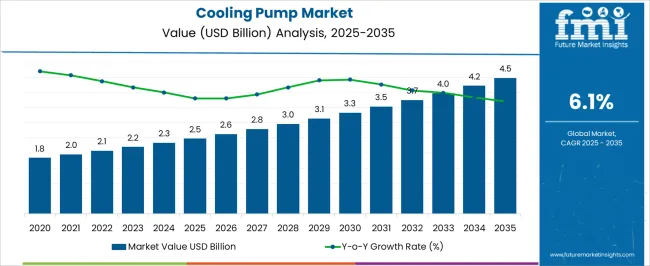

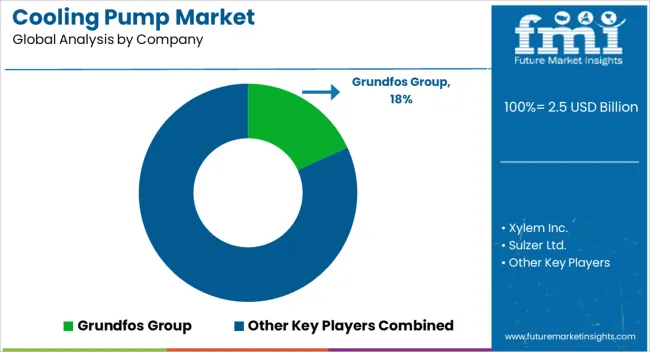

The cooling pump market, estimated at USD 2.5 billion in 2025 and projected to reach USD 4.5 billion by 2035 with a CAGR of 6.1%, reflects significant technology-driven contributions across its product portfolio. Centrifugal pumps are expected to maintain a dominant share, primarily due to their efficiency in large-scale industrial and HVAC applications, where high flow rates and consistent performance are critical.

The incremental annual value growth from USD 2.5 billion to USD 4.5 billion indicates that centrifugal technology adoption will continue to be a major driver of market expansion, supported by design optimizations that reduce energy consumption and improve operational lifespan. Positive displacement pumps, including gear, screw, and diaphragm variants, contribute meaningfully, particularly in applications requiring precise flow control and higher pressure tolerance, such as chemical processing and advanced cooling circuits.

Their share, while smaller than centrifugal units, is growing steadily as end-users increasingly prioritize accuracy, reliability, and reduced maintenance costs. Emerging technologies such as magnetic drive pumps and electronically controlled variable-speed pumps are gradually capturing market attention, reflecting a shift toward energy efficiency and integration with smart systems. The CAGR trajectory indicates that technology contributions are not uniform; centrifugal pumps continue to dominate in terms of absolute value, whereas innovative and precision technologies drive adoption in specialized segments. The technological differentiation defines competitive positioning, and the market’s growth is underpinned by ongoing improvements in pump efficiency, digital control integration, and application-specific customization, ensuring that each technology’s contribution evolves in alignment with industrial and commercial demand.

| Metric | Value |

|---|---|

| Cooling Pump Market Estimated Value in (2025 E) | USD 2.5 billion |

| Cooling Pump Market Forecast Value in (2035 F) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The cooling pump market represents a specialized segment within the global fluid handling and thermal management industry, emphasizing efficient heat transfer, energy optimization, and system reliability. Within the broader pump market, it accounts for about 5.1%, driven by demand in HVAC systems, power generation, industrial processes, and electronics cooling. In the building and industrial cooling equipment sector, it holds nearly 5.6%, reflecting adoption for water circulation, chiller systems, and temperature control applications.

Across the automotive and electric vehicle thermal management segment, the market captures 4.4%, supporting engine cooling, battery temperature regulation, and climate control. Within the renewable energy and power generation category, it represents 4.0%, highlighting use in solar thermal, nuclear, and combined cycle plants. In the industrial process cooling and automation sector, it secures 3.8%, emphasizing operational efficiency, reliability, and reduced energy consumption. Recent developments in this market have focused on energy efficiency, smart control, and corrosion-resistant materials. Innovations include variable speed and digitally controlled pumps, advanced impeller designs, and high-performance materials to withstand harsh environments. Key players are collaborating with HVAC manufacturers, power plant operators, and industrial system integrators to optimize performance, reduce maintenance, and enhance system longevity. Integration with IoT-enabled monitoring systems, predictive maintenance tools, and energy management software is gaining traction to maximize operational efficiency.

Additionally, environmentally friendly refrigerants, low noise designs, and compact configurations are being deployed for residential, commercial, and industrial applications. These trends demonstrate how innovation, sustainability, and operational reliability are shaping the cooling pump market.

The cooling pump market is experiencing steady expansion, fueled by rising demand for efficient thermal management solutions in industrial processes, power generation, and HVAC applications. Industry reports and manufacturer updates have emphasized the role of advanced cooling pumps in improving energy efficiency, reducing operational downtime, and extending equipment lifespan.

Increasing investment in manufacturing facilities, data centers, and renewable energy infrastructure has further boosted the need for reliable cooling systems. Technological innovations, including variable speed drives and improved impeller designs, have enhanced pump performance while lowering maintenance requirements.

Additionally, the adoption of cooling pumps in emerging markets is accelerating due to rapid industrialization and stricter environmental standards that prioritize efficient heat dissipation. Over the forecast period, market momentum is expected to be shaped by sustained demand for centrifugal pump designs, single-stage configurations, and mid-pressure ranges, as these options deliver a balance of performance, cost-effectiveness, and operational versatility across multiple industries.

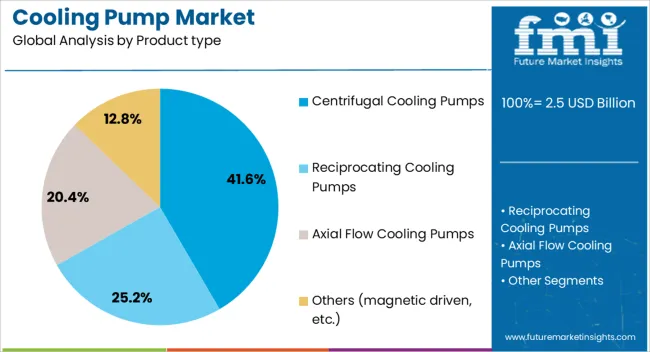

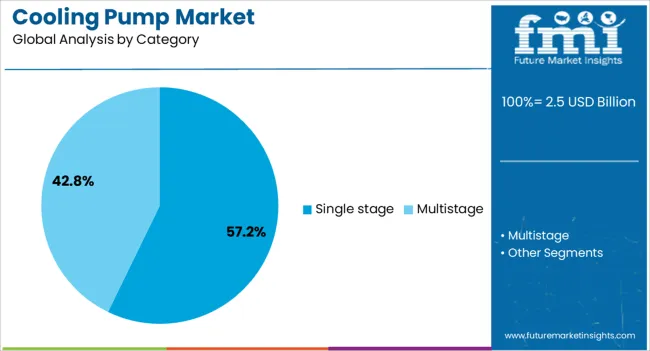

The cooling pump market is segmented by product type, category, pressure, power, end-use, distribution channel, and geographic regions. By product type, cooling pump market is divided into Centrifugal Cooling Pumps, Reciprocating Cooling Pumps, Axial Flow Cooling Pumps, and Others (magnetic driven, etc.). In terms of category, cooling pump market is classified into Single stage and Multistage.

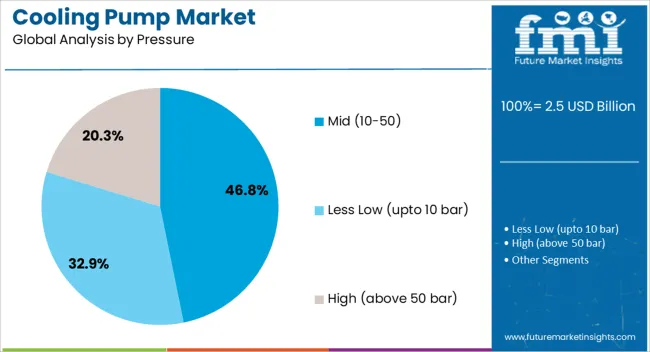

Based on pressure, cooling pump market is segmented into Mid (10-50), Less Low (upto 10 bar), and High (above 50 bar). By power, cooling pump market is segmented into Mid (2-4 HP), Low (less than 2 HP), and High (above 4 HP). By end-use, cooling pump market is segmented into Oil and Gas industry, Steel Industry, Chemical industry, Power industry, and Others (Pulp and paper, Automotive). By distribution channel, cooling pump market is segmented into Direct and Indirect. Regionally, the cooling pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The centrifugal cooling pumps segment is projected to account for 41.6% of the cooling pump market revenue in 2025, maintaining its lead due to its widespread application versatility and cost efficiency. This segment’s growth has been supported by the ability of centrifugal designs to handle large flow rates with relatively low maintenance requirements.

Engineering publications have noted that these pumps are particularly well-suited for continuous operation in industrial cooling circuits, where reliability and consistent performance are critical. Their straightforward design allows for easier integration into existing systems, while advancements in materials and impeller technology have improved efficiency and extended service life.

Additionally, centrifugal pumps have gained preference in sectors such as manufacturing, energy, and water treatment due to their adaptability to different cooling fluids and operating conditions.

The single stage segment is expected to contribute 57.2% of the cooling pump market revenue in 2025, holding its dominance through its simplicity, efficiency, and cost advantages. Single-stage cooling pumps have been favored for applications requiring moderate head and high flow rates, offering a reliable solution with minimal mechanical complexity.

Industry evaluations have highlighted that reduced moving parts in single-stage designs result in lower maintenance costs and downtime. Their compact footprint and ease of installation have made them attractive for both retrofit and new system projects.

Additionally, single-stage pumps often demonstrate higher operational efficiency at their optimal duty point compared to multi-stage alternatives, making them well-suited for industries prioritizing energy savings. As industrial operators seek to balance performance with operating costs, the single stage category is likely to remain the most utilized configuration in the cooling pump market.

The mid-pressure (10–50) segment is projected to account for 46.8% of the cooling pump market revenue in 2025, leading the pressure classification due to its suitability for a wide range of industrial and commercial cooling applications. This pressure range has been recognized for delivering sufficient flow and head to meet cooling requirements in sectors such as manufacturing, chemical processing, and HVAC systems, without the energy intensity of high-pressure systems.

Technical assessments have indicated that mid-pressure pumps offer an optimal balance between performance and energy consumption, reducing operational costs over time.

Furthermore, advancements in pump sealing technologies and wear-resistant materials have enhanced reliability under mid-pressure conditions, extending operational lifespan. With industries increasingly focusing on optimizing cooling efficiency and minimizing energy usage, mid-pressure cooling pumps are expected to retain their strong market presence.

The market has experienced significant growth as industrial, commercial, and residential sectors increasingly rely on efficient thermal management systems. Cooling pumps are essential components in HVAC systems, power plants, manufacturing processes, and automotive applications, circulating fluids to dissipate heat and maintain optimal operating conditions. Rising adoption of energy-efficient systems, technological advancements in pump design, and demand for reduced operational costs have driven market expansion. Materials innovation, variable-speed drives, and corrosion-resistant coatings improve pump durability and performance.

Industrial and power generation sectors have been primary drivers of the cooling pump market due to their critical need for temperature regulation. Power plants, refineries, and manufacturing facilities rely on cooling pumps to maintain safe operating temperatures, prevent equipment overheating, and optimize process efficiency. Large-scale circulation systems, coupled with advanced pump designs, ensure continuous and reliable cooling. The integration of energy-efficient motors and variable frequency drives enhances operational flexibility while reducing energy consumption. Industrial cooling pump installations also support thermal management in chemical processing, metallurgy, and pulp and paper operations. Growth in industrial activity, expansion of power generation capacity, and stringent operational safety standards continue to sustain demand for reliable and high-performance cooling pumps.

The HVAC sector has contributed substantially to cooling pump adoption, particularly in commercial buildings, hospitals, data centers, and educational institutions. Cooling pumps are utilized in chilled water systems, air handling units, and district cooling networks to circulate fluids and maintain thermal comfort. Energy efficiency, noise reduction, and compatibility with modern building management systems have become key factors in pump selection. The increasing trend toward green building certifications and energy-saving regulations drives the installation of high-efficiency pumps. Smart pumps equipped with sensors, automated controls, and predictive maintenance capabilities improve performance and reduce downtime. Rising urbanization, construction activity, and modernization of commercial infrastructure continue to fuel cooling pump demand in built environments.

Technological innovations have improved the efficiency, durability, and versatility of cooling pumps. Variable-speed drives, magnetic coupling, and advanced impeller designs reduce energy consumption while maintaining consistent fluid flow. Corrosion-resistant materials, ceramic coatings, and high-quality seals extend pump life in aggressive or high-temperature environments. Integration with digital monitoring, IoT-enabled sensors, and predictive maintenance systems allows real-time performance tracking, fault detection, and operational optimization. Modular pump designs facilitate easier installation, maintenance, and scalability in industrial and commercial applications. These innovations enhance reliability, reduce operating costs, and support sustainability goals. Continuous R&D ensures that cooling pumps remain competitive in an increasingly energy-conscious and technologically sophisticated market.

Despite growth, the market faces operational and maintenance challenges that can affect efficiency and longevity. Pumps operating under high temperatures, corrosive fluids, or fluctuating pressure conditions require regular inspection, lubrication, and component replacement to prevent downtime. Inadequate maintenance can lead to reduced flow rates, cavitation, or system failure, affecting industrial processes and building climate control. Initial investment costs for high-efficiency or digitally enabled pumps can be high, limiting adoption in smaller operations. Supply chain disruptions for specialized components and energy price fluctuations can further impact operational expenses. Manufacturers and service providers focus on preventive maintenance programs, robust design improvements, and training to overcome these challenges and ensure reliable pump performance across various applications.

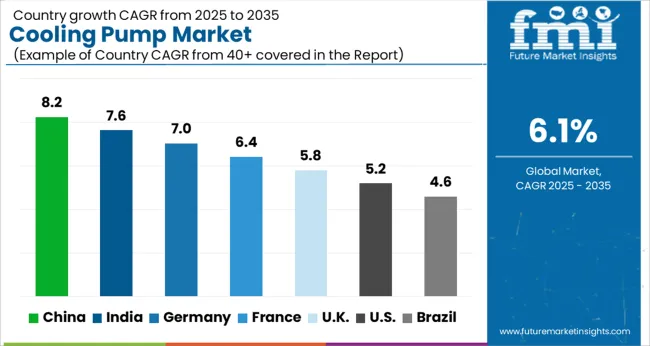

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The market is seeing consistent development across key regions. Germany expands at 7.0%, fueled by rising demand in industrial and HVAC systems. India grows at 7.6%, supported by increasing adoption in manufacturing and infrastructure projects. China leads with 8.2% growth, driven by large-scale deployment in industrial processes and power plants. The United Kingdom records 5.8% growth, aided by research in energy-efficient pump technologies. The United States grows at 5.2%, sustained by modernization in commercial and industrial cooling systems. Together, these countries depict a diverse landscape of manufacturing, technological innovation, and deployment influencing global market trends. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 8.2%, driven by increasing industrialization, power generation expansion, and rising HVAC infrastructure. Demand from manufacturing units, power plants, and commercial buildings encourages adoption of advanced cooling pump systems. Technological advancements, including energy-efficient designs, smart monitoring, and automated operation, enhance performance and reduce operational costs. Strategic partnerships between pump manufacturers and industrial solution providers strengthen supply chains and distribution networks. Government initiatives promoting energy efficiency and modernization of industrial infrastructure further support market expansion. China’s robust industrial sector and continuous investment in large-scale projects reinforce its position as a leading adopter of advanced cooling pump technologies.

India is anticipated to grow at a CAGR of 7.6% due to increasing industrial production, urban commercial infrastructure, and growth in power and manufacturing sectors. Adoption of energy-efficient and automated cooling solutions enhances operational efficiency. Collaboration between pump manufacturers and industrial technology providers strengthens distribution and service networks. Investments in modernization and industrial upgrades, coupled with government incentives for energy-saving equipment, boost market potential. Rising demand from power plants, HVAC systems, and manufacturing facilities fuels the need for advanced cooling pumps. India’s expanding industrial ecosystem and focus on sustainable and reliable industrial operations position the market for consistent growth.

Germany is expected to grow at a CAGR of 7.0%, propelled by industrial automation, renewable energy projects, and advanced HVAC systems. Technological developments in high-efficiency pumps, smart monitoring, and automated control improve performance and reliability. Industrial and commercial sectors increasingly rely on sophisticated cooling solutions to optimize energy consumption and maintain production efficiency. Collaboration between manufacturers, technology providers, and research institutions facilitates innovation adoption. Environmental regulations and energy efficiency mandates encourage the replacement of legacy systems with modern cooling pump solutions. Germany’s focus on sustainable manufacturing, green building standards, and renewable energy infrastructure drives consistent demand for advanced cooling pumps.

The market in the United Kingdom is projected to grow at a CAGR of 5.8%, driven by industrial modernization, renewable energy adoption, and commercial construction projects. Energy-efficient and automated pump solutions improve operational reliability and reduce maintenance costs. Growing focus on environmental sustainability, compliance with energy regulations, and adoption of advanced industrial equipment supports market expansion. Strategic collaborations between manufacturers and technology providers strengthen service and distribution networks. Rising demand from power plants, HVAC applications, and manufacturing industries creates opportunities for innovative cooling pump designs. The UK’s commitment to energy-efficient infrastructure and technological adoption ensures steady market growth.

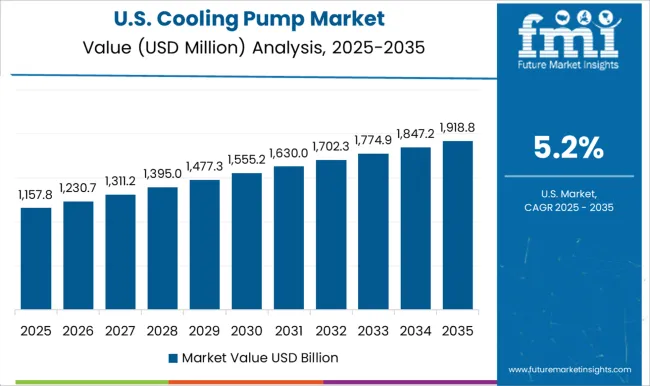

The United States is expected to grow at a CAGR of 5.2%, supported by increasing industrial activities, commercial HVAC installations, and power generation projects. Adoption of advanced, energy-efficient, and automated cooling pumps improves system reliability and lowers operational costs. Technological innovations in smart monitoring, predictive maintenance, and energy optimization enhance performance. Collaboration between manufacturers, technology partners, and service providers strengthens market competitiveness. Regulatory emphasis on energy efficiency and sustainable industrial operations drives the replacement of legacy systems with modern solutions. The US market benefits from strong industrial demand and investment in infrastructure modernization, positioning cooling pump manufacturers for steady growth.

The market has witnessed steady growth, driven by increasing demand across HVAC, power generation, industrial, and commercial sectors. Grundfos Group remains a global leader, offering energy-efficient centrifugal and inline cooling pumps designed for industrial, commercial, and residential applications. Xylem Inc. focuses on innovative pumping solutions with integrated smart controls, addressing water management and energy optimization challenges across industrial and municipal systems.

Sulzer Ltd. provides heavy-duty and specialized cooling pumps for industrial processes, power plants, and large-scale HVAC systems, emphasizing durability, reliability, and maintenance efficiency. Other regional and niche players contribute to the market by delivering tailored solutions, including compact and modular pump systems, catering to specific industrial or commercial requirements. These companies enhance operational efficiency, reduce energy consumption, and provide sustainable solutions for fluid handling. Technological advancements, such as variable speed drives, IoT-enabled monitoring, and corrosion-resistant materials, continue to shape market trends, meeting the growing need for high-performance, low-maintenance cooling pump solutions across diverse applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Product type | Centrifugal Cooling Pumps, Reciprocating Cooling Pumps, Axial Flow Cooling Pumps, and Others (magnetic driven, etc.) |

| Category | Single stage and Multistage |

| Pressure | Mid (10-50), Less Low (upto 10 bar), and High (above 50 bar) |

| Power | Mid (2-4 HP), Low (less than 2 HP), and High (above 4 HP) |

| End-Use | Oil and Gas industry, Steel Industry, Chemical industry, Power industry, and Others (Pulp and paper, Automotive) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Grundfos Group, Xylem Inc., and Sulzer Ltd. |

| Additional Attributes | Dollar sales by pump type and application, demand dynamics across HVAC, industrial, and automotive sectors, regional trends in cooling system adoption, innovation in energy efficiency, corrosion resistance, and smart monitoring, environmental impact of energy consumption and material disposal, and emerging use cases in data centers, renewable energy systems, and high-performance industrial processes. |

The global cooling pump market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the cooling pump market is projected to reach USD 4.5 billion by 2035.

The cooling pump market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in cooling pump market are centrifugal cooling pumps, reciprocating cooling pumps, axial flow cooling pumps and others (magnetic driven, etc.).

In terms of category, single stage segment to command 57.2% share in the cooling pump market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seawater Cooling Pumps Market

Automotive Electric Water Pump for Engine Cooling Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Essences Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Cooling Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Rental Market Size, Growth, and Forecast 2025 to 2035

Cooling Management System Market - Growth & Demand 2025 to 2035

Cooling Fans Market Growth - Trends & Forecast 2025 to 2035

Cooling Water Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Self Cooling Packaging Market Size and Share Forecast Outlook 2025 to 2035

Green Cooling Technologies Market

Vacuum Cooling Equipment Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Combined Cooling Heat and Power Plant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA