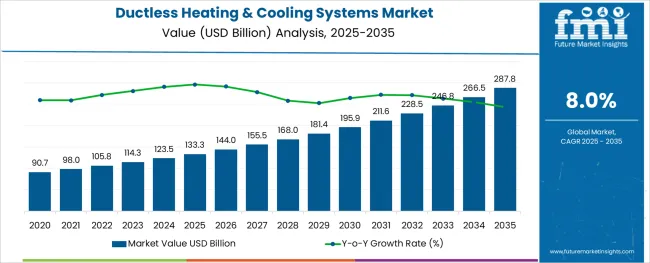

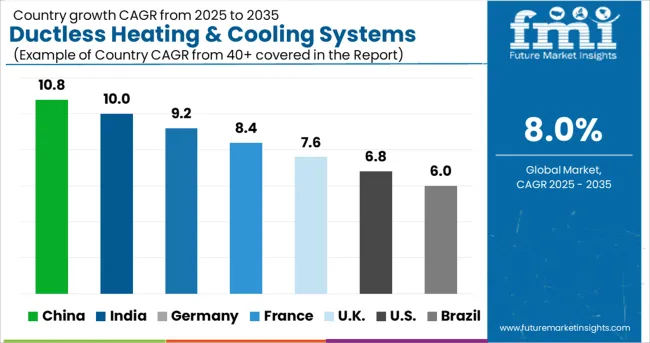

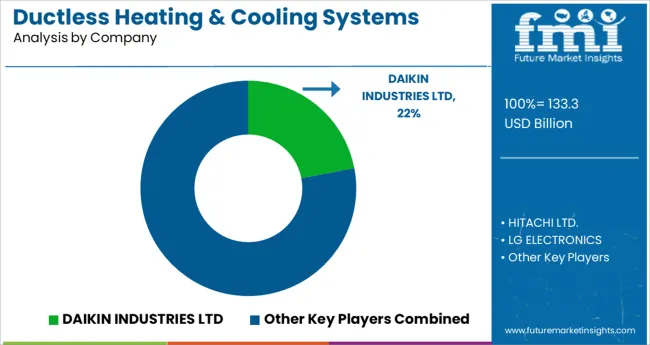

The Ductless Heating & Cooling Systems Market is estimated to be valued at USD 133.3 billion in 2025 and is projected to reach USD 287.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The ductless heating and cooling systems market is witnessing accelerated growth, driven by rising demand for energy-efficient, zone-specific climate control and increasing retrofitting activity across older buildings. Shifting consumer preferences toward compact, flexible HVAC solutions that require minimal structural modification have made ductless systems attractive in both developed and emerging economies.

Environmental regulations encouraging lower greenhouse gas emissions and the adoption of heat pump technologies have further reinforced market momentum. In addition, advances in inverter-based compressors, remote control capabilities, and smart home integration are enhancing product utility across residential and light-commercial environments.

As construction standards emphasize decarbonization and thermal efficiency, ductless systems are emerging as a core component of modern HVAC strategies. Future growth is expected to be supported by public incentives for energy retrofits, expanding infrastructure investments, and increased awareness of indoor air quality management

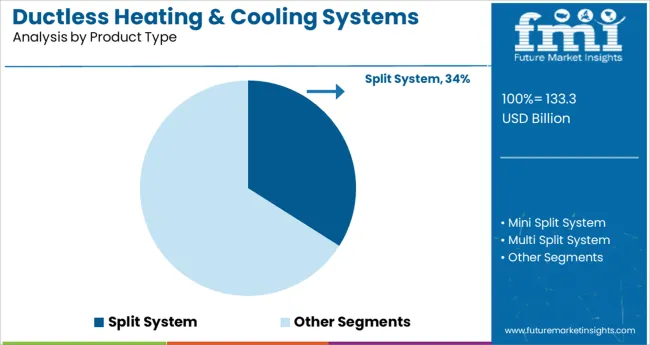

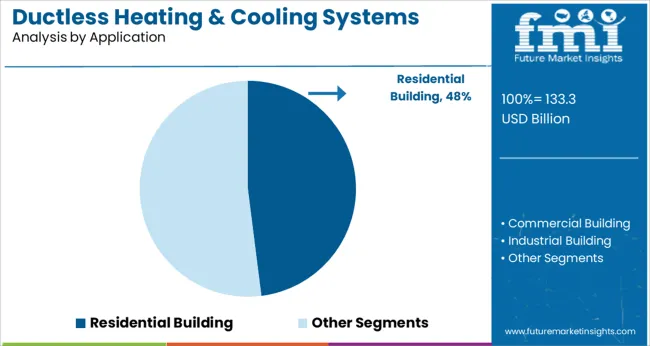

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Split System, Mini Split System, Multi Split System, VRF system, and Window Air conditioning System. In terms of Application, the market is classified into Residential Building, Commercial Building, and Industrial Building.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Split systems are projected to account for 34.0% of the overall revenue in the ductless heating and cooling systems market by 2025, establishing them as the leading product type. This dominance is being driven by the flexibility and efficiency of split systems in delivering targeted heating or cooling across individual rooms or zones.

Their modular design, quiet operation, and simplified installation process make them ideal for both new constructions and retrofits. Enhanced product offerings with inverter technology and smart thermostat compatibility have improved energy savings, driving greater adoption among cost-conscious consumers.

Additionally, split systems offer better control over temperature gradients compared to centralized ducted systems, making them suitable for diverse climate conditions. The combination of aesthetic integration, lower operating costs, and greater energy performance has firmly positioned split systems as the preferred ductless solution across key application areas.

The residential building segment is expected to contribute 48.0% of the total market revenue in 2025, making it the leading application area for ductless heating and cooling systems. Growth in this segment is being propelled by increased construction of single-family homes and urban apartments where space constraints and energy savings are primary concerns.

Homeowners are increasingly opting for ductless solutions to replace window units and outdated central systems, especially in markets with aging infrastructure. Supportive government subsidies for energy-efficient home upgrades and carbon reduction goals have further incentivized the adoption of ductless HVAC technologies.

Additionally, the rise of home automation and smart climate control systems has aligned well with ductless technologies, enhancing user experience and operational efficiency. With growing emphasis on indoor comfort, air quality, and reduced energy consumption, residential buildings remain the primary driver of ductless system installations globally.

Ductless systems are used in smart homes for controlling air temperature, humidity, and fresh air intake. Moreover, the energy consumption level of a ductless system can be optimized to a large extent by utilizing various components such as smart thermostats, sensors, control valves, heating and cooling coils, dampers, actuators, pumps, and fans.

These smart devices save energy and control the working of ductless heating & cooling systems with the help of technologies such as wireless communication, Internet connectivity, handheld devices, and cloud computing.

For example, ENERGY STAR certified ductless mini split systems use 60% less energy for heating and 30% less energy for cooling as compared to conventional room air conditioners. The energy-saving is possible as more sophisticated compressors and fans are used that can adjust speed to save energy.

The continuous development in technology and rapid innovation in various devices has increased the interest of customers toward the use of ductless systems in smart homes. Hence, the market is expected to show considerable potential in the coming years.

The presence of prominent HVAC equipment manufacturers and a transition towards sustainable and green building construction are some key factors that are expected to open opportunistic doors for the North American ductless heating & cooling systems market.

Over the last few years, demand for ductless heating and cooling systems has risen at a significant rate due to fluctuations in climatic conditions, changing lifestyles and rapid growth of the residential sector.

According to the most recent results from the 2024 Residential Energy Consumption Survey, 88% of USA households use air conditioning (AC). Two-thirds of USA households use central AC or a central heat pump as their main AC equipment. In 2024, the Midwest Census Region and South Census Region had the highest percentages of households using AC, at 92% and 93%, respectively.

The lowest percentage of households using AC was 73% in the West Census Region; this census region includes households in several climate areas, such as the marine climate region along the Pacific Coast, where residential AC use was 49%.

As the climatic conditions across the world continue to change drastically, demand for energy-efficient systems like ductless heating and cooling systems is set to rise at a healthy pace during the forthcoming years.

For instance, as per a report published by NASA, the Intergovernmental Panel on Climate Change (IPCC) has predicted a temperature rise of 2.5 to 10 degrees Fahrenheit over the next century. This will continue to generate growth opportunities in markets like cooling management system market, ductless heating & cooling systems market, and cooling systems market in the future.

Ductless heating and cooling systems are innovative energy systems used across various end-use verticals for maintaining temperature. These systems offer various advantages such as easy installation, lower operating expenses, greater efficiency, reduced carbon footprint and greater flexibility which makes them ideal alternatives to other heating and cooling solutions.

Demand for ductless heating and cooling systems is especially high in the residential sector where they are used to maintain a specific temperature. Rapid expansion of residential sector due to population explosion, changing lifestyle, and rising disposable income coupled with increasing consumer preference for energy efficient ductless heating and cooling systems will therefore continue to boost ductless heating and cooling systems market growth during the forecast period.

Similarly, emerging HVAC systems market trends such as rising demand for energy-efficient and sustainable heating and cooling technologies and the introduction of stringent government norms and regulations for reducing greenhouse gas emissions are expected to shape the growth of the ductless heating and cooling systems market during the forthcoming years.

The global sales of ductless heating & cooling systems are slated to grow at a CAGR of 8% during the forecast period from 2025 and 2035.

Factors such as rising demand for energy-efficient heating and cooling systems in residential, commercial, and industrial verticals, incorporation of IoT in HVAC systems, growing investments in the residential sector across developing countries, rapid expansion of the air condition systems market, booming HVAC systems market, and increasing consumer awareness about the benefits of ductless systems are some of the major factors driving growth in the global ductless heating & cooling systems market.

Ductless heating and cooling systems have become suitable temperature management solutions used across residential buildings due to their various attractive features. These systems manage temperature, humidity, and fresh air intake in smart homes without consuming too much energy. They provide highly adaptable heating and cooling solutions for zones and enclosed areas.

Recent advancements in ductless heating and cooling technologies have paved the way for the development of smart ductless heating and cooling systems which are perfect for usage in smart homes. These HVAC systems are incorporated with Internet of things which enables access to real-time HVAC system performance data and accurately interprets it.

Rising consumer awareness about the benefits of these smart ductless systems will help HVAC systems manufacturers to increase their sales, thereby creating room for the expansion of ductless systems market and ductless heat pump market size.

Similarly, rising consumer preference for smart homes is projected to boost the sales of ductless heating and cooling systems like Lennox HVAC systems during the forecast period.

Additionally, development of ecofriendly refrigerant with low GWP, emerging trends in ductless heating and cooling systems in commercial and residential buildings, and increase in new energy efficient solutions will further boost the sales of ductless heating and cooling systems in the future.

Although ductless heating and cooling systems are gradually replacing traditional heating and cooling systems, various factors are challenging the market growth.

Some of these factors are the rising environmental concerns due to the massive upsurge in the adoption of ductless heating and cooling systems and a lack of understanding about the benefits of ductless heating and cooling systems across low economies.

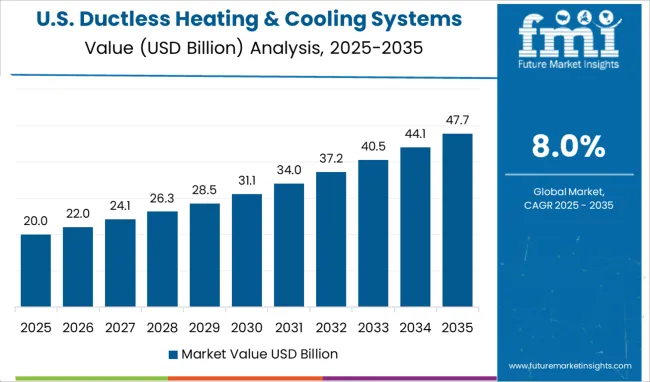

Rising Need for Energy-Efficient and Sustainable Buildings Encouraging Adoption Across the USA.

The USA ductless heating & cooling systems market is forecast to grow at a healthy CAGR over the forecast period, owing to the flourishing HVAC systems market, heavy presence of HVAC systems manufacturers, growing trend of energy-efficient and sustainable buildings, and expansion of ductless heat pumps market size.

Over the last few years, demand for ductless heating and cooling systems has risen at a significant rate due to fluctuations in climatic conditions, changing lifestyles, and rapid growth of the residential sector. According to the USA Energy Information Administration (EIA), space heating and cooling accounts for more than half of all residential energy consumption.

Rapid Urbanization Creating Demand for Ductless Heating and Cooling Systems in China.

As per FMI, the ductless heating and cooling systems market is China is poised to grow at a relatively higher CAGR over the forecast period, owing to the expansion of residential and industrial sectors, surge in the sales of ductless heat pumps, growing consumer awareness about the recent HVAC systems market tends, and flourishing cooling system market.

Similarly, rising investments by government and private companies in building and construction will further create sales prospects for heating and cooling systems across the country during the forecast period.

Demand for Mini-Split Systems to Remain High in the Market

As per FMI, mini-split system segment is likely to grow at a strong pace during the forecast period. This is attributed to the rising adoption of mini-split ductless heating and cooling systems in residential sector on account of their lower capacity and operating cost. It is estimated that ductless mini-split systems use 60% less energy to heat and 30% less energy to cool than standard room air conditioners.

Similarly, increasing investments in residential sector and expansion of the HVAC systems market across emerging economies will further assist the growth of this segment in the future.

Most of the Ductless Heating & Cooling Systems Sales to Remain Concentrated in Residential Sector.

Based on application, the residential building segment accounted for the largest revenue share of the global ductless heating & cooling systems market in 2024 and is forecast to grow at a considerable pace during the forecast period.

Booming residential sector worldwide, expansion of HVAC systems market, and rising adoption of energy ductless heating & cooling systems are some of the factors triggering the segment growth.

People throughout the world are showing a keen inclination towards reducing energy consumption in their homes for a sustainable future. According to the USA Energy Information Administration (EIA), energy consumed in the buildings sector (which includes residential and commercial end users) accounted for around 20.1% of the total delivered energy consumed worldwide. Thus, rising focus on minimizing energy consumption in the residential sector is likely to encourage the adoption of energy efficient ductless heating and cooling systems in the future.

However, with the robust expansion of the district cooling market and rapid industrialization across emerging economies, demand for ductless heating and cooling systems is expected to rise at a significant pace in commercial and industrial building segments during the assessment period.

Key ductless heating & cooling manufactures include Hitachi Ltd, LG Electronics, Mitsubishi Electric Co, Daikin Industries Ltd, Trane Technology, Johnson Controls, Lennox International Inc., Nortex, and Whirlpool Corporation.

These leading players are increasingly focusing on introducing novel products with better features. Besides this, they have adopted various strategies such as mergers, partnerships, acquisitions, strengthening of distribution channels, and price reduction to gain a competitive edge in the market.

For instance,

FMI’s latest analysis examines how drastic change in global temperature is creating space for the growth of ductless heating and cooling systems market. It provides comprehensive details on how market players are innovating to meet the end user demands.

The report is intended to enlighten customers with significant details about market drivers, restraints, prevailing trends, and emerging opportunities. It gives a comprehensive analysis of the overall market dynamics intended to enrich customer experience.

While North America and Europe remain at the epicenter of ductless heating and cooling systems market growth, the report highlights factors that will help Asia Pacific to take over the spotlight during the forecast period.

The study also highlights how growth in radiant heating and cooling systems market is influencing sales prospects of ductless heating & cooling systems. Besides this, impact of flourishing residential and commercial sectors on ductless systems market is being discussed in a detailed manner.

The Ductless Heating & Cooling Systems Market Analysis Includes:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historic Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Report Coverage | Market forecast, company share analysis, competition intelligence, DROT analysis, market dynamics and challenges, and strategic growth initiatives |

| Key Segments Covered | Product Type, Application, Region |

| Key regions covered | North America(USA, Canada, Rest of North America); Latin America(Brazil, Argentina, Mexico, Rest of Latin America); Western Europe(Germany, UK, France, Rest of Western Europe); Eastern Europe(Russia, Spain, Rest of Eastern Europe); South Asia Pacific(China, India, Japan, Malaysia, Thailand, Indonesia, South Korea, Rest of South Asia & Pacific); Middle East & Africa(GCC Countries, Turkey, Israel, Rest of MEA); Rest of the World(Oceania, Africa, South America) |

| Application | Residential Building, Commercial Building, Industrial Building |

| Key companies profiled | Hitachi Ltd; LG Electronics; Mitsubishi Electric Co; Daikin Industries Ltd; Trane Technology; Johnson Controls; Lennox International Inc.; Nortex; and Whirlpool Corporation. |

| Customization & pricing | Available upon request |

The global ductless heating & cooling systems market is estimated to be valued at USD 133.3 billion in 2025.

It is projected to reach USD 287.8 billion by 2035.

The market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types are split system, mini split system, multi split system, vrf system and window air conditioning system.

residential building segment is expected to dominate with a 48.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ductless Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Heating Pad Market

Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

Preheating Tunnel Furnace for Lithium Battery Market Size and Share Forecast Outlook 2025 to 2035

Self Heating Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Self-Heating Butter Knife Market Size and Share Forecast Outlook 2025 to 2035

Radiant Heating And Cooling Systems Market

Infrared Heating Pad Market Size and Share Forecast Outlook 2025 to 2035

District Heating Market Size and Share Forecast Outlook 2025 to 2035

District Heating Pipeline Network Market Size and Share Forecast Outlook 2025 to 2035

Flexible Heating Element Market

District Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

Renewable Heating Fuels Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heating Equipment Market Size and Share Forecast Outlook 2025 to 2035

Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

Residential Heating Equipment Market Size and Share Forecast Outlook 2025 to 2035

Europe Wood Pellet Heating System Market Growth – Trends & Forecast 2024-2034

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA