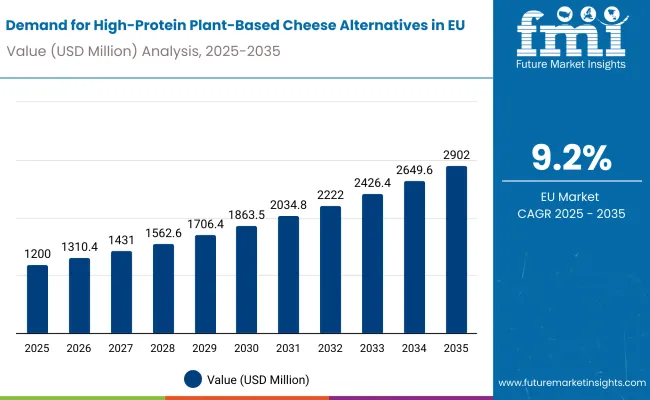

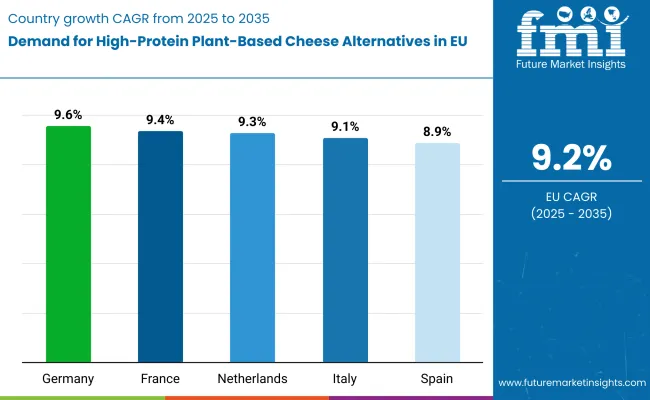

Sales of high-protein plant-based cheese alternatives in the European Union are estimated at USD 1.2 billion in 2025, with projections indicating a rise to USD 2.9 billion by 2035, reflecting a CAGR of approximately 9.2% over the forecast period. This growth reflects both a broadening consumer base and increased per capita consumption in key metropolitan centres across major EU nations.

The rise in demand is linked to shifting dietary preferences, growing awareness of sustainability, and evolving protein requirements among health-conscious consumers. By 2025, per capita consumption in leading EU countries such as Germany, France, and the Netherlands averages between 2.1 to 2.4 kilograms, with projections reaching 3.2 kilograms by 2035. Berlin leads among metropolitan areas, expected to generate USD 142 million in high-protein plant-based cheese alternative sales by 2035, followed by Paris (USD 118 million), Amsterdam (USD 89 million), Barcelona (USD 76 million), and Milan (USD 64 million).

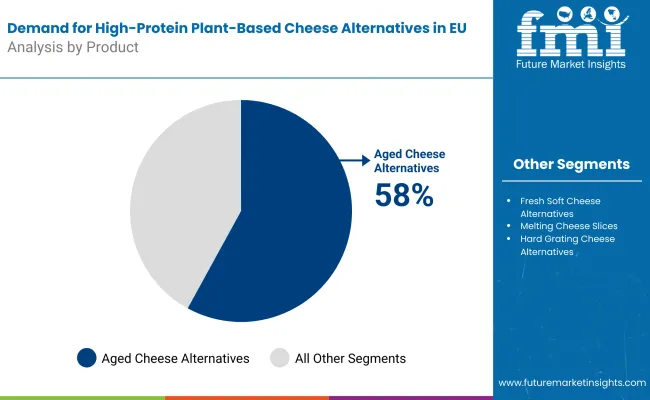

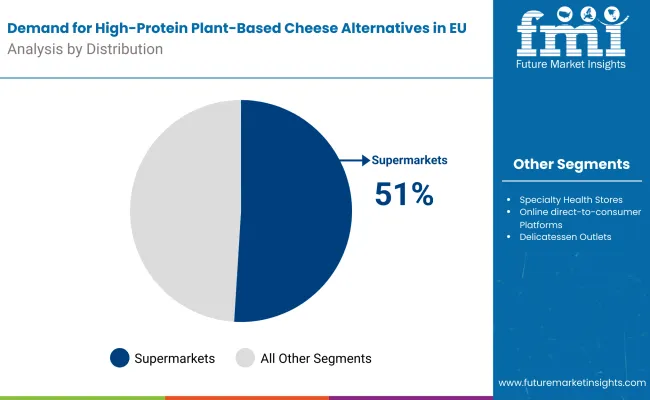

The largest contribution to demand continues to come from aged cheese alternatives, which are expected to account for 58% of total sales in 2025, owing to strong consumer acceptance, extended shelf life, and sophisticated flavor profiles that closely mimic traditional aged cheeses. By distribution channel, supermarkets represent the dominant retail format, responsible for 51% of all sales, while specialty health stores and online platforms are expanding rapidly.

Consumer adoption is particularly concentrated among health-conscious millennials and protein-focused athletes, with income and urban density emerging as significant drivers of demand. While price remains a limiting factor, the average price premium over conventional dairy cheese has declined from 34% in 2020 to 22% in 2025. Continued improvements in fermentation technology and scaling of pea and hemp protein formulations are expected to accelerate affordability and access across mid-income households. Regional disparities persist, but per capita demand in emerging Eastern European cities is narrowing the gap with traditionally strong Western European urban hubs.

The high-protein plant-based cheese alternatives segment in the EU is classified across several segments. By product, the key categories include aged cheese alternatives, fresh soft cheese alternatives, melting cheese slices, hard grating cheese alternatives, and specialty fermented varieties. By distribution channel, the segment spans supermarkets, specialty health stores, online direct-to-consumer platforms, delicatessen outlets, and organic food cooperatives.

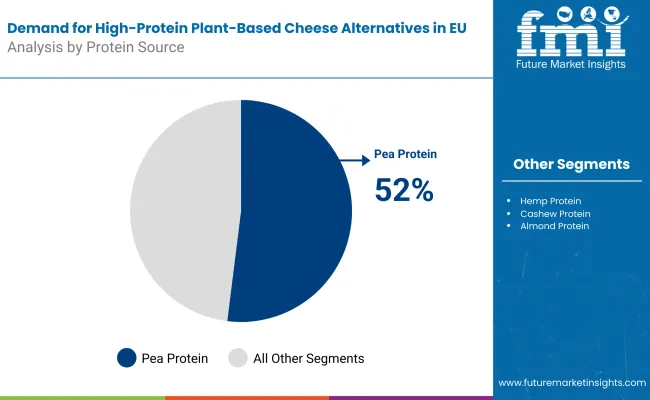

By protein source, formulations include pea protein, hemp protein, cashew protein, almond protein, and blended protein bases incorporating lupine and sunflower proteins. By consumer profile, the segment covers health-conscious millennials, protein-focused athletes, flexitarian families, vegan enthusiasts, and individuals with lactose intolerance or dairy allergies. By region, countries such as Germany, France, Netherlands, Italy, and Spain are included, along with coverage across all 27 EU member states. By city, key metro areas analyzed include Berlin, Paris, Amsterdam, Barcelona, and Milan.

Aged cheese alternatives are projected to dominate sales in 2025, supported by sophisticated fermentation processes, complex flavor development, and premium positioning that appeals to discerning consumers seeking authentic taste experiences.

High-protein plant-based cheese alternatives in the EU are distributed through a mix of mainstream retail and specialized sales channels. Supermarkets are expected to remain the primary point of sale in 2025, followed by specialty health stores and online platforms. Distribution strategies are evolving to match consumer shopping behavior, with growth coming from both traditional retail and emerging digital formats.

High-protein plant-based cheese alternatives in the EU utilize a variety of protein bases, selected for nutritional density, texture properties, allergen profile, and sustainability credentials. Pea protein remains the most widely used protein input, though alternatives like hemp and cashew proteins are gaining momentum among premium brands.

The high-protein plant-based cheese alternatives category appeals to a diverse consumer base across age groups, income levels, and dietary motivations. While preferences vary from health optimization to ethical considerations to performance enhancement, demand is concentrated among five key demographic clusters. Each group brings distinct purchase behaviors, channel preferences, and product expectations.

High-protein plant-based cheese alternative sales will not grow uniformly across every metropolitan area. Rising health consciousness and faster per-capita adoption in Eastern European cities give Prague and Warsaw a measurable edge, while mature Western European hubs such as Berlin expand more steadily from a higher base. The table below shows the compound annual growth rate (CAGR) each of the five largest cities is expected to record between 2025 and 2035.

Between 2025 and 2035, demand for high-protein plant-based cheese alternatives is projected to expand across all major EU metropolitan areas, but the pace of growth will vary based on health awareness trends, retail penetration, and baseline consumption levels. Among the top five cities analyzed, Prague and Warsaw are expected to register the fastest compound annual growth rate (CAGR) of 3.1%, outpacing more mature Western European hubs.

This acceleration is underpinned by a combination of factors: growing health consciousness, increasing disposable income, and expanding availability of premium plant-based formats across organic retailers and specialty health stores. In both cities, per capita consumption is projected to rise from 1.8 kg in 2025 to 2.4 kg by 2035, closing the gap with higher-consumption cities such as Berlin and Amsterdam. Retail assortment is also expanding faster in these regions, with new aged cheese alternatives and protein-enhanced formats gaining traction in upscale grocery chains and wellness-focused retailers.

Milan and Barcelona are each forecast to grow at a CAGR of 2.8% over the same period. Both cities already maintain established culinary ecosystems, with widespread access to premium plant-based cheese alternatives in specialty delicatessens, organic supermarkets, and gourmet food stores. In Milan, growth is supported by a strong food innovation culture, chef endorsements, and increasing uptake of artisanal plant-based cheese alternatives in high-end restaurants.

Barcelona reflects similar dynamics, particularly among health-conscious tourists and local flexitarian communities seeking authentic Mediterranean flavor profiles. In both cities, per capita consumption is projected to increase from 2.2 kg in 2025 to 2.9 kg by 2035, reflecting mainstreaming of premium plant-based alternatives.

Berlin, while maintaining the highest overall sales in absolute terms, is expected to grow at a CAGR of 2.6%, slightly below its Eastern European counterparts. The city already exhibits higher-than-average per capita intake (2.4 kg in 2025), extensive product saturation, and a dense network of specialty retailers. Growth will likely come from repeat purchasing, new protein-enhanced formulations, and premium aged variety expansion rather than first-time trial.

Collectively, these five metro areas represent the core of urban demand for high-protein plant-based cheese alternatives in the EU, but their individual growth paths highlight the importance of regional tailoring in protein positioning, flavor development, and channel strategy.

The competitive environment is characterized by a mix of established dairy alternatives manufacturers and newer, protein-focused specialists. Distribution breadth combined with protein innovation remains the decisive success factor: the five largest suppliers collectively reach more than 25,000 retail outlets across the EU and account for a majority of refrigerated shelf facings in the category.

Violife, owned by Upfield, is the most established participant with pan-European reach. The company offers more than 180 plant-based cheese SKUs, with recent expansion into high-protein aged varieties containing 18-22g protein per 100g serving. Its core range of aged cheese alternatives gives it deep penetration in mainstream supermarkets while maintaining premium positioning through specialty organic retailers across all major EU countries.

Kite Hill leverages advanced fermentation technology to create authentic aged cheese alternatives with enhanced protein profiles, utilizing proprietary almond and pea protein blends. Post-expansion into European operations has allowed Kite Hill to introduce artisanal cheese wheels and protein-fortified spreading varieties priced at premium levels, reinforcing its role as a quality-focused alternative to traditional European cheese-making.

Simply V, owned by Hochland Group, benefits from traditional dairy expertise and established distribution networks across German-speaking regions. Recent launches under the High-Protein sub-brand extend Simply V beyond basic alternatives into nutrient-dense aged varieties and melting slices expressly targeting fitness-conscious consumers.

The next tier comprises specialist and venture-backed companies. Nutcracker Cheese focuses on fermented aged alternatives using innovative protein combinations, Q2-2024 financial reports showed quarterly sales of EUR 18 million, signaling strong regional but expanding scale. Green Vie, now expanding across Southern Europe, adds Mediterranean-style aged cheese alternatives with enhanced protein content to complement traditional flavor profiles expected by local consumers.

Private-label programs at Carrefour (Carrefour Bio), Tesco (Plant Chef), and Albert Heijn (AH Excellent) are widening assortment at price points 12-18% below branded equivalents, putting margin pressure on smaller suppliers while supporting household entry into high-protein plant-based alternatives. Consolidation is therefore likely to continue as protein formulation expertise and omnichannel reach become critical for maintaining shelf visibility and promotional frequency in this rapidly evolving category.

| Attribute | Details |

|---|---|

| Study Coverage | EU sales and consumption of high-protein plant-based cheese alternatives from 2020 to 2035 |

| Base Year | 2025 |

| Historical Data | 2020 |

| Forecast Period | 2025 to 2035 |

| Units of Measurement | USD (sales), Metric Tonnes (volume), Kilograms per capita (consumption) |

| Geography Covered | All 27 EU member states, country-level and city-level granularity |

| Top Countries Analyzed | Germany, France, Netherlands, Italy, Spain, 27+ |

| Top Cities Analyzed | Berlin, Paris, Amsterdam, Milan, Barcelona and 50+ |

| By Product Format | Aged cheese alternatives, Fresh soft cheese alternatives, Melting slices, Hard grating varieties, Specialty fermented |

| By Distribution Channel | Supermarkets, Specialty health stores, Online DTC, Delicatessen outlets, Organic cooperatives |

| By Protein Source | Pea, Hemp, Cashew, Almond, Lupine-blends, Sunflower protein |

| By Consumer Profile | Health-conscious millennials, Protein-focused athletes, Flexitarian families, Vegan enthusiasts, Lactose-intolerant consumers |

| Metrics Provided | Sales (USD), Volume (MT), Per capita consumption (kg), CAGR (2025 to 2035), Share by segment |

| Price Analysis | Average unit prices by product format and protein content |

| Competitive Landscape | Company profiles, private label strategies, protein innovation focus, regional vs. pan-European |

| Forecast Drivers | Health consciousness trends, protein demand, retail expansion, demographic shifts |

By 2035, total EU sales of high-protein plant-based cheese alternatives are projected to reach USD 2.9 billion, up from USD 1.2 billion in 2025, reflecting a CAGR of approximately 9.2%.

Aged cheese alternatives hold the leading share, accounting for approximately 58% of total sales in 2025, followed by fresh soft cheese alternatives and melting cheese slices.

Prague and Warsaw lead in projected growth, each registering a CAGR of 3.1% between 2025 and 2035, due to rising health consciousness and expanding premium retail availability.

Supermarkets are the dominant sales channel (51% share in 2025), but specialty health stores and online direct-to-consumer platforms are growing at double-digit CAGR, especially in metropolitan regions.

Major players include Violife (Upfield), Kite Hill, Simply V (Hochland), Nutcracker Cheese, and Green Vie, with growing competition from private label brands like Carrefour Bio and Tesco Plant Chef.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High-Protein Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High-Protein Pudding Market – Trends, Consumer Demand & Industry Growth

Demand for Textured Pea for High Protein Savory in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Textured Wheat Systems for High-protein Savory in the EU Size and Share Forecast Outlook 2025 to 2035

Plant-Based Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-Based Protein Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant-Based Protein Beverages Market Trends – Growth & Forecast 2025 to 2035

Market Share Insights for Plant-Based Packaging Providers

Plant-Based Methionine Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-Based Energy Drink Market Trends - Growth & Consumer Preferences 2024 to 2034

Plant-Based Food Packaging Market Trends & Industry Growth Forecast 2024-2034

Plant-Based Bioplastic Shrink Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Pet Food Market Analysis – Growth, Applications & Outlook 2025-2035

Demand for Plant-Based Protein Flavor Maskers and Enhancers in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand for Plant-Based Eggs in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Plant-Based Fish in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Plant-Based Milk in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA