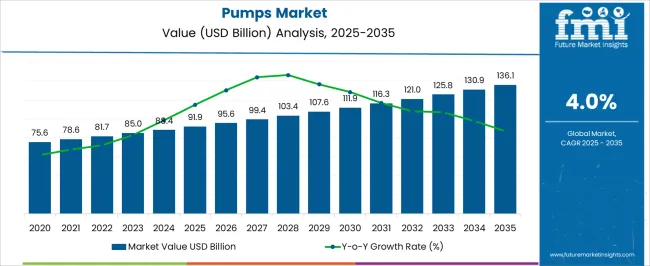

The pumps market is projected to grow from USD 91.9 billion in 2025 to USD 136.1 billion by 2035, representing a CAGR of 4.0%. Analyzing the decade-long growth pattern, the market demonstrates steady acceleration in the first half of the period and a slight deceleration toward the latter years. Between 2025 and 2030, the market increases from USD 91.9 billion to USD 111.9 billion, reflecting consistent demand growth driven by industrial automation, water and wastewater management, and expanding oil & gas infrastructure.

Rising adoption of energy-efficient pumps, government incentives for industrial modernization, and urban infrastructure development contribute to this acceleration phase. From 2030 to 2035, growth continues but at a marginally slower rate, rising from USD 111.9 billion to USD 136.1 billion. This slight deceleration is influenced by market maturation, rising competition, and stabilization of large-scale industrial projects in developed regions. Innovation in smart and IoT-enabled pumps, combined with expanding renewable energy applications and demand in emerging markets, sustains moderate growth. Overall, the growth trajectory exhibits a smooth, slightly concave pattern, with initial acceleration transitioning to moderate deceleration, highlighting a stable, mature market that balances steady demand expansion with gradual market saturation across key sectors.

| Metric | Value |

|---|---|

| Pumps Market Estimated Value in (2025 E) | USD 91.9 billion |

| Pumps Market Forecast Value in (2035 F) | USD 136.1 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The pumps market is strongly influenced by five interconnected parent industries, each contributing to demand, adoption, and technological advancement. The water and wastewater management market holds the largest share at 30%, as pumps are essential for ensuring reliable water supply, sewage treatment, and irrigation systems across municipal, agricultural, and industrial applications.

The oil and gas market contributes 25%, with pumps playing a critical role in the extraction, transport, and refining of crude oil, natural gas, and petrochemical products, ensuring operational efficiency and safety in complex processing environments. The chemical processing market accounts for 15%, where pumps handle corrosive, abrasive, and high-temperature fluids, supporting continuous operations in chemical plants and specialty manufacturing. The HVAC and building services market holds 15%, driven by the circulation of water and other fluids in heating, ventilation, and air-conditioning systems to maintain building functionality and operational efficiency. Finally, the food and beverage processing market represents 15%, with pumps deployed for liquid transfer, dosing, mixing, and sanitation in dairy, beverages, and packaged foods, ensuring quality and regulatory compliance.

Water management, oil & gas, and chemical processing segments account for 70% of overall demand, highlighting that industrial fluid handling, resource transportation, and process efficiency remain the primary growth drivers, while HVAC and food processing applications provide supplementary adoption opportunities. The market continues to expand globally, supported by infrastructure development, industrial growth, and increasing automation across end-use sectors.

The pumps market is witnessing robust growth, driven by sustained demand across industrial, municipal, and commercial sectors, supported by advancements in design efficiency, energy optimization, and operational reliability. Current market momentum is being influenced by infrastructure expansion, water and wastewater treatment investments, and heightened environmental compliance requirements.

Competitive dynamics are shaped by technological integration, with manufacturers focusing on automation, remote monitoring, and predictive maintenance capabilities to enhance performance and reduce lifecycle costs. Regional market strength is underpinned by urbanization, manufacturing growth, and energy sector activities, with developing economies emerging as significant demand hubs.

Future expansion is expected to be propelled by modernization of existing pumping systems, increased adoption of energy-efficient solutions to meet regulatory standards, and diversification into renewable energy and sustainable water management applications. Strategic capital investment in production capabilities, coupled with supply chain resilience, is anticipated to secure consistent market penetration and profitability over the forecast horizon.

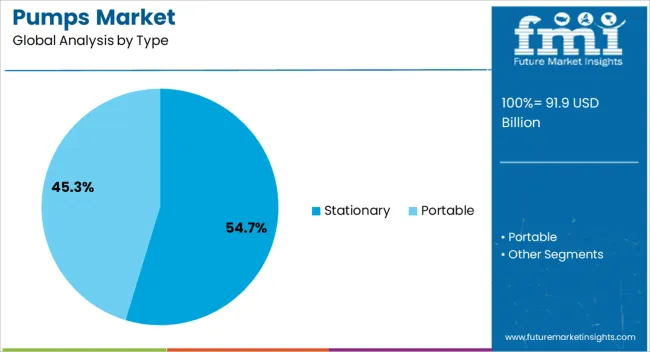

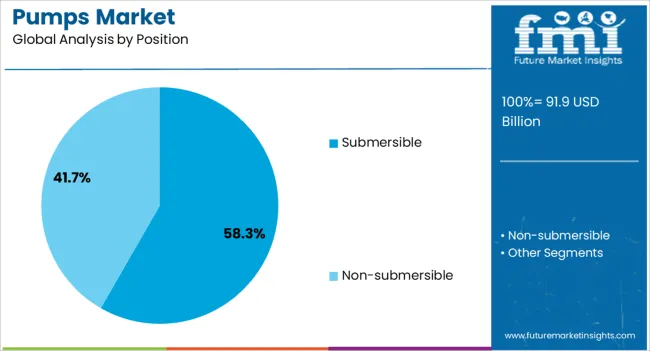

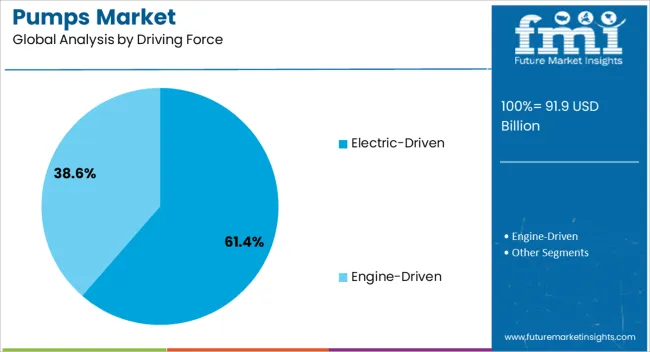

The pumps market is segmented by type, position, driving force, technology, end user, and geographic regions. By type, pumps market is divided into Stationary and Portable. In terms of position, pumps market is classified into Submersible and Non-submersible. Based on driving force, pumps market is segmented into Electric-Driven and Engine-Driven.

By technology, pumps market is segmented into Centrifugal Pump, Axial Flow Pump, Radial Flow Pump, Mixed Flow Pump, Position Displacement Pump, Reciprocating, Rotary, Others, and Others. By end user, the pumps market is segmented into Water & wastewater treatment, Mining, Building & construction, Oil & Gas, General Industries, Chemicals, Power generation, and Others (agriculture, etc.). Regionally, the pumps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stationary pump segment, holding 54.70% of the type category, maintains its lead position due to its operational stability, durability, and adaptability across a wide range of applications. Its dominant share is reinforced by suitability for continuous operation in industrial plants, municipal water systems, and large-scale process industries.

The segment benefits from lower maintenance requirements compared to portable alternatives, contributing to reduced total cost of ownership for end-users. Demand is further supported by integration with advanced monitoring systems, enabling predictive maintenance and minimizing downtime.

Infrastructure modernization and capacity expansion projects in sectors such as power generation, petrochemicals, and water management have further cemented the position of stationary pumps as a preferred solution. Ongoing innovations in material strength and corrosion resistance are enhancing longevity, ensuring sustained relevance in high-demand operating environments.

The submersible pump segment, representing 58.30% of the position category, leads the market owing to its superior efficiency in applications involving fluid extraction from deep or submerged locations. Its design eliminates the need for priming and minimizes noise levels, making it a favored choice for wastewater treatment, mining, and dewatering applications.

Operational advantages such as reduced risk of cavitation and the capability to handle solids-laden fluids have expanded its adoption in both municipal and industrial sectors. Energy-efficient motor designs and improved sealing technologies have further enhanced reliability and reduced maintenance costs.

Market growth is reinforced by infrastructure projects requiring high-capacity, continuous pumping operations under challenging conditions. The segment’s robust market share is expected to be sustained by ongoing innovations aimed at improving operational lifespan and adaptability to variable speed drives for optimized performance.

The electric-driven pump segment, accounting for 61.40% of the driving force category, dominates the market due to its cost efficiency, operational simplicity, and compatibility with a wide range of applications. Its adoption is being driven by increasing electrification of industrial operations and the push for reduced carbon emissions compared to diesel-driven alternatives.

Enhanced motor efficiency, coupled with integration of variable frequency drives, allows for precise flow control, reduced energy consumption, and extended equipment life. Expanding grid infrastructure and the proliferation of renewable energy sources are further supporting the segment’s growth trajectory.

Electric-driven pumps also benefit from lower operating costs, minimal maintenance needs, and ease of integration into automated systems. Regulatory focus on sustainable energy use and the shift toward environmentally responsible industrial operations are expected to solidify this segment’s leadership position in the coming years.

The pumps market is expanding as industrial, commercial, and residential sectors prioritize fluid handling, process efficiency, and energy optimization. Demand is driven by applications in water treatment, oil & gas, chemical processing, HVAC, and agriculture. Challenges include high capital expenditure, maintenance requirements, and compliance with regional safety and efficiency standards. Opportunities exist in energy-efficient designs, modular and smart pumps, and integration with digital monitoring systems. Trends highlight variable speed drives, IoT-enabled predictive maintenance, and corrosion-resistant materials.

Industries are increasingly adopting pumps to enhance process efficiency, reduce energy consumption, and ensure reliable fluid transfer across various applications. Pumps are critical in water and wastewater treatment, chemical processing, oil & gas transportation, and HVAC circulation systems. The shift toward automation, digital monitoring, and energy-efficient operation is accelerating market adoption. Key priorities include flow consistency, operational reliability, and minimal downtime. Growing industrialization, urban water infrastructure expansion, and modernization of process plants are driving demand for high-performance, precise, and adaptable pumping solutions. Pumps are becoming indispensable for optimizing production processes and operational efficiency across diverse sectors.

Market constraints include high initial investment, energy-intensive operation, and ongoing maintenance of pumps, motors, and control systems. Fluctuations in raw material prices such as stainless steel, cast iron, and specialty alloys impact manufacturing costs. Regulatory standards for energy efficiency, safety, and environmental compliance add complexity, particularly for water and chemical applications. Technical challenges include handling corrosive fluids, maintaining pressure stability, and ensuring long-term durability under continuous operation. Buyers increasingly seek suppliers with certified products, predictable supply chains, technical support, and preventive maintenance solutions to ensure reliability, efficiency, and compliance with local and international regulations.

Opportunities exist in energy-efficient pumps, modular designs for rapid deployment, and smart systems integrated with sensors for real-time monitoring. Variable speed drives, IoT-enabled diagnostics, and predictive maintenance improve operational efficiency and reduce downtime. Expansion in water infrastructure, industrial process automation, and renewable energy projects globally is driving adoption. Specialty pumps for chemical, oil & gas, and HVAC applications provide growth potential in niche segments. Suppliers offering customizable, high-performance, and digitally integrated pump solutions with application-specific technical support are well positioned to capitalize on emerging opportunities and strengthen partnerships with OEMs and industrial end-users.

The market is trending toward IoT-enabled pumps, corrosion-resistant alloys, and predictive maintenance solutions to improve efficiency, reliability, and operational life. Real-time monitoring enables early fault detection, energy optimization, and reduced maintenance costs. Modular, compact, and lightweight designs are gaining traction in industrial, municipal, and residential applications. Integration with digital platforms and automation systems supports seamless operation and remote diagnostics. Suppliers delivering application-ready, durable, and technologically advanced pumps are best positioned to meet the evolving demands of fluid handling, process optimization, and energy efficiency across global industrial and commercial sectors.

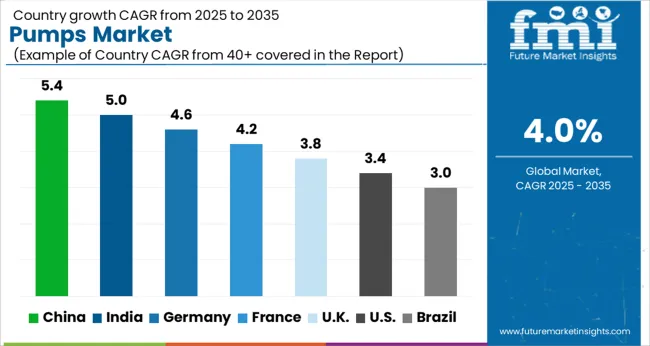

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

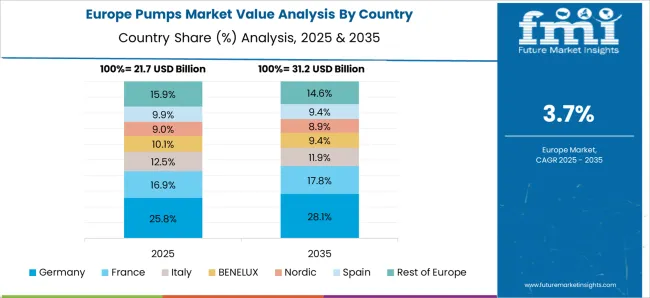

Global pumps demand is projected to rise at a 4.0 % CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 5.4 %, followed by India at 5.0 % and Germany at 4.6 %, while the UK posts 3.8 % and the United States records 3.4 %. These rates translate to a growth premium of +35 % for China, +25 % for India, and +15 % for Germany versus the baseline, whereas the UK and the United States trail by –5 % and –15 %, respectively. Divergence reflects local catalysts: industrial expansion in China, infrastructure and water-management projects in India, precision-engineering demand in Germany, aging industrial assets in the UK, and a mature equipment market in the United States. The analysis spans over 40+ countries, with the leading markets shown below.

The pumps market in China is expected to grow at a CAGR of 5.4% from 2025 to 2035, driven by rapid industrialization, urban infrastructure expansion, and increasing demand from water treatment, chemical, and energy sectors. Domestic manufacturers are investing in high-efficiency centrifugal, submersible, and metering pumps equipped with digital controls and advanced monitoring systems. Industrial clusters in Jiangsu, Zhejiang, and Guangdong provinces provide strong manufacturing and after-sales support, fostering quick adoption. Rising investments in municipal water supply, wastewater management, and renewable energy projects further boost demand. Companies are collaborating with global pump technology providers to enhance precision, durability, and energy performance. The market benefits from government initiatives promoting modernization of industrial equipment and infrastructure resilience.

The pumps market in India is forecasted to grow at a CAGR of 5.0% from 2025 to 2035, fueled by infrastructure development, agricultural irrigation, and industrial expansion. Centrifugal, submersible, and positive displacement pumps are increasingly adopted for water supply, wastewater treatment, and process industries. Major industrial hubs in Maharashtra, Gujarat, and Tamil Nadu offer strong supply chains and after-sales networks. Domestic players focus on cost-efficient and semi-automatic systems, while global technology partners support advanced designs for improved energy efficiency and reliability. Government initiatives like Jal Jeevan Mission, Smart Cities, and Make in India further boost demand. Urbanization, industrial growth, and rising water infrastructure projects are expected to drive long-term market expansion.

The pumps market in Germany is projected to expand at a CAGR of 4.6% from 2025 to 2035, driven by industrial automation, chemical manufacturing, and energy sector requirements. High-precision centrifugal, metering, and submersible pumps with advanced digital monitoring are widely deployed. German manufacturers emphasize energy efficiency, EU regulatory compliance, and sustainability in pump design. Industrial clusters across North Rhine-Westphalia and Baden-Württemberg provide strong technical expertise and after-sales service. Demand is also supported by renewable energy expansion, wastewater treatment projects, and precision manufacturing industries. Collaborations with research institutes facilitate development of advanced materials and high-performance pump technologies for specialty applications.

The UK pumps market is expected to grow at a CAGR of 3.8% from 2025 to 2035, supported by aging infrastructure, municipal water treatment projects, and industrial replacement cycles. Centrifugal and submersible pumps with advanced monitoring and energy-saving features are gaining traction. Industrial hubs in the Midlands and Northern England provide strong manufacturing and service support. Demand is further influenced by urban redevelopment projects, oil and gas facilities, and wastewater treatment expansions. Manufacturers focus on digital control, modular designs, and precision engineering to optimize operational efficiency. Government initiatives targeting energy efficiency and infrastructure modernization contribute to steady adoption across sectors.

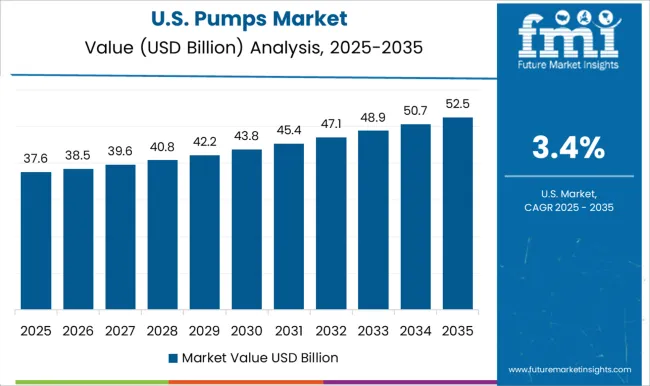

The USA pumps market is projected to grow at a CAGR of 3.4% from 2025 to 2035, supported by industrial maintenance, municipal water management, and energy sector applications. High-efficiency centrifugal, submersible, and chemical pumps are widely used across oil & gas, power, and water treatment industries. Industrial hubs in Texas, California, and Michigan provide strong manufacturing, deployment, and after-sales support. Manufacturers focus on reliability, automation, and precision monitoring to meet strict regulatory and operational standards. Adoption is further driven by the need for energy-saving technologies, replacement of aging infrastructure, and robust wastewater and irrigation systems. Corporate and municipal projects create stable demand for advanced pumping solutions.

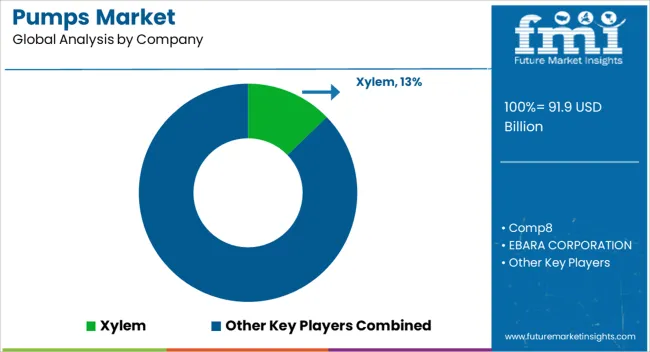

The pumps market is driven by industrial, municipal, and residential demand for fluid transport, water treatment, and process automation solutions. Centrifugal, positive displacement, submersible, and metering pumps are increasingly adopted across water and wastewater management, chemical processing, oil and gas, and HVAC applications. Rising infrastructure investment, urbanization, and industrial automation are fueling growth, while efficiency, reliability, and compliance with energy and environmental standards remain key market considerations. Competition is shaped by flow efficiency, durability, and application versatility. Xylem and Grundfos Holding A/S lead through smart, energy-efficient pumps optimized for water and wastewater systems, offering IoT-enabled monitoring and predictive maintenance. Flowserve Corporation and Sulzer Ltd focus on high-performance industrial pumps suitable for chemical, oil, and gas applications. EBARA Corporation and KSB SE & Co. KGaA differentiate via corrosion-resistant materials, high-pressure capabilities, and customized solutions. Ingersoll Rand, ITT Inc., Pentair, SPX FLOW, and SLB compete with modular designs, integration with automation systems, and reliability under continuous operations.

Smaller players such as Comp8, IWAKI Co., Ltd., The Weir Group PLC, and Vaughan Company emphasize niche applications, precision pumping, and cost-effective solutions. Strategies emphasize product innovation, efficiency, and multi-industry adaptability. Development of high-efficiency, low-maintenance, and corrosion-resistant pumps is prioritized. Smart monitoring, IoT integration, and predictive maintenance platforms are marketed to reduce downtime and optimize operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 91.9 Billion |

| Type | Stationary and Portable |

| Position | Submersible and Non-submersible |

| Driving Force | Electric-Driven and Engine-Driven |

| Technology | Centrifugal Pump, Axial Flow Pump, Radial Flow Pump, Mixed Flow Pump, Position Displacement Pump, Reciprocating, Rotary, Others, and Others |

| End User | Water & wastewater treatment, Mining, Building & construction, Oil & Gas, General Industries, Chemicals, Power generation, and Others (agriculture etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Xylem, Comp8, EBARA CORPORATION, Flowserve Corporation., Grundfos Holding A/S, Ingersoll Rand, ITT INC., IWAKI CO., LTD., KSB SE & Co. KGaA, Pentair, SLB, SPX FLOW, Inc., Sulzer Ltd, The Weir Group PLC, and Vaughan Company |

| Additional Attributes | Dollar sales by pump type (centrifugal, positive displacement, diaphragm, submersible), application (water & wastewater, oil & gas, chemicals, HVAC, power generation), and end-user (industrial, municipal, residential). Demand is driven by water infrastructure expansion, industrial automation, and energy efficiency initiatives. Regional trends show strong adoption in North America and Europe, while Asia-Pacific exhibits rapid growth due to industrialization, urban water projects, and rising energy demand. |

The global pumps market is estimated to be valued at USD 91.9 billion in 2025.

The market size for the pumps market is projected to reach USD 136.1 billion by 2035.

The pumps market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in pumps market are stationary and portable.

In terms of position, submersible segment to command 58.3% share in the pumps market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

Lobe Pumps Market

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Charge Pumps Market Size and Share Forecast Outlook 2025 to 2035

Spinal Pumps Market Size and Share Forecast Outlook 2025 to 2035

Facial Pumps Market Growth – Demand & Forecast 2025 to 2035

Insulin Pumps Market Size and Share Forecast Outlook 2025 to 2035

Airless Pumps Market Analysis - Size, Demand & Forecast 2025 to 2035

Competitive Overview of Airless Pumps Market Share

Jetting Pumps Market

Infusion Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Pumps Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Pumps Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Pumps & Filters Market Demand 2024 to 2034

Smart IoT Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Sea Water Pumps Market Growth - Trends & Forecast 2025 to 2035

Diaphragm Pumps Market Growth - Trends & Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Hydraulic Pumps Market Growth & Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA