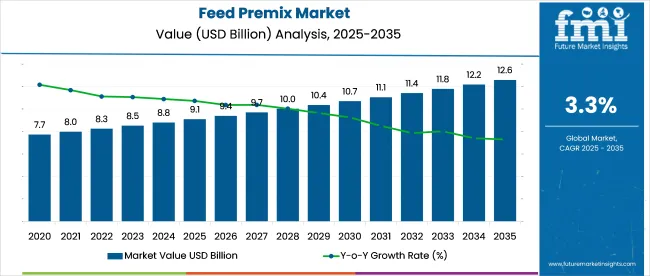

The global feed premix market is estimated to reach a valuation of USD 9.1 billion in 2025 and is anticipated to grow to USD 12.5 billion by 2035. This market is expected to grow at a CAGR of 3.3% over the forecast period. Between 2020 and 2025, the market expanded at a CAGR of 3.1%, indicating a gradual but consistent upward trend that is expected to continue.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 9.1 billion |

| Projected Industry Value (2035F) | USD 12.5 billion |

| CAGR (2025 to 2035) | 3.3% |

This growth trajectory underscores the market’s resilience and responsiveness to evolving agricultural and livestock management practices. With increased attention on food safety, animal health, and productivity, feed premixes have become a vital component in commercial livestock operations worldwide.

The industry registers 10-15% of the global animal feed market, which itself is valued at over USD 100 billion. Within the animal nutrition market, feed premixes represent around 20%, given their critical role in micronutrient delivery. In the broader agriculture inputs market, including fertilizers, crop protection, and animal inputs, feed premixes contribute a modest 5-7% share.

When considering the livestock farming market, which encompasses breeding, equipment, and feed, premixes represent around 8-10%, largely driven by intensive production systems. Within the food and beverage supply chain, feed premix accounts for less than 3%, due to its upstream role in animal production. These figures underscore the role of premixes as a niche yet essential component across interlinked value chains.

The broader structural shifts in agriculture, especially the rise of vertically integrated farming models, are reinforcing this demand for performance-driven feed solutions. Technological advancements in feed formulation, biotechnology, and data-enabled nutrition planning have allowed producers to optimize feed conversion ratios, reduce environmental impact, and align with sustainability targets.

As livestock operations consolidate and become more sophisticated, the value proposition of premixes grows, offering not just nutritional benefits but also cost efficiencies, environmental compliance, and long-term productivity gains. This strategic evolution positions premixes as a critical lever in the transformation of global animal protein supply chains.

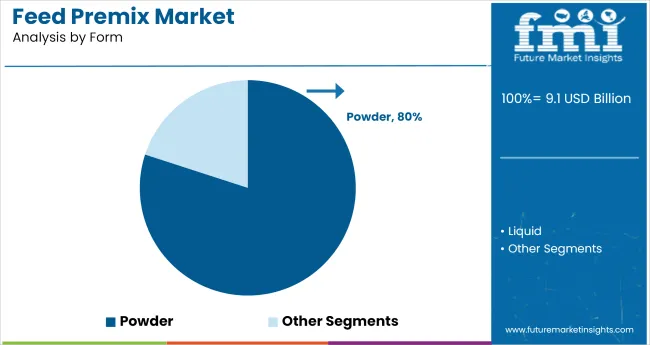

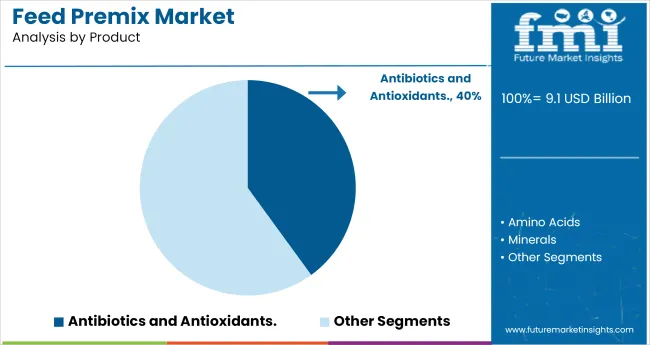

Powder form dominates the market due to its superior handling, stability, and efficient nutrient delivery, making it ideal for consistent and scalable livestock feeding. Antibiotics lead the product segment, valued for their effectiveness in enhancing animal growth, preventing diseases, and supporting productivity in high-density farming, despite increasing regulatory oversight.

The powder form is the leading segment in the market, accounting for 80% of the market share in 2025, primarily due to its superior handling, stability, and cost-effectiveness.

The antibiotics segment leads the market with a substantial 40% market share in 2025, driven by its proven role in enhancing feed efficiency, supporting animal growth, and preventing disease outbreaks.

Feed premix producers are adopting precision nutrient formulations to reduce additive waste and align with species-specific needs, improving inventory turnover and feed efficiency. Simultaneously, rising demand for antibiotic-free solutions is driving regulatory-compliant, dual-track formulations with a focus on traceable, audit-ready ingredients.

Nutrient Optimization Reshaping Feed Premix Formulations

Feed premix buyers are strategically streamlining nutrient profiles to meet animal-specific requirements while minimizing excess micronutrient usage. Across Latin America and Southeast Asia, producers have shifted from broad-spectrum formulations to precision inclusion of trace minerals and vitamins.

This shift is driven by fluctuating raw material costs and updated species-specific feeding guidelines that encourage more accurate dosing. As a result, feed converters report up to 9% less wastage of key additives. Contract manufacturers are adjusting batch sizes based on seasonally adjusted formulations, improving inventory turnover by 13%. This recalibration also aligns feed schedules with life cycle-driven nutrient needs, enhancing both feed conversion ratios and animal welfare outcomes.

Shifts in Antimicrobial Usage Driving Formulation Compliance

Changing regulatory and retail stances on antimicrobial use are transforming product design in the market. Following the enforcement of non-medicated feed mandates in regions like the EU and Australia, premix producers are phasing out growth-promoting antibiotic blends and adopting immune-supportive botanicals and acidifiers.

Distributors report that 31% of poultry premix contracts in Europe now require antibiotic-free labeling, reshaping demand across the supply chain. Compliance pressures have also altered procurement strategies, with buyers prioritizing ingredient traceability and supplier audit transparency. These shifts are fostering a dual-track portfolio strategy: one targeting conventional systems, another for export-aligned antibiotic-free operations.

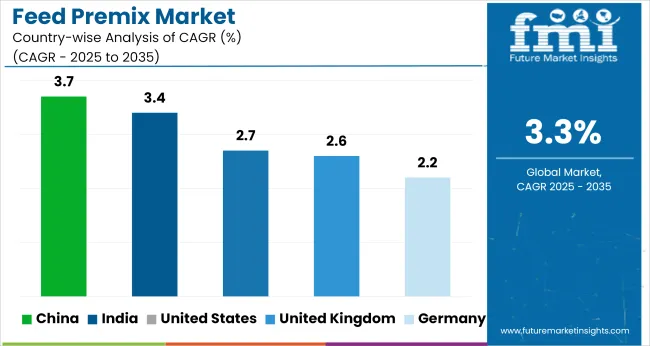

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.7% |

| United Kingdom | 2.6% |

| Germany | 2.2% |

| China | 3.7% |

| India | 3.4% |

The global feed premix market is forecast to grow at a CAGR of 3.3% between 2025 and 2035, with regional growth diverging across economic blocs. India, a BRICS member, leads with a projected 4.7% CAGR, supported by its expanding poultry and dairy sectors and the rising use of micronutrient blends to correct regional mineral deficiencies. Local producers are investing in compound premix plants near consumption zones to reduce freight costs and customize formulations by species.

China posts a 4.3% CAGR, with demand concentrated in integrated pig and aquaculture systems that rely on tailored vitamin and amino acid premixes to boost feed efficiency. ASEAN countries like Vietnam and the Philippines average 3.8%, driven by livestock consolidation and health-related feed regulations. OECD countries such as Germany and Canada report lower growth, 2.6% and 2.4% respectively, due to saturated livestock volumes and stricter controls on additive inclusion, reflecting a more mature stage of market evolution.

The USA feed premix market is estimated to grow at a 2.7% CAGR during the forecast period from 2025 to 2035. The market in the USA is largely driven by the intensification of commercial livestock operations, particularly in the poultry and swine sectors, where nutritional precision and performance efficiency are paramount.

A well-established animal protein industry, combined with ongoing reforms in feed safety and quality assurance, has encouraged the adoption of value-added premixes. USA producers are increasingly integrating product formulations into vertically coordinated supply chains to maintain consistency and traceability across large-scale operations. The growing consumer demand for antibiotic-free and premium meat is further pushing feed manufacturers to explore alternative functional additives within premixes.

Germany’s feed premix market is projected to expand at a 2.2% CAGR between 2025 and 2035. As one of the EU's most regulated markets for livestock feed, Germany’s industry is shaped by stringent compliance norms, particularly around antimicrobial usage, animal welfare, and sourcing.

German livestock producers, especially in swine and dairy sectors, are increasingly turning to customized premix solutions that align with Green Deal-aligned environmental goals and animal health optimization. With a strong emphasis on traceability and ingredient transparency, feed manufacturers are reformulating products to meet the evolving retail certification standards. The rise of organic and specialty livestock farming has created niche opportunities for tailored, antibiotic-free, and mineral-balanced premixes.

China’s feed premix market is set to register a 3.7% CAGR from 2025 to 2035, emerging as one of the fastest-growing markets globally. Following the restructuring of its swine industry post-ASF (African Swine Fever) outbreaks, China has modernized its livestock production facilities, leading to increased demand for premixes that enhance bio security, immunity, and performance.

Urbanization and rising incomes are shifting consumer preferences toward high-quality animal protein, encouraging producers to adopt advanced feeding systems. Government policies supporting feed safety, domestic production quality, and vertical integration across supply chains have further boosted the market. With consolidation across the livestock sector, large farms are increasingly adopting premix-based feeding strategies that allow nutrient customization, automation, and efficiency gains.

India’s feed premix market is expected to grow at a 3.4% CAGR between 2025 and 2035, slightly above the global average. The expansion is underpinned by the rapid development of the poultry and dairy industries, which are seeing a shift from backyard farming to organized production. Rising protein consumption in urban and semi-urban areas has led to greater demand for quality animal products, prompting producers to adopt nutritionally balanced premixes.

India’s fragmented but expanding feed industry is increasingly embracing premixes as a cost-effective method to address deficiencies in local feed raw materials. Government-led efforts under programs like the National Livestock Mission are incentivizing the use of fortified feed to improve productivity in indigenous breeds and reduce disease incidence.

The UK feed premix market is forecast to expand at a 2.6% CAGR from 2025 to 2035, driven by a focus on animal health standards, premium meat production, and post-Brexit supply chain realignments. In the wake of stricter veterinary medicine regulations and growing consumer interest in welfare-certified and antibiotic-free meat, British producers are reformulating feed strategies with targeted premix solutions.

The UK also sees growing demand for value-added livestock products in export markets, especially under private labeling and welfare-based branding. These dynamics are encouraging feed companies to deliver traceable, high-quality premix inputs that meet both domestic and EU-equivalent standards. The country’s expanding aquaculture and specialty animal sectors are contributing to new, formulation-specific premix needs.

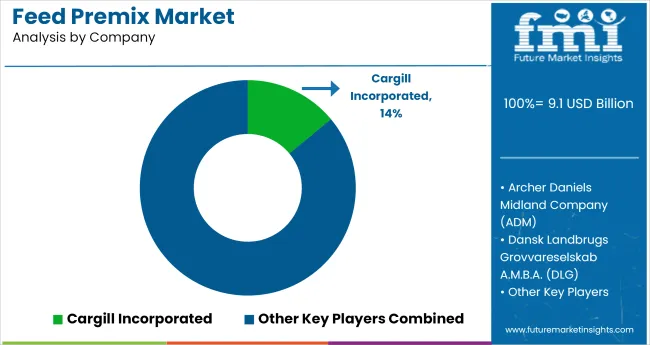

The industry is shaped by global agribusiness leaders and regional specialists focused on advanced nutrition, traceability, and animal health. Key players such as Cargill Incorporated, Archer Daniels Midland Company (ADM), and BASF SE lead the market with integrated supply chains and research-backed formulations.

Koninklijke DSM N.V. and Corbion N.V. drive in micronutrient precision and bio-based additives. Land O'Lakes, Inc. and Glanbia plc support growth through co-operative models and tailored livestock solutions. Regional firms like Godrej Agrovet in India and Farbest-Tallman Foods Corporation in the USA meet localized demand with species-specific blends. DLG (Dansk Landbrugs Grovvareselskab A.M.B.A.) strengthens European presence through feed strategies.

Recent Feed Premix Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 9.1 billion |

| Projected Market Size (2035) | USD 12.5 billion |

| CAGR (2025 to 2035) | 3.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in metric tons |

| Form Analyzed (Segment 1) | Powder and Liquid. |

| Product Analyzed (Segment 2) | Amino Acids, Vitamins, Minerals, Antibiotics, And Antioxidants. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Cargill Incorporated, Archer Daniels Midland Company (ADM), Dansk Landbrugs Grovvareselskab A.M.B.A. (DLG), BASF SE, Land O'Lakes, Inc., Godrej Agrovet, Koninklijke DSM N.V., Corbion N.V., Farbest -Tallman Foods Corporation, and Glanbia plc. |

| Additional Attributes | D ollar sales, share, growth rate by form and product type, regional demand shifts, regulatory trends, top buyer segments, distribution channel performance, and competitor positioning. |

The industry is segmented into powder and liquid.

The industry is segmented into amino acids, vitamins, minerals, antibiotics, and antioxidants.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 9.1 billion in 2025.

It is forecasted to reach USD 12.5 billion by 2035.

The industry is anticipated to grow at a CAGR of 3.3% during this period.

Powder is projected to lead the market with an 80% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 3.4%

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Premix Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA