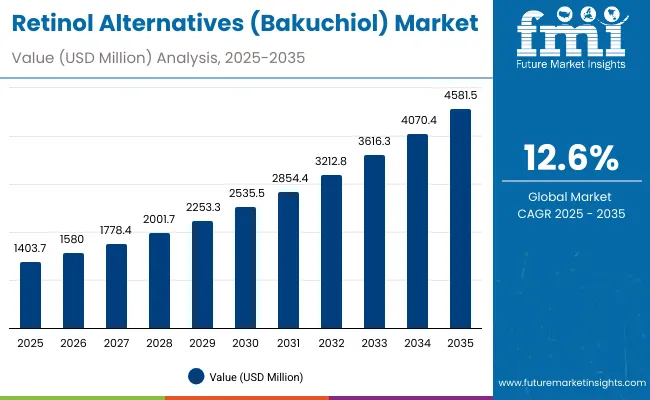

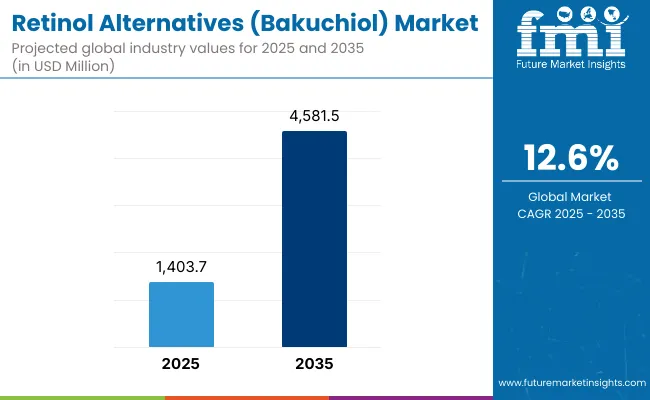

The Global Retinol Alternatives (Bakuchiol) Market is expected to record a valuation of USD 1,403.7 million in 2025 and USD 4,581.5 million in 2035, with an increase of USD 3,177.8 million, which equals a growth of more than 193% over the decade. The overall expansion represents a CAGR of 12.6% and a 3.2X increase in market size.

Global Retinol Alternatives (Bakuchiol) Market Key Takeaways

| Metric | Value |

|---|---|

| Global Retinol Alternatives ( Bakuchiol ) Market Estimated Value in (2025E) | USD 1,403.7 million |

| Global Retinol Alternatives ( Bakuchiol ) Market Forecast Value in (2035F) | USD 4,581.5 million |

| Forecast CAGR (2025 to 2035) | 12.6% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,403.7 million to USD 2,535.5 million, adding USD 1,131.8 million, which accounts for nearly 36% of the total decade growth. This phase records steady adoption in anti-aging skincare, acne control solutions, and brightening formulations, driven by consumer demand for natural and less-irritating alternatives to retinol. Serums dominate this period as they cater to over 52% of the demand, reflecting consumer preference for lightweight, potent delivery formats suitable for daily skincare routines.

The second half from 2030 to 2035 contributes USD 2,046 million, equal to 64% of total growth, as the market jumps from USD 2,535.5 million to USD 4,581.5 million. This acceleration is powered by widespread deployment of vegan, clean-label, and dermatologist-tested claims becoming mainstream in both premium and mass-market skincare lines.

Growth in Asia-Pacific, especially China and India with CAGRs of 22.2% and 22.4% respectively, drives global adoption. E-commerce platforms and subscription models expand rapidly, ensuring consumer accessibility to niche and premium bakuchiol-based products. By the end of the decade, global leaders will increasingly pivot towards multifunctional formulations that blend bakuchiol with other bioactives like vitamin C and peptides to strengthen efficacy.

From 2020 to 2024, the Global Retinol Alternatives (Bakuchiol) Market grew steadily from niche adoption to mainstream inclusion in natural and clean beauty portfolios, reaching early adoption in both the USA and European skincare industries. During this period, the competitive landscape was fragmented, with independent clean beauty brands controlling much of the momentum.

Leaders such as Herbivore Botanicals and The Ordinary focused on affordability and efficacy while promoting plant-based alternatives to retinol. Competitive differentiation relied on strong ingredient positioning, sustainability claims, and transparent formulations, while multinational players slowly entered with hybrid portfolios combining traditional retinol and bakuchiol.

Demand for retinol alternatives is expected to expand significantly to USD 1,403.7 million in 2025, with revenue mix shifting as vegan, natural/organic, and dermatologist-tested claims gain wider consumer trust. Traditional skincare leaders face rising competition from indie and niche brands, which are agile in integrating bakuchiol into serums, oils, and hybrid solutions targeting multiple skin concerns.

Major multinational players are pivoting to hybrid product development, integrating bakuchiol into anti-aging and brightening regimens to address sensitive-skin consumers. Emerging entrants are gaining share by offering eco-conscious sourcing, sustainable packaging, and cross-category expansion into men’s grooming and wellness-infused beauty. The competitive advantage is moving away from legacy branding alone to holistic brand ecosystems encompassing product efficacy, ingredient sustainability, and digital-first consumer engagement.

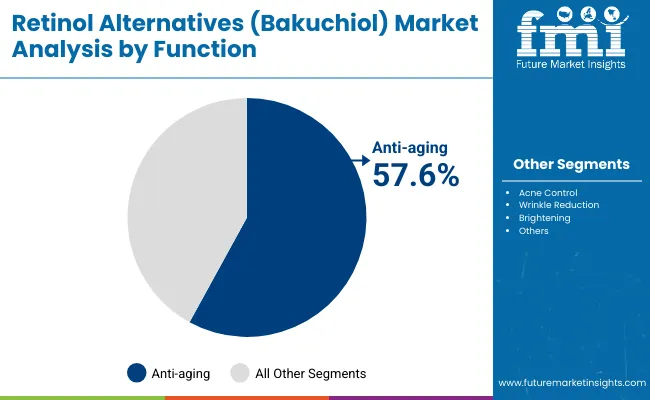

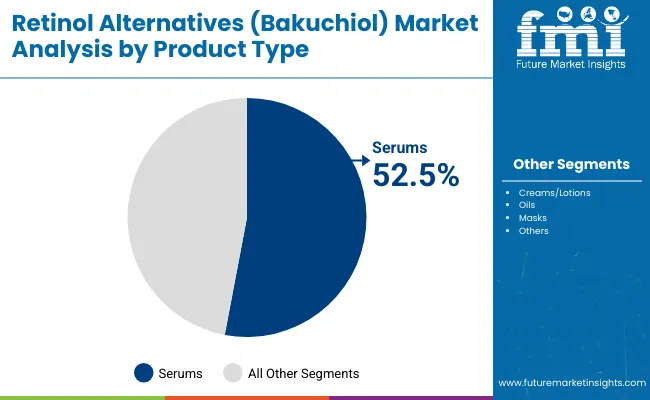

Advances in natural ingredient extraction and formulation science have improved the stability and efficacy of bakuchiol, allowing it to serve as a true plant-based alternative to retinol across diverse skincare applications. Anti-aging remains the dominant driver, accounting for nearly 58% of total market share in 2025, supported by rising consumer demand for wrinkle reduction and skin-firming solutions that do not cause irritation or dryness. Serums lead adoption due to their lightweight texture and high concentration, aligning with premium skincare regimens.

Expansion of clean-label beauty, along with demand for vegan and dermatologist-tested products, has fueled market growth. Consumers are increasingly avoiding synthetic retinoids and seeking gentler plant-derived solutions. Innovations in product positioningsuch as pairing bakuchiol with vitamin C, peptides, or hyaluronic acidare opening new application areas in brightening, hydration, and acne control. Segment growth is expected to be led by anti-aging functions, serum formats, and vegan claims due to their precision targeting and adaptability across consumer groups.

The market is segmented by function, product type, channel, and claim, highlighting the core elements driving adoption. Functions include anti-aging, acne control, wrinkle reduction, and brightening, catering to a wide spectrum of consumer needs. Product type classification covers serums, creams/lotions, oils, and masks to address diverse preferences in texture and format.

Based on channel, the segmentation includes e-commerce, pharmacies, specialty beauty stores, and mass retail. In terms of claim, categories encompass vegan, clean-label, natural/organic, and dermatologist-tested products. Regionally, the scope spans North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa, with leading country markets being the USA, China, India, Japan, Germany, and the UK.

| Function | Value Share % 2025 |

|---|---|

| Anti-aging | 57.6% |

| Others | 42.4% |

The anti-aging segment is projected to contribute nearly 58% of the Global Retinol Alternatives (Bakuchiol) Market revenue in 2025, maintaining its dominance as the most demanded functional category. This leadership is driven by widespread consumer demand for wrinkle reduction, skin-firming, and prevention of premature aging.

With increasing awareness of skin health among millennials and Gen Z, preventive skincare is gaining traction, boosting growth. The segment’s expansion is further reinforced by clinical studies validating bakuchiol’s ability to deliver results comparable to retinol but with fewer side effects such as redness or peeling.

| Product Type | Value Share % 2025 |

|---|---|

| Serums | 52.5% |

| Others | 47.5% |

The serum segment is forecasted to hold over 52% of the market share in 2025, led by its high consumer acceptance in premium skincare regimens. Serums are favored for their fast absorption, higher concentration of active ingredients, and compatibility with multi-step skincare routines.

These attributes make serums ideal for anti-aging, brightening, and acne control formulations. Consumer preference for lightweight, multifunctional products supports serum leadership, especially in Asia-Pacific markets where layering techniques (influenced by K-beauty) dominate.

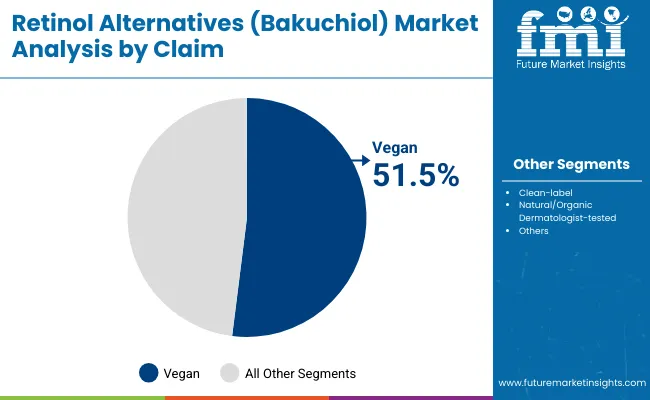

| Claim | Value Share % 2025 |

|---|---|

| Vegan | 51.5% |

| Others | 48.5% |

The vegan claim segment is projected to account for more than 51% of the Global Retinol Alternatives (Bakuchiol) Market revenue in 2025, establishing it as the leading claim category. This dominance is driven by consumer values shifting toward cruelty-free, plant-based beauty solutions.

Brands promoting vegan formulations have been able to align effectively with sustainability-conscious and ethically-driven consumer groups, particularly Gen Z and millennials. As global regulations push for more transparency in labeling, vegan products are expected to remain a core driver of adoption across both developed and emerging markets.

Rising Adoption of Bakuchiol in Anti-Aging Serums and Hybrid Formulations

The strongest driver is the integration of bakuchiol into anti-aging serums, which already command over 52.5% of product type share in 2025. Unlike retinol, which often causes irritation, bakuchiol provides a gentler alternative while still targeting wrinkles, firmillioness, and elasticity.

Brands like Herbivore Botanicals and Biossance are actively promoting bakuchiol-based serums as “retinol without irritation.” Furthermore, hybrid productswhere bakuchiol is combined with vitamin C, niacinamide, or hyaluronic acidare growing in popularity as consumers increasingly look for “all-in-one” formulations.

This functional innovation is critical, as anti-aging alone accounts for 57.6% of global demand in 2025 (USD 806.1 Million). The ability of bakuchiol to penetrate both mass and premium product lines positions this segment as the single largest engine of market growth.

Accelerated Demand in Asia-Pacific, Led by China and India

The second major driver is the rapid CAGR growth in Asia-Pacific markets, particularly China (22.2%) and India (22.4%) between 2025 to 2035. These two countries are not just growth regions but are emerging as influencers in global skincare demand. In China, the serum segment alone accounts for nearly 55% of national demand in 2025, signaling the dominance of lightweight formats preferred by younger consumers who follow K-beauty-inspired layering routines.

In India, rising awareness of anti-aging and the booming e-commerce ecosystem (Nykaa, Amazon India, etc.) is creating new distribution opportunities for both international and domestic brands. Combined, China and India will contribute disproportionately to overall global expansion, with their CAGR being more than double the USA and Europe.

Fragmentation and Lack of Standardization in Clinical Validation

Unlike retinol, which has decades of clinical research backing its efficacy, bakuchiol still suffers from limited standardized validation across geographies. Different suppliers provide varying quality grades, and regulatory acceptance in regions such as the EU and North America is inconsistent.

This undermines brand positioning, especially for multinational players who depend on clinical claims to market premium anti-aging products. The lack of standardized efficacy benchmarks is holding back large-scale adoption in dermatology-led pharmacy channels and restricts bakuchiol’s penetration into wrinkle reduction and dermatologist-prescribed categories.

High Cost of Extraction and Supply Chain Vulnerability

Bakuchiol is derived primarily from the seeds and leaves of the Psoraleacorylifolia plant. The extraction process is resource-intensive, and the limited sourcing base has resulted in volatile pricing. This creates an obstacle for mass-market brands, which rely on consistent ingredient supply for scaling affordable SKUs.

Compared to synthetic retinoids, bakuchiol faces a cost disadvantage that can squeeze margins, particularly in highly competitive e-commerce channels where price sensitivity is high. This barrier is magnified in emerging markets like India, where demand is strong but consumer spending on premium skincare is still cautious.

Vegan and Clean-Label Dominance in Brand Strategy

Vegan formulations are projected to generate USD 721.2 million in 2025, commanding over 51.5% of global market value, and this share is expected to expand further by 2035. This is not just a claim but a core brand strategy. Leading players like The Ordinary and BYBI Beauty use vegan and cruelty-free positioning as a major differentiator.

Beyond consumer demand, regulatory environments in Europe are pushing brands toward vegan, animal-free testing and plant-based sourcing. This trend is reshaping innovation pipelines, where new bakuchiol blends are marketed not just for anti-aging efficacy but also for sustainability and ethical appeal, giving brands dual positioning power.

Premiumization and Multi-Functional Skincare in Asia-Pacific

Another key trend is the premiumization of bakuchiol products in Asia-Pacific, especially in China, Japan, and India. These countries are seeing a rapid expansion of multi-functional skincareproducts that combine anti-aging with brightening, acne control, and hydration. In China, serums blending bakuchiol with niacinamide are positioned as both brightening and anti-aging solutions, tapping into consumer desire for porcelain-like skin.

In Japan, dermatologist-tested and sensitive-skin-friendly bakuchiol oils are rising, leveraging the country’s high trust in science-backed skincare. The trend signals that bakuchiol is moving beyond being a “retinol alternative” to becoming a central bioactive in holistic skincare regimens, especially in premium and mid-tier categories.

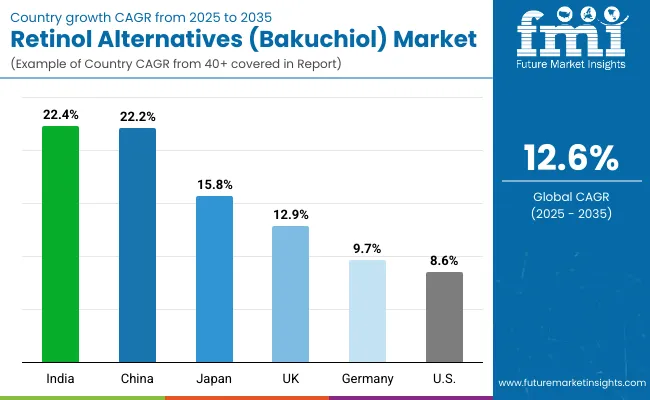

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 22.2% |

| USA | 8.6% |

| India | 22.4% |

| UK | 12.9% |

| Germany | 9.7% |

| Japan | 15.8% |

Between 2025 and 2035, the Global Retinol Alternatives (Bakuchiol) Market is expected to expand at sharply varied growth rates across key countries, reflecting different stages of consumer adoption and regulatory maturity. India (22.4%) and China (22.2%) are the fastest-growing markets, driven by young demographics, rising disposable incomes, and strong penetration of e-commerce platforms that make premium and clean-label skincare widely accessible.

In both countries, the shift toward preventive skincare among millennials and Gen Z is fueling demand for serums and vegan formulations, positioning bakuchiol as a core active in mainstream beauty. The growth is also amplified by cultural influence from K-beauty and J-beauty, which normalize multi-step skincare routines and create fertile ground for plant-based retinol alternatives.

In comparison, Japan (15.8%) and the UK (12.9%) show strong but steadier growth, reflecting more mature skincare markets where bakuchiol adoption is rising due to its dermatologist-tested and sensitive-skin-friendly reputation. Meanwhile, Germany (9.7%) and the USA (8.6%) record slower growth, largely because these markets already have established retinol usage and stricter regulatory landscapes that slow down large-scale replacement.

However, both remain critical in terms of absolute market value, with the USA maintaining one of the largest revenue bases due to high consumer spending on anti-aging. Together, these country-specific trajectories underline the dual nature of the market: explosive adoption in Asia-Pacific, where bakuchiol is becoming mainstream, versus steady integration in Western markets, where it is carving out a niche as a gentler, plant-based complement to retinol.

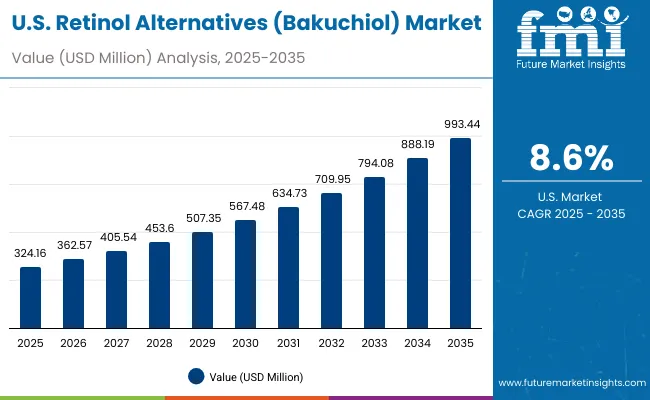

| Year | USA Retinol Alternatives ( Bakuchiol ) Market (USD Million) |

|---|---|

| 2025 | 324.2 |

| 2026 | 362.6 |

| 2027 | 405.5 |

| 2028 | 453.6 |

| 2029 | 507.4 |

| 2030 | 567.5 |

| 2031 | 634.7 |

| 2032 | 709.9 |

| 2033 | 794.1 |

| 2034 | 888.2 |

| 2035 | 993.4 |

The Global Retinol Alternatives (Bakuchiol) Market in the United States is projected to grow at a CAGR of 8.6%, led by increasing consumer demand for gentle anti-aging and wrinkle-reduction products. The dominance of serums and creams/lotion formats reflects USA consumers’ preference for layered skincare routines, with anti-aging accounting for 60.6% of functional demand in 2025 (USD 196 Million).

Dermatologist-tested and clean-label positioning are particularly strong in this region, as USA consumers are cautious about product safety and sensitivity concerns. Premium skincare players are expanding their bakuchiol ranges to capture high-income urban consumers, while mass retail channels are introducing affordable formulations to tap into broader adoption. E-commerce is driving much of the incremental sales, with platforms like Sephora, Ulta, and Amazon offering broad distribution for indie and multinational brands.

The Global Retinol Alternatives (Bakuchiol) Market in the United Kingdom is expected to grow at a CAGR of 12.9%, supported by strong adoption in premium skincare and ethical beauty categories. UK consumers are highly receptive to vegan and natural/organic claims, making the country a leader in plant-based product acceptance.

Retail chains such as Boots and Superdrug have been expanding their clean-beauty aisles, while niche brands leverage bakuchiol in serums and oils targeting anti-aging and brightening benefits. Heritage beauty houses are also incorporating bakuchiol into new launches to appeal to younger demographics demanding gentle but effective solutions. Government-backed sustainability programs and rising consumer awareness of cruelty-free standards further boost adoption.

India is witnessing rapid growth in the Global Retinol Alternatives (Bakuchiol) Market, which is forecast to expand at a CAGR of 22.4% through 2035. Demand is being fueled by a rising urban middle class, growing skincare awareness in tier-2 cities, and strong uptake in online channels like Nykaa and Flipkart. Indian consumers are increasingly concerned with preventive skincare, particularly in anti-aging and acne control, making bakuchiol an attractive choice for sensitive skin.

Domestic players are launching cost-effective serums and creams, while global brands are tailoring smaller pack sizes for affordability. Educational campaigns by dermatologists and influencers on social media platforms are accelerating acceptance.

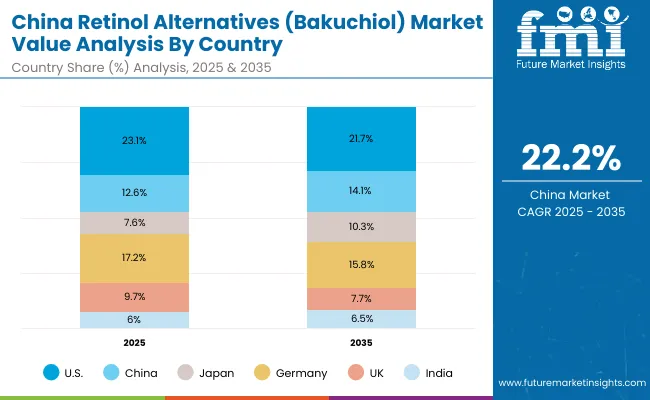

The Global Retinol Alternatives (Bakuchiol) Market in China is expected to grow at a CAGR of 22.2%, the highest among leading economies. This momentum is driven by serums dominating demand (54.9% share in 2025, USD 97 Million), influenced by K-beauty-inspired routines that favor layering and multifunctional products. The anti-aging category is expanding rapidly as younger Chinese consumers invest in preventive skincare earlier in life.

Domestic e-commerce platforms like Tmall and JD.com are enabling rapid brand expansion, while local firms compete with global entrants by offering competitively priced vegan and clean-label products. Government encouragement of sustainable cosmetics and the rise of AI-enabled skin analysis tools in retail are also supporting adoption.

| Country | 2025 Share (%) |

|---|---|

| USA | 23.1% |

| China | 12.6% |

| Japan | 7.6% |

| Germany | 17.2% |

| UK | 9.7% |

| India | 6.0% |

| Country | 2035 Share (%) |

|---|---|

| USA | 21.7% |

| China | 14.1% |

| Japan | 10.3% |

| Germany | 15.8% |

| UK | 7.7% |

| India | 6.5% |

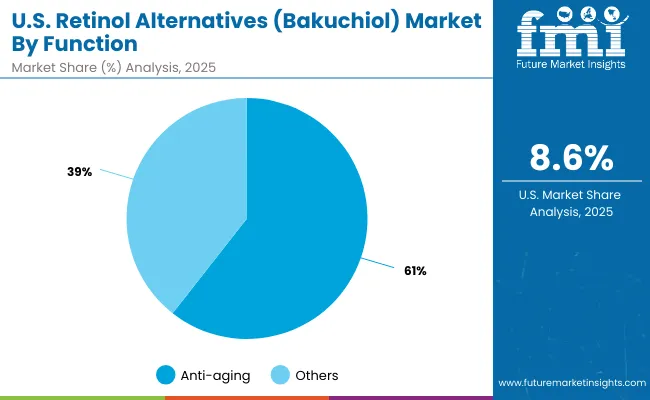

| USA by Function | Value Share % 2025 |

|---|---|

| Anti-aging | 60.6% |

| Others | 39.4% |

The Global Retinol Alternatives (Bakuchiol) Market in the United States is valued at USD 324.16 million in 2025, with anti-aging dominating at 60.6% (USD 196 million), followed by other functions such as acne control, brightening, and wrinkle reduction at 39.4% (USD 127.8 million).

The dominance of anti-aging in the USA is directly tied to the country’s demographic and spending patterns, where consumers over 30 actively seek preventive and corrective solutions that are dermatologist-tested and clinically validated. The market is also shaped by strong presence of premium brands in department stores, specialty beauty chains, and online platforms like Sephora, Ulta, and Amazon.

Anti-aging formulations with bakuchiol are being positioned as safer alternatives to retinol, attracting sensitive-skin consumers who previously avoided retinol-based products due to irritation risks. This has elevated bakuchiol’s appeal as an inclusive anti-aging active across multiple skin types. E-commerce plays a critical role in distribution, particularly with indie brands that leverage digital-first marketing. The trend toward clean-label, vegan claims has also reinforced USA consumer trust, making this market a significant opportunity base for both multinational and independent players.

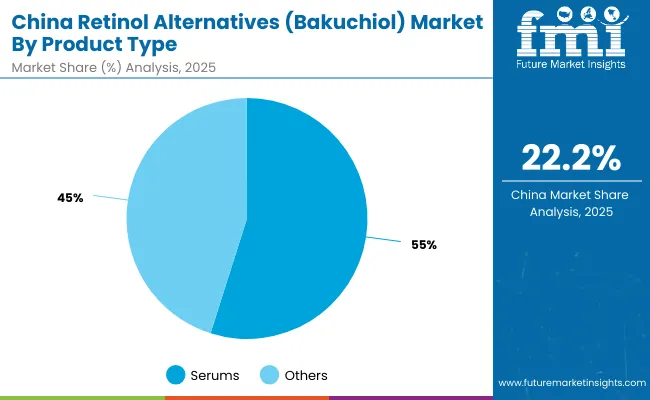

| China by Product Type | Value Share % 2025 |

|---|---|

| Serums | 54.9% |

| Others | 45.1% |

The Global Retinol Alternatives (Bakuchiol) Market in China is valued at USD 177 million in 2025, with serums dominating at 54.9% (USD 97 million), followed by creams, oils, and masks at 45.1% (USD 80 million). The dominance of serums reflects China’s cultural preference for multi-step skincare routines, where lightweight, high-efficacy products are layered for maximum effect. Younger demographics, influenced by K-beauty and J-beauty trends, are adopting bakuchiol-based serums for preventive anti-aging and brightening solutions, well before visible signs of aging appear.

E-commerce channels such as Tmall, JD.com, and Douyin are accelerating adoption, providing access to both global brands and competitive domestic players that offer affordable, vegan-certified formulations. The high CAGR of 22.2% (2025 to 2035) underlines China’s role as the fastest-expanding market for bakuchiol, fueled by cross-category adoption in skincare, men’s grooming, and hybrid wellness products. Domestic players are also capitalizing on local manufacturing efficiencies to deliver competitively priced products that appeal to middle-income consumers.

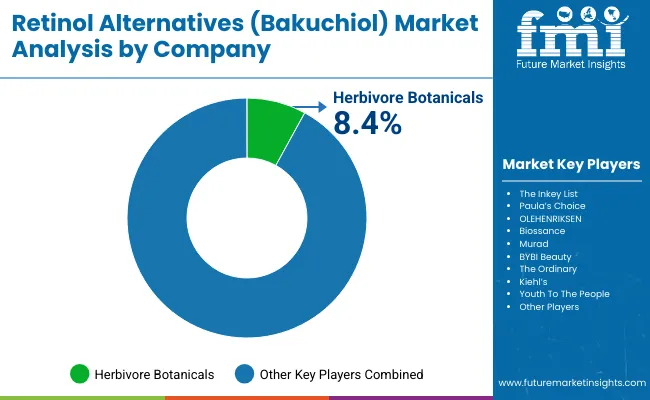

| Companies | Global Value Share 2025 |

|---|---|

| Herbivore Botanicals | 8.4% |

| Others | 91.6% |

The Global Retinol Alternatives (Bakuchiol) Market is highly fragmented, with indie brands, mid-sized innovators, and multinational skincare giants competing across functional and channel-specific categories. Leading clean beauty players such as Herbivore Botanicals, The Ordinary, and BYBI Beauty hold visible share in the vegan and natural/organic segment, with Herbivore Botanicals alone accounting for 8.4% of the global value in 2025.

These companies have built early-mover advantage by positioning bakuchiol serums and oils as natural retinol substitutes.Established skincare leaders such as Paula’s Choice, OLEHENRIKSEN, Biossance, and Murad cater to demand for dermatologist-tested, premium-quality products. Their strategy emphasizes scientific validation, strong retail partnerships, and marketing campaigns that highlight bakuchiol’s clinical comparability to retinol without irritation.

These brands are capturing both prestige and masstige segments, especially in North America and Europe.Meanwhile, multinational conglomerates like Kiehl’s, Youth To The People, and The Inkey List are scaling through global distribution, combining clean-label credibility with established retail infrastructure. Their portfolio expansion into bakuchiol reflects the rising demand for inclusivity and sensitive-skin-friendly anti-aging.

Competitive differentiation is shifting away from ingredient novelty alone toward integrated value propositions including sustainability credentials, multi-functional claims, and digital-first consumer engagement. As the market expands, the balance of power will increasingly depend on a brand’s ability to scale across e-commerce, retain consumer loyalty through subscription models, and deliver consistent efficacy through clinical-backed marketing.

Key Developments in Global Retinol Alternatives (Bakuchiol) Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,403.7 million |

| Function | Anti-aging, Acne control, Wrinkle reduction, and Brightening |

| Product Type | Serums, Creams/lotions, Oils, and Masks |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, and Mass retail |

| Claim | Vegan, Clean-label, Natural/organic, and Dermatologist-tested |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Herbivore Botanicals, The Inkey List, Paula’s Choice, OLEHENRIKSEN, Biossance , Murad, BYBI Beauty, The Ordinary, Kiehl’s , and Youth To The People |

| Additional Attributes | Dollar sales by function, product type, channel, and claim, adoption trends in anti-aging and brightening, rising demand for vegan and dermatologist-tested products, segment-specific growth in serums and e-commerce, integration of bakuchiol with complementary actives such as vitamin C and peptides, regional trends influenced by K-beauty, clean-label, and preventive skincare routines. |

The Global Retinol Alternatives (Bakuchiol) Market is estimated to be valued at USD 1,403.7 million in 2025.

The market size for the Global Retinol Alternatives (Bakuchiol) Market is projected to reach USD 4,581.5 million by 2035.

The Global Retinol Alternatives (Bakuchiol) Market is expected to grow at a 12.6% CAGR between 2025 and 2035.

The key product types in the Global Retinol Alternatives (Bakuchiol) Market are serums, creams/lotions, oils, and masks.

In terms of function, the anti-aging segment will command 57.6% share (USD 806.1 million) in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioactive Retinol Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Water-Soluble Retinol Market Size and Share Forecast Outlook 2025 to 2035

Alternatives For Injectable Diabetes Care Market Size and Share Forecast Outlook 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cheese Alternatives Market Analysis - Size, Share, and Forecast 2025 to 2035

Carmine Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Demand for Dairy Alternatives in the EU Size and Share Forecast Outlook 2025 to 2035

Sustainable Glycerin Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Carcinogenic Chemical Alternatives Market

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Titanium-Free Food Color Alternatives Market

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Protein Demand in Dairy Alternatives Analysis - Size Share and Forecast outlook 2025 to 2035

High-Protein Plant-Based Cheese Alternatives in the EU Analysis Size and Share Forecast Outlook 2025 to 2035

Bakuchiol Formulations Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bakuchiol Market Analysis by Form, Type, Application and Region: Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA