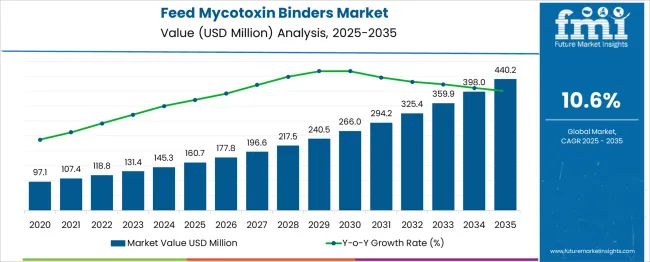

The Feed Mycotoxin Binders Market is estimated to be valued at USD 160.7 million in 2025 and is projected to reach USD 440.2 million by 2035, registering a compound annual growth rate (CAGR) of 10.6% over the forecast period. During the first five-year phase (2025–2030), the market will expand from USD 160.7 million to USD 266.0 million, generating USD 105.3 million, which accounts for 37.7% of the total incremental growth. This early growth will be driven by rising demand for high-quality feed additives, greater emphasis on livestock health, and stricter food safety regulations targeting contamination risks in poultry, swine, and ruminant diets. The second half (2030–2035) will contribute USD 174.2 million, representing 62.3% of incremental growth, signaling accelerated adoption as awareness of mycotoxin-related productivity losses and regulatory compliance intensifies globally. Annual increments in the first phase average USD 21 million per year, while later years see stronger gains supported by the shift toward multi-functional toxin binders with added gut health benefits. Manufacturers focusing on natural clay-based solutions, enzymatic detoxifiers, and region-specific formulations will capture maximum value within this USD 279.5 million opportunity, particularly in Asia-Pacific and Latin America, where feed contamination risks remain high.

| Metric | Value |

|---|---|

| Feed Mycotoxin Binders Market Estimated Value in (2025 E) | USD 160.7 million |

| Feed Mycotoxin Binders Market Forecast Value in (2035 F) | USD 440.2 million |

| Forecast CAGR (2025 to 2035) | 10.6% |

The feed mycotoxin binders market holds a critical share within several livestock and animal nutrition-related sectors. In the Animal Feed Additives Market, it accounts for approximately 8%, as binders are key in safeguarding feed quality alongside enzymes, probiotics, and vitamins. Within the Livestock Nutrition Market, its share is about 5%, given the broader inclusion of proteins, minerals, and energy-rich ingredients. For the Animal Health Solutions Market, it contributes around 4%, since binders indirectly support disease prevention by reducing toxin-related risks.

In the Poultry and Swine Feed Market, its share is close to 6%, as these species are highly vulnerable to mycotoxin contamination, driving higher binder usage. Within the Veterinary Preventive Care Market, its share is roughly 3%, considering preventive strategies also include vaccinations and biosecurity measures. Growth is driven by increasing concerns over feed contamination, stricter safety regulations, and the economic impact of mycotoxins on livestock productivity. The adoption of multi-functional binders with adsorption and detoxification properties is gaining traction, while innovation in organic and mineral-based solutions is enhancing performance across species. Expanding commercial livestock farming and rising demand for high-quality animal protein globally further reinforce the strategic role of mycotoxin binders in ensuring feed safety and optimizing herd health.

The feed mycotoxin binders market is experiencing sustained demand, driven by the rising global concern over mycotoxin contamination in animal feed and its impact on livestock health and productivity. Climate change and inconsistent grain storage practices have led to elevated risks of mycotoxin proliferation, especially in regions with high humidity.

Governments and industry bodies have increased regulatory scrutiny on permissible toxin levels in feed, prompting feed manufacturers to adopt binding solutions to meet safety standards. The expansion of intensive livestock farming and increasing awareness among producers regarding the economic losses from mycotoxicosis are fostering adoption of feed binders.

As innovations in compound feed and additive blends continue, mycotoxin binders are anticipated to remain an essential part of livestock health management protocols globally.

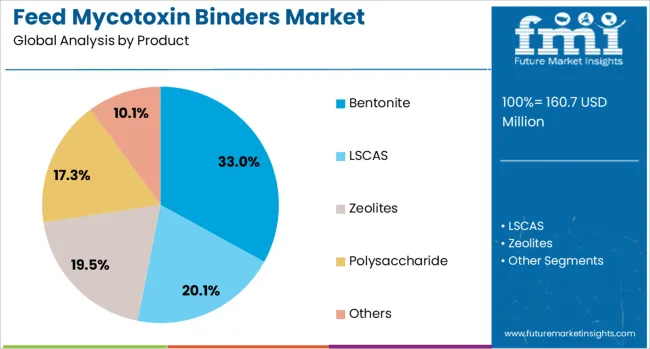

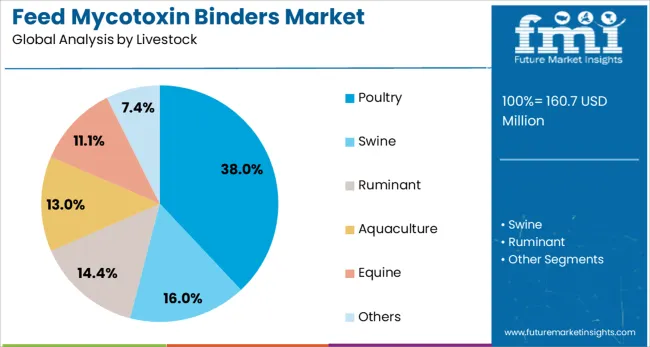

The feed mycotoxin binders market is segmented by product and livestock and geographic regions. By product of the feed mycotoxin binders market is divided into Bentonite, LSCAS, Zeolites, Polysaccharide, and Others. In terms of livestock of the feed mycotoxin binders market is classified into Poultry, Swine, Ruminant, Aquaculture, Equine, and Others. Regionally, the feed mycotoxin binders industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Bentonite is expected to hold 33.0% of the total revenue share in the feed mycotoxin binders market by 2025, making it the leading product segment. Its prominence is attributed to its high surface area, strong adsorption capacity, and ability to bind a wide range of mycotoxins including aflatoxins, fumonisins, and zearalenone.

Being a naturally occurring clay, bentonite is also considered safe and non-toxic, which has boosted its inclusion in poultry and swine diets. Moreover, regulatory bodies across Europe and Asia have approved bentonite for use in animal feed, further reinforcing its market position.

Its cost-effectiveness and compatibility with various feed formulations have supported its widespread commercial adoption.

Poultry is anticipated to account for 38.0% of the feed mycotoxin binders market share in 2025, positioning it as the leading livestock segment. The high metabolic rate and rapid feed turnover in poultry make birds particularly vulnerable to mycotoxin-related complications such as reduced feed intake, organ damage, and lower egg production.

Consequently, poultry producers have been early adopters of mycotoxin management strategies, including the integration of binders in feed. Rising demand for poultry meat and eggs, particularly in emerging economies, has intensified the focus on feed safety and quality.

The scalability of poultry operations and stricter international trade standards are further catalyzing the adoption of mycotoxin binders in this segment.

Growth in 2024 and 2025 was driven by rising cases of Fusarium and Aspergillus contamination impacting poultry and swine feed. Opportunities are emerging in multi-component binders and enzymatic detoxifiers targeting multiple toxin groups. Key trends include precision feed solutions, inclusion of yeast derivatives, and integration of binders into complete nutritional programs. However, restraints such as high inclusion costs, regional price sensitivity, and varying regulatory standards continue to limit adoption, particularly in emerging livestock-producing regions.

The major growth driver is the increasing prevalence of mycotoxin contamination in feed grains such as corn and soybean. In 2024 and 2025, poultry and swine producers widely adopted clay and yeast-based binders to mitigate the impact of aflatoxins and fumonisins on feed efficiency and animal health. Large-scale outbreaks in Asia and Latin America pushed integrators to include toxin mitigation solutions in preventive programs. These developments underline that maintaining feed safety and performance optimization remains a top priority for the livestock industry, ensuring steady adoption of mycotoxin binding solutions worldwide.

Significant opportunities are present in binders offering broad-spectrum protection and synergistic detoxification capabilities. In 2025, multi-component solutions combining clays, yeast cell walls, and enzymes were increasingly marketed for poultry and dairy segments to combat multiple toxin groups simultaneously. Premium opportunities emerged in value-added binders for aquafeed and pet food formulations, where performance consistency and regulatory compliance are critical. These patterns highlight that manufacturers investing in research-driven formulations and targeting high-value livestock segments can capture significant market share in regions experiencing complex contamination profiles and rising feed quality expectations.

Emerging trends center on precision dosing systems and functional ingredient integration. In 2024, feed mills began incorporating yeast derivatives and probiotics with toxin-binding properties into complete feed solutions, offering dual benefits of gut health and toxin neutralization. Formulations customized for specific toxin profiles became popular among integrators seeking targeted approaches. Digital tools for contamination mapping and predictive modeling also gained momentum in developed markets. These trends suggest that advanced binder solutions integrated into holistic nutritional strategies will dominate, driven by performance guarantees and the push toward efficient livestock production systems.

Market restraints include elevated inclusion costs, inconsistent global regulations, and uncertainty regarding efficacy validation. In 2024 and 2025, smaller feed producers in cost-sensitive markets hesitated to adopt premium binders due to narrow profit margins. Regional differences in approval processes for binder ingredients created compliance challenges for multinational suppliers, slowing product rollouts. Performance variability under diverse feed conditions further limited farmer confidence. These constraints underscore the need for standardized regulatory frameworks, cost-optimized formulations, and evidence-backed performance claims to drive broader adoption and maintain growth momentum across all livestock sectors.

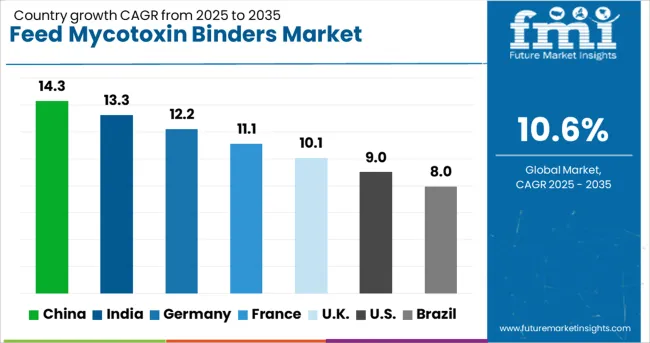

| Country | CAGR |

|---|---|

| China | 14.3% |

| India | 13.3% |

| Germany | 12.2% |

| France | 11.1% |

| UK | 10.1% |

| USA | 9.0% |

| Brazil | 8.0% |

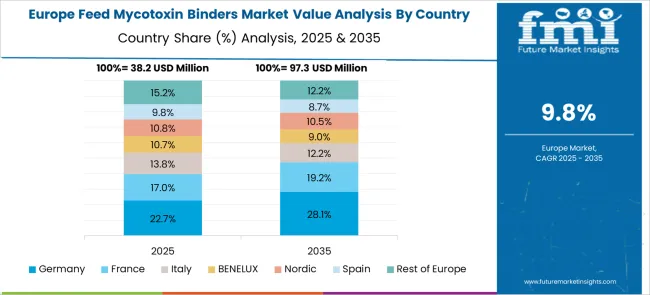

The global feed mycotoxin binders market is expected to grow at 10.6% CAGR during 2025–2035. China leads at 14.3% CAGR, driven by large-scale livestock production and stringent feed safety regulations. India follows at 13.3%, supported by rapid poultry and dairy sector growth and increased awareness about feed contamination risks. Germany records 12.2% CAGR, focusing on advanced binder formulations for premium livestock nutrition under EU feed compliance standards. The United Kingdom grows at 10.1%, while the United States posts 9.0%, reflecting strong demand for innovative toxin-control solutions in well-established feed markets. Asia-Pacific dominates global growth through high animal protein demand, while Europe and North America prioritize sustainable, multi-functional binder technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The feed mycotoxin binders market in China is forecasted to grow at 14.3% CAGR, driven by the country’s leading position in global poultry and swine production. Increased incidences of mycotoxin contamination due to climatic variability push demand for high-performance toxin control solutions. Leading domestic players and multinational companies focus on advanced binder formulations combining clay minerals, yeast cell walls, and enzymatic detoxifiers for broad-spectrum mycotoxin protection. Integration of digital feed management systems accelerates adoption of performance-oriented solutions among large-scale farms.

The feed mycotoxin binders market in India is projected to grow at 13.3% CAGR, supported by rapid expansion in poultry farming and aquaculture sectors. Rising awareness about feed quality and its direct impact on animal productivity drives binder adoption across commercial farms. Manufacturers develop cost-effective clay and aluminosilicate-based binders for rural markets, while enzyme-enhanced solutions gain traction in high-value livestock feed. Growth in compound feed manufacturing and organized dairy sector further boosts the use of binders for aflatoxin mitigation in cattle feed.

The feed mycotoxin binders market in Germany is expected to grow at 12.2% CAGR, driven by stringent EU feed safety directives and demand for performance-enhancing feed additives. Multi-functional binders incorporating clay, yeast extracts, and organic acids dominate adoption in poultry and swine sectors. Manufacturers invest in research for binders with improved binding specificity and stability under diverse pH conditions. Emphasis on sustainable livestock production promotes use of eco-compliant binder formulations, while predictive modeling tools optimize binder inclusion rates for risk mitigation.

The feed mycotoxin binders market in the United Kingdom is forecasted to grow at 10.1% CAGR, supported by the need to enhance livestock productivity and maintain feed quality standards. Growth in compound feed production for poultry and pig farming drives binder demand in both preventive and curative applications. Regulatory emphasis on safe feed practices accelerates the shift toward natural and organic binder ingredients. Digital monitoring platforms integrated with feed mills improve traceability and binder inclusion control. Product innovation focuses on multi-functional binders with immunomodulatory benefits for animal health.

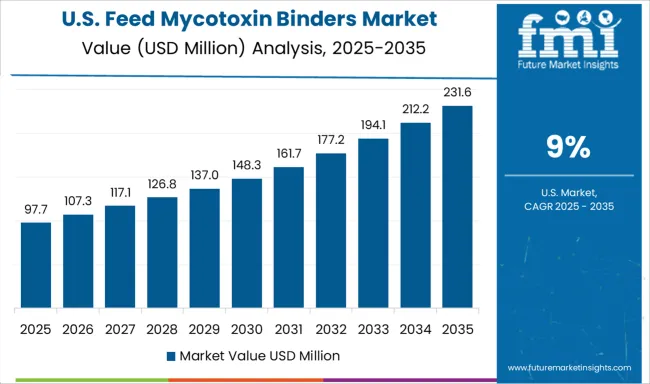

The feed mycotoxin binders market in the United States is projected to grow at 9.0% CAGR, reflecting robust demand in a mature feed industry focused on productivity enhancement. Advanced toxin control solutions integrated with enzymes and probiotics gain popularity for holistic gut health management. Manufacturers emphasize research on broad-spectrum binders capable of addressing multiple mycotoxins under varied feed processing conditions. Adoption of precision livestock farming technologies facilitates real-time feed quality monitoring, increasing the role of high-performance binders in risk management strategies.

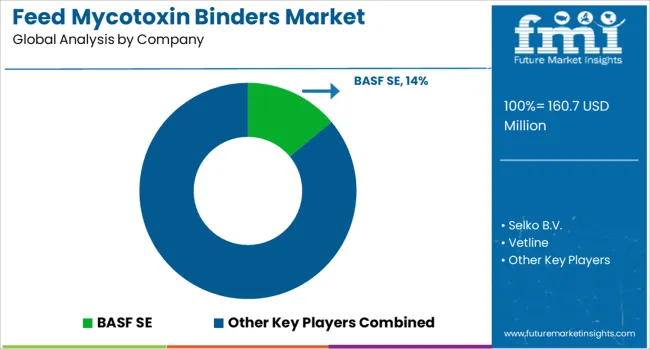

The feed mycotoxin binders market is dominated by BASF SE, which secures its leadership through a broad portfolio of advanced toxin control solutions that ensure feed safety and animal health. BASF’s dominance is reinforced by its strong R&D capabilities, global supply chain, and strategic partnerships with feed manufacturers to develop customized binding agents. Key players such as DSM, Alltech Inc., Kemin Industries Inc., Adisseo, and BIOMIN Holding GmbH maintain significant market shares by offering a range of inorganic and organic binders, enzymatic solutions, and multi-functional additives that enhance animal performance while mitigating mycotoxin risks.

These companies emphasize regulatory compliance, product efficacy, and integration into complete feed safety programs to cater to both poultry and livestock sectors. Emerging players including Selko B.V., Vetline, Novus International Inc., CHR Hansen, EWOS, Huvepharma, Perstorp, Trouw Nutrition, and Vibrac are expanding market presence through cost-effective formulations, targeted regional distribution, and innovation in combined mycotoxin deactivators and gut health enhancers. Their strategies often include addressing multiple toxins simultaneously and introducing user-friendly delivery formats.

Market growth is driven by rising concerns over feed contamination, increasing demand for high-quality animal protein, and stringent safety regulations in the livestock industry. Continuous advancements in binder technology, coupled with improved diagnostic solutions for mycotoxin detection, are expected to influence competitive strategies and accelerate adoption across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 160.7 Million |

| Product | Bentonite, LSCAS, Zeolites, Polysaccharide, and Others |

| Livestock | Poultry, Swine, Ruminant, Aquaculture, Equine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Selko B.V., Vetline, Kemin Industries Inc., BIOMIN Holding GmbH, Alltech Inc., Vibrac, Novus International Inc., Adisseo, CHR Hansen, DSM, EWOS, Huvepharma, Perstorp, and Trouw Nutrition |

| Additional Attributes | Dollar sales by binder type (clay, yeast, multi-component) and channel (feed mills, farms, online). Asia-Pacific and Latin America lead growth, driven by rising livestock density and climate-driven mycotoxin risks. Innovations include nano-adsorbents, probiotic-based blends, and integration with predictive analytics for toxin management under stringent additive regulations and sustainability mandates. |

The global feed mycotoxin binders market is estimated to be valued at USD 160.7 million in 2025.

The market size for the feed mycotoxin binders market is projected to reach USD 440.2 million by 2035.

The feed mycotoxin binders market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in feed mycotoxin binders market are bentonite, lscas, zeolites, polysaccharide and others.

In terms of livestock, poultry segment to command 38.0% share in the feed mycotoxin binders market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA