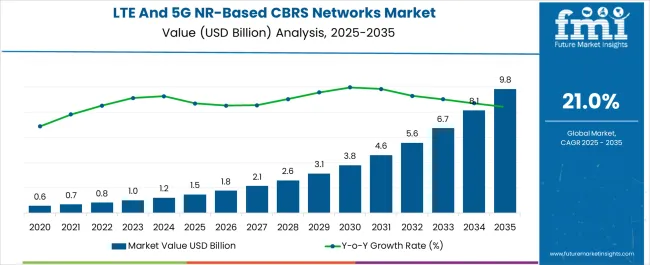

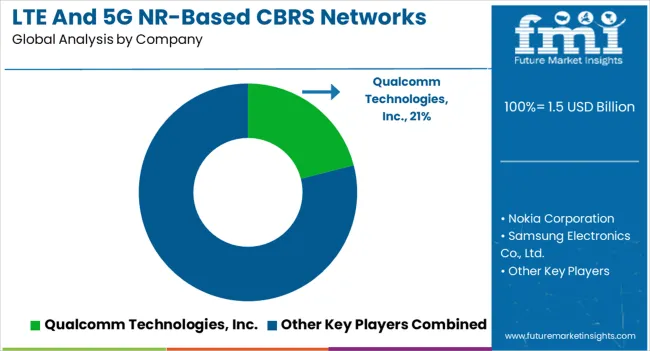

The LTE And 5G NR-Based CBRS Networks Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 9.8 billion by 2035, registering a compound annual growth rate (CAGR) of 21.0% over the forecast period. The long-term value accumulation curve follows an exponential pattern, with more than 70% of the total value addition expected between 2030 and 2035.

In the initial five-year period (2025 to 2030), the market increases from USD 1.5 billion to USD 3.8 billion, generating USD 2.3 billion in value, or approximately 23% of total growth. This phase is expected to be shaped by pilot rollouts, enterprise-grade LTE adoption, and private wireless deployments in controlled industrial environments.

| Metric | Value |

|---|---|

| LTE And 5G NR-Based CBRS Networks Market Estimated Value in (2025 E) | USD 1.5 billion |

| LTE And 5G NR-Based CBRS Networks Market Forecast Value in (2035 F) | USD 9.8 billion |

| Forecast CAGR (2025 to 2035) | 21.0% |

The LTE and 5G NR based CBRS networks market is undergoing significant transformation as enterprises, service providers, and industrial operators increasingly deploy private and shared spectrum networks. The use of the Citizens Broadband Radio Service band has enabled more efficient and cost-effective wireless deployments, especially for organizations seeking alternatives to traditional mobile operators. Growth is being driven by the need for secure, low-latency, and high-capacity connectivity to support digital transformation efforts across various sectors including manufacturing, utilities, and logistics.

Additionally, the integration of CBRS into fixed wireless access, indoor mobility, and mission-critical communication infrastructure is accelerating adoption. Strategic partnerships between technology vendors, cloud service providers, and mobile operators are contributing to robust ecosystem development.

The flexibility of CBRS to support both LTE and 5G NR technologies positions it as a foundational component in next-generation wireless infrastructure. As demand for high-speed and scalable wireless solutions rises, the market is expected to continue expanding across public, private, and hybrid network environments..

The LTE and 5G NR-based CBRS networks market is segmented by infrastructure submarkets, air interface technology application, and geographic regions. The infrastructure submarkets of the LTE and 5G NR-based CBRS networks market are divided into Radio Access Network (RAN), Mobile core, Transport network, Small Cell RUs (Radio Units), Distributed & Centralized Baseband Units. In terms of air interface technology, the LTE and 5G NR-based CBRS networks market, it is classified into LTE and 5 G NR. Based on the application of the LTE and 5G NR-based CBRS networks, the market is segmented into Mobile network densification, Fixed Wireless Access (FWA), Cable operators & new entrants, Neutral hosts, Private cellular networks. Regionally, the LTE and 5G NR-based CBRS networks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

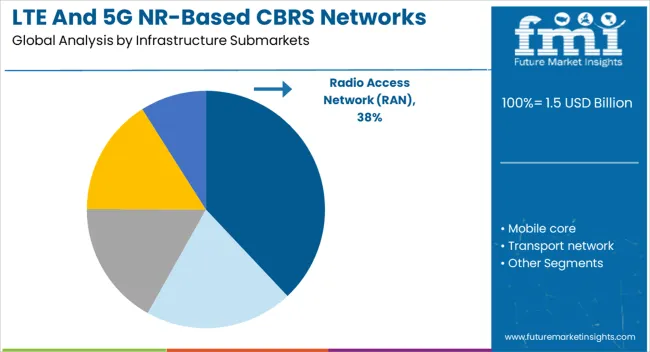

The radio access network subsegment within the infrastructure category is projected to account for 38% of the LTE and 5G NR-based CBRS networks market revenue in 2025. This leadership position has been supported by increasing demand for efficient spectrum utilization and localized connectivity solutions.

The growth of this subsegment has been influenced by the proliferation of private networks and enterprise deployments that require custom-configured RAN components to achieve optimal coverage and capacity. With CBRS facilitating shared spectrum access, there has been a notable increase in small cell and distributed antenna system installations, both of which rely heavily on scalable RAN infrastructure.

Furthermore, the adaptability of the RAN layer in managing network traffic dynamically has improved quality of service across various use cases. As edge computing and on-premise data processing gain momentum, RAN infrastructure has played a pivotal role in enabling low-latency connectivity and secure communications, which are essential for next-generation enterprise applications..

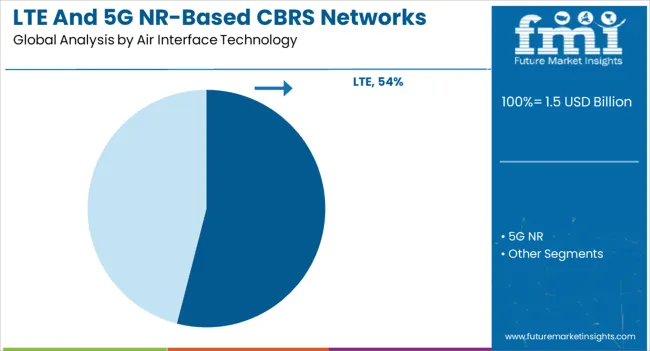

The LTE subsegment within the air interface technology category is anticipated to hold 54% of the LTE and 5G NR based CBRS networks market revenue share in 2025, making it the dominant technology. This has been attributed to its maturity, proven reliability, and strong ecosystem of devices and infrastructure vendors. LTE has been adopted widely in initial CBRS deployments due to its established standards and compatibility with a broad range of enterprise and industrial use cases.

The availability of LTE-based CBRS equipment and cost-effective spectrum access has encouraged rapid implementation in education, retail, and warehousing sectors. Additionally, the technology's ability to deliver consistent throughput and mobility management has ensured dependable performance for fixed and mobile broadband applications.

While 5G NR is emerging, LTE continues to provide an optimal balance of performance and affordability, especially in environments where ultra-low latency is not yet required. As organizations prioritize deployment speed and operational efficiency, LTE remains the preferred choice for many early-stage CBRS network rollouts..

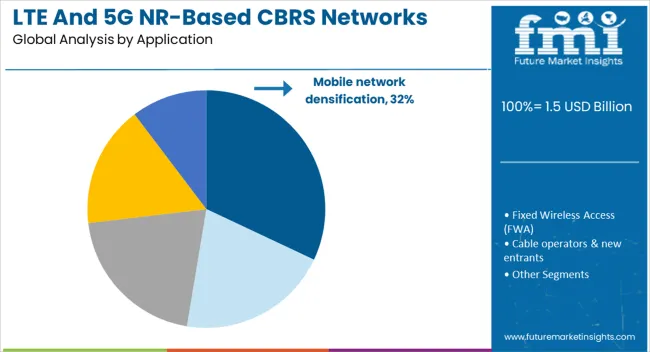

The mobile network densification subsegment within the application category is expected to represent 32% of the LTE and 5G NR based CBRS networks market revenue share in 2025. This prominence has been driven by increasing data consumption and the need for enhanced coverage and capacity in densely populated areas.

Mobile network densification strategies, including the use of small cells and localized base stations, have been supported by CBRS spectrum as a flexible and scalable solution to relieve congestion on traditional networks. The subsegment's growth has been further accelerated by mobile operators and enterprises seeking to extend coverage indoors and in high-traffic areas without relying solely on macro infrastructure.

The use of CBRS in network densification has provided a cost-effective pathway to improve user experience, reduce latency, and maintain high throughput. Additionally, the alignment of densification efforts with private 5G initiatives has positioned CBRS-based deployments as a critical enabler of high-performance mobile environments, especially in commercial campuses and urban centers..

The LTE and 5G NR based CBRS networks market has expanded as enterprises adopt shared-spectrum wireless infrastructure to lower deployment costs and improve service reliability. CBRS-enabled private networks have supported bandwidth-demanding applications across campuses, ports, factories, and smart cities. Seamless integration of LTE and 5G NR into band 48 infrastructure has enabled higher throughput and better indoor coverage. The shift toward digital transformation, coupled with increasing device compatibility and scalable deployment models, continues to drive adoption of CBRS for industrial, commercial, and institutional applications worldwide.

Private LTE and 5G NR based CBRS networks have been adopted in smart manufacturing and logistics to enable real-time automation, robotics control, and data-driven operations. CBRS allows enterprises to deploy independent cellular networks with lower latency, extended range, and enhanced security. Unlike Wi-Fi, these systems operate on managed spectrum tiers, reducing interference. Industrial operators have prioritized CBRS for equipment telemetry, vehicle-to-network communication, and video surveillance. Mid-sized factories and shipping yards have utilized LTE-based CBRS for initial deployments, while high-performance 5G NR upgrades are being installed in latency-sensitive environments. Mobile network operators and neutral host providers have developed tailored CBRS solutions targeting enterprise digitization. Integration with edge computing and cloud-based network cores has supported predictive maintenance, real-time analytics, and device orchestration, establishing CBRS as an alternative to traditional carrier networks.

Both LTE and 5G NR interfaces have been embedded in CBRS deployments to support a wide range of applications. Enterprises continue to rely on LTE for basic connectivity, with around 70% of installations still running LTE-based configurations. However, 5G NR is gaining traction in video analytics, AR/VR, and autonomous navigation use cases. Deployment models vary from greenfield private networks in manufacturing and healthcare to hybrid rollouts in logistics and hospitality. Infrastructure requirements include indoor small cells, outdoor macro nodes, dedicated network cores, and integrated spectrum access systems. Cloud-native orchestration platforms are being embedded into baseband units to handle dual-mode traffic flows. System integrators have played a critical role in designing scalable network blueprints. Equipment vendors have expanded their CBRS portfolios to offer modular kits compatible with both air interfaces, simplifying future transitions.

Despite market growth, several barriers have been encountered in CBRS network expansion. Device fragmentation has limited adoption, as not all smartphones, routers, or modules support band 48 across both LTE and 5G NR interfaces. Dynamic spectrum sharing among priority and general access license users has required interference mitigation tools and spectrum access systems. Delays in PAL auction processing and lack of global harmonization have slowed international deployments. System integration into legacy IT infrastructure has involved compatibility testing and reconfiguration of security protocols. Enterprise customers without in-house telecom expertise have faced challenges in designing and managing private network cores. Operational costs have increased when managed services are required. These limitations have affected adoption in non-industrial sectors. Continued standardization, operator partnerships, and integrated deployment kits will be required to reduce friction and expand CBRS use cases.

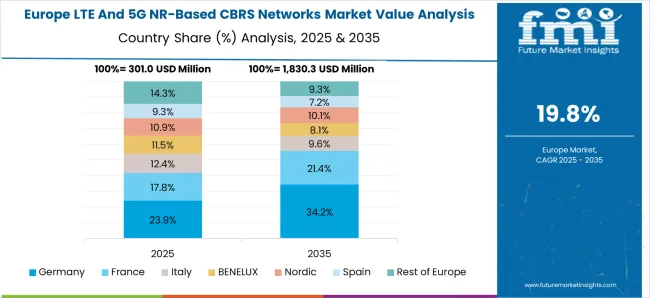

North America has maintained a dominant position in CBRS network rollouts due to early regulatory support and established vendor ecosystems. Enterprises across education, energy, and public safety have adopted CBRS to improve wireless coverage and reliability. In Asia-Pacific, interest in shared spectrum networks has grown in ports and smart cities, with Japan and Australia adopting CBRS-like bands for industrial trials. European adoption remains mixed due to fragmented spectrum policy, although neutral-host models have gained support. Fixed wireless access use cases are rising in Latin America and parts of Africa, where CBRS networks serve as last-mile alternatives to fiber. The vertical distribution is led by logistics, manufacturing, healthcare, and education. Partnerships among equipment vendors, cloud providers, and operators have accelerated time-to-market for CBRS solutions. Spectrum leasing platforms and remote network orchestration tools are further expanding market reach.

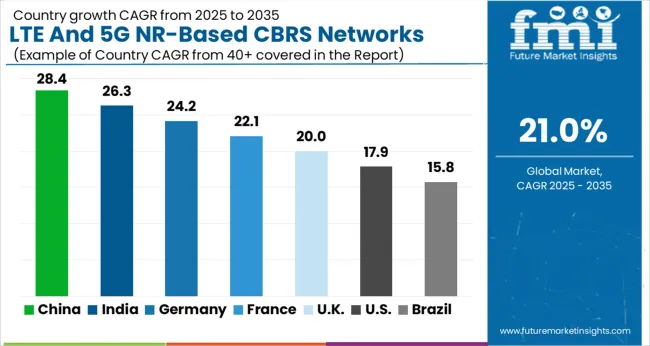

| Country | CAGR |

|---|---|

| China | 28.4% |

| India | 26.3% |

| Germany | 24.2% |

| France | 22.1% |

| UK | 20.0% |

| USA | 17.9% |

| Brazil | 15.8% |

Global demand for LTE and 5G NR-based CBRS networks is projected to expand at a CAGR of 21% from 2025 to 2035. China leads at 28.4%, followed by India at 26.3% and Germany at 24.2%. These three markets show a premium of +35%, +25%, and +15% over the global baseline. The United Kingdom, with 20.0%, is positioned marginally below trend, while the United States trails at 17.9%, marking a –15% deviation. China’s lead stems from vertically integrated telecom OEMs and aggressive mmWave rollout. India benefits from digital public infrastructure and private LTE in mining and manufacturing. Germany maintains strength through campus networks in industrial automation. Slower growth in the United States and United Kingdom stems from spectrum-sharing complexity and slower enterprise adoption. This report includes detailed coverage of 40+ countries, with five summarized below.

China is projected to register a CAGR of 28.4% between 2025 and 2035 in the LTE and 5G NR-based CBRS networks market. The country’s infrastructure leverage is rooted in massive state-led deployments of shared spectrum and integrated base station manufacturing. Leading telecom firms have begun bundling CBRS spectrum with AI-driven private networks for logistics zones and port automation. The scale of CBRS adoption in tier-2 cities surpasses that of developed economies. China’s leadership stems from a combination of national spectrum governance and vertically integrated network hardware ecosystems. Spectrum reuse, AI integration, and low-latency industrial networks have formed the backbone of regional manufacturing clusters.

India is forecast to achieve a CAGR of 26.3% from 2025 to 2035 in the LTE and 5G NR-based CBRS networks market. State-backed digital infrastructure projects and growing private participation in shared spectrum auctions have created favorable conditions. Tier-1 telecom operators are investing in CBRS to power smart manufacturing and extractive industries. The proliferation of CBRS networks in SEZs and brownfield industrial zones is reshaping industrial data connectivity standards. Indian IT firms are also integrating CBRS into low-code platforms for on-premises data solutions. Growth in India remains rooted in policy momentum and cost-effective deployment models focused on spectrum-sharing.

Germany is projected to grow at a CAGR of 24.2% during 2025–2035 in the LTE and 5G NR-based CBRS networks sector. The country’s advanced industrial base has embraced local CBRS networks for manufacturing optimization. Siemens and Bosch have adopted CBRS-driven campus networks for predictive maintenance and real-time system diagnostics. Federal support for standalone 5G under the Industrie 4.0 framework further reinforces CBRS deployment. The limited reliance on mobile carriers has allowed firms to establish and operate spectrum autonomously. Network resiliency, security, and data localization have emerged as core drivers for enterprise CBRS adoption.

The United Kingdom is forecast to grow at a CAGR of 20.0% in the LTE and 5G NR-based CBRS networks market from 2025 to 2035. Demand is gradually expanding among logistics and energy firms in Scotland and the Midlands. The CBRS market has been shaped by hybrid deployment models combining indoor DAS and small-cell configurations. However, spectrum-sharing constraints under Ofcom’s current licensing rules have moderated adoption rates. Infrastructure vendors such as BT Group and BAI Communications are targeting underground and urban tunnel networks. Despite innovation, growth remains modest due to procurement complexity and fragmented market awareness.

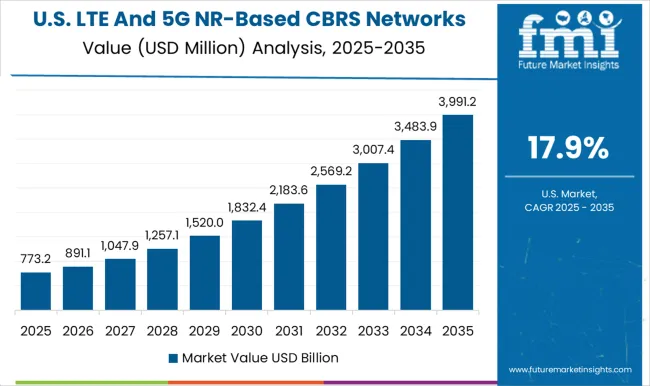

The United States is expected to witness a CAGR of 17.9% from 2025 to 2035 in the LTE and 5G NR-based CBRS networks market. Initial momentum from the 2020 PAL auction has given way to slower-than-expected commercial conversion. Network performance variability due to shared access tiers and limited GAA incentives has constrained broad industrial adoption. However, niche deployments continue in agriculture, warehousing, and energy. Amazon and Chevron have implemented limited-scope CBRS networks, focusing on edge compute and telemetry. The market’s trajectory is shaped by ecosystem fragmentation and lack of turnkey CBRS-as-a-service platforms.

Qualcomm Technologies, Inc. provides foundational chipsets supporting LTE and 5G NR operations over the CBRS band, enabling OEMs to deploy private wireless networks across enterprise and industrial environments. The company’s Snapdragon platforms are integrated into a broad range of CBRS-compatible devices and small cells.

Nokia Corporation delivers end-to-end CBRS solutions, including RAN hardware and core network components. Its focus lies in enabling private LTE and 5G networks for ports, logistics, and campus connectivity, supported by cloud-native deployment models. Samsung Electronics Co., Ltd. has introduced CBRS-compatible base stations and indoor radios aimed at enterprise-grade wireless coverage.

Its product lines support flexible spectrum usage and dynamic spectrum sharing across LTE and 5G. Ericsson offers scalable CBRS network infrastructure through its radio systems and integrated software features tailored for manufacturing, utility, and venue-based use cases. CommScope Inc. provides Citizens Broadband Radio Service Devices (CBSDs) and antenna systems supporting both indoor and outdoor deployments. Federated Wireless leads in spectrum access systems (SAS) and environmental sensing capabilities, enabling real-time coordination of CBRS spectrum sharing.

Google LLC plays a critical role through its SAS platform and edge networking efforts, while Airspan Networks and Baicells Technologies focus on small cell and neutral host solutions for scalable private and public CBRS networks. Private cellular network deployments using CBRS have surged across sectors like industrial automation, logistics, smart campuses and neutral host sites. Notable 5G NR CBRS projects include BMW’s autonomous logistics network in South Carolina and the USA Navy’s standalone system at Whidbey Island. Operators such as Comcast, Charter and Verizon are deploying CBRS radios to enhance network densification and capacity. Meanwhile, system integrator partnerships like Nokia–Kyndryl’s private LTE rollout across multiple Chevron Phillips facilities demonstrate growing enterprise adoption. Enhanced CBRS device availability and strand-mounted small-cell solutions further fuel market expansion.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Infrastructure Submarkets | Radio Access Network (RAN), Mobile core, Transport network, Small Cell RUs (Radio Units), and Distributed & Centralized Baseband Units |

| Air Interface Technology | LTE and 5G NR |

| Application | Mobile network densification, Fixed Wireless Access (FWA), Cable operators & new entrants, Neutral hosts, and Private cellular networks |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Qualcomm Technologies, Inc., Nokia Corporation, Samsung Electronics Co., Ltd., Ericsson, CommScope Inc., Federated Wireless, Google LLC, Airspan Networks, and Baicells Technologies |

| Additional Attributes | Dollar sales lead in LTE and 5G NR CBRS network equipment, driven by neutral host and enterprise deployments. Regional growth strong in North America. Innovations in dynamic spectrum access and edge computing. Use cases include private 5G and IoT networks. |

The global LTE and 5G NR-based CBRS networks market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the LTE and 5G NR-based CBRS networks market is projected to reach USD 9.8 billion by 2035.

The LTE and 5G NR-based CBRS networks market is expected to grow at a 21.0% CAGR between 2025 and 2035.

The key product types in LTE and 5G NR-based CBRS networks market are radio access network (ran), mobile core, transport network, small cell rus (radio units) and distributed & centralized baseband units.

In terms of air interface technology, LTE segment to command 54.0% share in the LTE and 5G NR-based CBRS networks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

In-depth Analysis of LTE and 5G Market

LTE and 5G Broadcast Market – Future of Video Streaming

LTE & LTE Advanced Market – 5G-Ready Mobile Networks

LTE & 5G for Critical Communications Market Size and Share Forecast Outlook 2025 to 2035

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Demand for 5G Driver Amplifier in Middle East & Africa Size and Share Forecast Outlook 2025 to 2035

Demand for Alternative Protein Meat Extenders with Shelf-life Control in CIS Size and Share Forecast Outlook 2025 to 2035

Demand for Filter Paper in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Filter Paper in Japan Size and Share Forecast Outlook 2025 to 2035

5G in Automotive and Smart Transportation Market by Solution ,Application,Industry , Warehousing & Logistics, Warehousing & Logistics, Public Safety and Others & Region Forecast till 2025 to 2035

Demand for LegalTech in USA Size and Share Forecast Outlook 2025 to 2035

Oil and Fuel Filter Market Growth - Trends & Forecast 2025 to 2035

Demand for Dairy Alternatives in the EU Size and Share Forecast Outlook 2025 to 2035

5G Edge Cloud Network and Services Market Size and Share Forecast Outlook 2025 to 2035

Floor Standing Filtered Bottle Filling Stations Market Size and Share Forecast Outlook 2025 to 2035

Safety and Process Filter Market Growth – Trends & Forecast 2024-2034

Complementary and Alternative Medicine for Anti Aging & Longetivity Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Voice Over LTE (VOLTE) and Voice Over Wi-Fi Market Share & Insights

VoLTE and Voice Over Wi-Fi Market Outlook 2025 to 2035

Pea Protein Demand in Dairy Alternatives Analysis - Size Share and Forecast outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA