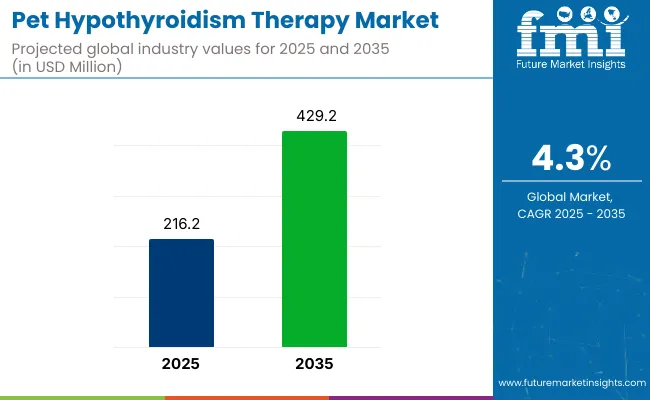

The global pet hypothyroidism therapy market is expected to reach USD 216.2 million in 2025 and is projected to grow to USD 429.2 million by 2035, with a CAGR of 4.3%. This growth is driven by the increasing prevalence of hypothyroidism in pets, particularly dogs, and the rising awareness of pet health. The demand for specialized medical treatments, such as hormone replacement therapies, is being fueled by the growing humanization of pets, particularly among Gen Z pet owners.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 216.2 million |

| Market Size in 2035 | USD 429.2 million |

| CAGR (2025 to 2035) | 4.3% |

The primary treatment for hypothyroidism in pets, levothyroxine sodium, is expected to be widely used for managing the condition in dogs. Tablet-based treatments are preferred due to their convenience and effectiveness, making them the most commonly prescribed form of therapy. Other treatment forms, such as injections and supplements, are being developed, but tablets are still considered the most common method.

The continued focus on improving treatments for pet hypothyroidism is expected to drive innovation in the market, with more efficient and targeted solutions being introduced. Other forms of treatment, such as injections and supplements, are being developed but tablets remain the most common form of therapy.

Innovation in hormone replacement therapies will continue to be driven by leading players such as Dechra Pharmaceuticals PLC, LLOYD, Inc., Merck & Co., Inc., Virbac, and Zoetis. According to Jeff Simmons, President & CEO of Elanco Animal Health, "Pet owners today, particularly Gen Zers, are more likely to see their pets as best friends, which drives an increased willingness to spend. At the same time, there’s increasing demand for animal protein." This shift in perception is expected to contribute to the growth of the pet healthcare market, including the pet hypothyroidism therapy segment.

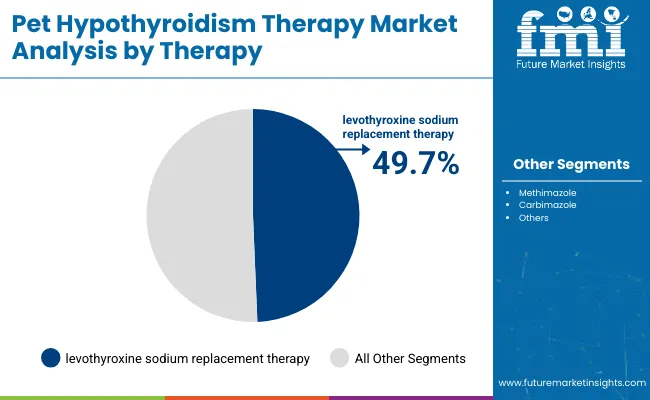

The pet hypothyroidism therapy market is categorized into several segments, including therapy type, dosage form, species, sales channels, and regions. The therapy segment includes levothyroxine sodium replacement therapy, methimazole, and carbimazole. In terms of dosage form, the market covers tablets and oral solutions.

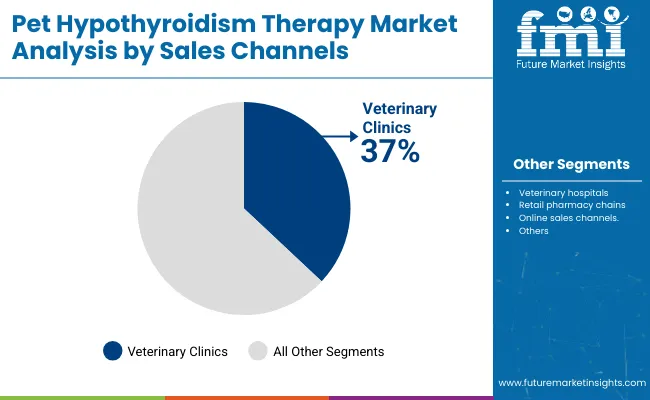

The species segment is divided into canine and feline species. Sales channels encompass veterinary hospitals, veterinary clinics, retail pharmacy chains, and online sales platforms. Geographically, the market spans across North America, Western Europe, East Asia, and South Asia, reflecting its broad global reach.

Levothyroxine sodium replacement is projected to dominate the pet hypothyroidism therapy market, accounting for 49.7% of the market share in 2025. This synthetic thyroid hormone is recognized for its effectiveness in managing hypothyroidism in pets, particularly dogs.

Tablets are projected to dominate the pet hypothyroidism therapy market, holding a 61.7% share by 2025. Their widespread use is attributed to their ease of administration, precise dosing, and convenience, making them the preferred choice for long-term management of hypothyroidism in pets.

Canines are expected to capture 55.9% of the market share for pet hypothyroidism therapies by 2025. Hypothyroidism is a prevalent endocrine disorder, especially in older dog breeds.

Veterinary clinics are anticipated to capture 37% of the pet hypothyroidism therapy market share by 2025. Clinics play a crucial role in diagnosing and treating hypothyroidism in pets, offering diagnostic tests and personalized treatment plans.

The pet hypothyroidism therapy market is being driven by the increasing prevalence of hypothyroidism in dogs and advancements in diagnostic and treatment options.However, challenges such as high treatment costs and the need for lifelong medication are limiting market growth.

Increasing prevalence of hypothyroidism in dogs is driving market growth

The increasing prevalence of hypothyroidism in dogs is significantly driving the pet hypothyroidism therapy market. This disorder, which leads to a decrease in the production of thyroxine hormones, is being recognized as one of the most common endocrine conditions in dogs. The condition causes various clinical signs, including metabolic and dermatological alterations.

The rising number of diagnosed cases is boosting the demand for effective therapeutic solutions. Advances in diagnostic techniques, enabling earlier and more accurate detection, are contributing to more timely interventions, thereby expanding the market for hypothyroidism therapies in pets.

High treatment costs and need for lifelong medication are limiting market growth

Despite the growing demand for hypothyroidism therapies, the market is being hindered by high treatment costs and the need for lifelong medication. The standard treatment for hypothyroidism in dogs, levothyroxine, requires ongoing administration and regular monitoring to adjust dosages appropriately. These long-term treatment requirements are creating significant financial commitments for pet owners.

Additionally, the need for continuous veterinary care and regular adjustments in medication dosages is increasing the overall cost. These factors are making it difficult for some pet owners to access and sustain treatment, which is limiting the growth of the pet hypothyroidism therapy market.

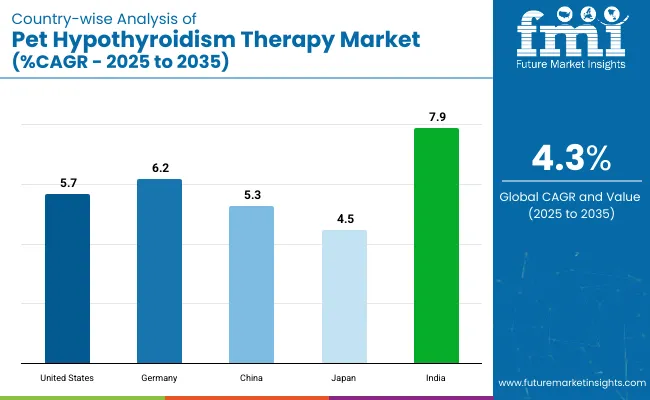

The pet hypothyroidism therapy market is expected to grow through 2035, driven by increasing awareness of pet health and the rising demand for effective thyroid treatments. Rapid growth is observed in emerging economies like China and India, while established markets like the USA and Germany are focusing on advancements in pet care and treatment options.

| Countries | CAGR (%) |

|---|---|

| United States | 5.7% |

| Germany | 6.2% |

| China | 5.3% |

| Japan | 4.5% |

| India | 7.9% |

The United States pet hypothyroidism therapy market is expected to grow at a CAGR of 5.7% through 2035. Growth is driven by increased awareness of hypothyroidism in pets and the availability of advanced thyroid replacement therapies.

The pet hypothyroidism therapy market is projected to grow at a CAGR of 6.2% through 2035. Growth is being supported by high standards of veterinary care and continued research into pet healthcare.

The pet hypothyroidism therapy market is expected to grow at a CAGR of 5.3% through 2035. The market is driven by rising health awareness among pet owners and the growing availability of veterinary care.

Thepet hypothyroidism therapy market is projected to grow at a CAGR of 4.5% through 2035. Growth is being supported by the country’s aging pet population and increasing demand for effective thyroid treatment solutions.

The pet hypothyroidism therapy market is expected to grow at a CAGR of 7.9% through 2035. Growth is being driven by rising pet ownership, increasing awareness of pet health, and improving healthcare infrastructure.

The pet hypothyroidism therapy market is segmented into key players and emerging players. Key players like Dechra Pharmaceuticals PLC, Merck & Co., Inc., Zoetis, Elanco Animal Health, Boehringer Ingelheim Animal Health, and Virbac dominate the market with their extensive product portfolios, technological advancements, and strong global presence.

FDA-approved levothyroxine sodium tablets, including Thyro-Tabs Canine and ThyroKare™, are offered for the treatment of hypothyroidism in dogs. Other significant players such as LLOYD, Inc., Ceva Animal Health, and Vetoquinol focus on hormone replacement therapies for hypothyroidism in pets. Emerging players like Norbrook Laboratories offer alternative therapies targeting regional markets.

Recent Pet Hypothyroidism Therapy Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 216.2 million |

| Projected Market Size (2035) | USD 429.2 million |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million doses for units |

| Therapies Covered (Segment 1) | Levothyroxine sodium replacement therapy; Methimazole;Carbimazole |

| Dosage Forms Covered (Segment 2) | Tablets; Oral solutions |

| Species Covered (Segment 3) | Canine; Feline |

| Sales Channels Covered (Segment 4) | Veterinary hospitals; Veterinary clinics; Retail pharmacy chains; Online sales channels |

| Regions Covered | North America; Western Europe; East Asia; South Asia |

| Countries Covered | United States; Canada; United Kingdom; Germany; France; Italy; Spain; Netherlands; China; Japan; South Korea; India; Pakistan; Bangladesh |

| Key Players Influencing the Market | Dechra Pharmaceuticals PLC; VetOne; Merck & Co., Inc.; Virbac ; LLOYD, Inc.; Grey Wolf Animal Health; Norbrook |

| Additional Attributes | Dollar sales by therapy type (levothyroxine sodium, methimazole, carbimazole); Market adoption in canine vs feline species; Growth of online sales channels vs veterinary clinics; Trends in tablet vs oral solution forms of therapy |

The market is segmented into levothyroxine sodium replacement therapy, methimazole, and carbimazole.

The market includes tablets and oral solutions.

The market is categorized into canine and feline species.

The market covers veterinary hospitals, veterinary clinics, retail pharmacy chains, and online sales channels.

The market spans North America, Western Europe, East Asia, and South Asia.

The market is expected to reach USD 429.2 million by 2035.

The market size is projected to be USD 216.2 million in 2025.

The market is expected to grow at a CAGR of 4.3%.

Levothyroxine sodium replacement therapy is expected to lead with a 49.7% market share in 2025.

India is expected to be the fastest growing with a CAGR of 7.9%.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA