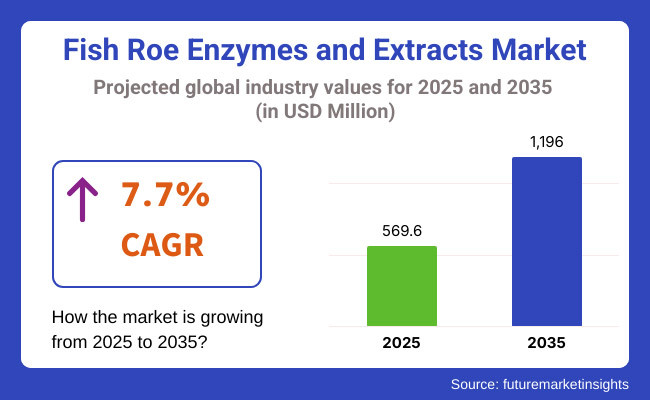

The worldwide demand for fish roe enzymes and extracts in 2023 was USD 495 million. Fish roe enzymes and extracts sales in 2024 were 7.7% higher than the previous year, and therefore the world demand was to be USD 569.6 million in 2025. Throughout the entire forecasting period (2025 to 2035), world total sales were to increase at the rate of 7.7% CAGR rate, thereby finally reaching the selling value of USD 1,196 million in the twelfth month of 2035.

Fish roe extracts and enzymes possess additional applications in other industries because of their nutritional content, bioactive compounds, and functional modification capacity. The drug, nutraceutical, and food & beverages industries are leading the market because of the need for functional foods and natural food commodities. Fish roe possesses immense protein content, vitamins, antioxidants, and omega-3 fatty acids and is thus utilized in dietary supplements and health-conscious products.

As more and more consumers become aware and opt for nature-friendly, eco-friendly, and healthy products, the market for fish roe enzymes and extracts has tremendous growth opportunities in the next decade.

Fish roe products and enzymes are highly nutritious and have many positive effects on health, most of which are because they have such gigantic quantities of omega-3 fatty acids that are so vital in the cardiovascular system, and in the brain as well. Growing demand for such products, together with the production of nutraceutical and dietary supplements, is driving improved market growth.

Other than this, natural ingredients and sustainable sourcing requirements have also played the role of driver forces that have pushed fish roe-based products into the spotlight. As clean label product and sustainable sourcing requirements continue to rise, the market for fish roe extracts and enzymes will experience tremendous growth, especially within food & beverage and nutraceutical markets.

The following table illustrates the comparative study of the variation in CAGR between six months of the base year (2024) and the current year (2025) in the global fish roe enzymes and extracts market. The study is a witness to the highest variations in performance and predicts revenue realization trends, thus making it easier for the stakeholders to comprehend the trend of development for the year. The first half (H1) is Jan to June and the second half (H2) is July to Dec.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 7.2% |

| H2 (2024 to 2034) | 7.4% |

| H1 (2025 to 2035) | 7.5% |

| H2 (2025 to 2035) | 7.7% |

In the first half (H1) of the period 2025 to 2035, the market will grow at a CAGR of 7.5%, followed by a slightly higher growth of 7.7% in the second half (H2) of the period. The latter part of the decade would also see expansion because demand for food ingredients in functional foods within the food, beverages, and the nutraceutical industry is rising. The sector expanded by 30 BPS during the first half (H1) decade, but business during the second half (H2) would see an improvement in growth with 20 BPS.

This robust growth prediction, fueled by health trends and sustainability, allows the fish roe enzymes and extracts market to achieve record high success during the forecasting period. The Fish Roe Enzymes and Extracts Market will grow higher as the demand for sustainable, functional, and natural ingredients persists across industries.

With extraction and sustainability technologies taking centre stage, the industry will also grow in nutraceuticals, cosmetics, and food and beverage sectors. With developing countries embracing such bioactive compounds and with consumer preferences towards natural and clean-label emerging as the next trend, the fish roe extracts and enzymes market also appears poised to continue its growth sprees in the coming years.

Local players, multinationals, and prospective Chinese players control fish roe enzyme and extract business all over the world to a large extent. A market is being developed due to the needs of food, cosmetic, nutraceutical, and pharmaceutical industries for bioactive molecules. Local players are being chosen increasingly while purchasing fish roe enzyme and extract, processing the same, and marketing and selling the above to local as well as foreign industries.

The combined Asian-Pacific, European and North American market is still dominated by local players. Local Canadian and US players are still in a dominant position since they focus on producing best-of-breed roe-derived extracts and enzymes for use in dietary supplements, functional foods, and cosmetics. The local players possess the leading phospholipid, omega compounds, and bioactive peptides-contained bioprocess technology to produce them from roe.

This, in return, has encouraged local manufacturing because health-focused and nature-looking products are highly sought after. European Norwegian, Danish, and Icelandic domestic firms are all European good firms. Seafood processing plants have been established by countries where the companies can purchase enzymes and bioactive material cheaply from roe.

The new Indian nutraceutical industry has also created the possibility of entering the game of consolidating domestic player’s base of fish roe extract business as functional food ingredients. The industry is also stimulated by applications of the collagen of marine animals, antioxidants, and omega fatty acids. Chinese companies established the foundation of their market for production and processing of fish roe.

China is now among the leading manufacturers and bioactive compound fish roe exporters to the food, nutraceutical, and cosmetic industries. Chinese companies dominate low-cost bulking and are thus well-placed to take advantage of entry points along value chains across the world. The global market for fish roe enzyme and extract is competitive where the domestic companies are as powerful as the multinationals and Chinese companies, taking turns.

Shift towards Functional Nutrition & Bioactive Nutrients of Fish Roe Extracts

Shift: Fish roe extracts and enzymes are becoming high-value functional ingredients to consumers, valued for their high content of bioactives in omega-3s, phospholipids, astaxanthin, and peptides. Natural health supplements from seaweed are experiencing growing demand drive growing use in sports recovery, brain function, and anti-ageing. Sea-based bioactives demand is growing, and leading the charge are fish roe extracts.

Strategic Response: Arctic Bioscience of Norway achieved 22% growth in sales of brain well-being supplements made from fish roe in 2024 owing to the boom in demand for brain well-being from the elderly and professionals. BioMarine Ingredients of Ireland registered 17% growth in sales with the integration of fish roe-based omega-3s in functional food systems. Maruha Nichiro (Japan) launched fish roe enzyme-based joint health nutraceuticals, and there was an increase in market share by 19% in the functional supplement segment.

Fish Roe Enzyme Technology Breakthroughs in Luxe Skincare & Cosmeceuticals

Shift: Fish roe extracts and enzymes are increasingly being applied to the beauty and skincare sector because of their anti-aging, rejuvenating, and collagen stimulation properties. Seabed products are currently the new crazes, and so is the same driving premium skincare sales to constantly be on an upward trend. Bio-tech-natural, skincare-aware consumers are running towards fish roe-derived cosmetics technologies.

Strategic Response: La Prairie (Switzerland) introduced caviar-enriched skin care with fish roe extract, propelling a 14% sales growth in its prestige anti-aging business. Shiseido (Japan) incorporated fish roe peptides into its high-performance cosmeceutical brand, propelling 11% skincare business revenue in 2024. Hikari Laboratories (Israel) introduced fish roe enzyme serums, propelling a 9% online skin care sales surge in six months. These strategic launches are positioning fish roe bioactives as luxury skin care actives.

Growing Demand for Sustainable & Traceable Fish Roe Extracts

Shift: Regulated requirements and sustainability issues are driving the brands towards diverting their sources of fish roe extracts into responsibly sourced and sustainable ones. Having 82% of consumers who require products with sustainable origin, ocean bioactive transparency has turned out to be the differentiator in the game of preference. Third-party certified and responsibly derived fish roe extracts by the brands create further trust in customers, hence making them do sales and perform in the market more effectively.

Strategic Response: Norway's Aker BioMarine obtained MSC accreditation for krill roe extracts and experienced a 16% sales increase from B2B purchasers among supplement companies. USA's Blue Circle Foods introduced blockchain-trackable caviar-derived extracts and experienced direct-to-consumer sales increases by 13% in 2024.

Japan's Nippon Suisan Kaisha introduced green fish roe enzyme extraction processes, reducing waste by 21% and selling ingredients by 18%. These green initiatives are propelling future business growth and regulation.

Increased Application of Fish Roe Enzymes as Protein-Rich Functional Foods

Shift: The clean-label and functional food industry is changing demand for fish roe bioactives as a high-protein value-added product. As interest in alternative, highly digestible proteins increases, fish roe enzymes are incorporated into protein shakes, meal supplements, and fortified milk. Sea-based protein expansion is revolutionizing the functional food and nutrition industry.

Strategic Response: Japan's Nissui Corporation brought to sports consumers and health-conscious consumers enzymatically treated fish roe protein powder foods that attained 15% growth in functional food sales.

Maruha Nichiro brought to market fish roe extract-based protein bars that gained 12% market share of its sports diet. AquaBioTech (EU) is developing fish roe-derived protein isolates for plant-based alternative applications, which gained positive acceptance during market trials. These items are bringing fish roe enzymes to the forefront as good-quality protein sources for the new nutritional requirements.

Fish Roe Enzymes Innovation in Pharmaceutical & Medical Applications

Shift: The drug sector is also high in demand for fish roe enzymes and extracts because of their cardiovascular, anti-inflammatory, and neuroprotective properties. Bioactive peptides of fish roe have been identified to heal wounds, boost the immune system, and regulate metabolism. With an increase in incidences of long-term disease such as diabetes and heart disease, there are heightened demands for sea bioactives to be included in drugs.

Strategic Response: Norway's Arctic Bioscience purified phospholipids from fish roe and utilized them to treat multiple sclerosis, which led to a 21% sales increase of medicinal-grade supplements. Japan's Maruha Nichiro collaborated with biotech firms to purify fish roe peptides utilized in managing blood pressure, leading to a 13% sales increase of pharmaceutical ingredients.

Blue Ocean Ingredients in the United States marketed fish roe enzyme-based wound dressing products, and use increased 18% for clinics and hospitals. These indicators suggest greater pharmaceutical value in contemporary medicine from fish roe bioactives.

Fish Roe Enzyme Use in Pet Food & Aquafeed

Shift: Fish roe enzyme and extract uses are observed to be increasing dramatically in pet food and aqua farming because of enhanced bioavailability, high omega-3 fatty acid content, and immunomodulation. Pet food customers need excellent quality functional pet ingredients, and aqua farmers need to provide high-density nutrient-rich sustainable feeding products, i.e., greater use of marine-sourced protein and enzyme additives.

Strategic Response: Pet vitamins supplemented with fish roe were introduced by NutriSource Pet Foods (USA) in high-end consumers, recording 14% in sales among high-end pet food purchasers. Fish roe peptide supplementation to aquafeed by the BioMar Group (Denmark) improved fish and 12% feed conversion by 17%.

Marubeni Nisshin Feed of Japan developed aqua farm animal diets containing fish roe enzymes to reduce feed conversion rates by 10% and make it possible for sustainable intake. These pioneering technologies are making fish roe bioactives the trendsetters in future pet and aquafeed nutrition.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of fish roe enzymes and extracts through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 6.9% |

| Germany | 7.3% |

| China | 8.6% |

| Japan | 7.9% |

| India | 9.5% |

The availability of naturally occurring enzymes and extracts from fish roe, with its potential applications in nutraceuticals, functional foods, and cosmetics, is a major reason for this growth in the USA fish roe enzymes and extracts market.

The expansion of this market is driven by the increasing interest of consumers in omega-3-rich fish roe extracts, proteolytic enzymes, and antioxidant-rich, bioactive compounds. Those ingredients are well known for the support of cardiovascular health, cognitive function, and anti-inflammatory response and are greatly sought in dietary supplements and wellness products.

The growing trend toward clean-label products and sustainably sourced ingredients is also increasing demand for market growth, with both consumers and manufacturers seeking eco-friendly, traceable marine-derived ingredients. Concentrates of omega-3 phospholipids, enzymatically hydrolyzed peptides and fish roe enzymes that boost collagen production are steadily appearing in both premium health supplements and beauty formulations.

Moreover, the advancements in enzymatic extraction and sustainable seafood processing are propelling the higher adoption of high-purity fish roe-derived supplements. With the FDA focusing on safety and quality through inspection and stringent regulations, manufacturers are increasingly employing the latest technologies for purification and processing to enhance bioavailability without compromising efficacy of the product.

There is interest but nothing in the pipeline yet in the area of new nutritional ingredients corresponding to fish roe-derived phospholipids and omega-3 concentrates, particularly in applications towards infant nutrition supplements, brain health products, medical nutrition.

Fish Roe Enzymes and Extracts Market Segmentation:Germany has stringent regulations issued by the European Union including marine biotechnology and functional food approved by the European Food Safety Authority. European consumers are well aware of the origins, sustainability, and efficacy of their products, driving demand for collagen-boosting fish roe enzymes, phospholipid-rich extracts, and bioavailable marine peptides in health and wellness applications.

The growing demand for marine-derived bioactive compounds in Germany is mainly driven by two factors, the aging population, and the growing interest regarding anti-aging and joint health. Digestive enzymes derived from fish roe are playing a role in metabolic wellness and skin rejuvenation and are now being increasingly integrated into cosmeceuticals, dietary supplements, and therapeutic formulations.

The European skincare industry, which is considered to favor natural and scientifically supported ingredients, has recently begun to adopt omega-3 phospholipid- and enzymatic hydrolyzed fish roe peptide-based formulations for advanced anti-aging and hydration solutions.

However, driven by the growing demand for high quality nutraceuticals and clean-label functional food products, with Germany also at the forefront, manufacturers are investing in the use of bioactive compounds derived from the marine environment to find premium dietary and cosmetic solutions. Inclusion of fish roe extracts in protein-enriched beverages, sports nutrition products, and medical-graded supplements, is likely to propel further expansion of the market.

Facilitating this growth with increased demand for Chinese fish roe enzymes and extracts in the treatment of marine based pharmaceuticals and application in functional beverages and traditional medicine. China's investments in marine biotechnology, supported by its government, have enabled its companies to scale up their production of fish roe-derived enzymes for metabolic health, cognitive function, and immune system regulation.

With growing consumers' demand for premium health products, the demand for omege-3 phospholipid concentrates and enzymatically hydrolyzed peptides of fish roe is rising. The combination of bioactive compounds are being increasingly utilized in functional foods, cognitive health supplements, and cardiovascular health products. Moreover, herbal medicine formulations will increasingly use fish roe-derived bioactive peptides in the traditional Chinese medicine (TCM) sector to utilize their anti-inflammatory and rejuvenating properties.

The Chinese market demand is also being driven by growing middle-class consumer spending, with consumers exhibiting a tendency towards premium functional skincare and functional dietary supplements. Marine-derived collagen boosters, omega-3 emulsions and antioxidant-rich fish roe extracts are appearing with increasing frequency in luxury skin care and beauty products.

In response, the potential synergies between marine biotechnology and personalized nutrition will likely lead to the progressive creation of bespoke fish roe-derived formulations, designed to cater to certain health and wellness requirements.

China is paving the way with improvement in extraction methods and bioavailability enhancement efforts, for marine-derived functional ingredients. With ongoing research involving fish roe enzymes and phospholipid-rich extracts, the market is projected to gain significant traction in pharmaceuticals, cosmeceuticals, and functional nutrition sectors.

| Segment | Value Share (2025) |

|---|---|

| Omega-3 & Phospholipid Extracts (By Application) | 63.7% |

Omega-3 and phospholipid extract is the most lucrative segment for fish roe enzymes and extracts, holding a more than 63.7% share of the market in 2025. These extracts are critical in terms of brain development, cardiovascular health and cognitive function and thus are the core in the nutraceutical, functional food and pharmaceutical market.

This includes EPA- and DHA-rich fish roe extracts, bioavailable phospholipids and enzymatically hydrolyzed omega-3 concentrates with more extensive absorption than more traditional fish oil supplements. As the trend toward marine-sourced, sustainably produced omega-3 continues, suppliers are ramping high-purity fish roe-based phospholipids with proven benefits to brain function and metabolism.

New techniques for the extraction and purification of bioactive compounds can improve the biological stability of bioactive compounds and optimize their activity in health applications.

In addition, the use of fermented fish roe oil and phospholipid emulsions in functional foods and infant nutrition is growing. Even higher in demand in the high-end health supplements and medical nutrition products market are these new formulations with improved digestibility with the goal of zero nutrient waste!

| Segment | Value Share (2025) |

|---|---|

| Proteolytic Enzymes & Bioactive Peptides (By Application) | 36.3% |

The proteolytic enzymes and bioactive peptides segment is expected to capture a 36.3% market share by 2025 as more is understood about bioactive marine enzymes in anti-inflammatory and collagen-enhancing applications. Its enzymes derived from fish roe are extremely bioavailable and functional which is why they are used in joint wellness supplements, cosmeceuticals, and metabolic function enhancers.

All of these enzymes are essential to reducing inflammation, increasing skin elasticity, and overall metabolic function, making them an important asset both in the skincare and nutraceutical market. With the interest in enzymatically hydrolyzed peptides and marine collagen boosters rising, the business is moving toward sustainable production of marine enzymes for high-value nutraceuticals and skincare ingredients. They work by harnessing new crossing and fermentation technology to extend enzyme efficiency, boost bioefficacy, and minimize waste.

Additionally, fish roe extract-based biostimulants are gaining popularity in functional well-being products. Bioactive substances are used in anti-aging creams, regenerative wellness products, and personalised nutrition products specifically designed to sustain longevity and cell repair.

The fish roe enzymes and extracts market is reported to be less fragmented due to the array of key players targeting end-use applications, such as enhancing purity extraction, functional ingredients derived from marine, and applications in pharmaceuticals, beauty, and nutrition. These investments include marine enzyme bioengineering, omega-3 encapsulation technologies and sustainable extraction methods.

The key players in the global sector like Arctic Bioscience, BioMarine Ingredients Ireland, Hofseth BioCare, Maruha Nichiro, and Nippon Suisan Kaisha come equipped with expert capabilities in bioactive marine enzymes, fish roe extracts rich in phospholipids, and sustainable marine ingredient development. Several companies are increasing their distribution network in North America and Europe to meet the growing need for functional fish roe products.

These strategies include partnerships with health supplement brands, investment in enzymatic bioactivity research, and high-purity omega-3 phospholipid concentrates. Brands are also focusing on marine ingredients with zero-waste! Marine ingredients are now being sourced with a zero-waste mentality, and extraction processes are regenerative.

For instance

The market includes various enzyme types, such as Protease, Lipase, Amylase, and Cellulase, along with other specialized enzymes, catering to diverse industrial applications.

These enzymes are derived from different sources, including Salmon Roe, Herring Roe, Caviar, and Capelin Roe, with additional contributions from other marine sources.

They are widely used across industries such as Food & Beverages, Bioenergy & Biogas, Pharmaceuticals, Cosmetics & Personal Care, and Dietary Supplements, with further applications in other specialized fields.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global fish roe enzymes and extracts industry is projected to reach USD 569.6 million in 2025.

Key players include Aroma NZ Ltd; SNP Korea Co., Ltd; BioPureDx; Frutarom Health; Laboratoires Expanscience; Croda International; Ashland Global Holdings Inc.; Lipotec Group.

Asia-Pacific is expected to dominate due to high demand for marine-based omega-3 and functional fish roe peptides.

The industry is forecasted to grow at a CAGR of 7.7% from 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Source, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Type, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Source, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Source, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 93: Europe Market Attractiveness by Source, 2023 to 2033

Figure 94: Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by Type, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Source, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Source, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Source, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 178: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 186: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 189: MEA Market Attractiveness by Source, 2023 to 2033

Figure 190: MEA Market Attractiveness by Application, 2023 to 2033

Figure 191: MEA Market Attractiveness by Type, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microencapsulated Fish Oil Market

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Laundry Detergent Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA