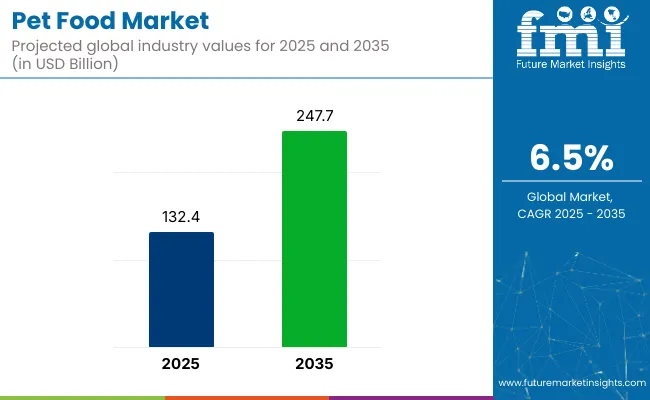

The pet food market is valued at USD 132.4 billion in 2025 and is projected to reach USD 247.7 billion by 2035, growing at a CAGR of 6.5%. The market expansion is driven by rising pet humanization, the premiumization of diets, and the shift toward tailored nutrition that addresses specific life-stage and breed requirements. The product innovation continues to enhance value propositions with formulations targeting digestive health, joint support, and immune function.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 132.4 billion |

| Forecast Value (2035) | USD 247.7 billion |

| CAGR (2025 to 2035) | 6.5% |

The market holds approximately 3.6% of the USD 72 billion animal nutrition market, 1.73% of the USD 150 billion pet care market, 0.072% of the USD 3.6 trillion packaged food market, and 0.026% of the USD 10 trillion global consumer goods market. Its growth is driven by rising pet ownership, demand for premium nutrition, and increasing humanization of pets worldwide.

Government regulations impacting the market focus on ensuring safety, quality, and accurate labeling of products. In the USA, the FDA’s Center for Veterinary Medicine oversees compliance with nutritional standards and ingredient approvals. In Europe, regulations under EFSA require strict safety assessments, while FEDIAF guidelines standardize pet food formulations.

Countries like Japan enforce rigorous standards under the Ministry of Agriculture for labeling and ingredient safety. Globally, regulations mandate transparency in sourcing, ban harmful additives, and require hygienic manufacturing practices to protect animal health and consumer trust, thereby shaping the operational landscape for pet food manufacturers.

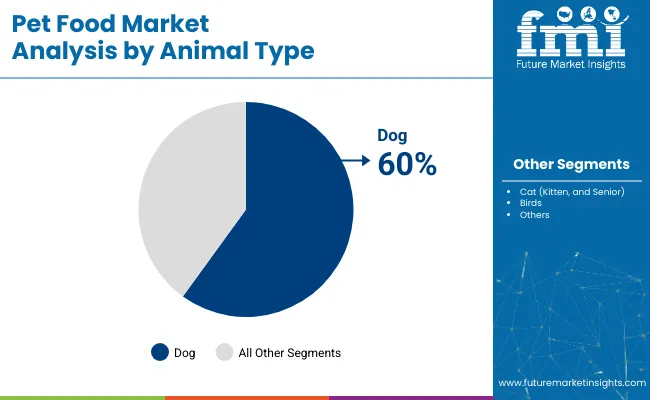

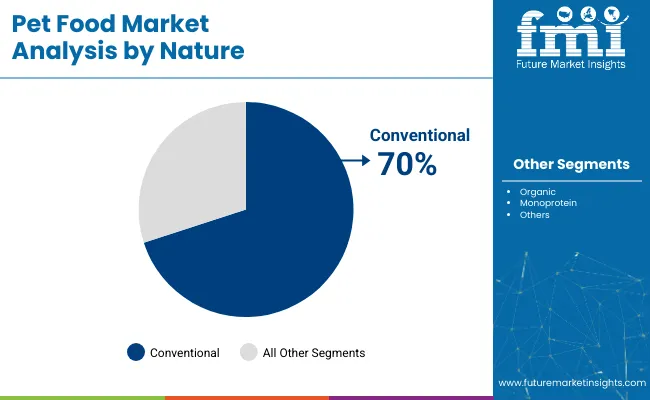

The UK is projected to be the fastest-growing market, expanding at a CAGR of 6.8% from 2025 to 2035. Conventional pet food will lead the nature segment with a 70% market share, while dog food will dominate the animal type segment with a 60% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 6.2% and 6.4%, respectively.

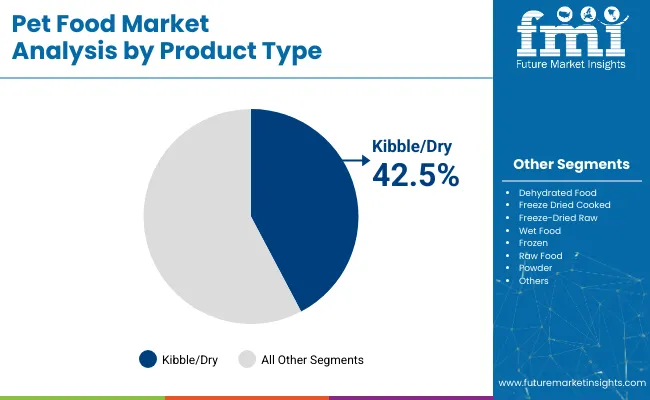

The pet food market is segmented by product type, source, animal type, nature, and region. By product type, the market is divided into kibble/dry (extruded, baked, coated), dehydrated food, freeze-dried cooked, freeze-dried raw, wet food, frozen, raw food, powder, and treats & chews (dog - paste, cremes, crunchy snacks, chew sticks, tablets, biscuits, jerky, rawhide; cat - pastes, crèmes, crunchy snacks, chew sticks, tablets, biscuits, cat milk/milk snacks).

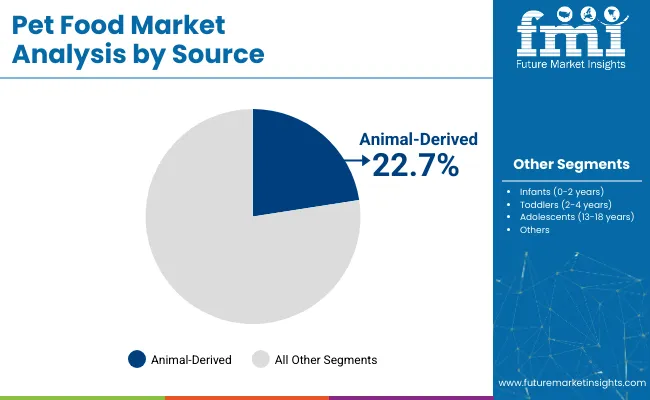

Based on the source, the market is segmented into animal-derived (fish, chicken, duck, beef, pork, venison, lamb, turkey), plant-derived, and insect-derived (crickets, mealworms, black soldier flies). By animal type, the market is bifurcated into cats (kittens, seniors), dogs (puppies, adults, seniors), birds, and others (rabbits, hamsters).

By nature, it is segmented into organic, monoprotein, and conventional. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, the Balkans and Baltic, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The Kibble/dry food is projected to lead the product type segment, accounting for 42.5% of market share by 2025. Kibble products are typically made from animal-derived proteins, cereals, grains, and added vitamins and minerals, offering pet owners a cost-effective and convenient solution for maintaining their pet's health and dietary consistency.

The animal-derived segment is expected to lead the source segment, accounting for approximately 22.7% of the market share in 2025. Their demand is driven by the high protein content preferred by pet owners for optimal growth and health.

The dog is expected to capture 60% of the market share in 2025. This is supported by higher pet ownership rates globally and rising demand for premium treats, age-specific formulations, and breed-targeted diets that cater to diverse nutritional needs.

The conventional is projected to dominate the nature segment, accounting for approximately 70% of the market share in 2025. The demand is driven by affordability, wide availability across retail channels, and trusted formulations suitable for general health maintenance in pets.

The pet food market has been experiencing steady growth, driven by increasing pet ownership, rising demand for premium nutrition, and a shift towards personalized, breed-specific formulations.

The UK leads the pet food market, driven by trends in premiumization and the humanization of pets, as consumers increasingly prioritize high-quality, tailored nutrition. France follows with a CAGR of 6.6%, supported by the rising demand for functional and eco-friendly pet products. Germany, expected to grow at 6.4%, is driven by a strong market for hypoallergenic and natural formulations, as well as increasing pet ownership.

The US market is expected to expand at a steady CAGR of 6.2%, driven by increased demand for organic, natural, and breed-specific diets, particularly for dogs and cats. Japan’s market, growing at 6.1%, is fueled by demand for small-breed formulations and age-specific diets, as urban households increasingly prioritize tailored nutrition. These regions highlight key growth drivers, including premiumization, humanization, and growing pet ownership, all of which contribute to the market’s steady expansion.

As the pet food industry evolves, countries such as the UK and France are witnessing a shift toward functional foods, with consumers increasingly opting for products that cater to their pets' health and well-being. Meanwhile, the USA and Japan are focused on specific formulations that cater to dietary needs based on breed, age, and size. As a result, these countries continue to be key exporters, distributors, and suppliers in the global pet food market.

The report provides an in-depth analysis of over 40 countries, with the five top-performing OECD countries highlighted below.

The Japanese pet food market is projected to grow at a CAGR of 6.1% from 2025 to 2035. Growth is driven by demand for specialized, age-specific, and small-breed formulations as urban households prefer tailored nutrition for pets..

The sales of pet food in Germany are forecast to expand at a CAGR of 6.4% during the forecast period. The demand is driven by hypoallergenic and natural formulations and shifting consumer preference towards monoprotein diets addressing sensitivities and organic options ensuring transparency.

The French pet food market is expected to grow at a CAGR of 6.6% from 2025 to 2035, driven by premiumization, pet humanization, and demand for functional treats enhancing mobility and digestion.

The USA pet food market is projected to grow at a CAGR of 6.2% from 2025 to 2035. Growth is driven by rising pet ownership, a preference for organic and natural diets, and strong demand for treats that target dental health and joint care.

The UK pet food revenue is forecast to grow at a CAGR of 6.8% from 2025 to 2035. Growth is driven by premiumization, rising direct-to-consumer e-commerce sales, and breed-specific formulations tailored to meet pet health needs.

The pet food market is moderately consolidated, with leading players such as Mars Petcare Inc., Nestlé Purina PetCare, Hill’s Pet Nutrition, Blue Buffalo (owned by General Mills), and Cargill Incorporated dominating the industry. These companies dominate the global landscape by offering a diverse portfolio of pet food products tailored to the nutritional needs of dogs, cats, and small animals.

Mars Petcare Inc. specializes in veterinary and breed-specific diets, while Nestlé Purina PetCare emphasizes science-backed formulations that support health conditions like digestion, weight management, and joint care. Hill’s Pet Nutrition and Blue Buffalo cater to the premium and natural food segments, driving innovation and consumer trust.

Pet food manufacturers are investing heavily in R&D, focusing on innovations like personalized nutrition, functional ingredients (e.g., probiotics and omega-3 fatty acids), and sustainable protein alternatives such as insect or plant-based sources. These developments align with the rising consumer demand for premium, health-oriented, and eco-friendly pet foods. As premium and natural segments grow at 5-7% annually, continuous R&D is driving product differentiation and market expansion..

Recent Pet Food Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 132.4 billion |

| Projected Market Size (2035) | USD 247.7 billion |

| CAGR (2025 to 2035) | 6.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD billion / Volume in metric tons |

| By Product Type | Kibble/Dry (Extruded, Baked, Coated), Dehydrated Food, Freeze Dried Cooked, Freeze-Dried Raw, Wet Food, Frozen, Raw Food, Powder, Treats and Chews, Dog (Paste, Crèmes, Crunchy snacks, Chew sticks, Tablets, Biscuits, Jerky, Rawhide), Cat (Pastes, Crèmes, Crunchy snacks, Chew sticks, Tablets, Biscuits, Cat Milk / Milk snacks) |

| By Source | Animal-Derived (Fish, Chicken, Duck, Beef, Pork, Venison, Lamb, Turkey), Plant-Derived, Insect-Derived (Crickets, Mealworms, Black Soldier Flies) |

| By Animal Type | Cat (Kitten, Senior), Dog (Puppy, Adult, Senior), Birds, Others (Rabbits, Hamsters, etc.) |

| By Nature | Organic, Monoprotein, and Conventional |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Simmons, Inc., Merrick Pet Care, Inc., Champion Petfoods LP, Nature's Variety, Archer Daniels Midland Company (ADM), Cargill, Incorporated, Hill's Pet Nutrition, General Mills, Inc. (Blue Buffalo), Mars Petcare Inc., Nestlé Purina PetCare, Hill's Pet Nutrition, J.M. Smucker Company, Diamonds, Blue Buffalo Co., Ltd., Spectrum Brands Holdings, Inc., Unicharm Corporation, Deuerer GmbH, Sunshine Mills, Inc., Nutriara Alimentos Ltda., Unicharm PetCare Corporation. |

| Additional Attributes | Market share analysis by product type and source, country-wise CAGR analysis, and brand positioning insights |

As per Nature, the industry has been categorized into Organic, Monoprotein, and Conventional.

As per Product Type, the industry has been categorized into Kibble/Dry (Extruded, Baked, Coated), Dehydrated Food, Freeze Dried Cooked, Freeze-Dried Raw, Wet Food, Frozen, Raw Food, Powder, Treats and Chews [Dog (Pastes, Crèmes, Crunchy snacks, Chew sticks, Tablets, Biscuits, Jerky, Rawhide), Cat (Pastes, Crèmes, Crunchy snacks, Chew sticks, Tablets, Biscuits, Cat Milk / Milk snacks)].

This segment is further categorized into Animal-Derived (Fish, Chicken, Duck, Beef, Pork, Venison, Lamb, and Turkey), Plant-Derived, Insect-Derived (Crickets, Mealworms, Black Solider Flies).

As per animal type this segment is categorized into Cat (Kitten, and Senior), Dog (Puppy, Adult, and Senior), Birds, and Others (Rabbits, Hamsters, etc.).

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Baltic and Balkans Countries and the Middle East & Africa.

The market is forecasted to reach USD 247.7 billion by 2035.

The market is projected to grow at a CAGR of 6.5% during this period.

Kibble/dry food is expected to lead with over 42.5% market share in 2025.

Animal-derived segment is expected to hold approximately 22.7% of the market share in 2025.

The UK is anticipated to be the fastest-growing market with a CAGR of 6.8% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Processing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Palatants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Pet Food Premix Market Analysis by Pet Type, Ingredient Type, Formand Sales ChannelThrough 2035

Pet Food Microalgae Market Insights - Nutritional Benefits & Growth 2025 to 2035

Pet Food Extrusion Market Analysis by Product Type, Animal Type, Ingredient Type, Extruder Type, Ingredient, Process and Region Through 2035

Pet Food Flavor Enhancers Market – Growth, Demand & Innovation

Wet Pet Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Comprehensive Analysis of Europe Pet Food Supplements Market by Nature, Form, Pet Type and Distribution Channel through 2035

Frozen Pet Food Market Growth – Premium Pet Nutrition & Demand 2024-2034

Natural Pet Food Market Insights - Nutrition & Consumer Trends 2025 to 2035

Analysis and Growth Projections for Organic Pet Food Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA