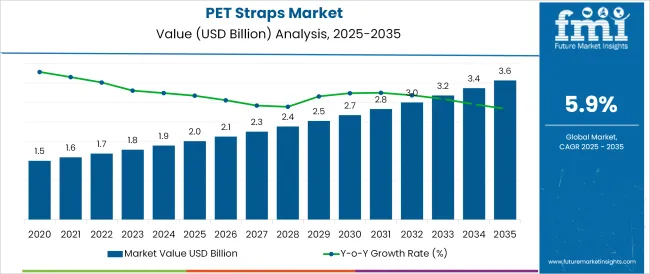

The PET Straps Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

The PET straps market is undergoing steady expansion as industries worldwide seek durable recyclable, and cost-effective strapping solutions for securing loads across logistics and manufacturing operations. Rising focus on sustainable packaging, particularly in line with extended producer responsibility (EPR) mandates, has elevated the use of PET over conventional materials.

The inherent strength, weather resistance, and recyclability of PET straps make them suitable for bundling in diverse sectors, including food and beverages, building materials, and metal processing. Additionally, advancements in extrusion and printing technologies are enabling better customization, traceability, and automation compatibility.

The integration of PET straps with smart packaging lines and automatic strapping systems has further enhanced operational efficiency. As cross-border trade and e-commerce logistics accelerate, the demand for reliable, eco-friendly secondary packaging materials is expected to rise significantly. Future growth is likely to be supported by material innovation, regional production expansion, and sector specific customization in PET strap dimensions.

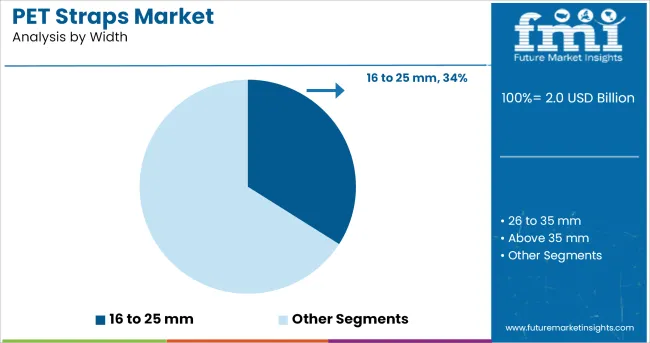

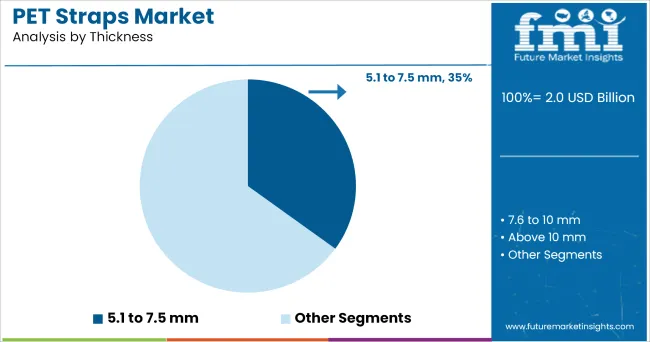

The market is segmented by Width, Thickness, and End-Use Industries and region. By Width, the market is divided into 16 to 25 mm, 26 to 35 mm, Above 35 mm, and 5 to 15 mm. In terms of Thickness, the market is classified into 5.1 to 7.5 mm, 7.6 to 10 mm, Above 10 mm, and Up to 250 kg.

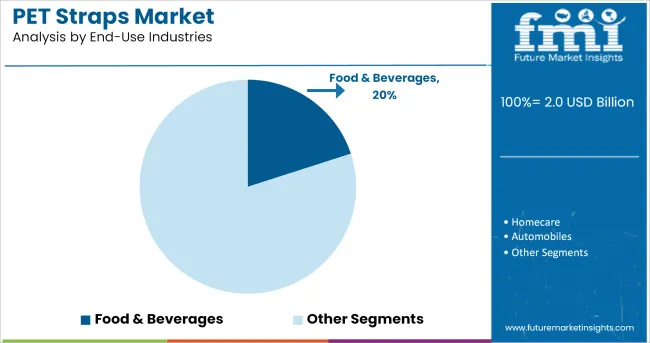

Based on End-Use Industries, the market is segmented into Food & Beverages, Homecare, Automobiles, Personal care & Cosmetics, Healthcare & Pharmaceuticals, Chemicals, Electronics and Electricals, Food & Beverages, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The width segment ranging from 16 to 25 mm is projected to hold a 34.0% revenue share in 2025, making it the leading category within PET strap dimensions. This range offers a critical balance between tensile strength and flexibility, making it ideal for heavy duty as well as general packaging applications.

It has gained widespread acceptance across palletizing operations, particularly where products require enhanced load stability during long haul transport or warehousing. Compatibility with both semi-automatic and automatic strapping machines has enabled efficient integration across industries.

Moreover, this width range supports operational safety and recyclability without compromising on performance, allowing businesses to align with sustainability mandates. Continued demand from sectors like metal fabrication, bricks, and beverages has reinforced the preference for 16 to 25 mm straps in high-load and high-frequency packaging environments.

PET straps with a thickness between 5.1 to 7.5 mm are anticipated to command a 35.0% revenue share in 2025, emerging as the most preferred segment by thickness. This dominance is attributed to the segment’s optimal balance between load resistance and cost efficiency especially in medium to heavy bundling applications.

The durability of this thickness range ensures minimal elongation under tension, supporting safe transportation of stacked and fragile items. Manufacturers have also standardized this thickness for compatibility with automated systems, boosting speed and reducing downtime in packaging operations.

This segment is especially favored in export packaging and FMCG logistics, where dimensional precision, break strength, and environmental resilience are critical. Its versatility across varying weight classes and compatibility with printing for traceability and branding have further consolidated its market leadership.

The food and beverages industry is projected to hold a 20.0% revenue share in 2025 within the PET straps market, establishing it as a key end-use segment. The need for safe and stable transportation of packaged consumables, especially in bulk or palletized formats, has driven the industry’s reliance on PET strapping.

The material’s hygienic profile, coupled with its resistance to UV, moisture, and chemical degradation, makes it highly suited for this sector’s stringent storage and transit requirements. Additionally, lightweight yet high-tensile PET straps are favored for securing bottled beverages, canned goods, and packaged foods without damaging the product or packaging integrity.

Sustainability objectives pursued by major F&B companies are also promoting the use of 100% recyclable PET strapping over traditional polypropylene or steel options. Increasing automation in food packaging lines, supported by strap compatible machinery, continues to encourage higher adoption rates within this end-use segment.

PET straps are utilized in an extensive range of usage for holding, heavy-duty bailing, bundling, palletizing, load unitizing in several end-use industries. PET straps will witness an exponential rise in demand during the forecast period because of their increased usage for packaging applications in pharmaceuticals, automobiles, food & beverage, electrical & electronics and others.

PET straps demand is keenly due to the variety of usage for product packaging in several end-use sectors, by which there is always a huge competition between key players to procure next-generation packaging solutions for end-users.

Moreover, the excellent shock and impact absorbing qualities of PET straps are the biggest reason for its extensive usage for heavyweight applications. Major competitors are invested in research and development to increase the usage of PET straps for more end-use industries. These factors will augment the market demand for PET Straps in the forecasted period.

The packaging sector across the globe is mainly focusing on providing sustainable yet biodegradable options for end-use industries. The rise in usage for environment-friendly packaging across the globe has subsequently skyrocketed the demand for the PET straps market in manufacturing sectors which include automobiles, food & beverage, retail, Electrical & electronics, pharmaceutical, and many more.

The regulations and legislation placed on plastic by governments across the globe have affected the demand for PET Straps. The PET straps manufacturers are focused on increasing the production capacity along with finding innovations along the process. These factors are anticipated to drive the PET straps market.

Numerous amount of opportunities is unfolding for the PET straps market, the ability to procure recyclable PET straps have taken the entire industry to follow the unexpected change. Extraction of contents from used PET straps and using them to manufacture PET Straps has plummeted the demand for the product.

This added feather of technology will be a great opportunity to decrease the usage of finances in the raw material purchase and help increase the revenue of the PET straps market.

The demand for eco-friendly and biodegradable solutions has made its way to the PET straps market. The increase in sales for end-use industries is expected to spontaneously affect the need for PET straps during the future years. This change is affected due to extensive PET straps for bundling, heavy-duty bailing, load unitizing.

The positive outlook of e-commerce will lead to more home deliveries which will rise the usage of PET straps and this will drive the market.

The durability of recycled variants of PET straps will always remain a question to discuss, as with subsequent recycling and reusing the strength goes down. This can cause loss of product and is a restraint that limits the demand for PET straps in the market.

However, using formulations of binding agents while constructing recycled products will exponentially improve the durability of the product, which in turn increases profitability for the players in PET straps.

Global Players

APAC Players

The key competitors implement various strategies such as product launch, merger & acquisition, expansion, innovation and others to survive and compete in the market

India will hold a major proportion of the PET straps market by the end of the forecast period due to an increase in usage of biodegradable materials for packaging and the significant presence of plastic polymer producers. Other factors that will lead to India’s share will be its new policies in the market on environmental regulations which are emphasized on reduction of non-recyclable plastic packaging and its skilled cheap labour.

The ever-expanding Indian end-use industries such as food & beverage, pharmaceutical, electronic, chemical, automobile, online retail, personal care products will cause an ever-lasting impact of the country in APAC market share. All these factors considered India will have a significant hold in the PET straps market in future.

The global PET straps market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the PET straps market is projected to reach USD 3.6 billion by 2035.

The PET straps market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in PET straps market are 16 to 25 mm, 26 to 35 mm, above 35 mm and 5 to 15 mm.

In terms of thickness, 5.1 to 7.5 mm segment to command 35.0% share in the PET straps market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

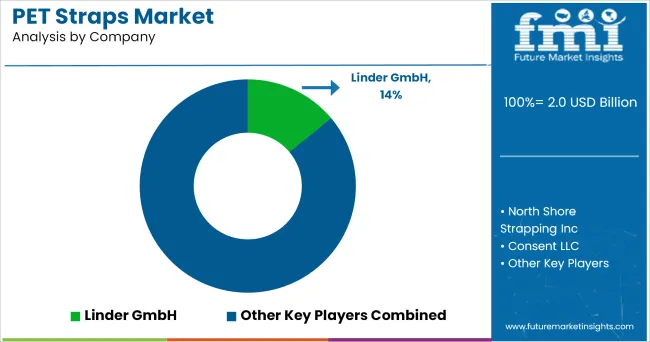

Market Positioning & Share in the PET Straps Market

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA