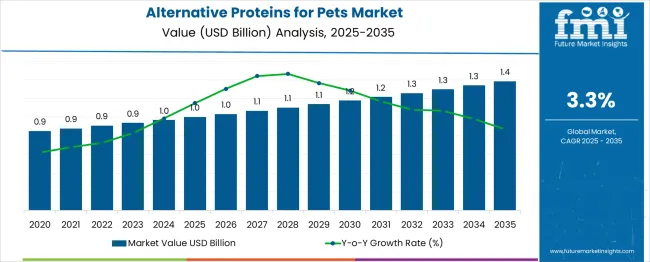

Year-on-year growth increases progressively from USD 1.0 billion in 2025 to USD 1.4 billion in 2035. This modest but steady rise reflects the early-stage nature of the segment, driven by growing awareness of sustainable and hypoallergenic pet food options.

Insect-based, plant-derived, and lab-grown proteins are gaining traction, especially in North America and Europe where premium pet nutrition trends dominate. Innovation in formulations and positive veterinary endorsements are likely to further enhance credibility. Over the next decade, increasing environmental consciousness and demand for novel protein sources are expected to gradually shift consumer preferences in favor of alternative proteins.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.0 billion |

| Industry Value (2035F) | USD 1.4 billion |

| CAGR (2025 to 2035) | 3.3% |

The alternative proteins for pets market operate at the intersection of sustainability, animal health, and functional nutrition. Within the USD 120 billion global pet food industry, alternative protein-based products make up 5-7%, supported by consumer shifts toward plant-based and insect-derived diets. In the USD 22.5 billion alternative protein segment, pet-focused formulations account for 10-12%, led by pea, algae, and cultured meat innovations.

Across the USD 40 billion functional pet nutrition market, 4-6% of the value is attributed to protein alternatives aimed at gut health, joint support, and allergen-free benefits. Sustainable feed formats, valued at USD 35 billion, see 3-4% penetration from insect meal and upcycled protein inputs. In veterinary nutrition, 5-8% of formulations now include non-traditional protein sources for sensitive pets.

Demand for Alternative Proteins for Pets is rising as consumers prioritize sustainable and hypoallergenic options. Insect-based sources, dog-specific formulations, and dry kibble formats are shaping innovation, driven by clean-label trends and environmentally conscious pet nutrition.

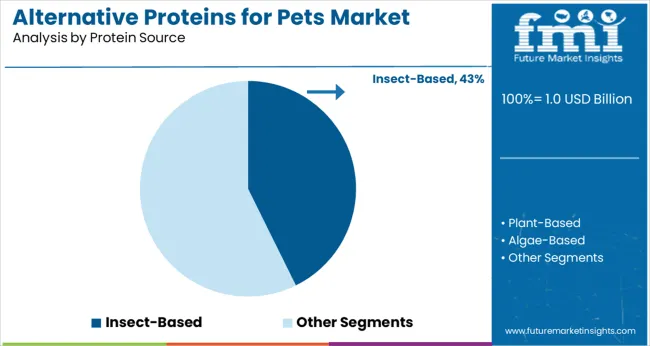

Insect-based protein is projected to dominate the market with 43% share in 2025. Pet food manufacturers are adopting black soldier fly larvae and mealworms as eco-friendly, high-protein alternatives to meat. Insects provide a complete amino acid profile, are hypoallergenic, and require minimal land and water resources. This aligns with rising consumer focus on environmental sustainability and digestive wellness.

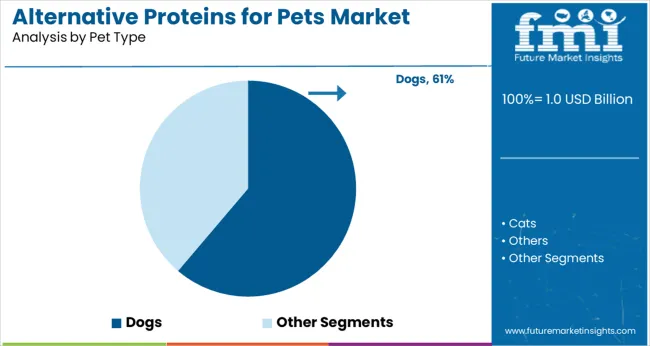

Dogs represent the largest pet category in this market, holding 61% share. Pet owners are increasingly turning to protein-rich, sustainable dog foods that support gut health and coat shine. Insect-based proteins and plant-derived ingredients are gaining popularity in formulations designed for large breeds and seniors.

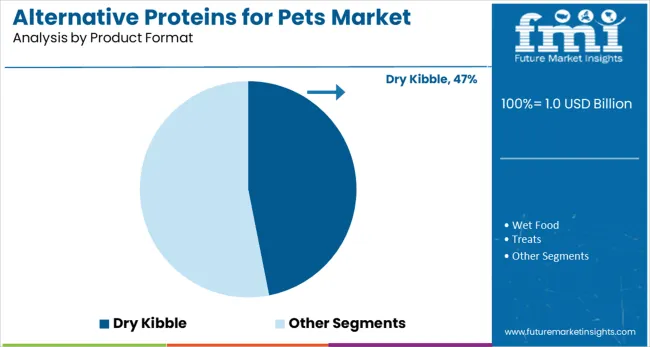

Dry kibble is set to remain the dominant product format, accounting for 47% of the market. It is preferred by pet owners for convenience, longer shelf life, and dental health benefits. Dry formulas incorporating novel proteins like insects, lentils, and algae cater to clean-label trends.

Hypoallergenic alternative proteins are projected to account for 24% of the market by functionality in 2025. This rise stems from growing pet sensitivities to traditional meat proteins such as beef and chicken. Insect-based and plant-derived proteins are gaining traction for their minimal allergen profiles and digestive ease. Health-conscious pet owners are actively seeking hypoallergenic formulations, particularly for breeds prone to food intolerances.

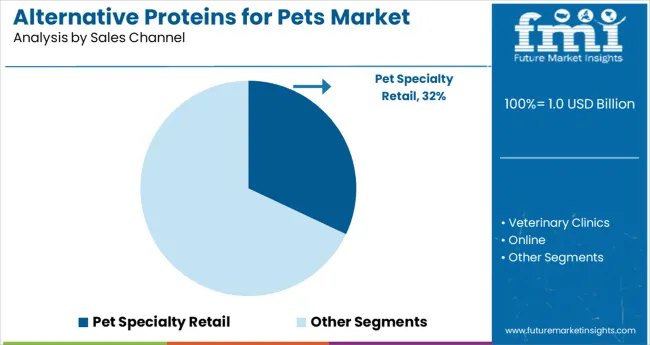

Pet specialty retail outlets are expected to contribute 32% of total sales in 2025. These dedicated stores provide expert guidance, curated product ranges, and in-store experiences that resonate with discerning pet parents. Premium positioning of alternative protein-based foods, especially hypoallergenic or novel formulations, aligns with the specialty retail model.

The market is expanding rapidly as brands respond to digestive sensitivities, sustainability positioning, and functional ingredient demand. Insect, mycoprotein, and algal sources are gaining traction in premium SKUs. Formulation advances and regulatory clearance are accelerating product launches in kibble, wet food, and treat formats.

Insect Protein Gains Shelf Space in Hypoallergenic SKUs

Insect-based pet food products grew 46% YoY in North America and Europe, driven by demand for hypoallergenic formulas and sustainable sourcing. Black soldier fly protein showed 92% digestibility in adult dog trials, outperforming soy and pea isolates. Brands using insect meals reported a 27% increase in customer retention for sensitive-stomach formulas. Shelf presence of insect-protein kibbles expanded by 31% in pet specialty stores. Single-protein SKUs with BSF gained 22% more traction in online channels, especially in the 2-5 kg pack segment. As consumer education improves and veterinary endorsements rise, insect protein is becoming a core ingredient in allergy-control and limited-ingredient product lines.

Mycoprotein and Algae Unlock Functional Formulation Options

Use of mycoprotein and algae-based ingredients in pet foods increased 39% in 2025, with formulators targeting gut health, omega-3 delivery, and immunity claims. Algae-derived DHA enriched treats recorded a 33% rise in repeat purchases, especially in senior dog segments. Mycoprotein blends improved amino acid profiles, supporting protein digestibility-corrected scores ≥0.95. Freeze-dried raw brands integrating algal protein saw 24% shelf life extension without chemical preservatives. Veterinary-formulated SKUs with algae and yeast extracts grew 28% in clinics, targeting coat health and inflammation. These novel proteins are enabling formulation differentiation, especially in high-margin segments like functional treats, breed-specific diets, and condition-targeted pet nutrition.

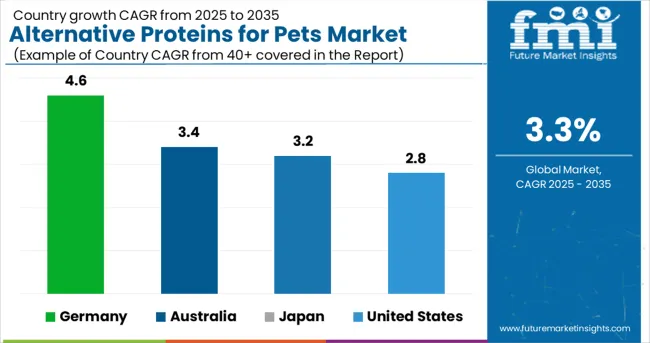

The global market for alternative proteins for pets is forecast to expand at a CAGR of 3.3% from 2025 to 2035, driven by shifting consumer preferences toward sustainable and allergen-free ingredients. Germany is positioned ahead of the global average with a CAGR of 4.6%, reflecting high pet ownership rates and growing demand for insect- and plant-based protein options within the EU. Australia is projected to grow at 3.4%, supported by rising awareness around environmental sustainability in pet nutrition. Japan’s CAGR is estimated at 3.2%, slightly below the global average, with growth driven by aging pet populations and premium wellness products. The United States trails at 2.8% CAGR, due to slower regulatory approvals and relatively cautious consumer adoption. As OECD markets refine their formulations and BRICS nations gradually introduce alternative pet diets, long-term innovation is likely to favor scalable, cruelty-free protein sources across both premium and mainstream categories.

The report provides insights across 40+ countries. The four below are highlighted for their strategic influence and growth trajectory.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.6% |

| Australia | 3.4% |

| Japan | 3.2% |

| United States | 2.8% |

The market in Germany is set to expand at a CAGR of 4.6% from 2025 to 2035. During 2020-2024, plant-based pet foods saw modest adoption among younger consumers. Moving forward, rising concern over meat sustainability and allergies in pets is set to drive demand for insect-based and cultured protein formulations.

The Australian market is forecasted to grow at a CAGR of 3.4% during 2025 to 2035. Between 2020 and 2024, awareness remained limited to niche consumer groups. In the upcoming decade, increased penetration of grain-free and novel protein diets is expected across metro cities, supported by a shift in consumer values.

The market in Japan is set to expand at a CAGR of 3.2% between 2025 and 2035. From 2020 to 2024, growth was modest due to conservative consumer behavior and reliance on traditional pet diets. The next phase will be marked by increased demand for premium, environmentally friendly pet nutrition.

The USA market is expected to grow at a CAGR of 2.8% from 2025 to 2035. Between 2020 and 2024, protein diversification in pet diets focused on grain-free kibble and meat blends. Going forward, sustainability and pet health will drive increased demand for insect, algae, and pea-based protein solutions.

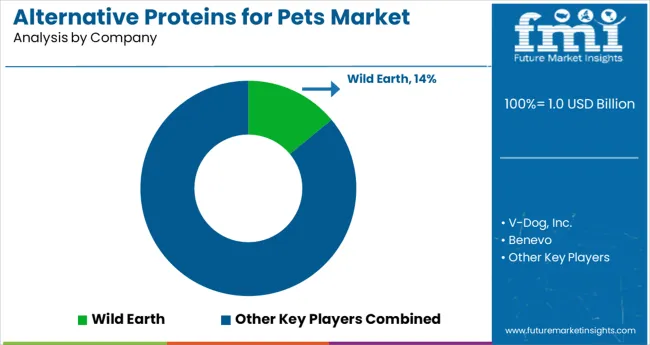

The market is emerging rapidly, led by a mix of biotech pioneers and sustainable pet food specialists. Wild Earth commands an early mover advantage, holding approximately 14% market share, with its yeast-based, high-protein dog food formulations backed by strong venture capital funding and retail partnerships. VDog and Benevo lead the vegan segment with broad direct-to-consumer reach across North America and Europe, respectively, each estimated at 6-8% share.

Yora Pet Foods and Omni Pet are disrupting the UK market with insect protein and mycoprotein-based recipes, aligned with eco-conscious consumer preferences. Protix and EntoProtein supply black soldier fly protein for pet food manufacturers, enabling scalability of sustainable formulations. Bene Meat Technologies and The EVERY Company bring precision fermentation to the sector, while Kerry Group is integrating postbiotic and fermented proteins into functional pet nutrition solutions.

Recent Alternative Proteins for Pets Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025E) | USD 1.0 billion |

| Projected Industry Value (2035F) | USD 1.4 billion |

| CAGR (2025 to 2035) | 3.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Protein Sources Analyzed (Segment 1) | Insect-Based (Black Soldier Fly, Mealworms, Crickets), Plant-Based (Pea, Soy, Lentil, Chickpea), Algae-Based (Spirulina, Chlorella), Fungi-Based (Mycoprotein, Fermented Mushroom), Yeast-Based (Nutritional, Torula), Cultivated Meat (Chicken, Fish, Beef) |

| Pet Types Covered (Segment 2) | Dogs, Cats, Others (Small Mammals, Reptiles) |

| Product Formats Included (Segment 3) | Dry Kibble, Wet Food, Treats, Supplements (Powder & Capsules), Fresh/Frozen Meals |

| Functionality/Claims (Segment 4) | Hypoallergenic, High-Protein, Gut Health Support, Sustainable, Grain-Free, Veterinary Formulated |

| Sales Channels Covered (Segment 5) | Pet Specialty Retail, Veterinary Clinics, Online, Grocery Chains, Pet Subscription Boxes |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Wild Earth, V-Dog, Inc., Benevo , Omni Pet, Yora Pet Foods, Protix, EntoProtein , Bene Meat Technologies, The EVERY Company, Kerry Group |

| Additional Attributes | Dollar sales gain traction from growing demand for sustainable, gut-friendly, hypoallergenic protein alternatives tailored for sensitive pets. |

The market is segmented by protein source into insect-based (Black Soldier Fly, Mealworms, Crickets), plant-based (Pea Protein, Soy Protein, Lentil Protein, Chickpea Protein), algae-based (Spirulina, Chlorella), fungi-based (Mycoprotein, Fermented Mushroom Protein), yeast-based (Nutritional Yeast, Torula Yeast), and cultivated meat (Chicken, Fish, Beef).

Segmentation by pet type includes dogs, cats, and others such as small mammals and reptiles.

Product formats include dry kibble, wet food, treats, supplements (powder and capsules), and fresh/frozen meals.

Functional and marketing claims include hypoallergenic, high-protein, gut health support, sustainable/environment-friendly, grain-free, and veterinary formulated.

Sales channels include pet specialty retail, veterinary clinics, online (direct-to-consumer and e-commerce platforms), grocery chains, and pet subscription boxes.

Regional analysis covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is valued at USD 1.0 billion in 2025.

The market is projected to reach USD 1.4 billion by 2035.

The market is expected to grow at a CAGR of 3.3% during the forecast period.

Insect-based protein dominates the market with a 43% share in 2025.

Germany is forecast to grow at the fastest pace with a CAGR of 4.6% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alternative Fuel Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Alternative Protein Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Alternative Protein Market Insights - Sustainable Food Trends 2025 to 2035

Alternative Retailing Technologies Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Online and In-Store Technologies

Alternative Accommodation Market Trends - Growth & Forecast 2025 to 2035

Alternative Tourism Market Growth – Forecast 2024-2034

Alternatives For Injectable Diabetes Care Market Size and Share Forecast Outlook 2025 to 2035

Alternative Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Meat Alternative Market Forecast and Outlook 2025 to 2035

Down Alternative Mattresses Market Size and Share Forecast Outlook 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cheese Alternatives Market Analysis - Size, Share, and Forecast 2025 to 2035

Retinol Alternatives (Bakuchiol) Market Size and Share Forecast Outlook 2025 to 2035

Carmine Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Demand for Alternative Protein Meat Extenders with Shelf-life Control in CIS Size and Share Forecast Outlook 2025 to 2035

Animal Feed Alternative Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA