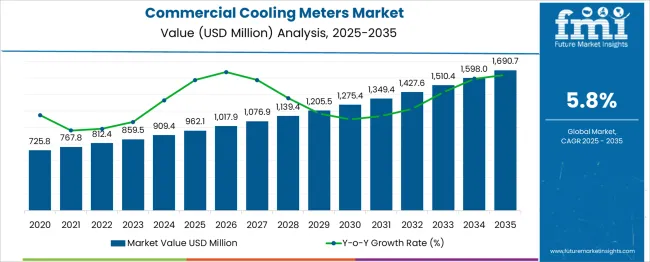

The commercial cooling meters market is forecasted to grow steadily from USD 725.8 million in 2020 to USD 1,690.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.8%. This growth reflects increasing demand for precise measurement and monitoring of cooling energy consumption in commercial buildings, driven by energy efficiency regulations and cost-saving initiatives. The absolute dollar opportunity, representing the incremental market value over the 15-year period, amounts to USD 964.9 million. This significant increase highlights strong potential for manufacturers and service providers to capitalize on the growing need for advanced cooling management solutions. Between 2020 and 2025, the market grows from USD 725.8 million to USD 962.1 million, marking a foundational phase driven by regulatory compliance and growing awareness about energy consumption. The period from 2025 to 2035 offers even larger growth potential, with the market expanding by USD 728.6 million to reach USD 1,690.7 million. This surge is supported by expanding commercial infrastructure, adoption of smart metering technologies, and ongoing efforts to reduce carbon footprints. Overall, the commercial cooling meters market presents a promising opportunity for long-term growth and innovation.

| Metric | Value |

|---|---|

| Commercial Cooling Meters Market Estimated Value in (2025 E) | USD 962.1 million |

| Commercial Cooling Meters Market Forecast Value in (2035 F) | USD 1690.7 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The commercial cooling meters market is witnessing robust expansion driven by heightened focus on energy management and sustainability goals in commercial infrastructure. Growing regulatory pressures for efficient energy usage and cost control have accelerated the adoption of precise metering solutions that enable real-time monitoring of cooling consumption. Technological advancements in metering devices, including integration with IoT platforms and smart building management systems, have improved operational efficiency and data accuracy.

The transition towards greener building codes and corporate environmental responsibility initiatives has further reinforced demand in commercial sectors. Additionally, rising construction activities in emerging markets and retrofit projects in mature markets are expanding the customer base.

The ongoing emphasis on reducing carbon footprints and optimizing HVAC systems is expected to fuel continued uptake of cooling meters capable of delivering granular consumption insights. Over the forecast period, increased investments in smart city projects and digital infrastructure upgrades will support sustained growth in the commercial cooling meters market globally.

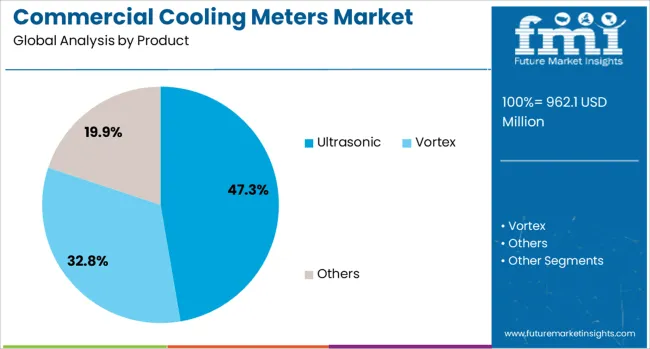

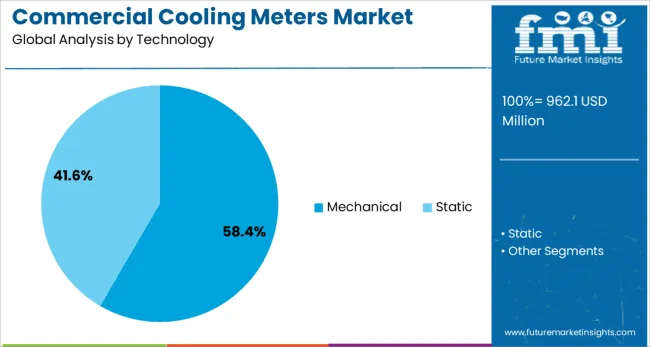

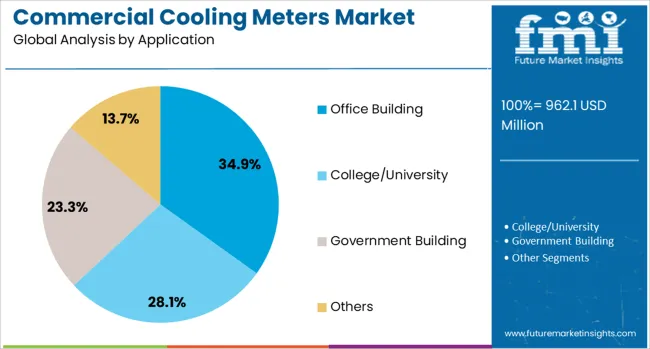

The commercial cooling meters market is segmented by product, technology application, and geographic regions. By product, the commercial cooling meters market is divided into Ultrasonic, Vortex, and Others. In terms of technology, the commercial cooling meters market is classified into Mechanical and Static. Based on application, the commercial cooling meters market is segmented into Office Building, College/University, Government Building, and Others. Regionally, the commercial cooling meters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ultrasonic product segment is anticipated to hold 47.3% of the commercial cooling meters market revenue share in 2025, establishing it as a leading product category. This prominence is driven by the segment’s advantages in accuracy, low maintenance, and non-intrusive measurement capabilities.

Ultrasonic meters provide reliable performance without moving parts, reducing wear and increasing lifespan in demanding commercial environments. The enhanced precision in flow measurement and compatibility with digital communication protocols have enabled integration into modern building management systems.

Moreover, ultrasonic meters facilitate real-time data transmission and remote diagnostics, which align with the growing trend toward smart and connected infrastructure. These factors have contributed to the segment’s wide adoption in office buildings, commercial complexes, and institutional facilities where accurate cooling load monitoring is critical for operational efficiency.

The mechanical technology segment is projected to account for 58.4% of the market revenue share in 2025, reflecting its continued relevance in commercial cooling meter deployments. Mechanical meters are favored for their robustness, proven reliability, and cost-effectiveness in a variety of commercial applications.

Despite the emergence of electronic alternatives, mechanical meters maintain a strong presence due to their simplicity and ease of installation in legacy systems. Their ability to perform reliably in harsh operating conditions has supported sustained demand in markets where budget constraints and long-term serviceability are prioritized.

Furthermore, mechanical meters are frequently used in hybrid metering solutions where integration with software-defined systems enhances overall measurement accuracy. The segment’s enduring adoption is supported by established supply chains, technician familiarity, and compatibility with existing infrastructure in many commercial buildings.

The office building application segment is expected to contribute 34.9% of the commercial cooling meters market revenue share in 2025, positioning it as the largest end-use segment. The segment’s growth is influenced by increasing investments in energy management and sustainability initiatives within commercial office spaces.

Office buildings require precise monitoring of cooling energy consumption to optimize HVAC system performance and reduce operational costs. The rising trend of green certifications such as LEED and WELL has intensified the demand for advanced metering solutions that enable granular energy data collection and analysis.

Additionally, the adoption of smart building technologies and IoT connectivity in office environments has facilitated the deployment of sophisticated cooling meters that support remote monitoring and automated control. These factors have collectively contributed to the office building segment’s dominance in the market, driven by the need for energy-efficient and cost-effective climate control solutions.

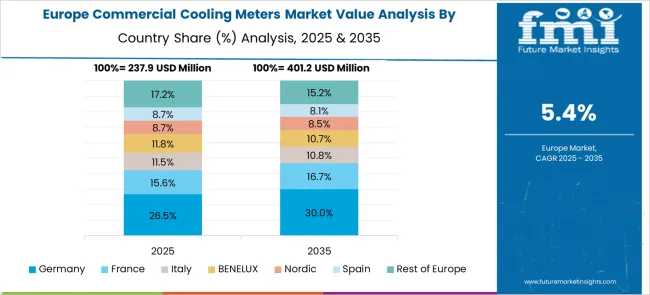

The commercial cooling meters market is expanding as businesses and property managers prioritize accurate measurement of cooling energy consumption to enhance energy efficiency and reduce costs. Cooling meters track chilled water or refrigerant flow and temperature, providing data to optimize HVAC system performance and billing in commercial buildings such as offices, hospitals, hotels, and malls. Demand grows alongside increasing adoption of centralized cooling systems and smart building technologies. North America and Europe lead due to stringent energy regulations and advanced infrastructure, while Asia-Pacific shows rapid growth driven by urbanization and commercial real estate development.

Commercial cooling meters utilize diverse technologies, including ultrasonic, electromagnetic, and mechanical flow measurement methods. Ultrasonic meters are favored for their non-intrusive design, high accuracy, and low maintenance, suitable for large commercial HVAC systems. Electromagnetic meters offer reliable measurements for conductive fluids like chilled water, while mechanical meters remain in use for cost-sensitive applications. Temperature sensors vary from simple thermistors to advanced RTDs, affecting measurement precision. The choice of meter depends on system size, fluid properties, installation constraints, and required accuracy. Manufacturers offering customizable, scalable solutions tailored to specific building requirements gain competitive advantage. Integration compatibility with building management systems further influences selection decisions.

With rising energy costs and environmental regulations, commercial entities seek precise cooling energy measurement to identify inefficiencies, optimize system operation, and enable fair cost allocation among tenants or departments. Cooling meters support energy audits and benchmarking efforts, facilitating compliance with green building standards such as LEED and BREEAM. Real-time data helps facility managers detect leaks, imbalances, and equipment faults promptly. The growing integration of cooling meters with IoT platforms and cloud-based analytics enables remote monitoring, predictive maintenance, and data-driven decision-making, promoting operational savings and sustainability goals.

Compliance with regional metering standards and accuracy requirements influences product design and certification. Different countries impose regulations on meter calibration, testing protocols, and reporting formats to ensure billing transparency and consumer protection. Installation in existing buildings can be complex due to limited space, varying pipe diameters, and system retrofits, impacting meter placement and accessibility. Proper installation and periodic maintenance are essential to avoid measurement errors caused by flow disturbances, temperature fluctuations, or sensor degradation. Vendors providing technical support, installation services, and user training help overcome these challenges, ensuring reliable long-term operation and customer satisfaction.

The rise of smart buildings and digital infrastructure is fueling demand for commercial cooling meters equipped with advanced communication protocols and data analytics capabilities. Modern cooling meters feature connectivity options such as Modbus, BACnet, and wireless IoT technologies, enabling seamless integration with building management systems (BMS) and energy management platforms. This integration allows real-time monitoring of cooling consumption, automated reporting, and enhanced system optimization. Digitalization supports predictive maintenance by analyzing trends and identifying potential faults before failures occur, reducing downtime and repair costs. As sustainability goals become integral to commercial property management, data-driven insights from cooling meters help optimize HVAC system performance and reduce carbon footprints. Vendors investing in smart, interoperable cooling meters with user-friendly software interfaces are positioned to capture growing market share amid increasing demand for connected and efficient commercial infrastructure solutions.

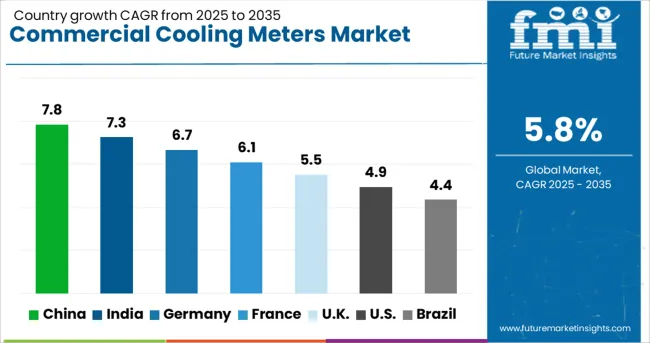

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global commercial cooling meters market is growing at a 5.8% CAGR, driven by increasing demand for efficient energy measurement in commercial refrigeration and HVAC systems. Among BRICS nations, China leads with 7.8% growth, supported by manufacturing capacity and expanding commercial infrastructure. India follows at 7.3%, fueled by growing retail and hospitality sectors. In the OECD region, Germany records 6.7% growth, reflecting stringent energy monitoring regulations. The United Kingdom grows at 5.5%, driven by increasing adoption of smart metering technologies. The United States, a mature market, shows 4.9% growth, shaped by established standards and modernization efforts. These countries collectively influence market dynamics through production scale, regulatory frameworks, and energy efficiency demands. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the commercial cooling meters market with a 7.8% growth rate, driven by rapid expansion in commercial real estate and increased demand for efficient energy management. Compared to India, China benefits from government initiatives promoting energy monitoring and cost reduction in large buildings. Manufacturers focus on developing smart and accurate cooling meters to support energy audits and optimize cooling systems. The growing number of industrial complexes and office spaces further fuels demand for commercial cooling meters. Integration with building management systems is becoming a key trend in the Chinese market.

commercial cooling meters market in India grows at 7.3%, supported by rising urban commercial infrastructure and increased focus on energy efficiency. Compared to Germany, India faces challenges in infrastructure quality but is rapidly adopting cooling meters for better energy consumption tracking. Government policies encouraging energy audits and incentives for energy-efficient equipment help drive market penetration. Manufacturers tailor products to suit local conditions and offer cost-effective solutions. Growth is further supported by the increasing number of malls, offices, and industrial parks.

Germany’s commercial cooling meters market expands at 6.7%, backed by stringent regulations on energy efficiency and emissions. Compared to the UK, Germany emphasizes precision metering for commercial buildings to comply with energy-saving mandates. Adoption of smart cooling meters integrated with digital systems is rising to optimize consumption and reduce operational costs. Established manufacturing base and technological expertise support product innovation. Demand is steady from commercial offices, shopping centers, and industrial facilities aiming for sustainability.

The United Kingdom commercial cooling meters market grows at 5.5%, driven by commercial building owners seeking to optimize energy costs. Compared to the USA, the UK places greater emphasis on regulatory compliance and sustainability reporting, encouraging widespread meter installation. Market growth is supported by advancements in wireless and IoT-enabled cooling meters. The rising adoption of green building certifications and energy management systems further boosts demand. Service providers offer installation and maintenance packages alongside meters.

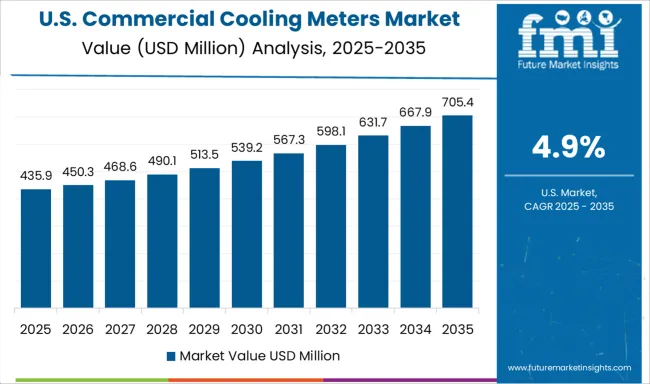

The United States commercial cooling meters market grows at 4.9%, driven by efficiency improvement goals in commercial real estate and industrial sectors. Compared to China, growth is slower but steady due to mature infrastructure and diversified energy sources. There is growing interest in advanced meters capable of remote monitoring and integration with energy management software. Manufacturers offer scalable solutions for different building sizes and usage patterns. Increasing awareness of operational cost savings sustains demand in office buildings, warehouses, and retail spaces.

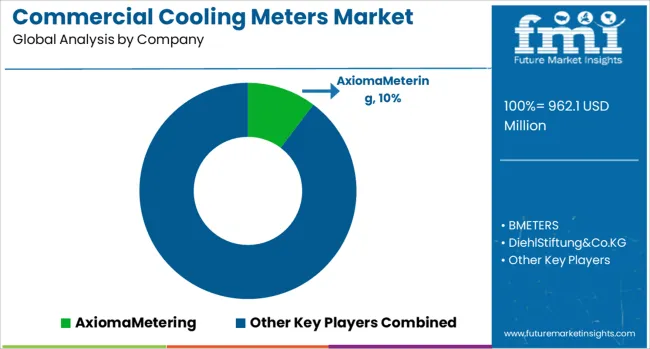

The commercial cooling meters market is led by companies specializing in precise energy measurement solutions that optimize cooling system efficiency and support sustainability goals in large commercial buildings. Axioma Metering and BMETERS offer technologically advanced meters with real-time data analytics, enabling facility managers to monitor and control cooling consumption effectively. Diehl Stiftung & Co. KG and Danfoss focus on robust, highly accurate cooling meters that cater to diverse HVAC applications, emphasizing reliability and compliance with international standards. Honeywell International Inc. and Schneider Electric bring extensive expertise in building automation and energy management systems, integrating cooling meters with smart controls to enhance operational efficiency and reduce energy waste.

Itron and Kamstrup are recognized for their innovation in wireless communication and IoT-enabled cooling meters, facilitating seamless data collection and remote monitoring. Companies like ista Energy Solutions Limited, Integra, Landis+Gyr, Sontex, and Siemens complement the market with scalable solutions designed for commercial complexes and district cooling networks. The competitive landscape prioritizes advancements in meter accuracy, connectivity, and interoperability, supporting the increasing demand for intelligent energy management systems to improve sustainability and cost savings in commercial cooling infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 962.1 Million |

| Product | Ultrasonic, Vortex, and Others |

| Technology | Mechanical and Static |

| Application | Office Building, College/University, Government Building, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Axioma Metering, BMETERS, Diehl Stiftung & Co. KG, Danfoss, Honeywell International Inc. istaEnergySolutionsLimited, Itron, Integra, Kamstrup, Landis+Gyr, Sontex, SchneiderElectric, and Siemens |

| Additional Attributes | Dollar sales in the Commercial Cooling Meters Market vary by type (electromagnetic, ultrasonic, thermal), application (HVAC systems, refrigeration, industrial cooling), end user (commercial buildings, manufacturing, data centers), and region (North America, Europe, Asia-Pacific). Growth is driven by energy efficiency regulations, demand for precise cooling measurement, and expanding commercial infrastructure. |

The global commercial cooling meters market is estimated to be valued at USD 962.1 million in 2025.

The market size for the commercial cooling meters market is projected to reach USD 1,690.7 million by 2035.

The commercial cooling meters market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in commercial cooling meters market are ultrasonic, vortex and others.

In terms of technology, mechanical segment to command 58.4% share in the commercial cooling meters market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.