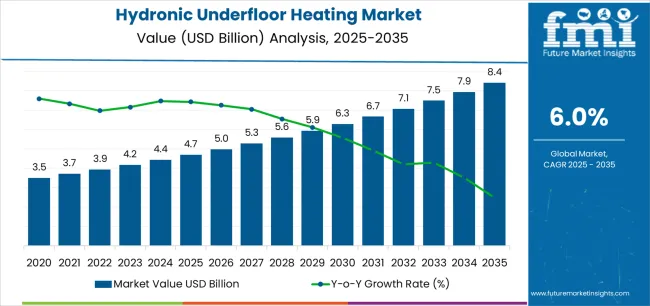

The global hydronic underfloor heating market is valued at USD 4.7 billion in 2025. It is slated to reach USD 8.4 billion by 2035, recording an absolute increase of USD 3.7 billion over the forecast period. This translates into a total growth of 78.7%, with the market forecast to expand at a CAGR of 6% between 2025 and 2035. The market size is expected to grow by nearly 1.79X during the same period, supported by increasing demand for energy-efficient heating solutions, growing adoption of heat pump technologies driven by electrification policies, expanding retrofit applications in existing buildings, and rising emphasis on sustainable and comfortable heating systems across diverse residential, commercial, and industrial building applications.

Between 2025 and 2030, the hydronic underfloor heating market is projected to expand from USD 4.7 billion to USD 6.3 billion, resulting in a value increase of USD 1.6 billion, which represents 43.2% of the total forecast growth for the decade. This phase of development will be shaped by increasing building energy efficiency regulations and decarbonization mandates, rising adoption of heat pump systems for low-temperature heating applications, and growing demand for smart thermostats and multi-zone control systems in residential and commercial buildings. Building developers and retrofit specialists are expanding their hydronic underfloor heating capabilities to address the growing demand for comfortable and energy-efficient heating solutions that ensure occupant comfort and environmental compliance.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4.7 billion |

| Forecast Value in (2035F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

From 2030 to 2035, the market is forecast to grow from USD 6.3 billion to USD 8.4 billion, adding another USD 2.1 billion, which constitutes 56.8% of the ten-year expansion. This period is expected to be characterized by the expansion of hydrogen-ready and biomass boiler integration for sustainable heating, the development of building management system connectivity and AI-powered optimization algorithms, and the growth of district heating coupling and solar-assisted hydronic applications. The growing adoption of net-zero building standards and advanced control technologies will drive demand for hydronic underfloor heating systems with enhanced efficiency and smart automation features.

Between 2020 and 2025, the hydronic underfloor heating market experienced steady growth, driven by increasing building energy performance standards and growing recognition of hydronic radiant systems as essential technologies for enhancing thermal comfort and reducing energy consumption in diverse residential and commercial building applications. The market developed as building engineers and HVAC designers recognized the potential for hydronic underfloor heating technology to improve occupant comfort, reduce heating energy costs, and support sustainability objectives while meeting stringent performance requirements. Technological advancement in low-temperature system design and smart control integration began emphasizing the critical importance of maintaining consistent comfort levels and operational efficiency in modern building environments.

Market expansion is being supported by the increasing global demand for energy-efficient building heating solutions driven by climate change mitigation policies and stringent building energy codes, alongside the corresponding need for advanced heating technologies that can enhance thermal comfort, enable renewable energy integration, and maintain operational efficiency across various residential, commercial, and industrial building applications. Modern building developers and facility managers are increasingly focused on implementing hydronic underfloor heating solutions that can reduce energy consumption, enhance occupant comfort, and provide consistent heating performance in demanding climate conditions.

The growing emphasis on building decarbonization and electrification is driving demand for hydronic underfloor heating systems that can support heat pump operation, enable low-temperature heating distribution, and ensure comprehensive energy performance optimization. Building owners' preference for heating technologies that combine comfort excellence with energy efficiency and sustainability credentials is creating opportunities for innovative hydronic underfloor heating implementations. The rising influence of smart building adoption and advanced automation technologies is also contributing to increased adoption of hydronic underfloor heating systems that can provide superior comfort characteristics without compromising energy performance or operational flexibility.

The market is segmented by application, heat source, pipe/panel material, build status, control & zoning, and region. By application, the market is divided into residential, commercial, and industrial. Based on heat source, the market is categorized into air-source heat pumps, gas condensing boilers, ground-source heat pumps, district heating, and others (including biomass/hydrogen-ready and solar-assisted). By pipe/panel material, the market includes PEX-a, PEX-b, PE-RT, multilayer composite (MLCP), and others. Based on build status, the market comprises retrofit and new build. By control & zoning, the market is segmented into smart thermostats & multi-zone controllers, basic thermostats, and BMS-integrated modules. Regionally, the market is divided into Europe, North America, Asia Pacific, Middle East & Africa, and Latin America.

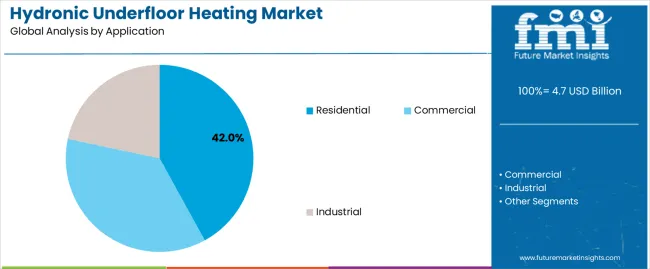

The residential segment is projected to maintain its leading position in the hydronic underfloor heating market in 2025 with a 42% market share, reaffirming its role as the preferred application category for single-family homes, multi-family apartments, and residential renovation projects. Homeowners and residential developers increasingly utilize hydronic underfloor heating for its superior comfort characteristics, excellent energy efficiency performance, and proven effectiveness in providing even heat distribution while reducing energy costs compared to traditional radiator systems. Hydronic underfloor heating technology's proven effectiveness and application versatility directly address the residential sector requirements for comfortable living environments and sustainable heating solutions across diverse housing types and climate zones.

This application segment forms the foundation of modern residential heating, as it represents the technology with the greatest contribution to occupant comfort improvements and established performance record across multiple housing applications and building types. Residential construction investments in energy-efficient heating technologies continue to strengthen adoption among developers and homeowners. With regulatory pressures requiring reduced building energy consumption and improved thermal performance, hydronic underfloor heating aligns with both environmental objectives and comfort requirements, making it the central component of comprehensive residential heating strategies.

The commercial segment maintains a 38.0% market share, driven by office buildings, retail spaces, hotels, hospitals, and educational facilities seeking enhanced occupant comfort and energy efficiency. Commercial applications benefit from hydronic underfloor heating's ability to provide consistent thermal comfort in high-occupancy spaces while maintaining architectural flexibility and reducing ceiling height requirements. The industrial segment captures 20.0% of market demand, encompassing warehouses, manufacturing facilities, and logistics centers requiring efficient space heating with minimal maintenance requirements and robust operational performance.

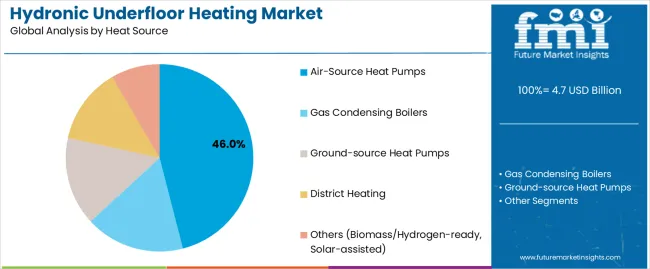

The air-source heat pumps segment is projected to represent the largest share of hydronic underfloor heating heat source demand in 2025 with a 46% market share, underscoring its critical role as the primary driver for electrification-driven heating adoption across residential renovations, new construction projects, and commercial building applications. Building owners prefer air-source heat pumps for hydronic systems due to their exceptional energy efficiency benefits, lower carbon emissions compared to fossil fuel alternatives, and ability to provide both heating and cooling capabilities while supporting decarbonization objectives and regulatory compliance. Positioned as essential technologies for sustainable building heating, air-source heat pumps offer both performance advantages and environmental benefits.

The segment is supported by continuous innovation in heat pump technology and the growing availability of high-temperature heat pump models that enable superior heating performance with enhanced efficiency ratings and expanded operating temperature ranges. Building owners are investing in comprehensive heat pump integration programs to support increasingly stringent building energy regulations and government incentive schemes promoting electrification. As building decarbonization accelerates and renewable electricity generation increases, the air-source heat pump segment will continue to dominate the market while supporting advanced system integration and energy optimization strategies.

Gas condensing boilers represent 24.0% of market demand, maintaining relevance in regions with established gas infrastructure and during transitional phases toward full electrification. Ground-source heat pumps account for 14.0%, driven by premium residential applications and commercial projects prioritizing maximum energy efficiency and long-term operational cost reduction. District heating holds 10.0% market share, prevalent in European urban areas and Scandinavian countries with established district heating networks. Others, including biomass/hydrogen-ready and solar-assisted systems, comprise 6.0% of market demand, representing emerging sustainable heating solutions and hybrid system configurations.

The hydronic underfloor heating market is advancing steadily due to increasing demand for energy-efficient heating solutions driven by building decarbonization policies and growing adoption of heat pump technologies that require low-temperature heating distribution providing enhanced comfort characteristics and sustainability benefits across diverse residential, commercial, and industrial building applications. The market faces challenges, including high initial installation costs compared to conventional radiator systems, complexity of retrofit installations in existing buildings with limited floor height, and dependence on skilled installers with hydronic system expertise. Innovation in low-profile panel technologies and smart control integration continues to influence product development and market expansion patterns.

The growing adoption of air-source and ground-source heat pumps is driving demand for specialized hydronic underfloor heating solutions that address optimal operating conditions including low supply water temperatures, large heat emitter surface areas, and efficient heat distribution characteristics. Heat pump systems achieve maximum energy efficiency when paired with low-temperature heating distribution, making hydronic underfloor heating the ideal complement for electrification-driven building heating. Building owners and developers are increasingly recognizing the synergistic advantages of heat pump and hydronic underfloor heating integration for achieving net-zero carbon targets and regulatory compliance, creating opportunities for integrated system solutions specifically designed for electrified heating applications.

Modern hydronic underfloor heating system manufacturers are incorporating smart thermostat technologies and building management system connectivity to enhance comfort control, reduce energy consumption, and support comprehensive building optimization through zone-based temperature management and adaptive learning algorithms. Leading companies are developing AI-powered control systems with predictive heating algorithms, implementing weather compensation and occupancy sensing, and advancing technologies that minimize energy waste and operational intervention requirements. These technologies improve user experience while enabling new market opportunities, including demand response participation, energy storage integration, and intelligent building ecosystem connectivity. Advanced automation integration also allows building owners to support comprehensive sustainability objectives and operational cost reduction beyond traditional heating system capabilities.

The expansion of building renovation activities, aging heating system replacement cycles, and government retrofit incentive programs is driving demand for low-profile hydronic underfloor heating panels and thin-screed systems that minimize floor height increases and installation disruption in occupied buildings. These advanced retrofit solutions incorporate innovative panel designs with reduced thickness profiles, rapid installation methodologies, and enhanced thermal response characteristics that address the constraints of existing building modifications, creating premium market segments with differentiated installation propositions. Manufacturers are investing in modular panel development and quick-connect piping technologies to serve the extensive retrofit market opportunity while supporting building energy performance improvement and occupant comfort enhancement.

| Country | CAGR (2025-2035) |

|---|---|

| Japan | 6.2% |

| United Kingdom | 6.1% |

| South Korea | 6.1% |

| United States | 6.0% |

| Germany | 5.7% |

| France | 5.5% |

| Canada | 5.6% |

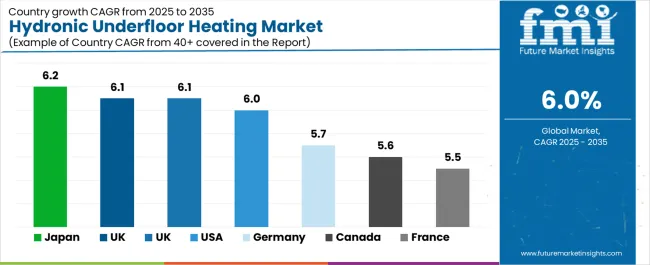

The hydronic underfloor heating market is experiencing solid growth globally, with Japan leading at a 6.2% CAGR through 2035, driven by thin-panel retrofit solutions for urban condominiums, aging population preference for radiant comfort, and compact living space optimization requirements. The United Kingdom follows at 6.1%, supported by boiler phase-out incentives, Boiler Upgrade Scheme grants, and aggressive heat pump deployment targets under decarbonization policies. South Korea shows growth at 6.1%, emphasizing modern Ondol heating evolution, smart-home zoning integration, and high-rise apartment applications. The United States demonstrates 6.0% growth, supported by Inflation Reduction Act-backed electrification incentives, heat pump adoption acceleration, and residential renovation activities. Germany records 5.7%, focusing on Energy Performance of Buildings Directive-driven low-temperature hydronic retrofits, heat pump market leadership, and sustainable building standards. France exhibits 5.5% growth, emphasizing RE2020 building regulations and district heating network coupling. Canada shows 5.6% growth, supported by cold-climate heat pump integration and residential energy efficiency programs.

The report covers an in-depth analysis of 40+ countries, with top-performing countries are highlighted below.

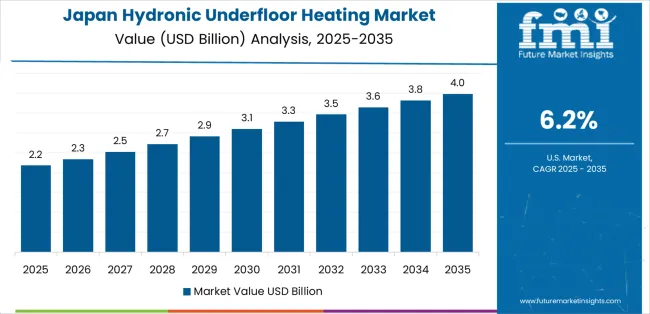

Revenue from hydronic underfloor heating in Japan is projected to exhibit exceptional growth with a CAGR of 6.2% through 2035, driven by extensive thin-panel retrofit solutions for urban condominium renovations and rapidly growing aging population preference for radiant floor heating comfort supported by government building energy efficiency initiatives and demographic transition programs. The country's massive urban housing stock and increasing investment in residential renovation technologies are creating substantial demand for hydronic underfloor heating solutions. Major HVAC manufacturers and building services companies are establishing comprehensive retrofit system capabilities to serve both domestic renovation markets and new construction applications.

Demand for hydronic underfloor heating in the United Kingdom is expanding at a CAGR of 6.1%, supported by the country's aggressive boiler phase-out policies, comprehensive Boiler Upgrade Scheme grant programs, and increasing heat pump adoption driven by government decarbonization mandates and renewable heating incentives. The country's commitment to net-zero carbon targets and substantial financial support mechanisms are driving sophisticated hydronic underfloor heating capabilities throughout residential and commercial sectors. Leading heating system manufacturers and renewable energy installers are establishing extensive installation and service networks to address growing retrofit and new construction demand.

Revenue from hydronic underfloor heating in South Korea is growing at a CAGR of 6.1%, supported by the country's traditional Ondol floor heating culture evolution into modern hydronic systems, expanding smart home technology integration, and comprehensive high-rise apartment construction incorporating advanced building services. The nation's sophisticated construction industry and emphasis on residential comfort are driving advanced hydronic underfloor heating capabilities throughout urban housing sectors. Leading construction companies and building systems integrators are investing extensively in smart control technologies and energy-efficient heating solutions.

Demand for hydronic underfloor heating in the United States is expected to expand at a CAGR of 6.0%, supported by the country's Inflation Reduction Act electrification incentives, accelerating heat pump adoption rates, and growing residential renovation activities driven by energy efficiency awareness and comfort improvement objectives. The nation's comprehensive policy support and expanding contractor expertise are driving demand for sophisticated hydronic underfloor heating solutions. HVAC contractors and green building specialists are investing in installation capability development and technical training to serve both retrofit and new construction markets.

Revenue from hydronic underfloor heating in Germany is projected to grow at a CAGR of 5.7%, driven by the country's Energy Performance of Buildings Directive implementation, heat pump market leadership position, and comprehensive building energy efficiency standards supporting low-temperature heating system adoption. Germany's engineering excellence and sustainability commitment are driving sophisticated hydronic capabilities throughout residential and commercial sectors. Leading heating system manufacturers and energy consulting firms are establishing comprehensive solution offerings for next-generation sustainable building heating.

Demand for hydronic underfloor heating in France is anticipated to expand at a CAGR of 5.5%, driven by the country's RE2020 building regulation implementation, strong district heating network infrastructure, and comprehensive energy transition policies supporting sustainable heating technology adoption. France's regulatory leadership and urban heating infrastructure are supporting investment in advanced hydronic underfloor heating technologies. Major construction companies and heating system providers are establishing comprehensive capabilities incorporating renewable energy integration and low-temperature distribution systems.

Revenue from hydronic underfloor heating in Canada is forecasted to grow at a CAGR of 5.6%, supported by the country's cold-climate heat pump technology development, residential energy efficiency program availability, and growing homeowner interest in comfortable and efficient heating solutions for harsh winter conditions. Canada's extreme climate requirements and energy efficiency awareness are driving demand for robust hydronic underfloor heating products. Leading HVAC contractors and energy efficiency specialists are investing in specialized installation capabilities for cold-climate applications.

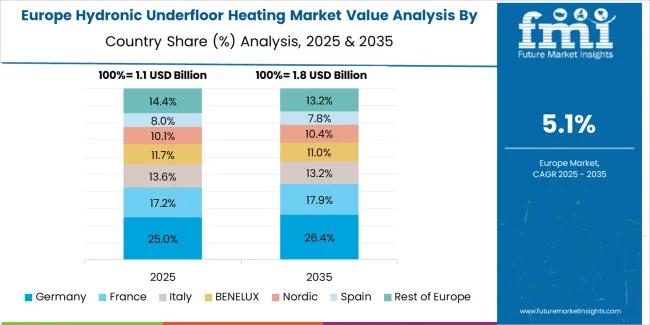

The hydronic underfloor heating market in Europe is projected to grow from USD 2.5 billion in 2025 to USD 4.1 billion by 2035, registering a CAGR of 5.1% over the forecast period. Germany is expected to lead with a 24.0% market share in 2025, easing to 23.6% by 2035, supported by large-scale low-temperature retrofit programs, heat pump market leadership, and comprehensive building energy efficiency regulations.

The United Kingdom holds 18.0% in 2025, rising to 18.4% by 2035, driven by boiler phase-out policies, Boiler Upgrade Scheme grants, and aggressive heat pump deployment targets. France accounts for 15.0% in 2025, nudging to 15.3% by 2035, supported by RE2020 building standards and district heating network coupling. Italy stands at 12.0% in 2025, reaching 12.2% by 2035 through hospitality sector installations and residential refurbishment projects. Nordics & Benelux together represent 11.0% in 2025, rising to 11.3% by 2035 with heat pump-centric building practices and advanced energy efficiency standards. Spain accounts for 9.0% in 2025, reaching 9.2% by 2035 via multi-family new construction and residential development projects. The Netherlands maintains 6.0% in 2025, steady at 6.0% by 2035 with gas-to-low-temperature heating transitions and sustainable building initiatives. The Rest of Europe region is 5.0% in 2025, adjusting to 4.0% by 2035, reflecting steady scaling across Central and Eastern European markets with growing heat pump adoption and building modernization programs.

The hydronic underfloor heating market is characterized by competition among established building systems manufacturers, diversified HVAC companies, and specialized radiant heating system providers. Companies are investing in low-profile retrofit technology development, smart control system integration, product portfolio expansion, and heat pump compatibility optimization to deliver high-performance, energy-efficient, and user-friendly hydronic underfloor heating solutions. Innovation in thin-panel design, rapid installation systems, and AI-powered control technologies is central to strengthening market position and competitive advantage.

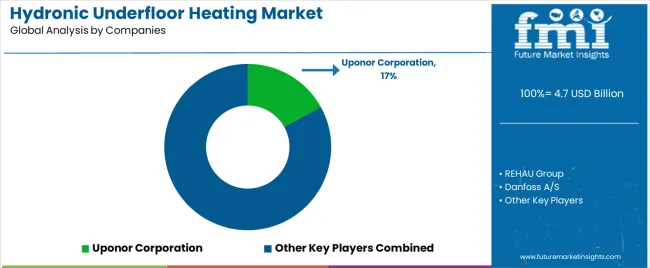

Uponor Corporation leads the market with a 17.0% share, offering comprehensive hydronic underfloor heating solutions with a focus on PEX piping systems, manifold distribution technologies, and integrated control platforms across diverse residential, commercial, and industrial applications. The company maintains strong market presence through extensive product portfolios covering complete system components from piping and manifolds to control systems and installation accessories. REHAU Group provides innovative hydronic heating solutions with emphasis on sustainable materials and rapid installation methodologies, having rolled out low-profile retrofit radiant panels and updated RAUTHERM SPEED installation systems to reduce labor time on refurbishment projects during 2024-2025.

Danfoss A/S delivers high-performance control and balancing solutions with focus on heat pump integration and system optimization. The company introduced next-generation hydronic balancing and proportional-integral control solutions and expanded heat pump integration kits for low-temperature radiant systems in 2024. Warmup Plc offers comprehensive underfloor heating systems with emphasis on user-friendly installation and smart control features. Honeywell International Inc. provides advanced thermostat and control technologies with comprehensive building automation integration. Mitsubishi Electric Corporation specializes in heat pump solutions optimized for hydronic applications, having expanded the Ecodan R290 air-to-water heat pump range with new 8.5-12 kW models to support high-temperature hydronic retrofits in 2025.

Hydronic underfloor heating represents a critical building services technology segment within residential, commercial, and industrial construction applications, projected to grow from USD 4.7 billion in 2025 to USD 8.4 billion by 2035 at a 6.0% CAGR. These high-performance radiant heating systems-primarily PEX piping and panel configurations for diverse building types-serve as essential comfort technologies in space heating, renovation projects, and sustainable building applications where enhanced thermal comfort, energy efficiency, and low-temperature heating distribution are essential. Market expansion is driven by increasing building decarbonization policies, growing heat pump adoption rates, expanding retrofit opportunities, and rising demand for smart control and zoning capabilities across diverse building and facility types.

How Building Regulators Could Strengthen Performance Standards and Energy Efficiency Requirements?

How Industry Associations Could Advance Installation Standards and Market Development?

How Hydronic Underfloor Heating Manufacturers Could Drive Innovation and Market Leadership?

How Building Developers and Property Owners Could Optimize System Performance and Value?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 4.7 billion |

| Application | Residential, Commercial, Industrial |

| Heat Source | Air-source Heat Pumps, Gas Condensing Boilers, Ground-source Heat Pumps, District Heating, Others (Biomass/Hydrogen-ready, Solar-assisted) |

| Pipe/Panel Material | PEX-a, PEX-b, PE-RT, Multilayer Composite (MLCP), Others |

| Build Status | Retrofit, New Build |

| Control & Zoning | Smart Thermostats & Multi-Zone Controllers, Basic Thermostats, BMS-Integrated Modules |

| Regions Covered | Europe, North America, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | Japan, United Kingdom, South Korea, United States, Germany, France, Canada, and 40+ countries |

| Key Companies Profiled | Uponor Corporation, REHAU Group, Danfoss A/S, Warmup Plc, Honeywell International Inc., Mitsubishi Electric Corporation |

| Additional Attributes | Dollar sales by application, heat source, pipe/panel material, build status, and control & zoning categories, regional demand trends, competitive landscape, technological advancements in low-profile retrofit systems, smart control integration, heat pump optimization, and energy efficiency enhancement |

The global hydronic underfloor heating market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the hydronic underfloor heating market is projected to reach USD 8.4 billion by 2035.

The hydronic underfloor heating market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in hydronic underfloor heating market are residential , commercial and industrial.

In terms of heat source, air-source heat pumps segment to command 46.0% share in the hydronic underfloor heating market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Europe Hydronic Underfloor Heating Market Share & Trends

Europe Hydronic Underfloor Heating Market Insights – Trends, Demand & Growth 2025-2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Control Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Radiator Market Size and Share Forecast Outlook 2025 to 2035

Underfloor Air Distribution Systems Market

Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Commercial Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

Heating Pad Market

Self Heating Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Self-Heating Butter Knife Market Size and Share Forecast Outlook 2025 to 2035

Radiant Heating And Cooling Systems Market

Infrared Heating Pad Market Size and Share Forecast Outlook 2025 to 2035

District Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA