Global cooling management system market offers opportunities for expansion with the rising demand for efficient thermal management solutions across numerous industries including data centers, telecom, automotive, and consumer electronics.

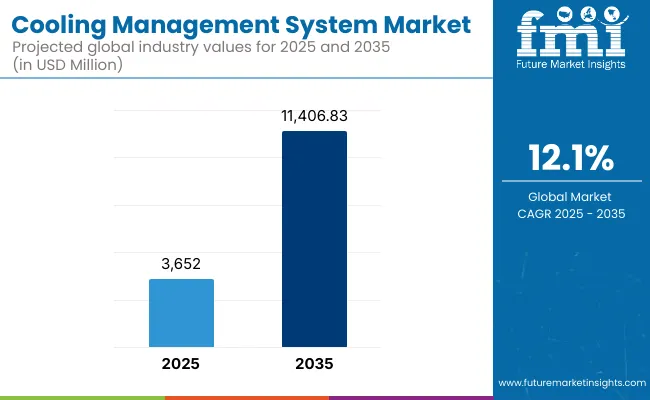

Power consumption grows and size shrinks due to the rising demand for high-performance cooling solutions for thermal dissipation. It is projected to be around USD 3,652 million in the year 2025. It is expected to grow to about USD 11,406.83 million at a compounded average growth rate of 12.1% during the year 2035.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 3,652 million |

| Projected Market Size in 2035 | USD 11,406.83 million |

| CAGR (2025 to 2035) | 12.1% |

The industry is also gaining ground through sheer technological innovation in the art of cooling technology, from liquid, in-row and overhead, to rear door and in-rack cooling infrastructure. IoT- and AI-based smart cooling solutions for real-time monitoring and predictive maintenance are streamlining operations and minimizing operating costs. Also, more emphasis on energy efficiency and sustainability is compelling organizations to adopt environmentally friendly cooling solutions.

North America has a well-established cooling management system market due to favourable locations of world-class data centers, technological innovation, and energy efficiency needs. The United States is a robust driver of the market, with ongoing investment in IT infrastructure and solid growth in high-end adoption.

Europe is also a major market with even greater focus on sustainable operation and energy-efficient solutions. Germany, France, and the United Kingdom are betting on next-generation cooling technologies to enable their growing data center infrastructures to withstand environmental regulation.

Due to mass industrialization, urbanization, and growth of IT and telecommunication sectors, the fastest growing market for cooling management systems is the Asia-Pacific. Japan, India, and China are major drivers, motivated by massive investment in manufacturing campuses and data centers that drive demand for effective cooling systems.

High Initial Investment, Complex Integration, and Maintenance Requirements

The cooling management system market also faces the initial massive capital outlay on cutting-edge cooling systems, incorporation into pre-conceived infrastructure, and regular maintenance to deliver maximum performance. Green solutions for environmental sustainability of cooling systems are also a concern to most companies.

Edge Computing Trend, AI Integration, and Green Solutions

Edge computing technology is driving demand for on premise cooling solutions, thereby providing an opportunity to develop low-profile and efficient cooling solutions. Upon integration with artificial intelligence and machine learning technology, it offers predictive maintenance and energy optimization, thus making the system more efficient. The need to be more sustainable is also creating demand for green and energy-saving cooling technologies, offering new market development opportunities.

Between 2020 and 2024, the cooling management system market posted steady growth on the back of rising usage of data centers and thermal management requirements across various industries. Smart technology and efficient solutions implemented for improved performance were the drivers. The trend was however marred by cost and integration complexity.

In the period 2025 to 2035, the industry will be undergoing revolutionary transformation with widespread application of liquid cooling technologies, predictive maintenance with AI, and the development of green and sustainable cooling solutions. The demand for energy efficiency and the need for cooling more advanced but smaller electronic devices will generate round-the-clock innovation in cooling management systems.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with energy efficiency standards, RoHS directives, and thermal safety regulations. |

| Consumer Trends | Growing demand for efficient thermal management in electronics and data centers. |

| Industry Adoption | Adoption in data centers, consumer electronics, and automotive sectors. |

| Supply Chain and Sourcing | Dependence on traditional materials and components for cooling systems. |

| Market Competition | Dominated by established players offering conventional cooling solutions. |

| Market Growth Drivers | Driven by increasing power densities in electronics and the need for effective heat dissipation. |

| Sustainability and Environmental Impact | Initial steps towards reducing energy consumption and improving cooling efficiency. |

| Integration of Smart Technologies | Limited incorporation of IoT and AI for monitoring and control. |

| Advancements in Equipment Design | Focus on improving efficiency and reducing size of traditional cooling equipment. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Higher take-up of tougher environmental laws that encourage sustainable and eco-friendly cooling technologies. |

| Consumer Trends | Greater demand for efficient, high-performance cooling systems that have lower environmental footprint. |

| Industry Adoption | Venturing into renewable energy, aerospace, and advanced manufacturing sectors. |

| Supply Chain and Sourcing | Transition to next-generation materials that have improved thermal conductivity and local production to compensate for supply chain disruption. |

| Market Competition | Higher rise of start-ups that produce new, sustainable, and AI-driven cooling technologies. |

| Market Growth Drivers | Driven by advancements in electronics production, energy efficiency focus, and convergence of new technologies. |

| Sustainability and Environmental Impact | Mass roll-out of green cooling technologies such as liquid cooling and phase change materials to reduce environmental footprint. |

| Integration of Smart Technologies | Mass roll-out of artificial intelligence-based thermal management systems for real-time monitoring and predictive maintenance. |

| Advancements in Equipment Design | Launch of solid-state and thermoelectric cooling technologies with compact and efficient solutions. |

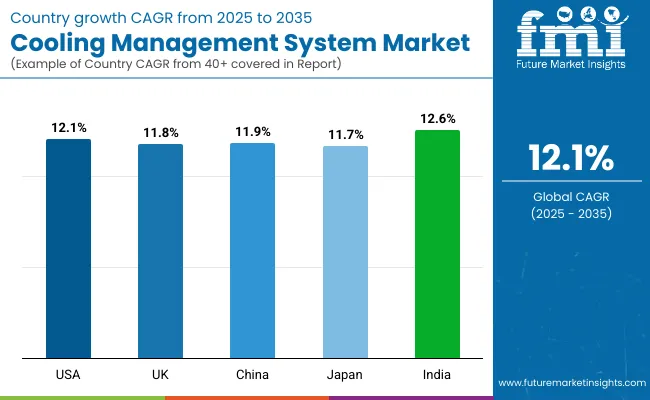

The USA cooling management system market has experienced phenomenal growth driven by the increase in data centers and increased deployment of high-performance computing hardware. Energy efficiency and sustainability are issues that have witnessed advanced cooling systems, such as liquid cooling systems, being incorporated to address heat dissipation. Government policy initiatives towards energy efficiency also encourage the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.1% |

There is growing demand in the United Kingdom for cooling management systems due to more emphasis on energy efficiency and more use of data centers. High-end cooling technology, like immersion and liquid cooling, is being implemented more and more in an attempt to tackle stringent environmental regulations as well as reduce operational expenses.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.8% |

The EU's strict environmental standards and emphasis on energy efficiency have been the greatest drivers for the rise in the cooling management system market. Higher uptake of green cooling technologies is being witnessed by Germany, France, and the Netherlands in industry and data centers. Lower carbon emissions and increased emphasis on sustainability are driving demand for advanced cooling technologies.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 11.9% |

Japan's high-tech electronics business and the explosion of the data center industry have created huge demand for effective cooling management. Focus in the nation on energy-saving and technological innovations has seen the latest cool technologies, i.e., solid-state and thermoelectric coolings, adopted with improved efficiency and performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.7% |

There is also a growing demand for cooling management systems in South Korea as a result of its thriving semiconductor and electronics sectors that are developing at a high rate. High-performance computing, along with expanding data centers, require advanced cooling technology to effectively control temperature levels. Thermal management systems with artificial intelligence are also required to provide more efficient cooling at lower operating costs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.6% |

| By Solution Type | Market Share (2025) |

|---|---|

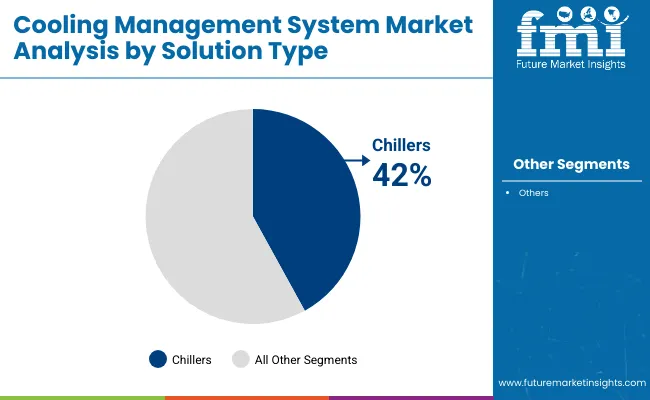

| Chillers | 42% |

Chillers are expected to lead the cooling management system market with 42% of overall demand in 2025. Chillers are a critical component of high-performance data centers and industrial processes where temperature is maintained continuously. Hyperscale data centers of cloud giants in Northern Europe, for example, use chillers with built-in heat recovery units to provide maximum cooling efficiency while lowering environmental footprints.

Chillers come into play in cases where enormous installations do not react to air-cooling. They are effective to sustain small temperature differences and are thus adequate for mission-sensitive systems like health care and banking where minute temperatures can impact running or data quality.

| By End Use Industry | Market Share (2025) |

|---|---|

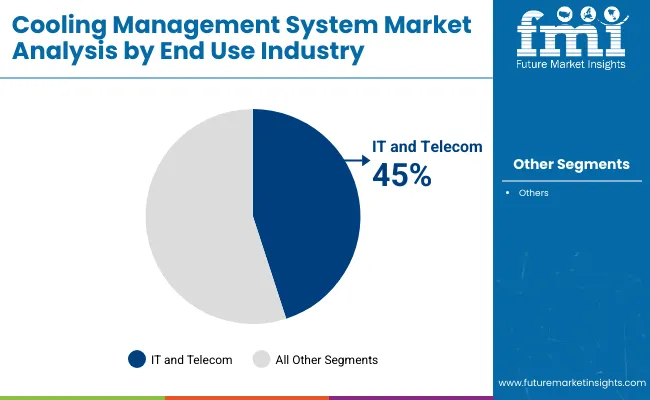

| IT and Telecom | 45% |

The IT and telecommunication industry is expected to take the highest market share of 45% in 2025. It is therefore because of fast growth due to aggressive expansion of data centers, network densification strategies, and 5G networks globally. North American and Asian-Pacific behemoth colocation data centers keep investing more in cooling to provide more heat load capacity from denser servers.

Cooling efficiency translates directly to cost of operation and uptime of the data center. Telecommunication and IT operators hence adopt the latest cooling technology like chillers and in-rack liquid solutions to support green operation under the growing pressure of rising energy prices and green goals.

The cooling management system market is set to witness enormous growth, driven by expanding demand for energy-efficient cooling technologies in sectors such as HVAC, automobile, and data centers. Improvements in smart technologies, IoT integration, and sustainable trends are the primary drivers driving market growth. Leading firms are emphasizing high-end solutions with minimum energy usage and low environmental footprint. Still, high capital costs and system integration challenges are its limitations.

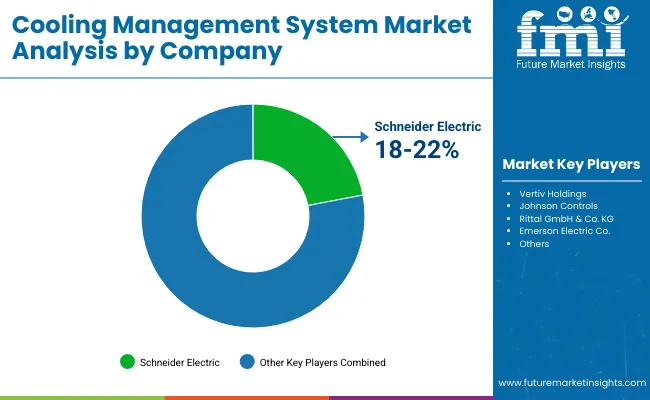

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schneider Electric | 18 - 22% |

| Vertiv Holdings | 15 - 19% |

| Johnson Controls | 12 - 16% |

| Rittal GmbH & Co. KG | 10 - 14% |

| Emerson Electric Co. | 8 - 12% |

| Other Companies (combined) | 20 - 30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schneider Electric | In 2024, announced the acquisition of a stake. The acquisition is designed to boost Schneider's abilities in data center cooling as demand driven by generative AI and large language models soars. |

| Vertiv Holdings | Sales in 2024 also rose, with adjusted profits up almost 50% and beating consensus expectations. Strong order growth and positioning across the cooling management portfolio. |

| Johnson Controls | Specializing in developing IoT-enabled cooling systems for improving energy efficiency and remote monitoring, addressing the evolving requirements of contemporary data centers and industrial infrastructures. |

| Rittal GmbH & Co. KG | Introduced advanced liquid cooling solutions designed for high-density data centers, with a focus on modularity and scalability to address a variety of customer needs. |

| Emerson Electric Co. | Focused on next-generation thermal management technologies designed for improved reliability and reduced operational costs in critical infrastructure environments. |

Key Company Insights

Schneider Electric (18-22%)

Schneider Electric consolidates its market leadership by strategic acquisitions and a full portfolio of cooling solutions, meeting the increasing needs of data centers and high-performance computing environments.

Vertiv Holdings (15-19%)

Vertiv shows solid financial performance and emphasis on innovative cooling technologies, establishing itself as a market leader.

Johnson Controls (12-16%)

Highlighting intelligent, networked cooling systems, Johnson Controls meets the growing demand for energy-saving and remotely accessible solutions in multiple industrial applications.

Rittal GmbH & Co. KG (10-14%)

Rittal's emphasis on scalable and modular cooling solutions well-position it to address the needs of high-density data centers, focusing on flexibility and efficiency.

Emerson Electric Co. (8-12%)

With investments in next-generation thermal management technologies, Emerson hopes to improve system reliability and lower operational expenses, meeting critical infrastructure needs.

Other Key Players (20-30% Combined)

The cooling management system market was valued at approximately USD 3,652 million in 2025.

The market is projected to reach around USD 11,406.83 million by 2035.

Key drivers include the increasing demand for data centers driven by cloud computing, big data, and AI, as well as the shift to electric vehicles (EVs) requiring efficient thermal management systems.

Specific country contributions are not detailed in the available sources.

The Chillers segment is expected to dominate the market, driven by the growing need for efficient cooling solutions in data centers.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Pump Market Size and Share Forecast Outlook 2025 to 2035

Cooling Essences Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Cooling Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Rental Market Size, Growth, and Forecast 2025 to 2035

Cooling Fans Market Growth - Trends & Forecast 2025 to 2035

Cooling Water Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Self Cooling Packaging Market Size and Share Forecast Outlook 2025 to 2035

Green Cooling Technologies Market

Vacuum Cooling Equipment Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Combined Cooling Heat and Power Plant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

District Cooling Market - Growth & Demand 2025 to 2035

Seawater Cooling Pumps Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA