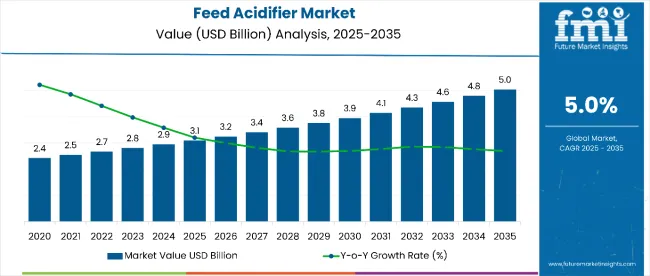

The feed acidifier market is estimated to be valued at USD 3.1 billion in 2025. It is projected to reach USD 5.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 3.1 billion |

| Projected Value (2035F) | USD 5.0 billion |

| CAGR (2025 to 2035) | 5% |

The market is projected to add an absolute dollar opportunity of USD 1.90 billion over the forecast period, reflecting a 1.52 times growth at a CAGR of 5%. Growth is expected to be shaped by rising demand for antibiotic-free feed additives, the expansion of livestock and poultry production, and the increasing preference for organic acids to improve gut health and nutrient absorption in farm animals.

By 2030, the market is likely to reach approximately USD 3.9 billion, accounting for USD 0.80 billion in incremental value over the first half of the decade. The remaining USD 1.10 billion is expected in the second half, suggesting a moderately back-loaded growth pattern driven by the adoption of innovative acidifier formulations and the expansion of livestock production in Asia-Pacific and Latin America.

Companies such as BASF SE, Corbion NV, and Kemin Industries Inc. are strengthening their market positions through innovation in coating technologies, improved formulations, and eco-friendly feed solutions. Strategic expansions, partnerships, and the development of high-performance, safe, and easy-to-use feed acidifiers are enhancing their competitive advantage. Regulatory compliance and product efficacy continue to anchor growth across multiple livestock segments globally.

The feed acidifier market is a subset of the global animal nutrition market, which is valued at approximately USD 70 billion, holding around 4.4% share. It also falls under the livestock feed additives market, representing about 15% of the total feed additives segment. Within the broader animal feed industry, feed acidifiers account for roughly 3% of overall feed formulation sales. Additionally, in the organic livestock solutions market, the segment represents approximately 12% share, reflecting its growing adoption in antibiotic-free and sustainable animal feed practices across major producing countries.

The market is being driven by growing demand for gut health improvement, antibiotic-free livestock production, and enhanced nutrient absorption. Innovations include coated acidifier powders, liquid formulations, and patented technologies such as SoftAcid® that reduce corrosion and improve handling safety. Recent developments include capacity expansion, digital farm integration, and precision livestock nutrition. Regional trends in Asia-Pacific, North America, and Europe indicate the adoption of advanced feed formulations and stricter regulatory compliance. At the same time, manufacturers focus on sustainability, high-performance formulations, and increased efficacy in swine, poultry, and dairy feed applications.

Feed acidifiers are increasingly adopted due to their ability to improve gut health, nutrient absorption, and feed efficiency in livestock and poultry. Their role in maintaining optimal pH levels and enhancing enzymatic digestion makes them a preferred alternative to antibiotics in animal nutrition, aligning with global trends toward antibiotic-free production.

Rising demand for sustainable and high-performance livestock feed, coupled with expanding poultry, swine, and dairy production in the Asia-Pacific, North America, and Latin America, is driving growth. Innovations in coated and liquid acidifier formulations, along with precision nutrition solutions, are further boosting adoption by feed manufacturers.

Stringent regulations on antibiotic use, increasing consumer awareness of food safety, and the need for higher productivity in animal farming are sustaining market expansion. With manufacturers focusing on efficacy, safety, and regulatory compliance, the feed acidifier market is well-positioned for continued growth across global livestock and poultry sectors.

The market is segmented by acid type, form, product type, livestock, and region. By acid type, the market is divided into propionic acid, formic acid, lactic acid, citric acid, malic acid, sorbic acid, and others (fumaric acid, butyric acid, benzoic acid). Based on form, the market is bifurcated into dry and liquid. By product type, the market is bifurcated into blended and single. In terms of livestock, the market is divided into poultry, swine, ruminants, aquaculture, pets, and others (equine). Regionally, the market is classified into North America, Europe, Asia-Pacific, Latin America, Japan and the Middle East & Africa.

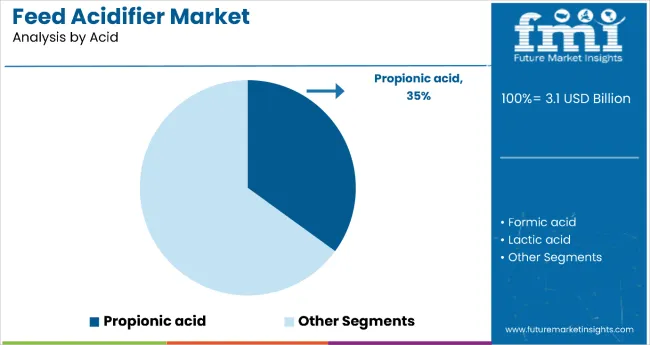

The propionic acid segment holds a dominant position with 35% market share in the acid type category due to its efficacy in inhibiting mold, improving gut microflora, and enhancing nutrient absorption in poultry and swine. Its role as a natural preservative in feed extends shelf life and reduces spoilage, making it preferred by feed manufacturers targeting high-quality production.

Propionic acid formulations are versatile, suitable for both powder and liquid feed, and can be blended with other organic acids to enhance antimicrobial activity. Manufacturers are investing in advanced coating technologies to improve handling safety and reduce corrosiveness. Rising awareness about antibiotic-free livestock production further reinforces the adoption of propionic acid-based acidifiers across global feed markets.

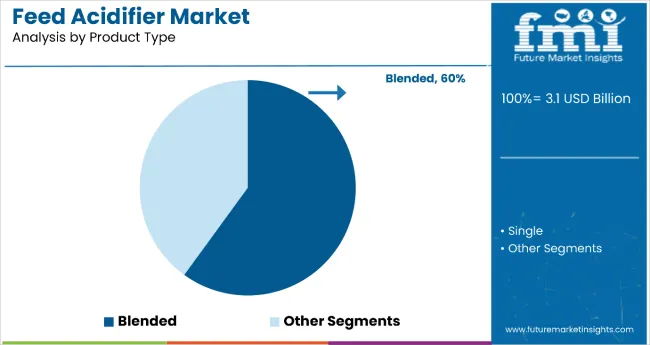

Blended feed acidifiers dominate the product type segment with 60% market share, reflecting their versatility in combining multiple acids to achieve synergistic effects on gut health and feed efficiency. These formulations allow precise pH regulation, improved digestion, and enhanced microbial control for poultry, swine, and dairy feeds.

Blended acidifiers provide feed producers the flexibility to formulate tailored solutions for different livestock requirements, improving overall performance and productivity. Manufacturers are increasingly focusing on developing high-purity, coated blended products that reduce dust, improve handling, and maintain efficacy during feed processing. The blended segment’s dominance is supported by rising demand for multifunctional, high-performance feed additives that meet regulatory compliance and promote sustainable livestock farming practices.

In 2025, global feed acidifier consumption is projected to grow substantially, with Asia-Pacific accounting for approximately 40% of the market. Key applications include gut health improvement, antibiotic-free feed enhancement, nutrient absorption optimization, and feed preservation. Manufacturers are introducing advanced blended formulations and coated acidifiers that improve handling safety, reduce corrosiveness, and maintain efficacy during feed processing. Rising adoption of digital farm monitoring, precision livestock nutrition, and sustainable feed practices is driving demand. Regulatory compliance, particularly regarding antibiotic reduction in livestock, is influencing formulation strategies and increasing adoption in poultry, swine, and dairy production.

Health and Performance Trends Drive Feed Acidifier Adoption

Feed acidifiers are increasingly preferred due to their ability to regulate gut microflora, enhance enzymatic digestion, and improve feed efficiency. Studies have shown that acidifier inclusion can improve nutrient digestibility by up to 15% compared to conventional feed. Blended and coated acidifiers are being deployed to achieve optimal pH balance, reduce pathogenic bacterial growth, and enhance immune responses in livestock. These benefits have resulted in higher adoption rates among industrial feed manufacturers, particularly in regions such as Asia-Pacific and Latin America, where intensive livestock and poultry production is expanding rapidly.

Supply Chain Challenges, Cost Factors, and Processing Constraints Limit Expansion

Market growth is restrained by raw material cost volatility, specialized handling requirements, and formulation complexities. Organic acids such as propionic and formic acid require careful storage and transport, increasing logistical costs by 12-18%. Coated and blended formulations necessitate advanced production facilities with precise dosing and quality control, extending development cycles by 4-6 weeks. Price sensitivity in developing economies, combined with regulatory compliance pressures, limits large-scale adoption despite rising awareness of health and productivity benefits. These constraints underscore the importance of innovation and supply chain optimization in maintaining market growth.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.7% |

| Japan | 5.0% |

| France | 4.9% |

| UK | 4.4% |

| Germany | 4.0% |

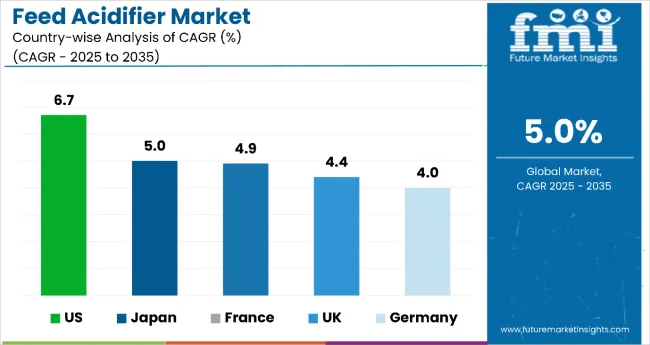

The feed acidifier market shows varying growth rates across major economies, with the USA leading at a CAGR of 6.7%, followed by Japan at 5%, France at 4.9%, the UK at 4.4%, and Germany at 4%. Higher growth in the USA is supported by large-scale poultry and swine production, technological adoption in feed formulations, and strict antibiotic-free mandates. Japan’s moderate growth reflects steady demand in precision livestock nutrition, while regulatory compliance, sustainable feed practices, and functional acidifier innovations drive European countries such as France, the UK, and Germany.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The feed acidifier market in the USA is projected to grow at a CAGR of 6.7% from 2025 to 2035, driven by demand for antibiotic-free feed additives and gut-health-promoting solutions. Producers are increasingly adopting blended and coated acidifiers to improve nutrient absorption, feed efficiency, and livestock performance in poultry and swine. Technological advancements in feed processing, coupled with heightened awareness of animal nutrition, are boosting adoption. Expansion in the Midwest and Southeast regions is particularly notable due to high livestock density.

Demand for feed acidifier in Japan is expected to expand at a CAGR of 5% from 2025 to 2035, supported by precision nutrition programs and high-quality livestock feed demand. Urban and industrial poultry and swine farms in regions like Hokkaido, Kyushu, and Chubu are increasingly using blended acidifiers to enhance gut health, feed digestibility, and nutrient utilization. Growth is further aided by government initiatives promoting antibiotic-free feed and sustainable farming practices. Coated formulations are preferred to improve handling safety and maintain efficacy during feed processing.

Revenue from feed acidifier in France is estimated to rise at a CAGR of 4.9% from 2025 to 2035, driven by stringent EU regulations on antibiotic-free feed and sustainable livestock production. Key growth regions include Brittany, Normandy, and Auvergne, where dairy and poultry feed demand is high. Adoption of propionic acid-based and blended acidifiers enhances feed quality, digestion, and gut microbiota management. Partnerships between feed manufacturers and livestock cooperatives support broader distribution and formulation innovation. Coated acidifiers are increasingly preferred for safe handling and storage in industrial feed operations.

Sales of feed acidifier in the UK are anticipated to increase at a CAGR of 4.4% from 2025 to 2035. Adoption is driven by functional feed additives for poultry and swine, regulatory compliance with EU-origin feed standards, and rising demand for antibiotic-free livestock nutrition. Key regions include England, Scotland, and Wales, where industrial feed production is concentrated. Blended acidifiers dominate due to enhanced efficacy, safety, and digestibility. Despite limited domestic production, the import of advanced formulations supports growth and strengthens feed quality and livestock performance.

The feed acidifier market in Germany is poised to strengthen at a CAGR of 4% from 2025 to 2035, driven by high livestock density, regulatory mandates, and the adoption of sustainable feed solutions. Growth is concentrated in the poultry and swine sectors across Bavaria, Lower Saxony, and North Rhine-Westphalia. Propionic acid-based and blended acidifiers are preferred for gut health improvement, nutrient absorption, and feed preservation. Coated acidifiers enhance handling safety and reduce corrosiveness, making them suitable for industrial feed applications. Research and innovation in feed formulations are further supporting market expansion.

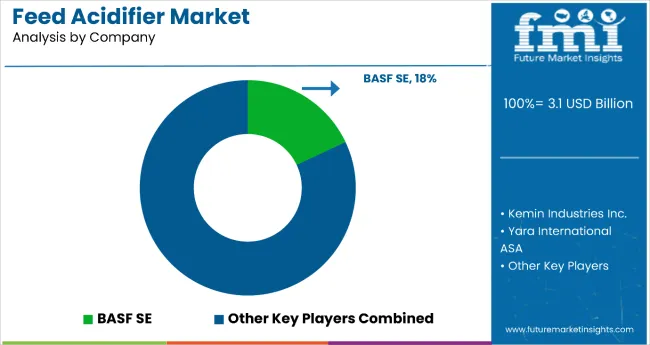

The feed acidifier market is moderately consolidated, comprising global chemical and feed additive giants, specialized animal nutrition companies, and regional manufacturers with varying degrees of formulation expertise and application technology. BASF SE, Corbion NV, and Kemin Industries Inc. lead the global feed acidifier segment, offering proprietary organic acids, blended formulations, and coated acidifiers for poultry, swine, and ruminant applications. Their competitive advantage lies in established distribution networks, extensive R&D capabilities, and experience in compliance with international feed safety standards, enabling reliable supply across large-scale commercial operations.

Companies such as Yara International ASA, Biomin Holding GmbH, and Pancosma SA differentiate themselves through specialty acidifier solutions, including propionic, formic, and lactic acid-based products designed for improved gut health, nutrient absorption, and feed preservation. These players leverage application-specific expertise and coating technologies to reduce corrosiveness, optimize handling, and enhance efficacy in complex feed formulations. Regional players such as Nutrex NV, Jefo Nutrition Inc., and Addcon Group GmbH emphasize localized solutions, blending feed acidifiers with other performance additives and providing technical support to small- and medium-scale livestock producers.

Entry barriers in the feed acidifier market remain significant due to the need for advanced formulation technologies, precise dosing capabilities, regulatory compliance across multiple jurisdictions, and supply chain integration for raw acids and coated products. Competitiveness increasingly depends on formulation innovation, product safety, handling efficiency, and the ability to offer customized acidifier solutions for diverse livestock species and production systems. Continuous investment in R&D, pilot-scale trials, and collaborations with feed manufacturers are essential for maintaining market leadership and expanding adoption in emerging regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Acid Type | Propionic acid, Formic acid, Lactic acid, Citric acid, Malic acid, Sorbic acid, Others (Fumaric Acid, Butyric Acid, Benzoic Ac id) |

| Form | Dry and Liquid |

| Product Type | Blended and Single |

| Livestock | Poultry, Swine, Ruminants, Aquaculture, Pets, Others (Equine) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Japan, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | BASF SE, Corbion NV, Yara International ASA, Biomin Holding GmbH, Kemin Industries Inc., Nutrex NV, Peterlabs Holdings Berhad, Pancosma SA, Novus International Inc., Addcon Group GmbH, Jefo Nutrition Inc., Impextraco NV |

| Additional Attributes | Dollar sales by application and purity grade, regional demand trends, competitive landscape, consumer preferences for natural versus synthetic alternatives, integration with sustainable sourcing practices, innovations in extraction technology and quality standardization for diverse industrial applications |

The global feed acidifier market is estimated to be valued at USD 3.1 billion in 2025.

The feed acidifier market size is projected to reach USD 5.0 billion by 2035.

The feed acidifier market is expected to grow at a 5% CAGR between 2025 and 2035.

The propionic acid segment is projected to lead the feed acidifier market with 35% market share in 2025.

In terms of product type, the blended segment will command 60% share in the feed acidifier market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Phytogenic Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA