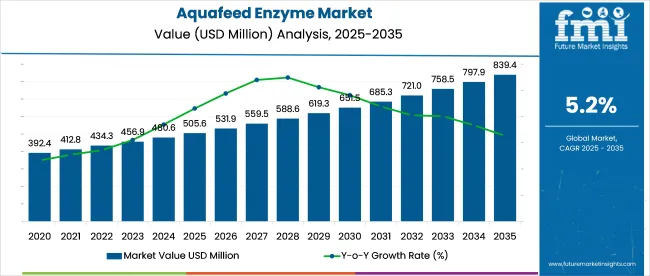

The global aquafeed enzymes market is projected to increase from USD 505.6 million in 2025 to USD 838.6 million by 2035, expanding an absolute growth of USD 333 million and a CAGR of 5.2%.

| Attributes | Description |

|---|---|

| Estimated Global Aquafeed Enzymes Industry Size (2025E) | USD 505.6 million |

| Projected Global Aquafeed Enzymes Industry Value (2035F) | USD 838.6 million |

| Value-based CAGR (2025 to 2035) | 5.2% |

More than 60% of this growth will be driven by Asia Pacific, primarily due to industrial-scale aquaculture expansion in China, India, Vietnam, and Indonesia. Countries in this region produced over 70% of global aquaculture output by volume in 2023, and enzyme use in pelleted and extruded feed has increased due to cost pressures caused by lower fishmeal inclusion.

In 2025, the industry holds 6.4% of the broader aquafeed market, which is valued at around USD 7.9 billion. Within the animal feed enzymes market, estimated at USD 2.9 billion, aquafeed enzymes account for roughly 17.4%, reflecting their niche yet expanding role. Against the total feed additives market, valued at USD 22.4 billion, aquafeed enzymes contribute just 2.3%.

Within the broader animal nutrition segment, estimated at USD 70 billion, their share is around 0.7%. When positioned against the global industrial enzymes market, projected at USD 20.3 billion in 2025, the share narrows to 2.5%. These figures highlight product as a fast-growing but relatively small subsegment, with growth driven by efficiency gains in aquaculture feed formulations.

The underlying driver is the shift from marine-based to plant-based feed ingredients. Enzymes like phytase have demonstrated up to 45% improved phosphorus digestibility, while protease inclusion has been shown to increase amino acid availability by 18-25% in shrimp and carp diets (DSM trials, 2024).

Feed accounts for up to 70% of operational costs in aquaculture, making enzyme use a cost-leveraging strategy. Between 2022 and 2024, enzyme penetration in aquafeed rose from 18% to 31% globally, with higher uptake in pelleted feed formats compared to mash or wet feeds. The reduction in nitrogen discharge through enzyme-aided digestion has become particularly relevant under new effluent restrictions introduced in ASEAN markets and pilot zoning projects in Latin America.

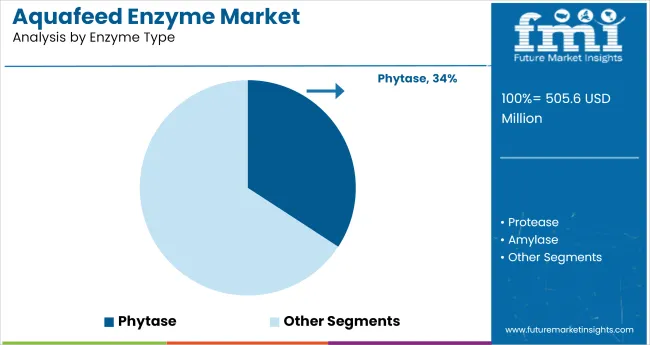

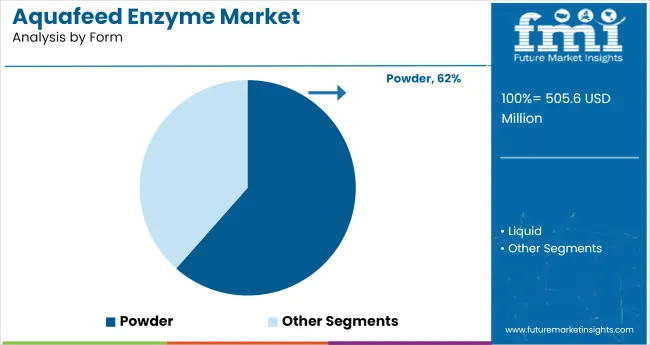

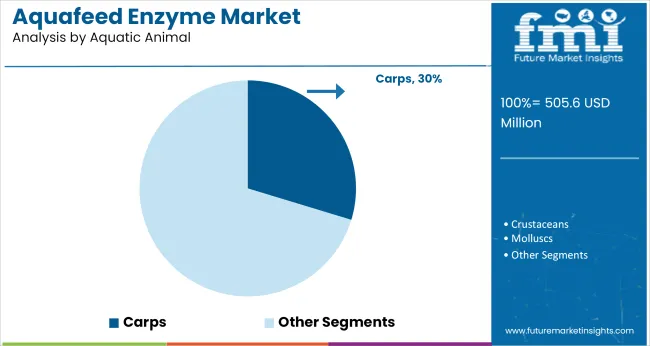

Phytase leads enzyme adoption due to its effectiveness in enhancing phosphorus absorption from plant-based feeds. Powder formulations dominate because of their stability and ease in large-scale feed production. Carps drive the highest enzyme demand, driven by volume-intensive farming in Asia using plant-derived feed inputs.

Phytase registers the dominant share among enzyme types in the aquafeed enzymes market, accounting for 34.2% of total revenue in 2025. Its strong position is attributed to its proven role in improving phosphorus digestibility and reducing reliance on inorganic phosphorus supplements, which remain expensive and environmentally challenging.

Powder form leads the aquafeed enzymes market in 2025, capturing 61.5% of total value. Its dominance stems from superior shelf stability, ease of blending with dry compound feeds, and compatibility with heat-stable premix formulations used in pelleted or extruded feeds.

Carps represent the leading segment in the aquafeed enzymes market for 2025, accounting for roughly 29.7% of total demand. Their dominance is linked not to value per unit but to the vast scale of carp aquaculture, particularly in China, India, and Bangladesh, regions that collectively produce over 50% of global aquaculture output by volume.

Rising use of plant-based feed and cost pressures are driving phytase adoption to improve nutrient absorption and reduce fishmeal reliance. Regulatory limits on effluent discharge and demand for standardized feed have further accelerated enzyme use in commercial aquaculture systems.

Phytate Degradation and Nutrient Optimization Drive Adoption

The growing shift toward plant-based aquafeed inputs has intensified demand for enzyme supplementation, particularly phytase, which improves phosphorus bioavailability and offsets expensive inorganic additives.

Feed cost reduction through higher nutrient utilization remains a top priority for commercial producers managing large aquatic stocks. Enzymes also help reduce anti-nutritional factors that impair digestion in fish and shrimp, particularly in low-fishmeal diets. This technical advantage supports broader enzyme integration across major aquaculture systems.

Environmental Compliance and Commercial Feed Standardization Boost Use

Tightening effluent discharge regulations across Asia and Europe have accelerated the uptake of enzymes, especially in intensive aquaculture farms with measurable nutrient outputs. Producers view enzymes as a non-chemical intervention to reduce nitrogen and phosphorus waste in water bodies.

At the same time, the need for standardized commercial feeds has pushed feed mills to incorporate powder-form enzymes that are heat-stable and easily dosed during extrusion. These factors together strengthen the case for enzymes as a long-term cost and compliance tool.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

| Germany | 5.1% |

| Japan | 5.0% |

| China | 5.6% |

| India | 6.0% |

The aquafeed enzymes market is projected to grow at a global CAGR of 5.2% between 2025 and 2035, though regional dynamics show sharper contrasts. China, a BRICS nation, leads with 6.7% CAGR, supported by its dominance in fish and shrimp aquaculture and government-backed research in enzyme-enhanced feed conversion. India follows closely at 6.3%, driven by the expansion of pangasius and carp farming and rising demand for cost-efficient feed with better protein digestibility.

ASEAN countries such as Vietnam and Indonesia average 5.8%, slightly above the global benchmark, due to export-focused shrimp farming and incentives for non-antibiotic feed systems. In contrast, OECD countries like Norway and the United States post slower growth, 4.5% and 4.1% respectively, owing to feed regulation complexity and slower reformulation cycles in the salmon and trout segments. This regional divergence highlights how emerging markets are using enzymes to lower input costs and optimize yield, while mature markets move cautiously under tight compliance.

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The USA Aquafeed Enzymes market is estimated to grow at 4.9% CAGR during the study period.Growth in the United States is being guided by the commercial-scale adoption of functional feed technologies in aquaculture operations. While finfish production, such as trout and catfish, dominates domestic output, a notable shift toward species-specific feed formulation has created room for enzyme customization.

USA-based feed manufacturers are leveraging enzyme blends like phytase and protease to support the growth of high-protein, plant-based diets for freshwater and marine species. Environmental compliance under Clean Water Act revisions has pressured operators to lower phosphorus and nitrogen discharge, where enzymes offer a cost-effective compliance tool. Consolidation across feed mills is also driving a move toward standardized enzyme application in extruded feed.

Germany’s Aquafeed Enzymes market is projected to expand at a 5.1% CAGR from 2025 to 2035.Germany’s aquafeed enzymes demand is increasing steadily, driven by the country’s compliance with EU nitrogen discharge caps andaquaculture certification schemes. With recirculating aquaculture systems (RAS) gaining ground, especially for salmonids and perch, enzyme use is becoming integral in reducing sludge buildup and optimizing nutrient use in closed-loop systems.

The country imports a large portion of its aquafeed, but domestic blending operations have increasingly turned to enzyme-integrated formulations to improve the digestibility of high-fiber ingredients like wheat middlings and rapeseed meal. Regulatory incentives under Germany’s Blue Bioeconomy strategy also support the integration of enzymes into compound feeds for inland aquaculture.

China’s Aquafeed Enzymes market is forecast to grow at a CAGR of 5.6% through 2035.China remains the world’s largest aquaculture producer, and enzyme use in aquafeed is rising as plant-based feed inputs increase and fishmeal dependency declines. Feed manufacturers are responding to policy goals under China’s Aquaculture Green Development Plan, which encourages nutrient-efficient and environmentally friendly feed.

With carp, tilapia, and catfish dominating freshwater systems, enzymes such as phytase and carbohydrase are widely deployed to improve phosphorus and fiber utilization from soybean meal and cottonseed cake. Industrial feed plants in provinces like Guangdong and Hubei are moving toward automatic dosing systems for enzymes, supporting scale-up and consistency. The presence of regional feed centers has also accelerated enzyme formulation R&D.

Japan’s Aquafeed Enzymes market is expected to grow at 5.0% CAGR during the forecast period. In Japan, enzyme inclusion in aquafeed is gaining ground as producers focus on improving feed conversion ratios in high-value marine species like amberjack, sea bream, and eel.

Domestic aquaculture is constrained by limited coastline and rising feed costs, leading to the adoption of precision-formulated diets where enzymes play a critical role in maximizing nutrient uptake. Japan’s Ministry of Agriculture, Forestry and Fisheries has backed enzyme trials under its Aquatic Resource Sustainability framework, promoting their use in low-impact feed production. The country’s aquafeed manufacturers have also started exporting enzyme-based diets to Southeast Asia, extending the influence of their feed.

India’s Aquafeed Enzymes market is on track to grow at 6.0% CAGR through 2035.India is registering the highest growth among major aquafeed enzyme markets, driven by its expanding shrimp and freshwater fish farming sectors.

As the country pushes to double its aquaculture output under the PMMSY (Pradhan MantriMatsyaSampadaYojana), feed conversion efficiency has become critical. Enzymes like protease, xylanase, and phytase are being widely integrated into both pelleted and extruded feeds to offset the challenges of digesting rice bran, maize, and cottonseed meal.

Domestic feed manufacturers, especially in Andhra Pradesh and Tamil Nadu, are collaborating with international enzyme providers to introduce thermo-stable and species-specific enzyme blends. Awareness campaigns around non-antibiotic growth strategies have also promoted enzyme use.

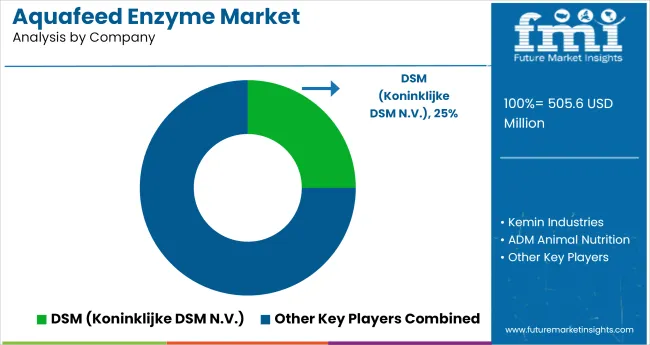

In the aquafeed enzymes market, key suppliers are advancing growth by aligning enzymes with aquaculture-specific feed challenges. Companies such as Kemin Industries, DSM, and BASF SE are leading with thermo-stable enzyme solutions designed for high-temperature extrusion processes. Ab Vista and Huvepharma are focusing on gut-specific enzyme targeting, catering to shrimp and carp farming systems in Asia.

ADM Animal Nutrition and American Biosystem support large-scale feed mill integration via pre-mixed enzyme complexes, improving feed conversion ratios. Chinese players like Weifang Yuexiang and Chaoyang Starzyme are expanding mid-tier access with cost-effective solutions.

Creative Enzymes is carving a niche through tailored protease formulations. Competitive dynamics are shaped by IP in enzyme stability, strategic feed partnerships, and compliance with regional nutrient discharge regulations.

Recent Aquafeed Enzymes Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 505.6 million |

| Projected Market Size (2035) | USD 838.6 million |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and volume in metric tons |

| Enzyme Type Analyzed (Segment 1) | Protease, Amylase, Lipase, Non-Starch Polysaccharidases, Phytase, Glucose Oxidase, and Lysozyme. |

| Form Analyzed (Segment 2) | Liquid and Powder. |

| Aquatic Animal Analyzed (Segment 3) | Carps, Crustaceans, Molluscs, Tilapias, Catfish, Salmon, and Others ( Sturgeons and Paddlefishes) |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Kemin Industries, ADM Animal Nutrition, American Biosystem, Creative Enzymes, DSM (Koninklijke DSM N.V.), Hostazym X (Huvepharma), BASF SE (Nutrition BASF), Ab Vista, Weifang Yuexiang Chemical Co., Ltd., and Chaoyang Starzyme Bioengineering Co., Ltd |

| Additional Attributes | Dollar sales, volume demand, regional share, pricing benchmarks, enzyme adoption by species, feed format compatibility, regulatory trends, formulation partnerships, capacity expansions, competitive share, and projected CAGR. |

The industry is segmented into protease, amylase, lipase, non-starch polysaccharidases, phytase, glucose oxidase, and lysozyme.

The industry is segmented into liquid and powder.

The industry finds carps, crustaceans, molluscs, tilapias, catfish, salmon, and others (sturgeons and paddlefishes)

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 505.6 million in 2025.

It is forecasted to reach USD 838.6 million by 2035.

The industry is anticipated to grow at a CAGR of 5.2% during this period.

Powder is projected to lead the market with a 61.5% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 6.0%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aquafeed Market Size and Share Forecast Outlook 2025 to 2035

Microalgae-Based Aquafeed Market – Growth & Sustainable Feed Trends

Enzymes for Laundry Detergent Market Size and Share Forecast Outlook 2025 to 2035

Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Enzymes Market Analysis by Product Type, End User and Region through 2035

Brewing Enzymes Market Growth - Fermentation Efficiency & Industry Expansion 2024 to 2034

Biofuel Enzymes Market

Fish Roe Enzymes and Extracts Market Analysis by Type, Source and Application Through 2035

Technical Enzymes Market Outlook – Growth, Demand & Forecast 2020 to 2030

Industrial Enzymes Market Size and Share Forecast Outlook 2025 to 2035

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Tropical Fruit Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biology Enzymes, Kits & Reagents Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA