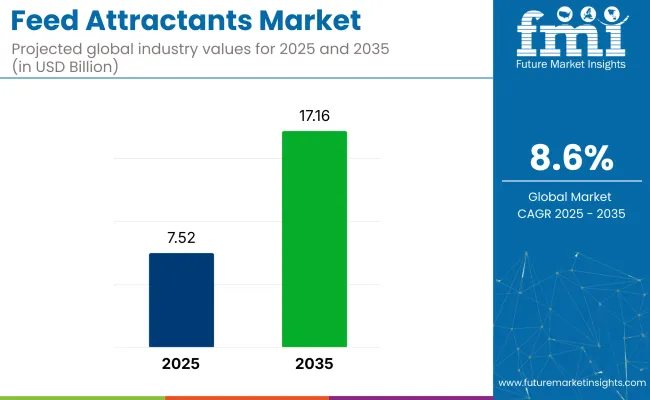

Feed attractants revenue is expected to climb from USD 7.52 billion in 2025 to USD 17.16 billion by 2035, corresponding to an 8.6% CAGR across the period.

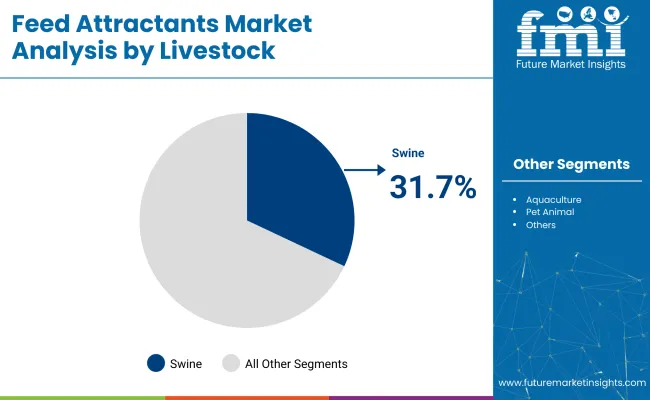

Demand has been driven by the pursuit of higher feed‐conversion efficiency and palatability improvement in intensive production systems. Swine dietsareprojected to hold 31.7% share in 2025 and have relied on refined flavor-enhancing compounds to counter weaning stress and preserve growth rates under antibiotic-reduction mandates.

Organic compounds are anticipated to command 45% share, their inclusion being favoured for recognised safety profiles, uniform dispersion, and broad compatibility with amino-acid matrices.

Bulk packaging is expected to retain 54.2% share, reflecting volume movement through compound-feed manufacturers. Retail sales are projected to account for 40% of distribution, supported by small-holder and game-management demand for farm-store pack sizes.

Production is scaled through modular spray-drying and encapsulation lines capable of delivering uniform particle sizes for premix integration. Formulation flexibility has been maintained by blending carbohydrate carriers with organic acids, nucleotides, and botanical extracts, ensuring target flavour profiles without compromising nutrient density. Constant developments keep the industry active.

Phileo by Lesaffre launched its Aquasaf Shrimpprogramme in April 2024, bundling yeast probiotics, postbiotics and attractant peptides with on-farm guidance; three pillars target gut integrity, immune resilience and fishmeal substitution, ensuring feed intake and profitability amid intensifying Asian shrimp production and exports.

The feed attractants market holds specific shares within its parent markets. In the animal feed additives market, it accounts for around 4-6%, as attractants are a key part of the additives used to enhance feed consumption. Within the animal nutrition market, the share is approximately 3-5%, driven by the need for products that improve animal feed intake and digestion. In the livestock farming market, feed attractants contribute about 2-4%, optimizing feed efficiency and performance.

The aquaculture feed market holds a share of 5-7%, with attractants being crucial for enhancing the palatability of aquatic animal feeds. The pet food market contributes around 4-6%, as attractants are used for improving the appeal of pet food.

Investment across 2025 targets swine-specific attractants, bulk packaging formats, organic compound blends, behavior-modification functionalities, and retail-oriented distribution. Each focus area supports precise intake control, efficient freight handling, residue-free labeling, feed-conversion optimization, and small-holder accessibility across global livestock production networks.

Swine formulations hold 31.7% share, as nursery and grow-finish diets require reliable intake stimulation under confined housing conditions.

A 54.2% share has been possessed by bulk packaging in 2025, owing to mill-direct deliveries benefit from reduced unit costs and streamlined material handling at large integrator sites.

A share of 45% is accounted for by organic compound attractants in 2025, as synthetic-free declarations satisfy retailer audits and export certificates in antibiotic-reduction programs

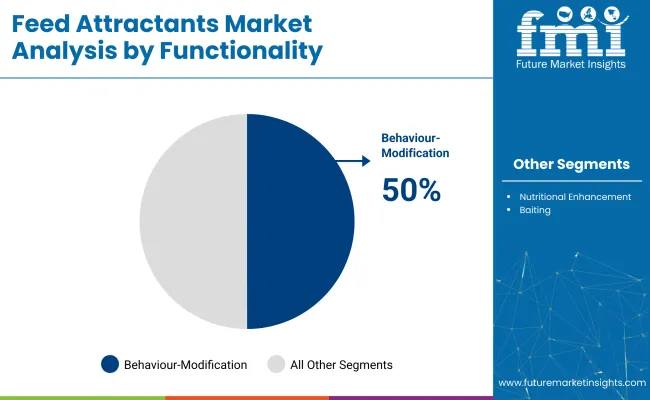

A 50% share has been held by behavior-modification attractants in 2025, reflecting their role in stabilizing feeding patterns and mitigating social stress within intensive production systems.

Retail sales account for a 40% sharein 2025, as cooperative stores and veterinary outlets source attractants in convenient pack sizes for backyard and niche producers

The shift toward antibiotic-free animal diets has intensified feed attractant usage, especially in aquaculture and swine. At the same time, volatile raw material sourcing and inconsistent compound standardization are restricting consistent formulation outcomes across commercial feed operations.

Antibiotic-Free Protocols Accelerating Attractant Inclusion Rates

Regulatory bans on antibiotic growth promoters in the EU, South Korea, and Vietnam have driven the integration of feed attractants to maintain intake and feed conversion ratios. Fishmeal substitutes in aquaculture have lowered palatability, making marine peptide-based attractants necessary in shrimp and tilapia feed. Swine starter diets now incorporate nucleotides, glutamate salts, and yeast extracts to preserve early-stage appetite. Compound feed mills in Thailand and Spain have partnered with ingredient providers like Nutriad and Phodé to standardize attractant blends by species and life stage. Intake trials are now embedded in pre-launch protocols to validate efficacy against conventional antibiotic regimes.

Standardization Gaps Undermining Performance in Large-Scale Operations

Feed attractant efficacy often varies due to inconsistent raw input quality, especially in natural-origin compounds like fish hydrolysates or yeast extracts. Variability in peptide profile, salt content, and fermentation residue creates batch inconsistency across geographies. Poultry and ruminant feed formulators in India and Brazil report fluctuations in daily feed intake linked to seasonal shifts in attractant performance. Without global standards for attractant classification or potency benchmarks, integrators struggle to lock consistent inclusion rates. Performance predictability is a barrier to scale-up beyond pilot-stage use.

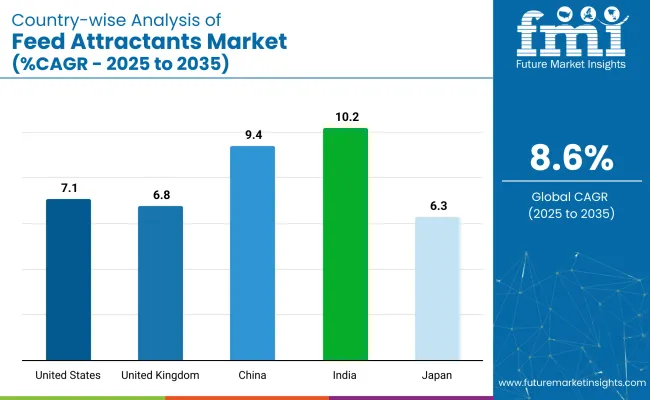

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025-2035) |

|---|---|

| United States | 7.1 % |

| United Kingdom | 6.8 % |

| China | 9.4 % |

| Japan | 6.3 % |

| India | 10.2 % |

The demand for feed attractants is expected to rise at an 8.5 % CAGR from 2025 to 2035. Among five profiled markets, India leads at 10.2 %, China follows at 9.4 %, and the United States reaches 7.1 %; the United Kingdom logs 6.8 % and Japan 6.3 %. These figures translate a +20 % premium for India and +11 % for China versus baseline, while the United States, United Kingdom, and Japan trail by –16 %, –20 %, and –26 %. Catalysts differ: shrimp-feed enhancers lift India’s BRICS growth; China gains from swine-herd rebuilding and umami additives; OECD United States relies on pet-food lines; the United Kingdom sees limited herd expansion; Japan’s aqua flavours inch ahead amid meat output.

India is forecasted to witness robust growth in the feed attractants market, with a CAGR of 10.2% through 2035. India’s feed attractants demand has intensified as compounders reformulate around oilseed cakes and protein extenders. Aquaculture feed usage has surged due to state-backed inland fisheries missions, prompting higher inclusion of krill extracts and fermented yeast blends in carp and prawn diets. Poultry producers are adopting attractants to offset variability in broken rice and corn digestibility. Regulatory mandates now require proper labeling of feed ingredients, indirectly supporting branded attractant suppliers. Buyer preference is shifting toward organoleptic enhancers that deliver consistent intake in small ruminants and backyard poultry flocks.

China’s feed attractants market is projected to grow at an impressive 9.4% CAGR between 2025 and 2035. In China, flavor modulator adoption is increasing as compounders replace synthetic amino acids with enzymatically hydrolyzed protein sources. Attractants have become a default input in shrimp, eel, and tilapia feeds, especially in recirculating aquaculture systems. Pig integrators are incorporating proprietary scent compounds to combat stress-related feed refusal during post-weaning transitions. Since the phase-out of in-feed antibiotics, the sector has seen a shift toward palatability enhancers for both health maintenance and conversion efficiency.

A CAGR of 7.1% is expected for the feed attractants market in the United States between 2025 and 2035. The United States feed sector is utilizing attractants to support formula optimization under volatile corn and soy pricing. Flavoring agents are integrated across dairy, poultry, and swine diets, especially where producers are limiting protein to meet nutrient-excretion regulations. Ruminant premixes often feature molasses or vanilla derivatives to improve intake of urea-based blends. Pet food manufacturers are also leveraging meat-digest palatants to differentiate in a competitive companion animal nutrition landscape.

A growth rate of 6.8% CAGR is anticipated for the feed attractants market in the United Kingdom between 2025 and 2035. The United Kingdom’s feed manufacturers are aligning attractant usage with shifts in ingredient sourcing and animal welfare compliance. As synthetic amino acid imports tighten, feed formulators are leaning on attractants to balance palatability across rapeseed-based diets. Pig producers are experimenting with attractant-infused creep feeds for neonatal acceptance. In monogastric sectors, specific blends are being deployed to improve intake consistency during heat stress and seasonal transitions.

The feed attractants market in Japan is projected to expand at a rate of 6.3% CAGR over the forecast period. Japan’s aquaculture-centered feed market has incorporated attractants as standard in pellet and microencapsulated feeds. Producers of yellowtail and sea bream have increased usage of krill and squid extract blends to ensure feed acceptance in temperature-sensitive recirculating systems. As fisheries reform limits marine resource access, attractants are supporting transition to plant-protein-based diets. High-end feed processors are formulating palatant-infused lines for export-oriented hatcheries focused on quality certification and reduced feed conversion ratios.

The industry has a high competition, with leading players like Monster Meal, Tucker Milling, and Innovad focusing on developing specialized products that enhance the appeal and nutritional value of animal feed. Kemin Industries and Darling Ingredients leverage their strong research and development capabilities to introduce innovative feed attractants that meet the needs of various livestock. Companies like Adisseo and BigTine focus on regional growth, offering tailored solutions for specific animal types or markets. Smaller players like Attrax and Boarmasters differentiate themselves by focusing on niche segments. The market remains fragmented, with both large firms and smaller, specialized companies competing on product innovation, regional presence, and customer-specific solutions.

Recent Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Market Value (2025) | USD 7.52 billion |

| Projected Market Value (2035) | USD 17.16 billion |

| CAGR (2025 to 2035) | 8.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Composition | Organic compounds (amino acids, fatty acids, carbohydrates), Inorganic compounds (mineral salts, acidifiers, pH modifiers), Bio-additives (enzymes, probiotics, prebiotics), others |

| Functionality | Behavior modification (feeding, breeding), Nutritional enhancement (growth, health stimulants), Baiting |

| Livestock | Ruminant, Poultry, Swine, Aquaculture, Pet animal, Others |

| Sales Channel | Retail sales, Wholesale, Industrial sales, Online sales |

| Packaging Type | Bulk packaging, Retail packaging, Customized packaging |

| Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Monster Meal, Tucker Milling, Innovad , 4S Advanced Wildlife Solutions, Double Down Deer Feed, Merton Feed Company, LLC, Standley Feed and Seed, Attrax , Boarmasters , BigTine , PVS Laboratories Limited, Advance Aqua Biotechnologies India, Kemin Industries, Inc., Darling Ingredients, Adisseo , Chongqing Mintai New Agrotech Development Group Co., Ltd. |

| Additional Attributes | Dollar sales, CAGR trends, product type distribution, size preferences, absorbency level demand, price range segmentation, competitor dollar sales & market share, regional growth patterns |

The segmentation is into organic compounds (amino acids, fatty acids, carbohydrates, and others), inorganic compounds (mineral salts, acidifiers, and pH modifiers), bio-additives (enzymes, probiotics, and prebiotics), and others.

The segmentation is into behavior modification (feeding behavior, and breeding behavior), nutritional enhancement (growth stimulants, and health stimulants), and baiting.

The segmentation is into ruminant, poultry, swine, aquaculture, pet animal, and others.

The segmentation is into retail sales, wholesale, industrial sales, and online sales.

The segmentation is into bulk packaging, retail packaging, and customized packaging.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The projected market value of the feed attractants market in 2025 is USD 7.52 billion.

The forecast market value of the feed attractants market by 2035 is USD 17.16 billion.

The expected CAGR for the feed attractants market from 2025 to 2035 is 8.6%.

Behaviour-modification functionality will lead the feed attractants market in 2035, with a 50% share.

India is expected to experience the highest growth in the industry, with a CAGR 10.2%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Phytogenic Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Encapsulation Market Analysis- Size, Growth, and Forecast 2025 to 2035

Feed Grain Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Barley Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Feed Amino Acids Market Analysis by Product, Application, and Region through 2035

Feed Phosphate Market Analysis by Product, Livestock, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA