systems, and smart infrastructure projects. Telecom operators are deploying private networks to enhance low-latency communications for utilities, transport, and defense. Government programs promoting digital transformation in urban and rural areas are accelerating adoption. Strategic partnerships with technology providers are strengthening nationwide network capabilities.

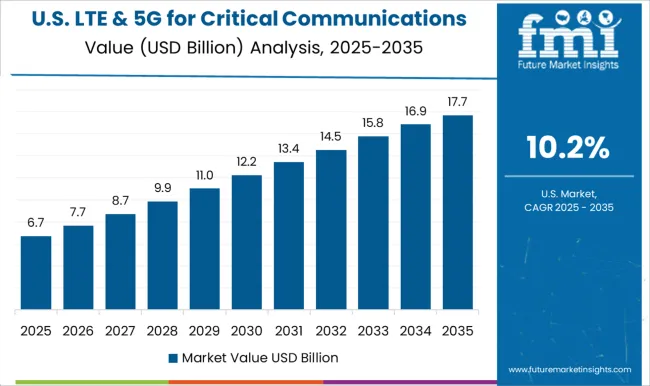

The United States is projected to expand at a CAGR of 10.2% in LTE and 5G for critical communications between 2025 and 2035. Large-scale adoption is driven by emergency services, industrial automation, and defense requirements. Federal programs supporting mission-critical communication networks and investments in low-latency private networks are accelerating deployment. Leading telecom operators are collaborating with industrial and technology providers to enhance network reliability. Integration of 5G solutions across utilities, transport, and public safety sectors is further driving market growth.

The market is shaped by leading global technology providers and network operators delivering reliable, secure, and high-speed communication solutions for mission-critical applications. Ericsson, Nokia, and Huawei drive the market through advanced infrastructure deployment, private network solutions, and strategic collaborations with public safety agencies and enterprise clients. Their focus on network resilience, low latency, and secure connectivity enables efficient communication for emergency services, transportation, and industrial sectors. Motorola Solutions and Airbus contribute with specialized hardware and end-to-end communication platforms, combining radios, terminals, and integrated software to ensure seamless interoperability across public safety networks.

Samsung Electronics focuses on device innovation, supporting robust 5G connectivity for critical use cases, while AT&T and Verizon provide managed network services, spectrum access, and nationwide coverage tailored for emergency and enterprise applications. Hytera and Sepura strengthen the market with portable communication devices, network integration solutions, and secure data handling, particularly for local and regional deployments. Emerging players often differentiate through niche solutions, enhanced cybersecurity, and tailored services for industrial or governmental clients. Entry barriers are substantial due to the need for extensive regulatory approvals, spectrum allocation, and technology certifications, making market participation capital-intensive and technologically demanding. Collectively, these providers drive the adoption of LTE and 5G as reliable communication backbones for safety-critical operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.9 Billion |

| Component | Hardware, Software, and Services |

| Technology | 5G and LTE |

| Application | Public safety, Transportation, Utilities, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ericsson, Airbus, AT&T, Huawei, Hytera, Motorola Solutions, Nokia, Samsung Electronics, Sepura, and Verizon |

| Additional Attributes | Dollar sales by network type and end-use segment, demand dynamics across public safety, utilities, transportation, and industrial operations, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in mission-critical push-to-talk, ultra-reliable low-latency communications, and secure broadband integration, environmental impact of network energy consumption, equipment lifecycle, and emerging use cases in emergency response coordination, smart grid communication, and autonomous industrial operations. |

The global LTE & 5G for critical communications market is estimated to be valued at USD 9.9 billion in 2025.

The market size for the LTE & 5G for critical communications market is projected to reach USD 30.8 billion by 2035.

The LTE & 5G for critical communications market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in LTE & 5G for critical communications market are hardware, _base stations, _routers , _'end use devices , _others, software, services, _consulting & system integration , _training & support and _maintenance & managed services.

In terms of technology, 5G segment to command 57.6% share in the LTE & 5G for critical communications market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LTE & LTE Advanced Market – 5G-Ready Mobile Networks

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

LTE Modem Market

LTE And 5G NR-Based CBRS Networks Market Size and Share Forecast Outlook 2025 to 2035

In-depth Analysis of LTE and 5G Market

LTE and 5G Broadcast Market – Future of Video Streaming

Alternative Fuel Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Alternative Protein Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Alternative Protein Market Insights - Sustainable Food Trends 2025 to 2035

Alternative Retailing Technologies Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Online and In-Store Technologies

Alternative Accommodation Market Trends - Growth & Forecast 2025 to 2035

Alternative Tourism Market Growth – Forecast 2024-2034

Alternatives For Injectable Diabetes Care Market Size and Share Forecast Outlook 2025 to 2035

Alternative Proteins for Pets Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alternative Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Malted Rye Flour Market Size and Share Forecast Outlook 2025 to 2035

Filter Integrity Test Systems Market Size and Share Forecast Outlook 2025 to 2035

Multefire Market Size and Share Forecast Outlook 2025 to 2035

Malted barley flour Market Size and Share Forecast Outlook 2025 to 2035

Holter ECG Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA