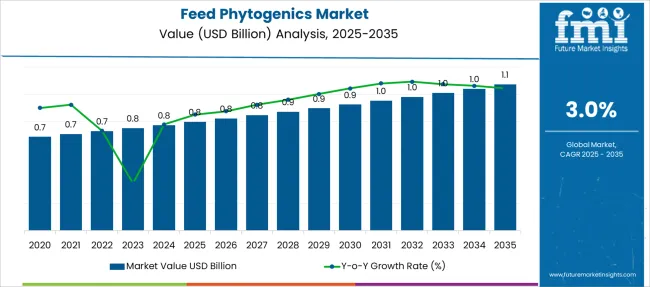

The Feed Phytogenics Market is estimated to be valued at USD 0.8 billion in 2025 and is projected to reach USD 1.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period.

| Metric | Value |

|---|---|

| Feed Phytogenics Market Estimated Value in (2025 E) | USD 0.8 billion |

| Feed Phytogenics Market Forecast Value in (2035 F) | USD 1.1 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The feed phytogenics market is expanding steadily, driven by the growing demand for natural additives in animal nutrition. Increasing consumer preference for antibiotic-free and organic meat products has prompted the adoption of phytogenic feed additives that enhance animal health and productivity. Scientific studies and industry reports have shown that phytogenics can improve feed efficiency, boost immune response, and reduce gastrointestinal diseases in livestock.

The poultry sector has particularly embraced these products to meet the rising global demand for poultry meat and eggs. Regulatory bodies have also encouraged the use of natural feed supplements as alternatives to antibiotics, supporting market growth.

Advancements in extraction and formulation technologies have improved the efficacy and stability of essential oils and other phytogenic products. As livestock producers aim for sustainable and cost-effective solutions, the feed phytogenics market is expected to grow with essential oils leading the product segment and poultry representing the largest livestock category.

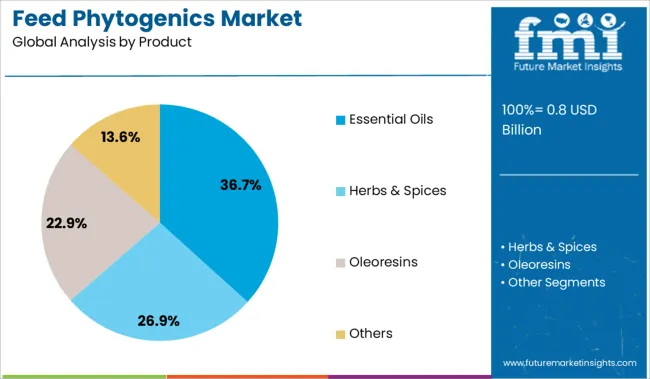

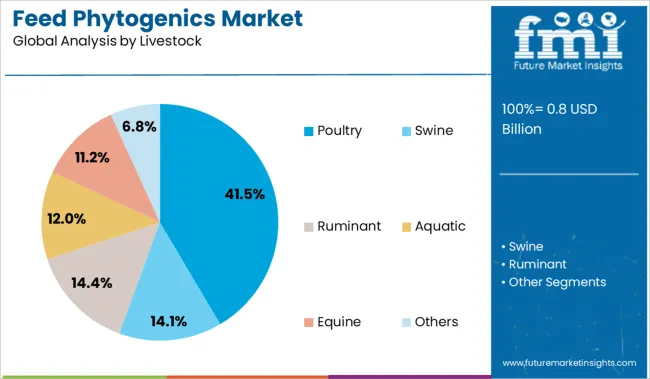

The market is segmented by Product, Livestock, and region. By Product, the market is divided into Essential Oils, Herbs & Spices, Oleoresins, and Others. In terms of Livestock, the market is classified into Poultry, Swine, Ruminant, Aquatic, Equine, and Others.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Essential Oils segment is expected to hold 36.7% of the feed phytogenics market revenue in 2025, making it the leading product category. This segment’s growth is attributed to the potent bioactive properties of essential oils, which contribute to antimicrobial effects and improved digestion in livestock. Their natural origin appeals to producers seeking alternatives to synthetic additives and antibiotics.

Essential oils have been shown to enhance feed palatability and support gut health, resulting in better weight gain and feed conversion ratios. The segment benefits from ongoing research optimizing oil blends and delivery systems to maximize effectiveness.

With increasing emphasis on animal welfare and clean-label production, essential oils are forecast to maintain strong demand within feed phytogenics.

The Poultry segment is projected to represent 41.5% of the feed phytogenics market revenue in 2025, sustaining its position as the dominant livestock category. Growth in this segment has been driven by the global increase in poultry consumption and the industry's move toward antibiotic-free production systems.

Poultry producers have widely adopted phytogenic additives to enhance bird health, improve gut microbiota balance, and reduce mortality rates. The relatively short production cycles in poultry farming allow rapid integration of new feed additives and quick realization of benefits.

Additionally, stricter regulations on antibiotic use in many countries have accelerated the adoption of natural feed supplements in poultry diets. As demand for high-quality poultry products continues to rise, the Poultry segment is expected to remain the primary growth driver in the feed phytogenics market.

The feed phytogenics market is expanding as producers seek natural alternatives to antibiotic growth promoters, especially in the poultry and swine sectors. However, price volatility of botanical inputs and region-specific usage patterns pose key challenges for consistent supply and product standardization.

The global feed phytogenics market is gaining momentum due to the livestock sector’s growing shift away from antibiotic growth promoters (AGPs). With increasing regulatory pressure and consumer demand for residue-free meat, producers are exploring natural feed additives like phytogenics to maintain animal health and performance. Phytogenics, comprising herbs, spices, and essential oils, support gut health, enhance nutrient absorption, and improve feed palatability. Their antimicrobial and anti-inflammatory properties contribute to reduced disease incidence and improved productivity. The poultry and swine segments, in particular, are driving adoption due to their sensitivity to gut health disturbances. This shift is particularly pronounced in Europe and the Asia-Pacific region, where stringent regulations and high production intensity fuel demand for natural feed ingredients.

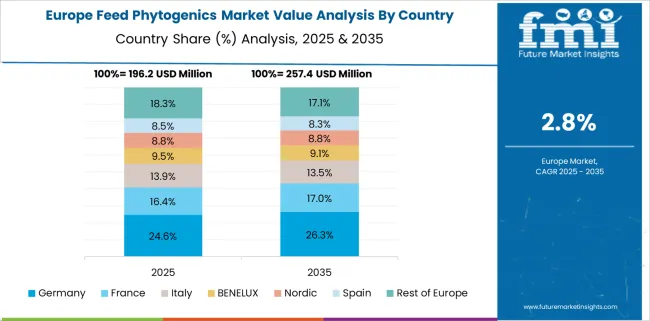

One of the major challenges in the feed phytogenics market is the fluctuation in the availability and pricing of botanical raw materials. Climatic variability, regional agricultural outputs, and competing demand from human nutraceuticals and cosmetics can significantly affect supply consistency and cost. Manufacturers often face difficulties in standardizing bioactive compounds across batches, leading to quality control and formulation challenges. Usage patterns vary widely across regions, while Europe emphasizes essential oil-based phytogenics for gut modulation, Asian markets integrate traditional botanical ingredients rooted in local livestock practices. Such regional diversity in feed formulation preferences necessitates tailored approaches in product development, marketing, and distribution strategies.

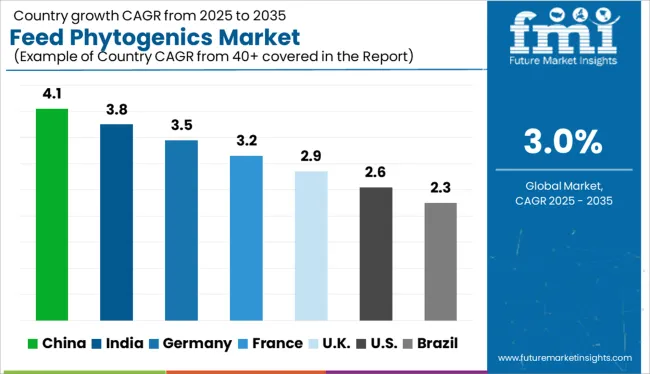

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

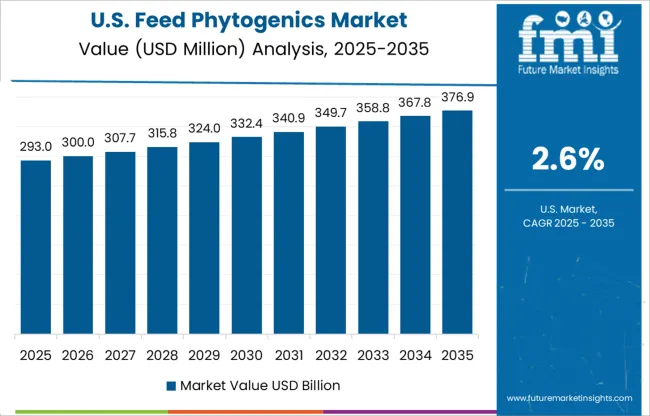

| USA | 2.6% |

| Brazil | 2.3% |

The global feed phytogenics market is projected to grow at a CAGR of 3.0% from 2025 to 2035, supported by the demand for natural growth promoters and antimicrobial alternatives in animal nutrition. Rising regulatory restrictions on antibiotic use and consumer preference for clean-label meat are driving adoption globally. BRICS economies are outpacing the global average, with China growing at 4.1% and India at 3.8%. China’s intensive livestock farming and India’s expanding poultry and dairy sectors are major contributors. These markets benefit from favorable government policies and increased awareness of feed efficiency. Within the OECD group, Germany leads with a CAGR of 3.5%, driven by sustainability regulations and high-value animal protein exports. The UK (2.9%) and the US (2.6%) are seeing steady uptake in phytogenic feed additives across swine and cattle operations. ASEAN countries are emerging as demand centers due to export-focused meat production and the shift toward antibiotic-free systems.

The CAGR in the United Kingdom rose from around 2.3% during 2020–2024 to approximately 2.9% between 2025–2035, closely aligning with the global average of 3.0%. This improvement is attributed to the UK's gradual phase-out of antibiotic growth promoters and the increasing demand for residue-free meat among retailers and consumers. From 2020–2024, adoption remained limited due to high costs and limited awareness among mid-sized poultry producers. However, post-Brexit regulatory shifts and improved trade partnerships with EU phytogenic suppliers contributed to increased imports and localized distribution networks after 2025. British livestock producers began trialing essential oil and herbal extract blends for swine and poultry gut health, supported by R&D collaborations with feed additive companies.

The CAGR in the United States increased modestly from approximately 2.1% in 2020–2024 to about 2.6% for the 2025–2035 forecast period. During the earlier period, growth was hindered by limited policy pressure on AGP use and slow adoption in conventional beef and dairy segments. However, momentum began to build post-2025 as large integrators and meat processors invested in clean-label livestock supply chains to meet retail and foodservice demands. Consumer scrutiny of meat origin and additives encouraged major players to shift toward phytogenic-enhanced feed, particularly in poultry. Essential oil blends with antioxidant properties have gained preference over synthetic additives.

Germany’s CAGR moved up from around 2.7% during 2020–2024 to approximately 3.5% in the 2025–2035 period, outpacing the global growth rate. This rise was driven by Germany’s strict AGP regulations and growing demand for natural alternatives in its intensive livestock production systems. In the earlier years, growth was moderate due to limited farmer awareness outside of large integrator groups. From 2025 onward, increased government-backed research into plant-based feed efficiency and the availability of standardized essential oil products enhanced credibility and market expansion. Feed cooperatives promoted adoption among dairy and swine producers.

The CAGR in China accelerated from nearly 3.2% during 2020–2024 to a higher 4.1% during the 2025–2035 period, reflecting strong regulatory and industry alignment with AGP restrictions. In the early period, smaller farms showed reluctance due to cost concerns and variability in product quality. However, post-2024, government programs incentivized phytogenic integration into swine and poultry feed formulations. Local manufacturers scaled up essential oil processing units, especially in Guangdong and Shandong. Imports of premium plant extracts from Europe were streamlined through national registration protocols.

India’s CAGR increased from around 2.5% in 2020–2024 to 3.8% in the 2025–2035 period, backed by rising livestock intensification and phytogenic feed awareness among poultry and aquaculture producers. Early growth was constrained by fragmented distribution networks and a lack of product standardization. Post-2025, several Indian nutraceutical firms entered the feed phytogenics space, leveraging domestic herb supplies such as neem, tulsi, and ashwagandha. Veterinary schools and feed consultants began recommending phytogenics for reducing antibiotic reliance in broilers and layers. Regional feed hubs in Telangana and Maharashtra piloted herbal-integrated feed models to enhance productivity.

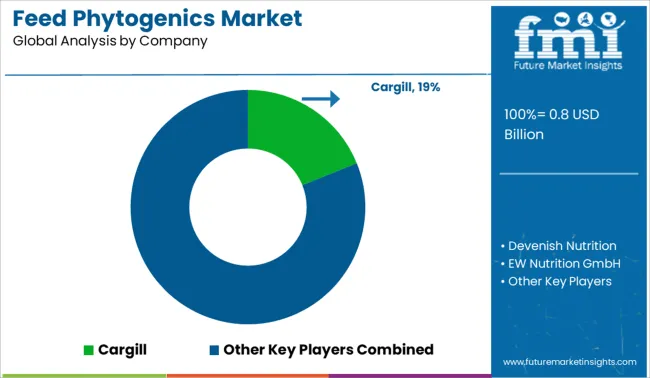

In the global feed phytogenics market, major players are focusing on gut health, palatability, and natural alternatives to antibiotic growth promoters across livestock feed applications. Key players such as Cargill, ADM, DSM, and EW Nutrition GmbH are developing essential oil and herbal extract-based additives tailored to poultry and swine nutrition. Companies like Devenish Nutrition, Delacon Biotechnik GmbH, and Phytobiotics Futterzusatzstoffe GmbH are advancing botanical formulations with proven antimicrobial and anti-inflammatory benefits. Indian firms such as Vinayak Ingredients, Ayurvet Limited, and Natural Remedies Pvt. Ltd. are leveraging native herbs and cost-effective delivery formats for regional expansion. PMI Additives, ROHA (a JJT Group company), and Dostofarm GmbH are enhancing their feed portfolios with functional phytogenics. Emerging specialists like Nutricare Life Sciences, Norex Flavors, and Natural Herbs & Formulations are actively building localized distribution and veterinary partnerships.

In September 2024, Cargill announced the acquisition of two US feed mills to boost its production and distribution capabilities to better serve its customers.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.8 Billion |

| Product | Essential Oils, Herbs & Spices, Oleoresins, and Others |

| Livestock | Poultry, Swine, Ruminant, Aquatic, Equine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill, Devenish Nutrition, EW Nutrition GmbH, Dodson & Horrell, PMI Additives, DSM, ADM, ROHA A JJT Group, Vinayak Ingredients, AVT Natural Products, Norex Flavors Pvt. Ltd., Ayurvet Limited, Natural Herbs & Formulations, Indian Herbs Specialities Pvt. Ltd., Dostofarm GmbH, Nutricare Life Sciences Limited, Natural Remedies Pvt. Ltd, Delacon Biotechnik GmbH, DowDuPont, and Phytobiotics Futterzusatzstoffe GmbH |

| Additional Attributes | Dollar sales, share by livestock segment, growth by region, key botanical preferences, regulatory drivers, pricing trends, competitive benchmarking, and distribution channel shifts. |

The global feed phytogenics market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the feed phytogenics market is projected to reach USD 1.1 billion by 2035.

The feed phytogenics market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in feed phytogenics market are essential oils, herbs & spices, oleoresins and others.

In terms of livestock, poultry segment to command 41.5% share in the feed phytogenics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Phytogenic Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA