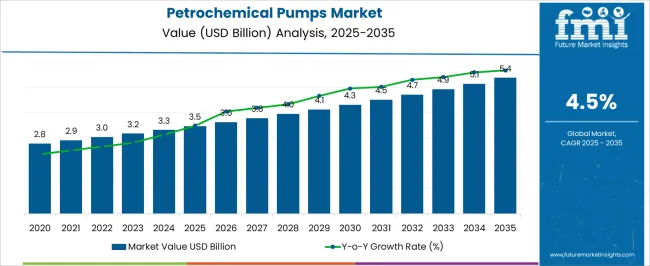

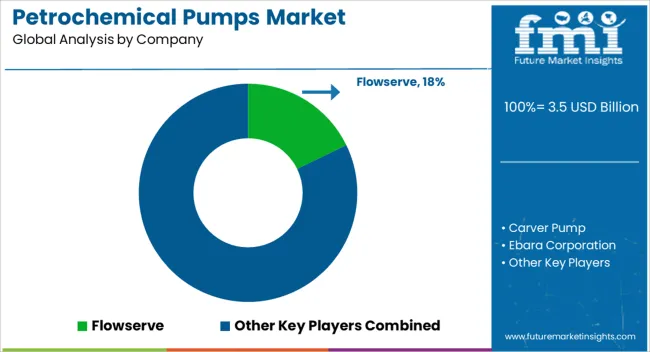

The petrochemical pumps market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 5.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. Yearly growth figures highlight a gradual yet consistent rise, reaching USD 3.8 billion in 2027 and USD 4.3 billion by 2030. This trajectory suggests a steady demand for pumping equipment used in critical petrochemical operations. Pumps remain central to maintaining reliability and efficiency in transporting, processing, and handling fluids in petrochemical facilities, underscoring the importance of robust machinery in meeting production and operational needs.

By 2035, the petrochemical pumps market is anticipated to reach USD 5.4 billion, reflecting the essential role these systems play in the global energy and chemical sectors. The growth trend signals rising replacement demand as well as investments in advanced pumping solutions to ensure longer operational lifespans and reduced downtime. Industries are expected to prioritize efficiency and precision, reinforcing the position of pumps as an indispensable component of the petrochemical value chain.

| Metric | Value |

|---|---|

| Petrochemical Pumps Market Estimated Value in (2025 E) | USD 3.5 billion |

| Petrochemical Pumps Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The petrochemical pumps market forms a critical part of the broader industrial pumps market, accounting for nearly 7-8% of the total share. These pumps are indispensable in handling corrosive fluids, volatile chemicals, and hydrocarbons within large-scale petrochemical operations. In the oil and gas equipment market, petrochemical pumps hold around 5-6% share, as they are used in upstream, midstream, and downstream operations, ensuring safe and efficient fluid transfer.

The reliability of these pumps is vital to refinery operations, making them a consistent demand driver despite volatility in oil prices. Within the petrochemical industry market itself, the share of petrochemical pumps is higher, estimated at 10-12%, given their direct role in processing feedstock and refining it into end-use chemicals and polymers. In the chemical processing equipment market, their contribution is about 6-7%, supported by demand for high-performance pumping solutions that can withstand corrosive environments. The energy and power market also represents a smaller but notable share of around 2-3%, as petrochemical pumps are used in auxiliary processes within power generation plants that rely on fuel derivatives.

The petrochemical pumps market is undergoing notable expansion, fueled by growing demand across upstream, midstream, and downstream operations. Rising investments in refinery expansion and chemical processing plants, especially in Asia-Pacific and the Middle East, are increasing the deployment of specialized pumps.

Environmental regulations and safety standards have driven the shift toward corrosion-resistant and energy-efficient materials in pump design. Technological advances in seal-less and variable-speed pump systems are improving operational uptime and reducing energy consumption.

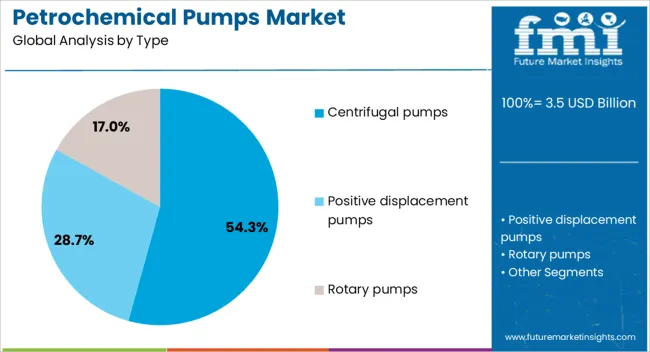

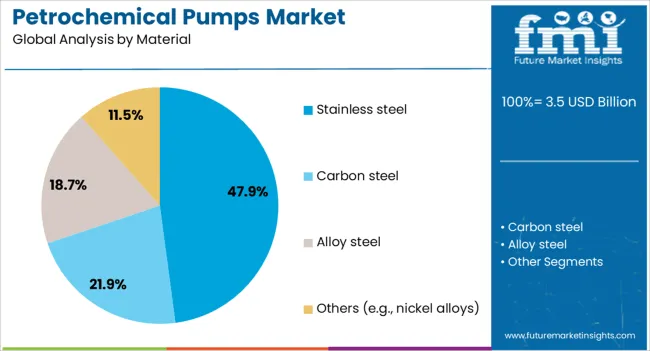

The petrochemical pumps market is segmented by type, material, application, end use industry, distribution channel, and geographic regions. By type, petrochemical pumps market is divided into Centrifugal pumps, Positive displacement pumps, and Rotary pumps. In terms of material, petrochemical pumps market is classified into Stainless steel, Carbon steel, Alloy steel, and Others (e.g., nickel alloys).

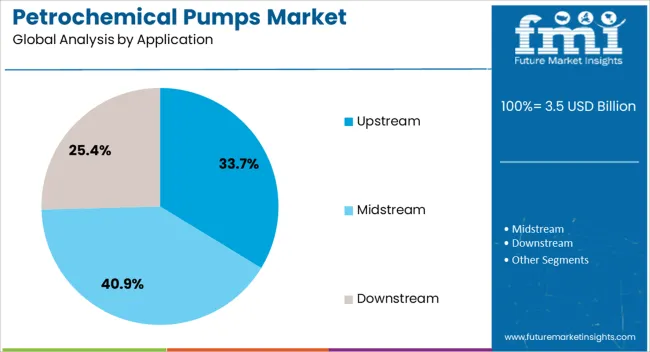

Based on application, petrochemical pumps market is segmented into Upstream, Midstream, and Downstream. By end use industry, petrochemical pumps market is segmented into Oil & gas, Chemical, Power generation, and Others (e.g., water treatment). By distribution channel, petrochemical pumps market is segmented into Direct sales and Indirect sales. Regionally, the petrochemical pumps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Centrifugal pumps are anticipated to account for 54.30% of total revenue in the petrochemical pumps market by 2025, making them the leading pump type. Their widespread use is driven by their ability to handle high flow rates with relatively low maintenance and a compact design.

These pumps are highly adaptable to various viscosity ranges and temperature conditions, which are common in petrochemical operations. The scalability of centrifugal pumps makes them ideal for high-volume circulation tasks in both upstream extraction and downstream refining processes.

Enhanced sealing technologies and smart control systems are further improving their reliability, solidifying their dominance in modern petrochemical plants.

Stainless steel is projected to hold 47.90% of the total market share by 2025, emerging as the dominant material used in petrochemical pumps. Its corrosion resistance, high strength, and thermal durability make it especially suitable for chemically aggressive and high-temperature environments.

Stainless steel components ensure extended service life and reduced maintenance, which are critical in continuous-process industries like petrochemicals.

The growing focus on compliance with safety and emission standards is also contributing to the preference for robust materials like stainless steel, particularly in pumps handling flammable or toxic substances.

The upstream application segment is expected to capture 33.70% of the petrochemical pumps market share by 2025, making it the leading application category. This segment’s growth is being propelled by increased global oil and gas exploration activities, particularly in offshore and deep-water environments.

Upstream operations require pumps that can manage high-pressure and abrasive conditions while maintaining energy efficiency and operational safety.

As more remote and challenging reserves are tapped, demand for technologically advanced pumping systems with real-time monitoring and low failure rates is set to rise, strengthening the segment’s market share.

The petrochemical pumps market is supported by growing demand from refinery expansions and chemical processing plants. Opportunities are concentrated in greenfield projects and modernization initiatives, while the trend toward energy-efficient pumping systems is reshaping preferences. High costs and maintenance requirements remain key challenges. Despite these hurdles, the market is expected to expand steadily, as demand for reliable fluid handling in petrochemical operations strengthens worldwide, particularly in emerging economies with rising industrial capacity.

The demand for petrochemical pumps is rising as refineries and chemical processing plants expand globally. These pumps are essential for transferring aggressive fluids, hydrocarbons, and chemicals under demanding conditions. Rapid industrialization in Asia-Pacific and the Middle East has resulted in significant refinery expansions, strengthening demand for specialized pumping solutions. Stringent safety and operational reliability requirements further encourage the adoption of high-performance pumps. With petrochemical consumption increasing for plastics, fertilizers, and solvents, the need for advanced pumps capable of handling corrosive and volatile fluids continues to grow.

Significant opportunities are emerging from greenfield petrochemical projects and modernization of existing facilities. Governments and private enterprises are investing heavily in new petrochemical complexes to meet surging demand, especially in India, China, and the Middle East. Pump manufacturers that offer energy-efficient and low-maintenance solutions are well-positioned to secure long-term contracts. Moreover, digital technologies enabling predictive maintenance and remote monitoring create new opportunities for value-added services. Companies focusing on customized pump designs for specific chemical handling and environmental compliance will capture substantial growth in these modernization initiatives.

A clear trend is shaping toward energy-efficient and low-emission pumping systems. Rising operational costs and pressure to optimize energy consumption in petrochemical facilities have led companies to adopt pumps with higher efficiency ratings. Variable frequency drives, advanced seal technologies, and smart monitoring systems are increasingly integrated to reduce downtime and lifecycle costs. The focus on minimizing environmental impact is also pushing the industry toward pumps designed for reduced leakage and higher reliability. This shift is redefining buyer preferences, with energy-efficient solutions gaining significant market traction.

The market faces challenges due to the high capital and operational costs associated with petrochemical pumps. Their specialized design and material requirements make them expensive compared to conventional pumps. Frequent maintenance needs, driven by the harsh chemical environment, add further costs to plant operations. Smaller companies often find it difficult to compete with established manufacturers who can offer advanced solutions with longer lifespans. Additionally, volatile crude oil prices can delay petrochemical projects, creating uncertainty in demand. Overcoming these challenges requires innovation in cost optimization and robust aftermarket services.

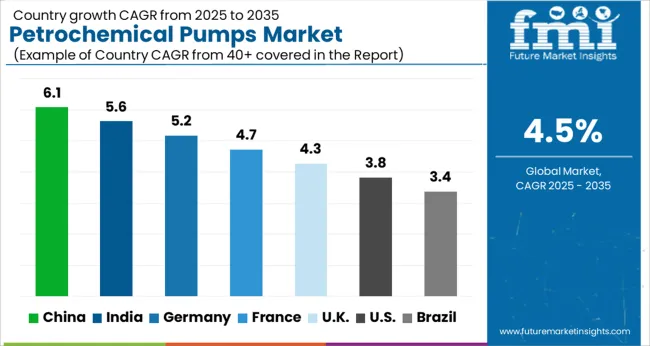

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global petrochemical pumps market is projected to grow at a CAGR of 4.5% from 2025 to 2035. China leads with a growth rate of 6.1%, followed by India at 5.6% and France at 4.7%. The United Kingdom records a growth rate of 4.3%, while the United States shows the slowest growth at 3.8%. Expansion is supported by refinery upgrades, increasing petrochemical consumption, and replacement of outdated pumping systems with efficient alternatives. Emerging economies such as China and India benefit from strong petrochemical production and capacity expansion programs, while developed economies like the USA, UK, and France focus more on modernization, regulatory compliance, and specialty chemical production. This report includes insights on 40+ countries; the top markets are shown here for reference.

The petrochemical pumps market in China is projected to expand at a CAGR of 6.1%. China dominates global petrochemical output, with large-scale refinery expansions and chemical production plants fueling consistent pump demand. The government’s focus on energy infrastructure modernization and the growing role of China as a global chemical exporter strengthen the market outlook. Both domestic and international pump manufacturers are actively competing, ensuring technology upgrades and availability. The replacement cycle for older equipment also supports market growth, with industries preferring energy-efficient and reliable pump systems. With China’s petrochemical production continuously scaling, pump demand is expected to remain strong throughout the forecast period.

The petrochemical pumps market in India is expected to grow at a CAGR of 5.6%. Growth is supported by large-scale investments in petrochemical plants, refinery capacity upgrades, and rising consumption of petrochemical derivatives in plastics and packaging. Public–private partnerships play an important role, as joint ventures with international firms strengthen domestic availability of advanced pumping solutions. India’s focus on self-reliance in petrochemical production through the “Make in India” program enhances local manufacturing capacity. Rising infrastructure development also boosts downstream chemical processing, which directly sustains demand for efficient pump systems. The country is emerging as one of Asia’s most attractive markets due to rapid consumption growth and increasing refinery investments.

The petrochemical pumps market in France is forecasted to record a CAGR of 4.7%. Growth in the country is influenced more by modernization and replacement demand rather than large-scale new installations. Refinery and chemical plant operators are upgrading existing pumping systems to comply with strict energy-efficiency and safety standards. The country’s petrochemical industry, though mature, benefits from steady demand for specialty and fine chemicals, sustaining pump usage. Equipment suppliers in France are focusing on reliability, low maintenance, and energy optimization to appeal to industrial buyers. While growth remains moderate compared to Asian markets, consistent replacement cycles provide stability to the French petrochemical pumps industry.

The petrochemical pumps market in the United Kingdom is set to grow at a CAGR of 4.3%. The country’s smaller petrochemical production base restricts large-scale demand, yet modernization of existing facilities keeps the market stable. Energy efficiency and safety remain central to pump adoption, with refiners investing in high-performance, reliable systems. While the UK depends on imports for certain petrochemicals, ongoing infrastructure development and compliance with environmental standards create consistent replacement demand. Pump suppliers are addressing customer needs with customized solutions that lower maintenance costs. Compared to fast-growing Asian regions, the UK market is relatively modest but holds steady through modernization and efficiency-driven investment.

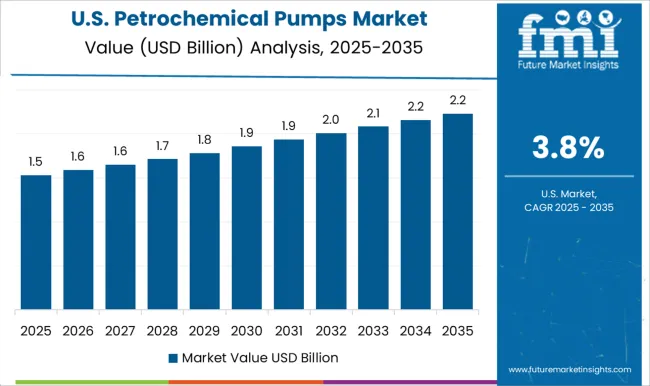

The petrochemical pumps market in the United States is expected to expand at a CAGR of 3.8%. A mature refining industry defines the country’s outlook, with pump demand largely driven by replacements rather than new installations. The USA benefits from growing specialty petrochemical production, which requires precise and durable pumping systems. Pump suppliers in the USA focus on improving energy efficiency and reducing operational costs to meet industry regulations. While growth is slower compared to Asia, steady consumption of chemicals and exports maintain stable demand. Long-term prospects are tied to upgrades in older plants and compliance with environmental and efficiency requirements.

Competition in the petrochemical pumps market is centered on reliability, efficiency, and handling of aggressive fluids. Flowserve and Sulzer present brochures emphasizing high-capacity, corrosion-resistant designs aimed at large refineries and chemical plants. KSB and Ebara Corporation highlight energy-saving pump technologies, positioning themselves around lifecycle cost reduction. Grundfos and Xylem focus on modular systems and intelligent monitoring, making their offerings attractive for facilities integrating digital maintenance practices. IDEX, Sundyne, and PSG Dover showcase compact pump lines engineered for precision in high-pressure chemical processes, stressing durability and safety. Carver Pump and Truflo Pumps market themselves with tailored solutions for niche petrochemical operations. Brochures reflect a strategy of positioning products as both technically advanced and compliance-ready. HERMETIC Pumpen leads with seal-less magnetic drive pumps, presenting them as ideal for hazardous environments where leakage prevention is crucial. Hayward Gordon and SPP Pumps concentrate on heavy-duty slurry and abrasive media handling, differentiating through robust construction. Ruhrpumpen highlights global service reach, emphasizing prompt technical support as a competitive advantage. ITT Goulds Pumps markets versatile configurations that reduce downtime, stressing ease of maintenance. Each company frames its product range through application-specific brochures—whether crude oil transfer, catalytic cracking, or wastewater management—shaping buyer perception. Competition is driven not only by pump performance but also by how persuasively product literature aligns with petrochemical plant priorities of uptime, safety, and operational economy.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Type | Centrifugal pumps, Positive displacement pumps, and Rotary pumps |

| Material | Stainless steel, Carbon steel, Alloy steel, and Others (e.g., nickel alloys) |

| Application | Upstream, Midstream, and Downstream |

| End Use Industry | Oil & gas, Chemical, Power generation, and Others (e.g., water treatment) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Flowserve, Carver Pump, Ebara Corporation, Grundfos, Hayward Gordon, HERMETIC Pumpen, IDEX, ITT Goulds Pumps, KSB, PSG Dover, Ruhrpumpen, SPP Pumps, Sulzer, Sundyne, Truflo Pumps, and Xylem |

| Additional Attributes | Dollar sales by pump type (centrifugal, positive displacement, diaphragm) and application (refining, petrochemical, chemical processing) are key metrics. Trends include rising demand for energy-efficient pumping solutions, increased use in large-scale refineries, and focus on leak prevention. Regional adoption, technological improvements, and regulatory compliance are driving market growth. |

The global petrochemical pumps market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the petrochemical pumps market is projected to reach USD 5.4 billion by 2035.

The petrochemical pumps market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in petrochemical pumps market are centrifugal pumps, positive displacement pumps and rotary pumps.

In terms of material, stainless steel segment to command 47.9% share in the petrochemical pumps market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

Lobe Pumps Market

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Charge Pumps Market Size and Share Forecast Outlook 2025 to 2035

Spinal Pumps Market Size and Share Forecast Outlook 2025 to 2035

Facial Pumps Market Growth – Demand & Forecast 2025 to 2035

Insulin Pumps Market Size and Share Forecast Outlook 2025 to 2035

Airless Pumps Market Analysis - Size, Demand & Forecast 2025 to 2035

Competitive Overview of Airless Pumps Market Share

Jetting Pumps Market

Infusion Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Pumps Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Pumps Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Pumps & Filters Market Demand 2024 to 2034

Smart IoT Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA