The feed additive nosiheptide premix market is experiencing steady growth, driven by the global focus on improving animal health and feed efficiency, particularly in poultry production. Veterinary journals and livestock nutrition studies have emphasized nosiheptide’s effectiveness as a narrow-spectrum antibiotic that enhances gut health and feed conversion while reducing pathogenic bacterial load.

Regulatory frameworks in several countries continue to support the use of non-medically important antibiotics like nosiheptide in livestock feed, as part of efforts to mitigate antimicrobial resistance without compromising animal productivity. Additionally, the rise in poultry meat consumption worldwide has increased the demand for performance-boosting additives that offer consistent results without compromising food safety.

Feed manufacturers are investing in standardized premix formulations that offer precision dosing and compatibility with other micronutrients. Future market expansion is expected to be supported by growing awareness among producers about antibiotic alternatives, and by the continued preference for cost-effective, narrow-spectrum additives that meet both regulatory and production demands. Segmental momentum is being driven by lower concentration formulations and poultry-focused applications due to their wide-scale adoption and favorable outcomes in commercial farming environments.

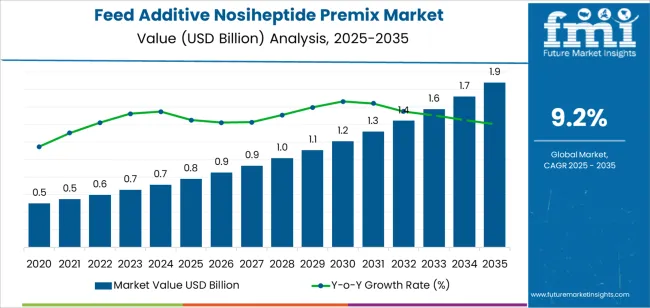

| Metric | Value |

|---|---|

| Feed Additive Nosiheptide Premix Market Estimated Value in (2025 E) | USD 0.8 billion |

| Feed Additive Nosiheptide Premix Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

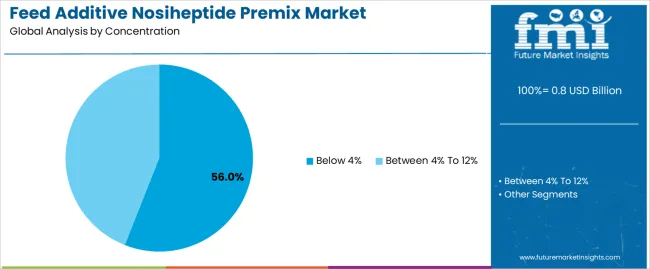

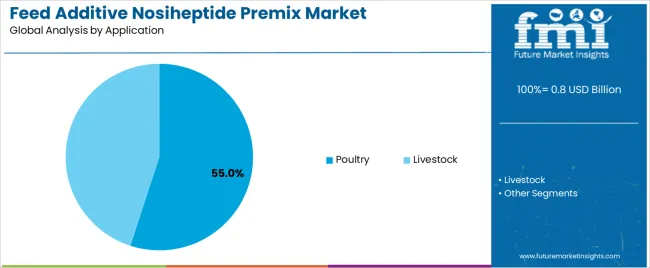

The market is segmented by Concentration and Application and region. By Concentration, the market is divided into Below 4% and Between 4% To 12%. In terms of Application, the market is classified into Poultry and Livestock. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Below 4% concentration segment is projected to contribute 56.00% of the nosiheptide premix market revenue in 2025, maintaining its lead due to its widespread use across commercial feed applications. Growth of this segment has been supported by its effectiveness in delivering optimal health and growth outcomes in poultry without exceeding regulatory residue limits.

Animal nutrition specialists have favored lower concentrations for their safety profile, allowing long-term use without compromising feed palatability or inducing microbial resistance. Feed manufacturers have formulated Below 4% premixes to ensure ease of uniform mixing and minimal risk of dosage errors.

Furthermore, economic considerations in large-scale poultry operations have encouraged the use of lower concentration premixes, which offer cost efficiency while maintaining therapeutic efficacy. This concentration range has become the industry standard, supported by feed safety guidelines and its compatibility with a range of dietary formulations. As compliance with food safety regulations continues to influence additive formulation strategies, the Below 4% segment is expected to retain its dominance.

The Poultry segment is projected to account for 55.0% of the feed additive nosiheptide premix market revenue in 2025, positioning itself as the leading application category. This growth has been attributed to the consistent demand for poultry meat and eggs, particularly in Asia-Pacific and Latin American markets, where nosiheptide has been widely integrated into broiler and layer feed programs.

Industry reports and poultry health research have emphasized nosiheptide’s role in improving intestinal health, reducing Clostridium perfringens incidence, and enhancing feed efficiency, all of which are critical to optimizing poultry performance. Regulatory acceptance of nosiheptide as a non-critical antibiotic in many countries has allowed producers to continue its use under controlled dosing, especially in regions with partial antibiotic restrictions.

Commercial poultry producers have relied on nosiheptide premix to support consistent weight gain and flock uniformity, contributing to predictable production outcomes. With the poultry sector continuing to expand and intensify, the demand for feed additives that support efficient, safe, and profitable production is expected to sustain the Poultry segment’s leading position.

Nosiheptide Premix Has a Key Role in the Gut Health Management Revolution

The surge of antibiotic resistance in poultry is leading to a revolution in gut health management. Producers, as well as consumers, are becoming concerned over the potential human health risks linked with antibiotic use in poultry farming. This has created prospects for alternatives like nosiheptide premix.

The product stands to benefit substantially from this shift as it provides a promising approach to boost bird performance and gut health without relying on antibiotics.

Nosiheptide premix has the potential to increase nutrient absorption, digestion, and overall bird health, resulting in better growth rates and lower disease susceptibility. This approach gets well with the expanding demand for responsible and sustainable poultry production.

Innovation in the Feed-Additive Nosiheptide Premix Industry

The industry is projected to be led by product development and innovation. In upcoming years, more firms are expected to be seen reformulating nosiheptide premix for improved functionalities. These include enhanced shelf life, easier application, and improved compatibility with existing feed additives. This could include innovations in premix packaging, encapsulation technologies, and particle size.

Over the forecast period 2025 to 2035, the market is projected to witness customized products for species-specific including chickens, geese, turkeys, and ducks. Key players offering advanced delivery methods and dosages to best address the distinct gut health requirements of every bird type. As many players focus on innovation and development the competition and effectiveness of evolving poultry health are enhanced.

Firms Adjust to Green Processes as Environmental Concerns Become Overbearing

With concerns increasing over the environment, manufacturers are focusing on sustainability and it is going to be key for the growth of the nosiheptide premix industry. Manufacturers are investing in sustainable and eco-friendly sources of raw materials for nosiheptide premix production in partnership with suppliers of raw materials.

Manufacturers are expected to explore eco-friendly processes during the production process. This could entail reducing waste generation, limiting energy consumption, and executing recycling initiatives. By following sustainable practices, manufacturers are appealing to eco-conscious consumers and producers while also contributing to a sustainable food system.

The global feed additive nosiheptide premix market recorded a CAGR of 10.9% during the historical period between 2020 and 2025. The expansion of the feed additive nosiheptide premix market was positive, as it reached a value of USD 0.8 million in 2025.

During the historical period, nosiheptide premix offered a unique mode of action. Research was initiated to provide strong evidence for its distinct functionality in boosting gut health and growth. The initiation of scientific discoveries fueled the demand for feed additive nosiheptide premixes.

Approvals for nosiheptide premix in main poultry-producing countries have opened doors for broader acceptance. Further, players were dealt with challenges in developing nosiheptide premix at a commercially viable scale before 2025. By overcoming this challenge and offering new developments, players are attracting a new consumer base.

In 2024, coronavirus hit the industry and caused the shutdown of running factories. The economic slowdown also caused demand for poultry and livestock in HORECA and the residential sector to peter out. In the subsequent years, when the deadly virus loosened its grip, the market settled and continued to grow in the forecast period.

The upward trajectory of feed additive nosiheptide premix is expected to shoot up at a 9.2% CAGR through 2035. By the end of 2035, the market is projected to reach USD 1,720 million. Promising results of this premix in ducks and chickens have led players to explore the safety and efficacy of these premixes in other poultry species like geese or turkeys. This is expected to offer growth avenues for new market segments.

Distinct long-term studies evaluate the effect of nosiheptide premix on the gut microbiome, poultry health, and potential resistance development over long periods. These are also instrumental in improving the sales of feed additive nosiheptide premix.

Top-tier companies that provide nosiheptide premix offerings are investing in research and development as they have enough funds to sustain such endeavors. The result of these efforts is the creation of improved or new product formulations to meet the evolving requirements of livestock producers.

In research activities, focus is being given to addressing specific challenges like antibiotic resistance, targeting new animal species, and creating more effective formulations.

On the back of steady revenue streams of tier 1 companies, they are entering new markets or enlarging their presence in existing ones. Players are thus maneuvering the marketspace with partnerships, acquisitions, or organic growth tactics.

Cost optimization is another method to keep companies’ growth in check. For cost-cutting, companies are seeking efficient manufacturing processes, streamlining operations, or negotiating better deals with suppliers.

Tier 2 companies include those who exercise power over regional markets. These players are targeting certain regional requirements or emphasize under-served segments.

A few examples of this strategy include specializing in certain types of livestock, offering customized premix options, or serving organic or antibiotic-free production systems. Further, players are closely monitoring and adhering to certain regulations associated with nosiheptide premixes in various regions

The following table has been formulated that provides a screenshot of growth patterns spotted over five key pockets. The United States leads the industry in terms of percentage. However, the country’s growth is estimated to be at the tail end due to a slightly slower uptake in the next ten years. In countries of Asia Pacific, like China, Japan, and South Korea, the sector is rising at 10%, 11%, and 12% CAGRs, respectively.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 9.5% |

| United Kingdom | 10.5% |

| China | 10% |

| Japan | 11% |

| South Korea | 12% |

The United States feed additive nosiheptide premix market is projected to maintain its dominance globally. The industry is estimated to touch USD 1.9 million by 2035. In the upcoming decade, the consumption rate is forecast to expand at 9.5% CAGR.

Nosiheptide premix is a sulfur-containing peptide antibiotic that is solely used for animal feed. The product is gaining widespread recognition on account of its environmental friendliness.

Several companies in the United States engineer feed solutions using high-quality feed ingredients for chickens. These solutions are developed, customized, sourced, and offered across the globe. Companies are also hiring feed additive specialists to offer value-added products.

The United Kingdom industry is maneuvering at a speed of 10.5% CAGR. It is poised to reach USD 69.5 million by 2035. New feed options in the industry and shifting preferences have changed the industry dynamics over the years. Throughout 2020 to 2025, the adoption of feed additive nosiheptide premix in the nation increased at 14.2% CAGR.

The poultry sector in the United Kingdom supports the economy. British farmers rear around 1 billion broilers for consumption on an annual basis. The sector contributes over USD 4.99 billion to the United Kingdom economy, creating growth prospects for the target industry.

The poultry meat sector extends employment to about 1,00,000 people, ranging from farm managers and farmers to processors, lorry drivers, and haulage companies. Besides, thousands of additional workers are hired for seasonal poultry production every Christmas. The flourishing poultry sector in the United Kingdom gives impetus to the feed additive nosiheptide demand.

The use of feed additive nosiheptide premix as a growth promoter for livestock is projected to sustain over the next decade. Players are strengthening their distribution channels to deepen their penetration across the nation. They are also employing varied tactics to attract a larger consumer base.

The feed additive nosiheptide premix market in China is forecast to register a CAGR of 10% from 2025 to 2035. By 2035, sales in the country are set to total USD 271.4 million.

Rising human population and inflating incomes of people residing in China are proportionally raising the demand for food and various other livelihood resources. The demand for nutritious and wholesome food is ever-expanding and the animal husbandry sector has contributed to the requirements of people.

Several measures have been applied to accelerate the productivity of livestock, including the use of feed additive nosiheptide premix. The use of this premix has been instrumental in raising the production of fish, eggs, milk, and meat.

Players offering feed additive nosiheptide premixes are developing high-quality animal protein. Additionally, they are tying up with other players to learn from each other’s expertise and thrive in the industry.

The top-performing sectors are mentioned below. The below 4% segment in the concentration category accounted for a share of 56% in 2025. Under the application category, the poultry segment led with a 65% value share in 2025.

| Segment | Below 4% (Concentration) |

|---|---|

| Value Share (2025) | 56% |

Based on concentration, the below 4% segment accounted for 56% of the share in the feed additive nosiheptide premix market. The demand for such solutions is rising as research suggests that a concentration below 4% is enough to offer desired benefits in poultry gut performance and health.

A higher degree of concentration has no relation to further improvement. It could, however, raise the production costs. Thus, below 4% nosiheptide premix remains highly popular among consumers.

| Segment | Poultry (Application) |

|---|---|

| Value Share (2025) | 65% |

The use of feed additive nosiheptide premix for rearing poultry is expected to generate significant remuneration. According to the analysis, poultry segment’s share in the industry was 65% in 2025. Over the forecast period, this segment is anticipated to rise at an 8.8% CAGR.

Studies have been conducted that validate that nosiheptide premix boosts growth and leads to better feed conversion in ducks and chickens. The product can increase the yields and potentially lower the production costs for poultry farmers.

The use of nosiheptide premixes also prevents and manages diarrhea, which is a common problem in poultry that impacts development and survival rates. By enhancing gut health, the development of birds will also be healthier.

Increasing concerns about antibiotic resistance have been instrumental in exploring nosiheptide premix as a possible alternative to promote development and gut health in poultry. It is claimed to offer a different mode of action than antibiotics, thus reducing the chances of resistance development.

The feed additive nosiheptide premix market is competitive, with players strategically partnering to increase their share. Players are uniting with renowned poultry health and animal feed companies that could strengthen distribution networks and increase market access.

Companies in the feed additive nosiheptide premix landscape are also seeking regulatory approvals and penetrating new countries with substantial poultry production for the expanded customer base. Besides, the emerging methods for sustainably sourcing the raw materials that are deployed in the nosiheptide premix production is improving its appeal to discerning producers and consumers. In line with this, players are implementing eco-friendly practices through nosiheptide premix manufacturing to improve their image in the marketplace.

Profiling of Key Companies

ZHEJIANG ESIGMA BIOTECHNOLOGY CO., LTD.

The company was registered in 2020 in Hangzhou. It is a leading manufacturer, exporter, and distributor of poultry feed supplements in China. In emerging and neighboring countries like India, the company is verified by Trade India and considered a trusted seller of enlisted products. With wide experience in supplying and trading nosiheptide, the company has made a name for itself in various domains. The company has a customer-centric approach. It has a significant presence across the globe and serves a substantial consumer base. The quality-assured poultry feed supplements by ZHEJIANG ESIGMA BIOTECHNOLOGY CO., LTD. are easily available.

FENGCHEN GROUP CO., LTD.

FENGCHEN GROUP CO., LTD. is a Chinese pharmaceutical product supplier. The company sells poultry or livestock at competitive prices to boost feed efficiency remarkably. The feed additive nosiheptide premix is used to increase the weight of the poultry and livestock. The company is further focusing on upgrading the production line to raise its competitiveness in the industry.

In terms of concentration, the industry is bifurcated into below 4% and between 4% to 12%.

Based on application, the industry is classified into livestock and poultry.

Key countries of regions like North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been examined in the report.

The global feed additive nosiheptide premix market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the feed additive nosiheptide premix market is projected to reach USD 1.9 billion by 2035.

The feed additive nosiheptide premix market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in feed additive nosiheptide premix market are below 4% and between 4% to 12%.

In terms of application, poultry segment to command 55.0% share in the feed additive nosiheptide premix market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Aqua Feed Additives Market Analysis by Species Type, Ingredient and Other Additives Types Through 2035

A detailed global analysis of Brand Share Analysis for Aqua Feed Additives Industry

Novel Feed Additives Market – Trends, Demand & Livestock Innovations

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Analyzing Animal Feed Additives Market Share & Industry Leaders

Natural Feed Additives Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Aqua Feed Additives Market Trends – Growth, Demand & Forecast 2025–2035

Medicated Feed Additives Market Size and Share Forecast Outlook 2025 to 2035

UK Animal Feed Additives Market Trends – Growth, Demand & Forecast 2025–2035

Microbial Feed Additives Market – Growth, Probiotics & Livestock Nutrition

Phytogenic Feed Additives Market Size and Share Forecast Outlook 2025 to 2035

Postbiotic Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

Europe Aqua Feed Additives Market Report – Demand, Trends & Forecast 2025–2035

ASEAN Animal Feed Additives Market Insights – Demand, Size & Industry Trends 2025–2035

Antimicrobial Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Europe Animal Feed Additives Market Insights – Size, Trends & Forecast 2025–2035

Australia Aqua Feed Additives Market Insights – Size, Share & Trends 2025-2035

Australia Animal Feed Additives Market Analysis – Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA