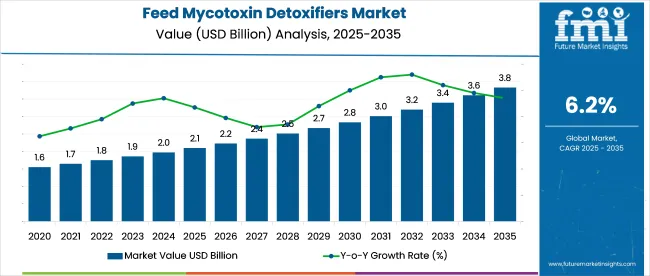

The feed mycotoxin detoxifiers market is estimated to be worth USD 2.1 billion in 2025 and is projected to reach a value of USD 3.8 billion by 2035, expanding at a CAGR of 6.2% over the assessment period of 2025 to 2035. Producers are increasing inclusion rates of detoxifiers in feed rations to counter the impact of aflatoxins, deoxynivalenol, and fumonisins that compromise gut health and reduce weight gain.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 2.1 billion |

| Projected Industry Value (2035F) | USD 3.8 billion |

| Value-based CAGR (2025 to 2035) | 6.2% |

In Europe and parts of Asia, over 60% of feed-grade corn and wheat now show detectable mycotoxin levels, pushing integrators to adopt multi-component detoxifier blends. These blends often combine organic binders, yeast cell walls, and enzymatic agents to ensure broader efficacy across toxin classes.

Dairy and poultry operations are leading consumption due to the higher economic losses linked to mycotoxin-induced fertility drops and poor feed efficiency. Feed mills are integrating detoxifiers into base concentrates for broader use across regions with fluctuating raw material quality. Precision dosing systems are also improving application consistency, further encouraging adoption across industrial-scale livestock enterprises.

As of 2025, the feed mycotoxin detoxifiers market is viewed as a focused niche within the broader animal feed industry. It accounts for around 2-3% of the global feed additives market, supported by rising concerns about toxin contamination in livestock diets. Within the overall animal nutrition sector, its share is estimated at 1.5-2.5%, as producers look to minimize performance losses due to contaminated feed.

About 2-3% of the livestock feed market uses detoxifiers, especially in poultry and swine diets. In aquaculture, close to 1-2% of feed formulations include detox agents to manage risks in fish and shrimp production. Its share in the specialty feed ingredients segment is pegged at 3-4%, owing to its targeted role in high-efficiency formulations.

The market is gaining traction across poultry and aquaculture sectors, supported by rising concerns over contaminated feed and livestock health. Growth is further fueled by increased demand for mycotoxin binders, distribution expansion through hypermarkets, and a shift toward safe, performance-boosting additives in animal diets.

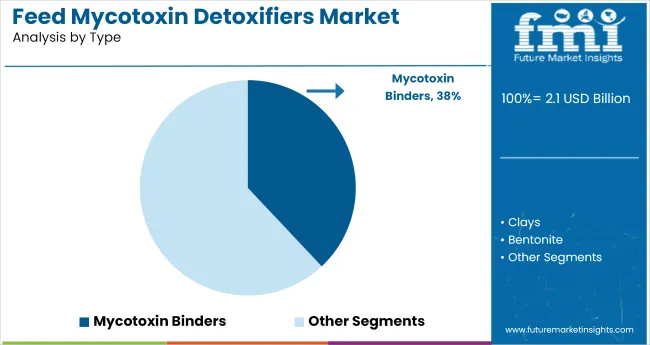

Mycotoxin binders are forecasted to dominate the type category, securing 38% share of the global feed mycotoxin detoxifiers market by 2025. These agents play a critical role in neutralizing harmful fungal toxins that compromise feed safety and animal health. Their cost-effectiveness and ease of integration into existing feed formulations are driving rapid adoption across livestock producers worldwide.

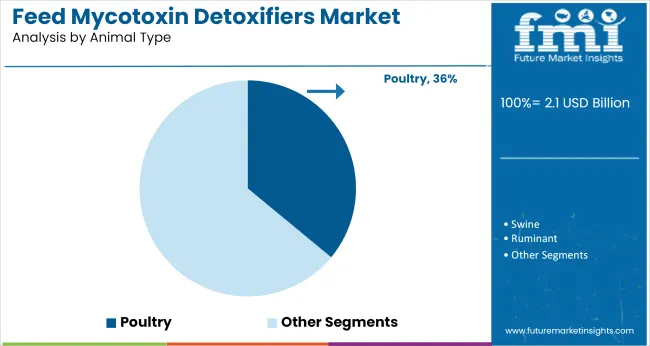

Poultry is projected to be the leading animal type in the feed mycotoxin detoxifiers market, accounting for 36% share by 2025. The intensive nature of poultry farming and higher sensitivity of chickens to mycotoxins makes detoxifiers essential to maintaining feed safety. Continuous demand for high-protein meat and eggs also amplifies the need for toxin-free rations.

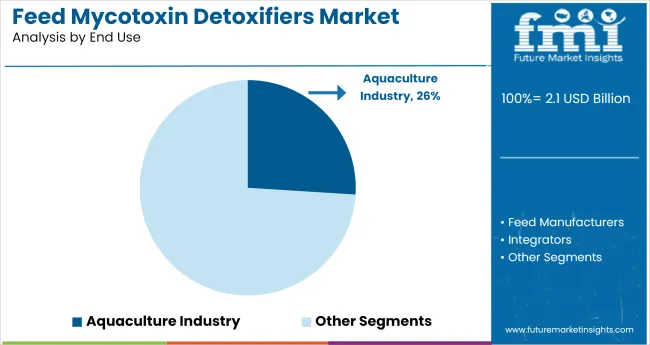

Aquaculture is expected to contribute 26% of total demand for feed mycotoxin detoxifiers by 2025, driven by the growing emphasis on clean feed inputs in fish and shrimp farming. Aquatic species are highly vulnerable to waterborne mycotoxins, necessitating detoxifiers in both pelletized and powdered feed forms.

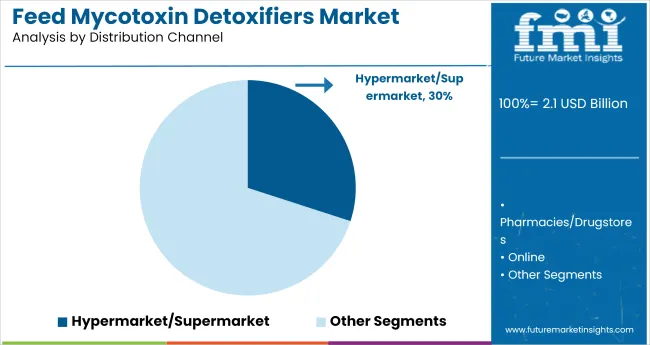

Hypermarkets and supermarkets are set to capture 30% of the distribution channel share for feed mycotoxin detoxifiers by 2025. These retail formats offer direct access to a wide customer base including small-scale farmers and commercial livestock operators. Product visibility, competitive pricing, and convenience are key factors behind their growing relevance.

The market is expanding due to increasing contamination risks linked to climate volatility and poor post-harvest storage. In 2024, over 62% of global compound feed tested positive for multiple mycotoxins.

Growth of Non-Clay-Based and Synergistic Formulations

Smectite and bentonite clays dominate binder applications, but non-clay formulations are gaining ground. Enzyme blends, yeast cell wall extracts, and microbial detoxifiers are being integrated to broaden spectrum and improve gut compatibility. In 2024, biological detoxifiers held 18% market share in EU livestock applications.

Regulatory Shifts and Residue Concerns Fueling R&D

EU and North American feed regulators are tightening scrutiny over residue accumulation and binding selectivity. The European Food Safety Authority (EFSA) now recommends performance trials for binder efficacy on non-target nutrient binding. As a result, manufacturers are investing in pH-stable binders and targeted biotransformation molecules.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.4% |

| China | 6.8% |

| Brazil | 6.6% |

| Germany | 5.9% |

| United States | 5.5% |

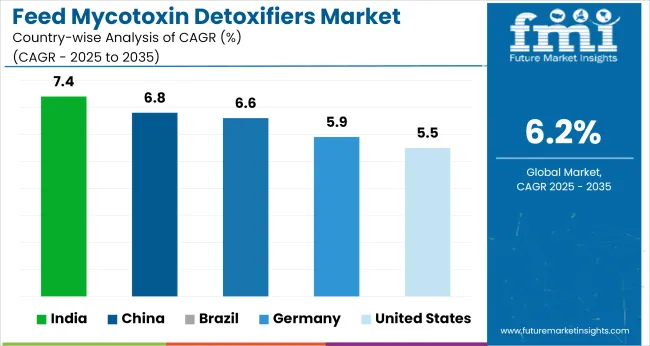

The market is projected to grow at a global CAGR of 6.2% from 2025 to 2035. Among the five leading countries, India (BRICS) reports the highest CAGR at 7.4%, outperforming the global rate by 1.2 percentage points. China (BRICS) follows at 6.8%, benefitting from scaled livestock operations and a steady rise in awareness of mycotoxin contamination.

Brazil (BRICS) records a solid 6.6%, just above the global baseline, supported by the expansion of poultry and ruminant feed industries. Germany (OECD) stands at 5.9%, slightly underperforming by 0.3 points, constrained by regulatory transitions in feed additive classifications.

The USA (OECD) trails at 5.5%, showing a 0.7-point gap versus the global trend, due to slower adoption of advanced detoxifier blends. This spread highlights faster uptake in BRICS economies, where climate-sensitive storage and bulk grain transport increase the risk of mycotoxin presence across supply chains.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

India is expected to register a CAGR of 7.4% from 2025 to 2035, positioning itself as a rapidly expanding market for mycotoxin detoxifiers. The high susceptibility of Indian feedstock, especially maize and oilseed cakes, to fungal contamination is driving urgent demand. Monsoon-dependent moisture levels and storage limitations further increase the risk of aflatoxins and fumonisins.

Poultry and dairy sectors, which dominate the country’s livestock output, are adopting toxin binders and enzymatic solutions to protect animal health and performance. Regulatory support and expansion of organized feed production are also accelerating adoption.

Expanding at a CAGR of 6.8% through 2035, China’s feed mycotoxin detoxifiers market is gaining strength due to large-scale feed operations and stringent food safety priorities. Feed contamination incidents have driven the uptake of adsorbents, enzyme-based solutions, and advanced deactivation technologies.

Swine and poultry sectors remain the largest consumers, especially in southern regions prone to high humidity and mold growth. Increasing imports of grains and oilseeds have further amplified risk exposure, prompting producers to incorporate detoxifiers in core formulations.

Brazil’s market is set to grow at a CAGR of 6.6% between 2025 and 2035, propelled by expansion in the poultry, beef, and swine sectors. The country’s tropical climate fosters high mold proliferation in feed ingredients, especially corn and soybean meal.

Integrators and feed mills are adopting detoxifiers to mitigate risks posed by aflatoxins, zearalenone, and DON. The export-driven nature of Brazil’s meat industry is also encouraging adherence to strict quality standards. Increased investments in mycotoxin monitoring and analytics are reinforcing the shift toward preventive feed management.

Germany is projected to grow at a CAGR of 5.9% from 2025 to 2035, with mycotoxin mitigation becoming an integral part of precision livestock nutrition. The country’s temperate climate and strict feed safety regulations have led to consistent use of detoxifiers, especially in poultry and pig feeds.

Feed mills are incorporating clay-based adsorbents, yeast extracts, and microbial solutions that address a broad spectrum of toxins. The trend toward antibiotic-free meat production is also reinforcing the need for gut health protection via detoxification.

The USA feed detoxifier market is expected to grow at a CAGR of 5.5% during the forecast period, driven by heightened awareness of feed quality in large-scale animal production systems. Mycotoxin presence in stored grains, particularly corn and DDGS, is a major concern in Midwest states. Leading feed producers are deploying synthetic and organic solutions to neutralize toxins and maintain animal performance. The growing shift toward natural additives is also spurring demand for yeast and bentonite-based detoxifiers.

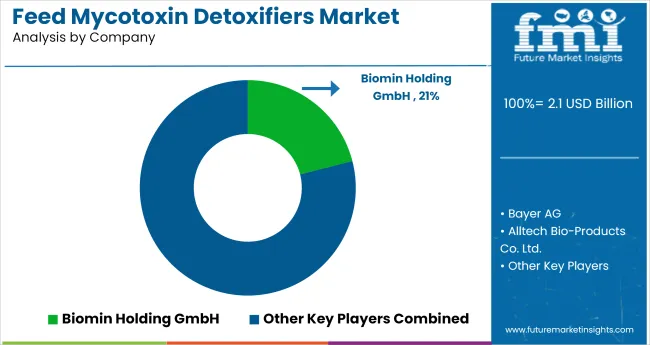

Biomin Holding GmbH leads the global mycotoxin detoxifier market with an estimated 21% share, driven by its patented Mycofix® technology and strong presence in Europe and Asia. Alltech captures around 18% of the market, with extensive adoption of its yeast-based binders in poultry and swine feed sectors across North America.

ADM leverages its integrated value chain to distribute over 20,000 MT of detoxifiers annually across global feed mills. Kemin Industries focuses on multi-functional toxin binders, contributing to its steady 9-10% market share. Impextraco and Amlan International remain key regional players, especially in Latin America and Southeast Asia. New entrants are emphasizing mineral-organic hybrids to address regulatory shifts and expanding contamination risks from climate volatility.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.1 billion |

| Projected Market Size (2035) | USD 3.8 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Types Analyzed (Segment 1) | Mycotoxin Binders, Clays, Bentonite, Mycotoxin Modifiers, Yeasts, Enzymes |

| End Uses Analyzed (Segment 2) | Aquaculture Operations, Integrators, Feed Manufacturers, Individual Farmers |

| Animal Types Analyzed (Segment 3) | Poultry, Ruminants, Swine, Pets, Aquaculture Species, Rodents, Others (Dogs, Cats, Horses) |

| Distribution Channels Analyzed (Segment 4) | Pharmacies & Drugstores, Health & Beauty Stores, Hypermarkets & Supermarkets, Direct Selling Networks, Online Platforms |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan & Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Biomin Holding GmbH, Bayer AG, Alltech Bio-Products Co. Ltd., Poortershaven Industrial Minerals BV, Archer Daniels Midland Company, Cenzone Tech Inc., Belgium Impextraco, Amlan International, Chr. Hansen Holding A/S, Kemin Industries Inc., Others |

| Additional Attributes | Dollar sales by type and animal species, increasing adoption of toxin-binding additives, regulatory focus on feed safety, and growing prevalence of fungal contaminants in livestock nutrition chains. |

The market is segmented by type into mycotoxin binders, clays, bentonite, mycotoxin modifiers, yeasts, and enzymes, each offering specific mechanisms to neutralize or adsorb toxins in animal feed.

End-use segmentation includes aquaculture operations, integrators, feed manufacturers, and individual farmers, reflecting diverse applications across commercial and independent production systems.

The market serves a wide range of species including poultry, ruminants, swine, pets, aquaculture species, rodents, and other animals such as dogs, cats, and horses.

Distribution occurs through pharmacies and drugstores, health and beauty stores, hypermarkets and supermarkets, direct selling networks, and online platforms.

Geographic analysis spans North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The market is valued at USD 2.1 billion in 2025.

The market is forecasted to reach USD 3.8 billion by 2035.

The market is expected to expand at a CAGR of 6.2% during the forecast period.

The aquaculture industry accounts for 26% of the market in 2025.

India is the fastest-growing country with a CAGR of 7.4% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Phytogenic Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA