The Europe pet food supplements market is projected to grow to USD 275.7 million by 2025, and is also expected to reach USD 489.0 million by 2035 growing at a CAGR of 5.9% from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Value (2025E) | USD 275.7 Million |

| Projected Europe Value (2035F) | USD 489.0 Million |

| Value-based CAGR (2025 to 2035) | 5.9% |

The Europe pet food supplements market is estimated to be steady growing through 2035, owing to the growing pet humanization trend, preventive health measures and rising focus on pets natural and functional nutrition. Pet owners are treating their pets as family, resulting in an increased interest in joint health, digestion, immunity, and skin & coat supplements.

Consumer demand for clean-label, breed-specific and age-targeted formulas, as well as increased recommendations from veterinarians are driving product innovation. An additional key driver for product availability and variety growth in Europe is the rise of online shopping platforms, allowing pet parents to conveniently access trustworthy brands of supplements.

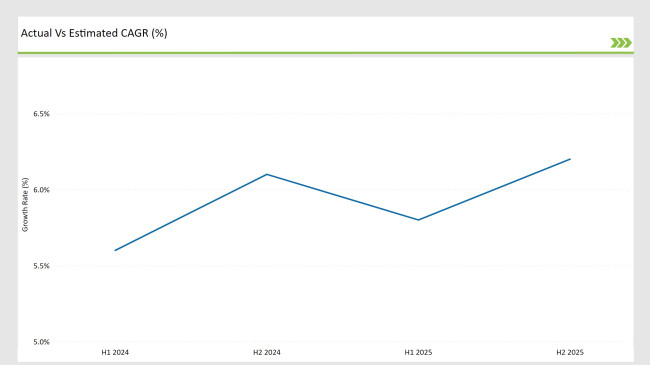

The table below is a detailed comparative assessment tracking the variance in Compound Annual Growth Rate (CAGR) for the base year(2024) and current year (2025) specifically for the European pet food supplements market. This bi-annual review showcases the most significant changes in competitive landscapes and revenue capture trends, enabling all industry participants with much needed clarity around likely growth drivers throughout the year. H1 is January to June, H2 is July to December

Across the European pet food supplements market, the segment is set to expand with a compound annual growth rate (CAGR) of 5.6% in H1 of 2024 and 6.1% in H2 of 2024. For 2025, GDP growth is projected to 5.8% in H1 and 6.2% in H2. The rise is indicative of increased consumer confidence, strong e-commerce penetration, and innovations in specialized pet nutrition products.

| Date | Development/Event & Details |

|---|---|

| July 2024 | The UK became the first European country to approve lab-grown meat for use in pet food. The approval was granted to Meatly, a startup focused on cultivated meat, signaling growing momentum for sustainable, ethical alternatives in pet nutrition. |

| February 2025 | Meatly launched “Chick Bites,” the world’s first cultivated meat dog treats. Initially available in select UK pet stores, this innovation demonstrates increasing consumer acceptance of novel proteins for pets. |

| January 2025 | Zoomark 2025 industry discussions emphasized the expanding role of pet food supplements in supporting joint health, digestive well-being, immunity, and aging-related conditions, with demand particularly strong in Western Europe. |

| 2024 | The European pet nutraceuticals market is growing steadily, driven by rising pet ownership, the humanization of pets, and increased awareness around preventive health. Supplements are being integrated more frequently into daily feeding routines. |

| 2024 | Personalized pet nutrition continues to shape the market, with a notable increase in demand for breed-specific supplements, probiotics, omega-3s, and glucosamine-based formulas. E-commerce channels are also boosting accessibility and awareness. |

Europe Pet Food Supplements Market

The Europe pet food supplements market is taking off, supported by booming pet ownership, growing knowledge about their pets' health and nutrition, and the verticalization of pets. From digestive health to skin and coat health, and energy, pet parents are looking for solutions to help their pet feel their best.

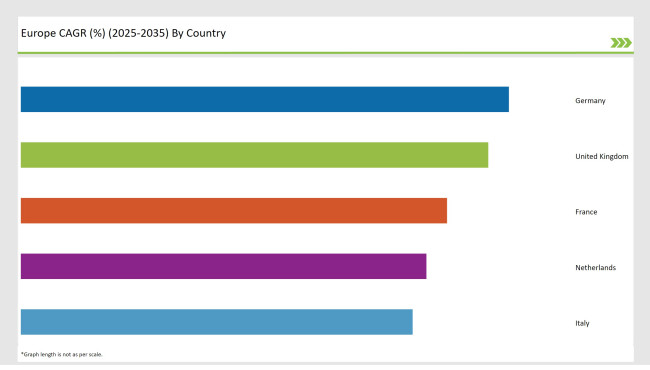

The growth is being led by Germany, the UK, France, and Italy, due to large pet populations and increased spending on pet health products. Furthermore, increasing penetration of e-commerce platforms has made it easier for customers to obtain a wide variety of pet supplements, which in turn is expected to help market growth.

Trending: Natural Ingredients and Vet Endorsements

The rising demand for natural and organic pet food supplements is a prominent trend in the European market for pet food supplements. Pet supplements prepared with high-quality, naturally derived ingredients without the inclusion of synthetic additives and preservatives are becoming more popular among pet owners. This turn of events reflects a wider consumer preference for clean-label products. This is because veterinarians are well-positioned to affect purchasing decisions-the words of a vet can make or break a pet supplement product.

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The country is still leading the scene globally for pet food supplements with preventive pet care in focus and significant attention towards functional nutrition. Pet owners are opting for scientifically formulated supplements to address specific health concerns such as joint health, digestive support, immune function, and skin & coat care.

A well-regulated supplement industry and a highly developed veterinary infrastructure gives it an extra boost. Consumer trust is high in clinical research-backed and veterinarian-recommended products. At the same time, leading brands are aligning with trends in clean-label and natural ingredients, a key driver of Germany’s premium pet segment.

Although e-commerce platforms and specialty pet retailers dominate the distribution landscape, veterinary clinics contribute heavily to product endorsement. Germany will continue to lead in pet supplements innovation and adoption, driven by rising disposable income and the increasing prevalence of pet ownership, especially among senior dogs and cats.

Pet Food Supply Supplements Market in the United Kingdom is one of the prominent market trends in the Europe region owing to cultural shift towards pet humanization where pet treated as family and consumer is growing through the positive response. This trajectory is apparent in the growing demand for natural, vegan and plant-based supplements that reflect human health trends.

Growing demand for offerings targeting anxiety, mobility, and general vitality has become prominent among the UK’s increasingly preventative and quality-of-life centric pet owner demographic. The trend is toward functional soft chews, calming products and probiotic formulations. The survey also showed a particular penchant among consumers for formats that are easily administered and palatable, such as chewables and liquids.

Distribution is dominated by online channels, including Amazon, subscription services, and brand-direct platforms. There is also growing activity in the UK market from startups and D2C brands providing customized supplement solutions. The UK is an important market for pet nutrition innovation, with a strong consumer preference for products that are eco-conscious, transparent and clinically supported.

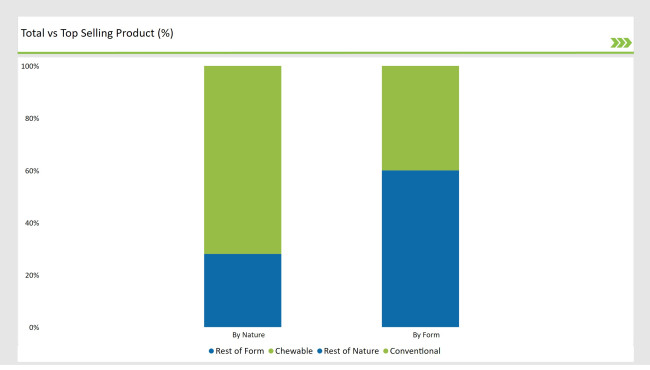

% share of Individual Categories by Nature and Form in 2025

Although conventional supplements are leading in the European market, organic is taking a bigger share of the pie as pet owners become increasingly mindful in terms of quality and traceability of ingredients. Organic offerings are marketed as healthier and safer for long-term pet wellness-especially in markets such as Germany, the UK, and the Nordics.

Chewable formats are leading due to the convenience they offer and acceptance by pets, especially dogs. Liquid pet supplements, however, are seeing appreciable growth as they are easy to mix with food and have better absorption rates and diverse application for all stages of pets. Liquid products are particularly favored in senior and kitten formulas, where digestive support and joint health need faster-acting, bioavailable solutions. Leading players including Nestlé Purina, Zesty Paws, and Vetoquinol are advancing new concepts such as flavor masking, soft chew technologies, and clean-label formulations that address changing consumer preferences.

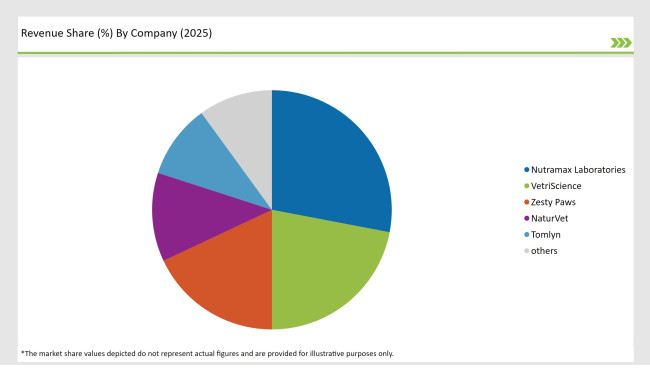

2025 Market share of Europe Pet Food Supplement Suppliers

Note: Above chart is indicative in nature

The Europe pet food supplements market is moderately or highly concentrated. The key players that dominate the market share are Nutramax Laboratories, VetriScience, and Zesty Paws, owing to their well-established formulations of veterinary supplements, high brand loyalty, targeted supplements such as joint health, digestion, and immunity.

Tomlyn and NaturVet hold a strong presence through multi-function supplements and increasing e-commerce penetration. Significantly smaller than Zesty Paws, Pet Naturals of Vermont keeps growing through a natural ingredient positioning and growing European distribution.

As per Nature, the industry has been categorized into Organic and Conventional.

As per Form, the industry has been categorized into Capsules, Chewable, Gel, and Liquid.

As per Pet Type, the industry has been categorized into Cat (Kitten, Senior) and Dog (Puppy, Adult, Senior).

As per Distribution Channel, the industry has been categorized into Store-Based Retailing, Hypermarkets/Supermarkets, Convenience Stores, Mom & Pop Stores, Pet Food Stores, Independent Grocery Retailers, Other Retail Formats, and Online Retailers.

Industry analysis has been carried out in key countries of Germany, The United Kingdom, France, Italy, Spain, BENELUX, Nordic, Russia, Poland, and Rest of Europe.

The Europe pet food supplements market is estimated to reach USD 275.7 million by 2025.

The market is expected to grow to USD 489.0 million by 2035, reflecting strong demand for pet wellness products.

The Europe pet food supplements market is projected to expand at a CAGR of 5.9% over the period.

Top companies include Nutramax Laboratories, Pet Naturals of Vermont, NaturVet, Tomlyn, VetriScience, Zesty Paws, VetIQ, MPP, Pro-Sense, Makondo Pets, and Gimborne.

Key drivers include rising pet humanization, increased awareness of pet health, growth in preventative veterinary care, and a surge in demand for supplements targeting joint health, digestion, skin & coat, and immunity.

Table 1: Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Volume (MT) Forecast by Country, 2018 to 2033

Table 3: Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Volume (MT) Forecast by Form, 2018 to 2033

Table 7: Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 8: Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 9: Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 11: Germany Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 12: Germany Volume (MT) Forecast by Nature, 2018 to 2033

Table 13: Germany Value (US$ Million) Forecast by Form, 2018 to 2033

Table 14: Germany Volume (MT) Forecast by Form, 2018 to 2033

Table 15: Germany Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 16: Germany Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 17: Germany Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: Germany Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 19: UK Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 20: UK Volume (MT) Forecast by Nature, 2018 to 2033

Table 21: UK Value (US$ Million) Forecast by Form, 2018 to 2033

Table 22: UK Volume (MT) Forecast by Form, 2018 to 2033

Table 23: UK Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 24: UK Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 25: UK Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 26: UK Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 27: France Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: France Volume (MT) Forecast by Nature, 2018 to 2033

Table 29: France Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: France Volume (MT) Forecast by Form, 2018 to 2033

Table 31: France Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 32: France Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 33: France Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 34: France Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 35: Italy Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 36: Italy Volume (MT) Forecast by Nature, 2018 to 2033

Table 37: Italy Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: Italy Volume (MT) Forecast by Form, 2018 to 2033

Table 39: Italy Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 40: Italy Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 41: Italy Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 42: Italy Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 43: Spain Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 44: Spain Volume (MT) Forecast by Nature, 2018 to 2033

Table 45: Spain Value (US$ Million) Forecast by Form, 2018 to 2033

Table 46: Spain Volume (MT) Forecast by Form, 2018 to 2033

Table 47: Spain Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 48: Spain Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 49: Spain Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Spain Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 51: BENELUX Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 52: BENELUX Volume (MT) Forecast by Nature, 2018 to 2033

Table 53: BENELUX Value (US$ Million) Forecast by Form, 2018 to 2033

Table 54: BENELUX Volume (MT) Forecast by Form, 2018 to 2033

Table 55: BENELUX Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 56: BENELUX Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 57: BENELUX Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 58: BENELUX Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 59: Nordic Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 60: Nordic Volume (MT) Forecast by Nature, 2018 to 2033

Table 61: Nordic Value (US$ Million) Forecast by Form, 2018 to 2033

Table 62: Nordic Volume (MT) Forecast by Form, 2018 to 2033

Table 63: Nordic Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 64: Nordic Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 65: Nordic Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 66: Nordic Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 67: Russia Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 68: Russia Volume (MT) Forecast by Nature, 2018 to 2033

Table 69: Russia Value (US$ Million) Forecast by Form, 2018 to 2033

Table 70: Russia Volume (MT) Forecast by Form, 2018 to 2033

Table 71: Russia Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 72: Russia Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 73: Russia Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 74: Russia Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 75: Poland Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 76: Poland Volume (MT) Forecast by Nature, 2018 to 2033

Table 77: Poland Value (US$ Million) Forecast by Form, 2018 to 2033

Table 78: Poland Volume (MT) Forecast by Form, 2018 to 2033

Table 79: Poland Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 80: Poland Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 81: Poland Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 82: Poland Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 83: Rest of Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 84: Rest of Volume (MT) Forecast by Nature, 2018 to 2033

Table 85: Rest of Value (US$ Million) Forecast by Form, 2018 to 2033

Table 86: Rest of Volume (MT) Forecast by Form, 2018 to 2033

Table 87: Rest of Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 88: Rest of Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 89: Rest of Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 90: Rest of Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Value (US$ Million) by Form, 2023 to 2033

Figure 3: Value (US$ Million) by Pet Type, 2023 to 2033

Figure 4: Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Value (US$ Million) by Country, 2023 to 2033

Figure 6: Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 7: Volume (MT) Analysis by Country, 2018 to 2033

Figure 8: Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 9: Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 10: Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 11: Volume (MT) Analysis by Nature, 2018 to 2033

Figure 12: Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 13: Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 14: Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 15: Volume (MT) Analysis by Form, 2018 to 2033

Figure 16: Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 17: Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 18: Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 19: Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 20: Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 21: Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 22: Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Attractiveness by Nature, 2023 to 2033

Figure 27: Attractiveness by Form, 2023 to 2033

Figure 28: Attractiveness by Pet Type, 2023 to 2033

Figure 29: Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Attractiveness by Country, 2023 to 2033

Figure 31: Germany Value (US$ Million) by Nature, 2023 to 2033

Figure 32: Germany Value (US$ Million) by Form, 2023 to 2033

Figure 33: Germany Value (US$ Million) by Pet Type, 2023 to 2033

Figure 34: Germany Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: Germany Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 36: Germany Volume (MT) Analysis by Nature, 2018 to 2033

Figure 37: Germany Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 38: Germany Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 39: Germany Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 40: Germany Volume (MT) Analysis by Form, 2018 to 2033

Figure 41: Germany Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 42: Germany Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 43: Germany Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 44: Germany Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 45: Germany Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 46: Germany Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 47: Germany Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 48: Germany Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 49: Germany Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 50: Germany Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 51: Germany Attractiveness by Nature, 2023 to 2033

Figure 52: Germany Attractiveness by Form, 2023 to 2033

Figure 53: Germany Attractiveness by Pet Type, 2023 to 2033

Figure 54: Germany Attractiveness by Distribution Channel, 2023 to 2033

Figure 55: UK Value (US$ Million) by Nature, 2023 to 2033

Figure 56: UK Value (US$ Million) by Form, 2023 to 2033

Figure 57: UK Value (US$ Million) by Pet Type, 2023 to 2033

Figure 58: UK Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 59: UK Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 60: UK Volume (MT) Analysis by Nature, 2018 to 2033

Figure 61: UK Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 62: UK Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 63: UK Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 64: UK Volume (MT) Analysis by Form, 2018 to 2033

Figure 65: UK Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 66: UK Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 67: UK Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 68: UK Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 69: UK Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 70: UK Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 71: UK Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 72: UK Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 73: UK Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 74: UK Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 75: UK Attractiveness by Nature, 2023 to 2033

Figure 76: UK Attractiveness by Form, 2023 to 2033

Figure 77: UK Attractiveness by Pet Type, 2023 to 2033

Figure 78: UK Attractiveness by Distribution Channel, 2023 to 2033

Figure 79: France Value (US$ Million) by Nature, 2023 to 2033

Figure 80: France Value (US$ Million) by Form, 2023 to 2033

Figure 81: France Value (US$ Million) by Pet Type, 2023 to 2033

Figure 82: France Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 83: France Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 84: France Volume (MT) Analysis by Nature, 2018 to 2033

Figure 85: France Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 86: France Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 87: France Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 88: France Volume (MT) Analysis by Form, 2018 to 2033

Figure 89: France Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 90: France Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 91: France Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 92: France Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 93: France Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 94: France Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 95: France Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 96: France Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 97: France Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 98: France Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 99: France Attractiveness by Nature, 2023 to 2033

Figure 100: France Attractiveness by Form, 2023 to 2033

Figure 101: France Attractiveness by Pet Type, 2023 to 2033

Figure 102: France Attractiveness by Distribution Channel, 2023 to 2033

Figure 103: Italy Value (US$ Million) by Nature, 2023 to 2033

Figure 104: Italy Value (US$ Million) by Form, 2023 to 2033

Figure 105: Italy Value (US$ Million) by Pet Type, 2023 to 2033

Figure 106: Italy Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 107: Italy Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 108: Italy Volume (MT) Analysis by Nature, 2018 to 2033

Figure 109: Italy Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 110: Italy Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 111: Italy Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 112: Italy Volume (MT) Analysis by Form, 2018 to 2033

Figure 113: Italy Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 114: Italy Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 115: Italy Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 116: Italy Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 117: Italy Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 118: Italy Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 119: Italy Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 120: Italy Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 121: Italy Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 122: Italy Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 123: Italy Attractiveness by Nature, 2023 to 2033

Figure 124: Italy Attractiveness by Form, 2023 to 2033

Figure 125: Italy Attractiveness by Pet Type, 2023 to 2033

Figure 126: Italy Attractiveness by Distribution Channel, 2023 to 2033

Figure 127: Spain Value (US$ Million) by Nature, 2023 to 2033

Figure 128: Spain Value (US$ Million) by Form, 2023 to 2033

Figure 129: Spain Value (US$ Million) by Pet Type, 2023 to 2033

Figure 130: Spain Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 131: Spain Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 132: Spain Volume (MT) Analysis by Nature, 2018 to 2033

Figure 133: Spain Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 134: Spain Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 135: Spain Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 136: Spain Volume (MT) Analysis by Form, 2018 to 2033

Figure 137: Spain Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 138: Spain Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 139: Spain Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 140: Spain Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 141: Spain Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 142: Spain Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 143: Spain Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Spain Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 145: Spain Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 146: Spain Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 147: Spain Attractiveness by Nature, 2023 to 2033

Figure 148: Spain Attractiveness by Form, 2023 to 2033

Figure 149: Spain Attractiveness by Pet Type, 2023 to 2033

Figure 150: Spain Attractiveness by Distribution Channel, 2023 to 2033

Figure 151: BENELUX Value (US$ Million) by Nature, 2023 to 2033

Figure 152: BENELUX Value (US$ Million) by Form, 2023 to 2033

Figure 153: BENELUX Value (US$ Million) by Pet Type, 2023 to 2033

Figure 154: BENELUX Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: BENELUX Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 156: BENELUX Volume (MT) Analysis by Nature, 2018 to 2033

Figure 157: BENELUX Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 158: BENELUX Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 159: BENELUX Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 160: BENELUX Volume (MT) Analysis by Form, 2018 to 2033

Figure 161: BENELUX Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 162: BENELUX Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 163: BENELUX Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 164: BENELUX Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 165: BENELUX Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 166: BENELUX Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 167: BENELUX Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 168: BENELUX Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 169: BENELUX Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 170: BENELUX Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 171: BENELUX Attractiveness by Nature, 2023 to 2033

Figure 172: BENELUX Attractiveness by Form, 2023 to 2033

Figure 173: BENELUX Attractiveness by Pet Type, 2023 to 2033

Figure 174: BENELUX Attractiveness by Distribution Channel, 2023 to 2033

Figure 175: Nordic Value (US$ Million) by Nature, 2023 to 2033

Figure 176: Nordic Value (US$ Million) by Form, 2023 to 2033

Figure 177: Nordic Value (US$ Million) by Pet Type, 2023 to 2033

Figure 178: Nordic Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 179: Nordic Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 180: Nordic Volume (MT) Analysis by Nature, 2018 to 2033

Figure 181: Nordic Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 182: Nordic Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 183: Nordic Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 184: Nordic Volume (MT) Analysis by Form, 2018 to 2033

Figure 185: Nordic Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 186: Nordic Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 187: Nordic Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 188: Nordic Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 189: Nordic Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 190: Nordic Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 191: Nordic Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 192: Nordic Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 193: Nordic Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 194: Nordic Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 195: Nordic Attractiveness by Nature, 2023 to 2033

Figure 196: Nordic Attractiveness by Form, 2023 to 2033

Figure 197: Nordic Attractiveness by Pet Type, 2023 to 2033

Figure 198: Nordic Attractiveness by Distribution Channel, 2023 to 2033

Figure 199: Russia Value (US$ Million) by Nature, 2023 to 2033

Figure 200: Russia Value (US$ Million) by Form, 2023 to 2033

Figure 201: Russia Value (US$ Million) by Pet Type, 2023 to 2033

Figure 202: Russia Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 203: Russia Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 204: Russia Volume (MT) Analysis by Nature, 2018 to 2033

Figure 205: Russia Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 206: Russia Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 207: Russia Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 208: Russia Volume (MT) Analysis by Form, 2018 to 2033

Figure 209: Russia Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 210: Russia Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 211: Russia Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 212: Russia Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 213: Russia Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 214: Russia Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 215: Russia Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 216: Russia Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 217: Russia Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 218: Russia Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 219: Russia Attractiveness by Nature, 2023 to 2033

Figure 220: Russia Attractiveness by Form, 2023 to 2033

Figure 221: Russia Attractiveness by Pet Type, 2023 to 2033

Figure 222: Russia Attractiveness by Distribution Channel, 2023 to 2033

Figure 223: Poland Value (US$ Million) by Nature, 2023 to 2033

Figure 224: Poland Value (US$ Million) by Form, 2023 to 2033

Figure 225: Poland Value (US$ Million) by Pet Type, 2023 to 2033

Figure 226: Poland Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 227: Poland Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 228: Poland Volume (MT) Analysis by Nature, 2018 to 2033

Figure 229: Poland Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 230: Poland Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 231: Poland Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 232: Poland Volume (MT) Analysis by Form, 2018 to 2033

Figure 233: Poland Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 234: Poland Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 235: Poland Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 236: Poland Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 237: Poland Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 238: Poland Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 239: Poland Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 240: Poland Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 241: Poland Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 242: Poland Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 243: Poland Attractiveness by Nature, 2023 to 2033

Figure 244: Poland Attractiveness by Form, 2023 to 2033

Figure 245: Poland Attractiveness by Pet Type, 2023 to 2033

Figure 246: Poland Attractiveness by Distribution Channel, 2023 to 2033

Figure 247: Rest of Value (US$ Million) by Nature, 2023 to 2033

Figure 248: Rest of Value (US$ Million) by Form, 2023 to 2033

Figure 249: Rest of Value (US$ Million) by Pet Type, 2023 to 2033

Figure 250: Rest of Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 251: Rest of Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 252: Rest of Volume (MT) Analysis by Nature, 2018 to 2033

Figure 253: Rest of Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 254: Rest of Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 255: Rest of Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 256: Rest of Volume (MT) Analysis by Form, 2018 to 2033

Figure 257: Rest of Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 258: Rest of Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 259: Rest of Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 260: Rest of Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 261: Rest of Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 262: Rest of Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 263: Rest of Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 264: Rest of Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 265: Rest of Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 266: Rest of Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 267: Rest of Attractiveness by Nature, 2023 to 2033

Figure 268: Rest of Attractiveness by Form, 2023 to 2033

Figure 269: Rest of Attractiveness by Pet Type, 2023 to 2033

Figure 270: Rest of Attractiveness by Distribution Channel, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe Postbiotic Pet Food Market Insights – Growth, Innovations & Forecast 2025-2035

Europe Plant-Based Pet Food Market Analysis – Growth, Applications & Outlook 2025-2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Processing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Palatants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pet Food Premix Market Analysis by Pet Type, Ingredient Type, Formand Sales ChannelThrough 2035

Pet Food Microalgae Market Insights - Nutritional Benefits & Growth 2025 to 2035

Pet Food Extrusion Market Analysis by Product Type, Animal Type, Ingredient Type, Extruder Type, Ingredient, Process and Region Through 2035

Pet Food Flavor Enhancers Market – Growth, Demand & Innovation

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA