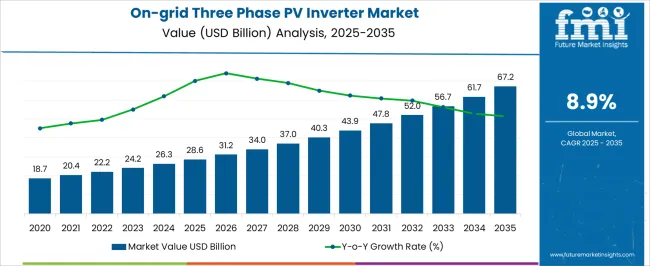

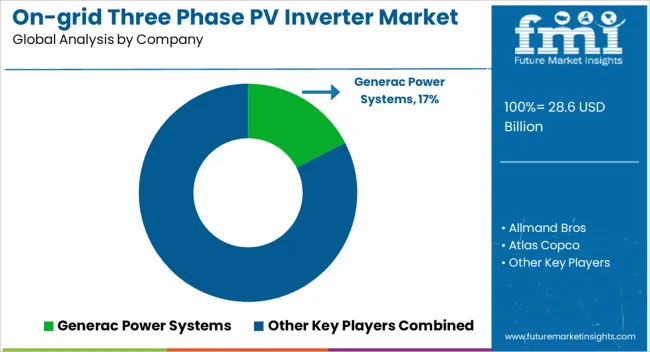

The on-grid three phase PV inverter market is anticipated at 28.6 USD billion in 2025 and is expected to reach 67.2 USD billion by 2035, expanding at a CAGR of 8.9%. The growth curve of this market takes the shape of a steady upward trajectory, where policy-driven installations and utility-scale solar projects have reinforced early-stage adoption, and future expansion is projected to gain momentum from technology cost declines, improved grid infrastructure, and enhanced inverter efficiencies.

Market expansion has been shaped by increasing solar energy integration into national grids, while evolving regulatory frameworks and carbon reduction commitments have strengthened the need for advanced three-phase inverter systems. Demand is not merely driven by cost reduction but also by the rising reliability expectations of distributed power networks and the pursuit of higher returns on investments for commercial and industrial applications. Anticipated growth is also being propelled by technological trends such as digital twin monitoring, hybrid inverter adoption, and advanced grid support functionalities that transform inverters into intelligent grid components.

Pricing trends suggest that while commoditization may occur in lower-capacity ranges, premium offerings with advanced functionalities are likely to command higher margins. The market curve thus demonstrates a transition from moderate to strong growth, reflecting a sustained momentum influenced by decarbonization goals, government subsidies, and private sector capital flows directed toward renewable expansion.

| Metric | Value |

|---|---|

| On-grid Three Phase PV Inverter Market Estimated Value in (2025 E) | USD 28.6 billion |

| On-grid Three Phase PV Inverter Market Forecast Value in (2035 F) | USD 67.2 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The on-grid three phase PV inverter market draws its demand from four primary parent markets, each contributing a specific percentage share and shaping overall growth momentum. The utility-scale solar power sector holds the largest share at 40%, as three-phase inverters are indispensable for connecting high-capacity photovoltaic installations to the grid, ensuring efficiency, reliability, and compliance with transmission requirements. The commercial and industrial solar segment contributes around 30%, driven by factories, warehouses, and business complexes installing rooftop and ground-mounted systems to offset energy costs and meet sustainability mandates. The residential solar segment accounts for 20%, where urban housing projects, gated communities, and rural electrification programs are increasingly adopting three-phase systems to handle higher loads and improve energy management.

The remaining 10% comes from hybrid and microgrid applications, where three-phase inverters play a role in enabling energy storage integration, smart grid participation, and backup power supply. Collectively, the dominance of utility and commercial sectors at 70% highlights how large-scale and business-driven installations are shaping the market, while residential and hybrid use cases sustain complementary demand. This share distribution signals that the sector is not only scaling in size but also evolving in function, with inverters moving beyond simple grid connection to becoming critical enablers of energy independence, stability, and smarter distributed networks.

The market is witnessing consistent expansion due to the global acceleration of solar energy adoption and large-scale integration of renewable sources into national grids. The ongoing shift toward decentralized energy production, combined with favorable policy frameworks and utility-scale solar project development, is contributing to steady demand.

Increased focus on improving grid stability, lowering operational costs, and optimizing power conversion efficiency has driven investments in advanced inverter technologies. Additionally, regulatory incentives and clean energy targets across both developed and developing regions are further supporting deployment.

The future outlook remains positive as governments, utility providers, and industrial operators continue to transition toward high-capacity grid-tied solar systems. Enhanced durability, remote monitoring capabilities, and compatibility with smart grid systems are reinforcing the relevance of three-phase on-grid inverters across multiple end-use scenarios.

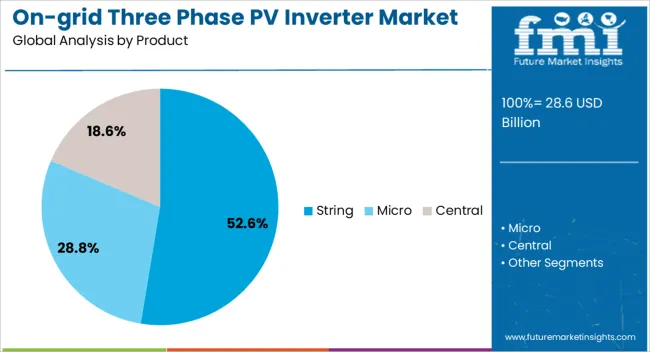

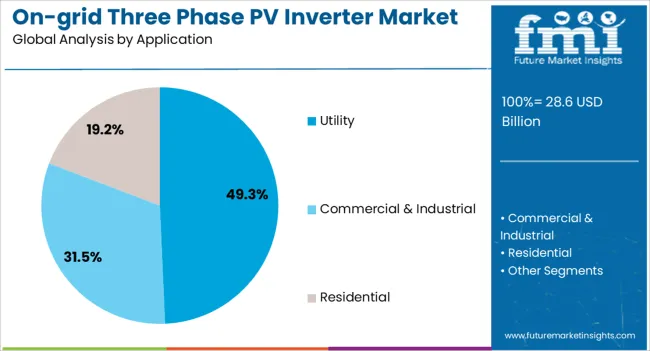

The on-grid three-phase PV inverter market is segmented by product, application, and geographic regions. By product, the on-grid three-phase PV inverter market is divided into String, Micro, and Central. In terms of application, the on-grid three-phase PV inverter market is classified into Utility, Commercial & Industrial, and Residential. Regionally, the on-grid three-phase PV inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The string product segment is projected to account for 52.6% of the total revenue in the On Grid Three Phase PV Inverter Market in 2025, making it the leading product category. This growth is being attributed to the increased deployment of medium to large-scale commercial and industrial solar systems where modularity, ease of installation, and efficient fault isolation are critical.

String inverters offer higher flexibility in design and are easier to scale, making them suitable for segmented installations across industrial rooftops and commercial spaces. Their ability to operate independently within different strings enhances system reliability and reduces downtime, contributing to widespread adoption.

Improvements in software-based control and real-time monitoring have further enhanced the operational efficiency of string inverters, making them a preferred choice for installers and developers. Additionally, reduced maintenance requirements and lower initial costs are supporting their dominance in large-scale distributed generation projects where performance and simplicity are key.

The utility application segment is expected to hold 49.3% of the on-grid three-phase PV Inverter Market revenue in 2025, establishing itself as the most prominent end-use category. The segment’s growth is being led by the large-scale adoption of solar farms and grid-connected solar infrastructure in response to growing electricity demand and global clean energy commitments.

Utility providers are increasingly deploying high-capacity PV inverter systems to manage energy flow efficiently, ensure grid compliance, and enable real-time energy analytics. The shift towards centralized solar installations, particularly in sun-rich economies, is contributing significantly to the rising demand.

Enhanced inverter durability, grid support functionalities, and compatibility with utility-grade energy management systems are further strengthening the utility segment’s position. The need for scalable power conversion infrastructure capable of integrating with national transmission networks has made three-phase inverters a strategic requirement in utility-scale solar developments, driving their uptake across key markets.

The on-grid three phase PV inverter market is being driven by utility-scale dominance, rising commercial adoption, expanding residential demand, and strong policy support. Competitive strategies and regulatory frameworks remain critical in shaping future growth.

The on-grid three phase PV inverter market is projected to benefit strongly from expanding utility-scale solar installations. Growing electricity needs and government mandates for renewable integration have accelerated the deployment of large solar farms across diverse geographies. Three-phase inverters are considered essential for such projects due to their capability to handle high-capacity systems, maintain voltage stability, and support reliable grid connections. With utilities under pressure to diversify away from fossil fuels, their reliance on advanced inverter systems is rising. Power producers are increasingly opting for inverters with grid-support functionalities, reactive power management, and enhanced efficiency. This trend is shaping a steady demand curve where utility-driven projects are expected to remain the leading growth contributor.

Commercial and industrial sectors have become significant growth drivers for the On-grid Three Phase PV Inverter market. Businesses are prioritizing solar adoption to cut operational expenses and to hedge against volatile energy prices. Warehouses, office complexes, factories, and shopping malls are incorporating rooftop solar arrays supported by three-phase inverters, given their superior efficiency in managing higher loads. Corporate energy transition goals are reinforcing this demand, creating long-term purchasing commitments from industrial clusters. Incentive programs for commercial entities and tax rebates for adopting clean energy equipment are strengthening adoption rates. This segment demonstrates not only resilience but also long-term profitability, as businesses value three-phase inverters for lowering dependence on conventional utility supply.

Although smaller in share compared to the utility and commercial sectors, residential adoption of three-phase inverters is witnessing consistent momentum. Housing societies, gated communities, and rural electrification initiatives are contributing to growing installations. Demand is supported by higher household electricity usage, where single-phase systems fall short in meeting modern energy requirements. Consumers are preferring three-phase inverters for stability and compatibility with larger rooftop systems, electric vehicle charging, and home appliances. Financing schemes and falling module prices are encouraging broader participation. While residential demand may not match the utility segment in scale, it remains strategically important for market penetration and for creating diversified revenue opportunities across different geographies.

Government regulations, trade policies, and subsidy frameworks are heavily influencing the On-grid three-phase PV Inverter market. Tariff structures, net metering policies, and favorable tax credits have incentivized adoption at multiple levels.

Competition among manufacturers has intensified, with companies striving to gain market share through pricing strategies, distribution networks, and localized production facilities. Industry players are positioning themselves not just on cost, but also on quality certifications, grid compliance, and after-sales service. Strategic partnerships with project developers are becoming common, ensuring long-term supply contracts. Policy-driven momentum combined with market competitiveness will continue to shape the curve of expansion, where leadership depends on both affordability and reliability.

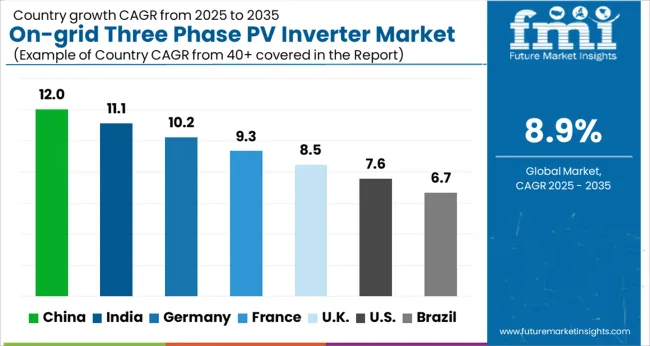

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

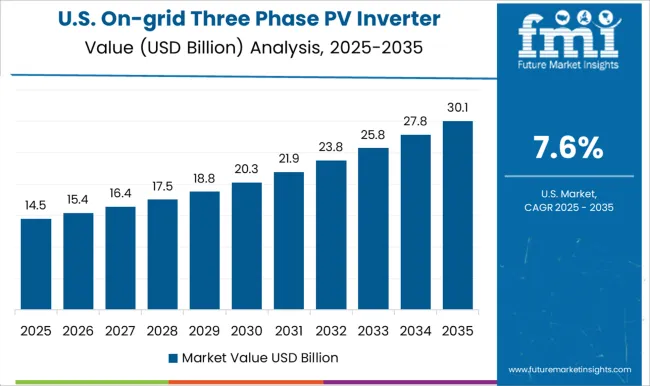

| USA | 7.6% |

| Brazil | 6.7% |

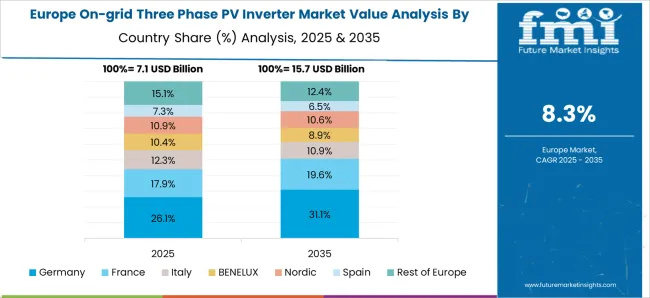

The global on-grid three phase PV inverter market is projected to grow at a CAGR of 8.9% from 2025 to 2035. China leads expansion at 12.0%, followed by India at 11.1%, Germany at 10.2%, France at 9.3%, the UK at 8.5%, and the USA at 7.6%. Growth is being reinforced by accelerated solar adoption, renewable energy targets, and increasing deployment of high-capacity solar farms. China and India are driving momentum with large-scale manufacturing, favorable policy support, and grid modernization initiatives. Germany and France focus on grid stability, efficiency, and compliance with evolving European Union directives. The UK demonstrates strong demand through commercial and residential projects, while the USA emphasizes grid reliability, cost competitiveness, and incentives for distributed energy adoption. The analysis includes over 40+ countries, with the leading markets detailed below.

The on-grid three phase PV inverter market in China is projected to grow at a CAGR of 12.0% between 2025 and 2035, supported by rapid solar expansion and a strong domestic manufacturing ecosystem. China dominates the inverter landscape with large-scale production capacities that reduce costs and ensure global export competitiveness. National policies, carbon neutrality pledges, and renewable portfolio standards are propelling utility-scale and rooftop solar projects. Advanced inverter technologies with grid-support functions, hybrid integration, and monitoring systems are widely deployed to strengthen grid stability. Both state-owned enterprises and private players are investing heavily in next-generation systems. China’s leadership is anchored in its manufacturing strength and strategic policy direction, making it the undisputed hub for inverter growth.

The on-grid three phase PV inverter market in India is anticipated to advance at a CAGR of 11.1% from 2025 to 2035, fueled by renewable energy targets and extensive government-backed solar programs. Large-scale solar parks, rooftop initiatives, and corporate power purchase agreements are creating consistent demand. Domestic manufacturing capacity under “Make in India” is improving supply resilience while reducing dependency on imports. Commercial and industrial installations are expanding rapidly, as enterprises prioritize lower energy costs and reduced grid dependency. Rooftop demand in urban and semi-urban areas is growing, supported by favorable financing schemes and subsidies. India’s market growth represents a critical balance of affordability and scale, positioning it as one of the fastest-emerging hubs for inverter deployment.

The on-grid three phase PV inverter market in France is projected to expand at a CAGR of 9.3% between 2025 and 2035, driven by EU energy directives and national decarbonization strategies. Distributed solar adoption across residential, commercial, and industrial sectors is rising, supported by incentives such as feed-in tariffs and net metering policies. Demand for advanced inverters is growing as grid operators prioritize stability, reactive power control, and system monitoring. Both local and international manufacturers are actively competing to provide certified, grid-compliant systems. Rooftop installations across businesses and communities are gaining visibility as part of the country’s renewable commitments. France’s trajectory reflects an advanced yet competitive marketplace where efficiency and compliance define the pace of adoption.

The on-grid three phase PV inverter market in the UK is anticipated to grow at a CAGR of 8.5% between 2025 and 2035, supported by renewable energy financing and net-zero commitments. Utility-scale solar parks and rooftop projects across commercial and industrial sectors are propelling demand. Government-backed green building programs and energy transition strategies are reinforcing adoption of three-phase inverters. Manufacturers are focusing on hybrid and storage-ready solutions to meet evolving consumer needs. Strict certification requirements ensure that only grid-compliant systems dominate the market. Residential adoption, though smaller in share, is gaining traction with the expansion of financing options. The UK market is progressing steadily, with emphasis on compliance and hybrid functionality creating growth opportunities.

The on-grid three phase PV inverter market in the USA is projected to advance at a CAGR of 7.6% between 2025 and 2035, reinforced by federal tax credits, state incentives, and rising adoption across utilities and businesses. Large-scale solar farms remain the primary demand driver, while commercial and industrial facilities deploy rooftop systems for energy cost reduction. Residential adoption is supported by financing options and declining hardware costs. Demand is shifting toward smart inverters with grid-support functions, cybersecurity compliance, and demand-side management capabilities. Domestic and global manufacturers are strengthening local supply chains to capture regional demand. The USA market’s expansion reflects a transition where affordability and digital integration remain equally important growth pillars.

Competition in the market is shaped by product reliability, grid compatibility, manufacturing capabilities, and after-sales support. Generac Power Systems and Caterpillar have established a strong position by offering integrated power solutions, where inverters are paired with backup systems and distributed generation technologies, appealing to commercial and industrial clients. Atlas Copco, Doosan Portable Power, and HIMOINSA emphasize performance in large-scale installations, focusing on durability, operational safety, and compatibility with modern grid standards. Players like Allmand Bros, Larson Electronics, and Light Boy specialize in providing adaptable solutions for field applications, catering to energy-intensive sectors that require mobile, efficient, and stable power conversion equipment. Multiquip, Trime, and Wacker Neuson contribute by targeting niche segments through modular systems and inverter solutions optimized for construction, rental fleets, and mid-scale projects. United Rentals and Youngman Richardson differentiate through rental and leasing models, making inverter-based systems accessible for temporary and short-term projects.

Inmesol gensets and Colorado Standby highlight customized system integration, ensuring adaptability to regional grid conditions and specific customer requirements. J C Bamford Excavators adds competitive weight by aligning its inverter-driven systems with broader equipment portfolios, enhancing brand recall across infrastructure and energy markets. Competitive strategies revolve around efficiency optimization, compliance with global energy standards, and lifecycle service models. Marketing efforts highlight grid-support functionalities, digital monitoring, fault tolerance, and compatibility with hybrid storage systems. The competitive environment demonstrates a mix of global brands scaling through innovation and smaller players securing market share via flexibility and customer-focused models, ensuring a dynamic balance of technology leadership and cost competitiveness across the inverter sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.6 Billion |

| Product | String, Micro, and Central |

| Application | Utility, Commercial & Industrial, and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Generac Power Systems, Allmand Bros, Atlas Copco, Caterpillar, Chicago Pneumatic, Colorado Standby, DMI, Doosan Portable Power, HIMOINSA, Inmesol gensets, J C Bamford Excavators, Larson Electronics, Light Boy, Multiquip, Trime, United Rentals, Wacker Neuson, and Youngman Richardson |

| Additional Attributes | Dollar sales, share, competitive landscape, technology trends, regional demand shifts, policy impacts, pricing strategies, and growth opportunities in solar adoption. |

The global on-grid three phase pv inverter market is estimated to be valued at USD 28.6 billion in 2025.

The market size for the on-grid three phase pv inverter market is projected to reach USD 67.2 billion by 2035.

The on-grid three phase pv inverter market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in on-grid three phase pv inverter market are string, micro and central.

In terms of application, utility segment to command 49.3% share in the on-grid three phase pv inverter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Three Wheeled Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Three-Wheel E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Three Piece Cans Market

Three Phase Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Power Device Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase String Inverter Market Size and Share Forecast Outlook 2025 to 2035

Electric Three Wheeler Market - Trends & Forecast 2025 to 2035

Automotive Three Way Catalytic Converter Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Standalone Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Inverter Duty Motor Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA