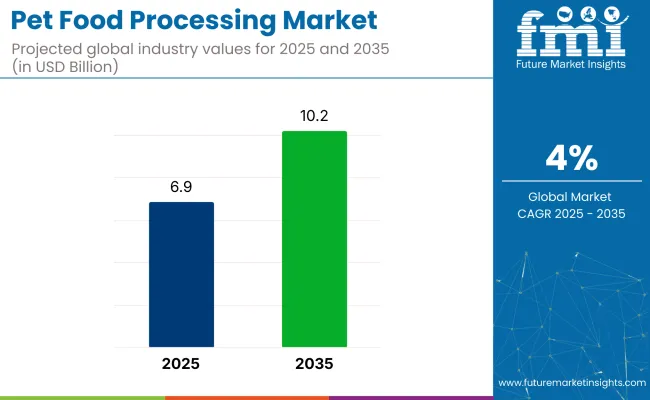

The global pet food processing market is projected to grow from USD 6.9 billion in 2025 to USD 10.2 billion by 2035, registering a CAGR of 4%. The market expansion is being driven by rising pet adoption rates, increasing humanization of pets, and growing demand for premium, nutritious, and diverse pet food products.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6.9 billion |

| Industry Value (2035F) | USD 10.2 billion |

| CAGR (2025 to 2035) | 4% |

Trends such as plant-based and insect-based pet food, alongside advanced processing techniques like extrusion and high-pressure processing (HPP), are enhancing product quality, safety, and production efficiency, thereby supporting market growth.

The market holds an estimated 100% share of the pet food production equipment market, as it forms its core segment. Within the animal food processing market, it accounts for approximately 35%, driven by rising pet food demand globally.

It contributes around 15% to the pet food market, given its role in producing final packaged products. In the broader pet care market, its share is about 8%, reflecting its equipment-focused nature.

Within the food processing equipment market, its share remains smaller at 3-5%, while in the overall industrial processing equipment market, its share is minimal below 0.02%.

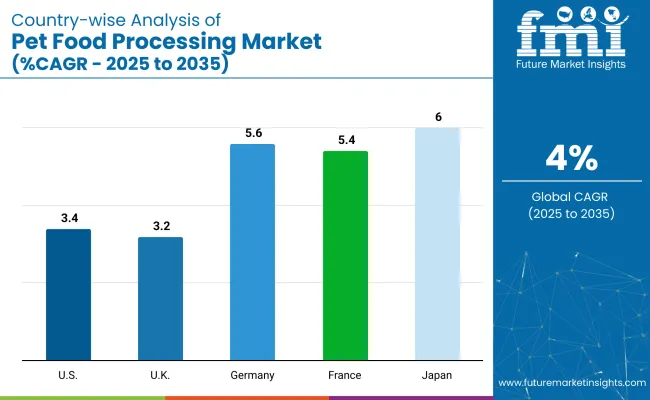

Government regulations impacting the market focus on pet food safety, quality control, and labelling standards. The Food Safety Modernization Act (FSMA) in the United States, EU Regulation No. 767/2009 on the placing of feed on the market in Europe, and the Pet Food Regulations under the Food Safety and Standards Act, 2006 in India set strict requirements for hygiene, nutritional content, and ingredient transparency in pet food production. Japan is projected to be the fastest-growing market, expanding at a CAGR of 6% from 2025 to 2035.

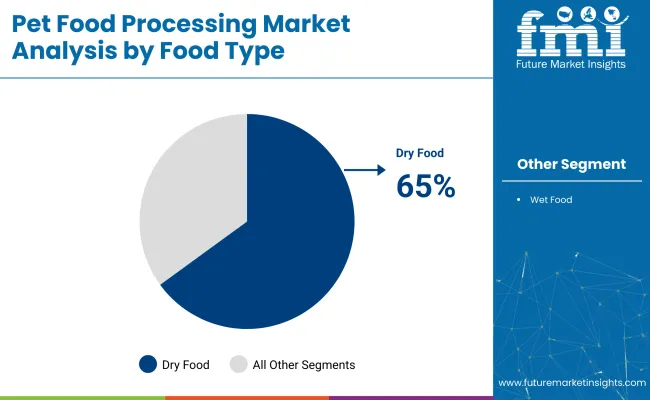

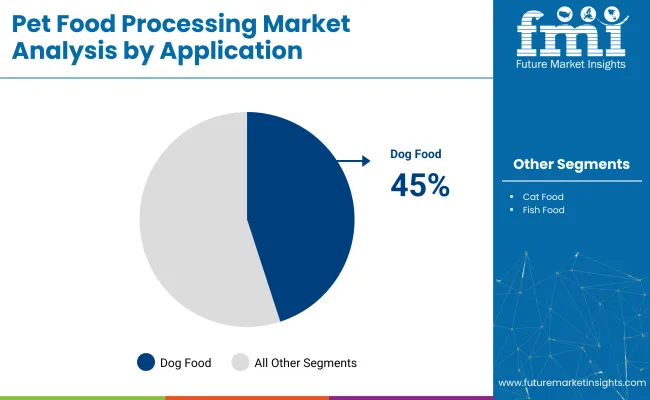

Dry food will lead the food type segment with a 65% share, while dog food will dominate the application segment with a 45% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 3.4% and 5.6%, respectively.

The pet food processing market is segmented by product type, food type, application, and region. By product type, the market is divided into mixing & blending equipment, forming equipment, baking & drying equipment, cooling equipment, and others(packaging equipment, extrusion equipment, grinding equipment, high-pressure processing equipment).

By food type, the market is bifurcated into dry food and wet food. Based on application, the market is segmented into dog food, cat food, and fish food. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

Mixing & blending equipment is projected to lead the product type segment, capturing 35% of the market share by 2025. These equipment types are crucial for ensuring homogenous mixtures of ingredients in pet food production.

Dry food is projected to lead the food type segment, accounting for 65% of the global market share by 2025. Its popularity stems from convenience, ease of storage, cost-effectiveness, and the growing trend of structured pet meals.

Dog food processing is expected to account for 45% of the market share by 2025, driven by the high number of dog owners globally and the growing demand for specialized, nutritious food for pets.

The global pet food processing market is experiencing steady growth, driven by rising pet ownership, increasing demand for nutritious and premium pet food, and technological advancements in processing equipment.

Recent Trends in the Pet Food Processing Market

Challenges in the Pet Food Processing Market

Japan pet food processing market momentum is anchored in data-driven product innovation, premium pet nutrition trends, and regulatory alignment with pet food safety standards. Germany and France maintain consistent demand driven by EU regulations on feed quality and technological upgrades in food processing sectors. In contrast, developed economies such as the USA(3.4% CAGR), UK (3.2% CAGR), and Japan (6% CAGR) are expanding at a steady 0.85-1.50x of the global growth rate.

In this market, Japan leads with the highest CAGR of 6%, driven by premiumisation and advanced processing technologies. Germany follows at 5.6%, supported by strict EU feed safety regulations and automation adoption.

France records a 5.4% CAGR, driven by clean label trends and multifunctional equipment demand. The USA grows at 3.4%, below the global average, focusing on premiumisation and regulatory compliance. The United Kingdom has the slowest growth at 3.2%, driven by vegan and natural pet food trends. Overall, Japan outpaces others, while the Uk and USA grow steadily but slower.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Japan pet food processing revenue is growing at a CAGR of 6% from 2025 to 2035. Growth is driven by rising pet ownership among aging demographics and demand for premium, functional pet food products. As a technology-driven OECD economy, Japan prioritizes advanced processing solutions such as high-pressure processing and automated extrusion lines to ensure safety and nutrient integrity.

The sales of pet food processing products in Germany are expanding at 5.6% CAGR during the forecast period, above the global average and strongly regulation-led. EU feed safety standards, automation in processing plants, and premium pet food trends are driving growth. Key applications include dog and cat food processing for export within Europe.

The French pet food processing market is projected to grow at a 5.4% CAGR during the forecast period, similar to Germany in its policy-backed adoption trajectory. Demand is driven by premiumisation, health-focused formulations, and clean label trends. Major applications include dog and cat food processing for domestic consumption and export.

The USA pet food processing market is projected to grow at 3.4% CAGR from 2025 to 2035, translating to 0.85x the global rate. Unlike emerging markets focused on production expansion, United States demand is driven by premiumisation, ingredient traceability, and FDA regulatory compliance. Major applications include dog food, cat food, and functional treats production.

The UK pet food processing revenue is projected to grow at a CAGR of 3.2% from 2025 to 2035, representing the slowest growth among the top OECD nations, at 0.80 times the global pace. Growth is supported by rising demand for vegan and natural pet food, alongside regulatory standards for feed safety.

The pet food processing market is moderately consolidated, with leading players like The Middleby Corporation, Andritz Group, Buhler Holding AG, GEA Group, and Baker Perkins Ltd dominating the industry. These companies provide advanced processing equipment catering to pet food manufacturers globally. The Middleby Corporation specializes in integrated food processing systems, while Andritz Group offers extrusion and drying technologies for high-volume pet food production.

Buhler Holding AG delivers innovative extrusion, mixing, and drying solutions. GEA Group focuses on hygienic processing equipment and automation, and Baker Perkins Ltd is known for its forming and baking technologies. Other key players like Clextral SAS, Precision Food Innovations, Mepaco Group, Coperion GMBH, and F.N. Smith Corporation contribute by providing specialized, high-performance equipment supporting diverse pet food formulations and production scales.

Recent Pet Food Processing Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 6.9 billion |

| Projected Market Size (2035) | USD 10.2 billion |

| CAGR (2025 to 2035) | 4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value /volume in units |

| Product Type Analyzed | Mixing & Blending Equipment, Forming Equipment, Baking & Drying Equipment, Cooling Equipment, and Others (Packaging Equipment, Extrusion Equipment, Grinding Equipment, High-Pressure Processing Equipment). |

| Food Type Analyzed | Dry Food and Wet Food |

| Application Analyzed | Dog Food, Cat Food, and Fish Food |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | The Middleby Corporation, Andritz Group, Buhler Holding AG, GEA Group, Baker Perkins Ltd, Clextral SAS, Precision Food Innovations, Mepaco Group, Coperion GMBH, F.N. Smith Corporation |

| Additional Attributes | Dollar sales by equipment type, share by food type, regional demand growth, policy influence, technology trends, competitive benchmarking |

The market is valued at USD 6.9 billion in 2025.

The market is forecasted to reach USD 10.2 billion by 2035, reflecting a CAGR of 4.%.

Dry food will lead the food type segment, accounting for 65% of the global market share in 2025.

Dog food processing will dominate the application segment with a 45% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 6% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA