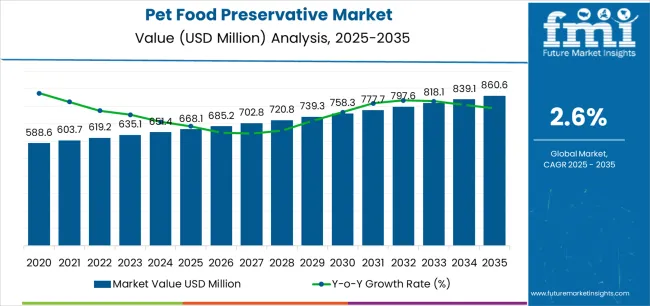

The Pet Food Preservative Market is estimated to be valued at USD 668.1 million in 2025 and is projected to reach USD 860.6 million by 2035, registering a compound annual growth rate (CAGR) of 2.6% over the forecast period.

The Pet Food Preservative market is witnessing steady growth, driven by increasing awareness among pet owners about food safety, nutritional quality, and extended shelf life. Rising pet ownership across developed and emerging regions is creating higher demand for high-quality dog and cat food, which requires reliable preservation solutions to maintain freshness and prevent microbial contamination. Technological advancements in natural and synthetic preservatives are enhancing product efficacy while complying with regulatory standards.

Innovations in preservative formulations, including the use of bioactive compounds and antimicrobial peptides, are improving food safety and extending shelf life without compromising nutritional content. Regulatory requirements for pet food safety, coupled with stringent quality standards, are reinforcing the adoption of effective preservatives.

As pet owners increasingly prioritize health, hygiene, and quality of feed, manufacturers are integrating advanced preservation technologies into their products The market is expected to witness sustained expansion as consumer demand, regulatory compliance, and product innovation collectively drive the adoption of pet food preservatives.

| Metric | Value |

|---|---|

| Pet Food Preservative Market Estimated Value in (2025 E) | USD 668.1 million |

| Pet Food Preservative Market Forecast Value in (2035 F) | USD 860.6 million |

| Forecast CAGR (2025 to 2035) | 2.6% |

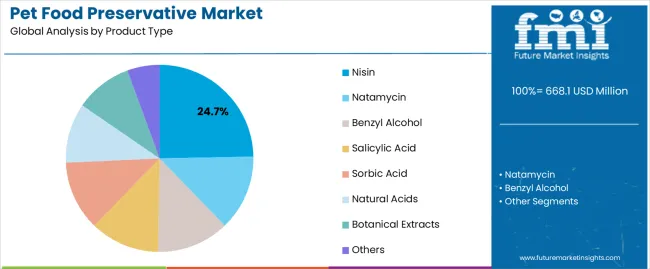

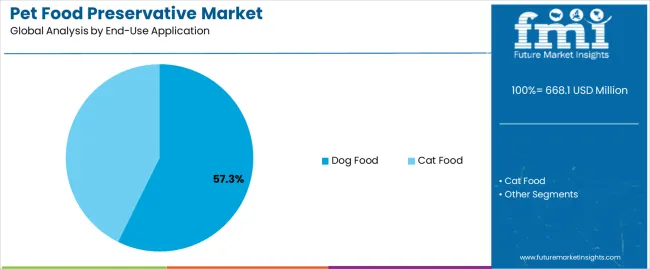

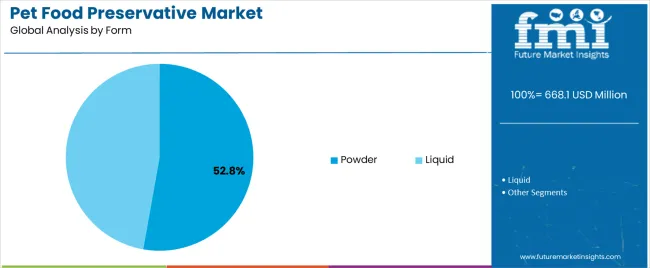

The market is segmented by Product Type, End-Use Application, and Form and region. By Product Type, the market is divided into Nisin, Natamycin, Benzyl Alcohol, Salicylic Acid, Sorbic Acid, Natural Acids, Botanical Extracts, and Others. In terms of End-Use Application, the market is classified into Dog Food and Cat Food. Based on Form, the market is segmented into Powder and Liquid. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Nisin product type segment is projected to hold 24.7% of the market revenue in 2025, establishing it as the leading product type. Its dominance is being driven by Nisin’s natural antimicrobial properties, which effectively inhibit the growth of spoilage bacteria and pathogens in pet food. The preservative is highly preferred for maintaining product safety and extending shelf life without altering nutritional quality or flavor.

Adoption is being reinforced by its regulatory acceptance as a safe preservative in pet food applications. Nisin’s compatibility with various pet food matrices, including dry, wet, and semi-moist formulations, enhances its versatility and market appeal. The ability to provide effective microbial control while meeting consumer demand for natural ingredients strengthens its position.

Manufacturers increasingly incorporate Nisin to improve food stability, ensure compliance with safety standards, and support brand trust With rising consumer focus on pet health and natural additives, the Nisin segment is expected to sustain its leading position in the market.

The dog food segment is anticipated to account for 57.3% of the market revenue in 2025, making it the leading end-use application. Growth in this segment is being driven by increasing dog ownership and heightened awareness of pet nutrition and health. Dog food products require preservatives to maintain quality, prevent spoilage, and extend shelf life, which ensures safe consumption and consistent nutrient retention.

Manufacturers are increasingly leveraging preservatives like Nisin to meet both safety and regulatory requirements, as well as consumer preferences for natural ingredients. Adoption is further supported by product diversification, including dry, semi-moist, and wet dog food, all of which benefit from effective preservative incorporation.

Rising consumer willingness to invest in premium dog food, coupled with regulatory oversight on microbial safety, reinforces the demand for preservatives As dog ownership continues to grow globally and pet owners prioritize food quality and health, the dog food segment is expected to remain the primary driver of market revenue.

The powder form segment is projected to hold 52.8% of the market revenue in 2025, establishing it as the leading form. Its growth is being driven by ease of incorporation into dry pet food formulations, superior stability, and cost-effectiveness compared with liquid or semi-moist forms. Powdered preservatives allow uniform distribution in food matrices, enhancing microbial protection and extending shelf life without impacting texture or flavor.

The ability to combine powder preservatives with other functional ingredients further increases adoption among manufacturers seeking high-quality, safe products. Powder forms also facilitate better storage and handling, reducing contamination risk and operational complexity.

Increasing consumer demand for dry dog and cat foods, coupled with regulatory emphasis on safety and shelf life, is supporting the preference for powdered preservatives As manufacturers continue to optimize production processes and ensure product stability, the powder form segment is expected to maintain its leading share in the market.

A shift towards premium and organic pet food products, with increasing pet ownership globally, has spurred the need for natural and organic pet food preservatives. As pet owners opt for products with better shelf life and high quality, food preservatives hold a prime position.

Rise in e-commerce and online sales channels, pet food products are more accessible to pet owners, leading to pet food demand. Pet food delivery has sour the need for effective preservatives to maintain product quality during shipping.

Urbanization and the busy lifestyle of owners have initiated the product quality need for pet food with effective preservatives. Shift toward sustainable and eco-friendly pet food products with natural and eco-friendly pet food preservatives is enhancing the preservative market growth.

Increasing regulations for pet food safety and quality globally have pushed manufacturers to shift towards formulated product solutions. Pet food preservatives that cater to specific pet food product formulations for wet or dry pet food to maintain product quality are in demand globally.

Catering to formulation for different breeds and pets globally is what manufacturers and big companies are scoring on. This variety and supplements are increasing the clamor for the market.

Competition from alternative pet food preservation methods like refrigeration and freezing is perceived as more natural and healthier options. This is deterring the market growth for preservatives.

Lack of awareness among pet owners about the importance of preservatives for the safety of pet food products. Pet owners see increased concerns over the potential health risks of some preservatives used in pet food products. Consumers prefer fresh and natural pet food products, leading to a decreased demand for pet food preservatives.

Limited availability of certain types of natural and organic preservatives leads to higher costs and limited market penetration. This eventually increases the cost of research for new preservatives, limiting the number of players in the market.

Potential for negative labeling and media coverage surrounding the use of preservatives in pet food products affect the market share and brand name.

The pet food preservative market report emphasizes the growing importance of natural and clean-label pet food ingredients to meet consumer demand for healthier and more sustainable options for their pets.

Manufacturers should invest in research to create new formulations for preservative products, meeting the consumer's needs and complying with regulations. Partnership with natural and organic preservative suppliers ensures a steady supply of high-quality ingredients.

Escalating awareness among pet owners and manufacturers about the benefits of preservatives in maintaining the quality and safety of pet food products. Optimizing the cost of production and distribution for preservative products to ensure affordability and accessibility for consumers. Marketing campaigns aimed to increase consumer trust and demand for preservative products, addressing concerns about potential risks.

Increased demand for pet food products with longer shelf stability is propelling the market. The fact that dogs are the most popular pets globally, the need for dog food is significantly higher than for other pet food products. This is boosting the surge for pet food preservatives with a market share of 56% for 2025.

| Attributes | Details |

|---|---|

| Top End-User Application | Dog Food |

| Market Share (2025) | 56% |

Dog foods are more prone to spoilage and deterioration due to their high moisture content. This makes preservatives vital to enhance their shelf life. Pet owners are increasingly concerned about the quality and safety of their food.

Use of preservatives is observed as an effective way to ensure that food remains fresh and safe for consumption. This, in turn, is encouraging dog food manufacturers to invest heavily in the development of preservatives that are both effective and safe for pets. Thus, the market for pet food preservatives is expanding broadly.

As pet owners have become more concerned about their pet health, they are also paying closer attention to what their pets eat. It's worth noting that the importance of these factors may vary depending on the region. Countries like the United States, China, Germany, Japan, Australia, and New Zealand are expanding broadly in the pet food preservative industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 13.20% |

| China | 12.80% |

| Germany | 9.60% |

| Japan | 4.90% |

| Australia and New Zealand | 3.20% |

The pet food industry in the United States is very competitive, with several well-known brands in the industry. Thus, the requirement to fulfill the demand for modern-day pet owners, manufacturers are formulating big-scale pet food preservatives to keep up with consumer expectations. The United States is at the forefront, with a CAGR of 13.20%, developing widely in the preservative market.

Increasing number of innovations and unique formulations in the field of animal nutrition have LED to the robust development of the pet food preservative market in the United States. With the United States leading in terms of pet population, laterally the market growth is hiked.

China is another country with potential for growth in the pet food preservative market. CAGR for China is predicted to be sturdy at 12.80% from 2025 to 2035.

China pet owners are desirous of maintaining the health of their pets. This is a key factor in China's surging market, with premium pet food and pet treats getting popular in China. With pet owners very much concerned about the coat and overall pet gut health, the market is pegging in China.

Germany, with a CAGR of 9.60%, is pegged to grow wide in the global market due to advanced technological methodologies used for products for pet food.

Automated Handling Solutions (AHS) and Advanced Material Processing (AMP) opened a facility in Germany in 2025, where processers can test out the equipment before buying it.

This has enhanced the food quality checks and the extent of preservatives used. With this technology boosting the pet food market, the pet food preservative market in Germany is skyrocketing.

Japan is marked to be one of the growing markets. For the forecast period, the CAGR for Japan is estimated to be 4.90%.

Japan’s pet food preservative market growth is due to changing economies and pet culture. Japan has a long cultural affinity towards pets, resulting in higher usage of commercial products; pet food quality is a priority in Japan.

Cats hold the second-largest share in Japan’s pet food market, and other animals, such as birds, small mammals, rodents, and ornamental fishes, have unique nutrient requirements. This has engaged a growing need for these preservatives in Japan.

More than two-thirds of Australian households have a pet. The value of Australia’s and New Zealand's pet food preservative markets is estimated to reach a CAGR of 3.20% through 2035.

New Zealand is among the big exporters of premium pet food, with large growth categories of treats and supplements accounting for the overall growth of the pet food market in these countries.

Supplements that mimic human requirements, like collagen and probiotics, are popular in Australia. Accounting for a big share, improving the shelf stability and making them a premium treat, the pet food market in Australia and New Zealand is steadily growing.

Major companies are expanding broadly with collaboration and hosting campaigns for awareness regarding pet food preservatives. Insights on the development of some companies are mentioned below:

| Company Name | Kemin Industries |

|---|---|

| Focus | Research and Development |

| Ongoing Development | Creating innovative preservative solutions that meet the specific needs of the pet food industry |

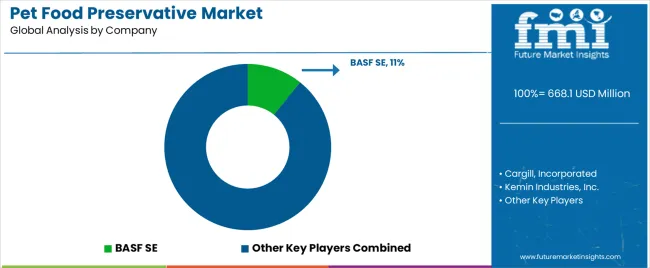

| Company Name | BASF SE |

|---|---|

| Focus | Sustainability and Innovation |

| Ongoing Development | Launched several sustainable preservative solutions to ensure that its products are widely available and easily accessible to consumers |

| Company Name | E.I. DuPont de Nemours and Company |

|---|---|

| Focus | Collaboration and Regulatory Issues |

| Ongoing Development | Collaborating with natural and organic preservative suppliers to ensure a steady supply of high-quality ingredients that meet regulatory requirements |

| Company Name | DSM Nutritional Products |

|---|---|

| Focus | Customer Service to manufacturers and Distributors |

| Ongoing Development | Launched several sustainable preservative solutions to build trust with consumers by highlighting the safety and quality of its preservative products |

Recent Advancements

The global pet food preservative market is estimated to be valued at USD 668.1 million in 2025.

The market size for the pet food preservative market is projected to reach USD 860.6 million by 2035.

The pet food preservative market is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in pet food preservative market are nisin, natamycin, benzyl alcohol, salicylic acid, sorbic acid, natural acids, botanical extracts and others.

In terms of end-use application, dog food segment to command 57.3% share in the pet food preservative market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Processing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Palatants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Pet Food Premix Market Analysis by Pet Type, Ingredient Type, Formand Sales ChannelThrough 2035

Pet Food Microalgae Market Insights - Nutritional Benefits & Growth 2025 to 2035

Pet Food Extrusion Market Analysis by Product Type, Animal Type, Ingredient Type, Extruder Type, Ingredient, Process and Region Through 2035

Pet Food Flavor Enhancers Market – Growth, Demand & Innovation

Global Food Preservatives Market Size, Growth, and Forecast for 2025 to 2035

Wet Pet Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA