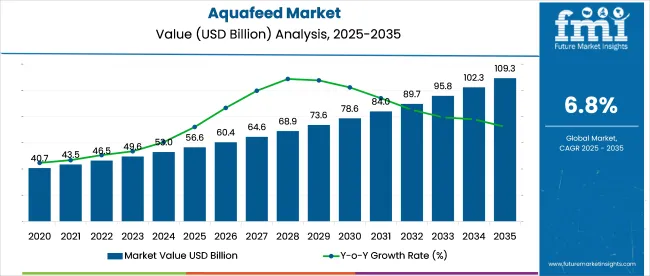

The aquafeed market is expected to reach USD 56.6 billion in 2025 and USD 109.2 billion by 2035. This market is expected to grow at a CAGR of 6.8% during the forecast period.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 56.6 billion |

| Projected Industry Value (2035F) | USD 109.2 billion |

| CAGR (2025 to 2035) | 6.8% |

This steady growth reflects a consistent expansion of commercial aquaculture operations, particularly in Asia-Pacific, where over 70% of the world’s aquaculture volume originates. The integration of functional additives, enhanced feed conversion ratios, and disease control formulations is influencing expenditure on specialized feed inputs.

The industry accounted for 15.2% of the global animal feed market, valued at USD 308 billion in 2025. Within the animal nutrition market, its share stands at 18.4%, reflecting its importance in high-efficiency protein production systems. In the aquaculture industry, aquafeed represents over 45% of total operational input costs, making it the most significant expenditure in farmed seafood value chains.

It contributes about 21.6% to the compound feed market, which includes poultry, swine, and ruminant feed. In the livestock feed additives market, its share is limited to around 12.3%, as aquatic species require more tailored additives. These proportions highlight the product’s critical but varying role across interconnected feed and animal production ecosystems.

The annual feed demand is being driven by intensified aquaculture in China, India, Vietnam, and Indonesia, together accounting for more than 65% of global aquaculture production by volume between 2020 and 2025. China alone contributes over one-third of the total output.

Rising demand for seafood from domestic and export markets has led to increased stocking densities and shorter production cycles, increasing feed consumption per unit of aquaculture output. Government subsidies in countries like India and Vietnam have also supported compound feed adoption by small and mid-scale farmers. In Europe and North America, feed is leaning toward precision-nutrition and probiotic-laden formulations, aiming to reduce antibiotic use and improve environmental outcomes.

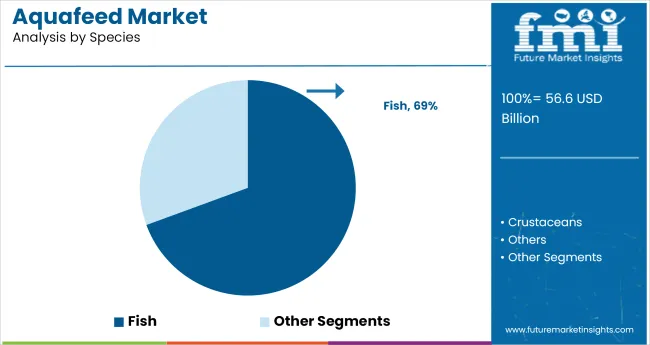

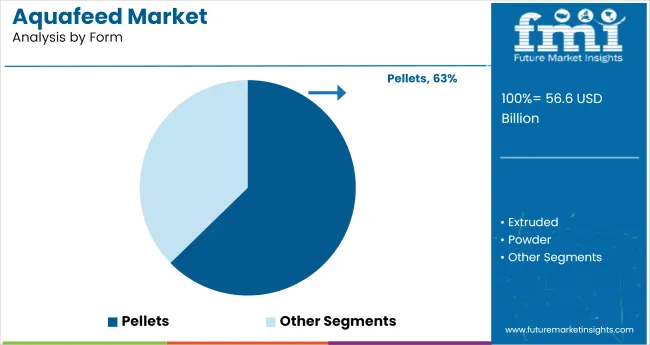

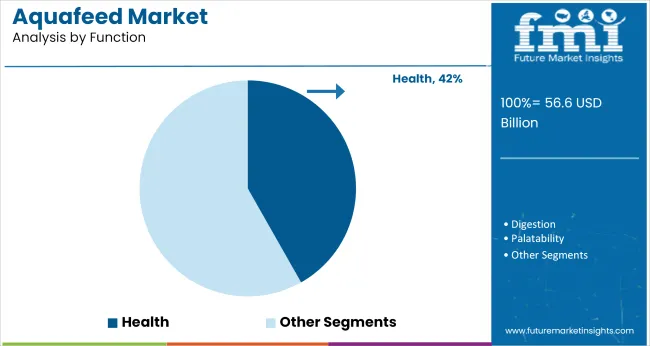

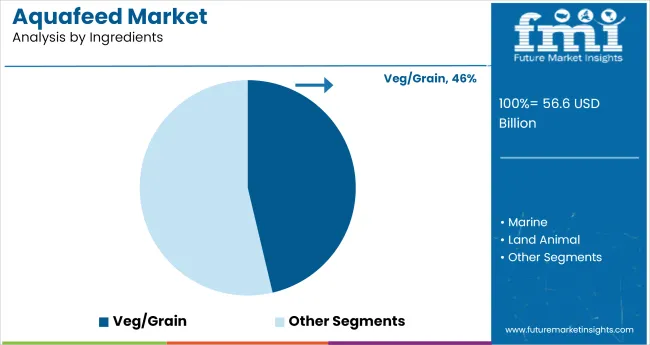

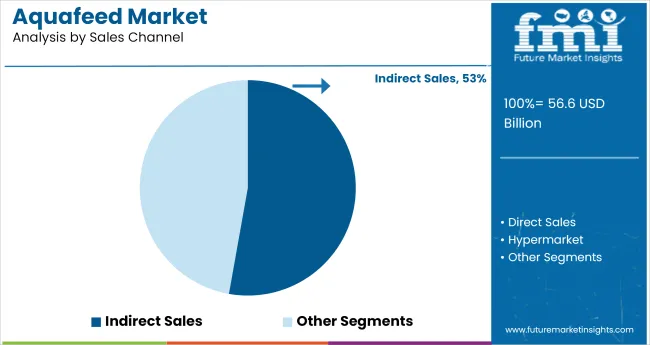

The aquafeed market in 2025 is led by the fish segment with a 69.4% share, pellet form at 62.7%, and health-focused formulations at 41.8%. Vegetable and grain-based ingredients dominate at 46.3%, while indirect sales channels account for 52.8%, driven by distributor networks in Asia and Africa.

The fish segment dominates the aquafeed market by species, accounting for 69.4% of the total revenue share in 2025. This dominance is attributed to the intensive farming of species such as tilapia, salmon, carp, and catfish across high-volume regions like China, India, Norway, and Chile.

The pellets segment is projected to lead the aquafeed market by form, capturing 62.7% of total revenue share in 2025.

Health-focused aquafeed formulations are projected to lead by function, accounting for 41.8% of total revenue share in 2025. This dominance is driven by escalating disease pressures in intensive aquaculture systems, where pathogens like Vibrio, Streptococcus, and parasitic infestations cause significant yield losses.

Vegetable and grain-based ingredients are projected to dominate aquafeed composition, accounting for 46.3% of total revenue share in 2025. This leadership stems from the global shift toward cost-effective and scalable protein and energy sources in commercial feed.

Indirect sales are projected to account for 52.8% of total aquafeed revenue in 2025, making them the most dominant distribution channel in the industry. This model relies heavily on a multilayered network of regional distributors, sub-dealers, and feed agents, especially across fragmented aquaculture markets in Asia and Africa.

Aquafeed producers are focusing on health-enhancing formulations to reduce antibiotic use and manage disease risks in intensive farming systems. Rising marine input costs are accelerating the shift to plant-based feed ingredients to ensure price stability and expand access for mid-scale producers.

Surge in Health-Driven Feed and Disease Management Pressures

A shift in aquafeed formulation priorities is underway as producers respond to disease outbreaks, rising mortality rates, and increasing scrutiny of antibiotic residues in farmed seafood. Health-oriented feeds are being adopted widely in intensive systems, particularly in OECD and BRICS nations, where fish farms operate under tighter biosecurity norms and are under pressure to transition toward antibiotic-free protocols.

Feed fortified with functional additives such as beta-glucans, nucleotides, and organic acids is enabling higher survival rates and shorter production cycles. Recirculating aquaculture systems (RAS) and offshore cage farms, where pathogen load management is critical, have become key users of these formulations.

Cost Rationalization Spurs Adoption of Plant-Based Feed Inputs

The industry is undergoing a feedstock transition as producers seek pricing stability and long-term input security amid marine resource constraints. Volatility in fishmeal and fish oil markets, driven by quota restrictions, ocean temperature shifts, and overfishing, has pushed manufacturers to favor plant-based inputs like soybean meal, corn gluten, and wheat bran.

These ingredients now form the base for most commercial feeds targeting omnivorous species such as tilapia, pangasius, and carp. Region-specific sourcing in India, China, and Brazil has enabled localized supply chains, reduced transport costs, and preserved margins for feed millers. While carnivorous species still require partial marine inputs, ongoing enzyme and amino acid enhancements are improving the performance of grain-based formulations.

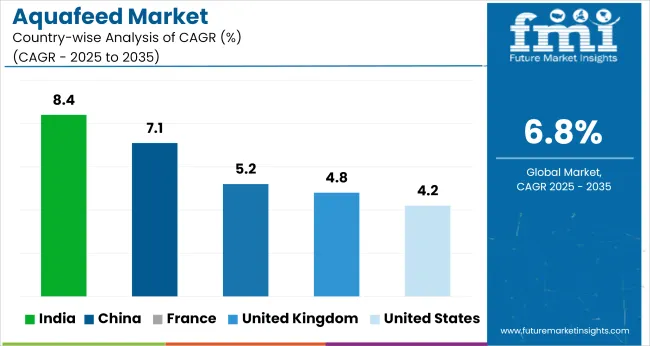

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

| United Kingdom | 4.8% |

| France | 5.2% |

| China | 7.1% |

| India | 8.4% |

The global aquafeed market is forecast to grow at a 6.8% CAGR between 2025 and 2035, with pronounced differences across economic blocs. China, a BRICS economy, leads with a CAGR of 8.2%, driven by integrated aquaculture hubs and rising demand for high-protein compound feed in tilapia and shrimp production.

India follows at 7.9%, supported by surging pangasius farming, coastal feed mill expansion, and government support for exports. Both countries benefit from localized feed formulation using oilseed cakes and crop residues, lowering cost-to-output ratios.

ASEAN nations such as Vietnam and Thailand record growth near 7.2%, driven by feed demand in shrimp and catfish exports, with steady investment in extrusion and pelletization capacity. OECD countries like Norway and Chile show slower growth at 5.1% and 4.8%, respectively, constrained by regulatory pressure on fishmeal inclusion and environmental caps on aquaculture density. This contrast reflects how emerging regions are scaling faster through volume, while mature markets navigate ecological limits.

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The USA aquafeed market is valued at a 4.2% CAGR between 2025 and 2035.This growth rate reflects the maturity of aquaculture infrastructure and the slower but steady expansion of inland aquafarming in the Pacific Northwest and Gulf Coast regions.

Though the country trails Asia in aquaculture volume, increased demand for locally farmed trout, catfish, and hybrid striped bass is pushing feed manufacturers to innovate with species-specific formulations. The growing push for antibiotic-free labeling and USDA traceability requirements is accelerating the shift toward health-oriented products.

Regulatory scrutiny from the FDA and consumer preferences for domestic seafood have incentivized recirculating aquaculture systems (RAS), which depend on precise feed control. USA feed companies are also investing in insect-based proteins and fermentation-derived inputs to lower their dependence on imported marine ingredients, offering greater resilience against price shocks.

The aquafeed market in the United Kingdom is expected to register a 4.8% CAGR from 2025 to 2035.Growth is being steered by continued investments in salmon aquaculture in Scotland and a rising emphasis on feed traceability across Europe. Stringent environmental standards have prompted producers to adopt low-phosphorus, high-efficiency feeds that reduce nutrient discharge.

The trend toward plant-based seafood substitutes has also influenced product demand indirectly, as integrated players seek diversified feedstock that aligns with ESG disclosures. Local manufacturers are increasingly collaborating with Nordic firms to incorporate omega-3-rich algae and single-cell proteins into mainstream feed.

Brexit-related trade realignments have also incentivized more domestic sourcing of feed ingredients, pushing investments in rapeseed meal and locally processed wheat gluten. Feed trials are underway to reduce reliance on imported fishmeal from Peru and West Africa, enhancing long-term and supply security.

France’s aquafeed market is projected to grow at a 5.2% CAGR through 2035.France’s expanding trout, carp, and hybrid catfish production is stimulating demand for nutritionally dense, region-specific products. Feed companies are leveraging EU Horizon-funded grants to develop insect-based formulations and heat-resistant amino acid complexes tailored to continental farming conditions.

The French government’s 2030 “Plan for Aquaculture” includes feed traceability mandates and performance-linked subsidies, which are encouraging upgrades in feed composition and supplier infrastructure. Consumer awareness around food safety has led to increased adoption of antibiotic-free and organic feed types, particularly among artisanal farmers in southern and central France.

The country’s historical reliance on fishmeal is slowly declining as producers blend domestic wheat, peas, and faba beans into custom feed formulations. Collaborations with feed cooperatives in Belgium and Germany are also boosting regional availability of high-efficiency pellets and precision feeding tools.

China’s aquafeed market is expected to grow at a 7.1% CAGR between 2025 and 2035.This outpaces the global average of 6.8%, driven by China’s dominant aquaculture sector and the expansion of high-value species farming. China’s inland provinces continue to lead tilapia, carp, and catfish production, while coastal regions are scaling marine finfish and shrimp operations using semi-intensive and intensive models.

The demand is being further propelled by the government's modernization drive under its "Green Aquaculture Plan," which includes targeted subsidies for low-pollution and enzyme-fortified feeds. As consumer demand shifts toward quality-certified, traceable seafood, large-scale producers are investing in automation, precision feeding, and feed conversion optimization.

Domestic feed companies are now blending soy protein concentrate, DDGS, and wheat bran with additives like probiotics, phytogenics, and organic minerals. China's Belt and Road-linked trade corridors are also expanding the export potential of locally produced feed to Southeast Asia and Africa.

India’s aquafeed market is projected to grow at an 8.4% CAGR during 2025 to 2035.As the fastest-growing among major markets, India’s expansion is anchored in vannamei shrimp and inland fish farming across Andhra Pradesh, Tamil Nadu, and West Bengal. The government’s PMMSY scheme has funneled investment into hatcheries, feed mills, and cold-chain infrastructure, spurring downstream feed demand.

Shrimp exports, accounting for over 70% of India’s aquaculture revenue, require biosecure, antibiotic-free feed to meet standards in the USA and EU markets. Domestic feed manufacturers are introducing immune-enhancing formulations and expanding production of floating and sinking pellets tailored for regional conditions.

Access to low-cost soybean, maize, and rice bran in central and eastern India is enabling competitive pricing. Strategic partnerships with Vietnamese and Thai integrators are also influencing feed standardization and distribution practices in key coastal clusters.

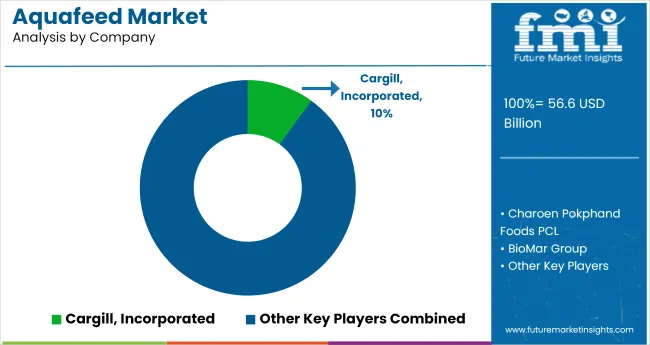

The aquafeed sector, leading companies are scaling operations through formulation, feedstock localization, and strategic vertical integration. Global producers like Cargill, BioMar, and Skretting are investing in enzyme-rich and health-enhancing formulations tailored to high-value species like salmon, vannamei shrimp, and barramundi.

Charoen Pokphand Foods and Ridley Corporation are leveraging domestic ingredient networks to stabilize costs while advancing feed traceability for export compliance. Regional firms such as Avanti Feeds, The Waterbase, and Biostadt India are addressing India’s booming shrimp sector with immune-boosting pellet formats and expanding dealership infrastructure.

Companies like INVE Aquaculture and Aller Aqua are targeting larval and specialty segments, where demand for micro-diets and stage-specific nutrients is rising. BENEO, Alltech, and AKER BIO MARINE support the backend with algae, prebiotics, and krill-based additives used by large mills across OECD and ASEAN regions. The market remains competitive, with firms prioritizing localized R&D, species-specific formulations, and forward integration into hatcheries and grow-out systems.

Recent Aquafeed Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 56.6 billion |

| Projected Market Size (2035) | USD 109.2 billion |

| CAGR (2025 to 2035) | 6.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in metric tons |

| Species Analyzed (Segment 1) | Crustaceans, Fish, and Others. |

| Form Analyzed (Segment 2) | Extruded, Powder, Liquid, and Pellets. |

| Function Analyzed (Segment 3) | Health, Digestion, Palatability, and Special Nutrition. |

| Ingredients Analyzed (Segment 4) | Marine, Land Animal, Veg/Grain, Carotenoid, Nutrients, and Others. |

| Sales Channels Analyzed (Segment 5) | Direct Sales, Indirect Sales, Hypermarket, Supermarket, Wholesalers, Specialty Stores, Online, and Others. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Cargill, Incorporated, Charoen Pokphand Foods PCL, BioMar Group, Ridley Corporation Limited, Aller Aqua, Biostadt India Limited, BENEO, Alltech, INVE Aquaculture, AKER BIO MARINE, Skretting, Purina Animal Nutrition LLC, Dibaq Aquaculture, Avanti Feeds Limited, The Waterbase Limited. |

| Additional Attributes | D ollar sales, share by form and function, regional growth hotspots, regulatory shifts, competitive benchmarking, and pricing forecasts across key sales channels. |

The industry is segmented into crustaceans, fish, and others.

The industry is segmented into extruded, powder, liquid, and pellets.

The industry finds health, digestion, palatability, and special nutrition.

The industry is segmented into marine, land animal, veg/grain, carotenoid, nutrients, and others.

The industry is segmented into direct sales, indirect sales, hypermarket, supermarket, wholesalers, specialty stores, online, and others.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The global aquafeed market is estimated to be valued at USD 56.6 billion in 2025.

The market size for the aquafeed market is projected to reach USD 105.8 billion by 2035.

The aquafeed market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in aquafeed market are fish, crustaceans and others.

In terms of form, pellets segment to command 63.0% share in the aquafeed market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aquafeed Enzyme Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Microalgae-Based Aquafeed Market – Growth & Sustainable Feed Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA