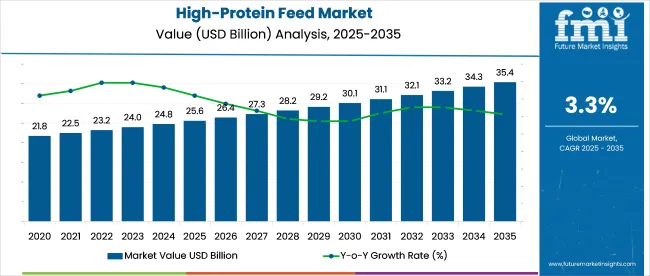

High protein feed volume was USD 25.6 billion in 2025 and is expected to total USD 35.4 billion by 2035, growing at a 3.3% CAGR. Over half of current usage is traced to poultry and swine diets, with aquafeed representing the fastest growing segment.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 25.6 billion |

| Projected Market Size in 2035 | USD 35.4 billion |

| CAGR (2025 to 2035) | 3.3% |

Supplychain upgrades are being spurred by investments in feed mills, extrusion lines, and precision blending facilities in key regions like North America, Europe, and Southeast Asia. Capacity constraints remain in microingredient fortification and amino acid synthesis, where biotechdriven strain optimization and industrial fermentation capabilities are being leveraged.

During the inauguration of Nutreco’s cell-feed powder facility in Boxmeer, Netherlands, CEO David Blakemore stated that “We recognise the possibilities in cultivated protein and think this industry holds tremendous potential. One of the biggest challenges it faces though is how to feed the protein cells cost-efficiently, sustainably and at very large scale. At Nutreco, we believe we can create cell culture media with a lower cost and enable the industry to scale up and bring to the masses something that is currently only available to a limited few.”

The high-protein feed market, estimated around 140-160 billion in 2025, holds a central position in several feed-related sectors. It accounts for roughly 25-30% of the global animal feed market, reflecting its essential role in livestock growth, muscle development, and feed efficiency. Within the compound feed market, its share reaches 35-40% due to inclusion in formulated rations for poultry, swine, and dairy.

In the functional animal feed market, high-protein inputs contribute 30-35% as they support reproductive health, immunity, and performance metrics. Within the broader protein ingredients market, feed applications represent about 20–25% of total demand. In the livestock and aquaculture nutrition sector, high-protein feed commands 40-45% of total value, driven by intensive production systems prioritizing feed conversion and weight gain.

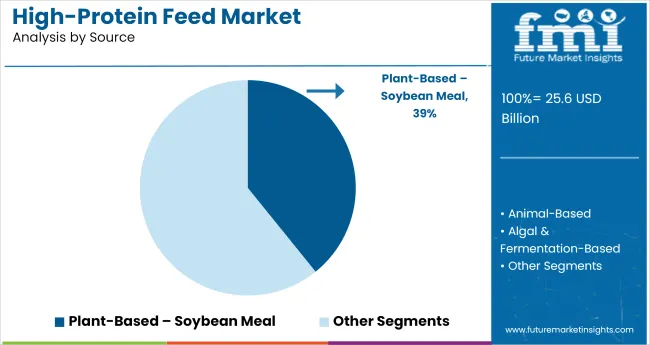

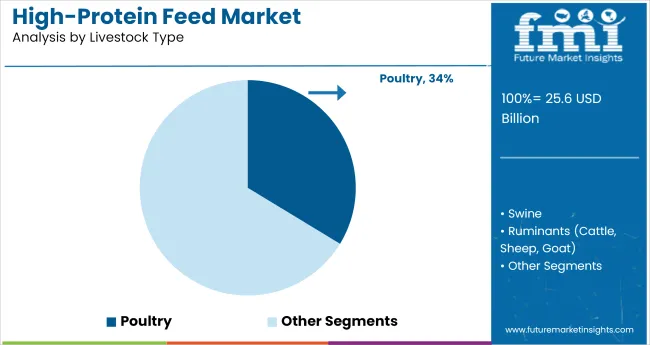

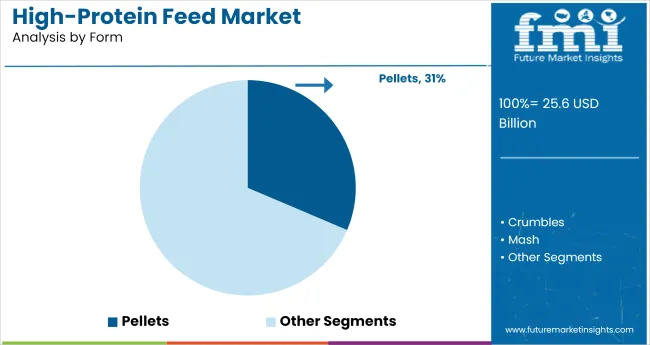

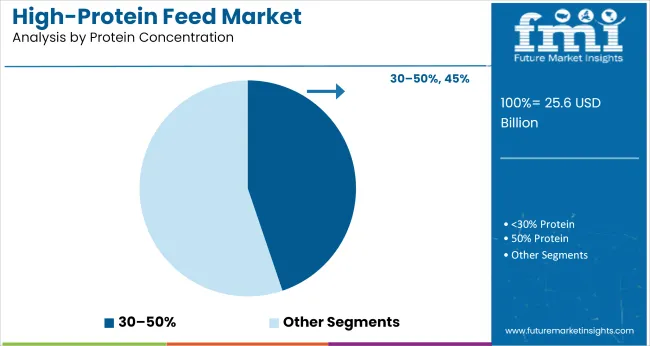

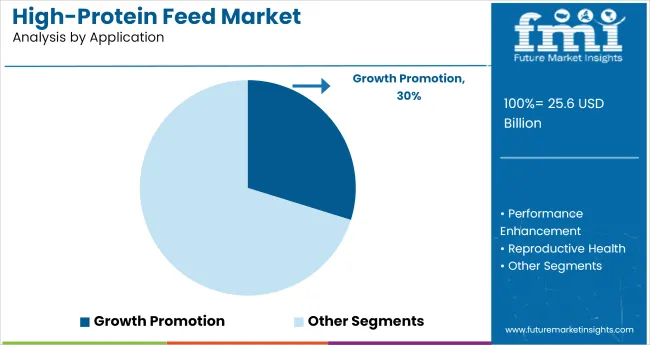

The market is led by soybean meal under plant-based sources with a 39% share. Poultry dominates livestock consumption at 34% share. Pellets account for 31% of form-based demand. The 30–50% protein concentration range holds 45% share, while growth promotion applications represent 30%.

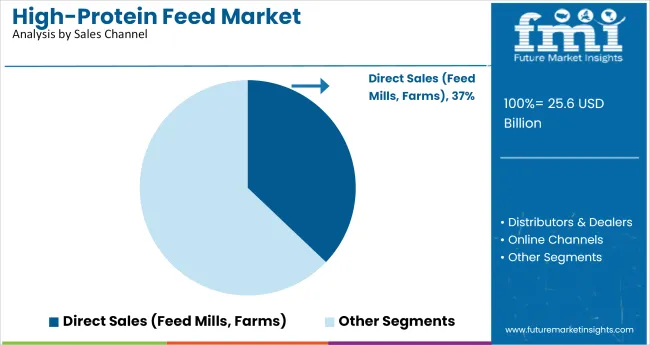

Direct sales channels contribute 37% of total distribution.Regional demand is concentrated in North America, East Asia, and South Asia & Pacific, followed by Latin America, Europe, and the Middle East & Africa, driven by industrial-scale livestock operations and feed mill expansions.

Soybean meal held a 39% share of the source segment in 2025, establishing itself as the most commonly used plant-based protein in compound feed. Its amino acid profile, digestibility, and cost efficiency have positioned it as a core ingredient across poultry, dairy, and aquaculture systems.

Used extensively in starter and finisher diets, soybean meal has enabled precise protein formulation, especially when paired with synthetic amino acids. Suppliers in the United States, Brazil, and China have scaled production to meet consistent demand from industrial feed mills.

Poultry feed consumption accounted for a 34% share in 2025 within the market. Protein-rich diets have been implemented across broiler, layer, and breeder segments to support rapid growth and improve feed conversion ratios. Inclusion of high-protein concentrates has also improved flock uniformity and carcass yield in commercial poultry operations.

Feed integrators in India, the USA, and the Philippines have driven adoption through fortified soy, canola, and fish-based blends. Layer diets have also benefited from consistent protein-to-energy calibration using these feeds.

Pelletized feed formats held a 31% share in 2025 due to their convenience in handling, transport, and mechanical feeding systems. Pelletizing enables uniform distribution of protein content, while reducing fines and segregation in high-density protein blends.

Heat-treated pellet production also contributes to microbial load control. Feed mills in Germany, the USA and Vietnam have increased pellet capacity for poultry and ruminant use. Pellets are preferred in climate-sensitive areas where moisture and spoilage risk are elevated.

The 30–50% protein range accounted for a 45% share, making it the largest concentration bracket in 2025. Feeds within this range are used in balanced rations across multiple livestock categories, including poultry, swine, and aquaculture. This segment allows flexibility in formulation while maintaining digestibility and protein efficiency. Manufacturers in the EU and Southeast Asia have standardized offerings within this range for easier nutrient profile management. The bracket has been especially favored in regions where regulatory feed compliance requires minimum guaranteed protein levels.

Growth promotion represented a 30% share of the application category in 2025. High-protein formulations have been used to support muscle development, skeletal integrity, and efficient feed-to-weight gain across poultry, cattle, and aquaculture species. Feeds enriched with lysine, methionine, and bioavailable minerals have enhanced productivity in both commercial and contract farming setups. Southeast Asia and Latin America have reported increased demand from poultry integrators and aquaculture clusters focused on achieving growth targets within shorter cycles.

Direct sales channels accounted for a 37% share of distribution in 2025. Feed manufacturers and bulk protein suppliers have prioritized B2B transactions with farms, cooperatives, and feed millers to ensure cost efficiency and customization. Contract arrangements have enabled consistent delivery and nutrition standardization. The segment has expanded in markets like Brazil, Indonesia, and the USA, where vertically integrated farms require feed customization aligned with performance goals.

The market is expanding due to rising livestock production, reduced reliance on soymeal, and increased adoption of alternative proteins. However, price volatility, fragmented regulatory approvals, and limited technical capacity among small producers continue to challenge consistent scale-up and integration.

Growth in Alternative Protein Sources for Animal Nutrition

The inclusion of high-protein ingredients is increasing due to their ability to support feed efficiency, animal growth rates, and reduced soy dependency. Countries like China are targeting a reduction in soymeal inclusion from 13% to 10% by 2030, encouraging shifts to novel proteins. Asia-Pacific, especially India and China, leads demand growth with aquafeed and poultry sectors adopting corn protein, DDGS, and insect meal at accelerating rates.

Volatile Input Costs and Regulatory Barriers Limiting Expansion

Price instability of traditional protein sources, such as soybean and DDGS, along with newer alternatives like insect protein, is creating forecasting and procurement challenges. Inconsistent regulatory frameworks, particularly for novel ingredients like microbial and synthetic proteins, delay product approvals and market entry. Smaller producers face hurdles adapting feed formulations due to cost and lack of technical resources, especially in regions with limited infrastructure or extension support.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 3.6% |

| Australia | 3.4% |

| China | 3.2% |

| South Korea | 3.0% |

| Japan | 2.9% |

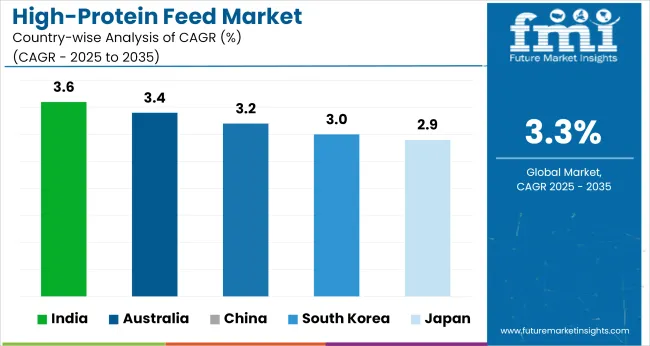

The global high-protein feed market is projected to grow at a CAGR of 3.3% from 2025 to 2035. The report includes detailed analysis of 40+ countries, with the top five presented as a reference. India, part of the BRICS group, leads with 3.6% growth, supported by rising demand for protein-enriched dairy and poultry feed. Australia, aligned with OECD economies, follows at 3.4%, driven by lupin and soybean meal integration across cattle and sheep sectors. China, also in BRICS, posts 3.2%, with growth centered on aquaculture and commercial swine diets.

South Korea, a key East Asian OECD economy, records 3.0% as protein diversification through insect meal and oilseed imports gains momentum. Japan, another OECD member, posts 2.9%, reflecting feed market maturity and slower adoption of new protein sources. All five countries remain close to or above the global average, highlighting varied feed strategies shaped by regional protein access, trade alignment, and species-specific demand.

The high-protein feed market in India is projected to expand at a CAGR of 3.6% between 2025 and 2035. Protein-enriched formulations are being adopted in dairy and poultry nutrition, especially across Punjab, Maharashtra, and Tamil Nadu. Increased inclusion of soybean meal, cottonseed cake, and fishmeal has been observed in concentrated feed mixes.

Feed cooperatives and state-backed procurement schemes have supported distribution in semi-intensive production zones. Local feed mills are blending native protein sources with synthetic amino acids to meet minimum digestibility benchmarks.

The high-protein feed market in Australia is forecast to grow at a CAGR of 3.4% through 2035. Sheep and cattle sectors are leading demand for high-protein additives focused on improving weight gain and reproductive efficiency. Lupin, faba bean, and canola meal are being used in protein balancing for pasture-fed livestock.

Feedlots in New South Wales and Western Australia are upgrading protein formulations for ruminants, with increased use of precision feed blending systems. Nutritional studies have validated protein-linked performance markers in commercial beef operations.

Demand for high-protein feed in China is growing at a CAGR of 3.2% through 2035. Focus has been placed on monogastric livestock nutrition, particularly in the swine and aquaculture segments. Soy protein concentrate and fermented meal variants are being deployed in piglet and juvenile fish diets. Feed mills in provinces like Shandong and Sichuan have scaled production of high-digestibility protein blends. Government mandates on protein efficiency ratios have driven R&D collaborations with agricultural universities and marine feed laboratories.

Sales of high-protein feed in South Korea areexpanding at a CAGR of 3.0% between 2025 and 2035. Demand is being shaped by poultry integrators and egg producers prioritizing feed conversion efficiency. Hydrolyzed vegetable protein and fish protein hydrolysates are being incorporated into broiler and layer diets to meet amino acid requirements. Imports of specialty protein premixes have increased, with Japanese and European suppliers expanding distribution. Urban feed plants are adopting small-batch protein blending with traceability-enabled formulation systems.

The high-protein feed market in Japan is expected to grow at a CAGR of 2.9% through 2035. Demand has increased in swine and dairy production where feed conversion and carcass quality remain key targets. Protein enrichment is being implemented using canola meal, soy flour, and imported fishmeal. Co-operative dairy groups in Hokkaido are driving regional uptake of fortified protein mixes in silage-based diets. Traceable feed certification and feed safety regulations have guided adoption across branded meat and milk supply chains.

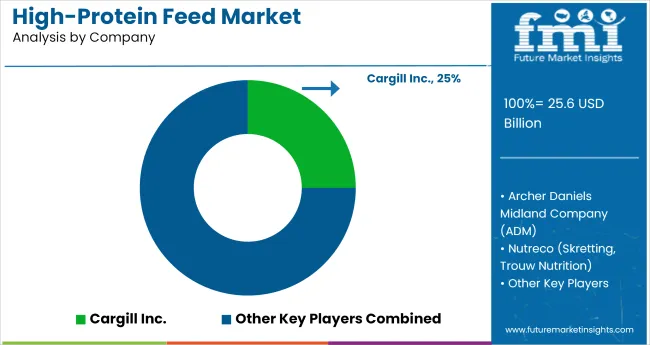

The high-protein feed market is led by vertically integrated agribusinesses with strong sourcing, R&D, and distribution infrastructure. Cargill Inc. and Archer Daniels Midland Company (ADM) dominate global volumes through soybean meal, canola protein, and alternative concentrates tailored to livestock and aquaculture.

Nutreco, via Skretting and Trouw Nutrition, targets value-added high-protein blends for performance enhancement across poultry, fish, and swine segments. Alltech Inc. emphasizes yeast-based proteins and fermentation technologies to enhance digestibility and amino acid profiles.

Ridley Corporation, under Mitsui control, serves the Asia-Pacific market with compound feed tailored to regional dietary formulations. Strategic priorities include backward integration into oilseed processing, patented feed optimization systems, and alignment with region-specific animal nutrition regulations to maintain high-protein content consistency.

Leading Company - Cargill Inc.Market Share - 25%

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 25.6 billion |

| Projected Market Size (2035) | USD 35.4 billion |

| CAGR (2025 to 2035) | 3.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million metric tons for volume |

| Sources Analyzed (Segment 1) | Plant-Based (Soybean Meal, Canola Meal, Sunflower Meal, Pea Protein, Cottonseed Meal, Lupin Meal), Animal-Based (Fish Meal, Meat & Bone Meal, Poultry By-product Meal, Blood Meal, Feather Meal), Algal & Fermentation-Based (Single Cell Protein, Yeast-Derived Protein, Microalgae Protein, Mycoprotein ) |

| Livestock Types Analyzed (Segment 2) | Poultry, Swine, Ruminants (Cattle, Sheep, Goat), Aquaculture, Pet Food, Equine, Specialty Animals (Rabbit, etc.) |

| Forms Analyzed (Segment 3) | Pellets, Crumbles, Mash, Extruded, Liquid Concentrate, Powder/Meal |

| Protein Concentrations Analyzed (Segment 4) | <30% Protein, 30–50% Protein, >50% Protein |

| Applications Analyzed (Segment 5) | Growth Promotion, Performance Enhancement, Reproductive Health, Immune Support, Feed Conversion Optimization |

| Sales Channels Analyzed (Segment 6) | Direct Sales (Feed Mills, Farms), Distributors & Dealers, Online Channels, Cooperatives |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Cargill Inc., Archer Daniels Midland Company (ADM), Nutreco (Skretting, Trouw Nutrition), Alltech Inc., Ridley Corporation ( Agribrands Purina, Mitsui) |

| Additional Attributes | Dollar sales, share by protein source and livestock application, rise of algal and microbial protein formats, segment shift toward >50% protein blends, demand for performance-based feed formulations across poultry and aquafeed segments |

The segment includes Plant-Based (Soybean Meal, Canola Meal, Sunflower Meal, Pea Protein, Cottonseed Meal, Lupin Meal), Animal-Based (Fish Meal, Meat & Bone Meal, Poultry By-product Meal, Blood Meal, Feather Meal), and Algal & Fermentation-Based (Single Cell Protein, Yeast-Derived Protein, Microalgae Protein, Mycoprotein).

This segment covers Poultry, Swine, Ruminants (Cattle, Sheep, Goat), Aquaculture, Pet Food, Equine, and Specialty Animals (Rabbit, etc.).

The industry is segmented into Pellets, Crumbles, Mash, Extruded, Liquid Concentrate, and Powder/Meal.

This includes <30% Protein, 30-50% Protein, and >50% Protein.

This segment includes Growth Promotion, Performance Enhancement, Reproductive Health, Immune Support, and Feed Conversion Optimization.

The segment is categorized into Direct Sales (Feed Mills, Farms), Distributors & Dealers, Online Channels, and Cooperatives.

The industry is projected to reach USD 25.6 billion in 2025.

The industry is expected to grow at a CAGR of 3.3% from 2025 to 2035.

Soybean meal is expected to lead with 39% share in 2025.

South Asia & Pacific, especially India, is projected to show leading growth at 3.6% CAGR.

The industry is projected to reach USD 35.4 billion by 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Phytogenic Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA