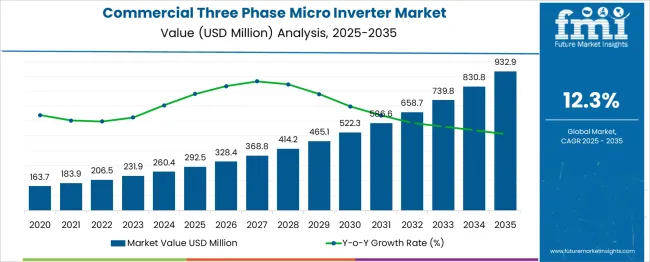

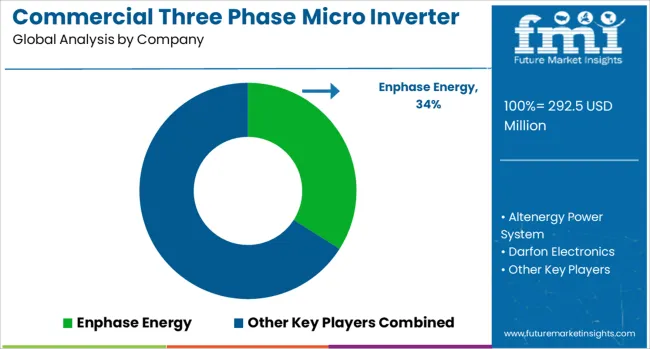

The Commercial Three Phase Micro Inverter Market is estimated to be valued at USD 292.5 million in 2025 and is projected to reach USD 932.9 million by 2035, registering a compound annual growth rate (CAGR) of 12.3% over the forecast period. Between 2025 and 2030, the market expands by approximately 78.5%, reaching USD 522.3 million. Annual values show steady growth: USD 328.4 million in 2026, USD 368.8 million in 2027, USD 414.2 million in 2028, and USD 465.1 million in 2029. This period of strong expansion favors vendors offering high-efficiency solutions, simplified installation, and grid-compliant operation.

Companies with scalable inverter systems, remote diagnostics, and robust after-sales support are positioned to gain market share as demand from commercial solar projects increases. Market share erosion may occur for providers lacking in performance, software compatibility, or regional service capabilities. Procurement decisions in the commercial segment are often driven by lifecycle cost and technical reliability, which puts pressure on vendors with limited differentiation or slow product development cycles. From 2025 to 2030, competitive advantage will belong to firms offering optimized cost-performance ratios, support for complex installations, and full compliance with evolving grid standards across key markets.

| Metric | Value |

|---|---|

| Commercial Three Phase Micro Inverter Market Estimated Value in (2025 E) | USD 292.5 million |

| Commercial Three Phase Micro Inverter Market Forecast Value in (2035 F) | USD 932.9 million |

| Forecast CAGR (2025 to 2035) | 12.3% |

The commercial three phase micro inverter market is exhibiting a clear upward trajectory, underpinned by its strong value proposition in efficiency, scalability, and operational reliability. In 2025, shipments reached approximately 292,000 units globally, and projections suggest this will grow to over 930,000 units by 2035. This volume expansion- over 3.1x growth within a decade reflects not just increased adoption, but also broader electrification and decentralization trends in commercial power infrastructure. The market is showing signs of early-stage maturity, with compound annual growth rates exceeding 12.0% between 2025 and 2035. Panel-level energy optimization, which reduces shading losses by up to 25%, makes these inverters particularly valuable for complex commercial installations.

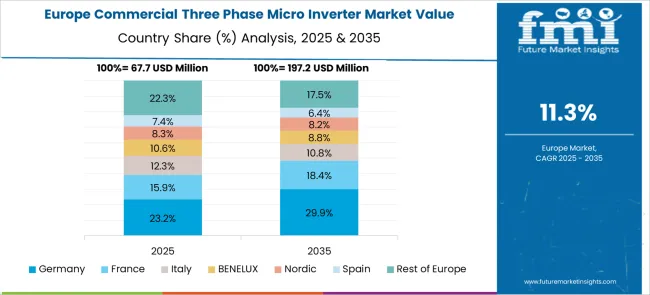

Moreover, facilities deploying micro inverters report efficiency improvements of 6% to 10% compared to traditional string inverter systems, particularly in heterogeneous irradiance conditions. North America currently holds nearly 35% of the global market share, followed by Europe at around 30%, driven by grid modernization mandates and favorable net metering schemes. The Asia-Pacific region, with a current share near 25%, is poised for faster growth, largely fueled by solar adoption in industrial parks and commercial rooftops. With average system-level payback periods shrinking to under six years, the commercial three phase micro inverter market is increasingly seen as a strategic investment, not just a technical upgrade.

With increasing electricity demands in commercial facilities and heightened sustainability mandates, the need for advanced inverter systems has accelerated. Commercial infrastructures are moving toward decentralized energy systems, where three phase micro inverters play a central role in maximizing solar energy capture while ensuring grid compliance and safety. Regulatory support for distributed energy resources and net metering frameworks is further enhancing market adoption.

Moreover, advancements in inverter technology, including improved conversion efficiency, thermal performance, and smart monitoring, have allowed businesses to manage energy usage and grid interaction better. As smart grids evolve and electrification of commercial systems expands, commercial entities are progressively investing in high-performance, scalable inverters that offer long-term operational benefits and compliance assurance, thereby establishing a resilient foundation for the market’s sustained growth..

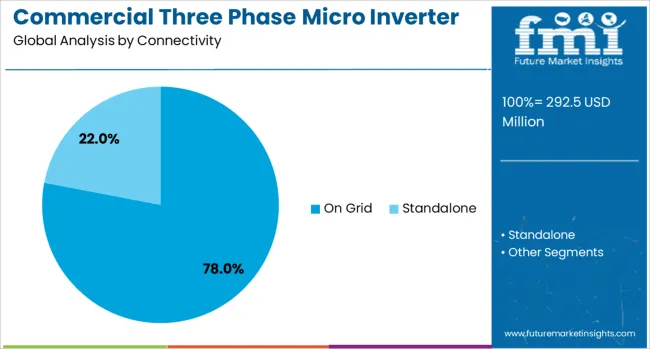

The commercial three phase micro inverter market is segmented by connectivity and geographic regions. The connectivity of the commercial three-phase micro inverter market is divided into On-Grid and Standalone. Regionally, the commercial three phase micro inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The on grid connectivity segment is anticipated to account for 78% of the Commercial Three Phase Micro Inverter market revenue share in 2025, establishing it as the leading connectivity type. The increasing need for seamless integration of commercial solar installations with public utility networks has driven this dominance. Businesses are prioritizing grid-connected systems to benefit from energy export incentives, net metering, and reduced dependency on diesel or fossil-fuel-based backup power.

On grid micro inverters are enabling optimized power conversion and continuous grid synchronization, which enhances energy reliability and regulatory compliance. Their compatibility with smart grid systems and remote energy monitoring platforms has been essential in supporting real-time load balancing and predictive maintenance.

Additionally, the scalability of on grid systems allows commercial users to expand their renewable infrastructure without major overhauls, thus reducing upfront capital expenditure. As energy regulations and sustainability targets tighten across global markets, the commercial sector continues to favor on grid connectivity for its operational efficiency, return on investment, and ease of integration into existing energy infrastructure.

The commercial three phase micro inverter market is expanding as businesses and industrial facilities adopt solar PV systems requiring robust and balanced power conversion. These inverters, mounted at panel-level, provide superior energy harvest, module-level diagnostics, and enhanced grid compliance with commercial three-phase power infrastructure. Increased demand stems from rooftop installations on warehouses, offices, and public facilities, where shading and panel mismatch reduce string inverter performance. Technology trends include embedded MPPT, real-time monitoring, and smart-grid integration. Growth is supported by regulatory incentives, sustainability targets, and rising distributed generation deployment. Leading firms focus on regional adaptation and performance innovation to serve commercial solar needs effectively.

Technological innovations are bolstering growth of commercial three phase micro inverters in solar projects. These devices now integrate advanced maximum power point tracking, multi-MPPT architectures, and thermal designs that enhance efficiency and reliability across three-phase grid environments. Smart control features enable panel-level diagnostics, enabling operators to identify issues, maximize energy yield, and reduce downtime. Some models offer compliance with grid codes for reactive power support and voltage ride‑through, improving utility compatibility. IoT-enabled systems support monitoring, remote firmware updates, and predictive maintenance. These advancements help systems adapt to varying load demands and grid conditions common in commercial settings. Micro inverter technologies now balance modularity with robustness, making them suited to expanding distributed energy assets in industrial and commercial sites where reliability and performance optimization are critical.

The commercial and industrial rooftop solar segments present substantial opportunity for three phase micro inverters. These installations often face shading, rooftop segmentation, and irregular panel orientations, conditions where micro inverters outperform conventional string inverters. Modularity enables easy expansion of systems without redesigning central inverters. Facility managers benefit from granular monitoring and redundancy, as failure of one inverter affects only its panel. Three phase configurations match building power infrastructure commonly 208 or 480 volts offering straightforward integration with minimal string design limitations. Industries and commercial campuses investing in energy cost savings and decarbonization are increasingly choosing panel-level electronics to meet performance and sustainability objectives. As solar adoption rises in commercial real estate and industrial parks, this provides a accelerated runway for three phase micro inverter deployment.

Despite advantages, commercial three phase micro inverters face adoption constraints related to cost and installation complexity. Unit costs per kilowatt remain higher than string inverters, increasing upfront investment for large-scale commercial projects. The need to wire and balance panels evenly across three phases increases design and labor complexity. Installation and commissioning may require specialized training, and service interventions at module level can be costly on large rooftops. In retrofit scenarios, integration with existing electrical infrastructure requires careful planning. For many developers and installers, proven string or optimized inverter systems remain reliable, lower-cost choices. Without economies of scale driving cost reductions or simplified installation protocols, some cost-conscious commercial buyers delay transitioning to micro inverter systems, limiting broader adoption despite technical benefits.

Government policies and grid compliance regulations significantly influence the adoption of three phase micro inverters. Many regions mandate rapid shutdown systems, voltage ride-through capabilities, and smart inverter functionality for distributed solar. Three phase micro inverters inherently support module-level shutdown compliance and grid code capabilities, making them appealing to commercial installers. Incentives such as tax credits, renewable energy targets, and distributed generation rebates further support uptake. Corporate sustainability goals and utility programs provide financial justification for system investment. In addition, insurance providers may favor installations with panel-level safety and fault isolation to minimize fire risk. As regulatory environments evolve, devices aligned with modern electrical codes and energy efficiency requirements gain traction. These regulatory drivers align well with three phase micro inverter capabilities, reinforcing their role in commercial solar deployment strategies.

| Country | CAGR |

|---|---|

| China | 16.6% |

| India | 15.4% |

| Germany | 14.1% |

| France | 12.9% |

| UK | 11.7% |

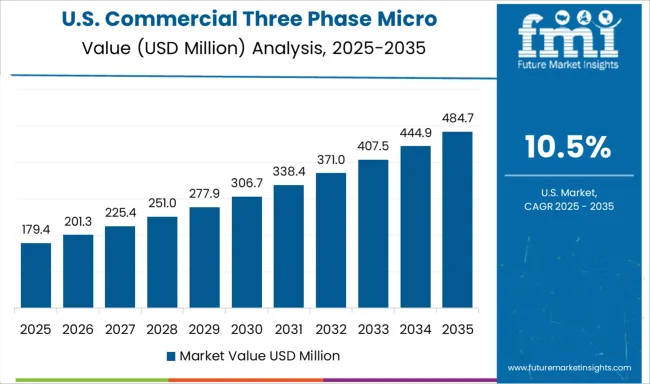

| USA | 10.5% |

| Brazil | 9.2% |

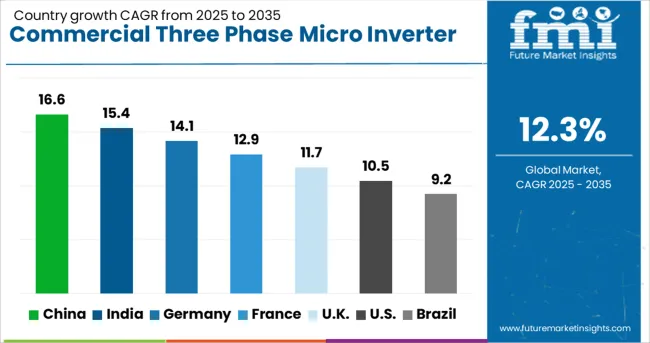

The commercial three phase micro inverter market is forecasted to grow at a CAGR of 12.3% through 2035, supported by the global acceleration toward clean, decentralized energy systems and the rise of commercial rooftop solar installations. China, leading with a 16.6% growth rate, benefits from large-scale solar deployments, policy incentives, and continuous technological upgrades. India, at 15.4%, is experiencing rapid adoption in commercial and industrial sectors due to government-backed solar initiatives and expanding power demand. Germany follows with 14.1%, driven by strong grid integration policies and advanced inverter regulations. The UK, growing at 11.7%, is embracing inverter technology as part of its decarbonization and smart grid goals. The USA, with a 10.5% growth rate, shows steady expansion led by tax incentives, energy independence strategies, and increasing investments in sustainable infrastructure. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is experiencing a CAGR of 16.6% in the commercial three phase micro inverter market, fueled by rapid solar energy expansion and supportive government incentives for distributed energy systems. The country’s dense industrial base and commercial rooftops present vast opportunities for micro inverter deployment. High efficiency requirements, safety concerns, and the need for granular monitoring have pushed many commercial solar developers to adopt micro inverter technologies. Domestic manufacturers focus on R&D to develop durable and cost-effective inverters suitable for extreme conditions. Partnerships between component suppliers, EPC firms, and utilities have made commercial installations more streamlined and profitable. Grid modernization efforts and real-time energy analytics further enhance demand for intelligent inverter systems, positioning China as a dominant force in this sector.

Commercial three phase micro inverter market in India is growing at a CAGR of 15.4 percent, supported by the rapid urbanization of commercial zones and rooftop solar adoption. The fragmented nature of India’s power grid and voltage fluctuations have made micro inverters attractive for their superior power optimization and module-level performance. Government initiatives such as solar subsidies, net metering policies, and rooftop solar mandates in commercial establishments are pushing market growth. Indian manufacturers and global players are expanding partnerships to offer regionally tailored, cost-effective micro inverter solutions. Educational institutions, office parks, and retail malls increasingly seek scalable inverter systems to ensure clean energy integration without major infrastructure upgrades.

The United Kingdom has recorded a CAGR of 11.7% in the commercial three phase micro inverter market, bolstered by clean energy targets, building efficiency regulations, and the growing need for reliable solar installations. Commercial users, particularly in hospitality, education, and office buildings, are turning to micro inverters for performance optimization and system reliability. The country’s unpredictable weather and shading issues on rooftops make module-level inverters highly desirable. Supportive schemes like the Smart Export Guarantee and local government programs incentivize micro inverter adoption. British startups and solar integrators are introducing scalable and compact inverter systems that cater to space-constrained urban rooftops.

Commercial three phase micro inverter market in Germany is expanding at a CAGR of 14.1%, primarily driven by the country’s energy transition goals and decentralized power generation model. Stringent energy efficiency regulations and emphasis on low-voltage, high-performance solar systems support the adoption of micro inverters. German engineering standards favor modular, fault-tolerant energy systems, making micro inverters ideal for commercial installations. Smart grid integration, real-time power tracking, and safety compliance are all central to market adoption. The growing demand for carbon neutrality across business sectors and increased electricity costs incentivize commercial entities to invest in intelligent solar infrastructure.

The United States commercial three phase micro inverter market is growing at a CAGR of 10.5 percent, driven by the rising demand for distributed solar solutions in commercial buildings and advancements in solar monitoring. Incentives under federal and state programs like the Investment Tax Credit (ITC) and Solar Renewable Energy Certificates (SRECs) continue to attract commercial property owners to micro inverter technology. Reliability during partial shading and simplified maintenance requirements are key drivers. USA-based manufacturers are improving inverter durability and software integration, offering features such as remote diagnostics and module-level shutdown capabilities. Sectors such as education, manufacturing, and retail are leading the charge in adopting commercial micro inverter systems.

The commercial three phase micro inverter market is gaining momentum as distributed solar energy systems scale up in commercial and industrial (C&I) environments. These micro inverters enable optimized power conversion at the panel level while supporting the higher power requirements and grid compliance needs of three-phase electrical systems. Their modular design enhances energy yield, simplifies system design, and increases fault tolerance making them ideal for decentralized solar installations. Enphase Energy is the undisputed leader in micro inverter technology and has begun addressing the commercial segment with high-power, three-phase capable solutions that offer panel-level monitoring, remote diagnostics, and high grid compatibility.

Altenergy Power System (APsystems) also plays a significant role, delivering multi-module micro inverter systems that balance efficiency and cost-effectiveness for small-to-medium commercial solar arrays. Darfon Electronics focuses on innovative, compact inverter designs with integrated monitoring features, targeting both rooftop and ground-mounted commercial systems. Chilicon Power, known for its high-performance micro inverters and communication gateways, brings flexibility and advanced analytics to commercial-scale deployments. Large industrial players like Siemens and SMA Solar Technology AG are expanding their inverter portfolios to include three-phase micro inverter solutions or hybrid systems for distributed commercial solar, leveraging their global infrastructure and engineering expertise. As the commercial solar market prioritizes higher uptime, safety, and energy optimization, suppliers that deliver scalable, smart, and grid-compliant micro inverter systems are best positioned for long-term leadership.

Enphase confirmed on June 4, 2025 that its IQ8P‑3P™ Commercial Microinverter, made with USA domestic content, was selected for three commercial solar installations: a 2 MW system at Manatee School for the Arts in Florida, a 666 kW installation at Rock Ridge Homes (Rhode Island), and a 150 kW project at Modesto Gospel Mission in California, totaling nearly 3 MW.

| Item | Value |

|---|---|

| Quantitative Units | USD 292.5 Million |

| Connectivity | On Grid and Standalone |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Enphase Energy, Altenergy Power System, Darfon Electronics, Chilicon Power, Siemens, and SMA Solar Technology AG |

| Additional Attributes | Dollar sales by commercial three-phase micro inverter type including low‑power and high‑power variants by application in on‑grid and standalone systems, and by geographic region including North America, Europe, and Asia‑Pacific; demand driven by commercial solar adoption, modular scalability, and panel-level monitoring; innovation in high-efficiency, configurable microinverters and grid‑compliant safety systems; costs influenced by power rating, regulatory certification, and installation complexity. |

The global commercial three phase micro inverter market is estimated to be valued at USD 292.5 million in 2025.

The market size for the commercial three phase micro inverter market is projected to reach USD 932.9 million by 2035.

The commercial three phase micro inverter market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types in commercial three phase micro inverter market are on grid and standalone.

In terms of , segment to command 0.0% share in the commercial three phase micro inverter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Commercial Single Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase String Inverter Market Size and Share Forecast Outlook 2025 to 2035

Commercial Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

On-grid Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Standalone Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three-Phase Unbalanced Regulating Device Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Power Device Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Microwave Ovens Market Analysis – Size, Share, and Forecast 2025 to 2035

Commercial Microwaves Market

PV Micro Inverters Market Trends & Forecast 2025 to 2035

Solar Microinverter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA