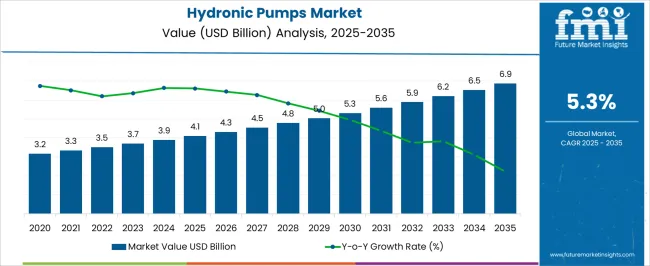

The hydronic pumps market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 6.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. The values from USD 4.1 billion in 2025 to USD 4.8 billion by 2028 indicate gradual yet reliable growth, demonstrating how the market is being driven by the rising use of efficient water circulation solutions in heating and cooling systems.

This steady upward movement is viewed as a response to the demand for pumps that provide consistent flow, low maintenance, and adaptability in residential, commercial, and industrial facilities. It can be argued that manufacturers who prioritize durability, operational stability, and compliance with global standards will maintain stronger positioning as demand for advanced hydronic systems grows. By 2035, the market is expected to reach USD 6.9 billion, emphasizing the role of hydronic pumps as vital components in ensuring energy-efficient temperature control and fluid management.

The CAGR projection suggests that suppliers offering a broad range of pump types, including circulator, end-suction, and inline, will likely dominate competitive share, as customers lean toward products that enhance reliability and minimize operational disruptions. In this outlook, the demand is not just volume-driven but preference-driven, with buyers placing value on lifecycle costs, noise reduction, and resilience under varied operating conditions. The continuous CAGR pattern strengthens the argument that the hydronic pumps market will remain attractive for long-term investments while fostering innovation in system integration and improved pumping efficiency.

| Metric | Value |

|---|---|

| Hydronic Pumps Market Estimated Value in (2025 E) | USD 4.1 billion |

| Hydronic Pumps Market Forecast Value in (2035 F) | USD 6.9 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The hydronic pumps market represents a vital subset of the global HVAC equipment market, where it accounts for nearly 6-7% share, as these pumps are integral to heating and cooling systems in residential, commercial, and industrial buildings. Within the broader building and construction market, hydronic pumps hold around 4-5% share, primarily driven by increasing demand for efficient heating and cooling infrastructure in new construction and retrofitting projects. In the plumbing and water management market, hydronic pumps contribute about 3-4% share, serving roles in circulating hot and chilled water for both domestic and industrial use.

In the energy and power systems market, the share is close to 2-3%, as hydronic pumps support thermal management in power plants and energy-efficient buildings. Meanwhile, in the industrial machinery and equipment market, hydronic pumps hold about 3-4% share, providing fluid circulation for process cooling, manufacturing operations, and system integration in various industries.

The hydronic pumps market is witnessing steady expansion, supported by growing adoption in residential, commercial, and industrial heating and cooling systems. Rising emphasis on energy efficiency and sustainable HVAC solutions has been prompting increased integration of advanced pump technologies across construction projects. Market players are focusing on optimizing pump designs, incorporating variable speed capabilities, and enhancing durability to meet evolving regulatory requirements and operational demands.

Urbanization and infrastructure development are driving installation rates, while retrofitting activities in older buildings are contributing to replacement demand. Supply chain resilience, combined with advancements in smart monitoring and control systems, is enabling more efficient operations and predictive maintenance, further boosting adoption.

Over the forecast period, strong policy support for energy conservation, coupled with technological innovations in pump control systems, is expected to strengthen market growth Competitive differentiation is being shaped by product reliability, lifecycle cost efficiency, and the ability to integrate with intelligent building management systems, positioning the sector for continued revenue expansion.

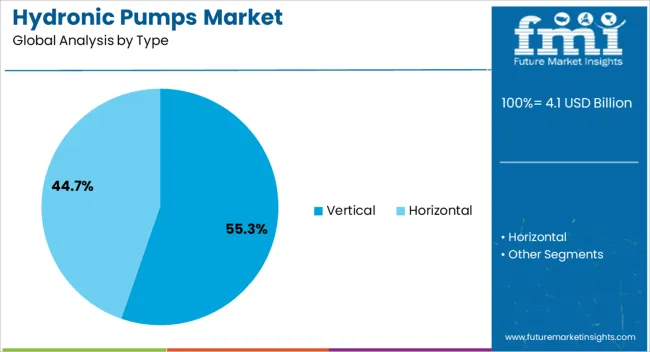

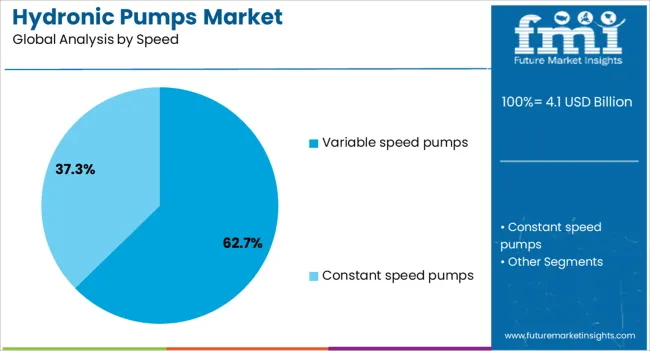

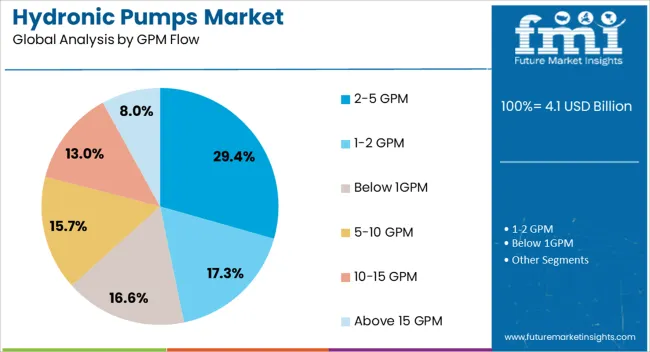

The hydronic pumps market is segmented by type, speed, GPM flow, power, usage, end use, distribution channel, and geographic regions. By type, hydronic pumps market is divided into Vertical and Horizontal. In terms of speed, hydronic pumps market is classified into Variable speed pumps and Constant speed pumps. Based on gpm flow, hydronic pumps market is segmented into 2-5 GPM, 1-2 GPM, Below 1GPM, 5-10 GPM, 10-15 GPM, and Above 15 GPM. By power, the hydronic pumps market is segmented into 100-500W, up to 100W, and above 500W.

By usage, hydronic pumps market is segmented into Chilled water, Steam, and Heated water. By end use, hydronic pumps market is segmented into Commercial, Industrial, and Residential. By distribution channel, hydronic pumps market is segmented into Direct and Indirect. Regionally, the hydronic pumps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vertical type segment, holding 55.3% of the type category, is leading the market due to its space-efficient design and suitability for high-capacity hydronic systems in commercial and industrial applications. Its vertical configuration allows for easier installation in mechanical rooms with limited footprint, enhancing adaptability in urban construction projects.

Demand has been reinforced by its operational reliability, reduced maintenance needs, and compatibility with a range of heating and cooling system designs. Manufacturers have been optimizing impeller design and casing materials to improve efficiency and extend service life, while compliance with energy performance standards has supported broader adoption.

The segment’s share has also been sustained by retrofitting activities, where vertical pumps are increasingly replacing older, less efficient models. Integration with variable frequency drives and advanced monitoring systems is further enhancing performance, ensuring the segment remains a preferred choice in both new installations and replacement markets.

The variable speed pumps segment, representing 62.7% of the speed category, has secured its dominant position due to its superior energy efficiency and operational flexibility. By adjusting pump speed in response to real-time demand, these systems significantly reduce energy consumption and extend equipment lifespan. This performance advantage has aligned with regulatory pushes for high-efficiency HVAC systems, driving adoption across commercial buildings, industrial plants, and high-end residential projects.

Enhanced control capabilities have enabled better system balancing, reducing noise and operational costs while improving overall thermal comfort. Manufacturers are integrating advanced motor technologies and digital control interfaces to improve responsiveness and energy optimization further.

Growing awareness of lifecycle cost benefits, combined with rebate programs and green building certifications, is reinforcing market penetration. Over time, as energy efficiency mandates tighten globally, the variable speed pumps segment is expected to maintain its leading role within the hydronic pumps market.

The 2–5 GPM flow segment, accounting for 29.4% of the flow category, has been leading demand due to its suitability for small to medium-scale hydronic applications, including residential and light commercial systems. Its flow capacity aligns well with the operational needs of compact HVAC setups, ensuring balanced performance without excessive energy consumption.

Adoption has been supported by its ease of installation, cost-effectiveness, and compatibility with modern control systems. Manufacturers have been focusing on enhancing hydraulic efficiency and minimizing noise levels, making these pumps an attractive choice for noise-sensitive environments.

Growth is further supported by the segment’s relevance in retrofit projects, where existing systems require reliable, moderate-flow replacements. The ongoing expansion of urban housing projects and the rising demand for decentralized HVAC solutions are expected to sustain demand for 2–5 GPM hydronic pumps, ensuring the segment retains a competitive position in the overall market landscape.

The hydronic pumps market is growing due to rising demand for efficient heating and cooling systems in residential, commercial, and industrial spaces. Opportunities lie in smart and variable speed pump technologies, while digitalization and energy optimization are driving notable trends. However, high upfront costs and technical complexity remain challenges. Overall, the market is expected to expand steadily, fueled by the global shift toward energy-efficient HVAC solutions and smart building practices.

The hydronic pumps market is witnessing steady demand due to their application in heating and cooling systems across residential, commercial, and industrial buildings. Rising construction activity, increasing demand for energy-efficient climate control, and the adoption of green building standards are driving market expansion. Hydronic pumps offer reliability, durability, and consistent performance for HVAC applications, making them highly sought after. Their ability to circulate water for radiant heating and chilled water cooling supports widespread adoption in both new installations and retrofit projects.

Significant opportunities are emerging with the adoption of smart hydronic pumps and variable speed systems. These solutions allow energy savings, adaptive performance, and integration into building management systems. Manufacturers focusing on IoT-enabled pumps, predictive maintenance features, and modular configurations are well-positioned to capture market share. Expanding opportunities in commercial real estate, hospitals, educational institutions, and industrial complexes offer long-term growth prospects. Furthermore, retrofitting older buildings with modern pump technologies opens additional avenues for demand in regions emphasizing energy efficiency and reduced operational costs.

A prominent trend in the hydronic pumps market is the move toward digitalization and energy optimization. Increasing adoption of pumps with smart sensors, real-time monitoring, and cloud-based connectivity aligns with global Industry 4.0 practices. Digital twin technologies and AI-driven diagnostics are being introduced for performance optimization. Energy-efficient motors, advanced hydraulics, and compact designs further reflect the shift toward sustainable practices. These trends highlight how manufacturers are focusing on innovation and performance to meet the growing requirement for intelligent, resource-efficient HVAC solutions across sectors.

Despite their advantages, hydronic pumps face challenges due to the high initial costs of advanced systems and complex installation requirements. Many small-scale projects prefer lower-cost alternatives, slowing adoption in price-sensitive regions. Technical expertise is required for installation and integration into building management systems, adding to overall expenses. Maintenance, including monitoring for leaks and performance issues, also increases lifecycle costs.

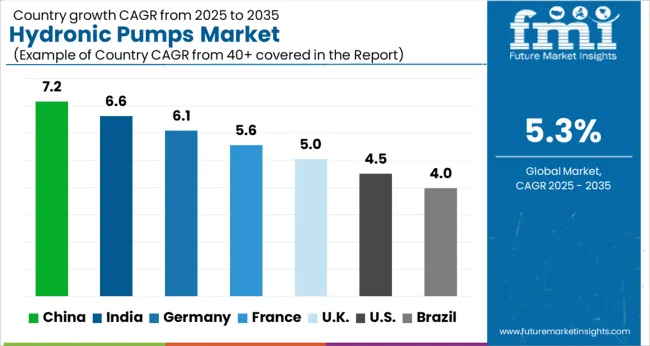

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

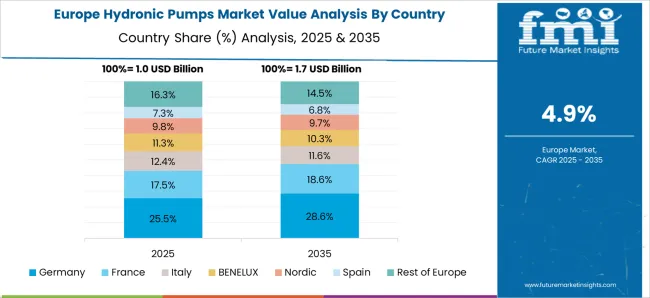

The global hydronic pumps market is projected to register a CAGR of 5.3% between 2025 and 2035. China leads the growth with a rate of 7.2%, followed by India at 6.6% and France at 5.6%. The United Kingdom shows steady progress at 5%, while the United States records the slowest growth at 4.5%. Expansion is supported by rising demand for efficient heating and cooling systems, government-backed energy policies, and modernization of residential and commercial infrastructure. While emerging markets such as China and India are focusing on new construction and widespread adoption of HVAC systems, developed markets including France, the UK, and the USA are investing in upgrading existing heating networks with advanced hydronic pump solutions to ensure efficiency, durability, and regulatory compliance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The hydronic pumps market in China is forecast to grow at 7.2% CAGR, supported by rapid infrastructure development, large-scale urban housing projects, and demand for district heating and cooling systems. Rising energy efficiency targets have encouraged adoption of advanced hydronic systems in commercial and residential spaces. Government-led initiatives to modernize heating networks and reduce carbon intensity further promote pump adoption. Demand is particularly strong in multi-story buildings, smart cities, and industrial complexes, where reliable water circulation is vital for comfort and process control. Both domestic and global manufacturers are focusing on energy-efficient, variable-speed pumps tailored to Chinese building standards. Strong growth in the construction and real estate sector, coupled with retrofitting projects in older districts, ensures China’s leading role in hydronic pump adoption.

The hydronic pumps market in India is expected to expand at 6.6% CAGR, driven by growing residential and commercial construction and rising adoption of centralized heating and cooling systems. While traditionally dependent on basic pumping solutions, the country is experiencing an increasing shift toward efficient hydronic systems in high-rise apartments, malls, hospitals, and office complexes. Government-backed housing schemes and infrastructure investments are creating opportunities for widespread deployment. Industrial facilities, especially in pharmaceuticals, textiles, and food processing, are adopting hydronic pumps for process efficiency. Domestic manufacturers are introducing cost-effective solutions, while global players are focusing on variable-speed and intelligent pump models to tap into premium markets. The expanding middle-class population, with increasing preference for comfort cooling, is expected to further accelerate adoption in India’s real estate and commercial hubs.

The hydronic pumps market in France is projected to register a 5.6% CAGR, supported by its strong focus on energy efficiency, sustainable heating solutions, and regulatory compliance with EU directives. France’s well-established residential heating infrastructure is undergoing steady modernization, with hydronic pumps being upgraded to meet efficiency standards. Demand is also rising in commercial and institutional buildings, where comfort control and reliability are critical. French manufacturers emphasize compact, durable, and energy-saving pump designs tailored for integration into modern HVAC systems. Retrofitting initiatives in older housing stock and government-backed programs to reduce energy consumption in buildings have accelerated replacement demand. Growth is moderate but consistent, reflecting the country’s balanced approach toward both new construction and modernization of existing heating networks.

The hydronic pumps market in the United Kingdom is expected to grow at 5% CAGR, supported by modernization of heating networks, energy efficiency initiatives, and replacement of aging systems. While new construction demand is relatively modest compared to emerging economies, the UK market benefits from high adoption of hydronic systems in both residential and commercial properties. Government programs encouraging energy savings and low-carbon heating technologies have supported adoption of modern pumps. Usage in office complexes, hospitals, and educational institutions reinforces growth, where efficiency and durability are primary requirements. Local and global manufacturers are focusing on compact, energy-saving models with intelligent controls to meet consumer expectations. The UK’s emphasis on upgrading existing housing stock ensures steady demand despite slower construction activity compared to Asia-Pacific markets.

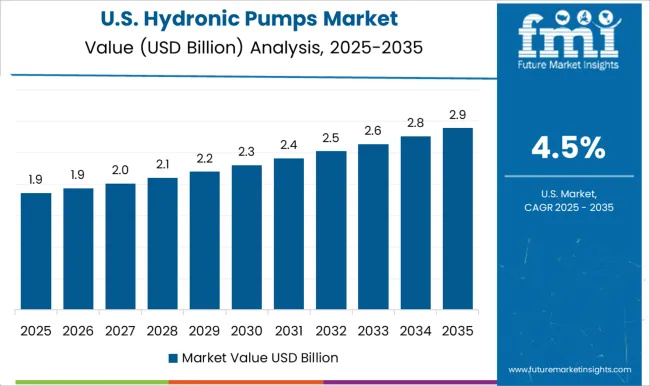

The hydronic pumps market in the United States is projected to expand at 4.5% CAGR, marking steady but slower growth compared to Asia and Europe. The adoption of hydronic systems is largely concentrated in colder regions, institutional buildings, and commercial complexes. Demand is influenced by retrofitting of aging heating networks and growing awareness of energy efficiency standards. The residential segment shows moderate adoption, as forced-air systems remain more common, but premium housing projects and green building initiatives are creating fresh opportunities. USA manufacturers are focusing on high-performance pumps with advanced controls, predictive maintenance, and integration into smart building systems. Growth is primarily driven by modernization and replacement rather than large-scale new installations, positioning the USA as a stable but mature market for hydronic pumps.

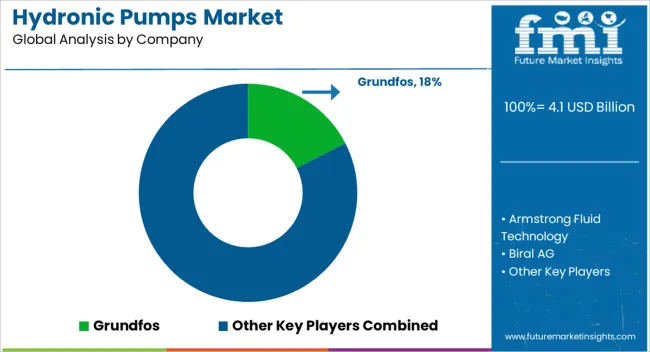

Key participants in the hydronic pumps market, including Grundfos, Wilo, and Xylem Inc., dominate by emphasizing high-efficiency solutions for heating, cooling, and hot water circulation systems. Grundfos highlights energy-efficient circulators with intelligent controls, showcased in brochures as systems that reduce operational costs while ensuring reliability. Wilo markets compact and digitally enabled pumps designed for both residential and commercial use, focusing on comfort, low noise, and automation. Xylem Inc. differentiates with advanced monitoring systems and strong after-sales service, framing its products as long-term, sustainable solutions for buildings and infrastructure.

Armstrong Fluid Technology and Danfoss are also strong competitors, promoting integrated hydronic solutions that combine pumping efficiency with smart building management. Other manufacturers, including KSB Group, Flowserve, and Sulzer Ltd., strengthen their position by providing robust pumps designed for large-scale HVAC and industrial applications. Franklin Electric and Pentair plc target residential and light commercial systems, while ITT Inc. and Taco Comfort Solutions promote user-friendly designs with easy installation and maintenance features. Uponor Corporation expands its presence by integrating hydronic pumps within complete piping and distribution systems. Biral AG and DAB Pumps emphasize compact, silent, and efficient designs for niche residential and small building applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Type | Vertical and Horizontal |

| Speed | Variable speed pumps and Constant speed pumps |

| GPM Flow | 2-5 GPM, 1-2 GPM, Below 1GPM, 5-10 GPM, 10-15 GPM, and Above 15 GPM |

| Power | 100-500W, Upto 100W, and Above 500W |

| Usage | Chilled water, Steam, and Heated water |

| End Use | Commercial, Industrial, and Residential |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Grundfos, Armstrong Fluid Technology, Biral AG, DAB Pumps, Danfoss, Flowserve Corporation, Franklin Electric, ITT Inc., KSB Group, Pentair plc, Sulzer Ltd., Taco Comfort Solutions, Uponor Corporation, Wilo, and Xylem Inc. |

| Additional Attributes | Dollar sales by pump type (circulator, booster, variable speed) and application (residential, commercial, industrial) are key metrics. Trends include rising demand for energy-efficient heating and cooling systems, integration with smart building technologies, and preference for low-maintenance solutions. Regional adoption, regulatory standards, and technological improvements are driving market growth. |

The global hydronic pumps market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the hydronic pumps market is projected to reach USD 6.9 billion by 2035.

The hydronic pumps market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in hydronic pumps market are vertical and horizontal.

In terms of speed, variable speed pumps segment to command 62.7% share in the hydronic pumps market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Control Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Radiator Market Size and Share Forecast Outlook 2025 to 2035

Examining Europe Hydronic Underfloor Heating Market Share & Trends

Europe Hydronic Underfloor Heating Market Insights – Trends, Demand & Growth 2025-2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

Lobe Pumps Market

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Charge Pumps Market Size and Share Forecast Outlook 2025 to 2035

Spinal Pumps Market Size and Share Forecast Outlook 2025 to 2035

Facial Pumps Market Growth – Demand & Forecast 2025 to 2035

Insulin Pumps Market Size and Share Forecast Outlook 2025 to 2035

Airless Pumps Market Analysis - Size, Demand & Forecast 2025 to 2035

Competitive Overview of Airless Pumps Market Share

Jetting Pumps Market

Infusion Pumps Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Pumps Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA