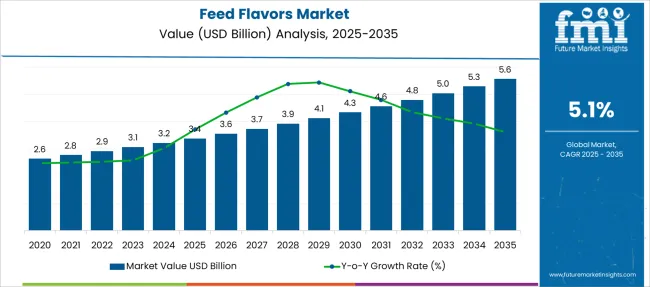

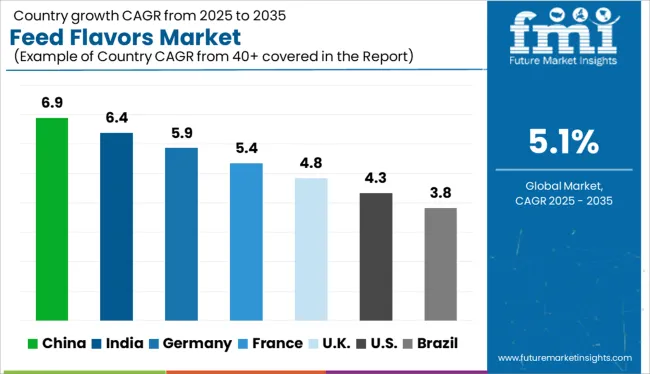

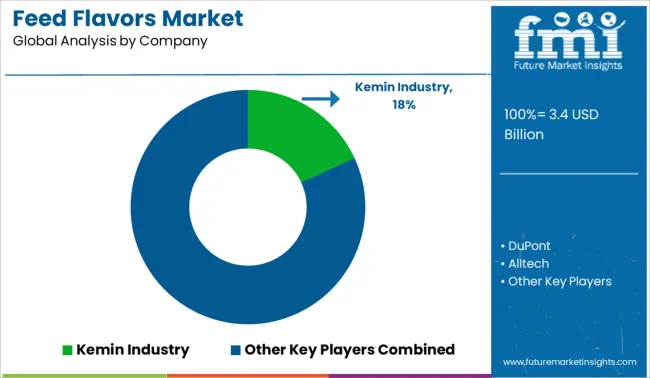

The Feed Flavors Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 5.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Feed Flavors Market Estimated Value in (2025 E) | USD 3.4 billion |

| Feed Flavors Market Forecast Value in (2035 F) | USD 5.6 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The feed flavors market is expanding steadily, driven by the need to improve palatability, feed intake, and livestock productivity under intensive farming systems. As feed formulations become more functional and efficiency-driven, the inclusion of flavors has become essential in enhancing taste and masking undesirable odors associated with nutrient-dense or medicated feeds.

Regulatory limitations on antibiotic growth promoters have increased the reliance on alternative sensory enhancers, including natural flavoring agents. Livestock producers are placing greater emphasis on animal welfare, nutritional consistency, and conversion ratios, all of which are positively influenced by improved flavor formulations.

Rising demand for protein-rich animal products and heightened awareness of feed quality are expected to continue shaping innovation in this space. Additionally, sustainable sourcing and cleaner-label animal nutrition trends are encouraging the use of botanical and fermented inputs, supporting market growth globally.

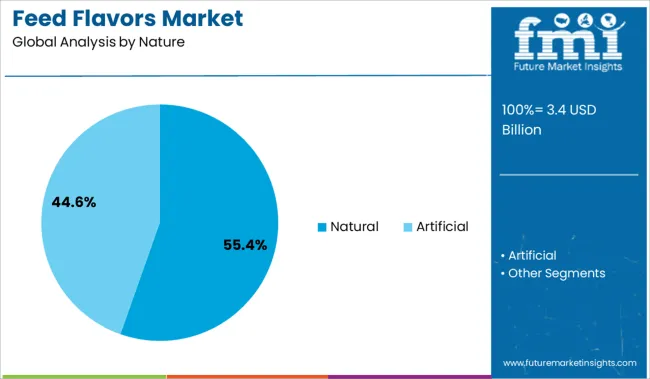

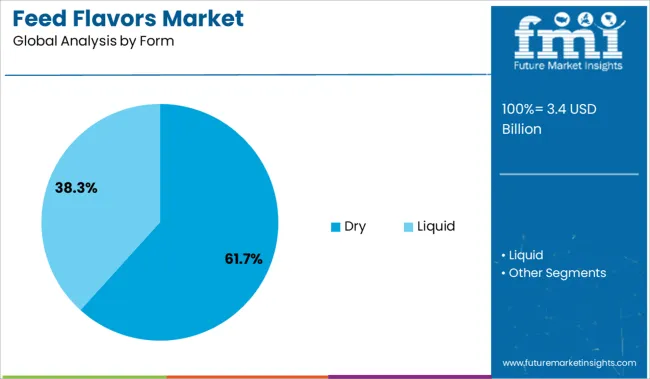

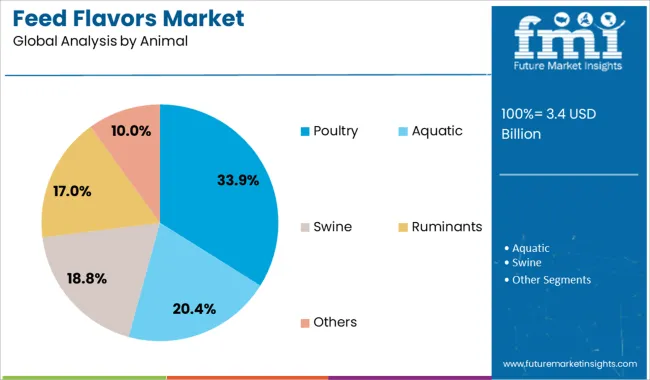

The market is segmented by Nature, Form, Animal, and Sales Channel and region. By Nature, the market is divided into Natural and Artificial. In terms of Form, the market is classified into Dry and Liquid. Based on Animal, the market is segmented into Poultry, Aquatic, Swine, Ruminants, and Others. By Sales Channel, the market is divided into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Natural feed flavors are projected to account for 55.4% of the total market share in 2025, making them the most widely used category by nature. Their dominance is being supported by increased regulatory scrutiny around artificial additives and rising consumer preference for clean-label meat and dairy products.

Feed manufacturers are prioritizing plant-derived flavoring compounds such as herbs, spices, and essential oils due to their improved acceptance in global livestock diets. Natural flavors are also associated with fewer residues, reduced risk of toxicity, and higher digestibility, making them suitable for long-term use across production cycles.

Additionally, branding opportunities linked to organic and antibiotic-free animal production have driven higher adoption of natural flavor profiles in feed compositions.

The dry form segment is expected to capture 61.7% of the overall market revenue in 2025, establishing it as the leading format used in feed flavor applications. This preference is driven by ease of handling, improved shelf life, and better integration with premixes, concentrates, and compound feeds.

Dry formulations allow for uniform distribution during mixing, ensuring consistent taste and feed intake across batches. Their resistance to microbial degradation and reduced transportation cost make them viable for bulk procurement and storage in commercial feed mills.

Moreover, advances in microencapsulation and spray-drying technology have enhanced the performance of dry flavors by improving aroma retention and controlled release properties, further reinforcing their dominance in industrial livestock nutrition.

Poultry is anticipated to represent 33.9% of the feed flavors market revenue in 2025, positioning it as the leading livestock segment. This is due to the sector’s high production volumes, short feeding cycles, and increased sensitivity of poultry species to taste and smell variations in feed.

Flavor additives are being strategically used to stimulate early feed intake in broilers and improve feed efficiency during critical growth phases. The rising global demand for poultry meat and eggs is prompting producers to adopt feed flavoring strategies that enhance flock performance, reduce feed wastage, and support overall health.

With antibiotic restrictions tightening in several regions, flavor-enhanced feed solutions are also gaining attention for their role in improving gut health and feed conversion without pharmacological support.

In the Historical outlook of the Feed Flavor market, the value increased from USD 2,260.7 Million in 2020 to USD 3.2 Million in 2024. The CAGR (2020 to 2024) is observed to be 5.2%.

Animals evaluate desirable meals using their senses of taste and smell. Live animals are extremely sensitive to dietary changes in flavor or taste. Low feed intake may be caused by unpleasant tastes or odors. Since it takes time to regain milk production, this would immediately affect milk output and diminish producers' return on investment.

Feed taste is important in overcoming all of these unfavorable circumstances. According to several studies, aged dairy cows favor citrus flavors and odors. The addition of feed flavor gives the feedstuffs flavor and scent, maintaining uniformity in the feed consumption.

The many tastes that can be employed include caramel toffee, dairy essence, citrus, strawberry, garlic, peppermint, and coconut essence. In this way, a rise in the demand for and widespread production of dairy products fuels the feed taste industry.

For the Future projection of the Feed Flavor market, the value increased from USD 2,912.9 Million in 2025 to USD 4,790.2 Million in 2035. The CAGR (2025 to 2035) is estimated to be 5.1%.

The major factors driving the growth of this market are the growing demand for livestock products, increasing awareness about the benefits of Feed Flavor, and the changing preferences of consumers. The rising demand for livestock products is one of the major factors driving the growth of the North American Feed Flavor market.

The USA contributes 30.3% of the total revenue for the Feed Flavor Market.

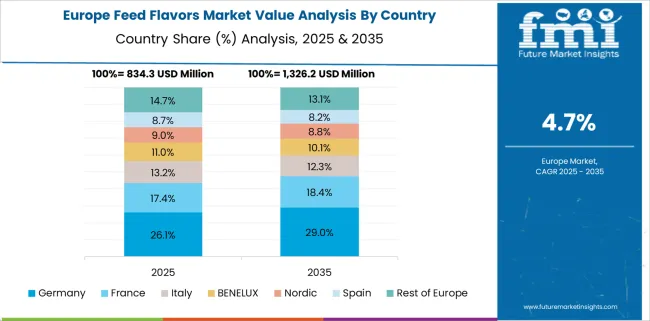

The major factors driving the growth of the Feed Flavor market in Europe are the growing demand for livestock and poultry products, and the increasing awareness of animal health and feed quality. The key players are focusing on expanding their production capacities to meet the growing demand for Feed Flavor in Europe.

Germany contributes 25.0% to the Feed Flavor market and the United Kingdom. CAGR for the forecast period is 4.9%.

The major drivers for the growth of the Asia Pacific Feed Flavor market are the increasing demand for livestock products, the need to improve the quality of feed, and the changing consumer preferences.

The Asia Pacific region is one of the fastest-growing markets for Feed Flavor due to the growing population and income levels. The demand for livestock products such as meat, milk, and eggs is also increasing in the region due to the growing population and changing consumer preferences.

Japan's contribution to the Feed Flavor market is 6.4% of the total market share, India and China are market drivers in the Asia Pacific and their latest CAGR in the Feed Flavor market is 3.4% and 6.2% respectively.

The Latin American market is driven by the growing demand for animal feed and the rising awareness of the benefits of Feed Flavor. This growth can be attributed to the growing demand for amino acids as they are essential for the proper development and growth of animals.

The Feed Flavor market in the Middle East and Africa(MEA) is growing at a steady pace. The main drivers of this growth are the increasing demand for animal feed and the growing awareness of the benefits of using flavors in animal feed. The major restraints on the growth of the Feed Flavor market in the Middle East and Africa(MEA) are the high cost of feed flavorings and the lack of awareness among farmers about the benefits of using flavors in animal feed.

From the Oceania region, Australia is contributing 2.4% of the total revenue of the Feed Flavor market.

Due to various vital feed additives, including vitamins, minerals, fiber, and others that are good for the animals' digestive tracts and guts, animal feed sometimes has unpleasant tastes. Feed tastes work as an antibiotic substitute in the feed while also balancing off the bitterness.

There are many benefits to using Feed Flavor. Feed Flavor can help improve the digestibility of your feed, which can lead to better absorption of nutrients. Additionally, Feed Flavor can help reduce the risk of digestive issues and improve gut health. Finally, Feed Flavor can help promote healthy growth and development in your animals.

The competitive landscape of the Feed Flavor market is highly fragmented with the presence of a large number of regional and international players. Key players in the market are focused on expanding their geographical presence and product portfolio to gain a competitive edge in the market.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa(MEA); RoW |

| Key Countries Covered | USA, Canada, Germany, United Kingdom, France, Russia, Brazil, Argentina, Japan, Australia, China, India |

| Key Segments Covered | Nature, Form, Animal, Sales Channel, Region |

| Key Companies Profiled | Kemin Industry; DuPont; Alltech; Nutriad; Pancosm; BIOMIN Holding GmbH; Origination O2D; Norel; Prinova Group; Agri-Flavors; Kerry Group; Bell Flavors & Fragrances; Pestell Minerals and Ingredients Inc. |

| Report Coverage | Drivers, Restraints, Opportunities and Threats Analysis, Market Forecast, Company Share Analysis, Market Dynamics and Challenges, Competitive Landscape, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global feed flavors market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the feed flavors market is projected to reach USD 5.6 billion by 2035.

The feed flavors market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in feed flavors market are natural and artificial.

In terms of form, dry segment to command 61.7% share in the feed flavors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA