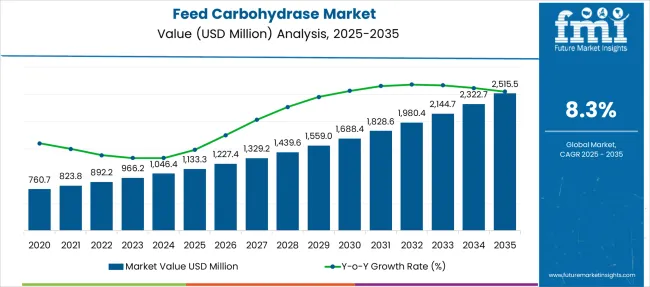

The Feed Carbohydrase Market is estimated to be valued at USD 1133.3 million in 2025 and is projected to reach USD 2515.5 million by 2035, registering a compound annual growth rate (CAGR) of 8.3% over the forecast period. As per our rolling CAGR analysis reveals three distinct phases. 2025-2028 sees growth from 1,133.3 to 1,439.6 million, adding USD 306.3 million at a short-term CAGR of 8.3%, influenced by swine and poultry feed efficiency adoption. 2028-2031 accelerates, moving from 1,439.6 to 1,980.4 million, gaining USD 540.8 million, with mid-term CAGR reaching 10.6%, as enzymatic innovations and cost-efficient feed strategies dominate.

The period, 2031-2035, delivers USD 535.1 million in value increase, achieving a CAGR of 6.2%, driven by product diversification and penetration in aquaculture. Incremental contributions peak between 2027-2030, where annual additions surpass USD 150 million, indicating strong elasticity with rising meat consumption and raw material cost optimization. Growth momentum tapers slightly post-2032, suggesting market maturity and higher dependency on precision livestock farming technologies.

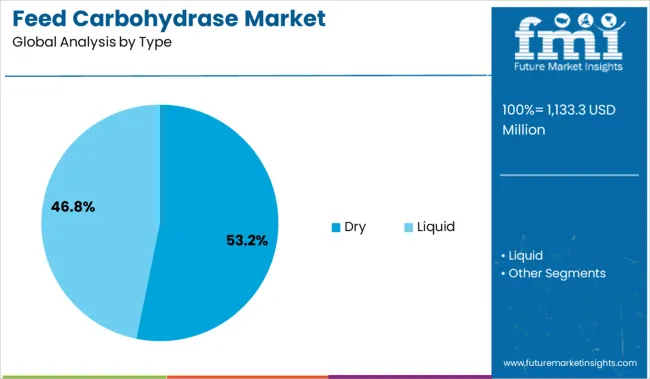

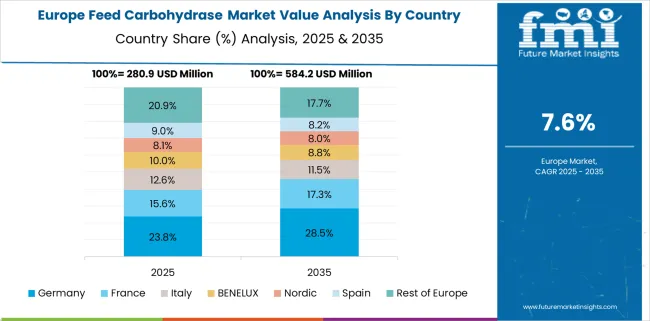

The dry formulation segment leads with 53.2% share in 2025, primarily due to its stability, extended shelf life, and easier incorporation in feed premixes. North America maintains a significant share owing to its highly industrialized livestock sector and focus on sustainable feed conversion. Asia-Pacific emerges as the fastest-growing region, propelled by rapid expansion in poultry and swine farming in China, India, and Southeast Asia. Europe continues steady growth supported by stringent regulations favoring feed efficiency and environmental compliance.

Post-2028, the adoption curve is expected to steepen as advancements in enzyme engineering introduce multi-functional carbohydrases that work across varying pH levels and feed ingredients. Integration of precision nutrition tools and enzyme supplementation strategies will shape the competitive landscape, establishing feed carbohydrases as a critical driver of profitability in global animal nutrition systems.

| Metric | Value |

|---|---|

| Feed Carbohydrase Market Estimated Value in (2025 E) | USD 1133.3 million |

| Feed Carbohydrase Market Forecast Value in (2035 F) | USD 2515.5 million |

| Forecast CAGR (2025 to 2035) | 8.3% |

The feed carbohydrase market is experiencing stable growth fueled by the increasing focus on animal nutrition optimization, rising feed costs, and the need to improve feed conversion ratios. Enzymes such as carbohydrases have become integral to livestock diets as they enhance nutrient digestibility and reduce anti nutritional factors in conventional feed ingredients.

The trend toward precision livestock farming and demand for sustainable animal protein production is reinforcing the adoption of enzyme supplemented feeds. Regulatory support for reducing antibiotic growth promoters and maximizing the utility of alternative feedstocks are further driving innovation in enzyme formulations.

With the growth of the poultry and swine industries across Asia Pacific and Latin America, feed producers are increasingly adopting carbohydrase enzymes to improve animal health, performance, and production efficiency. The outlook remains promising as enzyme technology continues to evolve in tandem with demand for cost effective and environmentally responsible feed solutions.

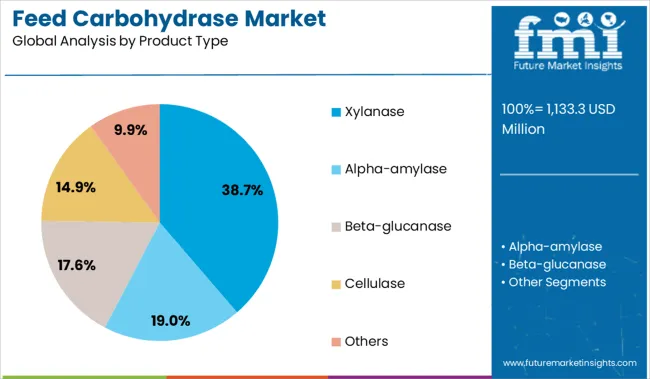

The feed carbohydrase market is segmented by type, product type, livestock, distribution channel, and region. By type, it includes dry and liquid forms, catering to different feed processing needs. In terms of product type, the segmentation comprises xylanase, alpha-amylase, beta-glucanase, cellulase, and others, each playing a role in enhancing nutrient digestibility.

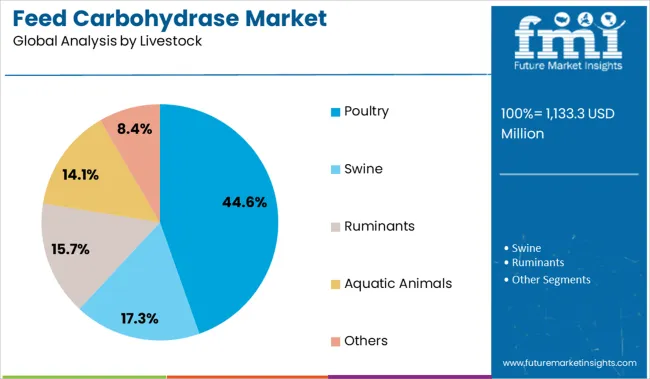

Based on livestock, the market is classified into poultry, swine, ruminants, aquatic animals, and other species, addressing diverse dietary requirements. By distribution channel, it is divided into online and offline platforms, reflecting both digital and traditional procurement modes. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The dry segment is expected to represent 53.20 percent of total market revenue by 2025 within the type category, positioning it as the leading format. This dominance is due to its longer shelf life, ease of storage, and compatibility with conventional feed manufacturing processes.

Dry formulations allow for uniform distribution during feed mixing and maintain enzyme stability under varied storage conditions. The format’s cost effectiveness and lower transportation requirements also contribute to its preference among feed manufacturers. With minimal risk of spoilage and simplified application in automated feed mills, the dry type continues to be the most widely adopted form in the feed carbohydrase market.

The xylanase segment is projected to hold 38.70 percent of the total market share by 2025 within the product type category, establishing itself as the dominant enzyme. This growth is attributed to its effectiveness in breaking down arabinoxylans found in wheat, corn, and barley-based diets, thereby improving nutrient absorption and energy availability.

Xylanase is widely used in poultry and swine feed to enhance gut health and feed efficiency. Its ability to reduce intestinal viscosity and improve digestive performance supports animal growth and reduces feed waste.

The enzyme’s stability across a range of pH and temperature conditions has made it a preferred choice among feed producers aiming for consistent performance outcomes.

The poultry segment is anticipated to account for 44.60 percent of total market revenue by 2025 under the livestock category, making it the most significant contributor. This growth is being driven by the rising global demand for poultry meat and eggs, which has intensified the focus on feed efficiency and cost management.

Carbohydrase enzymes are particularly beneficial in poultry diets where non starch polysaccharides impact nutrient availability. Their use in broiler and layer feeds helps improve growth rates, uniformity, and overall flock health.

Additionally, the scalability of poultry operations and rapid production cycles support the high adoption of enzyme based feed formulations. As poultry producers aim to maximize yield and minimize input costs, the role of carbohydrases in enhancing feed utilization continues to expand.

The Asia‑Pacific holds over 35% of current demand, led by China and India, followed by North America. Poultry accounts for near 43-47% of enzyme usage, while swine and aquaculture segments are growing rapidly. Dry enzyme formats make up about 55-60% of volume due to stability and ease of handling. Xylanase and alpha‑amylase enzymes dominate product mix, while multi‑enzyme blends for fiber and starch hydrolysis gain traction in feed premix systems.

Rising demand for animal protein continues to push adoption of carbohydrase enzymes in feed formulations. Trials have shown broiler feed conversion improvements up to 7 percentage points and enhanced digestibility in swine and fish diets. As poultry and swine diets contain high levels of non‑starch polysaccharides, xylanase and amylase enzymes contribute over 50% of global units deployed.

Nutritional efficiency gains reduce feed cost per kilogram of meat and support compliance with environmental nutrient discharge targets in large operations. Precision nutrition programs now incorporate enzyme cocktails to tailor blends to dietary grains. Adoption is highest in Asia‑Pacific livestock hubs, followed by rapid growth splintering in Europe and the Americas.

Challenges remain in enzyme procurement cost swings, complexity of blend integration, and spectrum of regulatory approvals. Carbohydrase prices fluctuate by 7-10 % annually based on raw material feedstock supply and energy inputs. Multi‑enzyme premixes require technical validation to avoid enzyme antagonism, increasing formulation lead times by 4-6 weeks. Smaller feed mills often lack capacity to blend or evaluate enzyme efficacy, especially in developing regions.

Compliance with livestock additive regulations especially in ruminants and aquaculture can add another 8-10 weeks to approval cycles. Fragmented cold chain and storage constraints also affect shelf stability: over 28% of liquid enzyme batches fail quality tests after 60 days without controlled conditions.

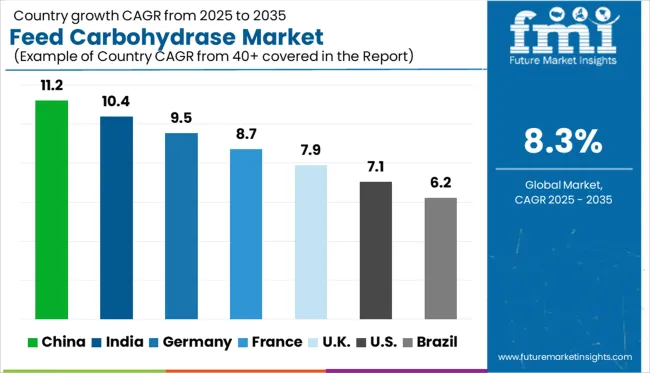

| Countries | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

| USA | 7.1% |

| Brazil | 6.2% |

The global feed carbohydrase market is expected to grow at a CAGR of 8.3% from 2025 to 2035. China (BRICS) leads with 11.2%, supported by expansion in commercial poultry and swine farming. India (BRICS) follows at 10.4%, driven by nutritional efficiency goals in livestock feed formulations. Germany (OECD) posts 9.5%, linked to enzyme adoption in precision animal nutrition. France records 8.7%, slightly above the global average, shaped by consistent output in compound feed production. The United States (OECD) comes in at 7.1%, reflecting mature market conditions and slower formulation shifts. The report includes insights from more than 40 countries, with the top five listed below.

China shows an 11.2% growth rate in feed carbohydrase, ahead of the 8.3% global average. Feed mills have integrated enzyme dosing systems targeting high-output pig and poultry farms. Regional co-ops fund additive optimization trials to address grain variation in inland supply chains. Carbohydrase blends are used to offset high-moisture corn across central and eastern provinces.

Distributors bundle dosage calculators with premix orders for swine producers. Water-soluble enzyme forms are preferred in aquafeed mixes. Academic partnerships have tracked enzyme stability across variable humidity conditions. Usage is linked with livestock feed conversion audits in state-level cooperatives. Producers report tighter specification limits on substrate ratios.

India records a 10.4% growth rate in feed carbohydrase, above the global benchmark. Use is highest in poultry integrators across Andhra Pradesh, Telangana, and Tamil Nadu. Dosing is optimized for multi-phase feed programs targeting early growth cycles. Cooperative mills standardize xylanase and amylase blends for low-energy maize.

Government feed extension labs issue performance indices for rural enzyme use. University-linked feed trials are quantifying the enzyme impact on native sorghum rations. Liquid enzyme application systems are growing in mid-sized compounders. Procurement teams source enzyme concentrates from SEZ-based manufacturing clusters. Regional audits are recording reductions in feed waste linked to enzyme usage.

France records an 8.7% growth rate in the feed carbohydrase market, aligned with the global average. Nutrient optimization is focused on layer hens and dairy crossbreeds. Regional mills favor phytase-carbohydrase blends in wheat-dominant feed bases. Output gains are tracked through digital dashboards used by cooperative nutritionists.

Value-based feed pricing includes enzyme performance scores verified by third-party labs. Carbohydrase suppliers offer batch-specific enzyme activity certificates. Adoption is supported by EU-linked digital traceability frameworks. Water-dispersible formulations are tested in on-farm slurry systems for effluent control.

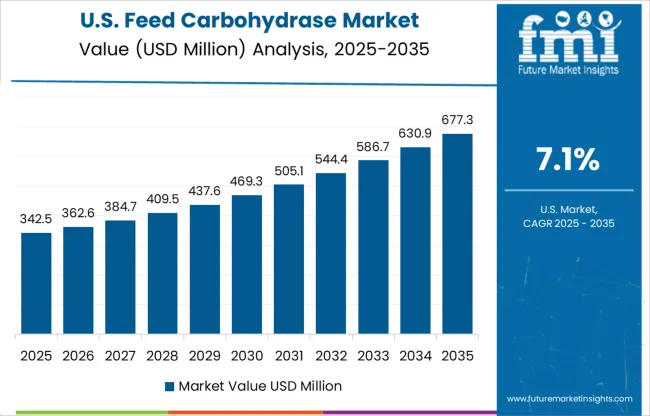

The United States is projected to register a 7.1% CAGR between 2025 and 2035, with market value increasing from USD 342.5 million in 2025 to USD 677.3 million by 2035. Growth depends on the adoption of enzyme blends in poultry and swine diets, enhanced formulations for fiber-rich feed, and improved digestibility solutions in ruminant nutrition. Leading feed manufacturers are standardizing enzyme dosing protocols across multiple livestock categories to ensure cost efficiency and uniform performance. Suppliers are developing thermostable carbohydrase variants compatible with pelleted feed and resistant to high-temperature processing environments.

Germany posts a 9.5% growth rate in feed carbohydrase, above the global 8.3%. Layer and broiler integrators embed enzymes into pelleted rations using in-line sprayers. Formulations target phytate-rich grains and variable barley types. Animal nutrition firms report a preference for multi-enzymatic pre-concentrates.

Quality control labs monitor enzyme shelf life under low-temperature transport conditions. Species, grain type, and digestion profile standardize feed enzyme catalogs. Mid-size producers embed mobile testing kits into monthly field service rounds. Smallholder pig farms favor dual-use carbohydrase-amylase combos due to input cost pressures.

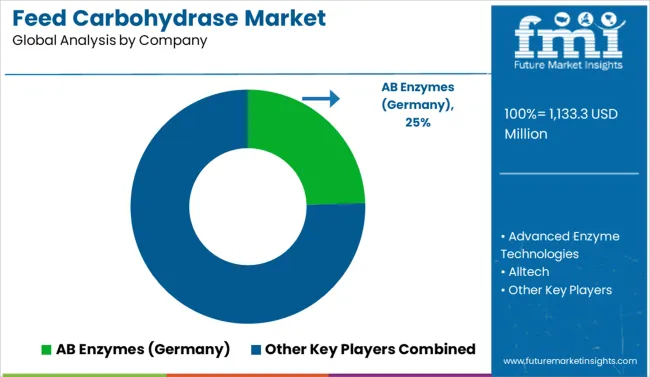

The feed carbohydrase market in 2025 is expanding across poultry, swine, and aquaculture sectors due to rising demand for improved feed digestibility and nutrient utilization. AB Enzymes holds a prominent market share, driven by its broad enzyme portfolio and strong presence in livestock nutrition. DuPont, Novozymes, and DSM supply carbohydrase blends optimized for diverse feed compositions and regional grain types. Chr. Hansen Holding A/S and Advanced Enzyme Technologies develop tailored enzyme solutions for feed mills and integrators.

BIOVET JSC, BIO-CAT, and BEC Feed Solutions serve regional markets with custom enzyme premixes. Barriers to entry include regulatory approvals, formulation stability under variable feed conditions, and distribution partnerships required for consistent product availability across feed manufacturing chains.

Key Developments in Feed Carbohydrase Market

The feed carbohydrase market is advancing through five key strategies, portfolio diversification, where leaders like AB Enzymes, DuPont, DSM, and Novozymes offer blends tailored to species and grain types; partnerships with feed mills by Chr. Hansen and Advanced Enzyme Technologies to secure integration; and regional customization by BIOVET JSC, BIO-CAT, and BEC Feed Solutions to address local diets. Regulatory compliance and heat-stable formulations remain critical for global acceptance. Companies also prioritize distribution expansion in Asia-Pacific and Latin America to ensure consistent supply and capture rising demand across poultry, swine, and aquaculture sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 1133.3 Million |

| Type | Dry and Liquid |

| Product Type | Xylanase, Alpha-amylase, Beta-glucanase, Cellulase, and Others |

| Livestock | Poultry, Swine, Ruminants, Aquatic Animals, and Others |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AB Enzymes (Germany), Advanced Enzyme Technologies, Alltech, Amano Enzyme Inc., AMORVET, Associated British Foods plc, BASF SE, BEC Feed Solutions Pty Ltd, BIO-CAT, Inc., BIOVET JSC, Chr. Hansen Holding A/S, DSM, DuPont, Dyadic International Inc., Novozymes, and NOVUS INTERNATIONAL |

| Additional Attributes | Dollar sales by enzyme type and livestock category, growing usage in poultry and swine nutrition, stable inclusion across ruminant and aquaculture feed, advancements in multi-enzyme formulations and thermostable blends enhance nutrient digestibility and feed conversion efficiency |

The global feed carbohydrase market is estimated to be valued at USD 1,133.3 million in 2025.

The market size for the feed carbohydrase market is projected to reach USD 2,515.5 million by 2035.

The feed carbohydrase market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in feed carbohydrase market are dry and liquid.

In terms of product type, xylanase segment to command 38.7% share in the feed carbohydrase market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Phytogenic Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA