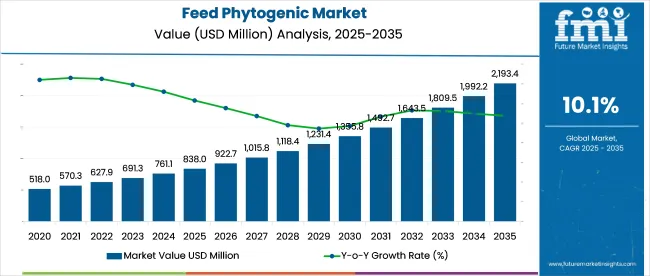

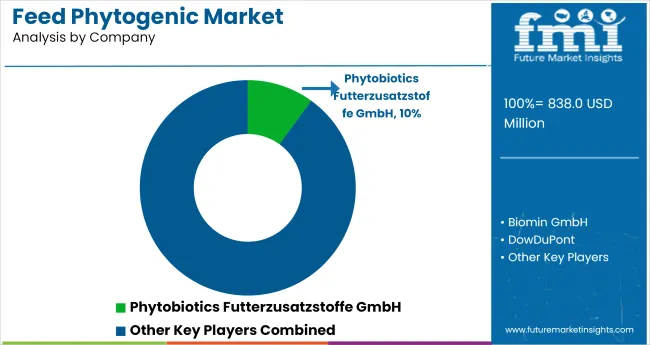

The global feed phytogenic market is set to witness substantial expansion, growing from USD 838.02 million in 2025 to USD 2,193.4 million by 2035, registering a healthy CAGR of 10.1%.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 838.02 million |

| Projected Industry Value (2035F) | USD 2,193.4 million |

| CAGR (2025 to 2035) | 10.1% |

This growth reflects a major transformation in global livestock production practices, particularly the increasing focus on plant-based additives as natural alternatives to antibiotic growth promoters (AGPs). Phytogenics, bioactive compounds derived from plants, such as herbs, spices, and essential oils, are being widely adopted in animal diets for their proven benefits in enhancing gut health, supporting immune function, and improving feed conversion ratios. Their integration into commercial livestock feed is driven by a combination of regulatory enforcement, consumer demand for clean-label meat, and ongoing in formulation technologies.

The industry accounts for 6-8% share of the global animal feed additives market, which itself is valued at over USD 11-13 billion. Within the animal nutrition market, which includes a broader range of supplements and feed ingredients, phytogenics represent a smaller share-around 2-3%, given their specialized functional use.

In the livestock feed market, estimated to exceed USD 500 billion globally, feed phytogenics contribute less than 1% by value, though their influence on performance and feed quality is disproportionately high. In the natural feed additives and functional ingredients for animal health segments, feed phytogenics hold a stronger position, comprising 15-20% due to growing demand for clean-label, residue-free alternatives to antibiotics in both developed and emerging livestock production systems.

The industry involves a multi-layered network of stakeholders-beginning with raw material suppliers of herbs, spices, and essential oils. These plant-derived materials are processed and standardized by phytogenic additive manufacturers, often employing technologies such as steam distillation or solvent extraction. The formulated phytogenic ingredients are then sold to premix and feed manufacturers, who incorporate them into complete feed products or additive premixes tailored for specific livestock.

Distribution channels include both direct B2B sales to integrators and indirect sales through distributors to independent farms. The value chain also involves contract research organizations and quality assurance entities ensuring standardization and efficacy, particularly as demand grows in key markets like Europe, Asia-Pacific, and Latin America.

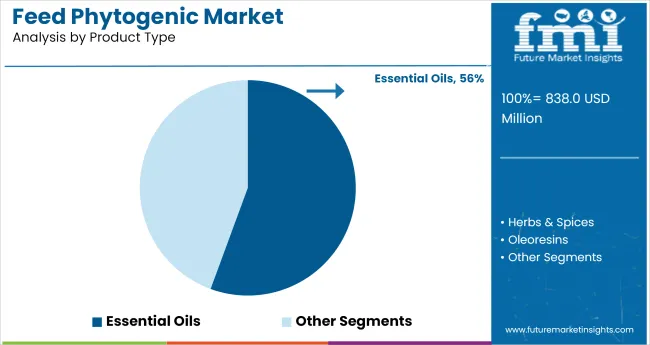

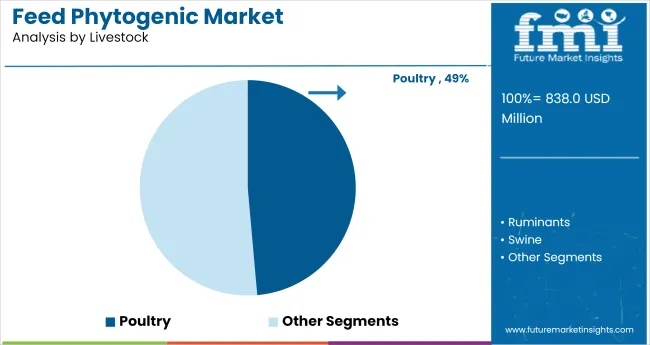

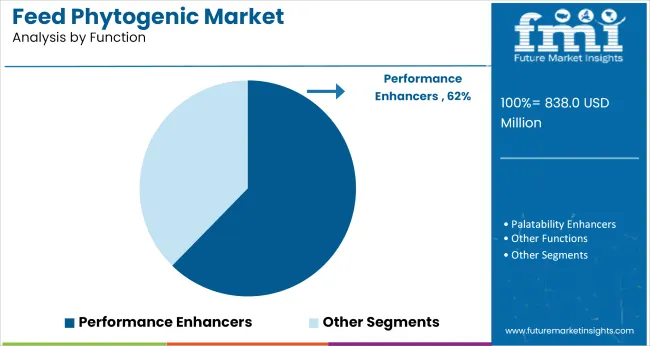

In 2025, essential oils dominate the feed phytogenic market with a 55.6% share due to their antimicrobial and performance-enhancing benefits, while the poultry segment leads livestock applications with a 48.6% share, driven by the need for antibiotic-free growth solutions. Performance enhancers top functional demand, holding a 62.3% share, as producers prioritize feed efficiency and productivity across species.

Essential oils dominate the market with a substantial 55.6% market share in 2025, making them the most widely used product type within the segment. Their leadership stems from their powerful antimicrobial, antioxidant, and anti-inflammatory properties, which help improve feed efficiency, gut health, and immune function in livestock.

The poultry segment stands as the leading consumer of feed phytogenics globally, with a commanding 48.6% market share in 2025. This dominance is primarily driven by the intensive nature of poultry farming, where feed efficiency, gut health, and growth performance are critical for profitability.

Performance enhancerslead the functional segmentation of the market, accounting for a significants 62.3% market share in 2025. This dominance is primarily due to the rising demand for natural solutions that improve feed conversion ratios (FCR), growth rates, and animal productivity.

Growing consumer demand for antibiotic-free, clean-label animal products and tightening global regulations on AGPs are driving the rapid adoption of phytogenic feed additives. Producers are increasingly turning to natural solutions to meet food safety standards and maintain animal health.

Rising Consumer Demand for Antibiotic-Free Animal Products

Growing awareness around food safety, antibiotic resistance, and residue-free meat has fueled a global shift in consumer preferences toward naturally raised livestock products. This trend is driving feed producers and integrators to replace antibiotic growth promoters with plant-based alternatives like phytogenics.

Consumers in developed markets, as well as health-conscious segments in emerging economies, are actively seeking poultry, meat, and dairy products sourced from animals fed on natural diets. This shift is influencing regulatory policies and pushing producers toward clean-label practices.

Regulatory Pressure on Antibiotic Growth Promoters (AGPs)

Tightening regulatory frameworks across key livestock-producing regions have become a major catalyst for the adoption of phytogenic feed additives. Countries in the European Union have long banned AGPs, and similar trends are emerging across Asia and Latin America. Regulatory compliance is no longer optional, forcing producers to look for effective natural substitutes that ensure animal health and productivity without antibiotics. As governments promote safe animal husbandry practices, phytogenics have emerged as a viable solution.

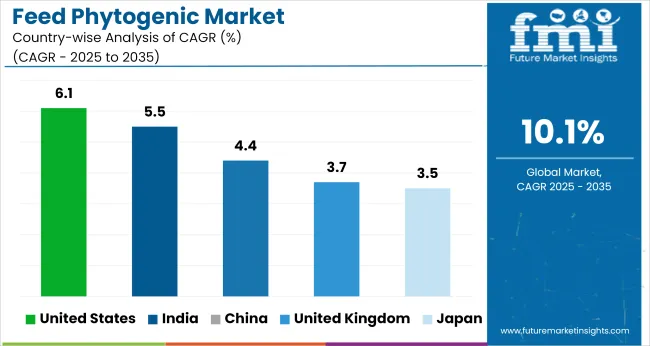

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

| United Kingdom | 3.7% |

| Japan | 3.5% |

| China | 4.4% |

| India | 5.5% |

The feed phytogenic market is projected to grow at varying rates across key global economies. The United States, with a CAGR of 6.1%, leads among developed nations due to its advanced regulatory enforcement and rising demand for antibiotic-free meat, while India follows with 5.5%, driven by rapid poultry sector expansion and urban demand for safe protein.

China is set to grow at 4.4%, supported by large-scale swine farming and a post-ASF focus on practices. The United Kingdom (3.7%) and Japan (3.5%) reflect more mature markets emphasizing food safety and ethical production. The USA, UK, and Japan belong to the OECD, while China and India are part of BRICS, showing divergent maturity and growth dynamics.

The USA feed phytogenic market is anticipated to expand at a CAGR of 6.1% from 2025 to 2035, reflecting the country's gradual yet steady shift toward natural feed solutions amid strong food safety regulations and consumer advocacy for antibiotic-free meat. Although the CAGR is below the global average, the USA market remains highly lucrative due to its scale, technological infrastructure, and pressure on producers to eliminate AGPs.

Large-scale poultry and swine producers are incorporating phytogenic additives to meet rising retail and export standards for clean-label meat. Consumer demand is further supported by health-conscious purchasing behavior and stringent USDA oversight. With major players like Cargill and Kemin based in the region, product and supply chain efficiency also contribute to market momentum.

India’s feed phytogenic market is projected to grow at a CAGR of 5.5% from 2025 to 2035, driven by the country’s large and expanding livestock population, particularly in poultry and dairy sectors. Although still emerging compared to mature markets, India shows strong potential due to increasing awareness about antibiotic residues and rising exports of meat and animal products.

Regulatory attention is growing, and consumers in urban centers are demanding safer, quality-assured animal protein. Indian feed manufacturers are increasingly partnering with global and regional phytogenic suppliers to develop cost-effective, performance-enhancing solutions for commercial poultry and aquaculture. The expansion of contract poultry farming and organized livestock systems is also boosting phytogenic adoption.

China’s feed phytogenic market is expected to register a CAGR of 4.4% between 2025 and 2035, as the country transitions toward safer, animal production systems in the post-ASF (African Swine Fever) era. While the CAGR is below the global average, China's volume potential is immense due to the size of its livestock industry.

The government’s increasing scrutiny on antibiotic use, coupled with consumer demand for residue-free pork and poultry, is gradually driving phytogenic adoption. Feed producers and integrators are under pressure to meet both domestic quality expectations and international trade standards. Domestic manufacturers are investing in local production of plant-derived feed solutions, helping reduce dependency on imports.

The feed phytogenic market in the United Kingdom is forecast to grow at a CAGR of approximately 3.7% from 2025 to 2035, supported by the country’s proactive stance on food traceability, antibiotic-free meat production, and animal welfare.

Although the CAGR trails global growth rates, the UK presents a mature, regulated environment that supports the long-term adoption of phytogenic additives. Poultry and dairy producers are increasingly reformulating feed with plant-based ingredients to meet both regulatory and supermarket-driven standards.

Consumer preferences strongly favor natural, ethically produced meat, making phytogenics a strategic priority for integrators and contract farmers alike. Post-Brexit trade realignments are prompting exporters to align more closely with EU-style production standards.

Japan’s feed phytogenic market is projected to grow at a CAGR of 3.5% from 2025 to 2035, shaped by its focus on premium-quality meat, animal health, and food safety. Although the market is relatively small in volume, it is characterized by high-value applications, particularly in swine and poultry segments.

The country’s strict food safety regulations and aging population are pushing for safer animal protein with fewer chemical residues. Japan also emphasizes traceability, encouraging livestock producers to adopt feed solutions that align with consumer expectations for transparency and clean-label nutrition. Imported phytogenic ingredients, especially essential oils, are gaining traction in niche and specialized farming systems.

In the feed phytogenic market, key players are leveraging plant-based, regulatory compliance, and species-specific formulations to gain competitive advantage. Companies like Phytobiotics Futterzusatzstoffe GmbH, Biomin GmbH, and Delacon Biotechnik GmbH are advancing precision-formulated additives using essential oils and plant extracts to enhance gut health and feed efficiency, particularly in poultry and swine. Multinational firms such as DowDuPont and Pancosma are capitalizing on global distribution and R&D infrastructure to scale their phytogenic portfolios across regulated and emerging markets.

Regional players like Natural Remedies Pvt. Ltd., Nutricare Life Sciences Limited, and Igusol are addressing local demand with cost-effective blends tailored for high-growth countries. Companies such as Dostofarm GmbH and Natural Herbs & Formulations are focusing on residue-free certification and clean-label ingredients. Competitive dynamics are increasingly shaped by the shift away from antibiotic growth promoters, driving players to invest in traceable sourcing, microencapsulation technology, and performance-driven formulations.

Recent Feed Phytogenic Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 838.02 million |

| Projected Market Size (2035) | USD 2,193.4 million |

| CAGR (2025 to 2035) | 10.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and volume in metric tons |

| Product Type Analyzed (Segment 1) | Essential Oils, Herbs & Spices, Oleoresins, and Other Product Types. |

| Livestock Analyzed (Segment 2) | Poultry, Ruminants, Swine, Aquatic Animals, and Other Livestock Animals. |

| Function Analyzed (Segment 3) | Performance Enhancers, Palatability Enhancers, and Other Functions. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Phytobiotics Futterzusatzstoffe GmbH, Biomin GmbH, DowDuPont, Pancosma, Delacon Biotechnik GmbH, Igusol, Natural Remedies Pvt. Ltd., Nutricare Life Sciences Limited, Dostofarm GmbH, Natural Herbs & Formulations, and other market players. |

| Additional Attributes | Dollar sales, share, leading product types, fastest-growing livestock segments, regional demand trends, key competitors, distribution channels, regulatory shifts, and future growth opportunities. |

The industry is segmented into essential oils, herbs & spices, oleoresins, and other product types.

The industry is segmented into poultry, ruminants, swine, aquatic animals, and other livestock animals.

The industry finds performance enhancers, palatability enhancers, and other functions.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 838.02 million in 2025.

It is forecasted to reach USD 2,193.4 million by 2035.

The industry is anticipated to grow at a CAGR of 10.1% during this period.

Performance enhancers are projected to lead the market with a 62.3% share in 2025.

North America, particularly the United States, is expected to be the key growth region with a projected growth rate of 6.1%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Phytogenic Feed Additives Market Size and Share Forecast Outlook 2025 to 2035

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA