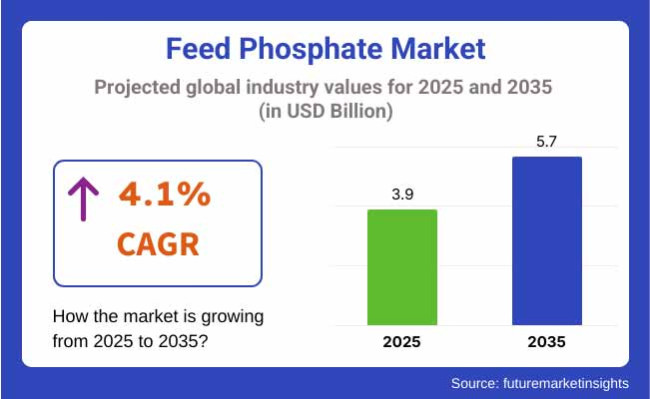

The global feed phosphate market is set to experience USD 3.9 billion in 2025. The industry is slated to depict 4.1% CAGR from 2025 to 2035, reaching USD 5.7 billion by 2035. Feed phosphates are integral to the growth of bone, digestion, and overall animal well-being. They are added mainly to poultry, swine, cattle, and aquaculture feeds.

To provide people with better meat and milk, farmers find it suitable to use phosphate supplementation, which is considered one of the best ways to improve bone health and metabolic and reproductive functions in animals. Also, the growing importance of precise nutrition and the special feed forms is pushing the demand for highly bioavailable phosphate sources.

Sustainability and environmental preservation are other factors changing the industry. Manufacturers have begun to produce feed phosphates from renewable sources and replace energy-intensive processes with technologies that are friendlier to the environments. The regulatory laws that urge the proper use of phosphate in animal feed also act as a push to the industry.

One of the advancements in product compounding is the embrace of purification techniques and the development of nano-phosphate formulations. On the other hand, the growth of phosphate reclamation and recycling projects is contributing to the decrease of traditional phosphate supply shortages along with long-term sustainability.

Nevertheless, the industry struggles with raw material price volatility, limitations in sodium and phosphate levels in feed mixtures due to regulations, and the threat of phosphate leaching to the soil and water ecosystems. In addition, added feed additives, e.g. organic acids and enzymes, could play a significant role in the evolution of the industry.

Even with those hindrances, still there are many chances of growth in the industry. The sales surge of functional feed additives, including phosphate, premixes, and specially blended products, is anticipated to push further development.

Funding for activities related to phosphate absorption research, and projects for reducing environmental impacts will boost innovations and, in this way, promote business growth. The industry is going to be steady because livestock and poultry industries have been continuing their focus on effective, eco-friendly feeding practices.

The global industry is expanding due to the rising demand for animal balanced diets and improved livestock production. Dicalcium phosphate and monocalcium phosphate are essential products that play a significant role in bone development, energy metabolism, and overall growth in poultry, cattle, and swine.

Swine and poultry operations are the biggest consumers as phosphorus supplementation is vital in the rate of growth and egg production. For aquaculture, good quality and digestible phosphates in feed have higher demands with an expansion in fish and shrimp farming.

Sustainability is guiding purchasing behaviour, and consumers want phosphates from environmentally sound mining and cost-optimized formulations to minimize phosphorus loss in manure. Besides, phosphate reserve concerns and volatile raw material prices are driving producers to innovate in terms of phosphate recovery and substitute feed additives.

The table below presents a comparative assessment of CAGR variation over six months for the base year (2024) and current year (2025) for the global industry. This analysis highlights key shifts in industry performance, providing stakeholders with a clearer vision of revenue realization patterns and growth trajectory over the year.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.1% |

| H2 (2024 to 2034) | 4.2% |

| H1 (2025 to 2035) | 4.3% |

| H2 (2025 to 2035) | 4.5% |

The above table presents the expected CAGR for the global demand space over the semi-annual period spanning from 2025 to 2035. In the first half (H1) of 2024, the industry is predicted to grow at a CAGR of 4.1%, followed by a slight increase to 4.2% in the second half (H2). Moving into 2025, the CAGR is projected to grow to 4.3% in the first half (H1) and continue its upward trend at 4.5% in the second half (H2).

The industry is experiencing stable growth, driven by rising demand for optimized livestock nutrition, increasing adoption of phosphate-enriched feed additives, and innovations in sustainable phosphate sourcing. The expansion of precision feeding techniques, enzyme-treated phosphate supplements, and microbial phytase formulations is further enhancing phosphate utilization efficiency.

Rising Demand for High-Performance Products in Poultry Nutrition

The poultry sector remains the largest consumer of products, with growing demand for high-performance poultry feed to enhance egg production, skeletal development, and overall bird health. The rising consumption of broiler meat and eggs, especially in Asia-Pacific and North America, has fueled the need for nutrient-rich phosphate-based feed formulations.

Products such as dicalcium phosphate (DCP) and monocalcium phosphate (MCP) are widely used to improve calcium absorption, optimize growth rates, and prevent skeletal deformities in poultry. Additionally, the growing preference for organic poultry farming has driven phosphate-based feed supplementation to replace synthetic additives.

The trend toward antibiotic-free animal nutrition is further boosting demand for phosphorus-rich feeds, ensuring better bone strength, immune function, and feed conversion efficiency in poultry farms. With increasing government regulations on feed ingredient quality and bioavailability, manufacturers are focusing on enhancing phosphate digestibility in poultry feed, leading to sustained growth in this segment.

Expanding Livestock Farming Driving Demand for Balanced Phosphate Nutrition

With global meat consumption steadily rising, livestock farmers are prioritizing balanced phosphate nutrition to ensure higher productivity and sustainability in cattle, swine, and ruminant farming. The dairy industry is witnessing high demand for products, as phosphorus supplementation plays a critical role in milk production, reproductive efficiency, and metabolic functions in dairy cattle.

Additionally, phosphorus-deficient diets in ruminants can lead to reduced fertility, lower weight gain, and compromised immune systems, prompting farmers to invest in optimized phosphate-based feed formulations. In the swine industry, products are essential for promoting growth, improving bone density, and enhancing muscle development, ensuring higher meat yield and better feed efficiency.

Moreover, the expansion of feedlot systems and intensive farming practices has led to increased demand for phosphate supplements to support efficient nutrient absorption and metabolic functions across different livestock categories. As feed manufacturers focus on sustainable phosphate sourcing and improved bioavailability, the industry is expected to witness continuous innovation and expansion in livestock nutrition solutions.

Sustainability Challenges Encouraging Innovation in Phosphate Feed Formulations

Environmental concerns related to phosphate mining, depletion of natural reserves, and phosphorus runoff into water bodies have prompted the feed industry to develop more sustainable phosphate feed formulations. Regulatory agencies such as the European Food Safety Authority (EFSA) and the USA Food and Drug Administration (FDA) have tightened restrictions on phosphate usage, driving the need for highly digestible and eco-friendly phosphate sources.

Innovations such as enzyme-treated phosphates, microbial phytase supplementation, and precision phosphate feeding strategies are gaining traction to minimize waste, reduce excess phosphorus excretion, and improve feed efficiency.

Additionally, alternative phosphate sources, such as recycled and synthetic phosphate compounds, are being explored to address supply chain constraints and cost fluctuations in natural phosphate reserves. As livestock farmers and feed manufacturers focus on reducing environmental impact while maintaining optimal animal nutrition, sustainable phosphate feed innovations will play a crucial role in shaping the future of the industry.

Between 2020 and 2024, the global industry followed a steady growth trend, driven primarily by the growth of the poultry and livestock industries, enhanced demand for quality animal nutrition, and policies promoted by governments in favor of maximum phosphate supplementation.

Growing world population and higher consumption of meat and dairy items encouraged feed manufacturers to develop more nutritionally concentrated formulas, which promoted better animal health, enhanced feed conversion ratios, and maximized performance. However, volatility in raw material supply, phosphate environmental concerns from runoff, and phosphate mining regulatory constraints impeded the industry during that period.

Forward to 2025 to 2035, the feed phosphate market is likely to pick up speed, driven by the progress of sustainable phosphate production, enhanced feed formulations, and innovations in livestock nutrition programs. The growing demand for precision feeding of livestock, coupled with the use of microbial phytase enzymes to increase phosphate digestibility, will fuel industry growth.

Besides this, increased development in aquaculture and awareness about phosphorus-deficient diets of ruminants will be adding to increasing phosphate consumption through various segments of livestock. Emerging technology and sustainable innovation in phosphate feed solutions will make the industry steadily increase its size, and efficiency in the supply chain as well as unconventional sources of phosphates will increasingly be in demand.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased usage of phosphates as animal feed additives to improve nutrition. | Increased focus on sustainable and alternative sources of phosphate. |

| Monocalcium and dicalcium phosphates dominate the industry share. | Migration toward precision-formulated blends of phosphate for enhanced animal well-being. |

| Phosphate emission regulations become tighter, causing efficiency improvements. | Adoption of low-emission and eco-friendly phosphate manufacturing technologies. |

| Livestock farming and aquaculture growth drive demand for phosphate. | Technological developments enable species-specific phosphate supplementation. |

| Increased R&D spending on improving phosphate digestibility. | Use of AI-driven nutrient optimization to reduce wastage of phosphate. |

The global industry is on the rise due to high-quality animal nutrition and the increase in livestock productivity. On the other hand, it is prone to certain risks such as stringent regulatory requirements concerning feed additives, phosphorus content, and environmental impact are difficult compliance barriers. Companies are required to conform to the new standards of the regulators so as to maintain their industry access and consumer confidence.

The increasing competition from organic and alternative mineral feed sources, and at the same time, the growing consumer preference for eco-friendly and non-GMO feed have a negative effect on the industry. To remain viable in the market place, producers should introduce innovative products, procure materials from sustainable sources, and practice openness in the production process so they can be in line with the changing industrial movement.

The environmental concerns associated with excess phosphorus runoff, polluted water, and Erosion of fertile soils have been the viewpoint that changed regulatory policies and due to that the industry had to change some of its practices. The corporations need to bring in the technologies that give efficient phosphorus utilization, make waste management plan, and follow the environmental sustainability standards to reduce both ecological impact and regulatory risks.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

| UK | 3.9% |

| France | 4.2% |

| Germany | 4.1% |

| Italy | 3.7% |

| South Korea | 4.5% |

| Japan | 3.6% |

| China | 5.2% |

| Australia | 4.0% |

| New Zealand | 3.8% |

The USA product demand is projected to witness strong growth with the expanding demand for high-performance feed additives in intensive livestock production. PLF technologies and automation are driving demand for phosphate-rich nutrition to record feed conversion ratios. The poultry as well as swine sectors are investing heavily in microbial phytase enzyme treatment to optimize the uptake of phosphate and reduce phosphorus runoff into the environment.

In addition, consumer demand in favor of organic and antibiotic-free livestock feed has prompted innovation in synthetically produced and environmentally friendly manufactured phosphate alternatives. Pressure from governments on phosphate resources has also encouraged the producers of feeds to seek recycled phosphorus sources as input for providing long-term sustainability to the chain.

Environmental regulations and sustainability efforts in the UK are driving the feed phosphate market. With the regulation of phosphorus runoffs on the horizon, producers are gravitating increasingly toward low-emission phosphate concentrates that enable optimized uptake and minimize losses.

The UK livestock farming sector's largest segment, dairy, has experienced an expansion in precision phosphate feeding programs to maximize milk production and enhance cattle metabolic well-being. Post-Brexit agricultural policies have also encouraged domestic production of phosphate feed solutions in the UK, avoiding supply chain weaknesses and enabling the country to pursue a farming industry with net-zero emissions.

France is still a major European user of products, particularly for beef and dairy farming. Emphasis on phosphorus-balanced feed formulations is growing as farmers seek to maximize milk yield and bone density in dairy cows. The beef industry is also experiencing increased use of highly digestible forms of phosphate to enhance feed conversion rates.

EU-funded sustainable approaches have also influenced the use of enzyme-treated phosphorus feed solutions, minimizing environmental effects. Precision livestock farming operations are increasing, and, as a result, value-added phosphate blends tailored to regional livestock nutritional requirements are being developed, optimizing supplementation without excess phosphorus waste.

Germany's industry is witnessing a transformation toward sustainability and efficiency in intensive livestock production. Improved feed formulations to optimize phosphorus have become the choice of Germany's dairy, poultry, and pig sectors.

With increasing pressure from the environment, German livestock producers are focusing on precision feeding techniques that make the best use of phosphates and minimize phosphorus buildup in soils. Regulatory conditions requiring the regulation of environmentally friendly agriculture practices have seen increasing investment in microbial and synthetic alternative phosphates and the promotion of environmental compliance and productivity improvements for livestock farmers.

Italy's livestock farming industry is marked by increasing demand for specialty phosphate feed options based on ruminant and monogastric nutrition. Demands lead to phosphate demand from the dairy and poultry sectors, and farmers are highly concerned about feed efficiency and mineral consumption.

The government's initiative toward sustainable farming has driven high utilization of organic sources of phosphate and phosphorus feed on the basis of enzymes. Being one of the major manufacturers of premium dairy products, it is crucial to maintain the best levels of phosphorus consumption in milk-producing animals, thereby impacting the creation of new phosphate formulations for feed.

South Korea's feed phosphate market is expanding because of its intensive poultry and pig production industries, which demand high-performance mineral supplements. The transition toward precision feeding culture has motivated the use of phosphate products that boost nutrient assimilation and minimize loss.

Ecological factors have instigated demands for environmentally friendly sources of phosphates, especially to address government stipulations regarding agri-greenhouse emissions. Also, innovation in feeding technologies among livestock is supporting the production of phosphate-added animal feeds that promote growth while staying within farmer costs.

Japanese business is improving with an emphasis on increasing feed efficiency and sustainability in otherwise declining livestock business. Land limitation is halting livestock growth, but farmers are maximizing phosphate use with high-capture feeds.

Reducing the wastage of phosphate has ensured greater dependence on enzyme-treated as well as artificial sources of phosphate. Besides, the Japanese dairy industry is looking for sophisticated feed phosphate solutions for rising milk output and meeting national sustainability targets. The growing need for quality, high-protein livestock products has also encouraged developments in phosphate feed additives.

China's phosphate feed market is growing strongly behind the nation's developing meat-producing industry, which is led by poultry and pig production. Producers are increasingly calling for high-performance phosphate feed solutions in an effort to maximize feed conversion levels and livestock yields.

Policy incentives for sustainable livestock nutrition have led investors to spend more money on microbial and synthetic alternative phosphates. The trend towards intensive commercial farming has also increased the utilization of precision-formulated phosphate feeds, where maximum phosphorus assimilation is ensured and smaller environmental signatures.

The Australian industry is witnessing consistent growth, and the nation boasts enormous beef and dairy sectors. With a strong emphasis on environmentally friendly grazing management systems, Australian farmers are supplementing phosphate-bearing minerals to support enhanced animal welfare and production.

The increased use of precision livestock farming technology is generating increased demand for customized phosphate feed solutions. In addition, legislative frameworks supporting low-phosphorus runoff practices have encouraged the utilization of environmentally friendly phosphate feed formulations to meet the country's long-term sustainability objectives.

New Zealand's dairy-led agricultural sector is primarily responsible for its feed phosphate industry. Being a top global dairy exporter, phosphorus optimization in animal nutrition has been of significant interest to the nation in order to maximize milk and reproductive performance.

The move towards grazing-based feeding systems necessitates strategic phosphate supplementation to ensure adequate nutrient balancing. With tightening environmental controls, the feed industry is seeking sustainable sources of phosphate that provide efficient phosphorus uptake without ecological damage. As precision feeding techniques gain popularity, the creation of specialty phosphate feed solutions will further propel the industry in New Zealand.

High Demand for Dicalcium Phosphate in Livestock and Poultry Nutrition

| Segment | Value Share (2025) |

|---|---|

| Dicalcium Phosphate (Type) | 42.6% |

In terms of various types of phosphate-based products, Dicalcium Phosphate (DCP) is expected to dominate the global marketplace with a value share of 42.6% in 2025. Its market-leading position is attributed, in large part, to its widespread use in animal feed supplements that are commonly used as two important sources of calcium and phosphorus, which are two essential nutrients for the healthy growth, bone health, and productivity of livestock used in fertilizers to improve the fertility of the soil.

Top producers like Nutrien Ltd., Mosaic Company, and OCP Group ship DCP in bulk to regions with high demand, like Asia-Pacific and Latin America, where livestock farming is on the upswing. The industry share of Ammonium Phosphate - including Monoammonium Phosphate (MAP) and diammonium Phosphate (DAP) - is 21.3%, which is used in agricultural fertilizers owing to its high nitrogen and phosphorus content.

These fertilizers are indispensable for increasing farm output and encouraging intensive farming. Ammonium phosphate is one of the most common fertilizers used in bulk agriculture in most countries like India, China, the USA, etc. Companies active in the production segment include players like CF Industries and Yara International, which lead progress in ammonium phosphate innovations such as sustainable fertilization and the halving of ammonium phosphate use per ton crop produced.

The robust demand for DCP and ammonium phosphate, primarily driven by the rising importance of food security, livestock nutrition, and sustainable agriculture, will further secure their positions as the leading players in the global phosphate industry.

Poultry Sector Dominates Feed Phosphate Market Due to High Demand

| Segment | Value Share (2025) |

|---|---|

| Poultry (Livestock) | 41.2% |

The phosphate market is categorized based on livestock into Poultry, Cattle, Aquaculture, Swine, and Pet. Poultry is the most lucrative end-use segment in the global phosphate industry, accounting for more than 41.2% value share in 2025.

This segment accounted for the largest share of the industry owing to the fastest growth of commercial poultry farming, especially in the Asia-Pacific and Latin America regions, due to high demand for the protein diet and improved feed conversion efficiency.

The use of phosphates, primarily Dicalcium Phosphate (DCP) and Monocalcium Phosphate (MCP), in poultry feed formulations is vital for promoting bone development, egg production, and growth performance. Major feed millers like Cargill, ADM, and Nutreco use a large amount of phosphoric acid also as an additive crucial to achieving nutritional expectations that lead to good, efficient production.

The second-largest segment is represented by cattle, which is projected to have a 24.6% market share in 2025. Phosphates are similarly essential for ruminant digestion, reproductive health, and milk yield in cattle feed. DCP continues to be the phosphate type of choice in this segment based on its high bioavailability and cost-effectiveness.

This growth in dairy farming explains the high demand for phosphate, especially in North America and Europe, and for beef production. Phosphea and EuroChem are among those investing in customized phosphate solutions for cattle, including defluorinated phosphates for improved digestive safety and nutritional balance.

Due to specialization, increasing livestock production, and the adoption of sustainable animal nutrition, animals such as poultry and cattle account for the majority of industry consumption globally in high-quality phosphate feed additives.

Major industries such as The Mosaic Company, OCP Group, PhosAgro, EuroChem, and Yara International are well-established in global production, supply, and distribution. They aim to maintain their competitive advantage by ensuring product consistency, optimizing phosphate formulations, as well as securing raw material sources.

The industry development increases due to the rising demand for meat and dairy products consumption, making livestock farming more efficient and bringing solutions to the growing public awareness about phosphorus runoff consequences on the environment. Due to the restrictions that are becoming more stringent, companies today invest more in green extraction techniques and sustainable phosphate sources.

Major strategy aspects involve mergers and acquisitions to strengthen their industry position, partnerships with livestock producers on customized nutrition solutions, and capitalizing on technological advancement in phosphate processing. Furthermore, companies are also making efforts by innovating new inventions, such as precision feeding solutions or improved bioavailability formulations, showing how firms are differentiating their offerings in a highly competitive industry.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| The Mosaic Company | 20-24% |

| OCP Group | 15-19% |

| PhosAgro | 12-16% |

| EuroChem | 10-14% |

| Yara International | 8-12% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings & Activities |

|---|---|

| The Mosaic Company | Leading producer of products, including mono and dicalcium phosphate, with a high emphasis placed on sustainable mining as well as supply chain optimization. |

| OCP Group | The principal supplier of phosphate-based products with vertically integrated operations to ensure cost-effectiveness and product availability. |

| PhosAgro | Expert in high-purity products sourced from low-cadmium phosphate rock, meeting stringent quality as well as safety levels. |

| EuroChem | Provides a diversified array of phosphate-based feed ingredients underpinned by a strong global distribution network. |

| Yara International | Emphasizes sustainable and innovative phosphate solutions, such as improved feed formulations, to maximize animal nutrition and environmental footprint. |

Key Company Insights

The Mosaic Company (20-24%)

Mosaic has sustainable phosphate mining and optimization of the global supply chain as its two planks of availability and quality, thereby becoming the industry leader in feed phosphates.

OCP Group (15-19%)

OCP Group enjoys significant advantages as it has phosphate mining and production entirely vertically integrated, providing economical and high-quality phosphate-based feed solutions.

PhosAgro (12-16%)

PhosAgro is known for high-purity, low-cadmium products that are marketed to global customers with stringent regulatory requirements regarding feed safety.

EuroChem (10-14%)

EuroChem globally leverages its production and distribution strength to provide a whole range of phosphate-based feed ingredients at an increasing rate as demanded.

Yara International (8-12%)

Yara is committed to sustainability and innovation in phosphate nutrition, creating solutions to enhance feed efficiency while reducing the environmental footprint.

Other Key Players

The industry is segmented into Monocalcium Phosphate, Tricalcium Phosphate, Dicalcium Phosphate, Ammonium Phosphate, and Defluorinated Phosphate.

The industry is segmented into poultry, cattle, aquaculture, swine, and pet.

The industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The industry is slated to reach USD 3.9 billion in 2025.

The industry is predicted to reach a size of USD 5.7 billion by 2035.

Key companies include The Mosaic Company, OCP Group, PhosAgro, EuroChem, Yara International, PotashCorp, WengFu Group Co., Ltd., FOSFITALIA GROUP, Malaysian Phosphate, Rotem Turkey, and Lifosa.

China, slated to grow at 5.2% CAGR during the forecast period, is poised for the fastest growth.

Dicalcium Phosphate is among the most widely used types.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Livestock, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Livestock, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Livestock, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 22: Europe Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 24: Europe Market Volume (Tons) Forecast by Livestock, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Asia Pacific Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 30: Asia Pacific Market Volume (Tons) Forecast by Livestock, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: MEA Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 36: MEA Market Volume (Tons) Forecast by Livestock, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Livestock, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by Livestock, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Livestock, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by Livestock, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Livestock, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Livestock, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 63: Europe Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 67: Europe Market Volume (Tons) Analysis by Livestock, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Europe Market Attractiveness by Livestock, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Tons) Analysis by Livestock, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Livestock, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 99: MEA Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 103: MEA Market Volume (Tons) Analysis by Livestock, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 106: MEA Market Attractiveness by Product, 2023 to 2033

Figure 107: MEA Market Attractiveness by Livestock, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Phosphated Ester Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Phosphate Salts Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA