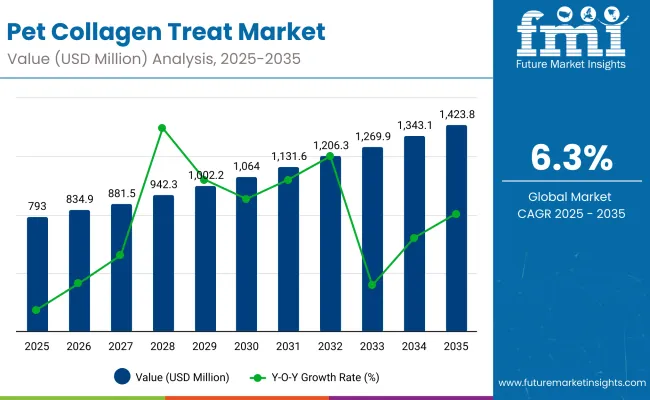

The Pet Collagen Treats Market is expected to achieve a valuation of USD 793.0 million in 2025, rising to USD 1,466.0 million by 2035. This represents an incremental gain of USD 673 million across the decade, supported by a steady CAGR of 6.3%. The trajectory reflects the transition of collagen from niche wellness to mainstream functional pet nutrition, underpinned by growing demand for preventive health solutions and the humanization of pets.

Pet Collagen Treats Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 793.0 Million |

| Market Forecast Value in (2035F) | USD 1,466.0 Million |

| Forecast CAGR (2025 to 2035) | 6.3% |

In the first phase (2025-2030), the market is projected to expand from USD 793.0 million to USD 1,078.9 million, contributing nearly USD 286 million, or about 42% of the decade’s growth. Uptake during this period is expected to be driven by increasing awareness of collagen’s joint and mobility benefits, particularly in aging dog populations. Premium chew formats and early penetration into online retail are anticipated to anchor performance.

During the second phase (2030-2035), growth is projected to accelerate further, with market value rising from USD 1,078.9 million to USD 1,466.0 million, contributing around USD 387 million, equal to 58% of total growth. Expansion in this period is likely to be powered by functional diversification into skin & coat health and dental support, while stronger veterinarian endorsements and subscription-led D2C models will reinforce repeat adoption. Regionally, North America and Europe are expected to remain value anchors, while South Asia & Pacific and Latin America post faster relative gains.

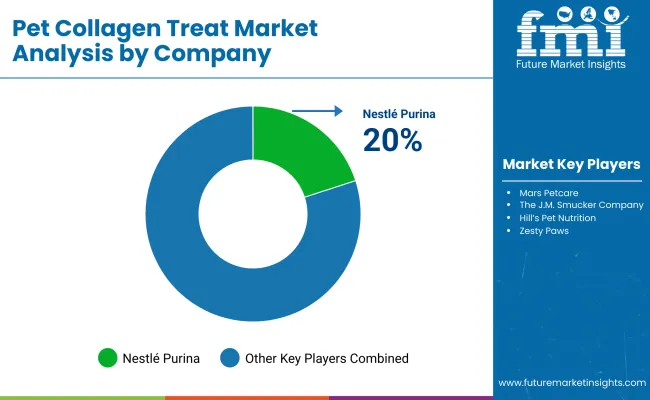

From 2020 to 2024, the Pet Collagen Treats Market expanded steadily as functional pet treats gained visibility, moving from early adoption to broader awareness. Growth during this period was primarily driven by dog-focused collagen chews, which accounted for the majority of demand. The competitive landscape was dominated by global leaders such as Nestlé Purina, The J.M. Smucker Company, Mars Petcare, Hill’s Pet Nutrition, and Zesty Paws (H&H Group), who leveraged scale, distribution, and brand authority. Market differentiation relied heavily on joint health claims, palatability, and dosing transparency, while niche players emphasized natural, clean-label, and marine collagen positioning to capture premium segments.

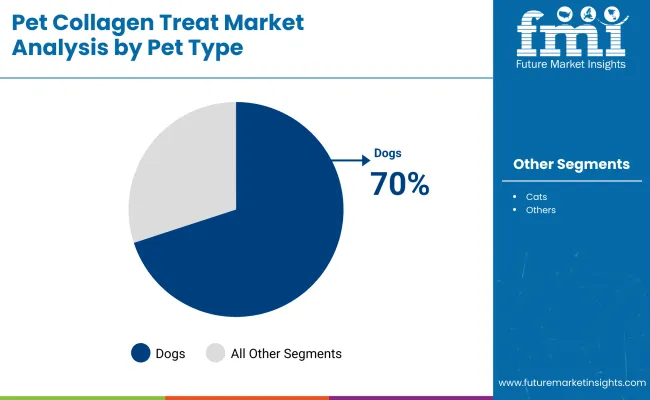

By 2025, demand for Pet Collagen Treats is projected to reach USD 793.0 million, with growth underpinned by preventive wellness routines and rising familiarity with collagen from human nutrition. Across the forecast horizon, the market is expected to nearly double in value to USD 1,466.0 million by 2035, reflecting a CAGR of 6.3%. Segment leadership will remain with dogs (70% share in 2025), while joint health benefits anchor adoption. However, accelerated growth is anticipated in skin & coat and dental support formulations, supported by diversified formats such as powders and jerky.

Competitive advantage is expected to shift from product novelty alone toward ecosystem strength, defined by transparent sourcing, clinical substantiation, subscription-driven online models, and certification-backed credibility. Challenger brands are anticipated to disrupt through vegan collagen alternatives, multifunctional blends, and D2C personalization strategies, while established players pivot toward sustainability narratives and premium vet-channel offerings to retain leadership.

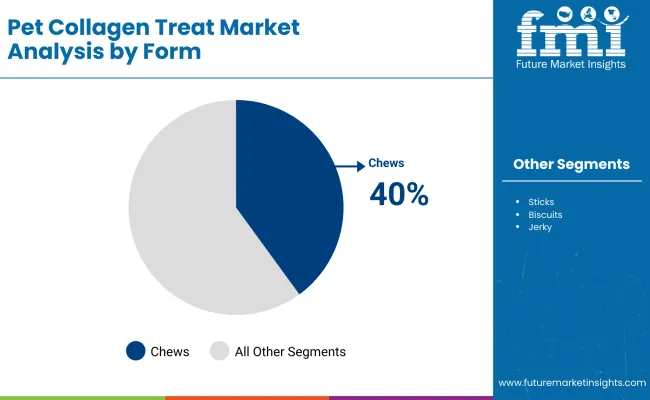

Advances in collagen sourcing and formulation have improved digestibility and palatability, allowing for more consistent health outcomes across pet categories. Chew formats have gained popularity due to their convenience and dosing accuracy, while powders are emerging as a fast-growth option for customizable supplementation. The rise of marine and plant-derived collagen has contributed to premium positioning and sustainability narratives that resonate with health-conscious pet owners. Segments such as dogs, joint health, and bovine collagen are driving core demand, while cats and alternative sources are gaining traction through specialized product innovation.

Expansion of preventive wellness routines and growing veterinarian endorsements have fueled market adoption. Innovations in subscription-driven D2C platforms, clean-label claims, and multifunctional formulations are expected to open new opportunities across premium tiers. Segment growth is projected to be led by dog-targeted treats, joint and skin & coat benefits, and bovine collagen, with powders and marine collagen advancing as the fastest-rising categories due to their adaptability, efficacy, and premium appeal.

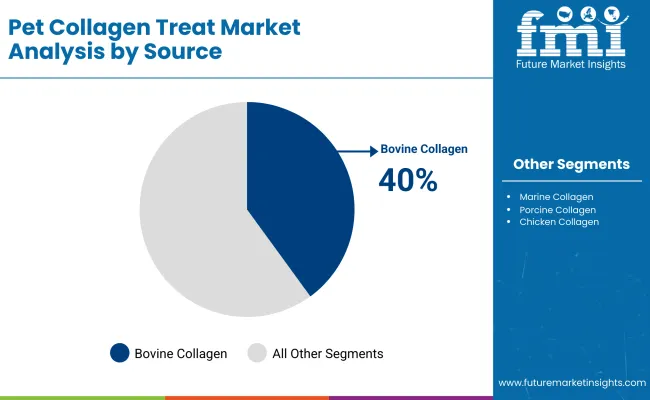

The market is segmented by pet type, collagen source, product form, functional benefit, distribution channel, price tier, and region. Among these, pet type, collagen source, and product form represent the most influential dimensions, shaping adoption patterns and consumer preferences. Dogs dominate as the primary consumer group, with rising demand also observed among cats. Bovine and marine collagen lead the source landscape, while plant-derived alternatives are gaining traction with rapid growth. In terms of form, chews and sticks capture the majority, while powders emerge as the fastest-growing. Together, these three segments define the structural backbone of the market, reflecting both established consumer routines and forward-looking trends such as premiumization, sustainability, and personalized nutrition.

| Pet Type Segment | Market Value Share, 2025 |

|---|---|

| Dogs | 70% |

| Cats | 25% |

| Others | 5% |

Bovine collagen is projected to contribute 40% of market share in 2025, supported by availability, cost efficiency, and established supply chains. Marine collagen, holding 25%, is expected to grow at a faster 9.8% CAGR, benefiting from premium positioning and digestibility advantages.

Plant-derived collagen, although niche at 5%, is forecast to be the fastest-growing subsegment (11% CAGR), reflecting demand for vegan and allergen-friendly options. Chicken collagen at 15% is anticipated to gain relevance for its palatability and compatibility, while porcine collagen maintains a stable role at 15% share. The source landscape is thus characterized by bovine dominance, marine-led premium growth, and plant-based innovation as an emerging disruptor.

| Product Form | Market Value Share, 2025 |

|---|---|

| Chews | 40% |

| Sticks | 25% |

| Biscuits | 15% |

| Jerky | 10% |

| Powders | 10% |

Chews are expected to dominate with a 40% share in 2025, favored for dosing consistency, convenience, and acceptance across pet types. Sticks follow with 25% share, sustaining steady growth as portable, high-compliance formats. Biscuits (15%) provide mass-market appeal but grow more modestly. Jerky (10%) is forecast to expand strongly (9.4% CAGR) due to palatability and owner familiarity.

Powders (10%) are expected to emerge as the fastest-growing form (10.5% CAGR), offering customization as toppers for meals. The form segment is thus balanced between traditional chewable anchoring volume and powders opening new adoption channels, ensuring flexibility in consumer choice and enabling functional diversification.

| Product Form | Market Value Share, 2025 |

|---|---|

| Bovine Collagen | 40% |

| Marine Collagen | 35% |

| Porcine Collagen | 10% |

| Chicken Collagen | 15% |

| Plant-derived Collagen | 5% |

Bovine collagen is projected to contribute 40% of market share in 2025, supported by availability, cost efficiency, and established supply chains. Marine collagen, holding 25%, is expected to grow at a faster 9.8% CAGR, benefiting from premium positioning and digestibility advantages. Plant-derived collagen, although niche at 5%, is forecast to be the fastest-growing subsegment (11% CAGR), reflecting demand for vegan and allergen-friendly options.

Chicken collagen at 15% is anticipated to gain relevance for its palatability and compatibility, while porcine collagen maintains a stable role at 15% share. The source landscape is thus characterized by bovine dominance, marine-led premium growth, and plant-based innovation as an emerging disruptor.

The adoption of collagen treats in pet wellness is being shaped by transparent sourcing requirements and evolving regulatory scrutiny, even as opportunities emerge from functional diversification, clinical substantiation, and subscription-based retail models that reinforce repeat purchasing and consumer trust.

Cross-Category Trust Transfer from Human Nutrition

A unique growth lever is being created through the trust transfer of collagen supplementation from human wellness to companion-animal applications. Pet owners already familiar with peptide-specific benefits in joint, skin, and gut health are applying this knowledge when choosing pet products. This established awareness base reduces educational barriers, accelerates adoption, and strengthens willingness to pay premiums for clinically supported formulations. The embedded credibility of collagen in human markets is being converted into a halo effect, ensuring that new pet products are not perceived as untested or experimental. Over the forecast period, this transfer of consumer trust is expected to enhance compliance, shorten trial-to-repeat cycles, and foster enduring loyalty across both retail and digital subscription channels.

Palatability versus Therapeutic Dosage Trade-Off

A significant barrier is being observed in balancing effective collagen dosing with product palatability. High concentrations required for clinically relevant outcomes often alter texture, odor, or taste, leading to compliance issues among pets. To mitigate this, manufacturers are investing in encapsulation, flavor-masking, and chew-time engineering technologies, which raise production costs and lengthen innovation cycles. Brands unable to reconcile efficacy with sensory acceptance risk product rejection and unfavorable reviews, especially in digital marketplaces where owner feedback is decisive. This dosage-palatability trade-off is expected to remain a structural restraint, placing continuous pressure on R&D investment and innovation pipelines.

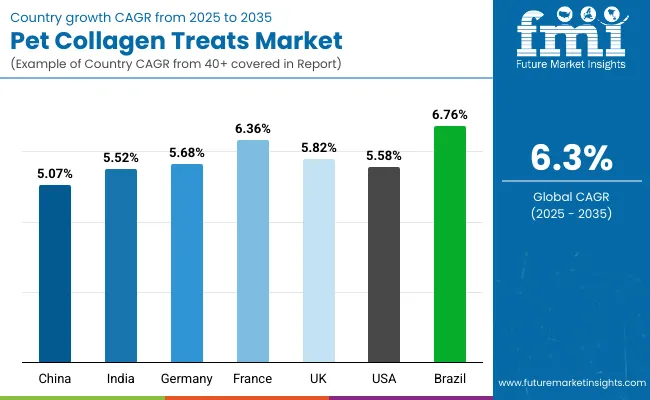

| Countries | CAGR |

|---|---|

| China | 5.07% |

| India | 5.52% |

| Germany | 5.68% |

| France | 6.36% |

| UK | 5.82% |

| USA | 5.58% |

| Brazil | 6.76% |

The Pet Collagen Treats Market demonstrates varied country-level growth patterns, influenced by pet humanization trends, veterinary endorsement, and retail structures. Brazil is projected to post the fastest expansion with a 6.76% CAGR, underpinned by supermarket penetration and growing middle-class pet expenditure. France follows with 6.36% CAGR, reflecting premium/natural product positioning and strong veterinary influence, enabling share gains from 13.1% in 2025 to 14.8% in 2035. Germany maintains leadership in Europe, accounting for 21.1% share in 2025, moderating to 20.8% by 2035, supported by high per-pet spending and strict quality standards. The UK is expected to remain stable, with share adjusting from 18.8% to 18.2%, supported by robust online retail and private-label expansion.

In Asia, India is forecast to expand at 5.52% CAGR, aided by rising pet ownership and e-commerce reach, though affordability limits broad penetration. China records steadier growth at 5.07% CAGR, where collagen is still a niche within functional treats, though marine collagen resonates in urban premium segments. The United States, the largest national market, grows at 5.58% CAGR, with momentum shaped by subscription-led digital models, premium retail, and vet-channel reinforcement. Collectively, these markets highlight a dual narrative: mature economies consolidating value leadership and emerging economies delivering incremental growth opportunities.

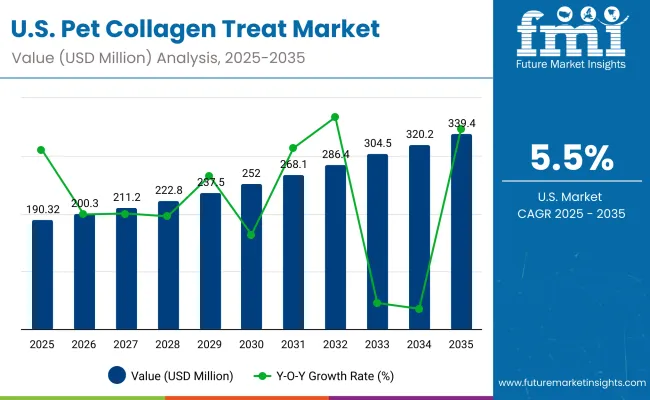

| Year | USA Pet Collagen Treats Market (USD Million) |

|---|---|

| 2025 | 190.32 |

| 2026 | 200.3 |

| 2027 | 211.2 |

| 2028 | 222.8 |

| 2029 | 237.5 |

| 2030 | 252.0 |

| 2031 | 268.1 |

| 2032 | 286.4 |

| 2033 | 304.5 |

| 2034 | 320.2 |

| 2035 | 339.4 |

The Pet Collagen Treats Market in the United States is forecast to advance at a 6.0% CAGR between 2025 and 2035, increasing in size from USD 179.5 million to USD 339.4 million. Expansion is expected to be supported by high awareness of collagen’s role in human wellness, a premium-oriented pet food culture, and the maturity of online subscription channels. Joint health is projected to remain the anchor benefit, while skin and coat outcomes are expected to accelerate repeat adoption.

The Pet Collagen Treats Market in the UK is projected to grow at a 5.82% CAGR between 2025 and 2035, with share moderating slightly from 18.8% to 18.2% of Europe. Expansion will be supported by strong online retail penetration and growth in private-label offerings through large grocery chains. Premium adoption is expected to remain resilient as collagen chews and sticks align with humanization trends.

The Pet Collagen Treats Market in India is expected to expand at a 5.52% CAGR from 2025 to 2035, driven by rising pet ownership and rapid digital retail adoption. Growth is projected to stem primarily from urban middle-class households seeking affordable preventive care solutions. Although affordability constraints persist, the segment is expected to benefit from increasing exposure to global functional treat brands.

The Pet Collagen Treats Market in China is forecast to grow at a 5.07% CAGR, reflecting steady but cautious adoption. Collagen remains a niche within the broader functional pet treat category, though urban premium consumers are projected to drive marine collagen adoption. Domestic brands are expected to leverage cost-competitive sourcing to challenge international players.

| Countries | 2025 |

|---|---|

| UK | 18.82% |

| Germany | 21.10% |

| Italy | 10.72% |

| France | 13.07% |

| Spain | 9.24% |

| BENELUX | 6.31% |

| Nordic | 5.53% |

| Rest of Europe | 15% |

| Countries | 2035 |

|---|---|

| UK | 18.20% |

| Germany | 20.76% |

| Italy | 11.80% |

| France | 14.78% |

| Spain | 10.81% |

| BENELUX | 5.18% |

| Nordic | 5.08% |

| Rest of Europe | 13% |

The Pet Collagen Treats Market in Germany is projected to record a 5.68% CAGR over the forecast period, with its European share adjusting from 21.1% in 2025 to 20.8% in 2035. Germany is expected to remain the largest European hub, supported by stringent quality compliance and high per-pet expenditure. Premium collagen treats with clean-label claims are forecast to gain preference among health-conscious owners.

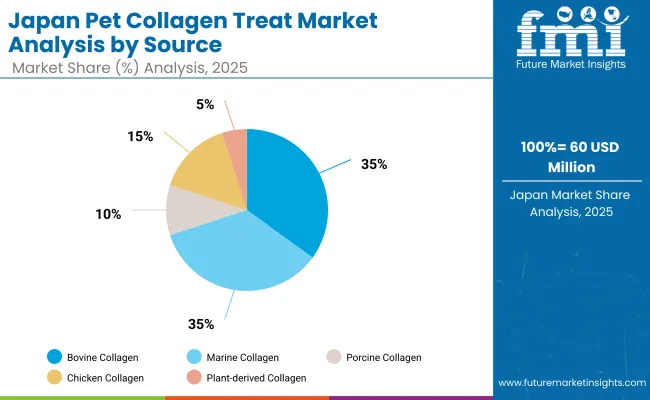

| Japan Source | 2025 Share |

|---|---|

| Bovine Collagen | 35% |

| Marine Collagen | 35% |

| Porcine Collagen | 10% |

| Chicken Collagen | 15% |

| Plant-derived Collagen | 5% |

| Japan Source | CAGR |

|---|---|

| Bovine Collagen | 8.30% |

| Marine Collagen | 9.70% |

| Porcine Collagen | 7.50% |

| Chicken Collagen | 9.00% |

| Plant-derived Collagen | 10.80% |

The Pet Collagen Treats Market in Japan is projected to be valued at USD 60 million in 2025, with bovine and marine collagen together contributing 70% of the market. This balanced reliance reflects both affordability in bovine sourcing and the premium perception of marine collagen, which aligns well with Japanese consumer trust in purity and digestibility. Plant-derived collagen, while niche at 5% share, is anticipated to post the fastest CAGR of 10.8%, underlining the early adoption of vegan and allergen-sensitive solutions in premium households.

Growth in Japan is expected to be shaped by a culture of preventive health, with collagen demand linked strongly to joint mobility support and coat health in aging small breeds. Palatability improvements and multifunctional blends with probiotics are anticipated to drive differentiation. Clean-label transparency, veterinary trust, and hybrid channels (e-commerce plus clinics) are expected to strengthen market credibility.

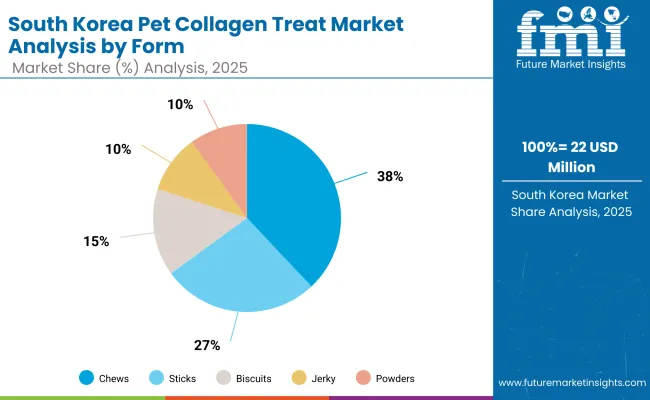

| South Korea Form | 2025 Share |

|---|---|

| Chews | 38% |

| Sticks | 27% |

| Biscuits | 15% |

| Jerky | 10% |

| Powders | 10% |

| South Korea Form | CAGR |

|---|---|

| Chews | 9.20% |

| Sticks | 9.00% |

| Biscuits | 8.60% |

| Jerky | 9.60% |

| Powders | 10.80% |

The Pet Collagen Treats Market in South Korea is projected to be valued at USD 22 million in 2025 and is expected to reach USD 54 million by 2035, advancing at a 9.4% CAGR. Chews are anticipated to maintain leadership with a 38% share in 2025, supported by their high palatability and dosing convenience. Sticks (27%) will remain the secondary choice, reflecting portability and consumer familiarity. Biscuits (15%) are projected to grow moderately, while jerky (10%) will see faster adoption at 9.6% CAGR. The standout growth is expected from powders (10% share, 10.8% CAGR), which are favored for customizable use as meal toppers, supporting broader compliance across pet types.

Growth is expected to be reinforced by high pet humanization, strong online retail infrastructure, and owner demand for premium wellness products. Clean-label narratives, functional stacking, and vet-driven trust are anticipated to elevate premium tiers further.

The Pet Collagen Treats Market is moderately fragmented, with global leaders, regional manufacturers, and niche-focused specialists competing across diverse consumer segments. Global pet nutrition leaders such as Nestlé Purina, The J.M. Smucker Company, Mars Petcare, Hill’s Pet Nutrition, and Zesty Paws (H&H Group) hold significant market share, supported by established distribution networks, strong veterinary endorsements, and wide portfolios of functional treats. Their strategies are increasingly emphasizing premium collagen chews, transparent sourcing claims, and subscription-driven e-commerce models to consolidate loyalty among pet owners.

Established mid-sized innovators, including regional brands in Asia and Europe, are catering to demand for marine-based, chicken-based, and plant-derived collagen products. These companies are accelerating adoption by introducing differentiated formats such as powders and jerky, designed for palatability and flexible dosing. Partnerships with veterinarians and specialty stores are being leveraged to gain consumer trust and build credibility against multinational incumbents.

Specialist providers, often positioned in niche markets, are focusing on vegan collagen alternatives, clean-label recipes, and allergen-sensitive formulations. Their strength lies in agility, customization, and the ability to respond quickly to evolving consumer demands, particularly in premium and urban markets. Competitive differentiation is shifting away from simple treat innovation toward ecosystem strength built on clinical substantiation, quality certification, and hybrid retail integration.

Key Developments in Pet Collagen Treats Market

| Item | Value |

|---|---|

| Quantitative Units | USD 793.0 Million |

| Pet Type | Dogs, Cats, Others (rabbits, ferrets, small pets) |

| Collagen Source | Bovine, Marine, Porcine, Chicken, Plant-derived (vegan/alt.) |

| Product Form | Chews, Sticks, Biscuits, Jerky, Powders (treat toppers) |

| Functional Benefits | Joint Health, Skin & Coat, Gut Health, Dental Support, All-in-One Wellness |

| Distribution Channels | Pet Specialty Stores, Supermarkets/Hypermarkets, Online Retail (D2C, Marketplaces), Veterinary Clinics, B2B/Private Label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestlé Purina, Mars Petcare, The J.M. Smucker Company, Hill’s Pet Nutrition (Colgate-Palmolive), Zesty Paws (H&H Group), plus regional innovators & private-label players |

| Additional Attributes | Dollar sales by pet type, collagen source, and form; rising demand for joint-health chews and multifunctional formulations; adoption trends in subscription-driven e-commerce and vet channels; premiumization through marine and plant-based collagen; regulatory influence on claim substantiation; clean-label, allergen-free, and sustainability narratives shaping differentiation; regional uptake patterns led by North America, Europe, and South Asia & Pacific. |

The global Pet Collagen Treats Market is estimated to be valued at USD 793.0 million in 2025.

The market size for the Pet Collagen Treats Market is projected to reach USD 1,466.0 million by 2035.

The Pet Collagen Treats Market is expected to expand at a CAGR of 6.3% between 2025 and 2035.

The key product forms in the Pet Collagen Treats Market are chews, sticks, biscuits, jerky, and powders (treat toppers).

In terms of pet type, the dog segment is expected to command 70% share of the global market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Pet Blood Pressure Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA